Bitget ریسرچ انسٹی ٹیوٹ: BTC ETF نے 2 دنوں سے خالص آمد کو جاری رکھا ہے، مارکیٹ مختصر مدت میں بحال ہو جائے گی

گزشتہ 24 گھنٹوں میں، مارکیٹ میں بہت سی نئی مقبول کرنسیاں اور عنوانات سامنے آئے ہیں، جو پیسہ کمانے کا اگلا موقع ہو سکتا ہے، بشمول:

-

Sectors with strong wealth creation effects are: real income sectors (BANANA, AAVE, APT, SUI) and other tokens that are about to be unlocked in large amounts;

-

Hot searched tokens and topics: Catizen, Ether.fi

-

Potential airdrop opportunities include: Plume Network, Movement

Data statistics time: September 11, 2024 4: 00 (UTC + 0)

1. بازار کا ماحول

In the past 24 hours, the price of BTC hovered around $56,000, and the total transaction volume of 11 US spot Bitcoin ETFs reached $711 million, the third lowest level since its launch. The US Bitcoin spot ETF had a net inflow of $116.97 million yesterday. The US Ethereum spot ETF had a net inflow of $11.4 million yesterday. The investment in the primary market has slowed down recently. Sonys Layer 2 network Soneium will cooperate with Sony Bank to launch a Japanese yen stablecoin, and the market continues to pay attention.

From a macro perspective, the cryptocurrency market has stabilized after last weeks volatility, but implied volatility remains high. The market remains vigilant about major events that will take place this week, especially the debate between Trump and Harris and the release of CPI data. Affected by the sharp drop last week, the market remains cautious about downside risks, and the risk reversal of Bitcoin and Ethereum still favors put options until October.

2. دولت سازی کا شعبہ

1) Sector changes: Real income sector (BANANA, AAVE)

بنیادی وجہ:

-

In the current sluggish market environment, the market is looking for projects in the crypto industry that can truly generate income and distribute income to token holders. As a leading TG Bot project, BANANA has a relatively stable market share and strong support for token prices. With the acquisition of the MEME market, the projects income price is objective. AAVEs recent on-chain data shows that the number of active lending users on the chain has reached a historical high. The increase in lending users will further increase the protocols revenue;

Increase: BANANA increased by 2.5% in the past 24 hours, and AAVE increased by 10.4% in the past 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

-

Market share: Market share is an important indicator for measuring these real income projects. Since the current crypto market share is limited, being able to maintain a top market share is the key to maintaining high sustainable income for the project. Currently, BANANA is among the top three TG Bots, AAVE is the first in the lending sector, and users have high stickiness and excellent overall performance.

-

Related revenue distribution policy: A new proposal for AAVE considers adding a fee conversion function to return part of the platforms net excess revenue to its key users. This move may also lead to the re-staking of the AAVE protocol, providing a new source of income for AAVE and its users.

2) Sectors that need to be paid attention to in the future: APT, SUI and other tokens that are about to be unlocked in large amounts

بنیادی وجہ:

-

On September 12, SUI and APT will unlock 3.24% and 2.35% of their circulation respectively, which is 82 million USD and 81 million USD according to the current market price. APT has a precedent of continuous violent pull before and after the big unlock, but it may be very different according to the current market conditions and market sentiment. You can focus on trading opportunities before and after the token big unlock.

Specific currency list: APT, SUI

3. صارف کی گرم تلاشیں۔

1) مشہور ڈیپس

Catizen:

Catizen is an innovative game based on the TON ecosystem. The game consists of a virtual cat cafe based on the MEOWverse structure. Different breeds of virtual cats can unlock different levels and player credentials. Steve Yun, chairman of the TON Foundation, tweeted to support the Telegram cat-themed game platform Catizen. The article mentioned that Catizen has 36 million registered users and more than 860,000 paying users. Various exchanges are about to launch Catizen. Bitget, OKX, Bybit, KuCoin and other exchanges have confirmed their launch.

