Changes in crypto investment and financing in 2024: primary and secondary markets decoupled, VC projects lose dominance

اصل | روزانہ سیارہ روزانہ ( @OdailyChina )

مصنف | فو ہو ( @ ونسنٹ 31515173 )

In 2024, the investment and financing enthusiasm in the کرپٹو field will be decoupled from the overall market trend, and VC coins will no longer dominate market performance.

At the macro level, the crypto market ushered in many historical moments in 2024. With the launch of the Bitcoin spot ETF, the launch of the Ethereum spot ETF, the clarification of regulatory policies in various countries, the Federal Reserve’s announcement of a rate cut, and Trump’s upcoming return to the White House, and other positive macro-level influences, Bitcoin successfully broke through the important mark of $100,000.

From the perspective of the crypto market, meme has become the focus of market attention, and different meme types in different periods have become boosters of market growth. VC projects have performed poorly, and the linear release cycle of tokens has become a chronic poison for VC projects.

Under the influence of comprehensive factors, the number of primary market financings has increased significantly, but the amount of financing has been more cautious.

Looking back at the primary market investment and financing activities in 2024, Odaily Planet Daily found that:

● The number of primary market financings in 2024 was 1,295, with a total disclosed financing amount of US$9.346 billion ;

● The AI sector is showing its edge, with a surge in financing in Q4 2024 ;

● The largest single investment amount was $525 million from Praxis.

Note: Odaily Planet Daily divides all projects that disclosed financing in Q1 (the actual close time is often earlier than the news release) into five major tracks based on the business type, service object, business model and other dimensions of each project: infrastructure, application, technology service provider, financial service provider and other service providers. Each track is divided into different sub-sectors including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain and others.

2024, belongs to BTC and meme coins

A comprehensive review of primary market financing over the past three years leads to an important conclusion: In 2024, investment and financing activities in the primary market have gradually decoupled from the overall trend of the crypto market. The market is mainly dominated by Bitcoin and meme sectors, while traditional VC projects have performed poorly and are unlikely to become the core driving force of the market.

From the data analysis, 2022 was the peak period of the last round of the crypto market cycle, and the primary market financing activities were highly active, and the changes in quantity and amount were almost synchronized with the market conditions. In the first quarter of 2022, the number of financings reached 562, with an amount of up to US$12.677 billion. However, as the market entered a downward cycle, financing activities shrank rapidly, and by the fourth quarter, the number of financings was only 330, and the amount dropped to US$3.375 billion.

2023 is a continuation of the bear market effect, with financing activities in the primary market and the overall market also performing poorly. The number and amount of financing continued to decline throughout the year, falling to 232 and US$1.725 billion respectively in the third quarter, hitting the lowest point in nearly three years. The primary market at this stage was obviously deeply affected by the trend of the market, and market sentiment and capital activity were suppressed.

2024 will be an important turning point for investment and financing activities in the primary market. Data shows that the number of financings has rebounded significantly. For example, the number of financings in the first quarter reached 411, an increase of nearly 69% from the fourth quarter of 2023. However, in contrast to the rebound in the number of financings, the amount of financing has been cautious, with the total quarterly financing amount hovering between US$1.8 billion and US$2.8 billion throughout the year. This shows that despite the recovery of capital activity, investors are more conservative in their investment of funds, further demonstrating the decoupling characteristics of the primary market from the broader market.

From the perspective of market heat distribution, the crypto market in 2024 is dominated by Bitcoin and meme sectors, which is in sharp contrast to the performance in the previous cycle. In the previous cycle, VC projects were usually the core of market hotspots, but in 2024, VC projects performed poorly overall and could no longer have a substantial impact on the market. This phenomenon makes the primary market lose its value as a reference indicator for the overall market.

The primary market in 2024 shows a trend of rationalization and independence. After the frenzy in 2022 and the cold winter in 2023, investors are obviously more cautious and pay more attention to the actual quality and long-term value of projects rather than blindly chasing market hotspots. This change may indicate that the primary market is gradually breaking away from the traditional crypto market cycle and entering a new stage of development.

The increase in the number of financings and the cautious amount reflect that VC institutions prefer to diversify their investments and are more conservative in capital allocation. This attitude shows that the return of market enthusiasm has not brought about a large-scale inflow of capital, but has prompted investors to pay more attention to projects that truly have potential. In other words, the primary market is no longer just a follower of the market, but has begun to play a role in shaping the future market landscape.

