Gate Ventures Research Insights: ReFi Innovation Opens a New Era of Consumer Applications

تعارف

Web3 uses blockchain technology to build an economic paradigm and cultural system that is completely different from the off-chain world. This paradigm shift shows its unlimited potential, but it also brings compatibility issues with Web2. For Mass Adoption, Web2 users often have completely different means of production and property. We imagine that if the assets of current Web2 users can be put back on the chain, it will not only inject more power into the on-chain economic ecology, but also allow users to obtain greater economic value. At the same time, this also brings richer off-chain asset categories to on-chain applications, promoting the diversified development of the on-chain ecology.

In this regard, WiFi Master Key is a typical case. WiFi Master Key was founded in 2012, when China was in the transition period from 3G to 4G, and Internet traffic fees were high. At this time, WiFi Master Key solved the user pain points of lack of public network and expensive private network through network sharing. Its main business model is to open users home WiFi and create a shared WiFi ecosystem. At its peak, the number of users of WiFi Master Key reached 900m and the MAU was 370m. WiFi Master Key stepped on the vent, but also declined due to the change of the times. On the one hand, Chinas traffic costs have also dropped rapidly, and many operators have begun to launch low-cost home WiFi and unlimited mobile traffic. At the same time, public WiFi facilities have been gradually built and improved. On the other hand, its products rely on cracking other peoples WiFi passwords to achieve sharing, which will lead to higher traffic costs and network jams. This model gradually aroused users disgust and eventually made it lose its market advantage.

Through this example, we can see that WIFI Master Key has built a reusable shared network through the existing huge WIFI infrastructure, and has reached a user base of nearly 1 billion through a nearly free network infrastructure. Web2 users have some existing and large-scale assets, which are restricted by the natural incompatibility of Web3s asset attributes, resulting in these huge assets being unable to exert more value.

We also realize that many existing infrastructures in Web2 can further unleash their potential through Web3s global liquidity, shared open economy, verifiable consensus blockchain, DeFi and other features. We call this model ReFi (Repurpose Fi).

ReFi is fundamentally different from the current DePIN project. Depin devices often require the purchase of hardware, but in fact, the scalability of these hardware is poor. To achieve real success, it is necessary to establish sales networks and supply chains in various places. However, for products that meet rigid demand scenarios, it is not enough to just make money. The competitiveness of the product itself must be sufficient to meet user needs. However, many teams lack both funds and the ability to build a complete ecosystem. Instead, they tend to rely on large sales agents such as KOL to promote mining machines, which eventually becomes a simple Ponzi game.

In contrast, ReFi significantly lowers the entry barrier by repurposing the existing global market of 8 billion users, without the need for additional hardware production and sales.

We will list some of the significant gains that may be brought by onchain of Web2 assets, and provide the community with some entrepreneurial thinking. This model directly avoids the current showy business model of DePIN that relies on hardware production and sales, and directly and widely onboards existing Web2 assets to help entrepreneurs succeed.

Case

WiFi

When ٹوکنomics is combined with WiFi, we found that if the existing scale of WiFi infrastructure can be directly opened to third-party users, users can earn income through WiFi rental and sharing, and projects can provide incentives by issuing Tokenomics.

This model is mainly aimed at users who want free, fast outdoor WiFi and usually need to stay in a certain place for a long time. The free WIFI is provided to thousands of households with existing WiFi infrastructure. With the sharp decline in traffic costs, the speed of the network becomes slower and the lag is the cost. Providing free network often cannot motivate them anymore. However, the introduction of Tokenomics can significantly motivate these users to reopen network resources and realize value exchange and revenue sharing.

The global Wi-Fi market size is valued at $14.5 billion in 2023 and is expected to reach $39.4 billion by 2028, with a compound annual growth rate of 22.2%. In 2024, the revenue of the mobile data market is expected to reach $0.6 trillion. The annual growth rate (CAGR) is expected to be 4.30% from 2024 to 2029, and the market size will reach $0.8 trillion by 2029. These data show that the WiFi sharing model combined with Tokenomics is expected to occupy a place in this fast-growing market.

Bandwidth

Grass is a successful ReFi example. Grasss goal is to directly contribute unused Internet bandwidth and get corresponding rewards. In fact, in the current market, large companies use residential proxy networks to proxy access through the local bandwidth of tens of millions of users, so the server will identify it as a real users access, avoiding DDOS rejection of a single node of a large company. Residential proxies are widely used in crawlers and data analysis, market research, social media management, electronic ticketing and other fields.

