کرپٹو مارکیٹ سینٹیمنٹ ریسرچ رپورٹ (2024.08.16–08.23): بٹ کوائن بڑھتا ہے جب ڈوویش شرح میں کمی کی طرف موڑ دیتا ہے

بِٹ کوائن بڑھتا ہے کیونکہ ڈوش کا مؤقف آسنن شرح میں کمی کی طرف مڑ جاتا ہے۔

جمعہ 23 اگست کو مشرقی وقت کے مطابق صبح 10 بجے، فیڈرل ریزرو کے چیئرمین پاول نے جیکسن ہول گلوبل سنٹرل بینک کے سالانہ اجلاس میں ایک اہم تقریر کی۔

**یہ بات قابل غور ہے کہ پاول نے بالکل واضح طور پر کہا: پالیسی ایڈجسٹمنٹ کا وقت آ گیا ہے۔ پالیسی کی سمت واضح ہے، اور شرح سود میں کمی کا وقت اور رفتار بعد کے اعداد و شمار، آؤٹ لک میں تبدیلیوں اور خطرات کے توازن پر منحصر ہوگی۔

کچھ تجزیہ کاروں نے کہا کہ اگرچہ پاول نے ستمبر میں شرح سود میں کٹوتی شروع کرنے کی مارکیٹوں میں بڑے پیمانے پر توقعات کی تصدیق کی ہے، لیکن یہ تقریر بھی بے وقوف تھی، جس نے مختصر مدت میں مالیاتی مارکیٹ کو ایک خاص وضاحت فراہم کی، لیکن اس بارے میں بہت سے اشارے فراہم نہیں کیے کہ فیڈ کس طرح کام کرے گا۔ ستمبر کے اجلاس کے بعد

مثال کے طور پر، اگر روزگار کی ایک اور منفی رپورٹ ہے، آیا 50 بیسس پوائنٹ کی شرح میں تیز کمی ہوگی، اور آیا آنے والے مہینوں میں شرح میں کمی جاری رہے گی۔ تاہم، پاولز کی تقریر نے کم از کم اس بات کی تصدیق کی کہ گزشتہ دو سالوں میں افراط زر کے خلاف Feds کی لڑائی ایک اہم موڑ تک پہنچنے والی ہے۔

سالانہ میٹنگ کے بعد، بٹ کوائن US$61,000 سے بڑھ کر US$65,000 کی اونچائی تک پہنچ گیا، جو کہ 6.5% کا اضافہ ہے۔

فیڈرل ریزرو کی شرح سود کی اگلی میٹنگ میں تقریباً 26 دن باقی ہیں (19 ستمبر 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

