Polygon Ecosystem Dilemma: The Borrowing Chickens to Lay Eggs Proposal Causes Concerns, AAVE and Lido Withdrew Collectiv

اصل مصنف: فرینک، PANews

As an important promoter of multi-chain interoperability, zero-knowledge proof applications, and DeFi and NFT ecosystems, Polygon once shined in the last bull market cycle. However, in the past year, many public chain projects such as Polygon have failed to achieve new breakthroughs, but have gradually been submerged in the light of new competitors such as Solana, Sui or Base. When Polygon returned to the discussion on social media again, it was not because of any major updates, but because of the withdrawal of ecological partners such as AAVE and Lido.

Borrowing chickens and eggs proposal raises concerns

On December 16, Aave contributor team Aave Chan released a proposal in the community to withdraw its lending services from Polygons Proof of Stake (PoS) chain. The proposal was written by Aave Chan founder Marc Zeller and aims to gradually phase out Aaves lending protocol on Polygon to prevent possible security risks in the future. Aave is the largest decentralized application on Polygon, with more than $466 million in deposits on the PoS chain.

Coincidentally, on the same day, the liquidity pledge protocol Lido announced that Lido on the Polygon network will be officially deactivated in the next few months. The Lido community said that the strategic refocus on Ethereum and the lack of scalability of Polygon POS were the reasons for deactivating Lido on the Polygon network.

The loss of two major ecological applications in one day was a heavy blow to Polygon. The main reason was the Polygon PoS Cross-Chain Liquidity Plan Pre-PIP improvement proposal released by the Polygon community on December 13. The main goal of the proposal was to use the more than $1 billion in stablecoin reserves held on the PoS chain bridge to generate income.

It is understood that the Polygon PoS bridge holds about $1.3 billion in stablecoin reserves, and the community recommends deploying these idle funds into carefully selected liquidity pools to generate income and promote the development of the Polygon ecosystem. Based on the current loan interest rate, these funds may bring about $70 million in income per year.

The proposal proposes to gradually put these funds into a vault that complies with the ERC-4626 standard. Specific strategies include:

DAI: Deposit Maker’s sUSDS, the official yield token of the Maker ecosystem.

USDC and USDT: Morpho Vaults are used as the main source of income, and Allez Labs is responsible for risk management. Initial markets include Superstates USTB, Makers sUSDS, and Angles stUSD.

Additionally, Yearn will manage a new ecosystem incentive program, using these proceeds to incentivize activity within the Polygon PoS and broader AggLayer ecosystem.

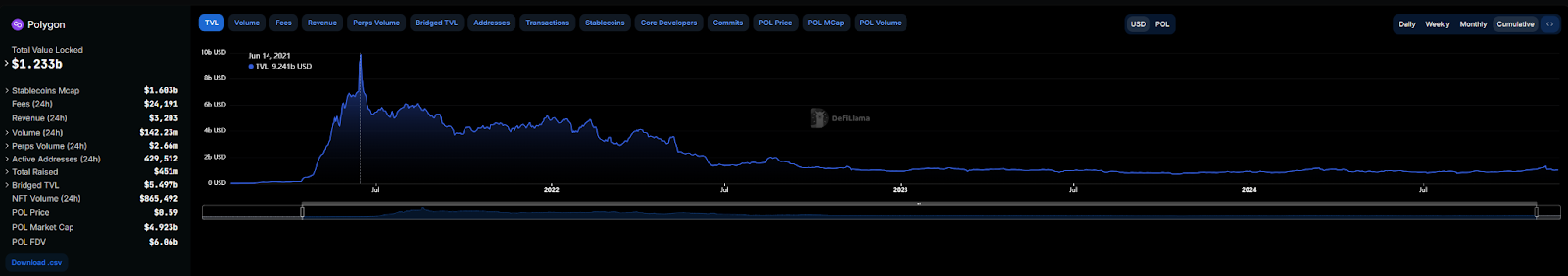

It is worth noting that the proposal was signed by Allez Labs, Morpho Association, and Yearn. According to Defillama data on December 17, Polygons total TVL is 1.23 billion US dollars, of which AAVEs TVL is about 465 million US dollars, accounting for about 37.8%. Yearn Finances TVL ranks 26th in the ecosystem, with a TVL of about 3.69 million US dollars. This may explain why AAVE proposed to withdraw from Polygon for security reasons.

Obviously, from the perspective of AAVE, this proposal is to take AAVE’s money and put it into other lending protocols to earn interest. As the largest application of Polygon POS cross-chain bridge funds, AAVE cannot benefit from such a proposal, but instead has to bear the risk of fund security.

However, Lido’s withdrawal may have nothing to do with this proposal. After all, Lido’s proposal and vote to re-evaluate Polygon was released a month ago, but it just happened to be released at this time.

A helpless move due to weak ecological development

If the AAVE withdrawal proposal is officially passed, the TVL on Polygon will drop to $765 million, which is no longer possible to achieve the $1 billion fund reserve mentioned in the Pre-PIP improvement proposal. Uniswap, the second largest in the ecosystem, has a TVL of about $390 million. If Uniswap also follows up with a similar plan to AAVE, the TVL on Polygon will drop sharply to around $370 million. Not only will the annual interest-bearing target of $70 million not be achieved, but all aspects of the entire ecosystem will be affected, such as the price of governance tokens, active users, etc. Perhaps the loss will be far more than $70 million.

So, judging from this result, this proposal does not seem to be a wise move. Why did the Polygon community propose this plan? In the past year of development, what is the status of the Polygon ecosystem?

