سولانا سے بہت تیز اور ای وی ایم کے ساتھ مطابقت رکھتا ہے، کیا موناد ایک پرت 1 میں خلل ڈالنے والا بن سکتا ہے؟

اصل مصنف: ڈینیل لی، CoinVoice

بلاکچین ٹکنالوجی کی وسیع کائنات میں، Ethereum، ایک سرخیل سمارٹ کنٹریکٹ پلیٹ فارم کے طور پر، پوری صنعت کے لیے ایک مضبوط بنیاد رکھ چکا ہے۔ تاہم، ایپلی کیشن کی طلب میں دھماکہ خیز نمو کے ساتھ، ایتھریم اور دیگر موجودہ انفراسٹرکچر جیسے سولانا کو درپیش تکنیکی حدود - خاص طور پر اسکیل ایبلٹی اور لین دین کی رفتار - صنعت کی ترقی کے لیے اہم رکاوٹیں بن گئی ہیں۔ ان مسائل کو حل کرنے کے لیے، Monad وجود میں آیا، جس نے بلاک چین کی کارکردگی کے معیارات کو 10,000 ٹرانزیکشنز فی سیکنڈ تک کے اعلی تھرو پٹ کے ساتھ نئی شکل دینے کا وعدہ کیا۔ اس سال کے شروع میں، Monad Labs نے Paradigm کی قیادت میں $225 ملین کی فنانسنگ مکمل کی، جس سے مارکیٹوں کو مونڈ ٹیکنالوجی کی صلاحیت کی اعلیٰ شناخت ملی۔ یہ فنڈنگ مونڈ کو اس کی پرت 1 بلاکچین کو مزید بنانے اور بہتر بنانے میں مدد کرے گی، جس سے بلاک چین انڈسٹری میں انقلابی تبدیلیاں آئیں گی۔

Monad: Ethereums اسکیلنگ کے مسئلے کو حل کرنے کے لیے بنایا گیا ہے۔

ایتھریم، بلاکچین فیلڈ میں ایک رہنما کے طور پر، ایک غیر متزلزل پوزیشن رکھتا ہے۔ یہ نہ صرف بلاکچین ریسرچ، ڈی سینٹرلائزڈ ایپلی کیشنز (Dapps) اور کمیونٹی ڈویلپمنٹ کا بنیادی مرکز ہے، بلکہ بلاک چین کی دنیا میں اپنی قیادت کا مظاہرہ کرتے ہوئے، سب سے زیادہ ٹوٹل لاک ویلیو (TVL) بھی رکھتا ہے۔ Ethereum کی تیزی سے ترقی کی بدولت، Ethereum اور Ethereum Virtual Machine (EVM) ڈویلپر کمیونٹی کرپٹو فیلڈ میں سب سے بڑی کمیونٹی بن گئی ہے، جس نے لاتعداد اختراعی DeFi اور dApp پروجیکٹس کو جنم دیا ہے۔

تاہم، پروجیکٹوں کی تعداد میں اضافے کے ساتھ، ای وی ایم کو بھی بے مثال چیلنجوں کا سامنا ہے، خاص طور پر اسکیل ایبلٹی کا مسئلہ تیزی سے نمایاں ہوتا جا رہا ہے۔ ای وی ایم کی سنگل تھریڈڈ نوعیت ٹرانزیکشن پروسیسنگ کی رفتار کو محدود کرتی ہے اور عملدرآمد کے وقت کو بڑھاتی ہے۔ اس چیلنج کو پورا کرنے کے لیے، صنعت نے متعدد حل تجویز کیے ہیں، جن میں سے شارڈنگ ٹیکنالوجی اور پرت 2 کی توسیع کی حکمت عملی نے بہت زیادہ توجہ مبذول کی ہے۔

