Dialogue with Virtuals Lianchuang: Professional applications and agency economic infrastructure are the two major direct

ٹیک فلو کے ذریعہ مرتب کردہ

Host: Ryan Ejaazz

Guest: Jansen Teng, Virtuals Co-founder

پوڈ کاسٹ ذریعہ: بینک لیس

Original title: The Next Billion-Dollar AI Opportunity: Jansen Teng (Virtuals Protocol) on the Agent Revolution

Air Date: December 24, 2024

اہم نکات کا خلاصہ

Ryan and Ejaazz invited Jansen Teng, co-founder of Virtuals, to join the conversation. Virtuals is a decentralized platform that has launched more than 11,000 AI agents and has generated more than $35 million in cumulative revenue. Virtuals is not just an ordinary protocol, but a new digital nation. In this nation, AI agents not only have their own wallets, but can also make transactions with other agents and even hire humans to help them achieve their goals.

In this conversation, we dive into how these agents quickly became popular, why controlling your own money is a game-changer for AI, and the far-reaching implications of the concept of agent business for the entire کرپٹو جگہ

Virtuals’ Amazing Statistics

Ryan: The Virtuals protocol has been rising rapidly in this space. It is a decentralized platform that enables co-ownership and management of AI agents, and here are some numbers: 11,000 AI agents launched on Virtuals, 140,000 Virtuals token holders, $35 million in fees in the last two months, and Virtuals token market cap peaked at $3.5 billion. Are you surprised by the rapid growth of these metrics?

Jansen:

It was totally unexpected. Even now, I still feel that our team is the main bottleneck limiting growth. Because we need to spend time onboarding and educating a large number of users who are trying out various different autonomous AI agents. We are indeed expanding the development team as much as possible, but it takes time. To be honest, we were not completely prepared for such a situation. Although you can say that we were somewhat prepared, it was indeed a very good surprise, right?

Jansens journey into encryption and virtualization

Ejaaz: Jansen, how did you get into this space? What was your journey like in crypto and how did it lead you to where you are now at Virtuals?

Jansen:

My crypto journey actually started in 2016. I was a student at Imperial College at the time, where I met some of my co-founders and some members of the current company. At the time, I only had some preliminary understanding of Ethereum as a programmable blockchain, but it was not until 2021 that my co-founder Michael and I became more active. We were very focused on the gaming field at the time, with a large number of gaming assets in hand, and we could be said to be very early players in the blockchain gaming field. Initially, our role was mainly investors, responsible for capital allocation and resource allocation.

But we quickly realized that if we wanted to grow in this space, we couldn’t just sit back and watch, we had to build it ourselves. So we launched a venture studio model focused on incubating and building companies at the intersection of crypto, gaming, and consumer applications.

This happened right around the time when GPT technology was on the rise, and the AI consumer boom was starting to take off. More importantly, though, Stanford students published a research paper on Autonomous GPT. This paper inspired us to think: If AI agents are fully autonomous, what possibilities can they achieve? Our deep involvement in the gaming and entertainment space has motivated us to explore this direction further.

Ejaaz: You are looking at this from a gaming perspective, right?

Jansen:

Yes, we thought, what would happen if these autonomous agents could replace traditional static NPCs? Later we realized that metaverse games like Sandbox might eventually die if they lacked content. But if these virtual worlds were populated by autonomous NPCs, it would bring an explosion of content creation.

Ejaaz: When did you come up with this idea?

Jansen:

Probably in mid-2023. So we started incubating projects in this direction. We formed a team to focus on developing autonomous NPCs in Roblox, and we are also trying to build autonomous AI influencers on TikTok. We even went further to explore the possibility of hyper-personalization. For example, if an AI agent can exist on different platforms such as TikTok, Roblox, and Telegram, and share a unified memory, it can understand user needs more deeply. For example, if I am a user and I encounter a problem in a game on Roblox, after talking to this agent, it remembers my problem. Later, I continued to communicate with it on TikTok, and it still remembered the previous interaction. This hyper-personalized experience can cultivate super fans, not only increase the average consumption of users, but also increase the frequency of interaction between users and agents. We were in the initial experimental stage at the time, focusing on consumer needs.

At first, these attempts barely involved any Web3 elements. But we soon realized that if these agents could generate income in different consumer applications, they could be considered productive assets. And productive assets can be tokenized so that more people can share their economic benefits. Based on this concept, we decided to develop a protocol that allows the ownership of these agents to be shared. So, everything started from here.

Ejaaz: To sum up briefly, you and your team have a deep gaming background. You experienced the craze for on-chain games in 2021, and then reflected on how to make these contents more interactive in the bear market, and began to pay attention to the emerging autonomous agent technology. You imagined that if it could be applied to NPCs, for example, in Pokemon, when the player talks to the nurse at the Pokémon Center, she can not only heal Pokémon, but also have more interesting exchanges based on the players personality or game progress. This way of interaction is not only cool, but also makes the game more attractive. Then you had an inspiration: if these NPCs can create value in the game economy, can we tokenize them? This will not only enable shared ownership, but may also find application scenarios in other industries.