In 2024, the number of primary market financings was 1,295, with a total disclosed financing amount of US$9.346 billion.

According to incomplete statistics from Odaily Planet Daily, there were 1,295 investment and financing events in the global crypto market in 2024 (excluding fund raising and mergers and acquisitions), with a total disclosed amount of US$9.346 billion, distributed in infrastructure, technology service providers, financial service providers, applications and other service providers. Among them, the application track received the most financing, a total of 606 transactions; the infrastructure track received the most financing, with a financing amount of US$3.976 billion. Both are ahead of other tracks in terms of financing amount and quantity.

As can be seen from the above figure, the application track, as the area closest to end users in the crypto industry, has always been the focus of attention in the primary market. In 2024, the financing performance of the application track achieved double growth compared with 2023, with the number and amount of financing increasing by about 20% year-on-year.

The financing performance of the infrastructure track in 2024 is particularly eye-catching. The number and amount of financing have increased significantly compared to 2023, with an increase of more than 50%. Behind this growth, not only is the demand for the continuous upgrading of the underlying technology infrastructure in the encryption industry, but also the rise of emerging fields such as AI (artificial intelligence) and DePIN (decentralized Internet of Things network), which has brought new development opportunities to the infrastructure track.

In general, the investment and financing activities in the global crypto market in 2024 present distinct characteristics. The application track and infrastructure track lead in quantity and amount, indicating the markets dual demand for end-user experience and underlying technology upgrades. At the same time, the technology service provider, financial service provider and other service provider tracks are brewing new opportunities in stable development, especially the financial service provider track, which is expected to usher in new breakthroughs in 2025 with the entry of mainstream finance.

The AI sector is showing its edge, and the amount of financing in Q4 2024 has surged