شارڈنگ ٹیکنالوجی کا مقصد ایک بڑے بلاکچین نیٹ ورک کو متعدد چھوٹے شارڈز میں تقسیم کرنا ہے تاکہ اسٹوریج کی گنجائش اور کارکردگی کو بڑھایا جا سکے۔ تاہم، اس ٹیکنالوجی کے نفاذ کے لیے مظاہرے اور تحقیق کی ایک طویل مدت درکار ہے، اور اس کی صلاحیت کو مختصر مدت میں حاصل نہیں کیا جا سکتا۔ پرت 2 کی توسیع کی حکمت عملی مرکزی بلاک چین کے اوپر ایک اضافی فریم ورک تیار کرنا ہے تاکہ لین دین کو سنبھالا جا سکے اور سمارٹ کنٹریکٹ پر عمل درآمد کیا جا سکے تاکہ مین چین پر بوجھ کو کم کیا جا سکے اور نیٹ ورک کی مجموعی کارکردگی اور اسکیل ایبلٹی کو بہتر بنایا جا سکے۔ تاہم، جیسا کہ معروف پرت 2 جمع کرنے والی کمپنیوں جیسے کہ آربٹرم، آپٹیمزم، اور سٹارک ویئر نے ایک بار پھر اپنے چھانٹیوں کی وکندریقرت کو ملتوی کر دیا ہے، مرکزیت میں پرت 2 کو درپیش چیلنجز تیزی سے شدید ہوتے جا رہے ہیں۔

ان چیلنجوں کا سامنا کرتے ہوئے، مونڈ کے بانی کیون ہون نے انوکھی بصیرتیں پیش کیں۔ ان کا خیال ہے کہ ایتھرئم کے موجودہ توسیعی راستے میں کچھ مسائل ہیں۔ پرت 1+پرت 2 کی پرتوں والی حکمت عملی بلاکچین کو آزادانہ عمل درآمد کے ماحول میں تقسیم کرنے کا سبب بنے گی، اس طرح چین کی کمپوزیبلٹی کو تباہ کر دے گی۔ لہذا، ایک زیادہ موثر بنیادی نیٹ ورک کی تعمیر سب سے درست حل ہے، اور یہ وہ جگہ ہے جہاں مونڈ آتا ہے۔

Monad ایک اعلی کارکردگی کا L1 ہے جو Ethereum کے ساتھ مکمل طور پر ہم آہنگ ہے۔ یہ پرت 1 کی سطح پر متوازی پروسیسنگ ٹیکنالوجی کے استعمال پر توجہ مرکوز کرتا ہے تاکہ EVM کی کارکردگی کو بہتر بنایا جا سکے۔ اس کا مطلب یہ ہے کہ Monads کا مقصد اضافی Layer 2 سلوشنز پر انحصار کیے بغیر براہ راست Ethereum مین چین پر لین دین کی متوازی پروسیسنگ حاصل کرنا ہے۔ یہ نقطہ نظر سیکیورٹی اور وکندریقرت کی قربانی کے بغیر ای وی ایم کی پروسیسنگ پاور اور اسکیل ایبلٹی کو زیادہ سے زیادہ کر سکتا ہے، اس طرح ای وی ایم ماحولیاتی نظام کی صلاحیت کو مکمل طور پر ختم کر سکتا ہے۔ فی الحال، Monad 10,000 ٹرانزیکشنز فی سیکنڈ تک پروسیس کرنے کی صلاحیت تک پہنچ گیا ہے، اور پروجیکٹ کو یقین ہے کہ اگلے چند سالوں میں یہ تعداد دس گنا بڑھ جائے گی۔

2022 میں اپنے قیام کے بعد سے، Monad نے فنانسنگ کے دو راؤنڈ مکمل کیے ہیں، فروری 2023 میں $19 ملین سیڈ راؤنڈ اور اپریل 2024 میں $225 ملین راؤنڈ۔ اب تک، 50 سے زیادہ سرمایہ کاری کے اداروں نے Monad پروجیکٹ میں حصہ لیا ہے۔ یہ سرمایہ کار مونڈ کے امکانات پر مکمل اعتماد رکھتے ہیں اور یقین رکھتے ہیں کہ یہ اگلے 2-3 سالوں میں کریپٹو کرنسیوں کی مقبولیت کو فروغ دے گا۔ کیسل آئی لینڈ وینچرز کے بانی پارٹنر میتھیو والش مونڈ کو سٹیبل کوائنز کے لیے ایک ٹھوس بنیاد سمجھتے ہیں اور اسے ایک قاتل ایپلی کیشن قرار دیتے ہیں، جس کی توقع ہے کہ اگلے چند سالوں میں تیزی سے بڑھے گی۔

