اصل مصنف: ایلکس لیو، فارسائٹ نیوز

If DeFi didnt exist, ETH would probably be priced at $400. DeFi has added the most market cap and use cases to ETH so far, not the other way around. Its no coincidence that when DeFi is ignored, sentiment in the ETH ecosystem is down. The only way to get ETH to new highs is through DeFi, and its time for everyone to realize that. – Sam Kazemian, founder of Frax Finance

What is the current crypto market like?

-

It is a bear market for altcoins . Although BTC is still fluctuating at a high of $60,000, many altcoins have already given back all their gains in this round, and even hit new lows. Most new coins are at their peak as soon as they debut.

-

There are more gamblers than believers – Value investing is a waste, all-in MEME makes you live in a palace. This is not a joke, but the true opinion of many friends who feel wealth anxiety in the industry. They only speculate on new things and not old things, and even if group members sell off each other, they will not let VC take over.

-

Lack of capital inflow – there is no so-called Mass Adoption, no inflow of retailers, only PVP between people in the field. If A wants to make money, B must lose money, and there is no common goal of making the pie bigger.

How can we break the deadlock? I think DeFi needs a renaissance.

The DeFi Dilemma

DeFi is also struggling in this cycle. In an era where traffic is king, it has lost its narrative heat and no one is interested. How did this situation come about?

90% of the crypto market is a narrative game, and the frustrating truth is — most influential Shillers and KOLs have nothing to do with DeFi token interests. It’s much more profitable to promote the meme coin they bought a few minutes ago or work with new protocols that allocate a large amount of tokens to KOLs.

Those who create narratives rarely actually hold DeFi tokens. KOLs also don’t see the value in mentioning OG DeFi projects because being an early insider is the biggest benefit: a large amount of token supply is held by the team or VC, and most of it has been unlocked.

Therefore, the task of promoting DeFi tokens seems to belong to the project builders themselves, as well as the true believers of DeFi.

In a word: DeFi’s dilemma is the inevitable result when the market is impetuous and speculators have the upper hand. But if the crypto market pursues 10% of actual use cases in addition to the 90% narrative games – when the market returns to rationality, the situation will be corrected.

DeFi, the future

DeFi has intrinsic value

DeFi tokens are valuable, the exact opposite of the low circulation, high FDV VC coins and meme coins that people hate.

OG DeFi Tokens (AAVE, MKR, COMP, CRV, etc.):

-

Most of them have been circulated

-

The revenue sharing mechanism is gaining attention

-

Time-proven PMF (product-market fit) and resilience for long-term building

Many DeFi protocols have achieved profitability and have a buyback mechanism (Maker), a ve token model (protocol revenue and external Bribes are given to token lockers, Curve), or a planned revenue sharing mechanism (Aave). Holding these tokens is equivalent to having a steady stream of cash flow.

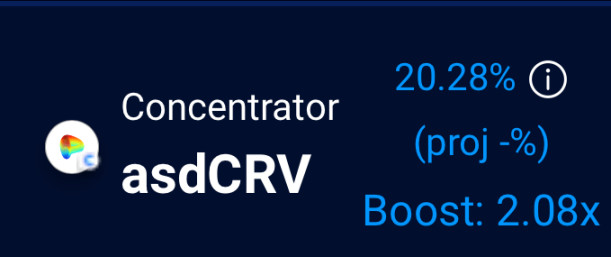

Currently, locking up Curve liquidity can earn an annualized return of 20%

DeFi is a core use case

What exactly is blockchain and what problems does it solve? In order to solve the problem of no one trusting each other, blockchain changes the traditional industry where only middlemen (banks, companies) need to store a few copies of data into a system where each participant has to store a copy, and then a consensus mechanism is used to determine a public account that everyone agrees on – essentially, redundant storage.

Redundant storage is more expensive and uneconomical, and can only compete with centralized solutions in use cases where someone is willing to pay the premium. Financial activities with strong property characteristics, such as transactions, transfers, and lending, can tolerate a certain degree of inefficiency and high costs (relative to centralized solutions) and pursue absolute security. Decentralized finance (DeFi) is the natural core use case of blockchain.

DeFi is the direction of the industry

The current market problems: more gamblers than believers, lack of capital inflow, can all be solved as the industry develops. But in what direction will the industry develop?

Larry Fink, CEO of Blackrock, a Wall Street giant and the biggest initiator of this cycle and a real trendsetter who promoted the passage of the Bitcoin ETF, said that in the future all stocks, bonds and other assets will be tokenized and put on the chain.

Can financial assets be put on-chain, bypassing the existing decentralized financial infrastructure? For stable asset exchange, such as foreign exchange conversion between on-chain USD and on-chain EUR, will Curve be chosen? Can on-chain interest rate derivatives (which have a trillion-dollar scale in traditional markets) directly/indirectly use Pendle? For collateralized lending of financial assets, is Aave, whose code has been battle-tested and has never failed, not considered? (Traditional finance is unwilling to completely decentralize and give up ownership? Can Aave launch a dedicated market for Lido, but not a customized market for Blackrock?)

Larry Fink interview

DeFi is the direction of the industry, and it has the volume to absorb funds that can change the industry landscape.

DeFi is experiencing a renaissance

DeFi is waking up.

Since Aave proposed the revenue sharing plan, the price of the coin has nearly doubled from the bottom. The lending position of the founder of Curve Finance was finally completely liquidated. After the bad news was exhausted, CRV rebounded from 0.18 USDT to 0.34 USDT. The on-chain data of various protocols are also improving:

Aave’s daily active addresses reached a near one-year high on August 19

With the DeFi revival, is the bull market far away?

Some of the views come from: https://x.com/DefiIgnas/status/1824447367417835559

This article is sourced from the internet: To break the altcoin bear market, a DeFi revival is needed

Related: Short video review: Top 10 highlights from the Nashville Convention

Original author: Luke Martin Compiled by: Odaily Planet Daily Azuma The 2024 Bitcoin Conference was held in Nashville, Tennessee from July 25 to July 27 local time in the United States. Due to the attendance and speech of former US President Trump, the attention of this conference can be described as the focus of all attention. In the early hours of Sunday morning, Odaily Planet Daily had already used 10,000 words to write the full text of Trumps 40-minute speech ( Full text of Trumps speech at the Bitcoin Conference: Will establish a strategic reserve of Bitcoin and fire Gary Gensler ). In order to help everyone feel the atmosphere of the conference more intuitively, Odaily Planet Daily will select the top ten most exciting moments of the Nashville conference…