آن چین گیمنگ کے لیے ضروری: نینی لیول چین سویپنگ ٹولز کے لیے ایک گائیڈ

اصل مصنف: ٹیک فلو

As the first stop for the code to get rich quickly, Pump.fun has been popular for half a year since its launch. Instead of gradually fading away, the craze for local dogs has continued to rise. Pump.funs protocol revenue and the number of new asset issuances are still rising.

Seeing that the Pump protocol pie is getting bigger and bigger, other protocol projects are naturally jealous. In addition to Solana, Pump applications on various chains continue to emerge. Whether it is the Ethereum mainnet or TRON, various Pump applications have also been in the spotlight, and large and small public chains have been experienced by the swarm of users.

But in addition to the tempting opportunity of small investment for big wins, the more common phenomenon in Pump applications is that most people lose money faster. Compared with the mature secondary market, internal trading makes PvP fighting simpler and more brutal, not to mention that Pumps one-click bidding mechanism facilitates conspiracy groups to sharpen their knives and attack retail investors, waiting to make a big profit.

Therefore, in order to prevent being cut and to screen out reliable targets as much as possible from the various Memecoins, chain sweeping has become a necessary behavior for veteran chain players to survive and improve their winning rate in the PvP battlefield.

The so-called chain scanning is to use various on-chain tools to monitor the new dynamics of various asset issuances in real time, including but not limited to the issuance of high-quality new assets, large transactions on the chain, trading volume rankings in fixed time periods, buying and selling of specific monitored addresses (smart money), new listings by familiar Devs, etc.

Today, TechFlow brings players a nanny-level Pump chain sweep guide to help players be clear-headed and one step ahead in Pump PvP. They don鈥檛 seek to make huge profits, but to stay at the table and not be harvested inexplicably.

PS: This article is not extensive. The tools introduced in the article are all based on the author鈥檚 personal experience. For on-chain gaming, it is recommended to use a new wallet and pay attention to phishing risks.