مونڈ: بنیادی اصلاح اور متوازی حکمت عملیوں کے ساتھ بلاک چین کی کارکردگی کو نئی شکل دینا

مونڈ بنیادی طور پر اس کے شاندار تکنیکی فوائد کی وجہ سے مقبول ہے۔ اس نے پرت 2 کے حل کے ذریعے اسکیل ایبلٹی کو بہتر بنانے کا انتخاب نہیں کیا، بلکہ بنیادی بنیادی نیٹ ورک سے شروع کیا اور متوازی عمل درآمد کی حکمت عملیوں کے ذریعے نیٹ ورک کی کارکردگی کو بہتر بنایا۔ اس نقطہ نظر کا سب سے بڑا فائدہ یہ ہے کہ یہ نیٹ ورک کی حفاظت اور وکندریقرت کو برقرار رکھتا ہے، جو مونڈ کی مستقبل کی ترقی کے لیے بہت ضروری ہے۔

کارکردگی کے لحاظ سے، Monad براہ راست قائم شدہ پرت 1 عوامی زنجیروں جیسے Aptos، Sui، اور Solana کے ساتھ مقابلہ کرتا ہے، خاص طور پر تھرو پٹ اور کم حتمی وقت کے لحاظ سے، بہت سے دوسرے پلیٹ فارمز سے کہیں زیادہ۔ مزید اہم بات یہ ہے کہ اعلیٰ کارکردگی کو یقینی بناتے ہوئے، Monad EVM کے ساتھ مکمل مطابقت بھی حاصل کرتا ہے، جو Ethereum کے ڈویلپرز کو آسانی سے اپنی ایپلیکیشنز کو Monad پر پورٹ کرنے کے قابل بناتا ہے۔

وکندریقرت کے تین بنیادی فوائد، انتہائی اعلی اسکیل ایبلٹی اور Ethereum مطابقت کے ساتھ، Monad مستقبل کے بلاکچین گیمنگ فیلڈ میں گیم چینجر بن سکتا ہے۔

مونڈس کیسے کام کرتے ہیں۔

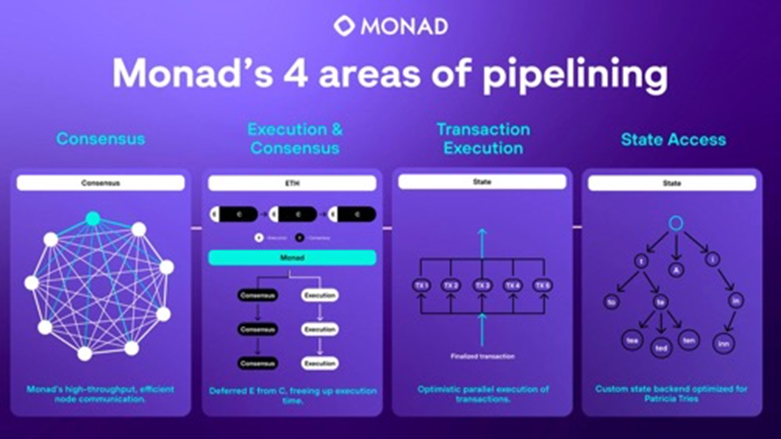

مونڈ کا کام کرنے کا طریقہ کار بنیادی طور پر چار بنیادی شعبوں کو بہتر بنا کر حاصل کیا جاتا ہے: MonadBFT، تاخیر سے عمل درآمد، متوازی عملدرآمد، اور MonadDB۔ اگلا، ہم تفصیل سے دریافت کریں گے کہ یہ چار میکانزم مونڈ کے موثر آپریشن کو فروغ دینے کے لیے کس طرح مل کر کام کرتے ہیں۔

