On-chain data interpretation: When will the new round of copycat season start?

Original author: Murphy, on-chain data analyst

On-chain data evaluation model – Copycat season

One day when I was in class, Mr. Xiaochi @FC_0X 0 sent me a WeChat message saying, There is a piece of data, which is the difference between the total inflow of stablecoins into exchanges and the dollar value of BTC withdrawn, that is, the remaining potential purchasing power and the volatility of altcoins may have a direct relationship. Can we use this logic to see the timing of altcoin launch?

As luck would have it, the data observations on the potential conditions of capital overflow mentioned in my courseware just corresponded to the launch time nodes of some large-cap altcoins. However, it was just a rough outline at the time, and I vaguely seemed to think of some places that were previously omitted…

After I came back, I sorted out the data and, following the ideas that Xiaochi gave me, I rethought a set of visual indicators that can effectively judge the copycat season. Here are my ideas:

Cottage Season Condition 1: Evaluation of Capital Overflow Condition

(شکل 1)

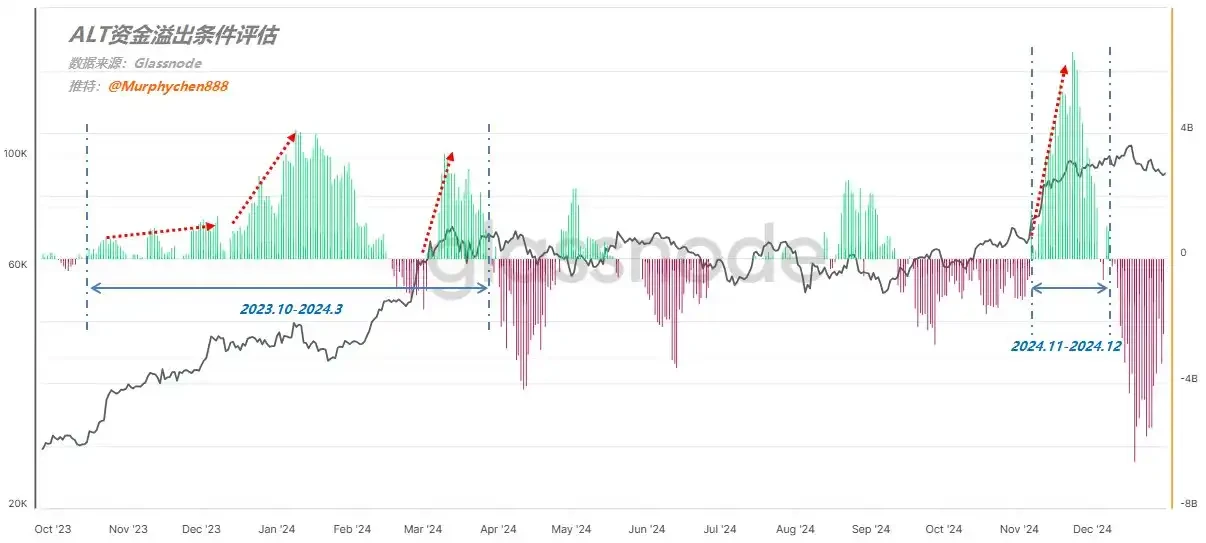

In Figure 1, the green color indicates whether the total amount of stablecoins flowing into the exchange within 30 days is greater than the USD value of BTC withdrawn from the exchange. If so, it means that in addition to buying BTC, these funds may also overflow into altcoins. The higher the green signal column, the greater the theoretical overflow value, and the more the prerequisites for the launch of the altcoin season are met.

From the data, the theoretical spillover value is the largest in the two periods of October 2023-March 2024 and November 2024-December 2024, which means that the possibility of a copycat season is higher in these two periods. There is also a short period between August and September, but it is not as large or lasting as the above two periods, so its influence is relatively weak.

Condition 2 of the Altcoin Season: Capital Inflows from Mainstream Assets

(شکل 2)