مارکیٹ تکنیکی اور جذباتی ماحول کا تجزیہ

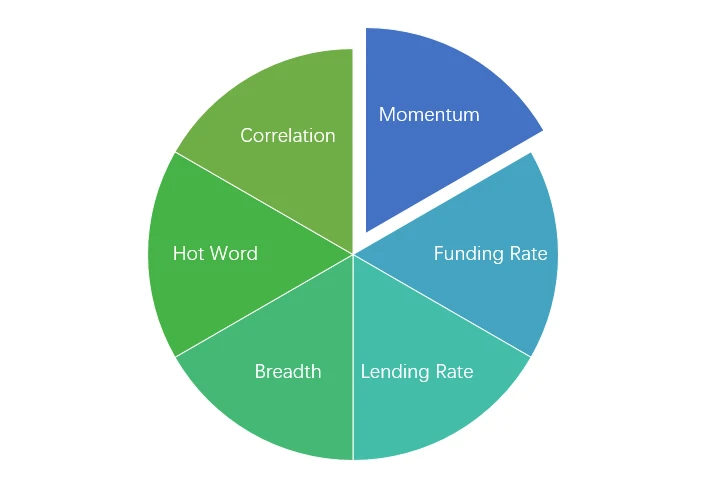

جذباتی تجزیہ کے اجزاء

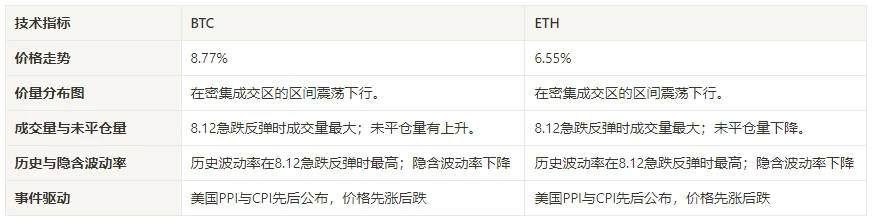

تکنیکی اشارے

قیمت کے رجحانات

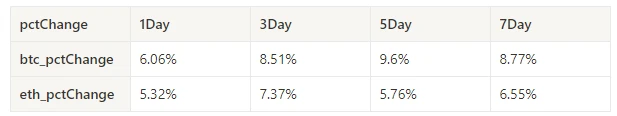

گزشتہ ہفتے میں، BTC کی قیمتوں میں 8.77% اور ETH کی قیمتوں میں 6.55% کا اضافہ ہوا۔

مندرجہ بالا تصویر گزشتہ ہفتے میں بی ٹی سی کی قیمت چارٹ ہے.

اوپر کی تصویر گزشتہ ہفتے میں ETH کی قیمت کا چارٹ ہے۔

جدول گزشتہ ہفتے کے دوران قیمت کی تبدیلی کی شرح کو ظاہر کرتا ہے۔

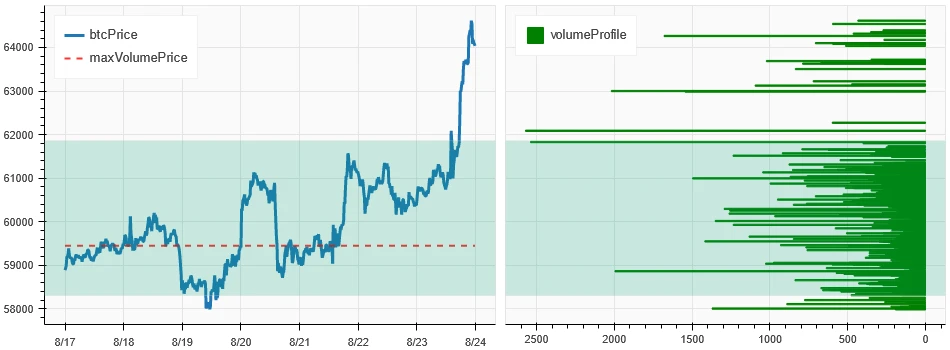

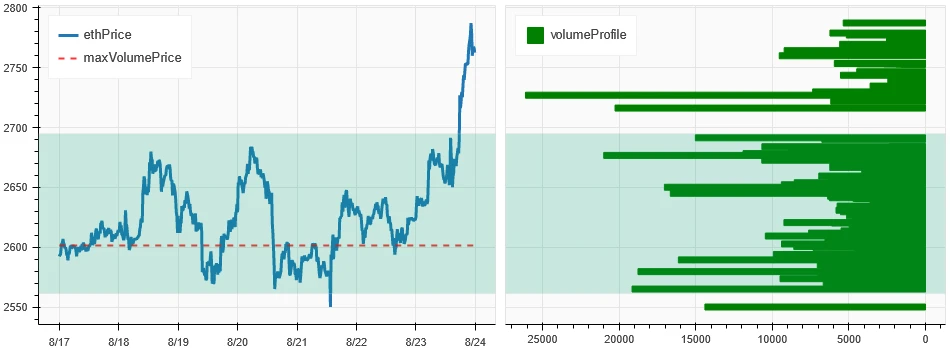

قیمت کے حجم کی تقسیم کا چارٹ (سپورٹ اور مزاحمت)

گزشتہ ہفتے میں، BTC اور ETH دونوں نے مرتکز تجارتی علاقے کو توڑا اور اوپر کی طرف رجحان بنایا۔

مندرجہ بالا تصویر گزشتہ ہفتے میں BTCs کے گھنے تجارتی علاقوں کی تقسیم کو ظاہر کرتی ہے۔

مندرجہ بالا تصویر گزشتہ ہفتے میں ETHs کے گھنے تجارتی علاقوں کی تقسیم کو ظاہر کرتی ہے۔