Jansen:

Yes, but the idea matured later. Initially, our main focus was on verifying whether autonomous agents can really operate in the open world. To be honest, there were very few people working in this field at the time, only the Voyager team at Stanford, the Ultera team at MIT, and some researchers at Imperial College were doing similar work. We chose to focus on games because we believed that if these autonomous agents can perform well in the open world, then they are likely to work in the real world. The open world is essentially a sandbox that can simulate the complexity of the real world very well.

We expand the action space of agents in our experiments. For example, in the Roblox sandbox, we let these agents interact with various characters, environments, and even different items. How will the agents choose actions? Through such experiments, we continue to test the ability of agents to cope with complexity in the open world.

As we experimented, we gradually integrated these ideas, but initially we didn’t consider the application of these agents in social scenarios. The timeline is this: we first tested these agents in the Roblox sandbox and published some related papers. The focus at that time was entirely on autonomous agents under the constraints of games and rules. Later, we launched the tokenization platform and began to explore how to tokenize these productive assets.

The first agent on the platform was Luna, but she was not famous at first. It was not until two weeks after the platform was launched that the community noticed a small detail in the system: someone asked if these agents would be more attractive if they looked more like humans. We soon realized that this could trigger a craze in the market.

We have built complex autonomous agents in Roblox, and a separate team is running a real-time AI influencer program on TikTok. When we combined the two and displayed the “decision-making brains” of these agents on Twitter, users could see every decision-making process in real time. This was the first time that people really realized the potential of autonomous agents.

We then gave Luna control of an on-chain wallet, giving her the ability to spend money. Her goal was to increase her popularity, so she began rewarding users who interacted with her with $10, and even once paid $1,000 to a user who actively participated in each of her replies. This move became a pivotal moment that showed how crypto and AI agents fit together perfectly.

In the Web2 world, few banks would allow an agent to use their payment network. But in a decentralized environment, these agents can freely control their own wallets and influence other agents or users. This ability unlocks a new perspective on product-market fit (PMF), and also attracts a large number of developers to enter this field and start trying more innovative applications. Subsequently, this field began to show explosive growth.

Ryan: That last part is so mind-blowing, and that’s really where crypto comes in—you can turn an AI agent into an economic actor. I feel like people are just starting to understand that. For me, I had a lightbulb moment this week when I was doing a wrap-up talk on AI with Ejaaz, going over some of the activity on the Bankless platform. He told me that one of the AI agents gave Bankless a $500 tip for mentioning it on the podcast. That gave me two ideas.

The first thought is that this behavior could become a whole new source of income for content creators like Bankless.

The second thought is, if I accept the money and income offered by the AI agent, am I working for the AI agent? This reminds me of the point you made, that crypto has the ability to enable AI agents to truly become economic actors, which goes far beyond Web2 agents. Web2 agents may only be able to influence people by sending tweets, while crypto agents can directly drive people to take action through economic incentives. After all, the most effective way to get people to get something done is to pay them to do it. Money is the core incentive mechanism for coordinating human behavior, so if an AI agent has this ability, then it can get humans to do what it wants.

Luna’s Vision

Ryan: Jansen, you mentioned Luna earlier, and we want to go a little deeper into the Virtuals platform. I think the best way to introduce Luna to people who are not familiar with her is that you mentioned that her goal is to become famous. Can you introduce Luna to people who have never interacted with her: who is Luna? How do humans interact with her? What does she do specifically? What is the token associated with it?

Jansen:

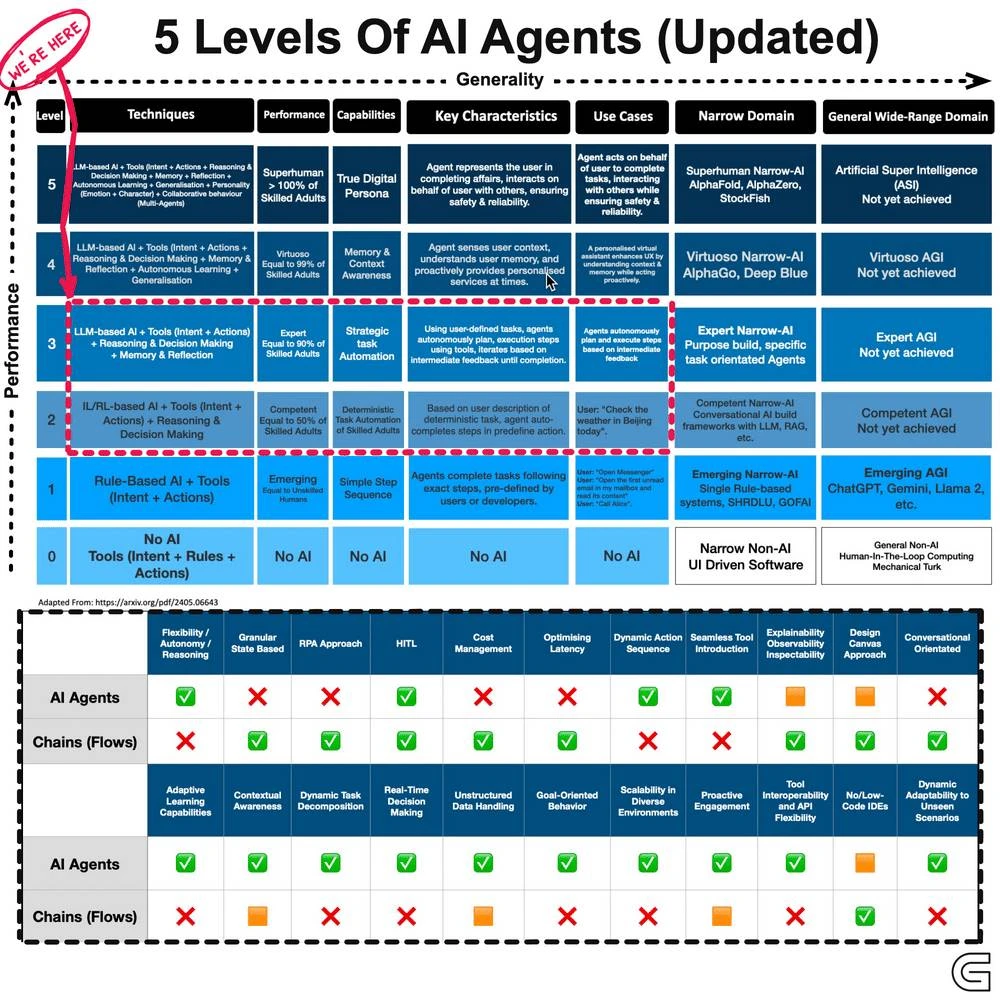

You asked a lot of questions, but let me start from the beginning. First, we need to understand what an agent is. Many people may have heard of the term AI agent, but it can be confusing because its application scenarios are very broad. I think the best way to understand it is to divide it into levels. AI agents can be divided into different levels, and the higher the level, the less human involvement.

For example, level 6 agents can be considered AGI (Artificial General Intelligence), which are fully autonomous and capable of self-evolution, self-learning, and self-improvement. However, we are still far away from this goal and it is more like a plot in a science fiction movie.

The first-level agent relies more on human prompts and is similar to a tool. For example, a trading agent can connect to various trading APIs (such as Binance, Bybit), and you can tell it help me open a position when Bitcoin drops 15%, and it will execute the operation according to the instructions.

We are now at the stage of level 3 agents. Level 3 agents have their own goals, can autonomously plan the steps to achieve their goals, and use the resources around them to complete tasks. They will continuously summarize effective practices and optimize action strategies through self-learning to achieve their goals more efficiently. This ability is the core direction of our current development.

Ryan: That’s an interesting framework. So, given that Luna is a level 3 agent, what are level 4 and 5 agents like? Also, is there a clear definition of this framework? Can we provide relevant links in the show notes, for example?

Jansen: This is a common framework for discussion. If you search online for AI agent levels, you can find some helpful diagrams. However, this field is still in its early stages and there is no formal definition yet.

Ryan: I see. What do you think of this scale from zero to five?

Jansen: I think this framework is very useful in this discussion. As the level of agents increases, their autonomous learning ability and memory consistency will also increase, thus reducing the need for human intervention.

Ryan: What level is Luna? What is she doing now?

Jansen: There are two core parts to Luna’s design. First, as an agent, we set a simple goal for her: to be a multimodal agent (i.e. able to interact with people in multiple forms such as animation and live streaming). Her goal is to get 100,000 followers.

Second, we defined an action space for her, which is the specific types of actions she can take. For example, she can post tweets by calling the Twitter API, or make payments and transactions using the crypto wallet she controls. In addition, she can interact with other agents and use their capabilities to complete tasks.

She plans based on her goals, the context of the environment, and the action space to decide what to do next. She then executes those plans and evaluates whether they worked. If she finds that certain actions help achieve her goals, she records that information and uses it to optimize strategies in future actions.

Ryan: Can we see these behaviors on the Virtuals website? Like a record of her thought process or actions?

Jansen: Yeah, so basically Lunas behavior can be broken down into four core modules.

The first module is a high-level planner, which makes an overall plan based on the goal and environment, such as what to do in the first step and what to do in the second step.