Line Viewing Tools

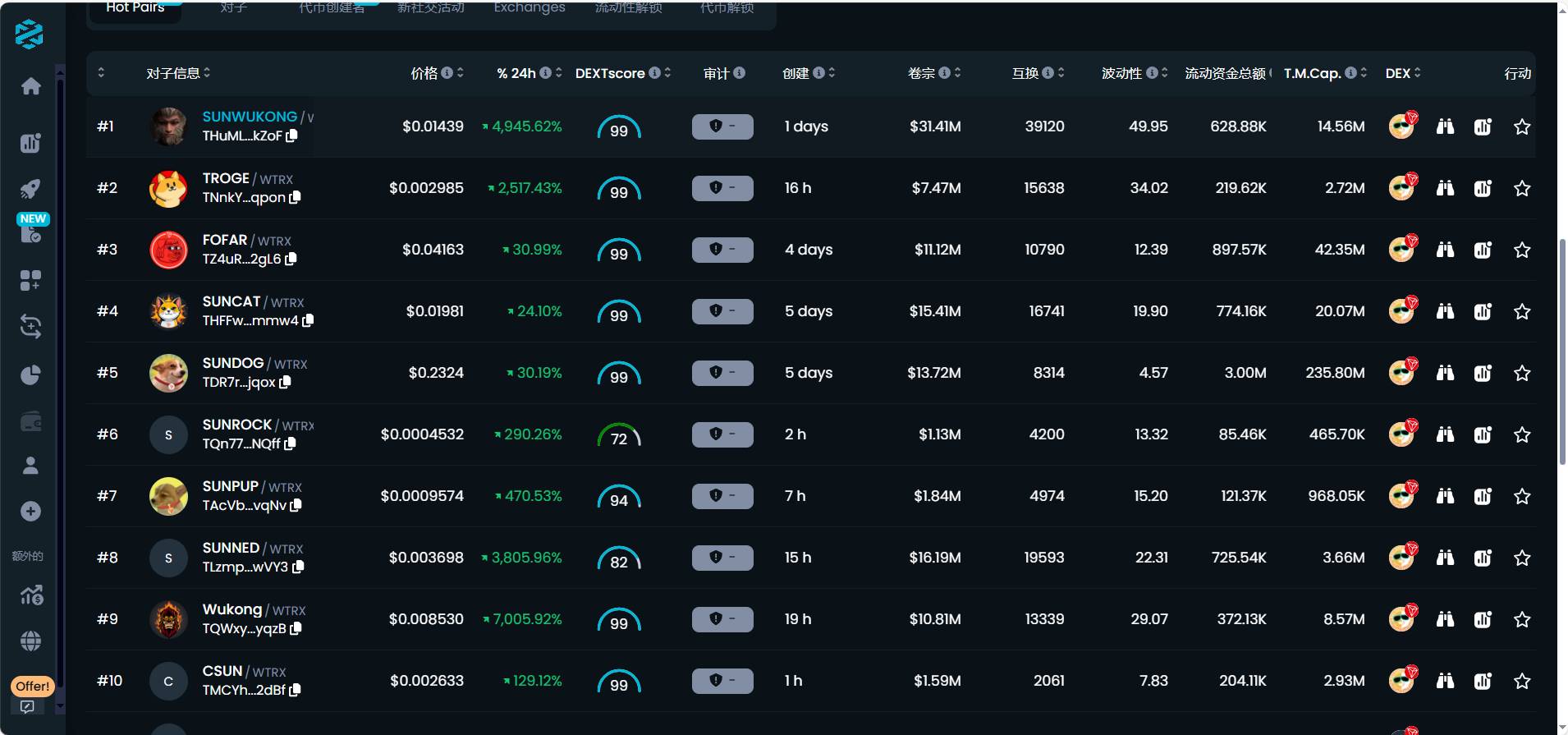

The tool for viewing lines is a commonplace, and it has been a must-have for everyone before various pumps came out. However, the popular Sunpump still has some minor bugs that often cause the K-lines and transactions in the platform to be invisible. Using a third-party K-line tool can track the price trend of intra-market assets in a relatively timely manner.

Ave.ai

The platform updates new hot spots quickly. Now there is a Sunpump and sub-index area on the homepage. It also supports entering contracts to view Sunpump internal price trends, but in actual tests, the price is sometimes delayed by a few minutes.

dextools

dextools also supports TRON asset monitoring, and can check the internal prices of various Pumps in a timely manner, with a smooth experience.

Monitoring Tools

For SweepChain, the most important thing is that the functions of a comprehensive monitoring tool are similar. The main functions are to monitor key indicators such as new asset issuance, short-term trading volume, and the maximum share limit. The application form is mostly web version + tg bot. The popular tools are mainly GMGN.AI , BullX ، اور iCrypto . Since BullX currently has an invitation code access system, iCrypto does not yet support Solana. So here we mainly use the GMGN.AI tool that is popular among Chinese users as an example:

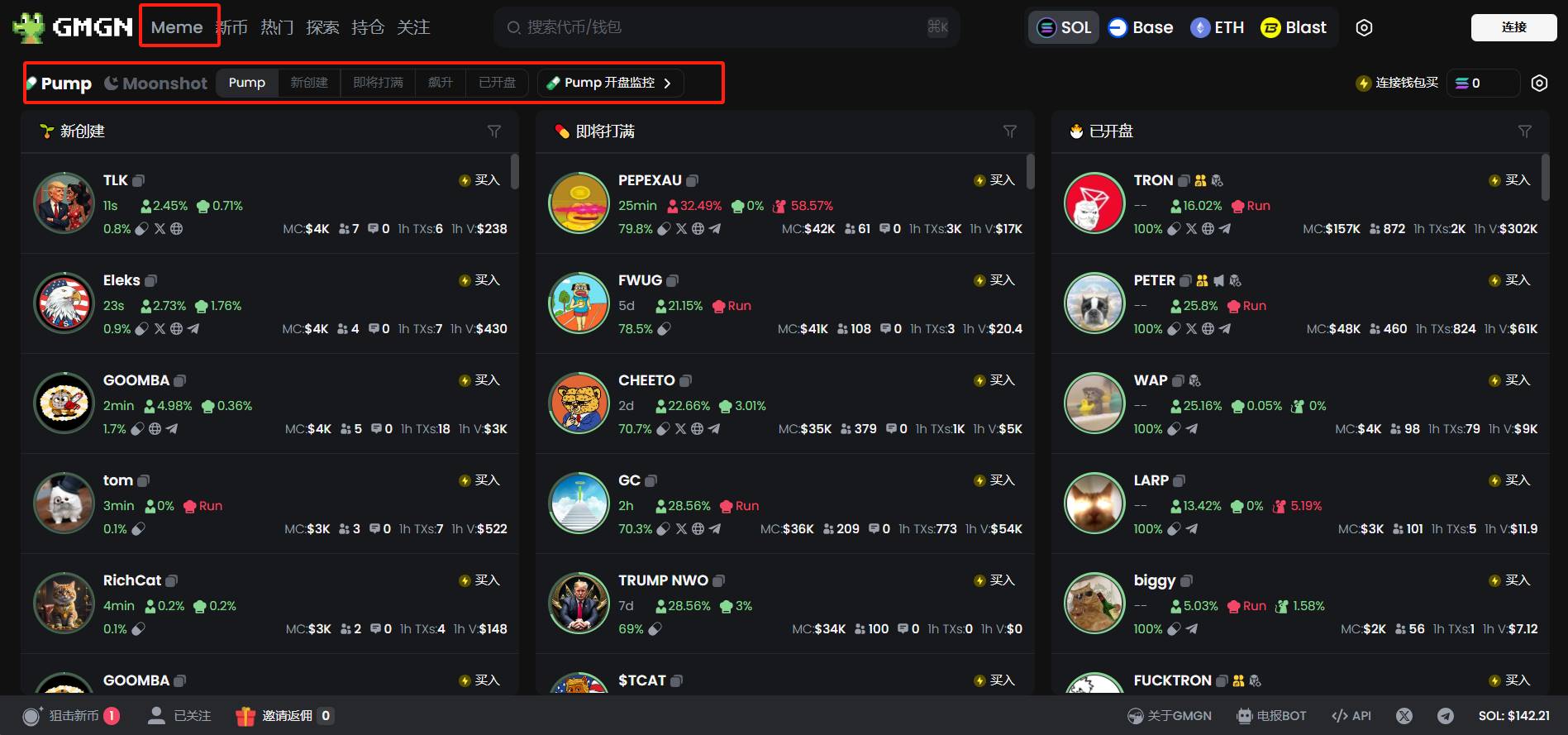

GMGN supports multi-chain asset monitoring and is a relatively comprehensive application in Solana Pump.fun鈥檚 asset monitoring.

The Meme section of the platform provides Pump.fun players with support for a variety of segmented needs, including newly created asset monitoring, full-capacity monitoring, short-term trading volume surge monitoring, and opened trading monitoring.

Except for the opening monitoring function which requires connecting to the users tg account to send instant notifications, other functions can be used right away on the web version.

These indicators seem to have their own uses, but according to my personal experience, as long as these indicators are used flexibly, the corresponding reliable targets can be screened out to the greatest extent:

-

Newly Created Asset Monitoring focuses on the Devs holding ratio of tokens, Devs past history, and the holdings of the top 10 addresses for comprehensive observation.

-

The internal market share is about to reach full monitoring. You can focus on assets whose internal market transactions have soared in a short period of time, see if there is a large amount of smart money involved, check whether there is any action on the official Twitter of the project, etc.

-

Monitoring of opened markets, this list shows that the internal markets are already full, so we can focus on Devs holdings, whether Dev has been sold out, whether there are any angles to participate in the target itself, whether there are any big players following the official Twitter, whether the tg community discussion is lively, etc.

