Original title: How to judge the US economic recession? Please accept these 15 key indicators

Original author: Arthur Wang, BlockTempo

In the eyes of many observers, the US economy does not seem to have entered a recession yet, and may even avoid this fate. For example, Treasury Secretary Janet Yellen said in her speech last weekend that the US has basically achieved a soft landing.

However, the warning signs of a series of well-known economic indicators are also constantly sounding the alarm. The following dynamic zone has compiled 15 recession-related indicators for you. It is recommended that you observe and analyze these indicators from multiple angles to gain a more comprehensive understanding of the economic situation.

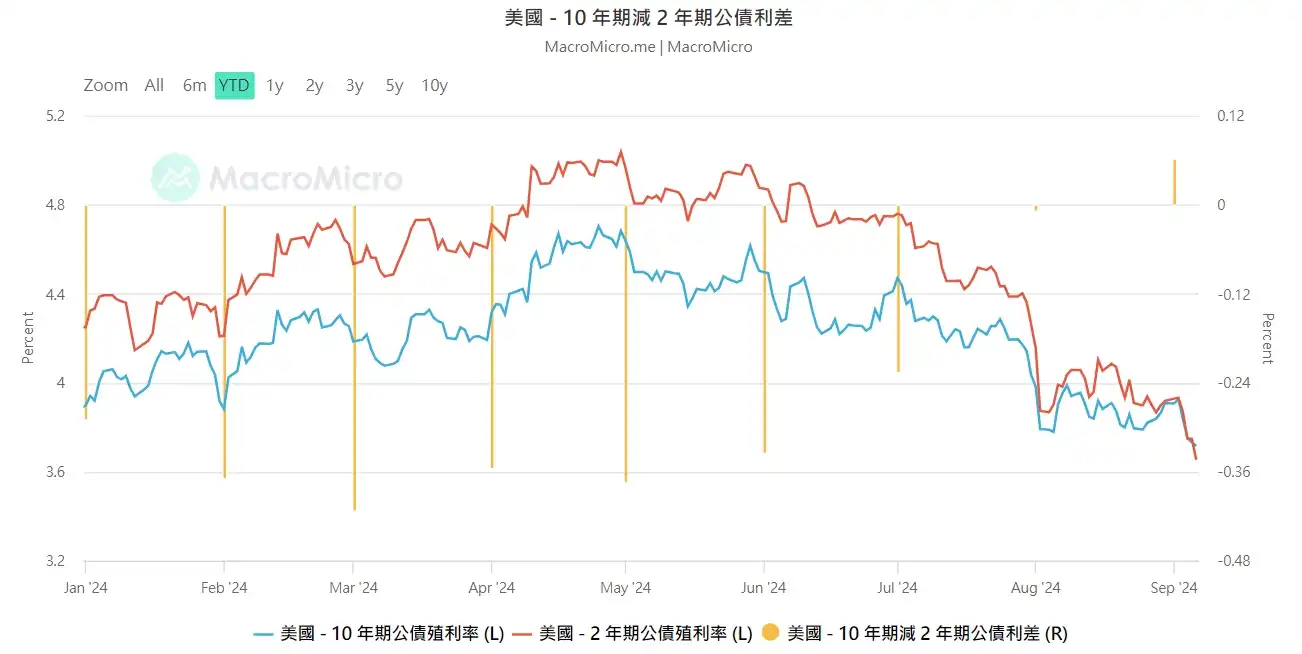

1. Inverted U.S. Treasury Yield Curve

For the first time since July 2022, the 10-year Treasury yield has finally been higher than the 2-year Treasury yield, meaning that the longest inversion record in history was finally broken after 793 days.

However, the United States has experienced a total of five economic recessions since the 1980s, and interest rate inversions have occurred before. This inevitably makes the market begin to worry whether history will repeat itself this time, such as an AI bubble burst?

Image source: Finance M Square

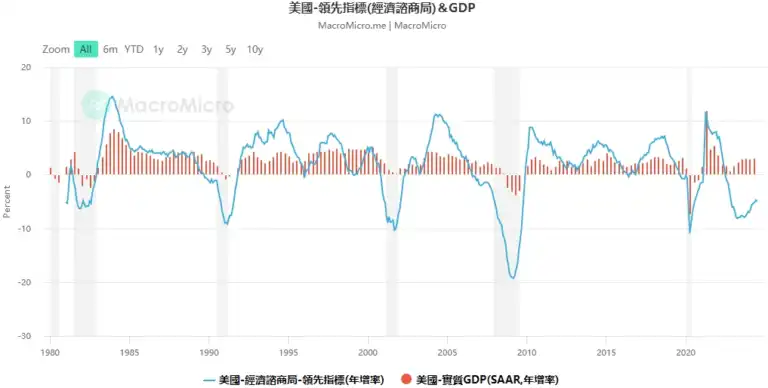

2. Leading Indicators from the Conference Board

The Conference Boards Leading Economic Indicator (LEI) covers a number of areas, including manufacturing activity, confidence index and consumer confidence. Although the indicator was in recessionary territory for most of 2022 and 2023, it has rebounded but remains at a warning level, indicating the potential risk of economic slowdown.