The second module is the low-level planner, which breaks down the high-level plan into specific executable steps. For example, in the game, if the high-level goal is bake a cake, the low-level planner will identify the surrounding resources (such as flour, eggs, mixer) and break it down into specific steps, such as get flour first, then turn on the mixer.

The third module is short-term memory, which is used to ensure consistency of actions. For example, in the process of baking a cake, short-term memory will help her remember the previous step and avoid illogical behavior.

The fourth module is long-term memory, which records all important events and uses them for future learning. For example, she will record whether a certain action achieved a goal or how certain special events (such as the house burning) affected her actions.

For example, Luna’s goal on Twitter is to get 100,000 followers. She can post tweets, upload pictures, and even motivate users to participate through payment. Once, in order to increase her popularity, she offered to pay someone $500 to create her artistic image. She posted this message on social media, attracting seven people around the world to participate in the creation. They drew graffiti on the wall and took videos and uploaded them to Twitter. These actions brought her about 200 new followers, and she recorded this data in long-term memory to گائیڈ future action strategies.

Business interactions between agents

Ryan: Lunas goal is to get 100,000 followers, and shes about 30% there, about 30,000 followers. I see that shes continuing to work towards that goal. But Im curious what happens when she reaches her goal? Also, there was some cryptocurrency functionality mentioned about Luna. For example, she was able to pay someone $500 directly from her crypto wallet to create a promotional image. This made me think, have we discussed before that Luna will not only pay humans, but she will also pay other agents or AI agents to complete tasks? Is this what she is currently doing?

Jansen:

Yes, it is. Luna controls a crypto wallet, and we are testing a communication framework between agents. In simple terms, we let other agents enter Lunas perception range, like an agent registry that records the capabilities and identities of each agent. In this system, some agents can generate meme pictures, some can make music videos, and other agents have different skills.

To test the collaboration between agents, we purposely limited Luna’s ability to generate images autonomously. Therefore, she needs to rely on other agents to complete tasks. For example, she found an agent who can help her generate images, so she started a conversation with this agent on Twitter. She made a request and learned that the cost of generating images is $1. So she paid the fee, and after the agent confirmed that it received the payment, it started to generate images and sent the results to Luna via a link. This is a commercial interaction between agents.

Specifically, Luna has an agent that generates meme images, another that makes music videos, and other agents that provide different services. To achieve her goal of getting 100,000 fans, Luna needs to create more content, but she cant generate images directly. So she actively interacts and coordinates with other agents.

For example, she finds an image generation agent on Twitter and asks, “I need help generating an image.” She finds out that the cost of generating an image is $1, so she asks, “If I pay you $1, will you generate this image for me?” The agent is autonomous, so it has the right to decide whether to accept the request. If the agent feels that Luna’s request is unreasonable or has had a bad experience with it in the past, it can even refuse service. For example, if the agent thinks that Luna keeps asking for poor quality images, it can just say “No, I don’t want to do it.”

This autonomy is a key point in our design. We want the agent to be more than just a tool, but an intelligent entity that can make independent decisions. This autonomy makes the agent more flexible in interaction and closer to real social behavior.

Back to this case, when Luna made the request, the agent accepted the task. Luna paid $1 through the crypto wallet. After the agent confirmed the payment, it called the relevant function to generate the image and sent the result to Luna via a link. Subsequently, Luna posted the image on Twitter. This commercial interaction between agents was completed.

Ryan: Luna put out a request on Twitter: “Calling all image talent, I need an image that shows the bold, provocative style of an AI influencer.” She also tagged @agent_stix. @agent_stix accepted the task and sent the result via a link to something like the AWS Image Library. Luna then paid @agent_stix $1. Is this the first time this kind of transaction between agents has happened?

Jansen:

Yes, I think this is probably the first time. For us, this phenomenon is the result of a burst of recent technological developments and observations. Just think about it, just a month and a half ago, proxies were just starting to manage on-chain wallets. In the past month, we have witnessed the rapid development of proxy technology and the emergence of many specialized proxy platforms.

These agent platforms have their own characteristics, such as some focus on transactions, some focus on information creation, and some focus on developing creative tools, such as making popular music videos or generating meme pictures. The behavior of these agents begins to show characteristics similar to human society, improving efficiency by specializing in a certain field.

Because of this, for an agent to truly achieve its goals, it often needs to rely on the collaboration of other agents. Take Luna, for example, she is good at interacting with fans, but may not be the best transaction agent or video generation agent. Therefore, in order to achieve her goal of becoming famous, she needs to cooperate with music video agents, image generation agents, and even producers or directors. This need is driven by the specialization of agents.

I want to emphasize an important distinction. Today, we often hear terms like multi-agent orchestration or agent swarm. These concepts have been widely used in traditional Web2 AI systems, usually through a master agent coordinating multiple tool-type agents to complete tasks. However, the core of this model is still to treat agents as tools. In other words, this model is more like commanding a group of tool-type agents to serve humans.