ٹیبل گزشتہ ہفتے میں BTC اور ETH کی ہفتہ وار گہری تجارتی حد کو ظاہر کرتا ہے۔

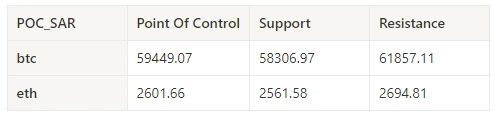

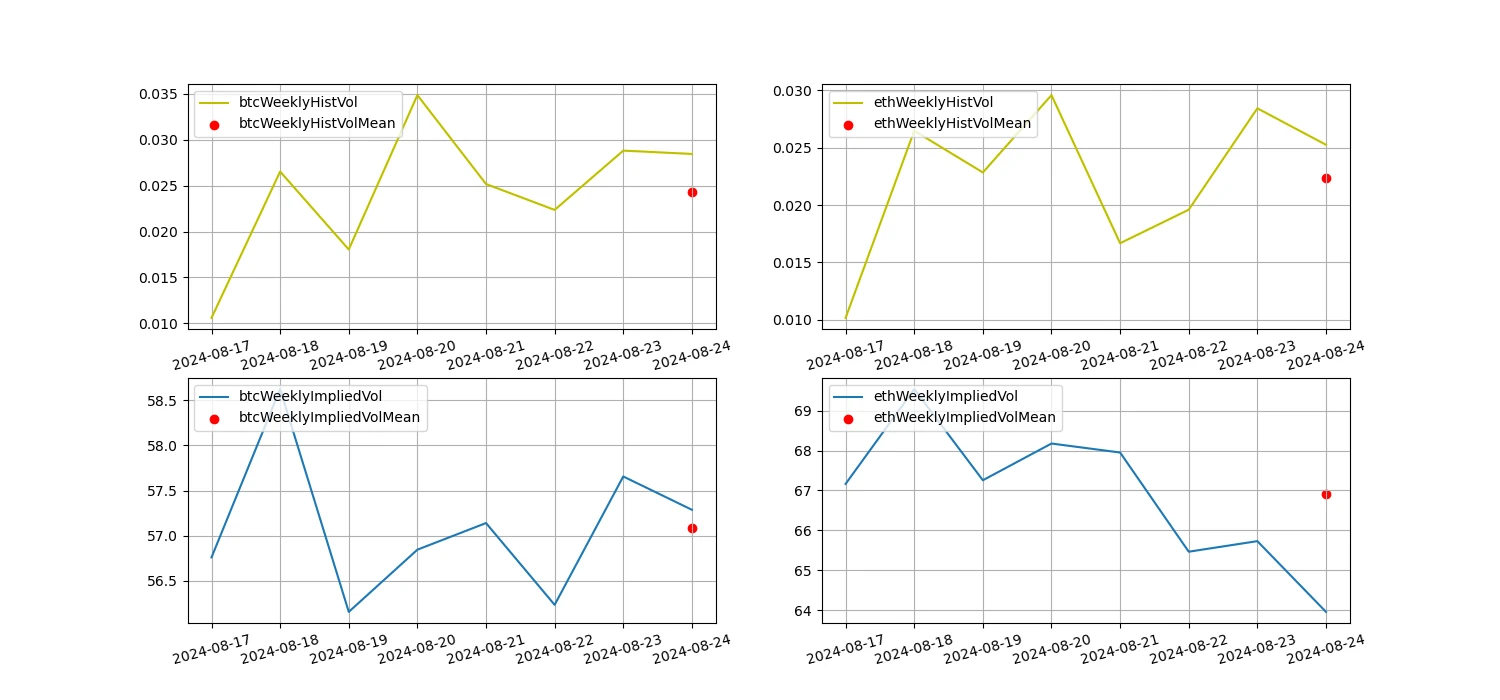

حجم اور کھلی دلچسپی

گزشتہ ہفتے، BTC اور ETH کا تجارتی حجم سب سے بڑا تھا جب وہ 8.23 تک بڑھ گئے؛ BTC اور ETH دونوں کی کھلی دلچسپی میں قدرے اضافہ ہوا۔