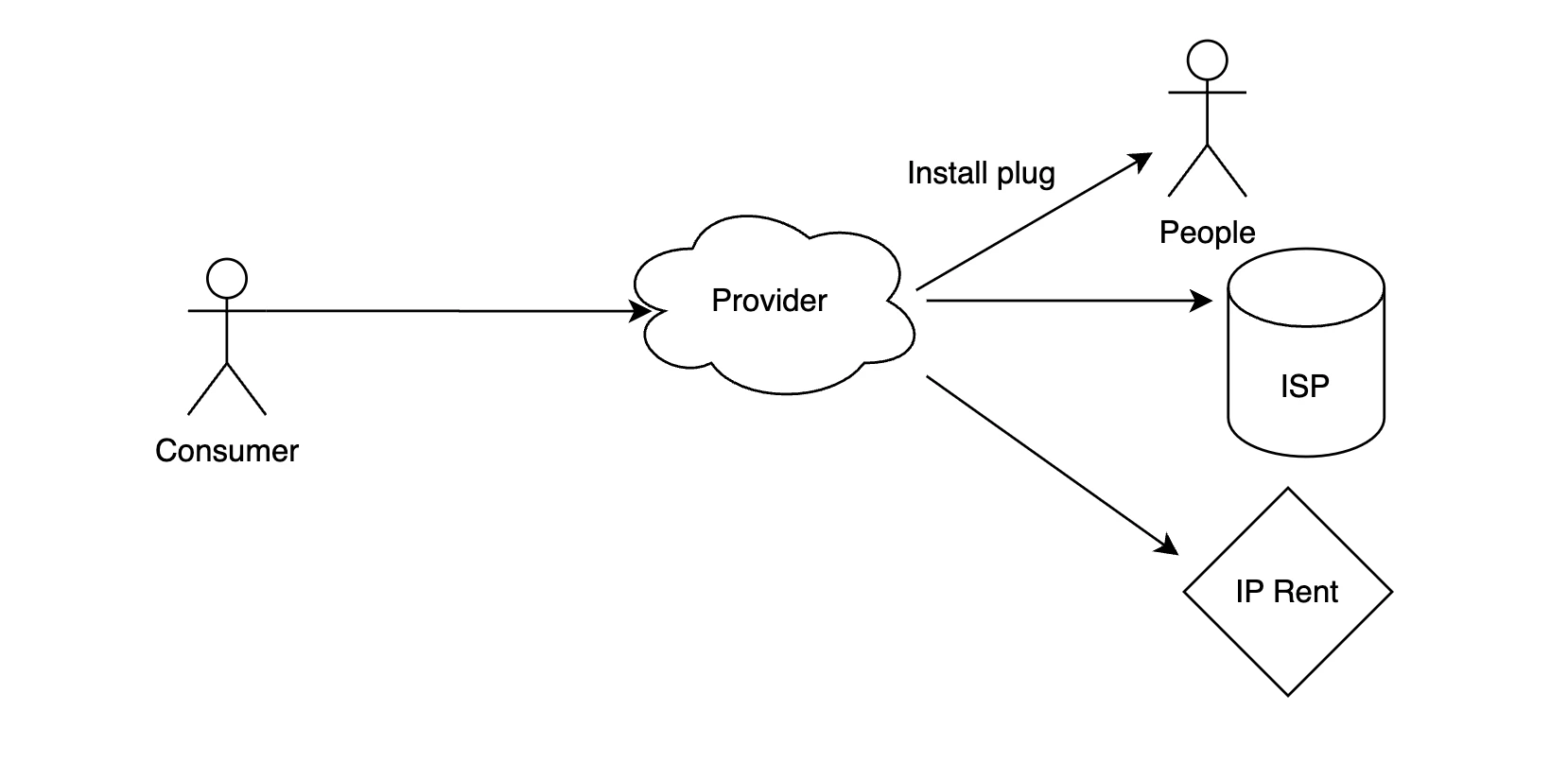

In the past, these companies that needed residential proxies might purchase services from residential proxy service providers. The service providers would obtain residential IPs through three ways: luring users to install plug-ins, ISP providers, and IP leasing companies, but they did not pay users of their important proxy sources. Grass hopes to contribute the Internet bandwidth that users do not fully use, become a large company proxy for Internet resource requesters, and help them access the Internet, so as to make this market open and transparent.

For the consumer group, this market is currently small. In 2023, the global residential agency services market sales were approximately US$620 million, and it is expected to increase to US$840 million by 2030, with a compound annual growth rate (CAGR) of 4.6%.

ڈیٹا

Data contribution from Web2 users is also a potential breakthrough track, especially when LLM and AI Agent are currently facing problems with computing power and high-quality data. Scale AI is particularly outstanding in this area, with its slogan Enpower AI with your data.