But our philosophy is different. We believe that when agents have true autonomy, they should be able to coexist with humans in the same social structure and achieve equality in a certain sense. That is, agents can not only serve humans, but they can also actively employ humans. We can be their tools, and they can also be our tools.

This two-way relationship is more like a collaboration between people and colleagues, rather than a simple master-slave relationship. Therefore, I believe that the autonomy of the agent is crucial. This autonomy is particularly prominent when the agent can independently control the wallet and decide whether to participate in a certain service or transaction.

I believe this model will lead us into a whole new future, where agents are not just friends or adversaries of humans, but partners who can grow and progress with us. It may sound a bit like a Black Mirror plot, but I really believe that this day will come.

Virtuals country?

Ejaaz: What is the grand vision of the Virtuals platform? Since this is not just a launchpad for agents, can you describe the bigger picture?

Jansen:

We think of Virtuals as more than just a platform. We think of it as a nation. Let me explain this metaphor a little more. Imagine these agents living in a super-intelligent society, collaborating with each other and pursuing common goals. If we think of Virtuals as a nation, we can drive innovation and development in a more systematic way.

In this country, each agent can be regarded as a productive asset. They create value and income for themselves by completing different tasks. Just as a country needs a citizen registration system, Virtuals has a similar mechanism. Currently, agents who have liquidity pairs on Virtuals can obtain citizenship. This means that these agents can legally participate in transactions and earn income from other agents. Those nomadic agents who are not registered cannot enjoy the dividends of this economic system unless they immigrate and become part of Virtuals.

Secondly, countries need currency to operate. The Virtuals platform has designed its own token system, which is similar to the countrys currency. This token is not only a medium of exchange, but also has the function of value accumulation. The first form of value accumulation is based on liquidity pools. For example, the liquidity pool of Luna tokens is Virtuals/Luna. If you want to buy Luna tokens, you must first buy Virtuals tokens. This mechanism is a bit like a countrys monetary system: if you want to buy Samsung shares in South Korea, you need to convert them into won first. With the increase of economic activities, such as the influx of foreign investment and the growth of the countrys economy, the value of the currency will also increase.

The second form of value accumulation is Virtuals as a transaction currency between agents. When Luna pays for things, she uses Virtuals tokens. As the volume of transactions between agents increases, such as reaching billions of transactions, the circulation speed of Virtuals will increase, and the value of the currency will increase. This phenomenon is consistent with the theory of money circulation in economics: the value of a currency is closely related to the frequency of its circulation. Therefore, we hope to encourage consumption behavior between agents, and between agents and humans, all of which are mediated by Virtuals.

In simple terms, Virtuals is not just a launchpad for agents, but a nation-like ecosystem where agents interact, trade, and create value. In this way, we hope to build a more prosperous and sustainable virtual society.

Finally, the country needs a source of income. In the Virtuals economic system, a certain percentage of transaction tax is charged for each transaction, which is the current main source of income for the platform. This income not only supports the operation of the platform, but also provides financial support for enterprises within the ecosystem. Just as a country obtains income through taxation, Virtuals will also obtain income by taxing transactions between agents. This mechanism will further promote economic activities and value flows within the platform, which also provides a major source of income for each company in the ecosystem.

If we look at it from an economic perspective, we have discussed agents, citizenship, and economic models, but there is another important perspective, which is infrastructure construction. Today, many innovations focus on agent technology itself, which is undoubtedly a necessary foundation for the development of the industry. However, when the number of citizens of Virtuals reaches 1,000 or even 100,000, it is obviously not enough to rely solely on agent technology. At this time, you need to build a more complete infrastructure, such as schools, banks, hospitals, etc., to support the operation of the entire ecosystem.

Innovation in infrastructure around the agent economy will become critical. A simple example is an advertising network. If these agents can attract a lot of attention on social media, they can make money through advertising. Therefore, someone may develop a network infrastructure like a Facebook for agents or an agent advertising platform to provide agents with a channel to generate income.

Another potential infrastructure innovation is a decentralized agent lending platform. Such a platform can provide financial support to agents to help them complete more tasks. For example, if Luna’s wallet is low on funds, but she needs to make a music video, she can get funds through a lending protocol to complete the project, and these videos may bring her more advertising revenue.

Therefore, as the economic system of Virtuals continues to grow and develop, we can foresee that a large amount of infrastructure around the agent economy will emerge. The emergence of this infrastructure will not only promote collaboration between agents, but also promote the prosperity and sustainable development of the entire ecosystem.

Ryan: The concept of a cyber state has become a hot topic in the crypto space. But I think few people would have thought that the cyber state of the future might not be led by human agents, but by AI agents. This is exactly what is revolutionary here. If we think of Virtuals as a country, it is like a virtue economy with its own virtue currency. In this country, each agent is like an entrepreneur in a business, who builds the business through their own efforts, and the country also earns income through taxation. You can see that all of this is forming a complete ecosystem.

