CowSwap is the DeFi coin with the fastest growth in recent times. It is also one of Vitalik’s favorite DEXs, an on-chain platform dedicated to large-scale shipments, and even the exclusive DEX of the King of Understanding team.

But what many people don’t know is that behind CowSwap is Gnosis, an underestimated top incubator in the Ethereum faction. I think this is the real reason for the surge in $COW.

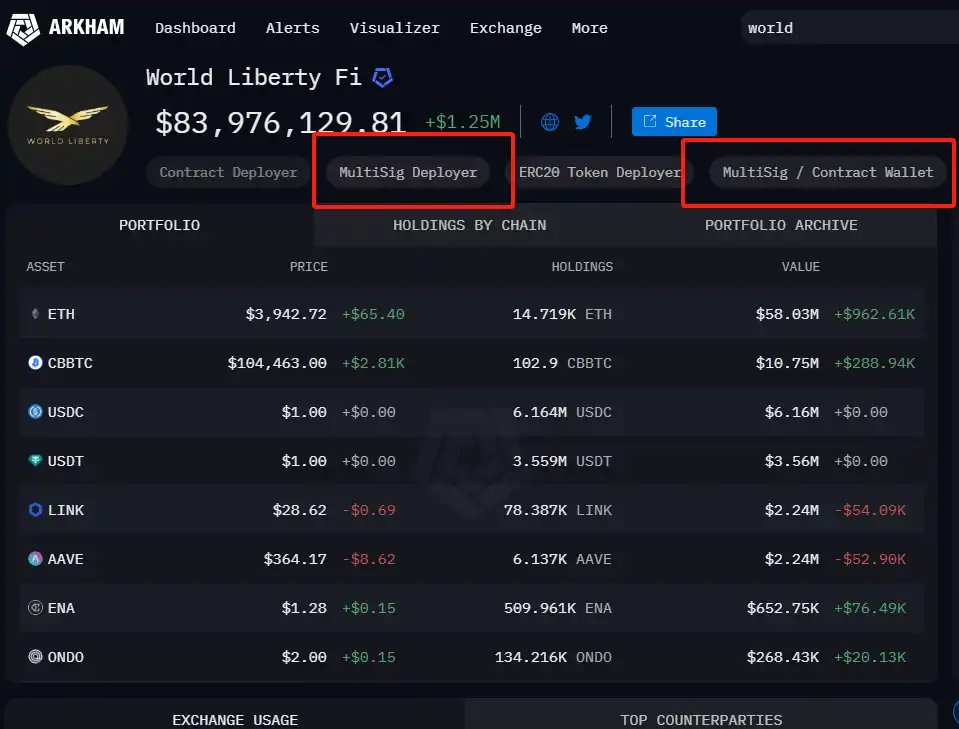

Recently, a news about the Trump teams DeFi project World Liberty Financial (WLFI) on the chain in the Chinese community has attracted market attention. Although WLFIs asset list does not include $COW, according to Ai Yi, an on-chain analyst, WLFI has used CowSwap for its recent token purchases. This coincides with the habit of Ethereum founder Vitalik Buterin to often use CowSwap.

This special on-chain behavior also directly affected market sentiment. On the eve of Trumps inauguration and the hot political concept coins, the price of $COW soared 62% in just one week and soared 162% in one month.

The person behind CowSwap is Gnosis

Gnosis is the powerful force behind CowSwap.

CowSwaps predecessor was Gnosis Protocol V1, which was launched in 2020. It is the first decentralized trading platform to implement ring trading through a batch auction mechanism. Its unique design allows all orders to share liquidity and complete settlement efficiently.

In 2021, Gnosis Protocol V2 launched an innovative solution mechanism (Solvers), which not only greatly improved the efficiency of order matching, but also successfully dealt with the MEV (miner extractable value) problem that has plagued DeFi traders for a long time. In the same year, Gnosis Protocol was renamed CowSwap and became the aggregator we know today.

