BTC’s charge towards the 100,000 mark has temporarily failed. Has the focus of funds changed?

اصل | روزانہ سیارہ روزانہ ( @OdailyChina )

مصنف: ازوما ( @azuma_eth )

BTC鈥檚 first attempt to hit $100,000 appears to be failing for now.

From last night to this morning, BTC has experienced its largest small correction in half a month . According to OKX market data, BTC once fell to 92601.6 USDT this morning. As of the time of writing (around 10:30, the following market data is based on this time point), it is temporarily reported at 94620 USDT, a 24-hour drop of 2.91%.

The reason why we emphasize that it is a small correction is that although BTC has fallen by more than 6,000 USDT compared to yesterdays highest point (98,876 USDT), based on the current price benchmark of US$90,000, the maximum decline is less than 5%, which is somewhat different from our previous thinking habits.

-

The most intuitive difference of this pullback is that Alt-coins did not collapse immediately when seeing the big brother pullback as usual. Although the surge in most Alt-coins that lasted for many days was slowed down, the general decline was not obvious, and some even maintained a small increase.

-

ETH, which is in a state of compensating for the rise, has rarely been tough. As of the time of writing, it is temporarily reported at 3452.2 USDT, with a 24-hour increase of 3.27%. Ecological projects such as LDO, ENS, and EIGEN are temporarily maintaining a strong performance.

-

SOL, which just hit a new high, has entered the callback phase , and is currently at 239.21 USDT, down 4.33% in 24 hours. In addition, perhaps affected by the DEXX hackers shipment, the Solana ecosystem meme sector suffered a general decline, with MOODENG, SLERF, and BONK all falling by more than 10%.

-

In terms of U.S. stocks, MicroStrategy (MSTR) closed at $403.45, down 4.37%; Coinbase (COIN) closed at $312.22, up 2.49%; MARA Holdings (MARA) closed at $26.42, up 1.5%.

کے مطابق سکے گیکو data, the total market value of کرپٹوcurrencies has fallen back to $3.41 trillion, a 24-hour decrease of 2.8%. Cryptocurrency users trading enthusiasm has also increased significantly. متبادل Fear and Greed Index reported 79 today. Although the level is still extreme greed, it has dropped significantly from the average of 90 last week.

مشتق تجارت کے لحاظ سے، کوئنگ گلاس data shows that in the past 24 hours, the entire network has a liquidation of US$526 million. Although long orders still account for more than half of the liquidation, the scale of short orders is also as high as US$141 million. In terms of currencies, BTC liquidated US$146 million and ETH liquidated US$86.93 million.

Reasons for pullback: profit taking overbought adjustment

In response to the short-term correction trend of BTC, various institutions/traders have given their own market judgments.

In its latest report, Bitfinex mentioned that long-term holders (LTH) have started to take profits.

Crypto Banter analyst Kyledoops also mentioned the same data, pointing out that long-term Bitcoin holders have sold 128,000 BTC, although the Bitcoin spot ETF absorbed 90% of the selling pressure during the same period.

Another group of views focused on the markets overbought structure.

Bitcoin has been overbought since Trumps election, so its normal for the rally to stall, said Stephane Ouellette, chief executive of cryptocurrency investment firm FRNT Financial Inc.

Tony Sycamore, market analyst at IG Australia Pty, also said that the recent Bitcoin pullback was a much-needed correction to remove overbought data, rather than a reversal lower or anything sinister.

بازار outlook: Is ETH more optimistic?

As for the future market trends, different parties hold relatively different views.

Adrian Przelozny, CEO of cryptocurrency exchange Independent Reserve, said that the current bullish market sentiment will continue until 2025; at the same time, well-known trader Eugene posted a message saying that he had taken profits on long positions and advised investors to remain cautious.

Relatively speaking, ETH, which has begun to enter the stage of compensatory growth, seems to have a more optimistic subsequent trend.