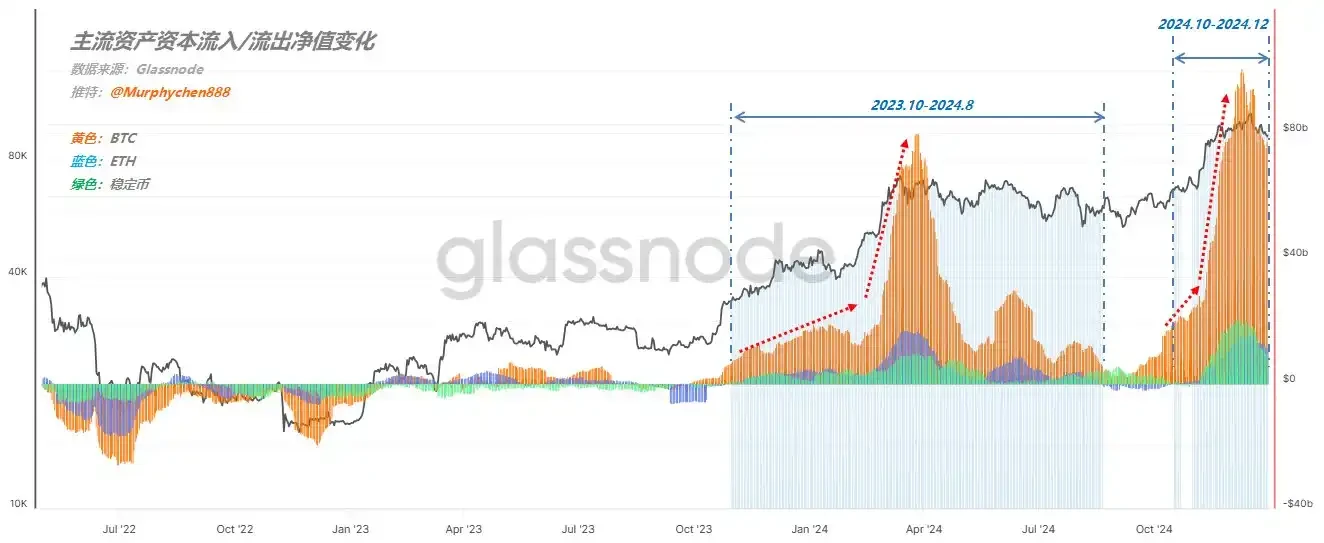

Historically, BTC tends to lead the overall sentiment of the کرپٹو market first, and then market confidence will flow to other large-cap mainstream coins, and finally further tilt towards ALT. The tool to visualize this capital rotation is to use the 30-day change in the realized market value of BTC and ETH and the total supply of stablecoins (as shown in Figure 2). When these three major mainstream assets all show net capital inflows, it is considered that market sentiment has begun to become excited and the overall risk appetite has increased, which is also one of the macro necessary conditions for the start of the cottage season.

From the data, the three major mainstream assets experienced net capital inflows in the two periods of October 2023-August 2024 and October 2024-December 2024, and peaked in March and December 2024. This is also the time when market sentiment is the most Fomo so far in this cycle.

Alternative Season Judgment 3: Positive Momentum of Alternative Coin بازار Cap Discreteness

(شکل 3)

The data basis for judging the start of the alt season also requires a third condition, which is to isolate positive momentum in the total market value of altcoins. We need to find a period of time when the total valuation of the 7D SMA within the altcoin range is greater than its total valuation of the 30D SMA. Because this can represent that the valuation of altcoins is amplified in the short term, and the liquidity flowing into altcoins is increasing rapidly.

In Figure 3, the red color is the 7-day average, and the blue color is the 30-day average. From the data, the red line crosses the blue line during the two periods of 2023.10-2024.4 and 2024.11-2024.12, which means that the liquidity of the currency circle begins to tilt towards altcoins, and the market value of altcoins is turning to a stage of positive momentum growth.

خلاصہ کریں۔

The above three conditions are considered from different perspectives. Condition 1 represents the possibility of capital overflow; Condition 2 represents the overall sentiment and risk preference; Condition 3 represents the liquidity tilt. When all of them are met at the same time, there is a high probability that a copycat is coming.

فی الحال، condition 2 is met, but 1 and 3 are not ; then we can conclude that there is a basis for launching the altcoin season, but liquidity is still concentrated in mainstream assets (especially BTC), and there is not much on-site funds overflowing into altcoins.

However, we can also see that the negative overflow in condition 1 is slowly shrinking, which is a positive sign. Although the cottage season that friends are looking forward to may have to wait patiently, what is coming will come.

The content shared in this article is for communication and research only and is not intended as investment advice.

This article is sourced from the internet: On-chain data interpretation: When will the new round of copycat season start?

Original | Odaily Planet Daily ( @OdailyChina ) Author|Nan Zhi ( @Assassin_Malvo ) In the meme market, in addition to narrative + community as the core driving force, there is also a type of token controlled by the so-called cabal. The manipulators of this type of token hoard early chips through insider wallets, and use multiple wallets to control the trend by brushing, pulling, and shipping, and cashing out at high points for profit. When the author explored the early wallets of MOODENG and ACT, he found that the number of independent addresses of early traders of MOODENG was far lower than normal, and there were several internal addresses of ACT that had never purchased any tokens before. ACTs single coin made hundreds of thousands of dollars in profit and…