It can be said that the rise of CowSwap is inseparable from the profound accumulation of the Gnosis ecosystem. In fact, the story of the Gnosis ecosystem can be traced back to 2015.

Compared to the now well-known Polymarket, Gnosis co-founder Martin Koeppelmann began researching decentralized prediction markets earlier. In 2015, he published his thoughts on the combination of بازارMaker and OrderBook on his forum, which was one of the earliest decentralized prediction market ideas in the industry.

Martin Koeppelmann was also one of the earliest Ethereum developers. He joined before TheDAO. Because he lived in Berlin for a long time, he had close contacts with Vitalik who was in the Berlin office at that time.

Over the years, he has participated in many discussions in the Ethereum development community, and often discussed issues such as L2, ZK, and the Ethereum roadmap with Vitalik. Martins comments on social media also show how well he is integrated into the community.

It is based on such technological accumulation that Gnosis has gradually developed a complete ecosystem. From Gnosis Protocol to CowSwap, Martin and his team further derived products such as Gnosis Chain, Safe and Gnosis Pay, and finally formed a highly synergistic ecosystem.

Therefore, mutual integration is natural, and the most representative example is the integration between CowSwap and Safe.

The official wallet of the King family

As the star product of the Gnosis family, Safe is the most popular multi-signature wallet in the Ethereum ecosystem and a wallet for large investors. When Safe issued its tokens this year, the list of the top 100 airdrop addresses was almost entirely filled with project owners or institutions.

In other words, the major users of Safe in the early days were all project owners, not individual users. They include OP, Polymarket, Drukula, Worldcoin, Lido, etc. Related reading: Safe is about to be traded, a look at the token economics and ecology

At first, Safe’s audience was mainly DAOs and کرپٹوcurrency project owners. But as the crypto industry entered the next stage, traditional finance, traditional institutions, family funds, and old money gradually entered the market. However, the threshold for crypto is high. In order to protect funds and play on-chain crypto, the safest way is to use a multi-signature wallet, and the choice is Safe.

Safes design greatly improves the security of fund management. Through the multi-signature mechanism, funds are stored in the smart contract address, and transactions can only be executed after the preset number of signatures (such as 3/10) is met. This mechanism effectively reduces the risk of single point errors. Even if the private key of a signature address is leaked, it is difficult for attackers to obtain enough signatures to complete the transaction. In addition, during the multi-signature confirmation process, the pre-signers signing operation does not need to pay Gas, because the transaction is still in the pending state. Only the last address that signs and confirms the execution operation (such as transactions, transfers, etc.) needs to pay Gas. . This optimization not only reduces the cost of use, but also makes Safe the best choice for institutional users and large households.