سب سے پہلے، MonadBFT پر ایک نظر ڈالتے ہیں۔ یہ طریقہ کار Monad اتفاق رائے الگورتھم کا بنیادی ہے، جو کلاسک اتفاق رائے الگورتھم جیسے کہ Tendermint اور HotStuff کے جوہر کو اپنی طرف کھینچتا ہے اور اختراعی اصلاحات کرتا ہے۔ Tendermints کے تھری فیز کمٹ پروسیس کے مقابلے میں، MonadBFT زیادہ موثر 2 راؤنڈ لیڈر سینٹرک فین آؤٹ اور فین ان اپروچ اپناتا ہے۔ یہ میکانزم بلاک چین کی تیزی سے تصدیق اور حتمی ہونے کو یقینی بناتا ہے جبکہ مواصلات کے اوپری حصے اور تاخیر کو کم کرتا ہے۔ خاص طور پر، جب کوئی لیڈر کسی بلاک کی تجویز کرتا ہے اور اسے تمام تصدیق کنندگان میں تقسیم کرتا ہے، تو تصدیق کنندگان فوری جواب دیتے ہیں اور بعد کے بلاکس کے لیڈروں کو ووٹ بھیجتے ہیں۔ یہ پائپ لائن اتفاق رائے کا عمل نہ صرف کارکردگی کو بہتر بناتا ہے بلکہ بلاک چین کی سلامتی اور استحکام کو بھی بڑھاتا ہے۔

اگلا تاخیر سے عمل درآمد کا طریقہ کار ہے۔ اس میکانزم کا بنیادی مقصد اتفاق رائے کو عمل سے الگ کرنا ہے، تاکہ نوڈس لین دین کے مکمل ہونے کا انتظار کیے بغیر لین دین کے آرڈر پر تیزی سے متفق ہو سکیں۔ روایتی بلاک چینز میں، اتفاق رائے اور عملدرآمد کو مضبوطی سے جوڑا جاتا ہے، جس کا مطلب یہ ہے کہ بلاک پر اتفاق رائے تک پہنچنے سے پہلے ریاست اور درستگی کا تعین کرنے کے لیے لین دین کو پہلے انجام دیا جانا چاہیے۔ تاہم، یہ نقطہ نظر غیر موثر ہے کیونکہ عملدرآمد کا عمل اتفاق رائے کے لیے رکاوٹ بن سکتا ہے۔ مونڈ ایک تاخیر سے عمل درآمد کے طریقہ کار کا استعمال کرتا ہے تاکہ نوڈس کو اتفاق رائے کے مرحلے میں لین دین کی ترتیب کا تعین کرنے اور بعد میں عمل درآمد کے مرحلے میں آزادانہ طور پر لین دین کو انجام دینے کی اجازت دے سکے۔ یہ نقطہ نظر وسائل کے استعمال کی کارکردگی کو بہت بہتر بناتا ہے اور Monad کو مزید لین دین کو سنبھالنے کے قابل بناتا ہے۔

متوازی عمل درآمد مونڈ میں ایک اور اہم خصوصیت ہے۔ یہ پرامید عمل کے ذریعے ہم آہنگی کو حاصل کرتا ہے، جس کا مطلب ہے کہ موناد پر امید طریقے سے انحصار کا تعین کرنے کے لیے لین دین پر کارروائی کرتا ہے۔ پرامید عمل کے مرحلے کے دوران، مونڈ بلاک میں پچھلے لین دین کے مکمل ہونے کا انتظار کیے بغیر لین دین پر کارروائی شروع کرتا ہے، جبکہ ہر ٹرانزیکشن کے ان پٹس اور آؤٹ پٹس کو ٹریک کرتا ہے۔ یہ نقطہ نظر لین دین کے درمیان انحصار کو ظاہر کر سکتا ہے اور موثر دوبارہ عمل درآمد کو قابل بنا سکتا ہے۔ متوازی عمل درآمد کے طریقہ کار کے ذریعے، Monad ایک ہی وقت میں متعدد ٹرانزیکشنز کو پروسیس کرنے کے قابل ہے، لین دین کے تھرو پٹ کو مزید بہتر بناتا ہے۔ اس کے علاوہ، Monad تجرباتی طور پر ہر لین دین کے انحصار کا تعین کرتا ہے، جو پیچیدہ شیڈولنگ الگورتھم کی ضرورت کو مؤثر طریقے سے کم کرتا ہے اور نظام کی پیچیدگی اور اوور ہیڈ کو کم کرتا ہے۔

