سچ کو جھوٹ سے الگ کریں، اور اپنی سرمایہ کاری کی تحقیق کو گمراہ کرنے کے لیے روزانہ ایکٹیو ایڈریس اشارے کا استعمال بند کر دیں۔

Original title: The fallacy of daily active addresses

Original article by Donovan Choy, Blockworks

اصل ترجمہ: TechFlow

Better use of blockchain metrics

Blockchain generates a lot of public data. On Crypto Twitter, people are constantly comparing blockchain A to blockchain B, and investors, researchers, and opinion leaders (KOLs) have many metrics to refer to when defending their opinions. However, the wrong use of these numbers often blurs peoples understanding of the field.

In today’s 0x Research article, we’ll explore three metrics and the issues they present: active addresses, blockchain “profitability,” and total value protection.

Active Addresses

“Active addresses” refers to how many active, paying users there are on a certain protocol.

“Facebook has three billion monthly active users” is a useful piece of information that tells us something about the social network. Since there aren’t enough profitable opportunities for spammers to flood Facebook, active addresses are a good way to assess the true value of the platform to consumers.

But for blockchains, active addresses are less valuable due to how easy it is to create new wallets and the obvious opportunities to profit through airdrops or protocol incentives.

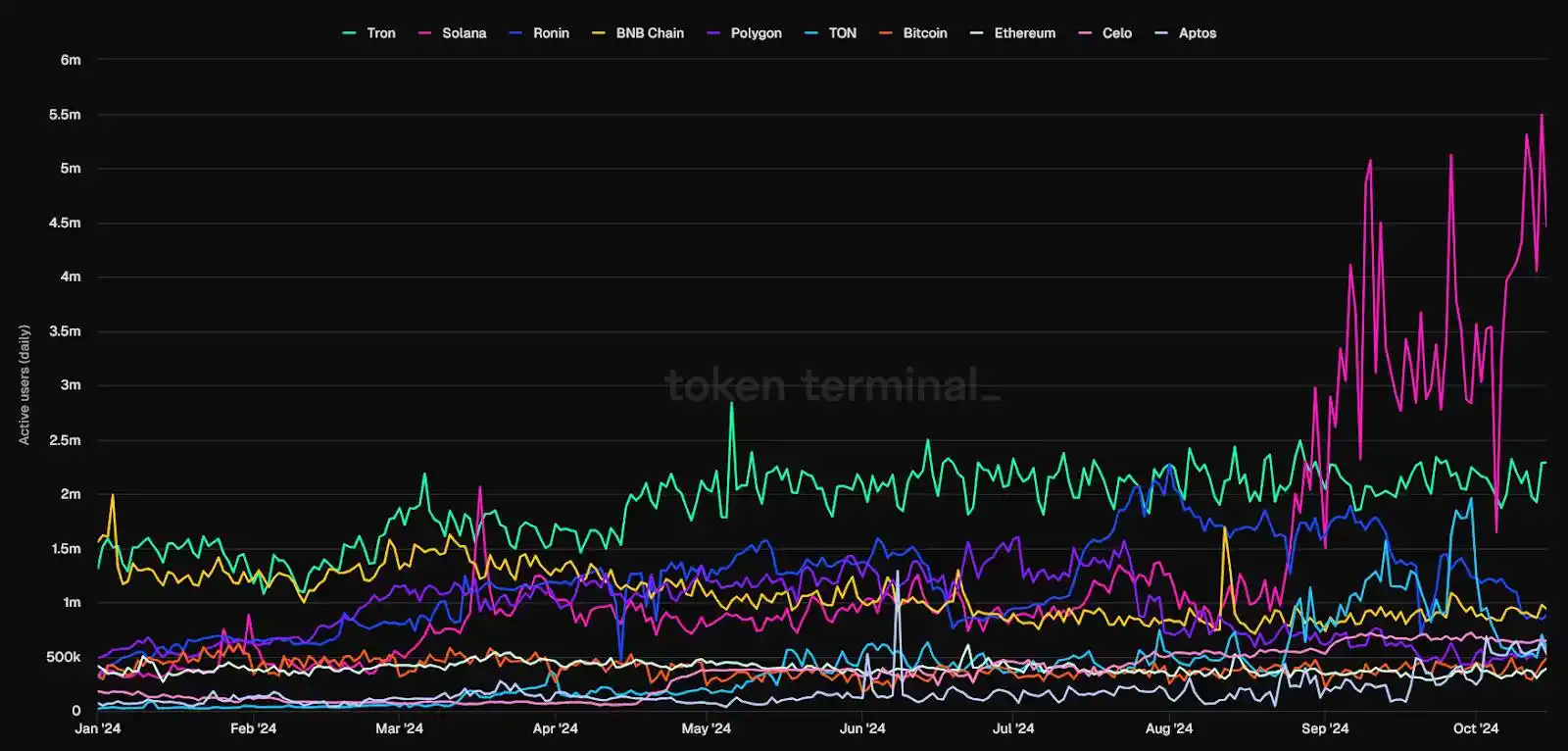

For example, the chart below shows a clear case: Solana has the most daily active addresses over the past month, so Solana looks very active.

ذریعہ: ٹوکنTerminal

Most Solana users trade on decentralized exchanges (DEXs), so we need to take a closer look at activity on DEXs. When we drilled down into Solana’s active addresses on its DEX, we found that the majority of addresses — about 3.4 million, 4.4 million total — traded less than $10 in lifetime volume over the past day.

This suggests that there may be a large amount of spam or bot activity due to Solana’s low transaction fees, rather than a large number of “quality” users.

Source: Blockworks Research

Here’s another example I mentioned earlier: Celo L1 (now L2) saw a surge in daily active addresses sending stablecoins to 646,000 in September. This number surpassed Tron, and thus caught the attention of Vitalik Buterin and CoinDesk.

After further analysis, Jack Hackworth, a data analyst at Variant Fund, found that 77% of Celo addresses transferred less than two cents, mainly because thousands of users received tiny amounts of funds through a universal basic income protocol called GoodDollar. In both cases, active addresses showed high usage, but after careful analysis, this statement did not hold true.

