Sean and I have known each other for a long time, and the opportunity for further contact came from Nathan.

Last month, Nathan said to me: Brother, let me introduce you to someone. This person has a studio and several friends are trading کرپٹوcurrencies together, mainly MEME coins.

I was shocked to hear that there is such a genius. It seems that our friends in the South are particularly quick to accept new things.

So I made an appointment with Sean the next week and met him and his friends. It was really shocking, everyone had three or four screens, and everyone was doing transactions there.

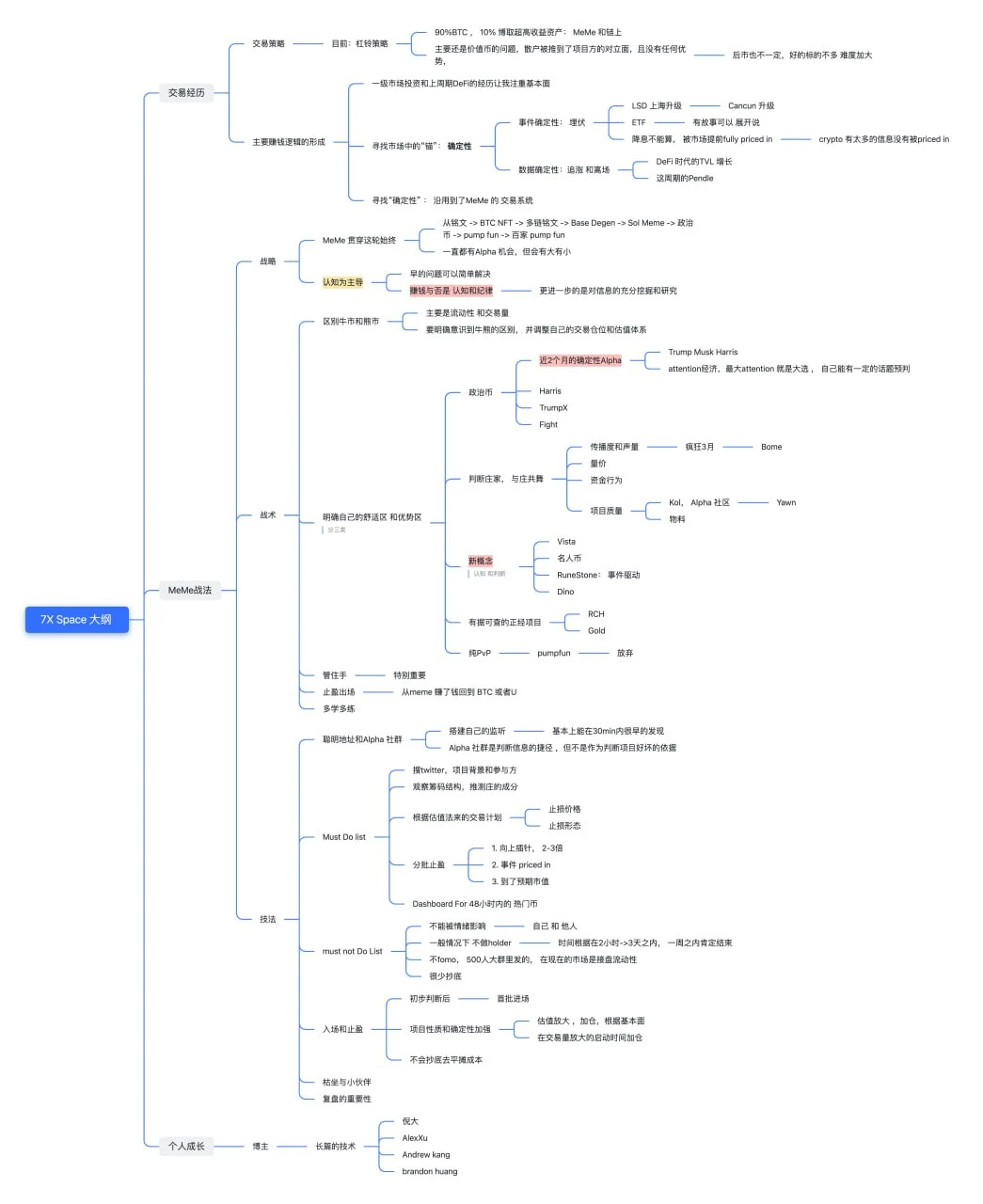

During this discussion on trading strategies, Sean even drew a picture, showing his seriousness.

In 2018, Sean briefly bought some Bitcoin.

But at that time he had no faith, he just made some asset allocation.

In 2020, when I saw the rise of DeFi, I thought it was amazing. I called it awesome and felt it could change the world of finance.

So at the end of that year, Sean started to enter the crypto industry full-time, and he couldnt stop from then on.