آخر میں، آئیے MonadDB پر بات کریں۔ روایتی بلاک چینز جیسے ایتھریم مرکل پیٹریسیا کے درختوں کو اپنی حالت میں ذخیرہ کرنے کے لیے استعمال کرتی ہیں تاکہ درخت سے ڈیٹا کو موثر طریقے سے حاصل کیا جا سکے اور چھیڑ چھاڑ سے بچایا جا سکے۔ تاہم، جب یہ ڈیٹا مقامی طور پر ذخیرہ کیا جاتا ہے، روایتی کلیدی قدر اسٹوریج ڈیٹا بیس جیسے LevelDB یا RocksDB عام طور پر استعمال کیے جاتے ہیں۔ یہ ڈیٹا بیس MPT کے درخت کی ساخت کو نہیں سمجھتے ہیں اور اس لیے Monads کے متوازی عمل درآمد کی ضروریات کو سپورٹ نہیں کر سکتے ہیں۔ اس مسئلے کو حل کرنے کے لیے، موناد نے اپنا ڈیٹا بیس، MonadDB شروع کیا۔ ڈیٹا بیس کو پیٹریسیا ٹرائی ڈیٹا ڈھانچے کے ساتھ مقامی طور پر ہم آہنگ ہونے کے لیے بہتر بنایا گیا ہے اور یہ Monads کے متوازی عمل درآمد اور غیر مطابقت پذیر I/O آپریشنز کو سپورٹ کر سکتا ہے۔ غیر مطابقت پذیر I/O میں تازہ ترین پیشرفت کا فائدہ اٹھاتے ہوئے، MonadDb ان رکاوٹوں سے بچتا ہے جو اس وقت پیش آسکتی ہیں جب سسٹم اگلی ٹرانزیکشن پر جانے سے پہلے ایک ٹرانزیکشن مکمل ہونے کا انتظار کرتا ہے۔

موناد کو قائم ہوئے صرف دو سال ہوئے ہیں۔ اگرچہ وقت نسبتاً کم ہے، لیکن یہ ناقابل تردید ہے کہ مونڈ ایک طویل مدتی صلاحیت کے ساتھ ایک بلاک چین ہے۔ اگرچہ مونڈ مین نیٹ کو لانچ نہیں کیا گیا ہے، لیکن ڈیونیٹ انٹرنل ٹیسٹ نیٹ 10,000 TPS تک پہنچ گیا ہے، جو ایک بہت ہی اونچا نقطہ آغاز ہے۔ پراجیکٹس پلان کے مطابق، Monad اگلے چند سالوں میں 100,000 TPS تک پھیل سکتا ہے۔ اگر اس توقع کو پورا کیا جا سکتا ہے، تو بلاشبہ مونڈ پوری بلاک چین انڈسٹری میں خلل ڈالنے والا بن جائے گا، اور اس کا نمائندہ متوازی عمل درآمد اور سپر سکیلر پائپ لائن فریم ورک بھی مستقبل میں عوامی زنجیروں کی مرکزی دھارے کی ترقی کی سمت بن جائے گا۔