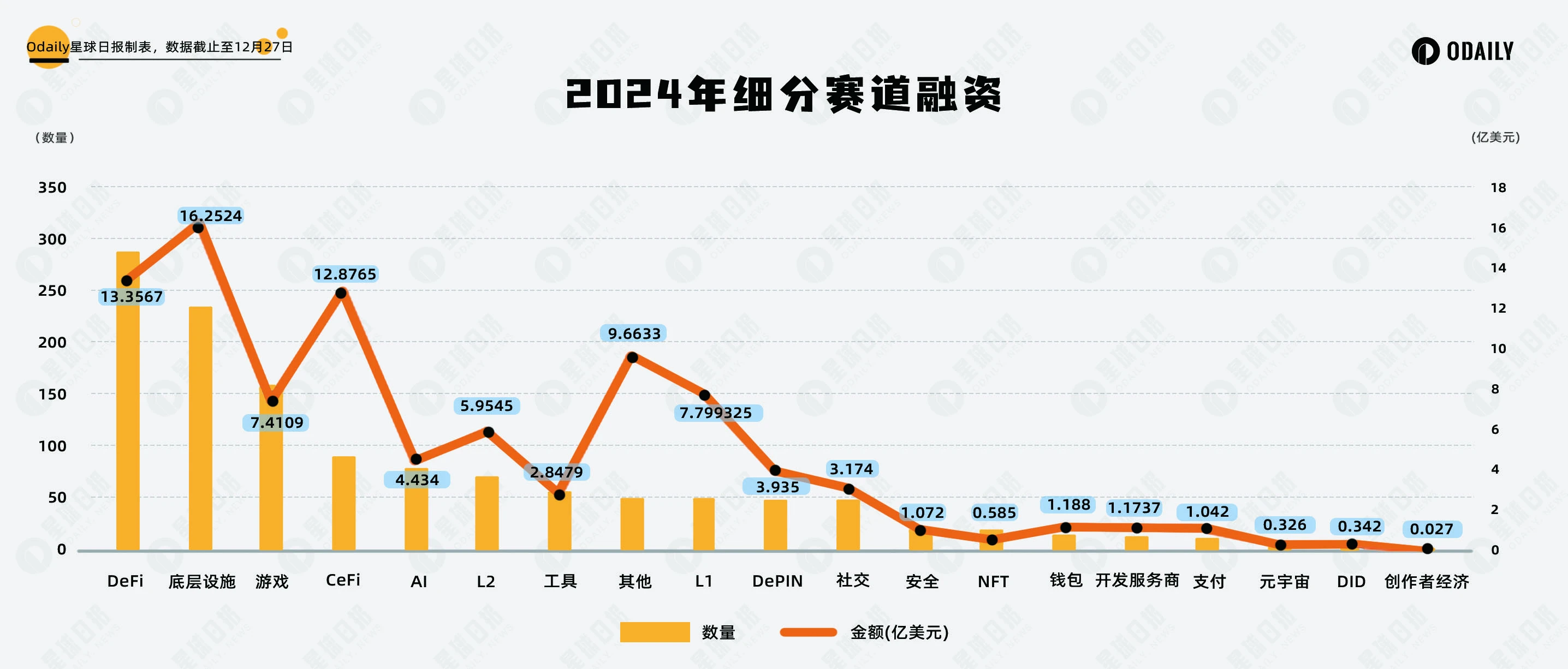

According to incomplete statistics from Odaily Planet Daily, financing events in the segmented tracks in 2024 were concentrated in DeFi, underlying infrastructure and games, with 289 transactions in the DeFi track, 236 transactions in the underlying infrastructure track, and 160 transactions in the GameFi track.

From the distribution of sub-track financing:

Looking at the sub-sectors in 2024, DeFi and underlying infrastructure sectors continue to maintain steady growth, ranking first in both total financing volume and number. This shows that the market demand for decentralized finance and underlying technologies remains strong, whether it is new protocol innovations in DeFi or the continuous optimization of underlying infrastructure such as multi-chain interoperability and blockchain security, which have become the focus of capital attention.

In contrast, the gaming sector performed well in the first three quarters, ranking in the top three in terms of financing, but experienced a significant decline in the fourth quarter, with only 29 projects announcing financing information. This trend reflects the phased weakening of GameFis popularity, and the market is more cautious about its short-term profitability and user growth prospects.

عین اسی وقت پر، the popularity of the AI sector has risen rapidly, becoming a highlight in 2024. In the early days, this track often developed together with other fields (such as DeFi and infrastructure) and was not divided separately. However, starting from the third quarter, the AI sector gradually stood out, especially in the fourth quarter, when the number and amount of financing doubled. The market has shown great concern about the application potential of AI+blockchain, and the rise of AI Agent has further ignited the enthusiasm of capital to invest in this track.

The largest single investment amount was $525 million for Praxis

From the list of the top 10 financing amounts in 2024, we can see that despite the fluctuations in the market environment, investment institutions still have strong confidence in infrastructure projects. Almost all of the top ten projects focus on underlying technologies and innovations, showing that institutions have high expectations for the future development of this track.

L1 public chains still attracted large-scale financing. In the list, in addition to the old public chain Avalanche, which completed a private round of financing of US$250 million, emerging projects such as Monad, Berachain and Babylon also showed strong growth momentum. These projects have won the attention of investors through technological innovation and ecological expansion.

Praxis is the financing champion in this list, with an investment of up to US$525 million. However, the specific development direction of the project is still relatively vague, mainly because it is managed in the form of a DAO organization, and entry into the DAO requires an application, which limits the disclosure of relevant information.

It is worth noting that Paradigm’s dominance in the list is obvious. As a top venture capital firm, Paradigm led the investment in the three major projects on the list – Monad, Farcaster and Babylon.

This article is sourced from the internet: Changes in crypto investment and financing in 2024: primary and secondary markets decoupled, VC projects lose dominance

Related: Matrixport بازار Observation: BTC’s new ATH has arrived. Can it break through $125,000 before the end of the year?

Over the past week, the price of BTC has shown an upward trend. On December 10, the price of BTC hit a low of $94,256 and then steadily rose and stabilized above 100,000. On the 16th and 17th, it broke through $105,000 and $107,000 respectively, reaching a high of $107,793.07 ATH, with the largest increase of 14.36% during the week. As of the time of publication of this article, the price of BTC has stabilized around $107,000, up about 5.6% from the end of last Friday. Affected by BTC, ETH also rose to $4,107.8 on December 16, the highest price recorded since December 2021, slightly higher than the peaks in March and early December this year. (The above data comes from Binance spot, December 17 at 16:30). The market believes…