The big guys who were crazy about SOL at the bottom of $8 have started to call orders for ETH

Original article by Chris Burniske, Partner at Placeholder

Odaily Planet Daily کے ذریعہ مرتب کردہ ( @OdailyChina )

ازوما نے ترجمہ کیا @azuma_eth )

ایڈیٹر کا نوٹ:

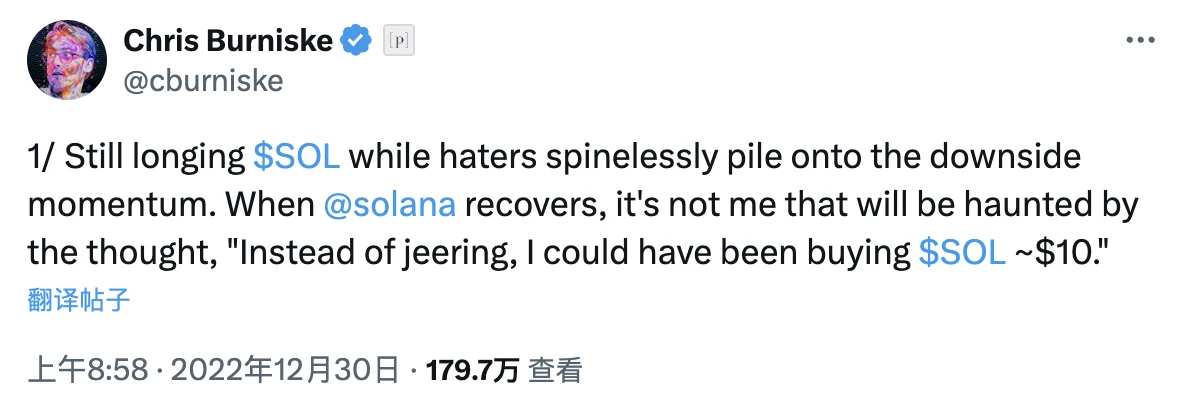

On December 30, 2022, Solana fell into its darkest hour, when SOL once fell to $8, the lowest price since the collapse of FTX. On the same day, Chris Burniske, former head of Ark Invest کرپٹو and current partner of Placeholder VC, published a milky article on X, publicly calling for more SOL and saying that he would continue to increase his position. Everyone knows the story after that. SOL has been soaring all the way, and has recently broken through $240, with a trend of continuing to set new highs.

By November 2024, Ethereum had gradually fallen into a low ebb due to narrative bottlenecks and other reasons. Burniske published a similar milk article again on November 17, publicly supporting Ethereum and predicting that the chain will be revived in the next few years.

The following is the original content of Burniske, translated by Odaily Planet Daily.

One of the reasons why Pplaceholder has been paying attention to Solana in the last bear market is that he believes it will become a mainstream blockchain for ordinary users because it has user experience advantages such as faster speed, lower fees, and smoother transactions. This is being reflected through the meme token craze.

But we have always been supporters of Ethereum, and that has never changed.

In the new cycle, while Ethereum may lose some share of the general user base to Solana (which has already happened) , the Ethereum community should continue to work hard to consolidate the network’s position as the center of the Internet Financial System (IFS). The IFS will become increasingly important between 2025-20230, attracting more users than we have seen so far.

Solana and other blockchains will also compete with Ethereum in the IFS space (which is happening), but Ethereum still has a solid foundation. It has been around for more than ten years, its brand awareness is second only to Bitcoin, it has deep liquidity, and companies can also build their own Layer 2 around Ethereum like Base.

Although everyone knows that Layer 2 architecture has liquidity fragmentation issues (which will be solved), it is a good fit for traditional financial enterprises because it allows enterprises to achieve better control and directly convert profits into profits. Other blockchains such as Avalanche have also been paying attention to this, and they have also adopted a similar subnet architecture and focused on the IFS field.

At recent Ethereum community events, I was excited about the discussion surrounding Ethereum.

The community is learning from this, and during the 2018-2021 bull run, I think the Bitcoin community got complacent because they thought they were successful and had an advantage. Around 2021, BTC was a bit “outdated” and was even mocked as a “baby boomer coin”, which sparked a resurgence and is part of the reason why Bitcoin is rising again in this cycle.

Similarly, it seems to me that parts of the Ethereum community have fallen into the same complacency trap from 2022 to now, but because Ethereum is now being questioned as a laggard, many parts of the Ethereum ecosystem are about to be revitalized.

Much like the resurgence that Bitcoin has experienced, we may see Ethereum undergo the same resurgence in the coming years, driven by self-reflection forced by competition.

The evolution of mainstream blockchains is an extremely long game — anyone who prematurely believes they have won the war will fall into complacency and eventually lose everything. We look forward to seeing how the status of Bitcoin, Ethereum, and Solana evolves in 2030 and beyond.

This article is sourced from the internet: The big guys who were crazy about SOL at the bottom of $8 have started to call orders for ETH

Animoca Brands, a company dedicated to promoting games and digital property rights in the open metaverse , announced today that it has completed a $10 million financing for its Mocaverse, which has previously raised $31.88 million in financing (see the announcement on December 8, 2023 for details ). The funds raised will be used to build an interoperable infrastructure technology stack for consumer adoption of cryptocurrencies and build a large user base ecosystem. At the same time, the investment comes with a free warrant for the utility token MOCA, which has a fully diluted value (FDV) of $1 billion. Participants in this round of financing include OKX Ventures, CMCC Global, Hong Shan (formerly Sequoia China), Republic Crypto, Decima Fund, Kingsway Capital, etc. Their participation will help Mocaverse expand its operating…