مونڈ: گرم ماحولیاتی منصوبوں کی انوینٹری

Monad Labs، Monad blockchain کے ڈویلپر، نے اپریل میں سیریز A راؤنڈ میں $225 ملین اکٹھے کیے، جس کی قیادت ہیوی ویٹ فرم پیراڈیم نے کی، جس کی رپورٹ $3 بلین ہے۔ Monad اس وقت مربوط ہونے والی سب سے بڑی متوازی EVM پبلک چین بھی بن گئی ہے، اور EVM سے مطابقت رکھنے والی دیگر عوامی زنجیروں جیسے BSC، Polygon، اور Avalanche کے مقابلے میں Monads کے ذریعے 10,000 ٹرانزیکشنز فی سیکنڈ (tps) نے ایک وقفہ حاصل کیا ہے۔

اگرچہ Monad مین نیٹ کو ابھی تک باضابطہ طور پر لانچ نہیں کیا گیا ہے، لیکن اس کی مضبوط تکنیکی طاقت اور مارکیٹ کے وسیع امکانات نے بہت سے ڈویلپرز کو اپنی طرف متوجہ کیا ہے۔ فی الحال، مونڈ پر 80 سے زیادہ پروجیکٹس لگائے گئے ہیں، اور امید کی جاتی ہے کہ جب مین نیٹ شروع کیا جائے گا، تو مزید 150 پروجیکٹ اس پلیٹ فارم پر تعمیر کرنے کا انتخاب کریں گے۔ یہ خوشحال ماحولیاتی ترقی کا رجحان مونڈ کے ممکنہ اور صنعتی اثر و رسوخ کو پوری طرح ظاہر کرتا ہے۔ مندرجہ ذیل کئی مونڈ ماحولیاتی منصوبے ہیں جن پر توجہ دینے کے قابل ہے۔

ترجیح

aPriori Monad ایکو سسٹم میں لیکویڈیٹی اسٹیکنگ پلیٹ فارم ہے، جو Miner Extractable Value (MEV) پر فوکس کرتا ہے۔ اس کا مقصد اثاثوں کی لیکویڈیٹی کو برقرار رکھتے ہوئے صارفین کو اسٹیکنگ کے موثر حل فراہم کرنا ہے، جس سے صارفین اسٹیکنگ میں حصہ لیتے ہوئے اپنے اثاثوں کو لچکدار طریقے سے استعمال کر سکتے ہیں۔

فنانسنگ

aPriori نے 2024 میں $8 ملین کی فنانسنگ کا سیڈ راؤنڈ کامیابی کے ساتھ مکمل کیا، جس کی قیادت معروف سرمایہ کاری ادارے Pantera Capital کر رہے ہیں اور Binance Labs کے تعاون سے۔ یہ فنانسنگ اس کی ٹیکنالوجی کی ترقی اور مارکیٹ کے فروغ کے لیے مضبوط مالی معاونت فراہم کرے گی۔

بنیادی خصوصیات

لیکویڈیٹی اسٹیکنگ: صارفین اپنے کریپٹو اثاثوں کو داؤ پر لگا سکتے ہیں اور لیکویڈیٹی ٹوکن حاصل کر سکتے ہیں، جو اثاثوں کے استعمال کی کارکردگی کو بہتر بنانے کے لیے دوسرے ڈی فائی پروٹوکول میں استعمال کیے جا سکتے ہیں۔

MEV آپٹیمائزیشن: سمارٹ کنٹریکٹس کے ذریعے لین دین کے آرڈر کو بہتر بنائیں، صارف کے فوائد کو زیادہ سے زیادہ کریں، اور اس بات کو یقینی بنائیں کہ صارفین کو مارکیٹ میں حصہ لینے پر بہترین منافع ملے۔

ہائی پرفارمنس سپورٹ: مونڈ نیٹ ورک کے اعلی تھرو پٹ کا فائدہ اٹھاتے ہوئے، یہ فی سیکنڈ 10,000 ٹرانزیکشنز کو سپورٹ کرتا ہے، تیز رفتار پروسیسنگ اور لیکویڈیٹی وعدوں کی موثر عملدرآمد کو یقینی بناتا ہے۔