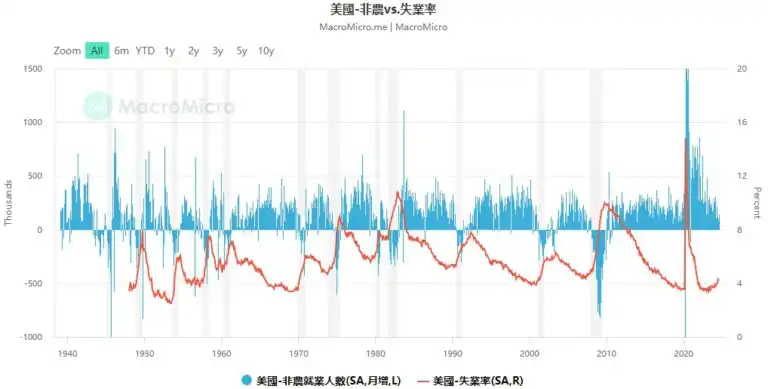

3. Non-agricultural employment data

In the past few economic recessions, this indicator usually turned negative first, followed by a rapid rise in the unemployment rate. Although the current unemployment rate remains at a relatively low level, if the number of non-agricultural employment drops sharply, we must pay close attention to changes in the unemployment rate.

4. Sams Rule Recession Indicator

The indicator, proposed by Federal Reserve economist Sam, states that when the three-month moving average of the unemployment rate exceeds the previous years low by 0.5%, it indicates that the economy is in recession.

Although the indicator has now reached 0.53%, Sam previously believed that this time it might not necessarily enter a recession, but also said that the situation has become more serious.

5. Consumer Confidence Index

The Consumer Confidence Index reflects consumers views on the economic outlook. Low consumer confidence usually indicates a reduction in consumer spending, which in turn affects economic growth. Since consumption accounts for 70% of the US GDP, the data released by the Conference Board and the University of Michigan are very useful.

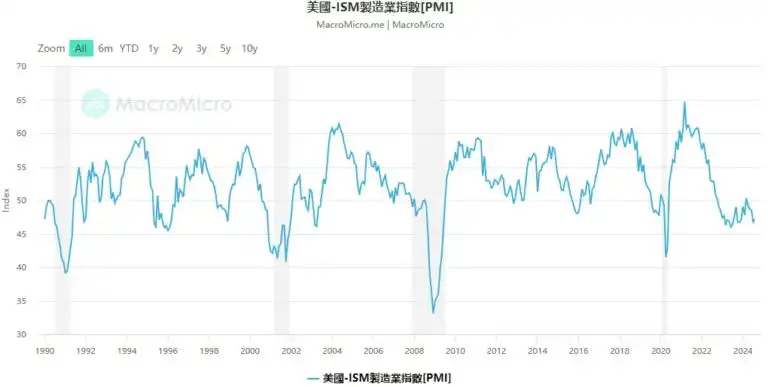

6. Manufacturing PMI (Purchasing Managers Index)

The PMI index is an important indicator of the health of the manufacturing industry. A value below 50 usually indicates an economic slowdown. The Institute for Supply Management conducts monthly surveys covering new orders, production, employment and other indicators, which are crucial to judging the economic situation.

7. Personal Consumption Expenditures (PCE)

PCE is an important component of the U.S. economy and a decrease in it typically signals the risk of a recession, with economic growth being suppressed as consumer spending decreases.

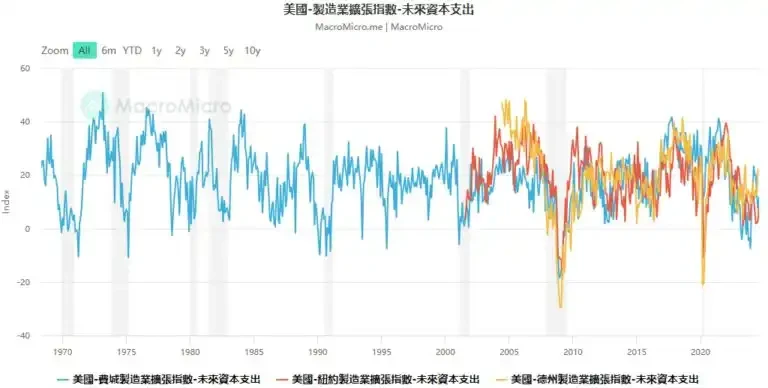

8. Capital Expenditure

Reduced business investment in equipment and buildings is often an early sign of an economic slowdown, and the Federal Reserves forecasts for future capital spending can provide clues about the direction of business investment.

