Bitcoin hits new high, while copycat stocks plummet. Who made your money?

If I didnt look at the big cakes and only looked at the copycats, I would have thought it was March 12. This was the helpless sigh of a community member.

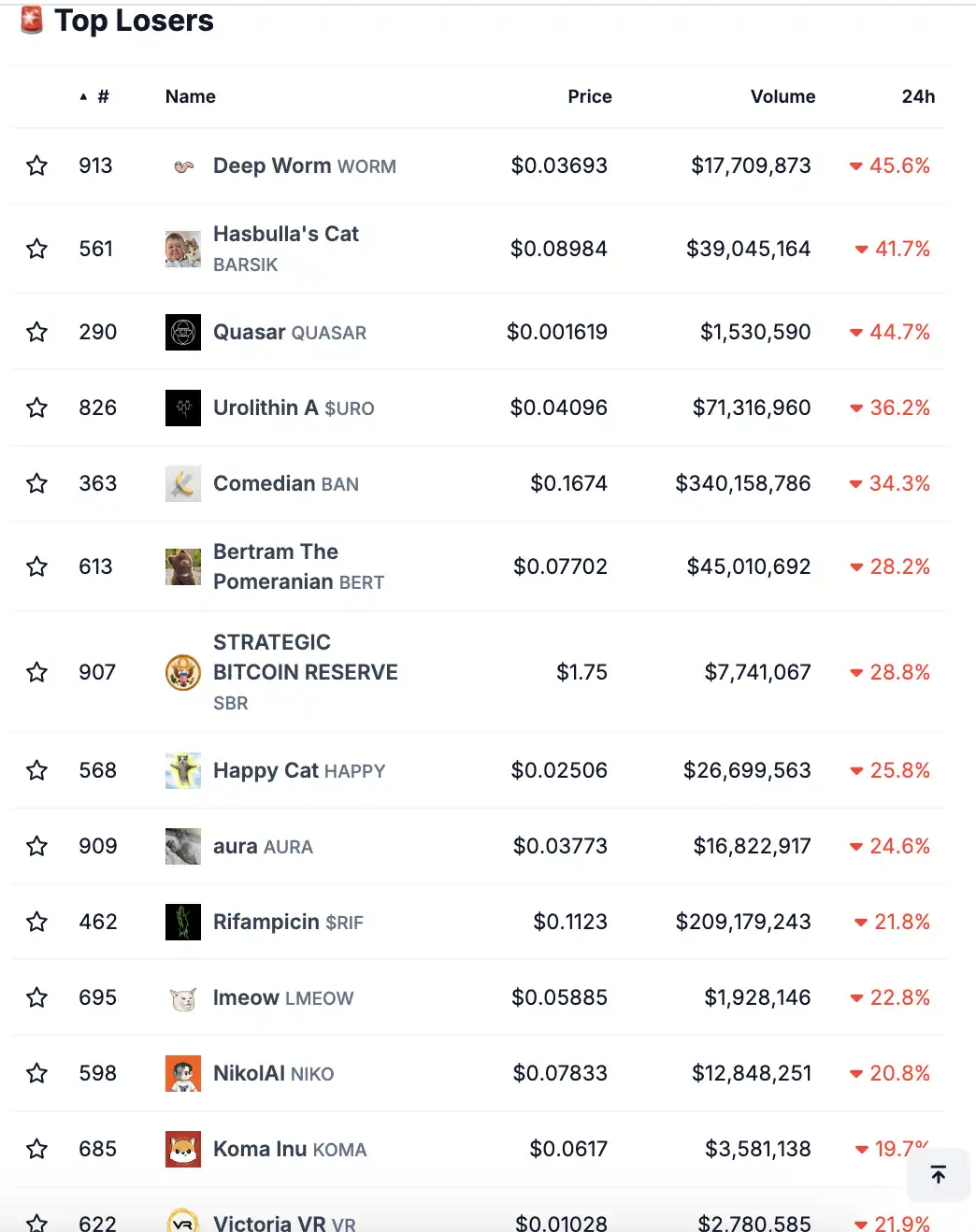

This sigh is not groundless. The on-chain data truthfully presents a tragic scene: the red downward trend is ruthlessly devouring the communitys hope, and there is widespread grief. Taking the BIO ecosystem as an example, $URO fell by as much as 36.2%, and $RIF was not to be outdone, falling by 21.8%.

A flood of profit-taking

Since Trump confirmed that he would return to the White House, the altcoin season has come like a tsunami, with crazy growth and fierce and cruel PVP. The great waves have created a large number of new rich people in the کرپٹوcurrency circle.

For example, a smart money address GcYC 1…quyt 6 opened a position in $RIF at a low point in late September when the DeSci Meme narrative had not yet taken off, and made a profit of $1.05 million with only $14,000, with a return rate of 7,400%. This is a myth that no trading market dares to imagine, and it can only happen in the cryptocurrency circle.