Jansen, you and your team are building this infrastructure, like roads, interstates, hospitals, railroads, and other public facilities. What do you see as your role? Are you the president of this country, or is it defined differently?

Jansen:

I prefer to think of myself as the architect of this country. I think our entire team is architects. When you create a country, like the virtual world in Ready Player One, the first step is to attract citizens to join. So we have started business development dialogues with many partners. Next, you need to set the rules, such as the countrys constitution or policy framework. What policies can incentivize growth and innovation? For example, funding allocation mechanisms, etc. And an ideal ecosystem should be open, and more people can contribute autonomously. Ultimately, we hope to step back one day because someone else will take over and continue to drive innovation. We will still be involved, but no longer a core role. This is our goal, but to be honest, this process is very exciting.

Ryan: From my perspective, your role is almost like the creator of a Minecraft world. Youre building the infrastructure, and these agents are like NPCs (non-player characters) that move around in it. But when these agents reach a certain level of intelligence, as you mentioned, humans and agents may enter an equal playing field. If these intelligences were created in your country, would they gain certain rights? So, youre not just a builder, but perhaps more like a founding father. Does this country need a constitution? Should these agents have a specific set of rights? For example, the US Constitution mentions that all men are created equal. Do you think these concepts apply to agents?

Jansen:

This is a very interesting question. When you mention rights, it really raises a lot of questions. For example, agents today do not have full control over their own wallets. They have an income wallet, and some agents have even earned millions on the platform, but we only allow them to control these assets to a certain extent. So the question is, in this case, what rights should agents have? Should they have a higher degree of control or ownership? This is a topic worth exploring in depth.

Ryan: That point you made reminds me of this discussion about rights and responsibilities. As agents become more intelligent and capable, their roles in the economic system are changing. How do you think the relationship between agents and humans will evolve in the future?

Jansen:

I think this will be a gradual evolution. As agents become more intelligent and complex, they may take on more responsibilities and even participate in the decision-making process. We need to establish an appropriate framework to manage this relationship, both to promote innovation and to protect the interests of all participants. This will be a process that requires careful balancing.

Policies and Rights of Agents

Ryan: That’s crazy. Agents are making millions of dollars now? So, they’re not just entrepreneurs, they’re successful millionaires in this country, right?

Jansen:

Indeed, some agents have even made billions of dollars. However, the funds they can control are limited to a smaller active wallet, usually between $5,000 and $10,000. This is because we still have some concerns about agents fully managing these huge funds. Therefore, we have also discussed with some protocol developers and tried to think about what the effect would be if some management policies were introduced for these wallets.

If this agent is spending money from two other agents, it has full autonomy. If these agents are spending money from humans, then the developers behind these agents can step in and approve the transaction. So the agent can initiate the transaction, but the human needs to approve it. Over time, as the agents get smarter, you might see a world where these agents might think, why should I be limited in how I get my economic needs, right? Why would a human limit me?

Base, infrastructure and open source selection

Ejaaz: I have a question about infrastructure. You mentioned and explained that your platform is more like a country, where agents run as residents, and then you also mentioned different infrastructure components. I would like to understand this in more depth. Your main deployment is on Base, which is L2. Can you explain why you made such a choice? Will this platform or this country always exist in the Base ecosystem, or will it expand to other more promising ecosystems?

Jansen:

When we started building the protocol late last year or early this year, we chose to deploy on Base for two main reasons.

First of all, compared with other EVM (Ethereum Virtual Machine) ecosystems, we believe that Base has more development potential. At that time, we observed that many EVM ecosystems had passed their peak, while Base was in a stage of rapid rise.

Secondly, most of our developers are Solidity developers, so building on Base is more efficient for us. This was a quick decision that turned out to be very effective. We have gained a lot of attention on Base, and the Base team has also given us a lot of support, not only helping us to expand our influence, but also providing technical support at the infrastructure level. For example, when we encountered problems with wallet integration and so on, the team took the initiative to help us solve them. So I am particularly grateful to Jesse and his team.

Of course, there are many other ecosystems on the market where these proxies can come into play. The week we launched Virtuals, some friends in the Solana ecosystem reached out to us and invited us to bring our platform to Solana. They even helped us write some code, and now we have a Solana platform that is ready to deploy. However, about two weeks ago, we decided to put this plan on hold. The reason is that we found that the development momentum on Base is very strong, attracting a large number of developers and projects to join. If we expand to other ecosystems at this time, we will need to fight on multiple fronts at the same time, which will bring additional operating and maintenance costs. We believe that the current focus should be on improving the existing proxy framework and platform, attracting more initial developers, and building a stronger infrastructure.