Scale AI Business Model, source: Scale AI

Scale AIs main business model is to connect users data, and the task platform connects cost-effective data workers in Southeast Asia. These data workers then label the data uploaded by users, and then input these data into the big model, and score the results of the big model. Data is extremely valuable as a training LLM or Specifically Model. Some people compare Scale AI to a shovel seller. The average hourly wage of data labelers is $1-2. This low-cost labor model helps Scale AI achieve efficient and large-scale operations.

For Web3 projects, we can use tokens to incentivize workers, which can significantly increase their hourly wages. We noticed that Vana, invested by Paradigm, is similar to the Data DAO model. Although it has a complete business model, it may face certain challenges in the environment of Web3, which is an attention investment. The reason is that the reach is too small. It is connected to Data DAO, so users have a low awareness of the product, which may lead to a lack of buying power in the coin price.

A relatively positive example is Aggregate, which directly faces Retailers and uploads ChatGPT conversation content to Aggregata for secondary training of other models. Aggregate has received investment support from Binance Labs. We believe that through the distribution of tokens, data providers and data labelers can be well motivated, and most of the profits will flow to business participants, not just the platform.

Currently, the data annotation market size is USD 838.2 million in 2024 and is further expected to reach USD 10.3462 billion by 2033, with a CAGR of 32.2%.

Energy

Daylight is another successful example, whose slogan is repurpose your surplus energy becoming a new revenue. The company received two rounds of financing from A16Z and Lattice Fund Lead, totaling $13.2 million. Daylight chooses to manage and generate power grids at the edge of the network, and uses tokenization to encourage people to install various electronic devices in their homes, such as solar panels, water heaters, etc., and control these devices through mobile phones while receiving token incentives. Daylight promotes the widespread use of clean energy and balances the transmission load of centralized power grids by adopting token incentives.

This model is closer to DePin, but if we can improve existing clean energy equipment instead of buying electronic equipment and achieve the improvement goal by tokenization, then this will be easier, because Daylight is essentially selling clean energy equipment, but the core of ReFi is to reuse the existing broad asset base. If we cooperate with existing manufacturers to build a system or any specification interface standard, such as manufacturers using those clean energy equipment can directly go on the chain to obtain token incentives, then it may also be a viable business model. We look forward to teams innovating in this field.

According to the report, the global power generation equipment market was valued at USD 110.4 billion in 2022 and is expected to reach USD 173.1 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

خلاصہ کریں۔

In this article, we found that Web3 is inherently incompatible with Web2 users, especially on the Web2 asset side. To this end, we proposed a new direction, ReFi (Repurpose Finance), which uses the existing huge existing infrastructure and user assets of Web2 to گائیڈ these assets to the chain through blockchain technology and token economics, thereby redeveloping their potential.

The core of ReFi is to tap into all the widely used resources in the world, including home graphics cards, WIFI networks, secondary use of bandwidth, data, energy, etc., which can be upgraded based on the huge existing scale. The concept of ReFi has a long history. The biggest difference between it and Depin is that there is no need to repurchase hardware. You only need to use token economics to find new directions for secondary use of the existing large-scale stock market.

However, we need to consider real needs and efficiency at the same time. Some repurpose directions may not be ideal. For example, Grass, where bandwidth is used for residential proxy networks, has a small market size, but this demand itself does not require high efficiency. In contrast, contributing bandwidth to transmit data to help AI data transmission and contributing GPUs for LLM training are not very realistic, because these scenarios have extremely high requirements for bandwidth and GPUs, and efficiency-first scenarios are often difficult to achieve real commercialization under current technical conditions.

We look forward to seeing more application scenarios of ReFi, which will help entrepreneurs directly utilize the existing assets of the worlds 8 billion Web2 users, integrate Web2 assets into the Web3 world through the advantages of blockchains global liquidity, distributed state storage, token economics, and so on, and usher in a new era of value creation and resource utilization.

دستبرداری:

This content does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decision. Please note that Gate.io and/or Gate Ventures may restrict or prohibit all or part of the Services from restricted regions. Please read their applicable user agreements for more information.

گیٹ وینچرز کے بارے میں

گیٹ وینچرز Gate.io کا وینچر کیپیٹل بازو ہے، جو وکندریقرت بنیادی ڈھانچے، ماحولیاتی نظام اور ایپلی کیشنز میں سرمایہ کاری پر توجہ مرکوز کرتا ہے جو ویب 3.0 دور میں دنیا کو نئی شکل دے گی۔ گیٹ وینچرز works with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine social and financial interaction models.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

This article is sourced from the internet: Gate Ventures Research Insights: ReFi Innovation Opens a New Era of Consumer Applications

Related: Weekly Editors Picks (1116-1122)

Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by. Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output. Now, come and read with us: Investment and Entrepreneurship Is an old VC who has gone through three cycles of value investment facing this round of meme anxiety? The polarization of…