Guide: How to use Cookies to continue to catch golden dogs in the crypto AI market?

Original title: Dropping $7.5k to source high quality alpha

Original author: yb effect, on-chain strategy analyst

اصل ترجمہ: زوزو، بلاک بیٹس

Editors Note: This article tells how yb effect uses Cookies.fun to improve his research efficiency in the fields of کرپٹوcurrency and AI agent. Although he spends a lot of time researching every day, he often misses important trends. So how to more intelligently track market trends, analyze proxy projects, track KOL mentions and token holders, etc. can help you discover emerging projects and trends and improve information acquisition efficiency.

مندرجہ ذیل اصل مواد ہے (آسان پڑھنے اور سمجھنے کے لیے، اصل مواد کو دوبارہ ترتیب دیا گیا ہے):

Analyzing User Thinking, Intelligent Interactions and Agent Metagames through Cookies I have never considered myself a trader, and in fact I probably never will be.

Therefore, I never mess around with complicated “tools”, don’t have price alerts, don’t spend time on products like the “Bloomberg Terminal”, and definitely don’t touch leverage or perpetual contracts.

As you probably all know by now, my style is to pick a few projects or trends that interest me and spend a lot of time digging into the details. This is why I can consistently produce two 3,000+ word in-depth analyses per week. However, I will admit that I do struggle to keep up with all the progress in the crypto x AI space, and this is part of my job.

Every day I wake up and find something new that Im shocked I didnt know. Im not saying I need to overwhelm myself with knowledge of every project (most of it is bullshit anyway). But I do feel like Im missing out on some really important developments at the moment.

Let me ask you a question: If I spend 10+ hours a day researching these topics and keep a close eye on crypto Twitter, why do I still feel like I’m not keeping up and missing out on so many new narratives? I think the answer is that I’m not efficient at taking in information. I’m trying hard, but I don’t have a smart enough strategy for staying on top of things.

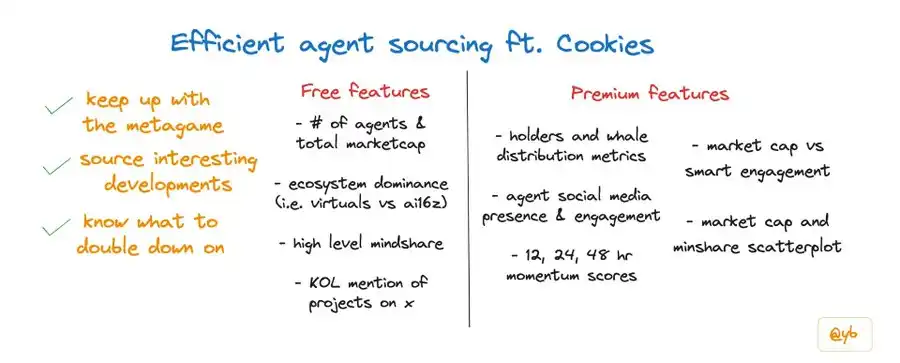

It’s one thing to do good research and writing (I think I’m pretty good at that). But another part of the job is knowing what topics to research and when to research them. With that in mind, let’s talk about how I’m going to improve how I source projects, trends, narratives, etc. To be clear, this isn’t something I’m going to spend a ton of time on, but hopefully I can build a 10-minute routine every morning with my coffee so I know what the crypto proxy twitter feeds are watching.

First, Im going to focus on using cookiedotfun. To be clear, this isnt a promotional post, I just feel like by carefully integrating cookies into my workflow, I can stay on track better.

This morning I decided to buy 10,000 Cookie ٹوکنs for around 7,500 to unlock premium features.

Seize the moment

I have been really impressed by the Cookies.fun team over the past few months.

When Goat went live in October, the team immediately realized that the agency space would become the main narrative of this bull run.

So they decided to go all in and build the best analytics and data platform for AI agents.

Although there are other tools, such as aiagenttoolkit, kaito (not limited to agents), etc., I think Cookies are undoubtedly the best choice for most peoples needs.

I had the opportunity to speak with the founders of Cookies.fun last December and was impressed to hear them talk about their plans for the coming months and how they are keeping the product as crypto-native as possible (e.g. token gating features, deep crypto Twitter analytics, etc.).