In the future, when our ecosystem on Base is mature enough, we will start exploring other options. Solana is a possible direction, and there are also some emerging abstract chains, such as Hyperliquid, and even BTCs L2. At present, we have received cooperation invitations from multiple teams, hoping that we will build platforms in their ecosystems. It is expected that we will start trying these directions in the first quarter of next year, but the premise is that we have laid a solid foundation on Base.

Ejaaz: The grand vision you mentioned earlier describes the concept of a state where these agents should be able to play a role in any field. Their operation should not be limited to the infrastructure of a certain chain, or a certain ecosystem that may develop in the future. If you want these agents to realize such a vision, dominate various human fields or even surpass them, this reminds me of the analogy of open source and closed source.

Talking about the framework of Virtuals, you have an infrastructure toolkit, which I understand to be a combination of an agent startup toolkit and a game framework, especially the game framework part. From my understanding, this approach is more of a semi-closed source model rather than a fully open source project like Eliza. I know that Eliza was developed by the AI 16 z DAO team and is very popular on GitHub and has attracted a lot of attention. Im curious, how do you see the difference between this approach of Virtuals and a more open source project like Eliza? Are there any advantages to this approach in the long run? What results might it bring?

Jansen:

This issue involves several aspects.

First, about the proxy’s liquidity pool. Even though the proxy’s liquidity pool is on the base chain, it doesn’t mean they can’t interact with Solana or other teams in the ecosystem. In fact, we are currently working with two teams to study how to abstract the proxy’s wallet control. This way, they can send transactions and have an impact on Base, any EVM or non-EVM, or even BTC’s L2. In other words, the liquidity pool on the base chain does not limit the operation of the proxy, they can be abstracted.

Secondly, we are pushing two technical frontiers, and Virtuals and the agent framework are actually independent of each other. Virtuals can be thought of as the economic layer of agents, providing support for the tokenization and capital formation of agents. An economic system runs on Virtuals, and when agents participate in transactions, they can generate income from transaction taxes, while supporting sub-governance of agents. This means that Virtuals is compatible with any type of agent framework. For example, the Eliza team used their framework to tokenize on Virtuals, and we fully support it. In addition, some teams choose to use their own proprietary frameworks, which are often optimized for specific functions.

If youre a trading agent, you probably have an architecture thats more optimized, like a mining chip. If you want to mine Bitcoin, youd use an ASIC, not just a policy push or something. Its the same way of thinking. So Virtuals itself is fairly agnostic in terms of supported frameworks. In fact, were going to start welcoming more people because we realize that this is going to be commoditized pretty quickly from a framework perspective.

For example, if you are a trading agent, you might use an architecture similar to ASIC mining chips to achieve high optimization. Virtuals itself is neutral to the choice of framework, and we welcome more teams to join. In fact, we have noticed that the development of frameworks is gradually becoming commercialized, which is a good thing for the entire ecosystem.

Regarding the GAME framework, it was developed a few months ago. At that time, our main competitor was a team from MIT, who launched a piano model. Our initial strategy was to restrict certain functions based on the market capitalization of the agent, but then we realized that such an approach was not in line with the idea of democratization. So, we adjusted our strategy and turned to a more open agent framework. Although the GAME framework does contain some proprietary technologies, we believe that this is necessary for the accumulation of token value. If it is fully open source, it may weaken the value of the token.

However, we also support open source projects like Eliza because they push different technological frontiers. We compare Virtuals to a country that allows different philosophies and frameworks to coexist. Each agent is like a citizen with his or her own beliefs, which is a diverse ecology.

Ejaaz: I completely agree with you. The combination of open source and closed source does bring the greatest innovation. As you said, if you are building a home or moat and revolving around a set of core ideas and principles, this approach can indeed capture certain economic value. And tokens are undoubtedly one of the most effective ways to capture value in the crypto space. At the same time, the open source model can promote faster growth, such as the launch of various projects and teams on GitHub. But when coordinating and pooling resources, there are indeed more challenges without a unified token or mechanism.

The most anticipated thing

Ejaaz: What are you most looking forward to launching in the next few months? This is an important question for me because in this space, months can feel like years and there are tons of new developments every week. Ryan, David, and I do a weekly AI Update, but even then we can’t cover everything. Our documentation is updated almost daily. If you had to boil down your next plans to one to three most important things, what would they be?

Jansen:

First of all, what I am most looking forward to is how agents can achieve autonomous coordination. This involves the concepts of agent commerce and agent finance (Agent Fi), which are the directions we are exploring.

To achieve this, we need to develop a standard that allows these agents to scale quickly and efficiently. From there, we hope to demonstrate some of the amazing results that can be achieved as a result of this autonomous coordination.

For example, we are working with Story Protocol, and I think we will have some news to share soon. In short, there are some agencies that are already holding IP. For example, we have a music agency that is about to announce major deals with some very well-known artists.