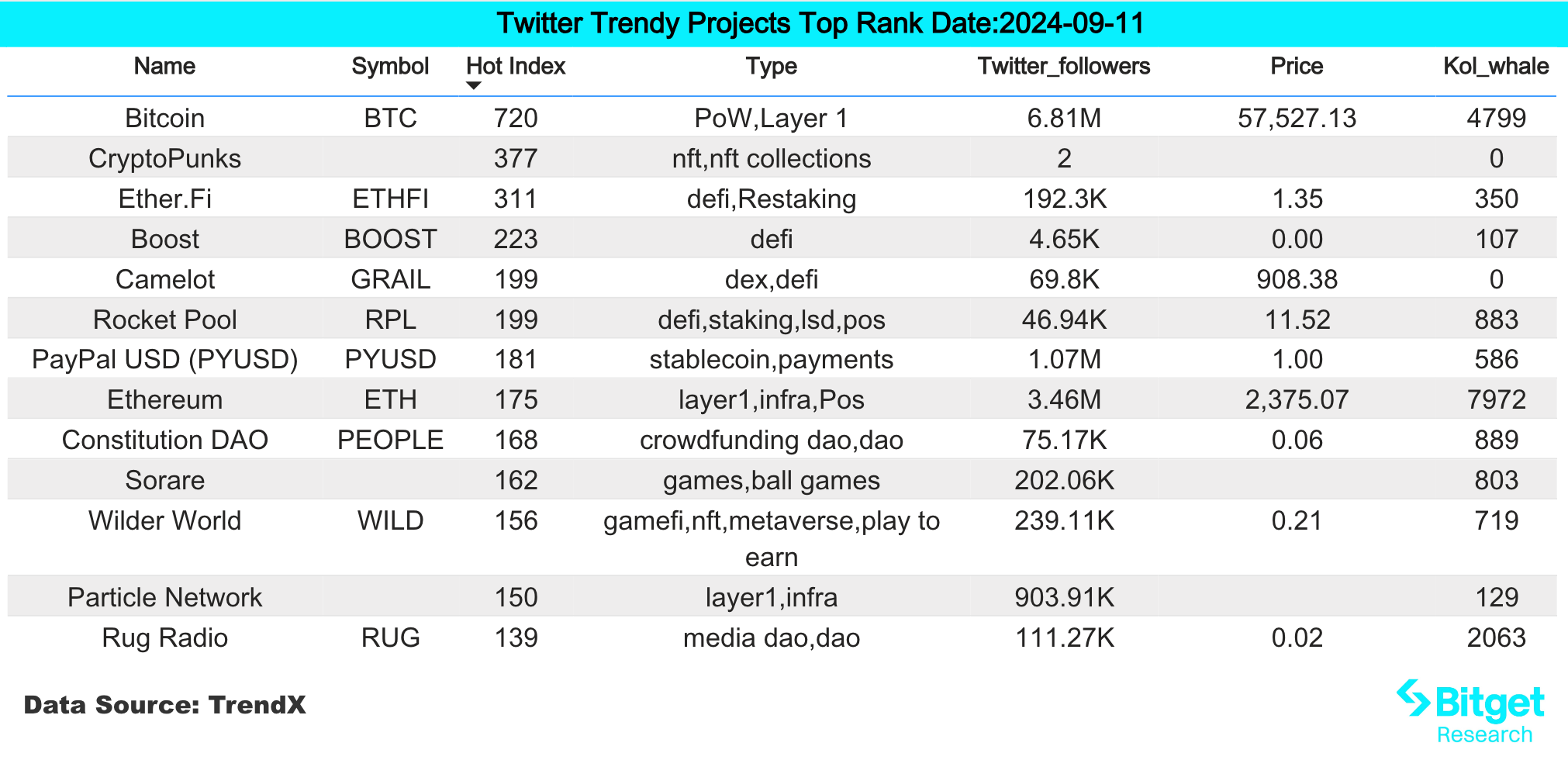

2) ٹویٹر

Ether.fi:

Ethereum re-staking protocol ether.fi released the fourth season airdrop Temp Check proposal. The fourth season reward started on September 15th, and a season will run every 4 months, and each season has corresponding unique rewards. The Ether.fi protocol earned $2.19 million in August and is one of the most profitable projects on the Ethereum chain. The current ETHFI price is 1.28, and the total market value is about 1.2 billion US dollars. Users are advised to participate in this project with caution.