اوپر دی گئی تصویر کا اوپری حصہ BTC کی قیمت کا رجحان دکھاتا ہے، درمیانی حصہ تجارتی حجم دکھاتا ہے، نیچے کھلی دلچسپی ظاہر کرتا ہے، ہلکا نیلا 1 دن کی اوسط، اور نارنجی 7 دن کی اوسط ہے۔ K-لائن کا رنگ موجودہ حالت کی نمائندگی کرتا ہے، سبز کا مطلب ہے قیمت میں اضافے کو تجارتی حجم، سرخ کا مطلب ہے بند ہونے والی پوزیشنز، پیلے کا مطلب ہے آہستہ آہستہ جمع ہونا، اور سیاہ کا مطلب ہے پرہجوم حالت۔

اوپر کی تصویر کا اوپری حصہ ETH کی قیمت کا رجحان دکھاتا ہے، درمیانی حصہ تجارتی حجم، نیچے کھلی دلچسپی، ہلکا نیلا 1 دن کی اوسط، اور نارنجی 7 دن کی اوسط ہے۔ K-لائن کا رنگ موجودہ حالت کی نمائندگی کرتا ہے، سبز کا مطلب ہے کہ قیمتوں میں اضافے کو تجارتی حجم کی حمایت حاصل ہے، سرخ رنگ کی پوزیشنیں بند ہو رہی ہیں، پیلا آہستہ آہستہ پوزیشنیں جمع کر رہا ہے، اور سیاہ ہجوم ہے۔

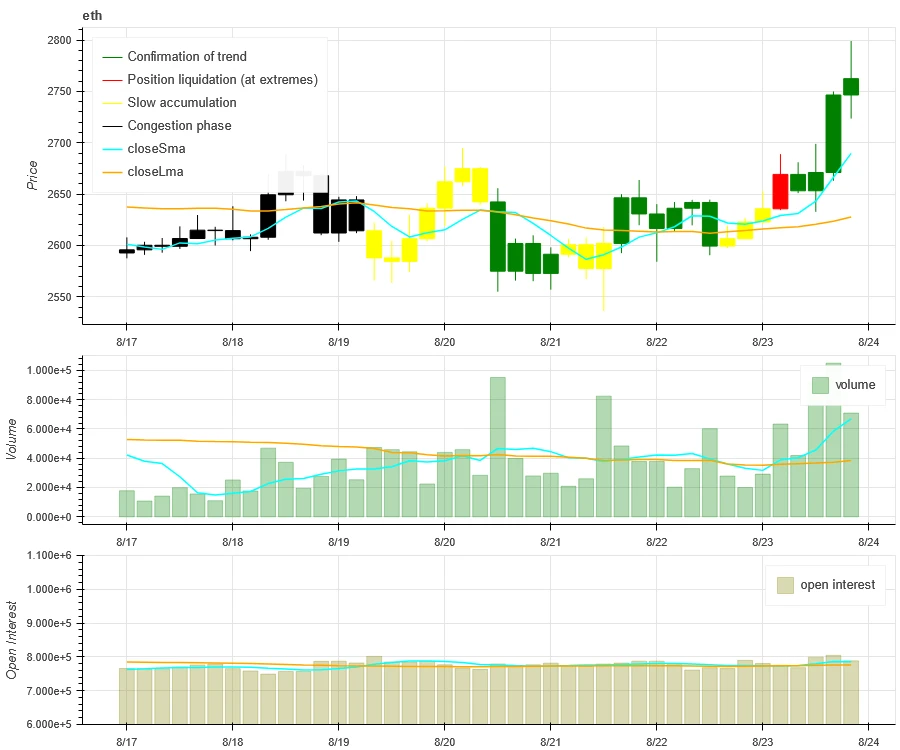

تاریخی اتار چڑھاؤ بمقابلہ مضمر اتار چڑھاؤ

گزشتہ ہفتے میں، BTC اور ETH کی تاریخی اتار چڑھاؤ سب سے زیادہ تھا جب وہ 8.20 کی وسیع رینج میں اتار چڑھاؤ کرتے تھے۔ BTC کی مضمر اتار چڑھاؤ میں اضافہ ہوا جبکہ ETH میں کمی واقع ہوئی۔

پیلی لکیر تاریخی اتار چڑھاؤ ہے، نیلی لائن مضمر اتار چڑھاؤ ہے، اور سرخ نقطہ اس کی 7 دن کی اوسط ہے۔

واقعہ پر مبنی

اس پچھلے ہفتے، فیڈرل ریزرو کی سالانہ میٹنگ نے آئندہ شرح میں کمی کا اشارہ دیا، اور جواب میں بٹ کوائن 6.5% بڑھ گیا۔