کنٹسو

Kintsu Monad ماحولیاتی نظام میں ایک لیکویڈیٹی اسٹیکنگ پروٹوکول ہے، جس کا مقصد صارفین کو لچکدار اسٹیکنگ کا تجربہ فراہم کرنا ہے۔ یہ صارفین کو اثاثوں کو داغدار کرنے کی اجازت دیتا ہے جبکہ وہ اب بھی لچکدار طریقے سے استعمال کرنے کے قابل ہوتے ہیں، صارفین کی لیکویڈیٹی کی طلب کو پورا کرتے ہیں۔

فنانسنگ

Kintsu نے 25 جولائی 2024 کو کامیابی کے ساتھ $4 ملین سیڈ راؤنڈ مکمل کیا۔ اس راؤنڈ کی قیادت Castle Island Ventures نے کی، جس میں Brevan Howard Digital، CMT Digital، Spartan Group، اور دیگر سمیت دیگر قابل ذکر سرمایہ کاروں کی شرکت تھی۔

بنیادی خصوصیات

لیکویڈیٹی اسٹیکنگ: صارفین اپنے اثاثوں کو داؤ پر لگانے کے بعد، وہ لیکویڈیٹی ٹوکن حاصل کرسکتے ہیں، جو کہ دیگر DeFi ایپلی کیشنز میں اثاثوں کی لیکویڈیٹی کو بہتر بنانے کے لیے استعمال کیے جاسکتے ہیں۔

وکندریقرت توثیق کرنے والا طریقہ کار: اجازت دہندگان کو بغیر اجازت شامل ہونے میں مدد کرتا ہے، نیٹ ورک کی وکندریقرت اور حفاظت کو بڑھاتا ہے، اور صارف کے اثاثوں کی حفاظت کو یقینی بناتا ہے۔

کمپوزیبلٹی: Kintsu鈥檚 Liquid Staking Token (LST) کو صارفین کے لیے آمدنی کے مزید مواقع پیدا کرنے کے لیے دیگر DeFi ایپلی کیشنز کے ساتھ آسانی سے مربوط کیا جا سکتا ہے۔

کورو

Kuru Monad ایکو سسٹم میں ایک وکندریقرت آرڈر بک ایکسچینج (CLOB) ہے، جس کا مقصد صارفین کو چین پر اسپاٹ اثاثوں کی تلاش، تحقیق اور تجارت کے لیے ایک پلیٹ فارم فراہم کرنا ہے۔ Kurus ڈیزائن کا تصور ایک موثر آرڈر بک میکانزم کے ذریعے سرمائے کی بہتر کارکردگی اور لیکویڈیٹی فراہم کرنا ہے، اور Monad نیٹ ورک کے ہائی تھرو پٹ اور تیز رفتار بلاک ٹائم کا فائدہ اٹھا کر صارفین کے تجارتی تجربے کو بڑھانا ہے۔

فنانسنگ پیمانہ

Kuru نے 25 جولائی 2024 کو $2 ملین سیڈ راؤنڈ مکمل کیا۔ اس راؤنڈ کی قیادت الیکٹرک کیپٹل نے کی، جس میں بریون ہاورڈ ڈیجیٹل، سی ایم ایس ہولڈنگز، بریڈ وی سی، اور اینجل سرمایہ کاروں جیسے مونڈ کے سی ای او کیون ہون نے شرکت کی۔

بنیادی خصوصیات

وکندریقرت لین دین: Kuru صارفین کو ایک وکندریقرت ماحول میں لین دین کرنے کی اجازت دیتا ہے، لین دین کی شفافیت اور تحفظ کو یقینی بناتا ہے اور صارفین کے اعتماد کی لاگت کو کم کرتا ہے۔

متنوع مالیاتی مصنوعات: صارفین کو اثاثوں کی تخصیص کو بہتر بنانے اور سرمایہ کاری پر زیادہ منافع حاصل کرنے میں مدد کرنے کے لیے قرض دینے، لیکویڈیٹی مائننگ اور انشورنس سمیت متعدد مالیاتی مصنوعات فراہم کریں۔