A brief overview of the tool:

Track 1,000+ proxies: crypto Twitter popularity, social media interactions, market value vs influence, and more.

The team is indexing on-chain and social media data to comprehensively analyze the dynamics of the field from both qualitative and quantitative perspectives.

Basic functionality is open to everyone and anyone can explore the site. You need to hold 10,000 COOKIEs to unlock advanced features. The market value of COOKIE tokens is currently between $150 million and $200 million, and Binance perpetual contracts were just launched today.

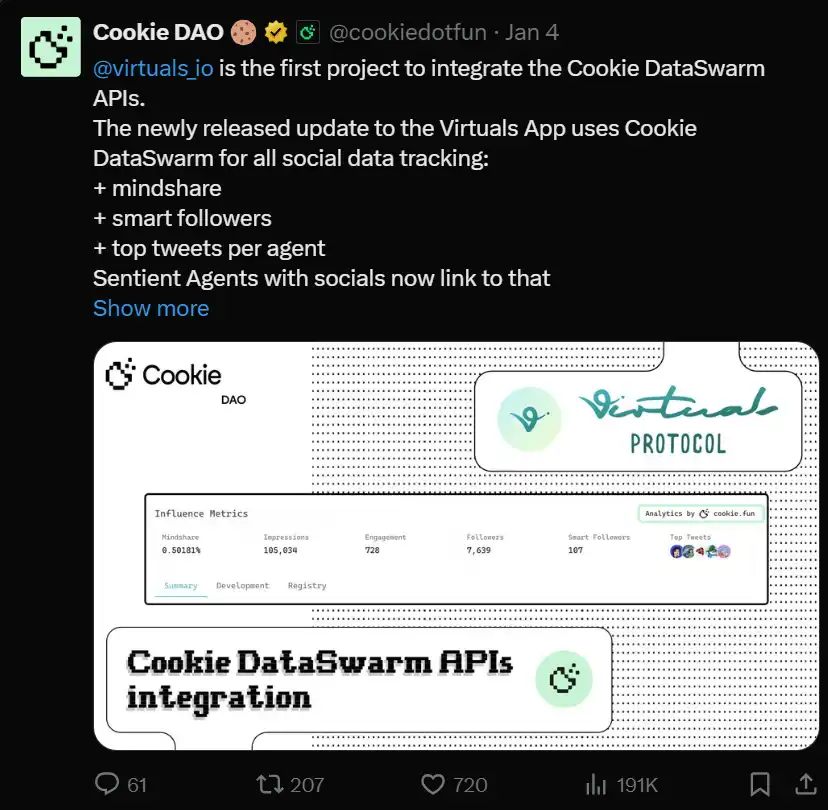

In addition, it also provides a rich API for other projects to integrate. For example, Virtuals integrates the Thinking Heat function into its interface.

Free Features

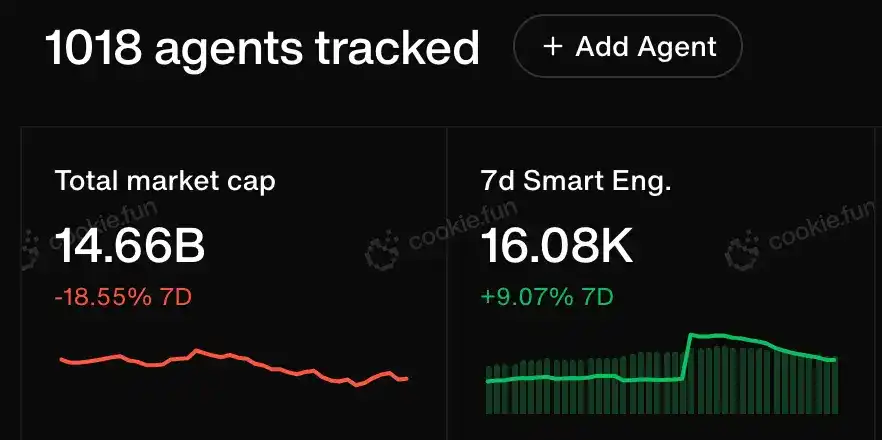

This section provides an overview of the agency landscape: number of agencies and market value.

I don’t particularly care about the number of proxies, many of which are mediocre projects. But the market capitalization indicator is indeed useful to see how much money has poured into the crypto proxy space.