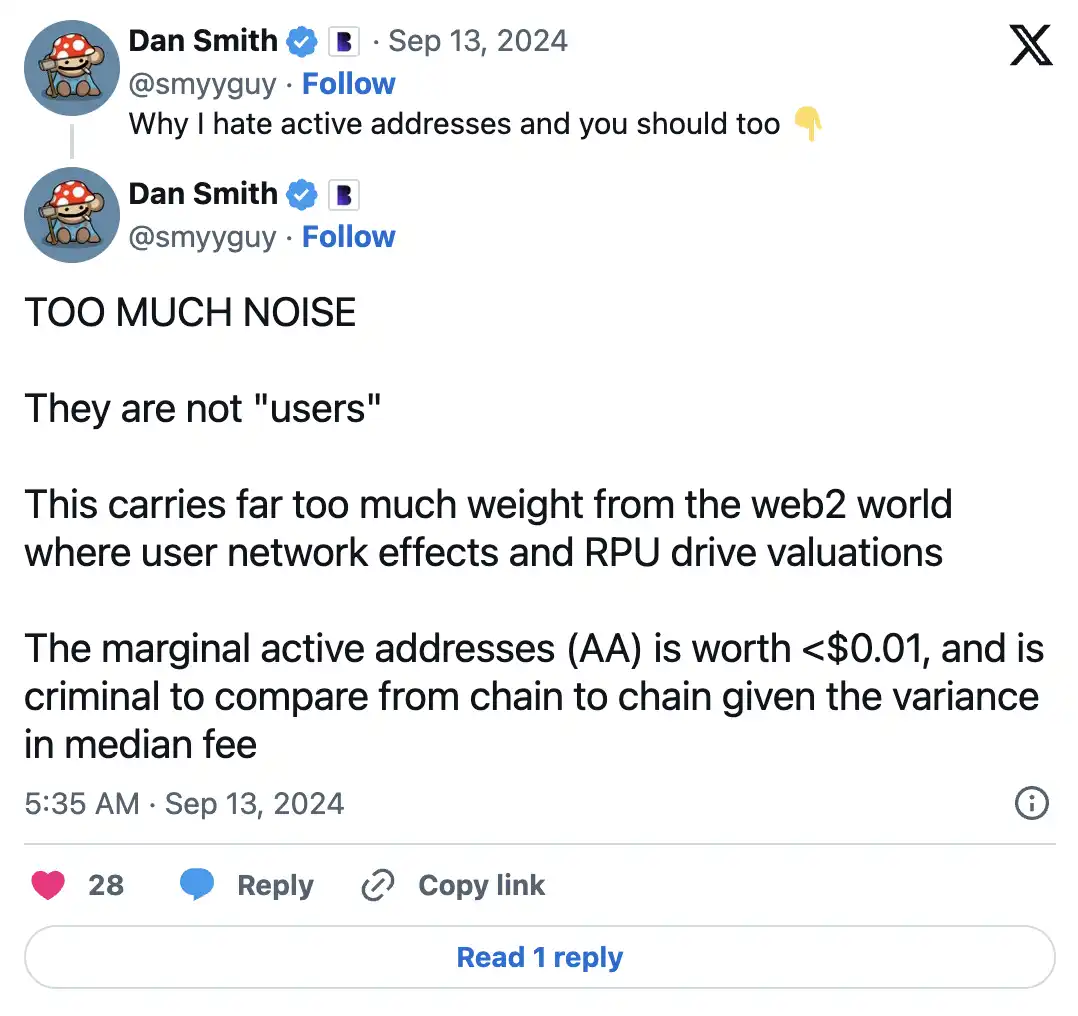

For more information, see Dan Smith’s research, which focuses on the misuse of daily active addresses.

Blockchain Profitability

بلاکچین سرگرمی کا مطالعہ کرنے کے لیے فعال پتوں پر توجہ مرکوز کرنے کے بجائے، نیٹ ورک فیس میٹرک کو دیکھنا بہتر ہے۔ فیس معیاری صارفین کے مسئلے کو مدنظر رکھے بغیر پروٹوکول کے استعمال کی گیس کی کل کھپت کو ظاہر کرتی ہے۔

Fees are often used by analysts and investors to determine which blockchains generate the most “revenue.” We then consider the issuance of tokens that a blockchain pays to validators as a cost. The result is the “profitability” of the blockchain.

This is how Token Terminal generates “financial statements” for کرپٹو protocols. For example, the chart below shows that Ethereum L1 has accumulated millions of dollars in losses in the past two months.

Source: Token Terminal

The only problem is that this calculation fails to take into account a key factor: unlike PoW chains (like Bitcoin), users on PoS chains can also easily earn token issuance rewards.

After all, if I can get 5% ETH/SOL staking yield from liquid staking platforms like Lido or Jito, why should I care if the network is unprofitable? Therefore, it is problematic to conclude that Ethereum is unprofitable by considering token issuance as a cost.

In the real world, inflation is harmful because when central banks print large amounts of money, the increased money supply reaches different participants in the economy at different times, and those who get the new money first benefit before real prices adjust. This is known as the Cantillon effect.

In a PoS blockchain economy, this is not the case, because inflation (i.e. token issuance) is received by everyone at the same time. Therefore, no one becomes richer or poorer as a result – everyones wealth remains the same.