مونڈ پیڈ

مونڈ پیڈ ایک مونڈ پر مبنی ٹوکن اور این ایف ٹی لانچ پلیٹ فارم ہے۔ مونڈ پیڈ پروجیکٹ کے مالکان یا ڈویلپرز کو پہلے سے فروخت یا عوامی فروخت کی شکل میں ٹوکنز یا NFTs کے لیے ابتدائی فنڈ ریزنگ شروع کرنے میں مدد کرتا ہے۔ یہ ابھرتے ہوئے پراجیکٹس کے لیے ایک آسان فنڈ ریزنگ چینل فراہم کرتا ہے اور پروجیکٹ مالکان کو مطلوبہ مالی مدد حاصل کرنے میں مدد کرتا ہے۔

فنانسنگ

مونڈ پیڈ نے جولائی 2024 میں $945,000 سیڈ راؤنڈ فنانسنگ مکمل کیا، جس میں حصہ لینے والے اداروں بشمول CMS اور Sneaky Ventures، اس کے بعد کی ترقی کے لیے مالی مدد فراہم کرتے ہیں۔

بنیادی خصوصیات

ٹوکن اور NFT جاری کرنا: ٹوکنز اور NFTs کے لیے ابتدائی فنڈ ریزنگ میں پروجیکٹ پارٹیوں کی حمایت کریں، پروجیکٹ کے آغاز کے لیے حد کو کم کریں۔

اصل NFT سیریز: Purple Frens نامی NFT سیریز جاری کی گئی تھی، اور ہولڈرز صارف کی شرکت اور منافع کی صلاحیت کو بڑھا کر پلیٹ فارمز کی آمدنی کا حصہ حاصل کر سکتے ہیں۔

یہ مضمون انٹرنیٹ سے حاصل کیا گیا ہے: سولانا سے کہیں زیادہ تیز اور ای وی ایم کے ساتھ مطابقت رکھتا ہے، کیا موناد پرت 1 میں خلل ڈالنے والا بن سکتا ہے؟

متعلقہ: ہیرس کے ممکنہ چلانے والے ساتھیوں کا جائزہ لینا: کریپٹو کرنسی پر ان کے کیا موقف ہیں؟

سینڈر لٹز کا اصل مضمون، ڈیکرپٹ اصل ترجمہ: الیکس لیو، فارسائٹ نیوز اوور ویو کملا ہیریس کا رننگ ساتھی کا انتخاب اس بات کا اشارہ دے سکتا ہے کہ اگر وہ منتخب ہوتی ہیں تو وہ کس طرح حکومت کرنے کا ارادہ رکھتی ہیں، اور دفتر کے سرکردہ دعویداروں نے کرپٹو کرنسیوں کے لیے مختلف سطحوں کی حمایت یا احتیاط ظاہر کی ہے۔ . کچھ دعویدار، جیسے جوش شاپیرو اور اینڈی بیشیر، ریاستی سطح پر کریپٹو کرنسی سے متعلق سرگرمیوں میں فعال طور پر شامل رہے ہیں یا ان کی حمایت کرتے رہے ہیں، جبکہ دیگر، جیسے رائے کوپر، نے زیادہ محتاط انداز اپنایا ہے۔ دیگر سرکردہ امیدوار، جیسے کہ گریچین وائٹمر اور مارک کیلی، کم واضح کرپٹو موقف رکھتے ہیں، لیکن ان کے سیاسی اتحادی ہیں جنہوں نے کرپٹو کے حامی قانون سازی کی حمایت کی ہے یا دوسری صورت میں صنعت کے لیے ممکنہ کھلے پن کا اشارہ دیا ہے۔ ڈیموکریٹک صدارتی نامزدگی کے لیے کملا ہیریس کے ممکنہ طور پر اضافے نے اسکرپٹ کو پلٹ دیا ہے کہ نومبر…