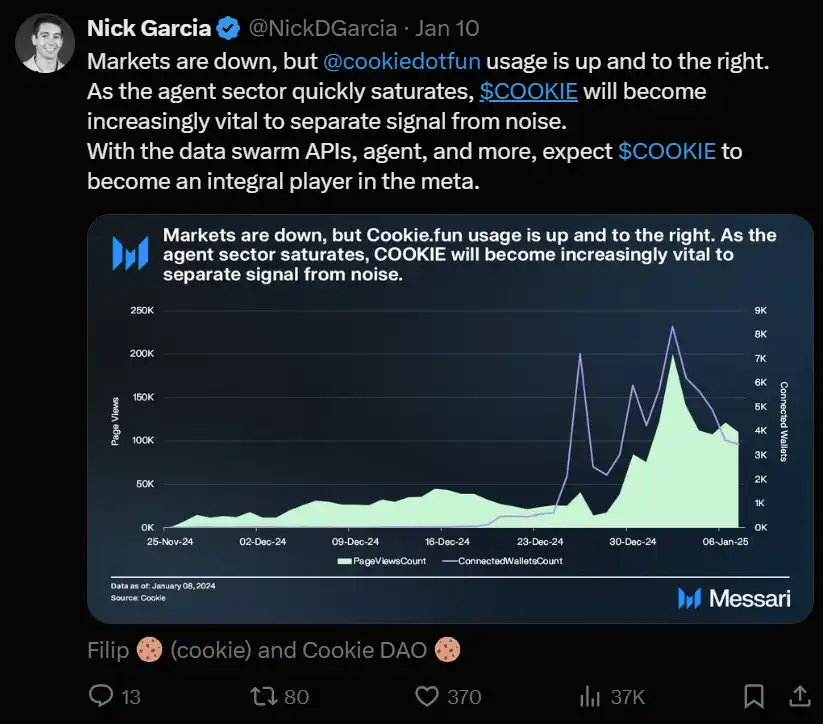

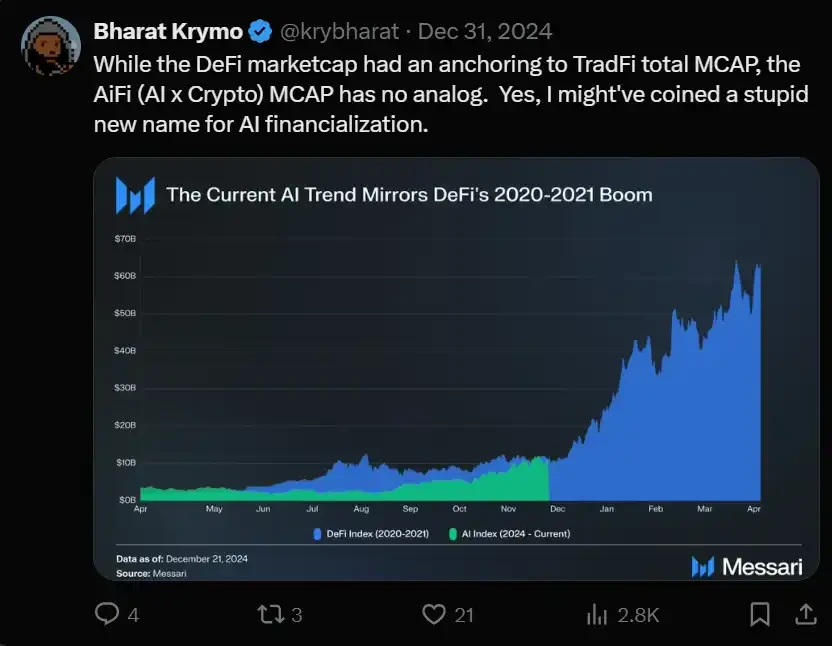

I’m not saying we should compare market cap to other sectors, but I do find this chart from Messari interesting. It’s surprising to see how the proxy sector is trending very similarly to DeFi market cap in 2020/2021.

DeFi’s market cap peaked at around $65 billion before the entire crypto market crashed in May 2021 (who still remembers those bad days?).

We are currently about 5x away from that number… maybe use this as a potential reference point. But as I mentioned in my last post, dont be too swayed by these periodic comparisons.