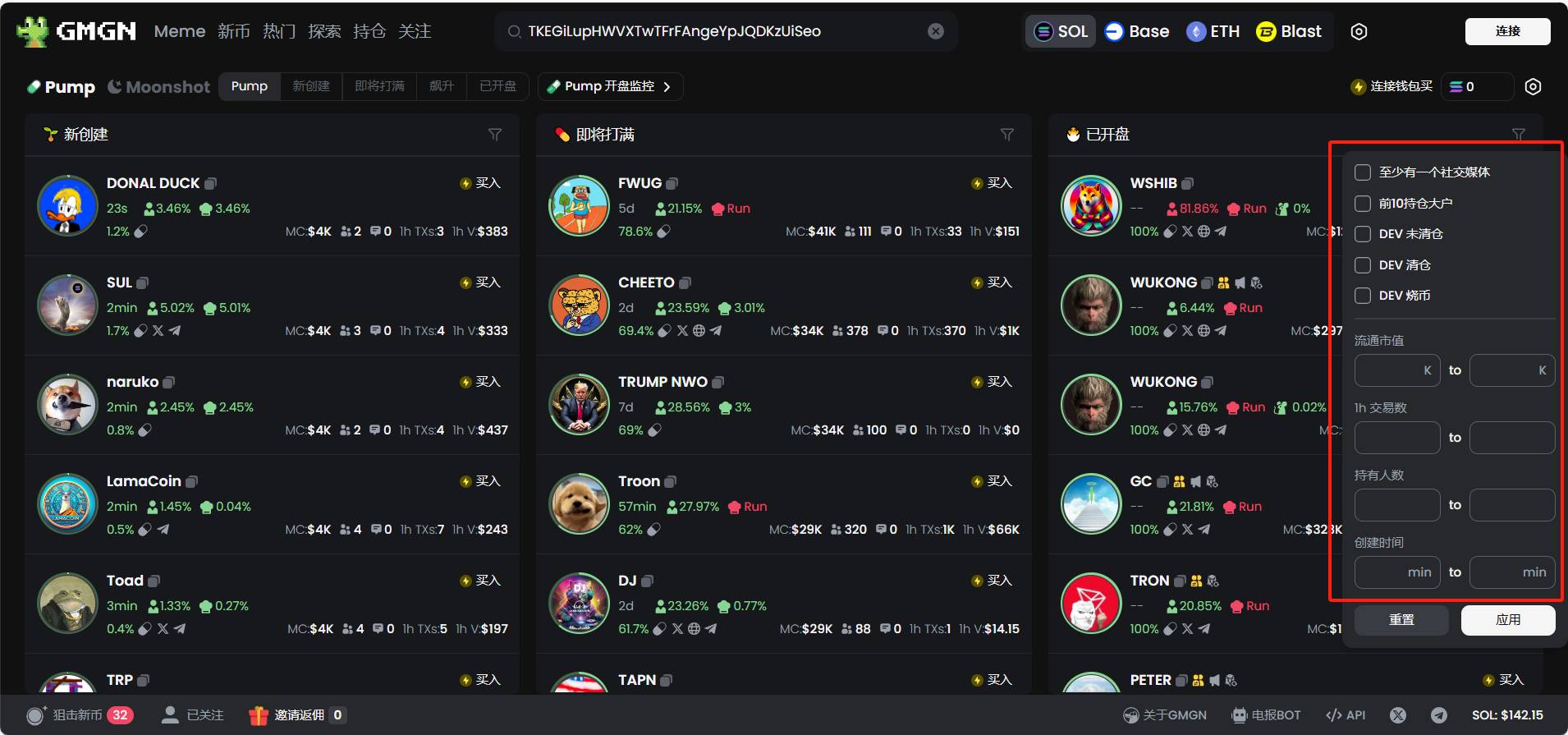

In addition, GMGN supports custom condition filtering, and can customize filtering for indicators such as social media accounts, Top address holdings, Dev actions, transaction volume, creation time, etc.

Unfortunately, GMGN is currently mainly used to monitor ETH and Solana assets, and does not yet support TRON asset monitoring.

ٹیلیگرام بوٹ

As on-chain PvP becomes more and more intense, being one step ahead has gradually become a winning magic weapon. Various Telegram Bots have also become increasingly popular and become essential tools for on-chain users.

Since the functions of trading bots are basically the same, here are a few bots that support Chinese and that I often use, covering various functions such as on-chain dynamic monitoring, trading, sniping, etc.

GMGN.AI Bot

As mentioned earlier, GMGN.AI is a web version + tg bot format. In addition to practical web tools, its TG Bot also covers a relatively comprehensive range, supporting various monitoring and trading forms, and supporting Chinese.

Pepe boost

Pepe boost is a TG Bot developed by a Chinese team. Players in the Chinese area should be familiar with it. It became famous during the Meme craze in the first half of the year.

Pepe boost supports ETH mainnet, Solana, and Base multi-chain, and supports practical on-chain functions such as copy trading, sniping, and monitoring.

Sunpump Monitoring Bot

Sunpump has been the hottest these days, but there is no reliable trading bot yet. Here are some dynamic monitoring bots for Sunpump on the chain for reference only:

KOL recommends Sunpump assets tweet monitoring: https://t.me/+Ff1co EzyIbYyYTg 1

SunPump reaches 30% of its asset information: https://t.me/sunpump1

SunPump communication channel (with some query functions): https://t.me/sunpumpcaode

خلاصہ

Investing is risky, please participate with caution. No matter how good the tools are, they are only auxiliary. The real secret to success is to restrain human nature, not to get carried away by FOMO, do a good job of risk control, integrate knowledge and action, and curb greed.

I wish you a smooth journey on the chain.

This article is sourced from the internet: Essential for on-chain gaming: A guide to nanny-level chain sweeping tools

Related: The German government can no longer sell its currency? BTC may have reached a local bottom

Original author: Mary Liu, BitpushNews Crypto markets stabilized on Monday after days of massive selling. During the early trading hours of the same day, the German government address transferred more than 10,000 bitcoins it held to crypto exchanges and market makers in several batches. The price of bitcoin once fell below $55,000. However, Arkham Intelligence data showed that during the closing hours of the U.S. stock market (corresponding to around 01:56 AM on Tuesday morning Beijing time), the German government address received 2,898 bitcoins returned by the exchange, equivalent to approximately $163 million, mainly from Coinbase, Kraken and Bitstamp. Steven Zheng, head of research at The Block, analyzed that the exchange is likely to return the bitcoin because it cannot sell it within the target price range. “Considering that some…