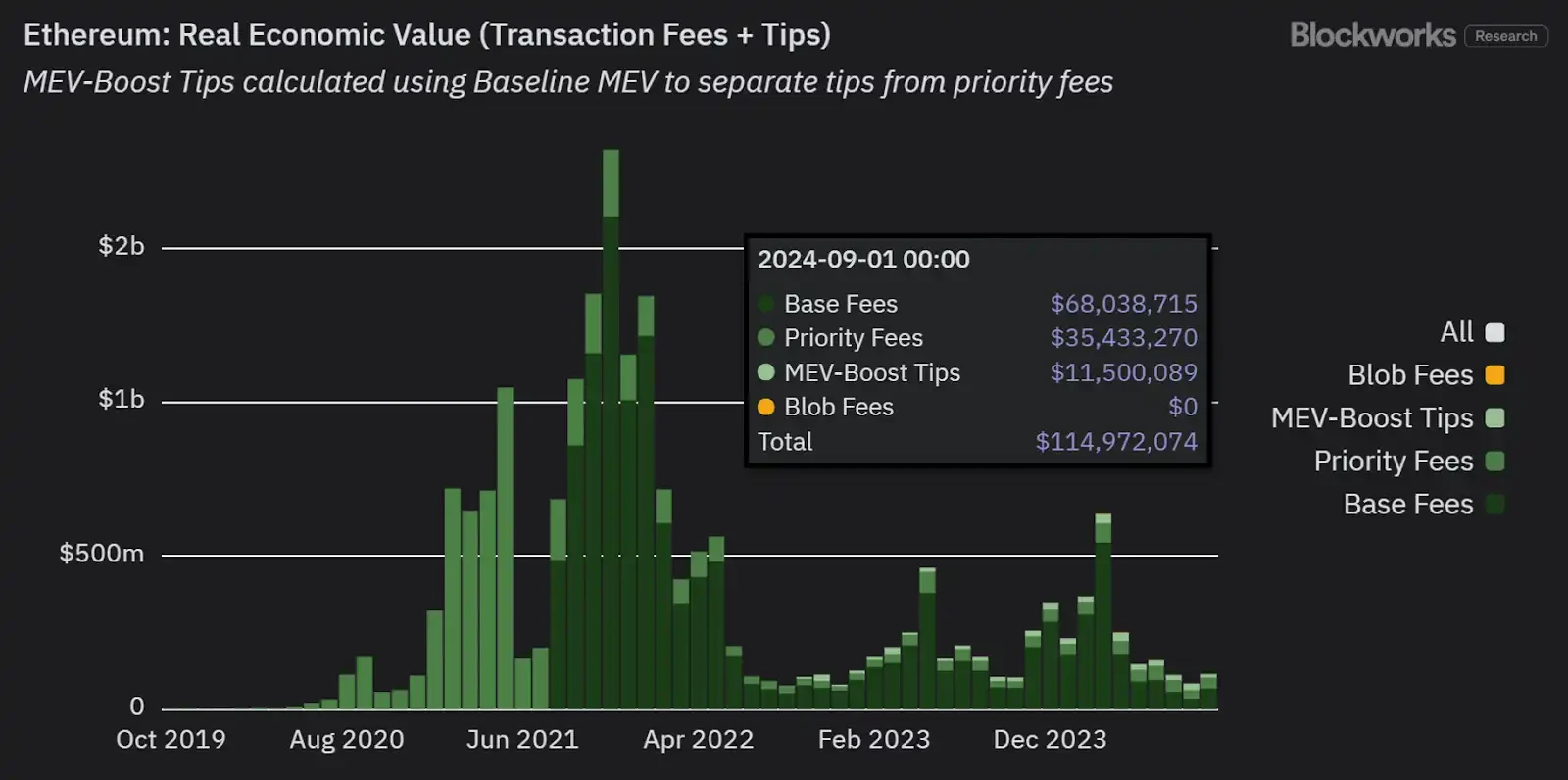

Instead, we can consider using an alternative metric called Real Economic Value (REV). REV combines network fees and MEV tips to validators, but does not include token issuance as a cost.

Based on this, we can see that Ethereum has actually been profitable over the past two months:

Source: Blockworks Research

REV is arguably a better indicator of the true demand for the network and a more comparable revenue metric to traditional finance (TradFi).

In summary, traditional profit and loss accounting methods are not easily and directly applicable to blockchain.

For more on this complex topic, listen to the recent Bell Curve podcast with Jon Charbonneau.