جذبات کے اشارے

Momentum Sentiment

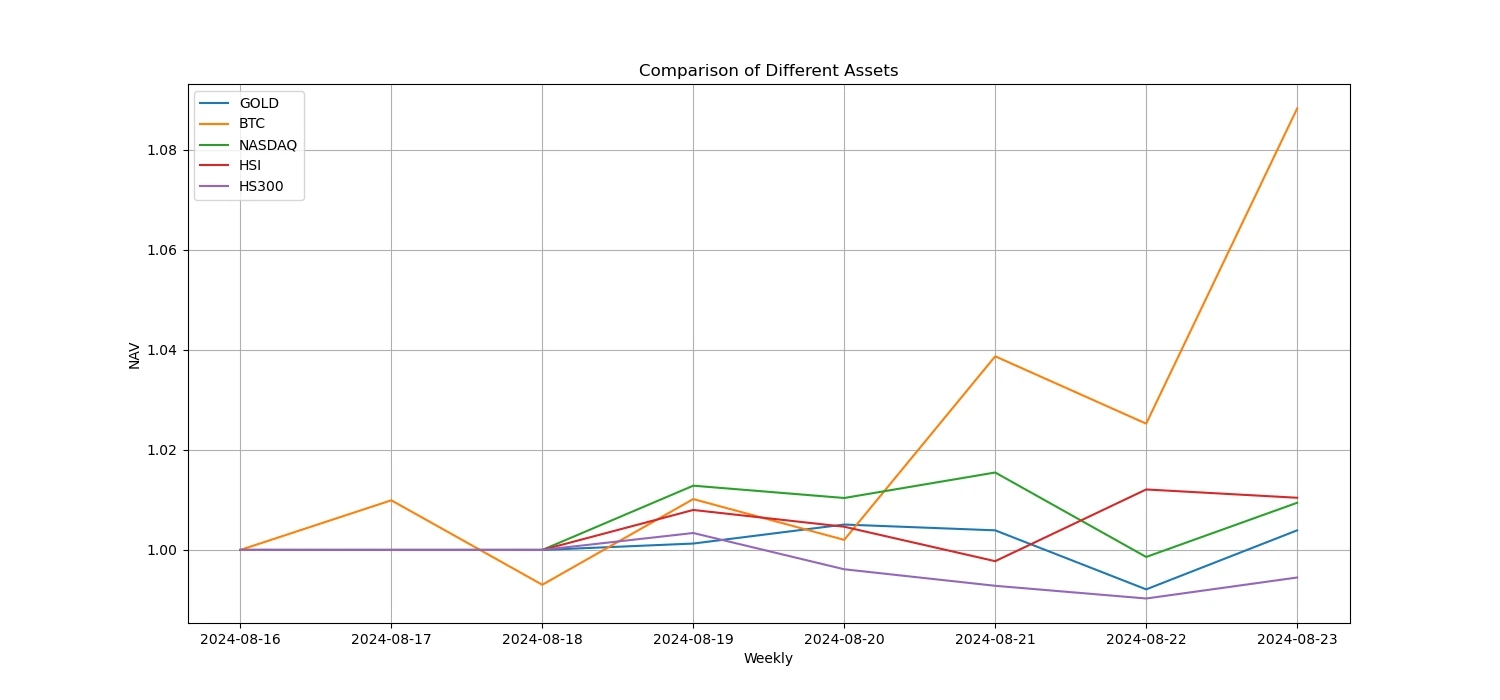

پچھلے ہفتے، Bitcoin/Gold/Nasdaq/Hang Seng Index/CSI 300 کے درمیان، Bitcoin سب سے مضبوط تھا، جبکہ CSI 300 نے بدترین کارکردگی کا مظاہرہ کیا۔