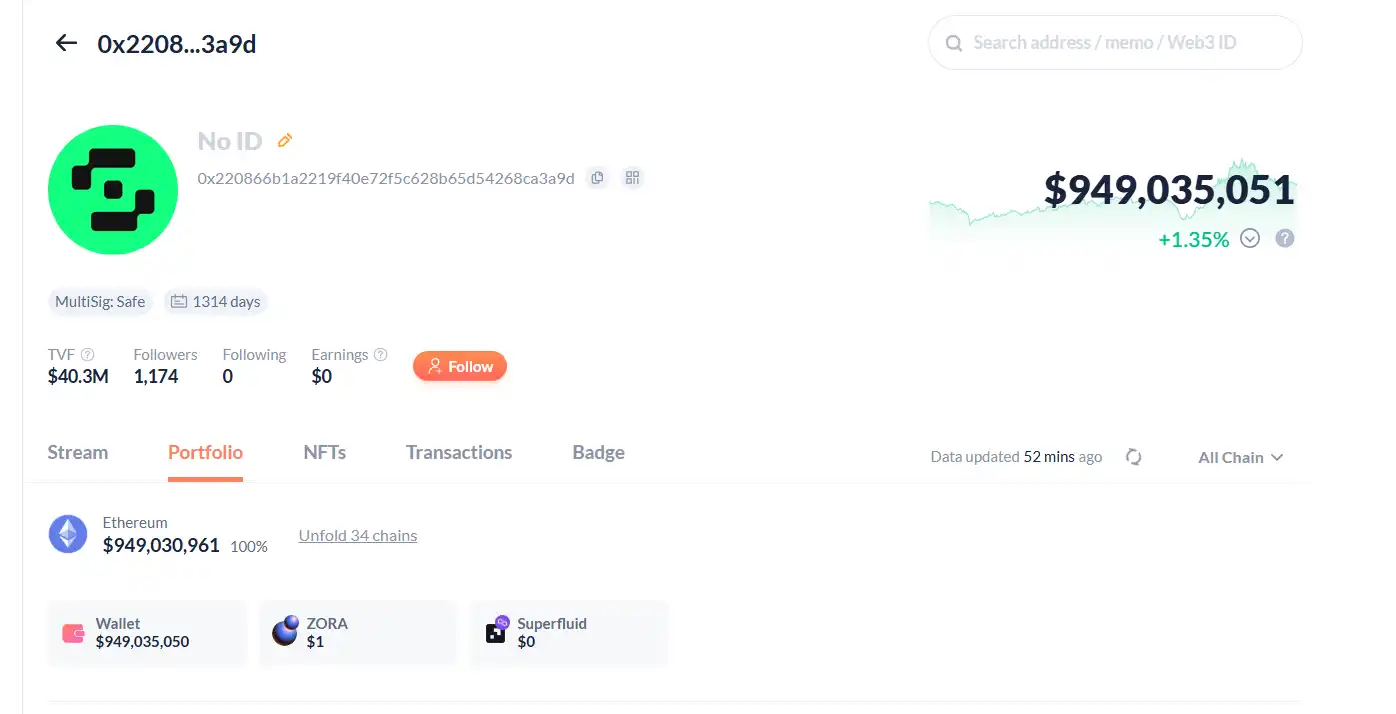

According to the Safe guardian’s disclosure to BlockBeats, there are two simple ways to determine whether an on-chain address is a Safe wallet address: one is the “MultiSig” multi-signature displayed on ARKHAM, and the other is that “MultiSig:Safe” will be directly displayed below the address on the debank page.

Trump project address

Vitaliks address

Most importantly, as part of the Gnosis family, the DEX built into Safe is CowSwap. This is why whales like Vitalik and the Trump team favor CowSwap.

Because from this perspective, Trump, Vitalik and other big whales may not only favor CowSwap because it is an anti-MEV aggregated DEX, but also because of the synergy effect of the Gnosis family, and it is a solution tailored to the real needs of big whales.

From incubator to investment DAO

As mentioned above, the Gnosis ecosystem has been in place since 2015. Initially, it was a prediction market platform based on Ethereum, and later developed into a Gnosis ecosystem, which spawned many projects such as Gnosis Chain, Safe, CowSwap, and Gnosis Pay.

Gnosis Chain, a well-known Ethereum sidechain in the last cycle, focuses on efficient and secure decentralized application construction. According to DefiLlama data, as of the time of writing, Gnosis Chains total locked value (TVL) is $349.31M, including $71.61M of native assets and $277.7M of cross-chain bridge assets. The market value of stablecoins reached $119.98M, of which DAI accounted for 74.07%, and the trading volume remained stable.

Gnosis Chain data, source: DefiLlama

Gnosis Pay is an on-chain payment debit card that provides users and institutions with a convenient payment experience by seamlessly integrating blockchain technology. As well as CowSwap and the multi-signature wallet Gnosis Safe (now called Safe). Related reading: Gnosis Card: The first Visa debit card bound to a wallet is coming .

GnosisDAO is the core governance body of the Gnosis ecosystem, promoting the incubation and development of innovative projects through decentralized autonomy. As the ecosystem incubation became more prosperous, Gnosis dao also began to try investment business.