Like many of his friends, Sean also started out working in the industry. He worked at BitDigital, a U.S.-listed mining company, where he was responsible for DeFi and Staking.

His strategy is mainly to buy big coins: BTC, Ethereum, and do market neutrality, such as through market neutrality of stablecoins and DeFi, or through arbitrage and market reset strategies.

So what is his specific strategy for making money?

According to Sean, he experienced both the bull and bear markets while working.

In 2024, as the market picks up, I will start trading and investing full time.

He has experienced a lot, from MEME to ETFs, and then to the mini bull market in March, with both gains and losses.

In summary, Seans current trading strategy tends to be a barbell strategy:

-

90% of the funds are invested in conservative assets with relatively high certainty, such as Bitcoin;

-

10% of the funds are used to gain super high returns, mainly in Meme coins or high-risk assets.

The reason for this strategy is that Sean discovered at the beginning of the year:

First, the performance of value coins is not as good as expected;

Second, the overall macro environment is not favorable for value coins, and it is impossible for everyone to make money like last year or in the previous cycle.

For example, in the last cycle, many people made a lot of money through SOL, BNB, and DeFi. At that time, SOL rose from 0.5 yuan to 200 yuan, and their value grew along with the participation of retail investors.

This tells us:

It is necessary to specify appropriate strategies based on the market. The macro environment is unfavorable for value coins. There are many good value coins and they are difficult to identify, so we need to be prudent.

Sean’s thoughts on “assets not priced by the market”:

In April and May of this year, Sean was on a business trip and sleeping on a plane.

When @pumpdotfun was very popular, there was another track that was also very popular, that is, political coins. In addition to the Trump project, Fight was also very popular at that time. Because he was sleeping, he didnt get the earliest wave.

But then a series of things happened, especially the rumors that Biden would withdraw from the election and Harris would take over. At that time, everyone was judging whether Biden would withdraw from the election.

But a little research shows that it is unlikely to be Gavin Newtom or anyone else, because the Biden and Harris campaigns have raised a lot of donations, and this money cannot be easily transferred to other candidates. So the Democratic Party is destined to only lock in Harris as the candidate.

Wall Street and people who are sensitive to American politics have long determined that Biden will withdraw from the election and Harris will be his successor, but this has not yet been transmitted to the cryptocurrency circle.

So Sean ambushed two related Meme coins in the Ethereum ecosystem, one ticker is Harris and the other ticker is Kamala.

Although he didn’t know which one would be the only one, he thought that the loss would be huge if he missed it, so he bought one Ethereum for both. The price of Ethereum rose 5 to 6 times on the day the news was announced, and 15 to 16 times the next day, and 5 to 6 times again after 5 to 6 months.

اس کے علاوہ، Sean will decide whether to chase the rise or exit the market based on the certainty of the data:

In the last cycle of DeFi, he used the law of TVL growth to gain profits. In this cycle, he found that similar opportunities could be realized on @pendle_fi.

At the same time, he will also judge market trends based on changes in data, such as by observing on-chain transaction data, group activity, gas fees, etc., to distinguish between bull markets and bear markets, thereby adjusting trading positions and valuation systems.

This tells us:

Look for and ambush certainty in the market in advance, and sell when the market prices it in.

How can MEME be hyped up to a hundred times its original value?

Sean said he has a complete transaction process: mainly relying on the smart address system and the Alpha community.

Building a smart address system and paying attention to the Alpha community are very necessary for discovering trading opportunities, but you cannot rely solely on them to judge the quality of a project.

When you find a smart address or multiple smart addresses that you are interested in buying a certain coin, you can consider following up, but you need to evaluate the background, story, and valuation of the project. You can try with a small amount of money at the beginning, and then increase your position after confirming the project situation.

At the same time, through the Alpha community, you can understand your position in the project, such as whether you are an early entrant.

The basic process is 👇

1. Understand the project background: After learning about a project, I will search Twitter’s CA to understand its background, participants, and the proportion of Chinese or overseas capital. If I cannot find relevant information, I may withdraw or not participate.

2. Observe the chip structure: determine the composition and operation methods of the banker, such as whether it purchases insider trading by raising taxes, whether there are KOLs and Smart Money bringing in chips, etc., and also observe whether the banker sells and the situation of the front-row profit addresses.

3. Develop a trading plan: Set valuation targets based on market conditions and adopt different profit-taking strategies in bull and bear markets.

4. Set stop loss and trading pattern: Generally speaking, EV can only be tripled, but at the same time, the risk of the coin returning to zero must be borne. In a bear market, the coin may be sold when it doubles or more than doubles, and particularly good coins may be sold at ten times, but according to Seans trading system, it may be sold at a maximum of five or seven times. Sean recommends that the EV setting should be strict enough. In addition, stop loss will be set according to common trading charts and patterns, such as double tops, breaking the previous low or high, etc., and leaving the market.