Total Transaction Value (TTV), not Total Value Security (TVS)

Oracles are critical infrastructure for blockchains to obtain off-chain data. Without Oracles like Chainlink, the blockchain economy cannot reliably reflect real-world prices.

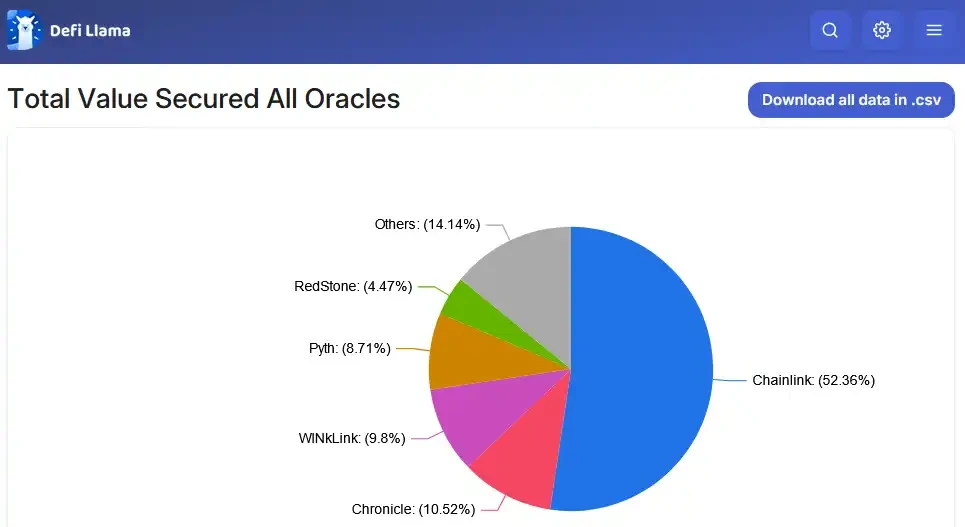

A common way to compare the market share of Oracle providers is to use the “Total Value Secured” (TVS) metric, which aggregates all TVL secured by Oracles. DefiLlama explicitly calculates this:

ماخذ: DefiLlama

The problem with TVS is that it obscures the activities that Oracles actually secure.

For example, Oracles that power high-frequency trading products such as perpetual contract exchanges continuously “pull” price updates from off-chain data sources with sub-second latency.

This is in contrast to “push” oracles used in lending protocols, which only need to update prices on-chain a few times a day because they don’t need to be updated frequently.

TVS focuses on the total value managed by Oracles, but ignores the performance strength of Oracles providers.

In other words, its like saying that a fancy steak and a salad are both priced at $50 on the menu, so they are of equal value to the diner. But obviously, it takes a lot more work to make a steak than a simple salad, and thats a factor worth considering.