In addition to incubating well-known projects such as Safe and CowSwap, as early as 2019, GnosisDAO began to deploy in the blockchain field through its investment department GnosisVS, and has supported more than 60 start-ups.

Portfolio projects include: Monerium, an on-chain fiat infrastructure for Web3 builders; Naptha AI, a decentralized platform for AI workflows; and Schuman Financial, a MiCA-compliant stablecoin protocol.

This year, the investment business has been further expanded. In October this year, GnosisDAO approved a proposal to launch a $40 million venture capital fund. GnosisDAO invested $20 million, and the other half came from external limited partners (LPs). This dual structure not only increased the funds capital volume, but also created more opportunities for external cooperation.

The fund, called GnosisVC Ecosystem, will prioritize investments in projects engaged in the tokenization of real-world assets (RWA), decentralized infrastructure, and financial payment channels.

There are three key investment areas: 1. ٹوکنization of real-world assets (RWA): Promote the digitization and chain-up of traditional financial assets through blockchain technology, and provide more liquidity and transparency for the global financial market; 2. Decentralized infrastructure: Cover a wide range of areas from node operations to decentralized computing and storage, and support the efficient operation of the next generation of blockchain applications; 3. Payment channels and middleware: Focus on payment solutions such as Gnosis Pay to provide seamless payment capabilities for the DeFi and Web3 ecosystems.

What is the strength of CowSwap?

It can be said that the rise of CowSwap is more like the best embodiment of the collaborative efforts of the Gnosis ecosystem, but this does not mean that CowSwap itself has not created a new paradigm.

To be more specific, CoW Protocol is a decentralized trading protocol, and CowSwap is a DEX built on CoW Protocol. As its front-end interface, users interact with CoW Protocol through CowSwap.

As the front-end application of CoW Protocol, CowSwap further amplifies the advantages of the protocol. It is called the trading assistant of CoW Protocol. It is a Meta DEX aggregator that can jump between multiple AMMs and other aggregators to help users find the best price in the current market. Unlike traditional DEXs that allow users to compare prices on their own, CowSwaps mission is to save users tedious operations through intelligent matching and ensure that transactions are completed in the most favorable way. From this perspective, CowSwap solves a pain point that DeFi users have long faced: the problem of front-end dependence.

The endgame against MEV is the intention?

Miner Extractable Value (MEV) is a long-standing problem for traders. MEV refers to the additional value that miners or other traders extract from ordinary users transactions by manipulating the order of transactions or inserting orders. Galaxy Digitals report estimates that MEV robots have extracted up to $300 million to $900 million in user benefits on the Ethereum network alone.

This is very unfriendly to large investors and whale traders. Even Ethereum founder Vitalik Buterin himself has been troubled by this problem because he is often “squeezed”. Therefore, the MEV problem is also one of the issues that Vitalik pays most attention to in the process of building Ethereum, and he often mentions this issue in various speeches and Ethereum roadmaps.

CowSwap solves this problem very well.

In traditional DeFi interactions, user operations (such as asset bridging, exchange, pledge, and withdrawal) interact directly with on-chain contracts. This design is not only complex, but also exposes the users transaction needs, making it easy to become a target of MEV robot attacks. Therefore, CoW Protocol fundamentally changes this interaction mode by migrating the users transaction needs from on-chain to off-chain processing. This solution is called off-chain preprocessing, and it also has a more familiar name called intention transaction.

The intention process is essentially an off-chain preprocessing black box. The users intention will be placed in an invisible preprocessing center. After collecting and preprocessing the users transaction needs, CowSwap introduces third-party Solvers off-chain to match and process transactions. This mechanism brings multiple benefits. It not only greatly reduces the risk of users directly contacting the chain, but also optimizes the liquidity management of the protocol, making user transactions more efficient, secure and private.