5. Take profits in batches: adopt a variety of profit-taking methods, such as selling part of the profits when the market explodes during the upward pin to adjust your mentality; exit the market in time when the event Price is in, and decisively take profits when the expected valuation is reached according to the trading plan to avoid raising the valuation target due to the influx of market funds and good project performance.

6. Set up a large-screen dashboard to track popular coins in real time.

This process is Seans winning formula.

What other interests does Sean have besides trading?

Sean prefers to read long articles:

For example, the articles written by Ni Da @Phyrex_Ni are relatively objective, based on facts, and do not contain too much subjective judgment.

There is also Alex @xuxiaopengmint from @Mint_Ventures. He particularly likes the articles Alex wrote about value coins. Although he hasn’t speculated on value coins for a long time and value coins have not been very active recently, there may be new opportunities in October and November.

In addition, there are some overseas bloggers, such as @Rewkang and @brandank_cr, whose market analysis logic is clear and has strong subjective opinions, but they are backed by data. Sean also thinks their articles are also very valuable for reference.

Sean’s advice to newbies:

You need to learn to stop profit in batches. There are three ways to stop profit👇

1. Pushing the needle upward: When the market explodes, it is a very good liquidity exit node, and you must sell part of it at this time. Generally speaking, his experience is that if the coin has doubled to three times, it may be sold. If you buy it late, sell it when it doubles; if you buy it early, sell it when it triples.

When piercing upwards, you must sell off a portion of the profits, which will help you adjust your mentality.

2. Event Price in: Exit at this time, such as Kamala being announced as a candidate, or Trump tweeting on X, these are the Price in nodes of the event, usually accompanied by an upward spike in price.

3. Expected valuation according to your trading plan: When the expected valuation is reached, you must decisively stop profit. You cannot raise the valuation target just because you see market funds pouring in and the project performs well. This is a very emotional approach. You must stop profit at this point, so that you can generally achieve a better exit.

Finally, a little tip:

Sean has a 24-hour and 48-hour Watch List of popular coins. The screen will show popular coins, especially those that have been washed out for a long time and suddenly start to rise. Sean will capture them at the first time and then chase the rise. This is a very good strategy.

Through this method, he seized many good time points to increase positions or take profits.

Finally we talked about how the dealer would also lose money.

I know some friends who are working on projects. They have also invested in many projects. For example, if a project only has hundreds of thousands of US dollars, they will not run away easily.

There are also differences between dealers. There are smart dealers and stupid dealers. Sometimes dealers will lose money. The core logic is actually a problem of funds and emotions. When spending 100 yuan cannot leverage greater profits, it is time to take a break.

After more contact with project parties, sponsors and dealers, I found that their final income is more often calculated on an annualized basis rather than in multiples.

The most important thing for them is certainty, especially being able to sell enough tokens when liquidity is good.

This is why many retail investors now think that buying these tokens is meaningless, because they have nothing to do with fundamental judgment. It is more about tracking addresses and address sets on the chain, which may be more valuable. This is why everyone likes to play with Meme coins now, because at least they will not use packaging stories to deceive us.

This article is sourced from the internet: Dialogue with trader Sean: Money will stay away from those who work hard

متعلقہ: ایک ٹویٹ نے لاکھوں کی مارکیٹ ویلیو میں ہلچل مچا دی۔ DOGE کیا ہے جسے مسک نے بار بار پکارا ہے؟

اصل مصنف: TechFlow BTC ایک پیش رفت کے دہانے پر ہے، اور جو لوگ سب سے زیادہ تکلیف دہ ہو سکتے ہیں وہ ثانوی کھلاڑی ہیں جو کاپی کیٹ مارکیٹ کا انتظار کر رہے ہیں۔ "زوال کی پیروی کریں لیکن عروج نہیں" حالیہ دنوں میں سیکنڈری مارکیٹ کی حقیقی تصویر کشی ہے۔ تاہم، اگرچہ ایکسچینج مارکیٹ بہت مشکل ہے، آن چین مارکیٹ ہمیشہ بھرپور ہوتی ہے، اور مختلف تھیمز اور زاویوں نے کوششیں بند نہیں کیں۔ کلٹ کوائنز کا جنون مکمل طور پر ختم نہیں ہوا ہے، اور مسک کا تصور جس نے گزشتہ عرصے میں ETH مین نیٹ کو اپنی لپیٹ میں لے لیا تھا، ایک بار پھر ہلچل مچا رہا ہے۔ جمع ہونے کی مدت کے بعد، کچھ تصوراتی شعبوں نے دوبارہ مارکیٹ کو کھینچنا شروع کر دیا ہے۔ آج ہم جس تصور پر بات کرنے جا رہے ہیں وہ ہے DOGE، جسے مسک…