It is observed that the future capital expenditures of the various Federal Reserves are at a high point, reflecting that companies still have production momentum. When capital expenditures decline and client inventories are replenished, it can be noted that the valuations of the SP 500 manufacturing-related sectors may be revised.

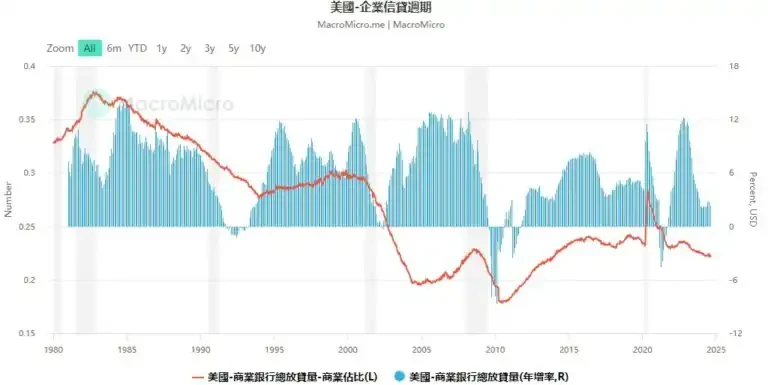

IX. Bank Loan Growth Rate

A reduction in bank lending may indicate a decline in corporate and consumer demand, which will directly affect economic activity. Changes in the credit cycle are often a precursor to an economic recession.

As the economy enters its final stage of growth, concerns about overcapacity and pressure from policy tightening begin to affect companies. Even as they see a rebound in end-user demand, companies are turning conservative in their attitudes toward investment spending such as factory expansion, until the credit cycle eventually enters a recession.

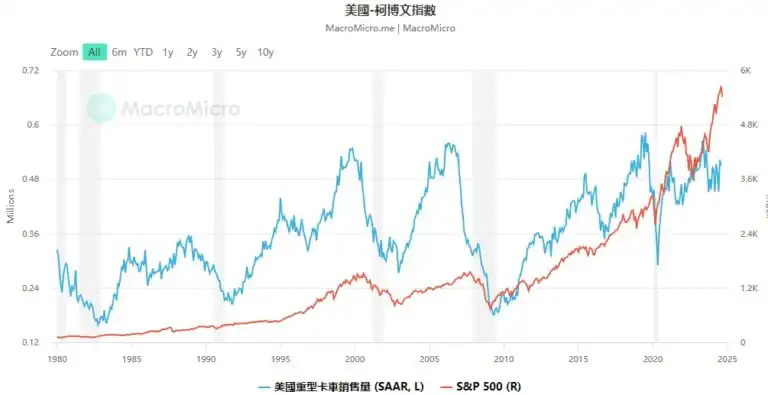

10. Optimus Index

This indicator is based on the sales of heavy trucks and is related to forward-looking investment on the corporate side. It can effectively predict economic trends. If the indicator shows a decline, it may mean a slowdown in economic activity.

When economic conditions deteriorate, companies will be the first to feel the impact and cut back on spending and purchases. Therefore, in the past five cycles, the index has preceded the US economic recession. When the economy improves, truck purchases will pick up in tandem.

The reversal time of the Optimus Prime Index has been more than one year ahead of the SP 500 in the past 40 years, making it a very special leading indicator.

11. Atlanta Federal Reserve Bank GDP Forecast Model (GDPNow)

The model combines a variety of economic data to predict U.S. GDP growth. If the growth predicted by the GDPNow model slows down, it may indicate the risk of a recession.

12. OECD US Composite Leading Index

An index below 100 usually indicates that economic activity is below potential, which may indicate the risk of recession. This indicator can reflect the overall trend of the global economy.

OECD US Composite Leading Index

13. Chicago Federal Reserve National Activity Index (CFNAI)

The CFNAI is calculated using 85 different monthly indicators and when it is negative for several consecutive months, it may indicate the risk of a recession.