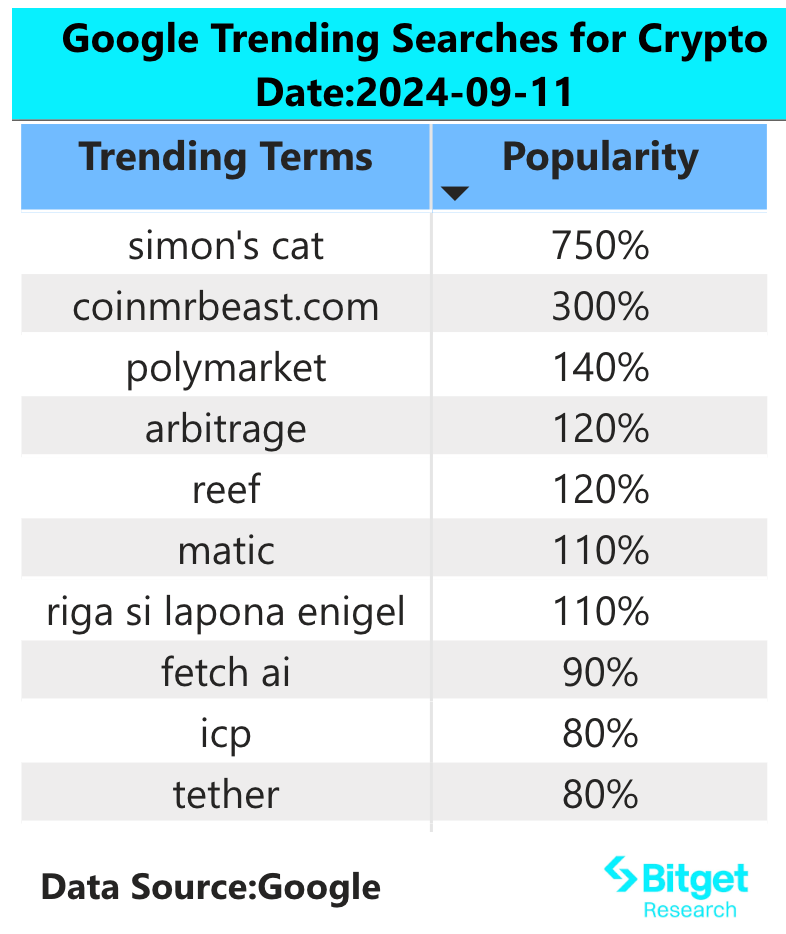

3) گوگل سرچ ریجن

عالمی نقطہ نظر سے:

Simons cat:

FLOKI officially announced that it has successfully completed the airdrop of Simons Cat (CAT) tokens to eligible FLOKI holders. According to the previously announced criteria, users who hold at least 400,000 FLOKI tokens have received proportional airdrops directly on Binance, OKX, and on-chain wallets. After receiving the airdrop, most users chose to sell, and the price of CAT tokens fell by 9.46% on the day. It is recommended to wait and see for the time being.

ہر علاقے میں گرم تلاشوں سے:

(1) Blum has become a major focus in South Asia, CIS and other regions, with the countries where related hot searches appearing include: Pakistan, Belarus and Ukraine.

(2) Hot searches in Europe and the United States are scattered, but the main tracks of interest are concentrated on public chains, memes, and exchanges. Among public chains, matic appeared in the hot search terms in Australia, France, Italy, Germany, and Switzerland. Meme tokens such as maneki, shib, doge, and cat were in the hot search terms in the United States, France, Spain, Germany, and Belgium, respectively.