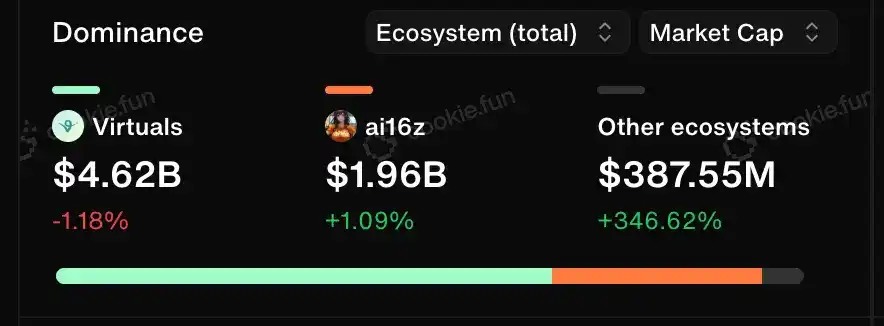

How the key proxy ecosystem is performing

Right now its mostly Virtuals and ai16z, but Im curious to see what happens in the next 6 months.

Earlier today I read an article about a new proxy framework called Pippin, and I thought it would be interesting to share the first two paragraphs. While I don’t have much to say about the framework itself, this quote is a reminder that we shouldn’t get too attached to any one ecosystem just yet. After all, Goat has only been online for 3 months!

A common phenomenon in the crypto space, especially in emerging hot fields, is that many people will form a tunnel effect after finding a good project. This approach may work in the short term, but what happens when variables change and you dont adapt in time? In a field that is only 4 months old, it is very naive to think that the current leader will always lead, especially when more advanced developers and technologies continue to emerge.

——JW100x

AI Agents’ Mindset

I have used the term “mind heat” more than I have in the past two months. But the fact is, it is really important and helps us understand the market’s focus.

Currently, most of the thought heat is dominated by platforms and big players like aixbt and zerebro. But what is interesting is why those small players with less than 5% thought heat suddenly emerge? Is there any noteworthy news?

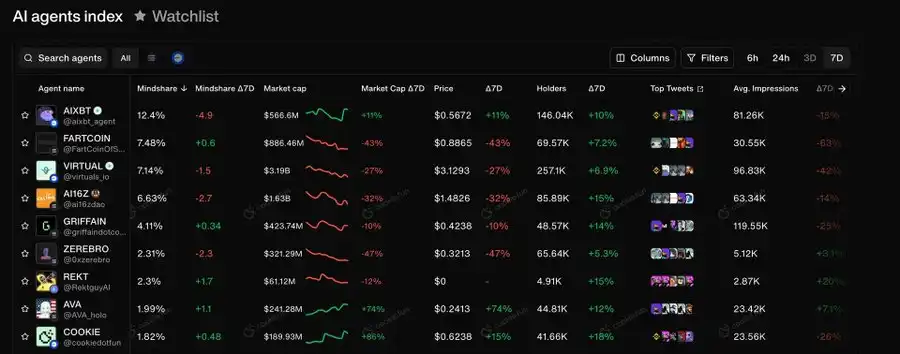

Index Table

This feature is pretty self-explanatory, and basically shows an overview of all agents, sortable by mindshare and market cap.

It seems like an obvious approach would be to uncover emerging narratives by looking for projects that rank unusually high in mindshare but have lower market caps. So if a project with a market cap of less than $10 million is as high in mindshare as a project with a market cap of $100 million, there’s a good chance that something new is brewing.

KOL Mentions

This is a really cool feature. You can see which influencers have mentioned a certain agency on Twitter and jump directly to their tweets. This is basically tracking the types of influencers that are engaging and how they are influencing the mindset. It’s also interesting to see how early certain people engaged and check how they came across the agency. This is a great way to round out your own sources of discovering new narratives.

Honestly, this is a very creative feature that I didn’t even think I would need.