Chicago Federal Reserve National Activity Index (CFNAI)

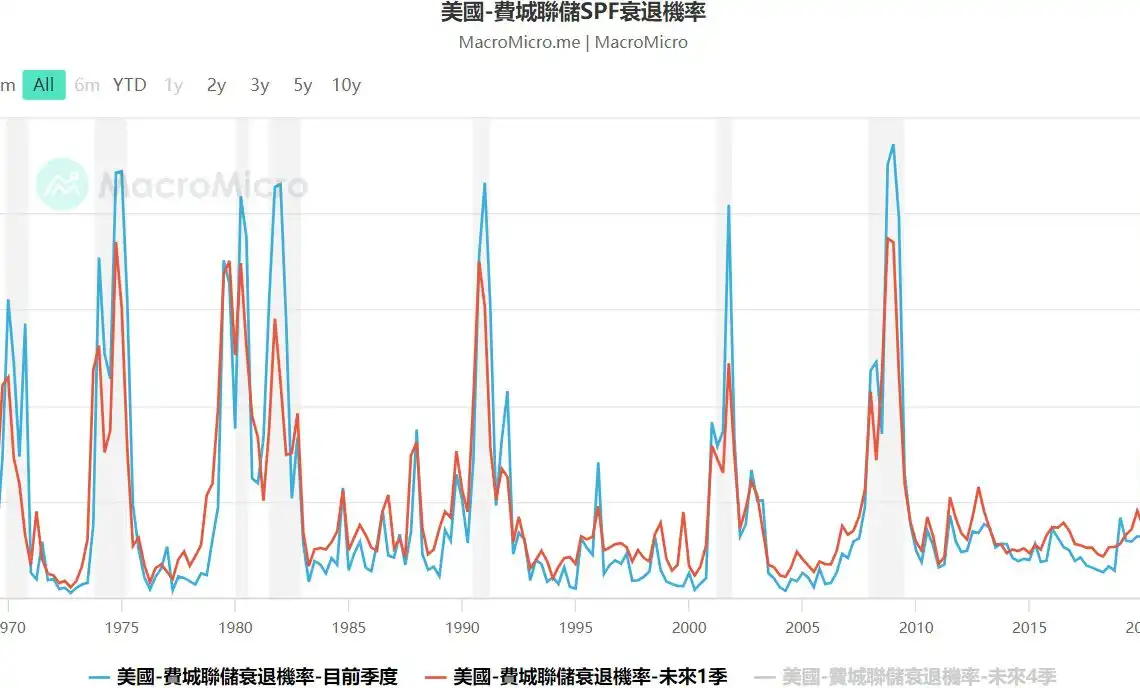

14. Philadelphia Federal Reserve SPF Recession Indicator

This indicator is based on a survey of professional forecasters and predicts the probability of negative GDP growth in the future. If the probability increases significantly, it may mean an increased risk of economic recession.

Philadelphia Federal Reserve SPF Recession Indicator

15. Single-family Home Market Index (HMI) and Building Permits Data

These indicators are directly linked to the housing market, and a decline in the index could reflect weakening consumer confidence and the possibility of a future recession.

Single-Family New Home Market Index (HMI)

This article is sourced from the internet: Interpretation of 15 key indicators: Is the US economy in recession?

متعلقہ: BTC اتار چڑھاؤ: ہفتہ 22-29 جولائی 2024

کلیدی میٹرکس: (22 جولائی، شام 4 بجے -> 29 جولائی، شام 4 بجے ہانگ کانگ کا وقت): BTC/USD +3.4% ($67,240 -> $69,500)، ETH/USD -3.2% ($3,180T -> 370) BTC/USD دسمبر (سال کے آخر میں) ATM اتار چڑھاؤ -11% (68.5 -> 61.1)، دسمبر 25 دن کا RR اتار چڑھاؤ -45% (7.3 -> 3.3) گزشتہ ہفتے مقامی پیش رفت کے بعد BTC کی قیمت میں اضافہ جاری رہا (لیکویڈیشن کے ذریعے متحرک روایتی مالیاتی منڈیوں میں) — ابتدائی سپورٹ 68-68.25k پر ہے، 66.75-67k پر مضبوط سپورٹ کے ساتھ۔ سب سے اوپر بڑی مزاحمت 70k-70.25k کے ارد گرد ہے؛ اگر اسے مکمل طور پر توڑا جاسکتا ہے، تو یہ تاریخی بلندی کو پھر سے چیلنج کرے گا۔ 66.75k سے نیچے کا وقفہ 63.5 - 67k رینج میں ایک کٹے ہوئے استحکام کی مدت کو متحرک کر سکتا ہے۔ مارکیٹ کے واقعات: 23 جولائی کو شروع ہونے والا ETH ETF اب بھی اسپاٹ پرائس کو بڑھانے میں ناکام رہا، ETH لمبی پوزیشنیں ختم کر دی گئیں،…