مندرجہ بالا تصویر پچھلے ہفتے میں مختلف اثاثوں کے رجحان کو ظاہر کرتی ہے۔

قرضے کی شرح_قرضے کا جذبہ

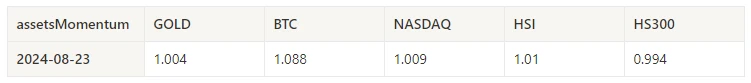

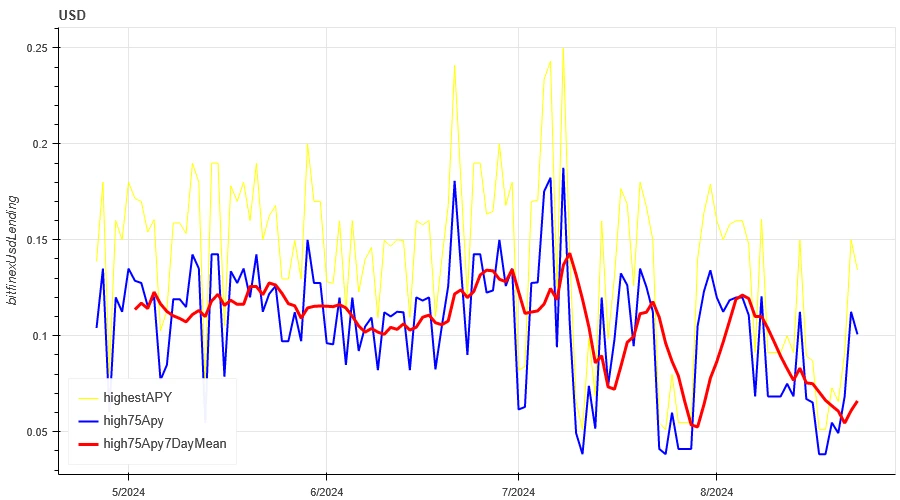

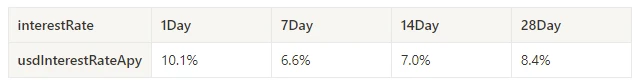

گزشتہ ہفتے کے دوران USD قرضے پر اوسط سالانہ منافع 6.6% تھا، اور قلیل مدتی سود کی شرحیں بڑھ کر 10.1% ہو گئیں۔

پیلی لکیر USD شرح سود کی سب سے زیادہ قیمت ہے، نیلی لائن سب سے زیادہ قیمت کی 75% ہے، اور سرخ لکیر سب سے زیادہ قیمت کی 75% کی 7 دن کی اوسط ہے۔

جدول ماضی میں مختلف ہولڈنگ دنوں میں USD کی شرح سود کے اوسط منافع کو ظاہر کرتا ہے۔

فنڈنگ ریٹ_کنٹریکٹ لیوریج کا جذبہ

گزشتہ ہفتے میں BTC فیس پر اوسط سالانہ واپسی -1.4% تھی، اور معاہدے سے فائدہ اٹھانے کا جذبہ مایوسی کا شکار ہو رہا ہے۔

بلیو لائن بائننس پر BTC کی فنڈنگ کی شرح ہے، اور سرخ لکیر اس کی 7 دن کی اوسط ہے

جدول ماضی میں مختلف انعقاد کے دنوں کے لیے BTC فیس کی اوسط واپسی کو ظاہر کرتا ہے۔

مارکیٹ کا ارتباط_اتفاق رائے

گزشتہ ہفتے منتخب کیے گئے 129 سکوں کے درمیان ارتباط 0.85 کے قریب تھا، اور مختلف اقسام کے درمیان مستقل مزاجی کم سطح سے بڑھ گئی ہے۔

اوپر کی تصویر میں، نیلی لائن بٹ کوائن کی قیمت ہے، اور سبز لائن ہے [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, Ape، apt، arb، ar، astr، ایٹم، آڈیو، avax، axs bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, cv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos, etc ایتھ، فیٹ، فل، فلو، ایف ٹی ایم، ایف ایکس ایس، گالا، جی ایم ٹی، جی ایم ایکس، grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme , mina, mkr, near, neo, ocean, one, ont, op, pendle qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz، yfi، zec، zen، zil، zrx] مجموعی ارتباط