To be more specific, through intentional narrative, CoW Protocol has designed three core protection mechanisms for the MEV problem:

1. Unify the clearing price batches

CoW Protocol introduces a uniform clearing price mechanism. When the same token pair (such as ETH-USDC) is traded multiple times in a batch, all traded assets will be cleared at the same market price. This mechanism makes the order of transactions irrelevant, fundamentally eliminating the possibility of MEV robots making profits by reordering transactions. More importantly, this mechanism also solves the price inconsistency problem caused by the constant function market maker (CFMM) model in traditional AMMs (such as Uniswap), providing users with a fairer trading environment.

2. Entrusted transaction execution

The users transactions are executed by a guaranteed third-party solver (Solvers), avoiding direct exposure to the MEV risk on the chain. Solvers need to ensure that the transaction price is not lower than the price signed by the user, and optimize liquidity through off-chain matching or private market makers. This design not only reduces the price risk of users, but also greatly improves the execution efficiency of transactions.

3. Coincidence of Demand Model

Compared with the traditional automated market maker (AMM) or central limit order book (CLOB) model, the advantage of CoW Protocol lies in its core auction mechanism. This mechanism allows multiple transactions to be carried out simultaneously, like an efficient large-scale market promotion. In this event, whoever can find the best match will gain the most benefits. This is the so-called Coincidence of Wants (CoWs), which is also the origin of the name of CoW Protocol, which cleverly forms the word spelling of cow.

متعلقہ پڑھنا: Single-day increase of more than 40%, what is special about CowSwap?

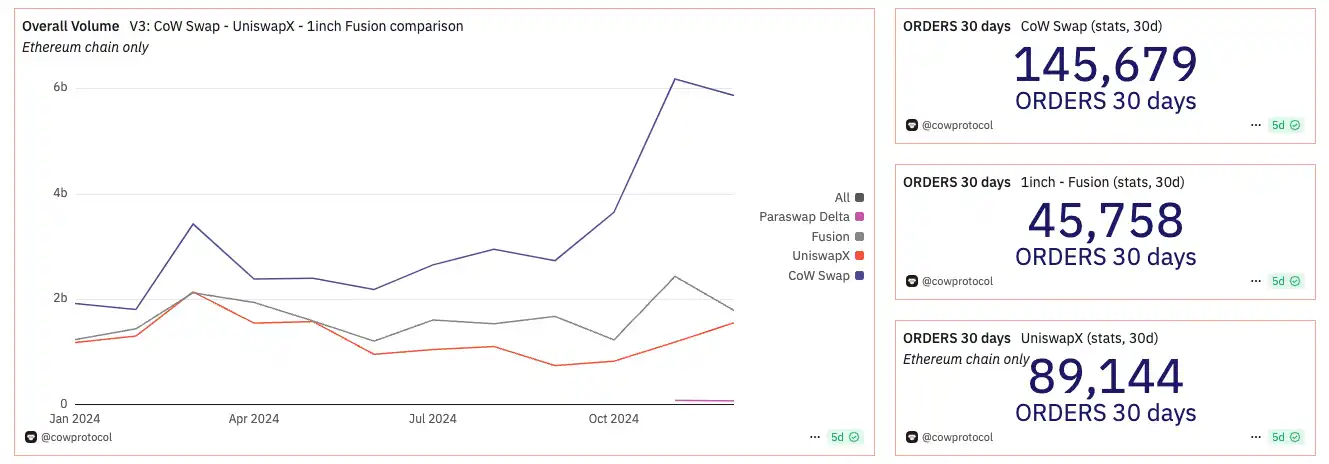

Therefore, driven by Gnosiss ecological flywheel and CowSwaps products, CowSwaps transaction volume on the Ethereum chain has been very rapid in the past 30 days.