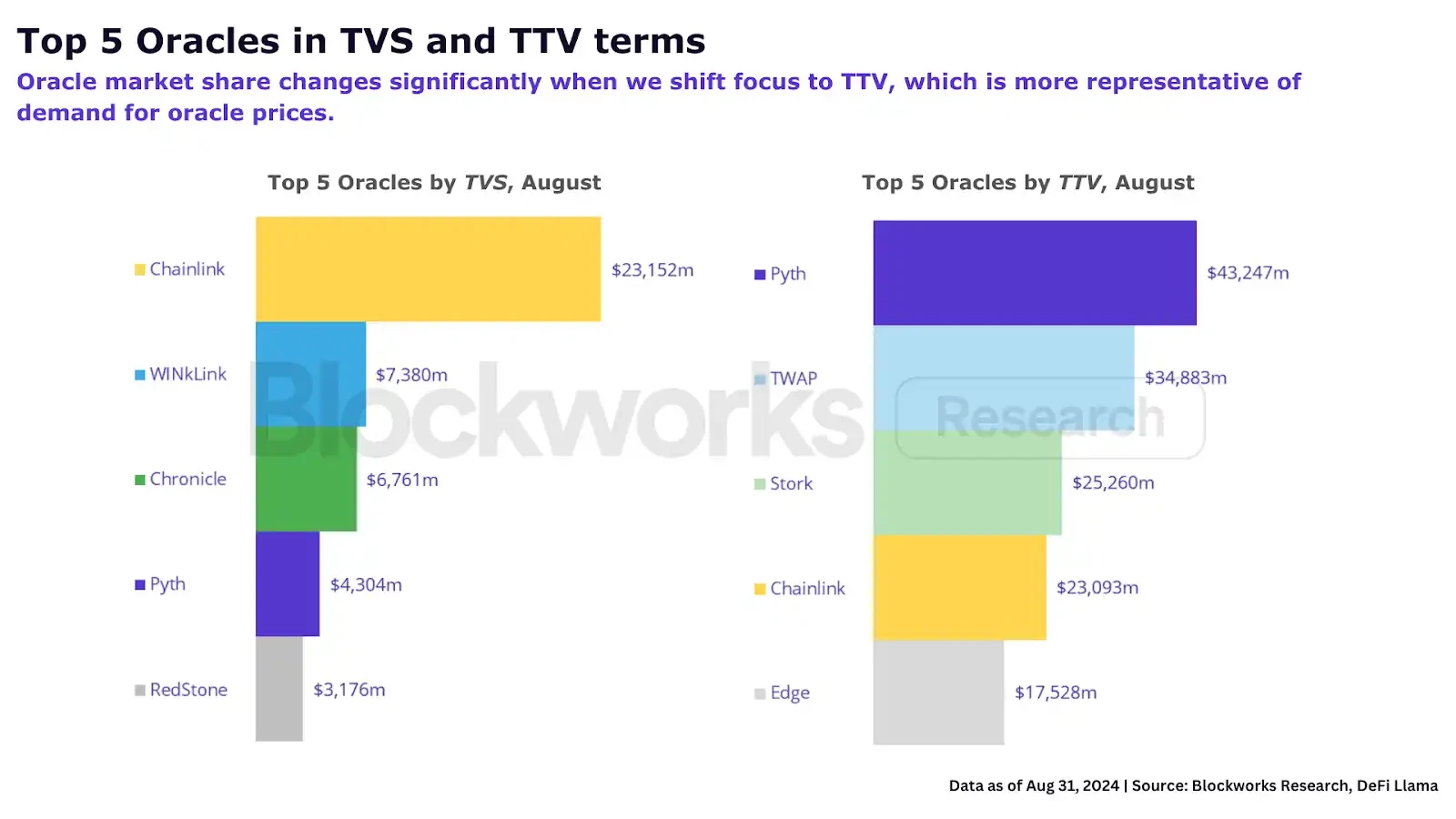

An alternative metric is total transaction value (TTV), which takes into account periodic transaction volume using Oracle update pricing.

TTV excludes low-frequency applications such as lending, CDPs, and re-collateralization, but as Ryan Connor explains, “Only 2-9% of oracle price updates come from these low-frequency protocols, which is a small percentage in the cryptocurrency space given the high volatility of the underlying indicators.”

When Oracles are evaluated based on TTV, market share changes dramatically.

مزید معلومات کے لیے دیکھیں Blockworks Research’s report on how TTV can better reflect Oracles’ fundamentals.

This article is sourced from the internet: Separate the true from the false, and stop using the daily active addresses indicator to mislead your investment research judgment

متعلقہ: پمپ تفریحی رجحان کا تجزیہ

In the recent cryptocurrency market, Pump Fun, as a representative of the new generation of Meme token issuance platforms, has set off an unprecedented speculative craze. Everyone fantasizes about exchanging 0.02 SOL for multiple returns, or even realizing the dream of getting rich overnight. This article will analyze the phenomenon, profitability and future of PumpFun. We will also pay attention to the Sun Pump project on the XRP chain to explore whether it can replicate the success of Pump Fun. In my opinion, when money becomes the core driving force, it will be more difficult to build a community that truly represents Meme culture. 1. Analysis of the Pump Fun Phenomenon Pump Fun Project Background and Its Rise in the بازار The rise of Pump Fun is closely related to…