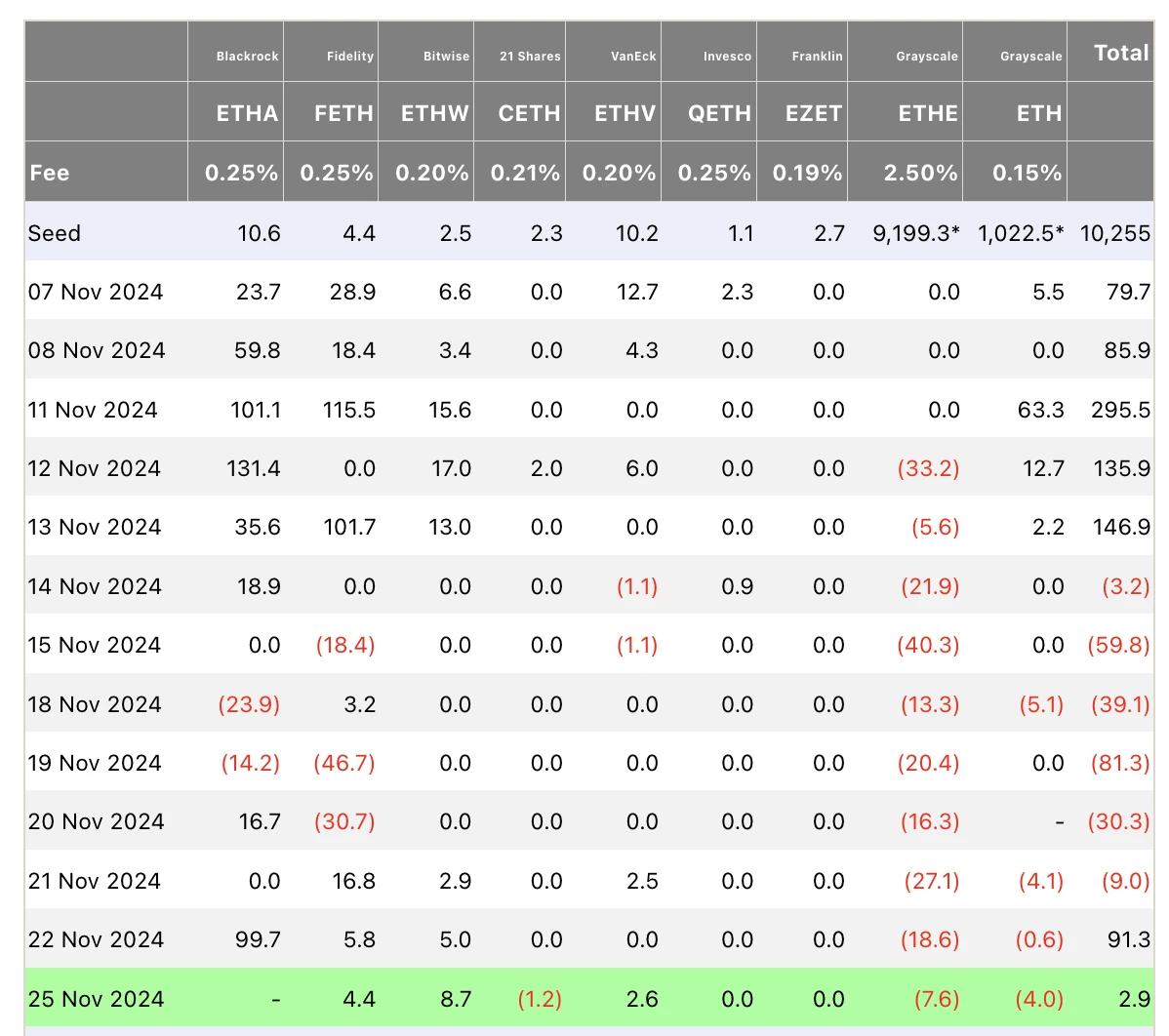

On the one hand, the BTC spot ETF has begun to turn to net outflow, ending a week-long net inflow trend; but on the other hand, the ETH spot ETF has seen net inflows for two consecutive days, also ending a week-long net outflow trend.