ممکنہ، استعداد ایئر ڈراپ مواقع

Plume Network

Plume Network is a modular L2 network dedicated to the RWA track. Its product form is to integrate asset tokenization and directly supply suppliers products on the chain. The project recently completed a seed round of financing with a financing amount of US$10 million. The participating institutions include Haun Ventures, Superscrypt, Galaxy, and SV Angel.

The project recently launched a test network and launched activities such as Earn Mile, Check In, and Passport.

Specific participation methods: 1) Visit the project official website, click Connet Wallet, and then enter the App; 2) Earn miles by Swap, Stake, Speculate, completing tasks on the platform, Check-in, etc.

تحریک

Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to its flagship product Movement L2, Movement Labs will also launch Move Stack, an execution layer framework compatible with rollup frameworks such as Optimism, Polygon and Arbitrum.

حال ہی میں، Movement Labs نے Polychain Capital کی قیادت میں US$38 ملین سیریز A فنانسنگ راؤنڈ مکمل کیا، جس میں بہت سے معروف اداروں جیسے کہ Hack VC، Foresight Ventures، اور Placeholder کی شرکت تھی۔

شرکت کا مخصوص طریقہ: موومنٹ zealy ٹاسک انٹرفیس درج کریں (نوٹ: سماجی کاموں میں ٹائم پیریڈ اور کام ہوتے ہیں جو مسلسل آن لائن ہوتے ہیں)، آپ DEX کے ساتھ بات چیت کر سکتے ہیں، اپنی مرضی سے کچھ ٹیسٹوں کے ساتھ تعامل کر سکتے ہیں، اور آفیشل ویب سائٹ سے آنے والے اقدامات کا انتظار کر سکتے ہیں۔

اصل لنک: https://www.bitget.fit/zh-CN/research/articles/12560603815513

銆怐اعلانیہ銆慣یہ مارکیٹ خطرناک ہے، لہذا سرمایہ کاری کرتے وقت محتاط رہیں۔ یہ مضمون سرمایہ کاری کے مشورے پر مشتمل نہیں ہے، اور صارفین کو اس بات پر غور کرنا چاہیے کہ آیا اس مضمون میں کوئی بھی آراء، خیالات یا نتائج ان کے مخصوص حالات کے لیے موزوں ہیں۔ اس معلومات پر مبنی سرمایہ کاری آپ کے اپنے خطرے پر ہے۔

This article is sourced from the internet: Bitget Research Institute: BTC ETF has continued to see net inflows for 2 days, the market will rebound in the short term but still needs to be vigilant against a second drop

5 اگست 2024 کو، بٹ کوائن مارکیٹ نے قیمتوں میں ایک اور اہم اتار چڑھاؤ کا تجربہ کیا۔ ایک دن کے اندر، بٹ کوائن کی قیمت گر گئی، جس نے بڑے پیمانے پر مارکیٹ کی توجہ اور بحث کو اپنی طرف متوجہ کیا۔ اس گراوٹ نے نہ صرف سرمایہ کاروں کو چوکس کر دیا بلکہ مارکیٹ کے تجزیہ کاروں کو اس کی وجوہات اور مستقبل کے ممکنہ ترقی کے رجحانات کو تلاش کرنے پر مجبور کر دیا۔ اس آرٹیکل میں، ہم Bitcoin پلنگ کے پیچھے تین بڑے بیئرش وارننگ سگنلز کی تشریح کریں گے، اور سرمایہ کاروں کو مزید جامع تناظر فراہم کرنے کے لیے تین بڑے تیزی کے سگنلز کو بھی دریافت کریں گے۔ تین بیئرش انتباہی علامات مارکیٹ کے جذبات میں تبدیلی کرپٹو کرنسی کی سرمایہ کاری میں مارکیٹ کا جذبہ اہم کردار ادا کرتا ہے۔ بٹ کوائن کے کریش ہونے سے پہلے، مارکیٹ میں حد سے زیادہ پر امید موڈ تھا۔ بہت سے سرمایہ کار اور تجزیہ کار توقع کر رہے تھے کہ Bitcoin ہر وقت کی بلندیوں کو توڑنا جاری رکھے گا۔ تاہم،…