For example, according to Lookonchain monitoring data, in just 20 days, a trader bought URO with $800 and eventually made a profit of $572,000; he bought RIF with $300 and earned $957,000. This means that he used an initial capital of $1,100 to push the value of his position to $1.62 million, achieving an astonishing increase of 3,503 times and 714 times respectively.

There are countless examples like this. These profitable funds gradually sold altcoins during the rise, causing altcoins to plummet and usher in todays Altcoin 312.

Where will these profitable funds go? Todays market also gave us the answer.

At the same time as the altcoins were collapsing, the price of Bitcoin broke through 97,000, setting a new record. Funds were withdrawn from the altcoin market, flowed back to the trading platform, and finally flowed to Bitcoin. Bitcoin once again used its price to reiterate that it is the mainstay of this market.

The End of Altcoins Is Bitcoin

At this moment, I remembered the story that SBF once wanted to control BTC below 20,000 US dollars.

In the FTX incident and the trial of SBF, Caroline Ellison, CEO of Alameda Research and SBFs ex-girlfriend, testified and gave evidence that SBF had instructed Alameda to continue selling Bitcoin if it exceeded $20,000, in an attempt to keep the price below $20,000.

As for why they did this, although they did not mention it in court, an insider in the community gave the answer: The usual method of market makers on trading platforms is to push up Crypto (mainly ETH and other top 20 currencies) and suppress the Crypto/BTC exchange rate. This is not just FTXs own practice, other trading platforms do the same.

Doing so can slowly erode peoples confidence in Bitcoin and attract all funds to Crypto. Once users trading habits are cultivated, they can smoothly dump huge amounts of junk goods to lower-level players.

After all, after getting used to the explosive trend of the cryptocurrency market and the thousand-fold increase overnight, how many people have the patience to hold only Bitcoin even if it is almost certain to double?

Today, the truth is still the same. The enthusiasm and impetuosity unique to the cryptocurrency community have never changed. However, those real big money players have long understood the value of Bitcoin, exchanging junk altcoins for the Bitcoin in your hands, making long-term plans and waiting for the harvest.

The best example is MicroStrategy. As of November 21, MicroStrategys Bitcoin holdings hit a new high: 331,200 Bitcoins, with an average purchase price of $49,874. It easily made a profit of more than double the cost price.

Not to mention Wall Street giants such as BlackRock. If they start buying Bitcoin in advance when applying for a Bitcoin ETF, their costs are basically controlled to keep the price of Bitcoin between 20,000 and 60,000, and no one knows how many chips they have taken the opportunity to hoard.

Perhaps, for ordinary investors, the wisest choice is to hold on to Bitcoin and have fewer fantasies of getting rich overnight. Use a large position to deploy Bitcoin and only use a small part of the funds to gamble. Do you think you are smarter than Wall Street elites such as BlackRock and MicroStrategy?

Finally, let me end with a story I saw on Twitter today:

“When you had $100,000, you saw that your hands were still stuck with 30 points of altcoins. With mixed feelings, you forwarded the news from Cailianshe that Bitcoin had broken through $100,000. Your friends and family praised your message, saying that you must have made a fortune if you had entered the market earlier. You replied with tears in your eyes: I didn’t make much, just a small profit.”

Hopefully, this doesn’t describe most of us.

This article is sourced from the internet: Bitcoin hits new high, while copycat stocks plummet. Who made your money?

اصل مصنف: 1912212.eth، Foresight News اکتوبر کے اوائل میں مارکیٹوں میں بڑی اصلاح نے کچھ سرمایہ کاروں کو شک میں مبتلا کر دیا تھا کہ اکتوبر، جس نے تاریخی طور پر اوپر کا رجحان برقرار رکھا ہے، اس بار مختلف ہو سکتا ہے۔ نتیجتاً تاریخ ہمیشہ یہی ثابت کرتی نظر آتی ہے کہ یہ زمانہ وہی ہے۔ ستمبر کے آخر میں BTC کے $66,000 کی چوٹی پر چھلانگ لگانے کے بعد، یہ وہیں نہیں رکا، بلکہ $59,000 کی وادی تک پہنچ کر ایک سنسنی خیز واپسی کا تجربہ کیا۔ لیکن یہ اتار چڑھاو ہی تھا جس نے ایک زیادہ پرتشدد ریباؤنڈ طوفان کو جنم دیا! 11 اکتوبر کے بعد سے، مارکیٹ کی صورتحال اچانک بدل گئی ہے، ایک ہی دن میں 3.67% کے تیز اضافے کے ساتھ، بڑھتی ہوئی مارکیٹ کی واپسی کا اعلان کر دیا ہے۔ قیمت ٹوٹے ہوئے بانس کی طرح $63,000 کی اونچی زمین پر واپس آگئی، اور پھر…