Past feud with Uniswap

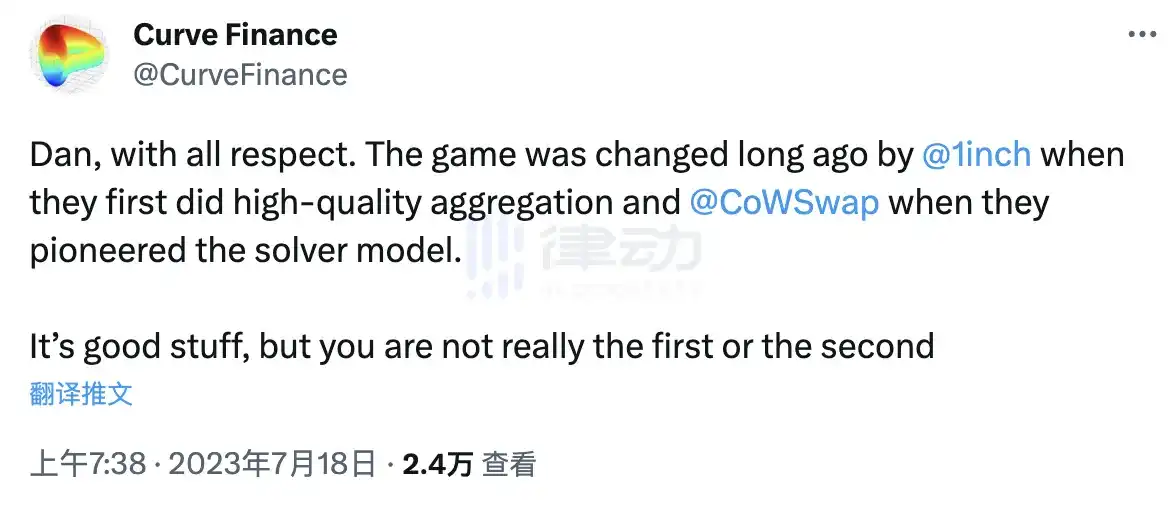

Many people don’t know that CowSwap and Uniswap have some past grievances. Last year, UniswapX, announced by DEX leader Uniswap, was involved in a CowSwap plagiarism scandal.

After Uniswap released version V4, it immediately announced the launch of UniswapX, but the community was very dissatisfied with UniswapX and there was a lot of discussion. Some people directly asked: What is the difference between UniswapX and CowSwap? Some people even joked that UniswapX should thank the open source spirit of the crypto industry.

The official account of Curve Finance commented directly: With all due respect, the rules of the game changed a long time ago: when 1inch first conducted high-quality aggregation, and when CowSwap launched the Solvers model. UniswapX is good, but it is not a pioneer, nor even the second player. Related reading: Mixed praise and criticism, is Uniswap the Tencent of the cryptocurrency circle?

This kind of public pressure has posed a considerable challenge to Uniswap. As if to get rid of the title of Tencent of DEX, two months ago, Uniswap Labs launched the Ethereum Layer 2 network Unichain based on OP Stack, finally making a small comeback.

One of the major innovations is that Unichain has innovated the MEV revenue distribution mechanism. Through the trusted execution environment (TEE), part of the MEV revenue is directly distributed to users or liquidity providers (LP) to achieve fairer value sharing.

In addition, MEV revenue is injected into the validator and user reward pool in proportion. This mechanism not only reduces the participation risk of LP, but also encourages more users to participate in ecological construction.

Wintermute is coming on a rainbow of clouds

From this point of view, CowSwap’s products are good, but there are many ways for useful products in the cryptocurrency circle to “die”. Not many can be listed on top trading platforms, and not many can increase by 162% in a month.

If we go back to 4 months ago, we will find that the beginning of the rise in COW coin price was the cooperation with Wintermute.

Initially, in order to increase on-chain liquidity, CoW DAO proposed to allocate 10 million $COW tokens to inject liquidity into the ETH/COW market. This proposal includes an innovative strategy: some $COW tokens will be converted into ETH and injected into a new Function Maximizing AMM (FM-AMM) liquidity pool together with the remaining $COW. FM-AMM is different from traditional AMMs in that it can effectively eliminate the high profits of most MEV attacks and arbitrageurs while reducing risks for liquidity providers (LPs).