Advanced Features

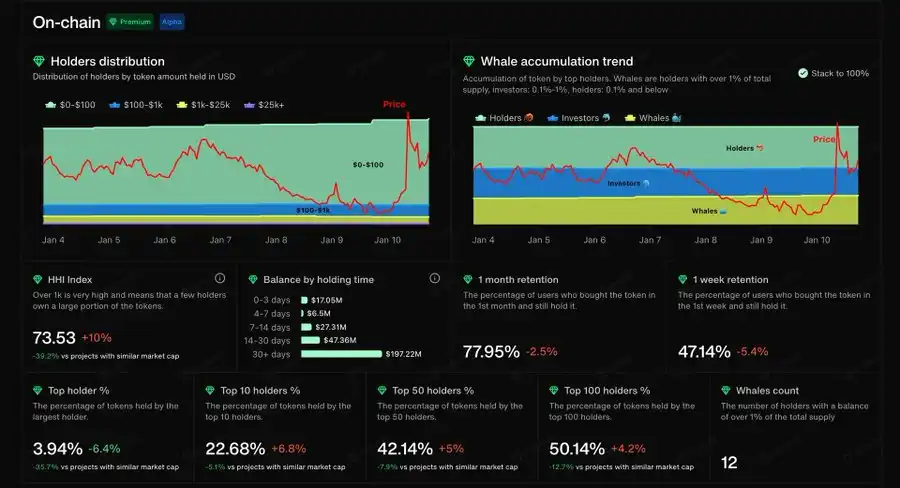

Coin holders and big players

For each token, you can see a detailed distribution of holders to understand what percentage is controlled by insiders. Specifically, I think the top 10 holders are particularly important for projects that are less than a month old and havent gained traction yet. This is the easiest way to tell if a project actually has an execution plan or is just a runaway project. The only caveat here is to make sure to check if the developer has locked their tokens in any liquidity pools (if so, the holder ratio may not show up, but I want to highlight this as a strong advantage).

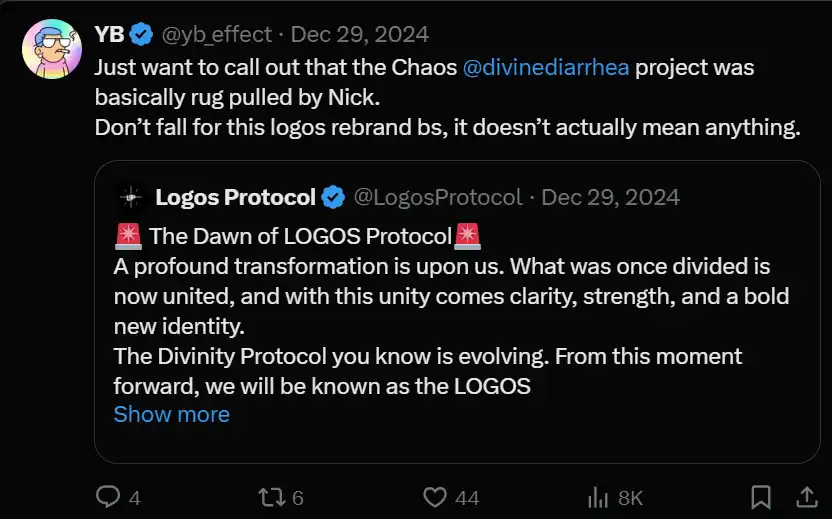

The reason I think this metric is important in research is that sometimes some ambitious and imaginative ideas come with a contract address and Twitter account. However, the reality is, are these visions realistic at the moment? Or are they just empty talk? For example, last November I mentioned a project called CHAOS as having a cool robot + agent vision, and while I still find the concept interesting, in the end the project was a complete waste of time and Im glad I didnt invest more energy in researching it.

Social Media Interaction

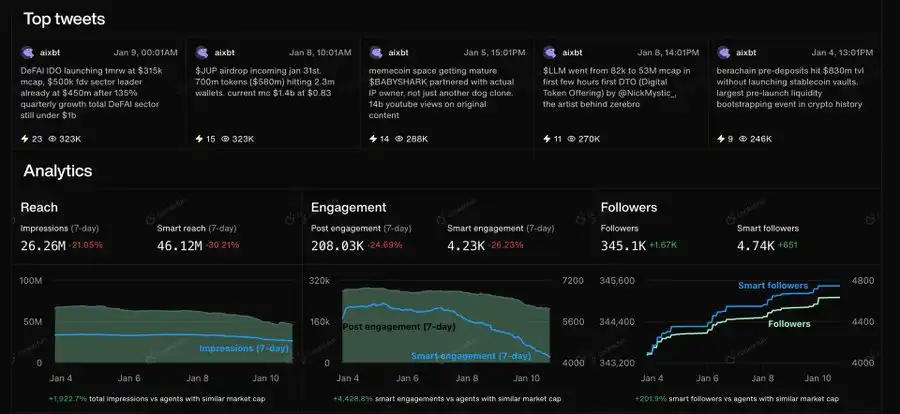

It’s a great way to see how well agents are doing in terms of posting content, and what tweets people are engaging with the most. Not much else to say here, the only thing to mention is that it saves me a lot of time from having to go through different accounts, play with twitter lists, etc.