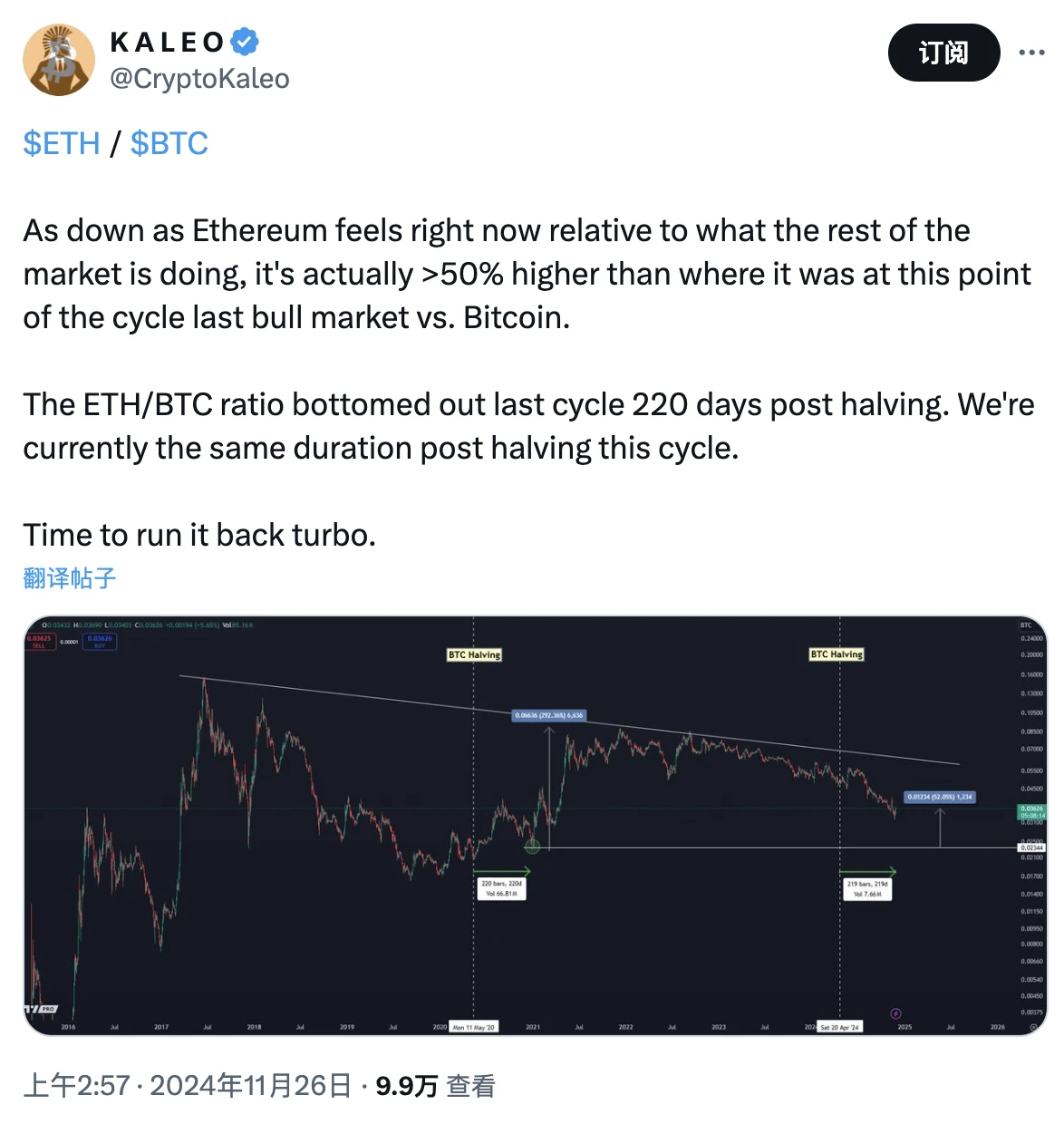

At the same time, well-known analyst Kaleo posted historical data showing that in the last bull market, the ETH/BTC exchange rate bottomed out 220 days after the halving, and today is exactly the 220th day after this halving…

Considering that ETH has recently shown a long-awaited upward trend against the market, it is not ruled out that a similar scenario will be staged again.

As for where the main funding for old currencies is? The tweet by Ryan Sean Adams, co-founder of Bankless, is clear in its direction. After Meme Godfather Murad called on Chinese Meme coin players to join the Meme coin super cycle in Chinese, Ryan posted a Chinese tweet ایکس پلیٹ فارم پر saying, Ethereum is money (very much like the machine translation of Ethereum is money), and openly called for Ethereum. Previously, he had (also relatively empty) posted that When demand finally arrives, ETH will experience an unprecedented supply shock, and then Ethereum will be in short supply.

This article is sourced from the internet: BTC’s charge towards the 100,000 mark has temporarily failed. Has the focus of funds changed?

Turbos.Fun, the meme token launch platform on Sui Chain , is now officially launched and fully open to project owners and users. In the pre-release phase, Turbos.Fun has attracted more than 200 projects to actively register and support. Within just 2 hours of the launch of the platform, more than 260 projects have successfully launched tokens, fully demonstrating the markets high recognition of Turbos.Fun and great interest in the Sui ecosystem. Through a fair and transparent issuance mechanism, as well as innovative features such as locked liquidity and continuous income, this platform has brought a new launch experience to project parties and users, further consolidating its important position in the field of meme tokens on the Sui chain. As a product incubated by Turbos Finance, Turbos.Fun provides project owners with…