Original author: Shaofaye 123, ForesightNews

Recently, the NFT trading platform Blur has seen weekly increases, with a monthly increase of nearly 80%. The NFT sector has seen unusual movements, with a monthly token return rate of 50%. The floor price of the blue-chip NFT series has rebounded by more than 30% in 7 days, and the NFT sector seems to be showing a warming trend. However, compared with the increase in Ethereum ecosystem NFTs, Solana and BTC ecosystem NFTs are still mediocre.

This article will give you a quick overview of the recent NFT data in the Ethereum sector and briefly analyze the reasons for the recovery.

Ethereum NFT sector data is positive

From the overall trend of the NFT sector, according to Sosovalue data, the NFT sector has performed well in the past month, and the overall data is gradually rising. The monthly return on investment can reach 50%, but compared with the nearly 100% monthly return rate of the popular narratives such as PayFi, RWA, and AI, it is still not part of the mainstream narrative of this round of speculation.

Image source: https://sosovalue.com/zh/assets/کرپٹوindex/NFT

According to CryptoSlam data, the overall sales of NFTs have also shown an upward trend. In October of this year, the total transaction volume of NFTs began to grow, breaking the trend of seven consecutive months of decline in monthly NFT sales, reaching US$356 million, an increase of 18% month-on-month. In addition, the number of NFT transactions has gradually increased. In October, the number of NFT transactions reached 7.2 million, an increase of 42% from 5 million in September. In November, NFT sales once again achieved significant growth, an increase of 57.8% from October, exceeding US$562 million. Ethereum network sales exceeded US$216 million, an increase of 12% from October.

Image source: https://www.cryptoslam.io/nftglobal?timeFrame=monthheaderPeriod=30d

Among them, CryptoPunks led the NFT market, with sales exceeding US$49 million in 30 days, a month-on-month increase of nearly 400%. In addition, according to Blur data, the floor prices of the blue-chip NFT series rebounded by more than 30% within 7 days. Among them, the floor price of Bored Ape Yacht Club rose by 72% in 7 days, the floor price of Pudgy Penguins rose by 29% in 7 days; the floor price of Mutant Ape Yacht Club rose by 97% in 7 days.

Compared with the recovery of the ETH NFT sector, the Solana NFT sector is still mediocre. According to CryptoSlam data, the CryptoSlam ETH NFT Composite Index, which measures the performance of the ETH NFT market, has rebounded by nearly 40% in the past three months. The Solanan NFT Index has hardly fluctuated in the past three months, and has fallen by 48% since the beginning of the year. Solana NFT infrastructure TNSR and MPLX have also not seen significant increases.

Image source: https://www.cryptoslam.io/indexes/cseth

Ethereum recovers, liquidity gradually overflows

Ethereum ETF has been hyped since its approval. As the net inflow of ETF continues to rise, the overall Ethereum ecosystem is slowly recovering. According to Sosovalue data, the number of days and amount of net inflows in the Ethereum ecosystem are increasing. The price of ETH has also risen accordingly, with a 45% increase in the past month, from the bottom of around 2,500 to 3,700 US dollars. The re-staking sector Puffer has doubled in the past week, and EIGEN has also increased by 30% in a week.

Source: https://sosovalue.com/zh/assets/etf/Total_Crypto_ETH_ETF_Fund_Flow?page=usETH

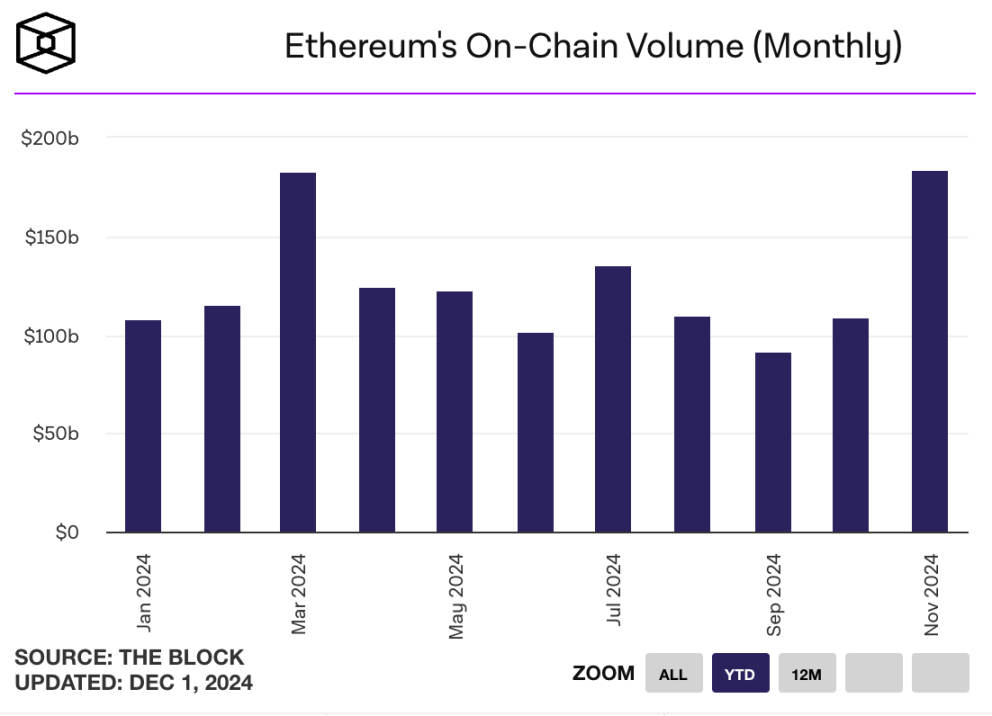

In addition to the recovery of exchange coin prices, on-chain liquidity has also gradually overflowed. According to data from The BLock, the monthly transaction volume on the Ethereum chain has gradually increased since the past three months, and the transaction volume in November exceeded that of March and reached this years peak of US$183.7 billion.

Source: https://www.theblock.co/data/on-chain-metrics/ایتھریم/ethereums-adjusted-on-chain-volume-monthly

In addition to the recovery of Ethereum and the overflow of liquidity, the overall price of the NFT sector is at a historically low level. Users who still hold NFTs for a long time may choose to sell less in the early stage of the launch. From the perspective of circulation and supply, the NFT market may have certain potential. In addition, with the METGE approaching, Truemarkets prediction that the market NFT will attract Vitalik to buy has also attracted considerable attention from the market.

However, whether the NFT market can rise again cannot be sustained by short-term liquidity overflow alone. Further innovation is needed to match demand and implement real application scenarios to be effective.

This article is sourced from the internet: Ethereum liquidity overflows, trapped NFTs are saved

Related: Coinbase founder: Some thoughts on the US election from the perspective of cryptocurrency

Original author: Brian Armstrong Original translation: Luffy, Foresight News I wanted to share some thoughts on the election from the perspective of cryptocurrency and Coinbase鈥檚 mission to increase economic freedom (a very political dimension). Regardless, this election was a huge win for crypto. 1. Pro-crypto Bernie Moreno鈥檚 victory over Sherrod Brown was key to Trump鈥檚 victory in Ohio. Sherrod was one of the most anti-crypto senators. 2. Cryptocurrency has the full support of the victorious presidential candidate Trump. 3. The state completely disavowed Senators Warren and Gary Gensler for years trying to illegally stifle the crypto industry. They both deserve blame for the Democratic Party鈥檚 failure (Biden and Harris should also take blame for this). 4. The next Congress will be the most crypto-friendly Congress ever. StandWithCrypto voters turned out…