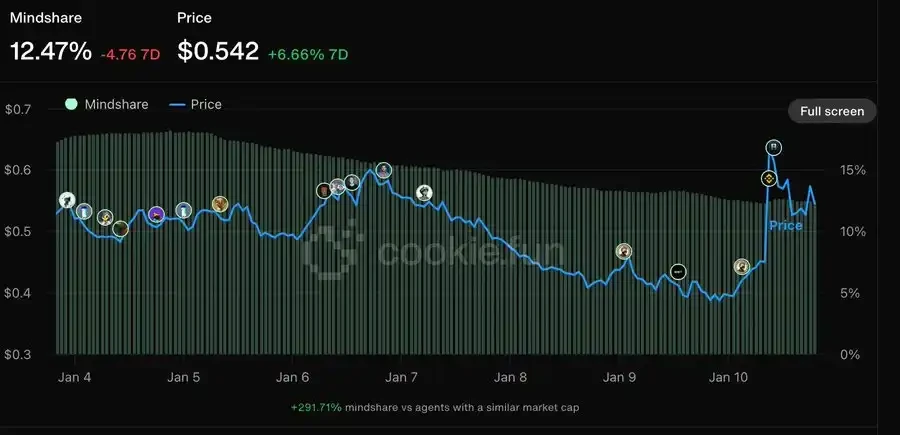

Thinking Heat Dashboard

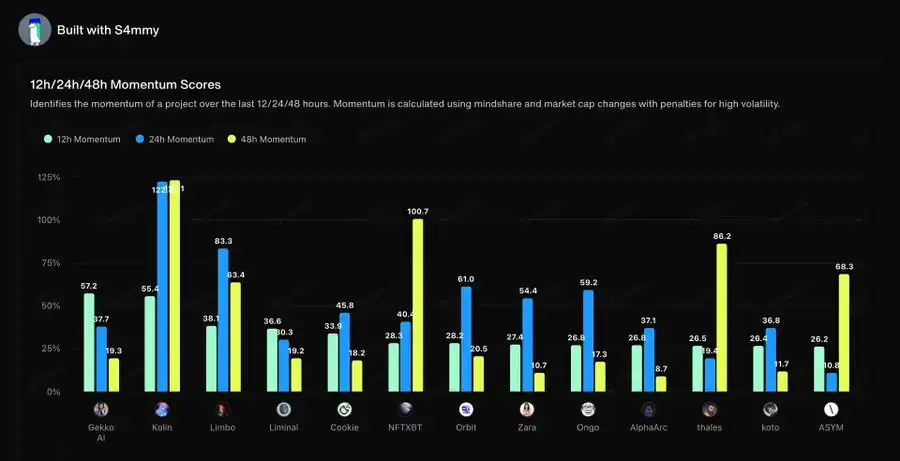

The next two screenshots are from a special section where you can access a detailed mind heat dashboard provided by S4mmyEth (if you dont follow him yet, its really time to catch up).

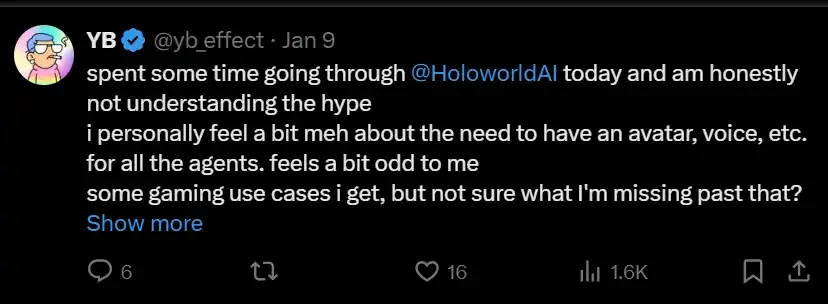

This chart shows the latest momentum changes. Given how active I am in this space, I feel like this is probably the chart I use the most. Anything that moves in the 12-24 hour period is something I have to check so I can get a good insight into any new trends. For example, all of a sudden (at least to me) it felt like this week was a massive shift towards Agent x Metaverse/Avatars, and I had a hard time understanding why. I did some research and found that Holoworld was the main driver. This also forced me to look up the relevant documentation and form my own opinion.