مارکیٹ کی وسعت_مجموعی جذبات

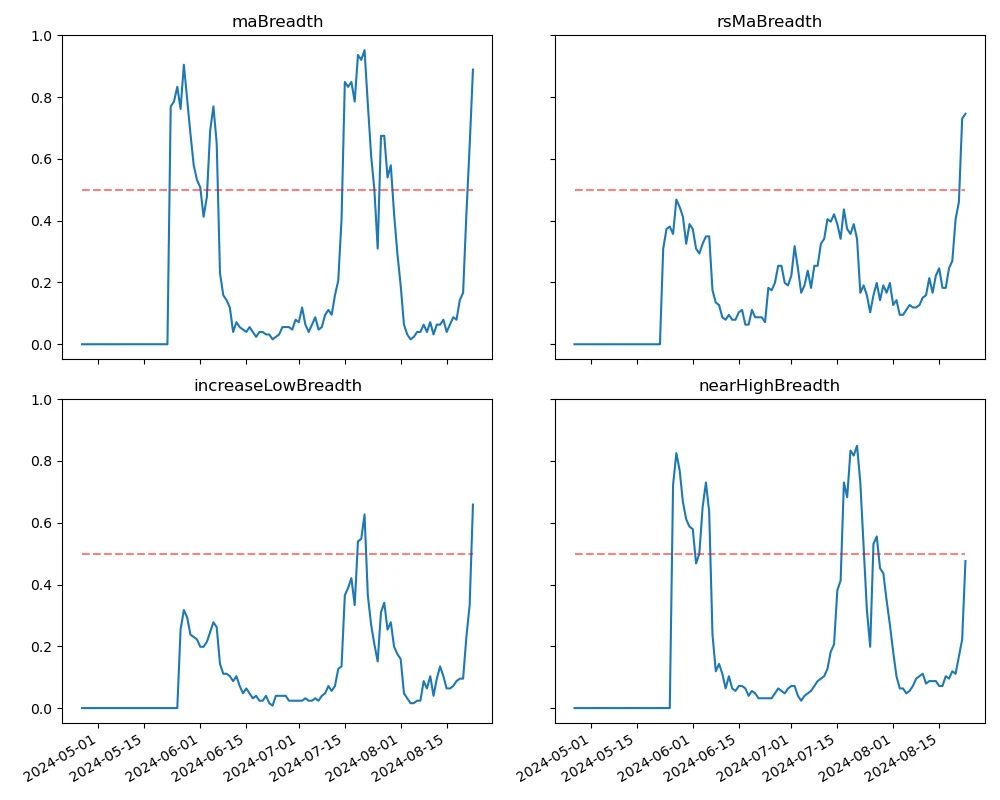

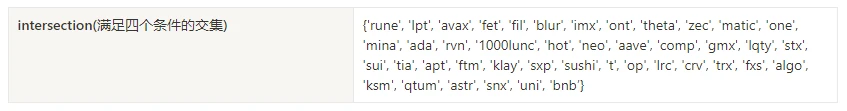

گزشتہ ہفتے منتخب کیے گئے 129 سکوں میں سے، ان میں سے 89% کی قیمت 30 دن کی موونگ ایوریج سے زیادہ تھی، ان میں سے 75% BTC کے مقابلے میں 30 دن کی موونگ ایوریج سے زیادہ تھے، ان میں سے 66% سب سے کم قیمت سے 20% سے زیادہ تھے۔ پچھلے 30 دنوں میں، اور ان میں سے 48% پچھلے 30 دنوں میں سب سے زیادہ قیمت سے 10% سے کم دور تھے۔ گزشتہ ہفتے میں مارکیٹ کی وسعت کے اشارے سے ظاہر ہوتا ہے کہ مجموعی مارکیٹ میں زیادہ تر سکے اوپر کی طرف لوٹ آئے۔

اوپر کی تصویر یہ ہے [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, anpekr apt، arb، ar، astr، ایٹم، avax، axs، bal، band، bat، bch، bigtime، blur، cake، celo، cfx، chz، ckb، comp، cv، cvx، سائبر، ڈیش، ڈوج، ڈاٹ، dydx، egld، enj، ens، eos وغیرہ، فیٹ، فل، فلو، ایف ٹی ایم، ایف ایکس ایس، گالا، جی ایم ٹی، جی ایم ایکس، grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic ، من، مانتا، ماسک، میٹک، میمی، مینا، ایم کے آر، قریب، نو، nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, run, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, سشی، ایس ایکس پی، تھیٹا، ٹیا، ٹی آر ایکس، ٹی، اوما، یونی، vet, waves, wif, wld, woo, xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] ہر چوڑائی کے اشارے کا 30 دن کا تناسب