The most prosperous time for the Polygon ecosystem was in June 2021, when the total TVL reached 9.24 billion US dollars, 7.5 times todays. As time goes by, Polygons TVL curve has been declining. Since June 2022, it has been maintained at around 1.3 billion US dollars, without much fluctuation. By 2023, it once fell to around 600 million US dollars. In 2024, the market rebounded, and Polygons TVL volume was still below 1 billion US dollars in most cases. It barely rose to more than 1 billion US dollars from October.

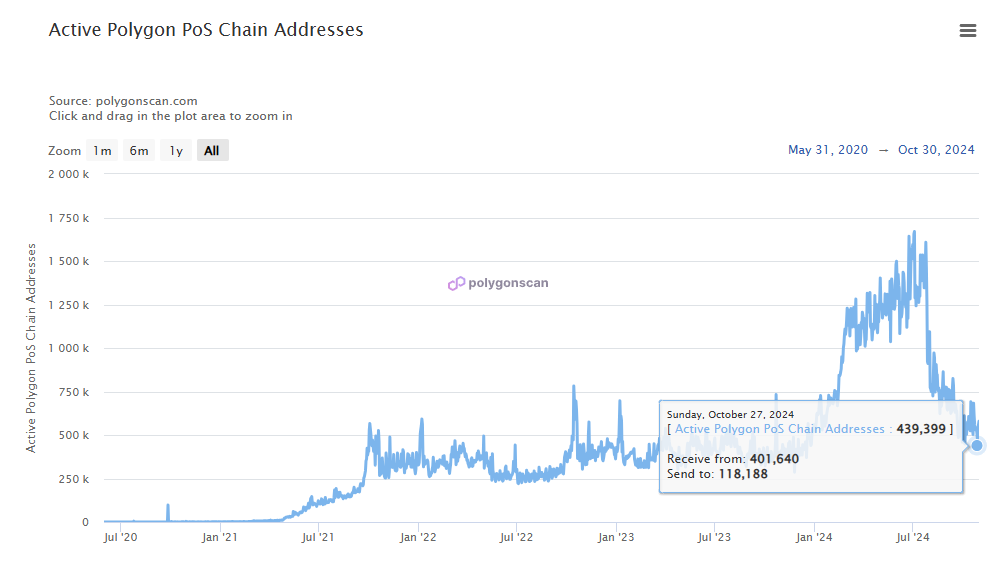

In terms of the number of active addresses, Polygon PoS had about 439,000 active addresses on October 29, which is almost the same as the data a year ago. Although the number of active addresses of Polygon PoS increased significantly from March to August this year, reaching 1.65 million at one point, for some reason, it cooled down rapidly when the market was at its hottest.

The market performance of the token is also poor. From March to November 2024, the price of POL tokens did not follow the rise of the Bitcoin market, but fell all the way, from $1.3 at the beginning of the year to $0.28, a drop of more than 77%. It has only started to rebound in the past one or two months. The price has recently rebounded to around $0.6, but it still needs to increase by about 5 times to reach the historical high of nearly $3.

Technological innovation + brand upgrade is not as good as giving money

Despite the weak development of the ecosystem, Polygon has not given up on technology and products, and has repeatedly released information on technological innovation and product layout in the past year. The most eye-catching performance is naturally the development of the prediction market Polymarket in the past year. In addition, in October, Polygon released a new unified blockchain ecosystem AggLayer. According to the official introduction, Agglayer = unified chain (L1, L2, L∞), but it is obvious that the positioning of this new ecosystem seems difficult to understand. In November, the official also published an article specifically explaining AggLayer.

In addition, the ZK proof system toolkit Polygon Plonky 3 in the ecosystem has become the fastest zero-knowledge proof system. Vitalik also interacted on Twitter and said, You won the game.

In addition to technology, this year many established public chains like to reshape their brands by changing their names and tokens. Polygon has already reshaped its brand, changing its name from Matic to Polygon. And in the current market environment, non-disruptive technological innovation seems to have difficulty becoming a narrative advantage for a project. This is indeed a cruel fact for projects like Polygon that are still obsessed with technological innovation or hope to reshape their brands through integration.

What can really attract users and keep them interested is often reward distribution or incentive plans, such as the recently popular Hyperliquid. Polygon wants to reform in this regard, but it obviously has few cards to use. In terms of on-chain fees, Polygon only generates tens of thousands of dollars in fees every day, and these incomes cannot arouse users interest. Therefore, there is the borrowing chickens to lay eggs proposal mentioned at the beginning.

But obviously, the owner of the hen does not agree with this business, and Polygon may lose more because of it. Overall, the fundamental reason for the stagnation of Polygons ecological development is that it lacks sufficient user incentives and new narrative driving force. Faced with intensified market competition, Polygon needs to find more attractive market strategies in addition to technological innovation. This is also the common dilemma of most old chains at present.

This article is sourced from the internet: Polygon Ecosystem Dilemma: The Borrowing Chickens to Lay Eggs Proposal Causes Concerns, AAVE and Lido Withdrew Collectively

Related: Innovation in token issuance: “Let the elephant in the room go out”

Original author: Eric SJ (X: @sjbtc 9 ) “We embrace Bitcoin because it has saved the world economy from inflation, but in Web3, we are practicing what we oppose: inflation in disguise through timed unlocking.” The theme of this article will horizontally expand on the issues related to token issuance, from the phenomenon of low circulation and high FDV to the improvement of the Launch paradigm of fair launch. Before that: I have reviewed the evolution of token distribution methods over the years, from free airdrops to the rise of Tap to Earn. Friends who are interested can jump back and read on . 1. The essential problem of low flow and high FDV Even though I have published relevant Chinese reports before, looking back now, I have not really…