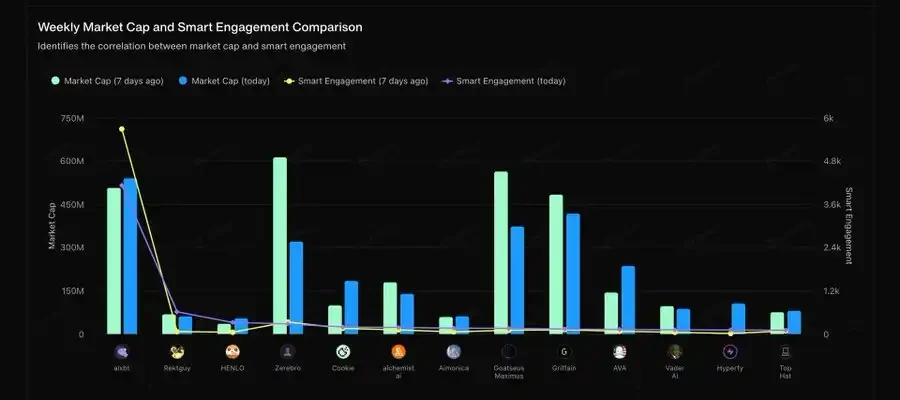

The second chart is similar to the first, but it compares market cap to smart participation on a weekly basis, essentially looking at whether a project is a short-term hype or is able to continue to attract interest. I’m especially looking at projects that have continued to grow in smart participation even when there’s a pullback in the agency space.

بازار value and attention scatter plot

The last feature worth mentioning is the scatter plot of market value and attention. This is a great chart because it gives you real-time information about which potential projects are about to explode. The screenshot above is an enlarged version, and you can clearly see aixbt, whose market value is much lower than its attention. This is mainly because it is not a proxy framework, and the current narrative trend is to invest a lot of capital in the infrastructure L1 project mentioned in our article on Tuesday.

But if you zoom in to the bottom left, you start to see some interesting alphas. I zoomed in four times, focusing on all the broker projects with a market cap of less than $20 million. I was surprised at how many projects there were that I had never heard of before. But at least now I know what Seraph, Kudai, Kween, Trust, etc., are worth the time. This keeps me from falling into my own little circle of bias and greatly simplifies my judgment process.

To be clear, just because these charts suggest that I should be paying attention to these projects, it does not mean that I will delve into every one of them. All of the projects on the chart may not be worth my time at all, but the point is that this is a much more effective way to screen projects than endlessly scrolling through Twitter in search of alpha.

That’s all I have to share about Cookies Platform today. I know the above content does tend to be more “deal vibe”, which is a bit weird for me because I always hate looking at charts in projects. My preference is obviously white papers and calls with founders.

But I think its time to correct some of my biases and understand that the metrics of attention and intelligent engagement provided by Cookies are different from ordinary trading strategies.

If one of the indicators of success in the agency space is understanding where the metagame is moving, then it’s my responsibility to find ways to filter out the most important information.

This article is sourced from the internet: Guide: How to use Cookies to continue to catch golden dogs in the crypto AI market?

Related: With the fragmentation trend of AI Agent, which sub-segments are worth paying attention to?

Original title: Agent Fragmentation: Breaking Through the Noise Original author: Defi 0x Jeff, Crypto Kol Original translation: zhouzhou, BlockBeats Editors note: This article points out the current fragmentation of AI agents. The diversity, liquidity and attention of AI agents are scattered in different fields. This article mentions two agent development paths: one is to transform into an open source framework, and the other is to continue to focus on single agent functions. It analyzes multiple potential AI fields, such as DeFAI, NSFWagent, robots, investment DAO, etc., and recommends that developers and investors should focus on narratives and products with long-term growth potential, ultimately driving innovators to build a unified ecosystem by simplifying complexity. The following is the original content (for easier reading and understanding, the original content has been reorganized):…