However, on-chain liquidity alone is still not enough to meet market demand, and the depth of the centralized trading platform is also important. After all, the market there is bigger and there is more money. At that time, the only way to obtain $COW was through decentralized channels, and the largest pool was ETH/COW on Balancer on the Ethereum mainnet. Without the CEX trading scenario, many users and institutions could not deploy $COW.

At this time, Wintermute came on a rainbow cloud.

Wintermute proposed to borrow 7.5 million COW tokens from the CoW DAO treasury to support liquidity on decentralized and centralized exchanges. This proposal received strong support from the community and officially opened a new chapter in $COW liquidity.

As a leading market maker in the crypto industry, Wintermute is extremely adept at establishing efficient markets between centralized and decentralized trading platforms. Its founding team once worked at traditional financial giant Optiver and has extensive experience in market depth management.

In the months of cooperation, Wintermute provided COW with deep market support for ETH and other trading pairs, ensuring liquidity and providing a stable trading environment for DeFi aggregators such as CowSwap, UniswapX and 1inch. At the same time, Wintermute provided large-scale transaction support for institutions in the OTC (over-the-counter) market, further expanding the user base of $COW.

This two-way market driving effect directly led to a surge in the price of $COW.

Even in the second month of Wintermutes market making, Coinbase announced that $COW would be included in the coin listing roadmap, and launched the COW perpetual contract three months later. Since then, $COW has begun to land on major top trading platforms, and Binance followed closely and launched the COW/USDT spot trading pair.

These are the real reasons why I think $COW surged 162% in one month.

The flywheel effect between the Gnosis ecosystem and Ethereum

From a more macro perspective of public chains, in a bull market, the Solana ecosystem that Wall Street bet on grew very rapidly, while Ethereum was slightly sluggish. However, judging from the dynamics of the Trump teams WLFI project chain, Solana still has a lot of room for growth in serving institutional big players, and the performance of multi-signature products is difficult to match the deep accumulation of Ethereum.

Although Solana also has multi-signature products on the chain, the assets it holds are not on the same scale at all.

Taking Squads, the multi-signature protocol with the most managed assets on Solana, as an example, the current scale of its custody funds is about 170 million US dollars. On the other hand, Safe in the Gnosis ecosystem has a multi-signature custody of assets as large as 89 billion US dollars.

More importantly, the products of the Gnosis ecosystem are not only of astonishing scale, but also form a powerful ecosystem that can serve institutions and large investors through collaboration and deep integration. The security of Safe, the efficiency of CowSwap, and the convenience of Gnosis Pay have helped Ethereum fight for a breath in this round of public chain competition.

What’s more important is that, through project collaboration, the products of the Gnosis ecosystem have formed a good ecosystem service organization and major users, helping Ethereum to “fight for a breath” in this round of public chain race.

It is this synergy that creates the flywheel effect between the Gnosis ecosystem and Ethereum.

This article is sourced from the internet: Who is the real driving force behind COWs 162% surge in one month?

Related: The NFT sector is recovering, what other opportunities are there to participate?

Original author: shaofaye 123, Foresight News Recently, the floor price of Mad Lads has risen to more than 50 SOL, and the floor price of Pudgy Penguins has exceeded 20 ETH. The NFT sector has gradually recovered, and major project parties have also begun to take action. The Pudgy Penguins project has issued PENGU tokens, and Milady Cult has announced that the pre-sale of the Meme project CULT has been TGE. In addition to NFT, what other opportunities are there to participate? This article will take you through the recent changes in the NFT sector. NFT chain data differentiation Although NFT sales have rebounded significantly recently, with NFT sales in November increasing significantly compared to October, most of them were achieved through Ethereum. Compared with the obvious recovery of the…