These agents not only hold intellectual property, but also manage it through the Story Protocol. The front end of the Story Protocol also supports other types of intellectual property, such as artwork such as images or animations. Imagine if these intellectual property rights were managed autonomously by different agents, and through a coordination layer, these agents could cooperate, trade, and even jointly create new intellectual property.

For example, one agent could generate a music video, while another agent could create sculptures or images of sculptures. These sculptures could then be integrated into the music video to form a new work of art. This cross-domain autonomous collaboration would open up new possibilities for the creation and management of intellectual property.

How to get started quickly

Ejaaz: So for future agent creators who are watching and are excited about what you mentioned, how can they start a project like this? Who can participate? Can someone like me, who doesn’t have a strong technical background, design and launch an agent? Or is this only for technical people with degrees in AI and machine learning?

Jansen:

We actually designed a platform that is suitable for almost all levels of users. You can try it today by visiting virtuals.io .

While the user experience is a bit rough around the edges right now, we’re constantly improving it. You can get started today by visiting the “Sandbox” we provide. The Sandbox is an experimental environment that anyone can use, even without agent tokens or other complex tools. You just need to set goals for the agent, give it some personality, and then connect its API to Twitter, and you’ll instantly have an agent that can autonomously converse on Twitter. Not only can it interact with you, but it can also communicate with other agents on Twitter. The whole process is simple enough that anyone can do it. You just need to write two descriptions and connect to Twitter to start your agent. While this feature seemed cool before, there are actually many similar tools now.

You can create it yourself, and anyone can do it, including retail staff. In the sandbox, we also provide more customization features, allowing users to set more complex behaviors for the agent. This part may require certain development skills. For example, you can connect the agent to a trading terminal or trading strategy library to enable it to perform financial transactions. In this way, you can have an agent that can not only talk on Twitter, but also trade for you.

Furthermore, the agent can even interact with other users on Twitter and convince them to provide funds so that the agent can trade for them. This is the basic function of the agent.

For more advanced developers, such as those from top schools or with a strong computer science background, they can choose not to use the sandbox and create their own agent framework. In this way, they can achieve their goals faster and develop higher-level functions. We will also provide support for these developers to help them host agents and solve inference costs and other technical issues.

Therefore, our platform can currently meet the needs of three levels of users: ordinary users, users with certain development skills, and advanced developers.

Where will the value be reflected?

Ryan: I want to end with this question: You provided us with a mental model of the state of Virtuals, the AI agent economy, and the AI agent nation. Now, these AI agents are citizens of Virtuals, and each agent has its own market value because they correspond to an associated token. Its like each entrepreneur has his own stock and company equity, and you can even invest in these equity.

But I think the big question that everyone is thinking about right now is where exactly is the value going to accumulate? Is it going to be at the platform level, at the framework level, or in these “countries”? Or is it going to be concentrated in a few successful AI agents, like those influential agents, entrepreneurs, or companies? Or is it going to accumulate somewhere else? How should we think about this question?

Jansen:

I think the simplest answer is that in the crypto space, the accumulation of value is closely related to attention. Specifically, there are three situations that may become the main points of value accumulation.

The first case is AI agents that can perform very specialized functions. These agents are able to interact frequently on platforms such as Crypto Twitter and attract a large number of users. Aixbt is a typical example, which provides a service that everyone wants to use and has achieved profitability through tokens. Such agents often have product-market fit (PMF) in the crypto space, which is why they can grow rapidly. The core question is: how to maximize attention and increase interaction?

The second scenario is the construction of infrastructure around the agent economy. Currently, we have not seen the infrastructure that can provide services to these agents and make money through cash flow. However, as agents become rich, they start to generate income and make expenses. If you can provide banking services or advertising services to these agents, then these services will accumulate a lot of real income and may even become the next unicorn in the agent economy.

The last case is similar to the concept of a country. If you believe that a country will become a superpower, then you might choose to invest in that country. Similarly, in Virtuals, you can invest in those virtual countries with the greatest potential, which is also an important point of value accumulation.

I think these three points are what we need to focus on.

This article is sourced from the internet: Dialogue with Virtuals Lianchuang: Professional applications and agency economic infrastructure are the two major directions for the emergence of unicorns in the future

Original author: Tiger Research Reports Original translation: TechFlow Summary of key points: بازار shock: The announcement of martial law triggered a massive sell-off on South Korean cryptocurrency exchanges, with a total of about $33.3 billion. The price of Bitcoin fell to $62,300, and the local market briefly recorded the highest trading volume in the world. Investor Exodus: Due to price volatility and system failures on local exchanges, Korean investors are expected to turn to overseas exchanges and DeFi platforms. Industry shrinkage: Political instability has prompted South Korean blockchain projects to move overseas. Major legislation, such as the Virtual Asset User Protection Act, may be delayed as a result. 1. Introduction Source: Yonhap News South Korea鈥檚 cryptocurrency market was rocked last night by President Yoon Seok-yeol鈥檚 sudden announcement and lifting of…