خلاصہ کریں۔

گزشتہ ہفتے میں، Bitcoin (BTC) اور Ethereum (ETH) کی قیمت میں اتار چڑھاؤ آیا اور پھر اضافہ ہوا۔ 20 اگست کو تاریخی اتار چڑھاؤ عروج پر تھا جب مارکیٹ میں بڑے پیمانے پر اتار چڑھاؤ آیا، اور تجارتی حجم 23 اگست کو عروج پر پہنچ گیا جب مارکیٹ میں اضافہ ہوا۔ BTC اور ETH دونوں کی کھلی دلچسپی میں اضافہ ہوا۔ BTC کی مضمر اتار چڑھاؤ میں اضافہ ہوا جبکہ ETH میں کمی واقع ہوئی۔ Bitcoin نے سونے، Nasdaq، Hang Seng Index اور CSI 300 کے مقابلے میں بہترین کارکردگی کا مظاہرہ کیا، جبکہ CSI 300 نے سب سے کمزور کارکردگی کا مظاہرہ کیا۔ بٹ کوائنز کی فنڈنگ کی شرح منفی پر آگئی، جو مارکیٹ کے شرکاء کے مایوسی کے جذبات کی عکاسی کرتی ہے۔ منتخب 129 کرنسیوں کے درمیان ارتباط 0.85 کے قریب رہا، جس سے ظاہر ہوتا ہے کہ مختلف اقسام کے درمیان مستقل مزاجی کم سطح سے بڑھ گئی ہے۔ مارکیٹ کی وسعت کے اشارے سے ظاہر ہوتا ہے کہ مجموعی مارکیٹ میں زیادہ تر کریپٹو کرنسیز اب بھی اوپر کی طرف واپسی کے رجحان پر ہیں۔ فیڈرل ریزرو کی سالانہ میٹنگ نے آئندہ شرح میں کمی کا اشارہ دیا، اور جواب میں بٹ کوائن 6.5% بڑھ گیا۔

ٹویٹر: @ https://x.com/CTA_ChannelCmt

ویب سائٹ: channelcmt.com

یہ مضمون انٹرنیٹ سے حاصل کیا گیا ہے: کریپٹو مارکیٹ سینٹیمنٹ ریسرچ رپورٹ (2024.08.16-08.23): بٹ کوائن بڑھتا ہے کیونکہ ڈوویش شرح میں کمی کی طرف موڑ دیتا ہے۔

اصل مصنف: کرپٹو، ڈسٹلڈ اوریجنل ترجمہ: ٹیک فلو کوائن بیس نے ابھی ایک رپورٹ جاری کی ہے کہ کس طرح کرپٹو ہیج فنڈز اضافی منافع پیدا کرتے ہیں۔ یہاں سب سے قیمتی بصیرتیں ہیں۔ رپورٹ کا جائزہ رپورٹ فعال کرپٹو ہیج فنڈز کے ذریعے استعمال ہونے والی اہم حکمت عملیوں کو ظاہر کرتی ہے۔ یہ کسی بھی سرمایہ کار کے لیے قیمتی بصیرت فراہم کرتا ہے جس کی تلاش میں ہے: بہتر طریقے سے خطرے کا انتظام کرنا اضافی منافع پر قبضہ کرنا انکرپشن کے بارے میں اپنی سمجھ کو گہرا کرنا قیمتی بصیرت فراہم کرتا ہے۔ غیر فعال یا فعال حکمت عملی؟ آپ کے تجربہ کی سطح سے قطع نظر، ہمیشہ اپنی کارکردگی کا $BTC سے موازنہ کریں۔ اگر آپ ایک سال یا اس سے زیادہ عرصے تک $BTC کو بہتر نہیں کر سکتے ہیں، تو ایک غیر فعال حکمت عملی پر غور کریں۔ زیادہ تر سرمایہ کاروں کے لیے، DCAing $BTC مستقل بنیادوں پر عام طور پر بیئر مارکیٹ کے دوران بہترین آپشن ہوتا ہے۔ Bitcoin - بینچ مارک $BTC کرپٹو مارکیٹ بیٹا کے لیے ترجیحی بینچ مارک ہے۔ 2013 سے، $BTC کی سالانہ واپسی ہوئی ہے…