Stablecoin APY ارننگ گائیڈ: اپنے کریپٹو اثاثوں کو اپنا کرایہ ادا کرنے دیں۔

کریپٹو مارکیٹ کی ایک خصوصیت ہے: ہر کوئی اس بارے میں بات کر رہا ہے کہ پیسہ کیسے کمایا جائے اور دوسروں نے کتنا پیسہ کمایا، لیکن بہت کم لوگ اس بارے میں بات کرتے ہیں کہ کس طرح ڈرا ڈاؤن کو کنٹرول کیا جائے، کمائے گئے سٹیبل کوائنز سے کیسے نمٹا جائے، اور زیادہ معقول رقم کیسے حاصل کی جائے۔ نقد بہاؤ

After all, the crypto industry is highly reflexive. When the bull market comes, even pigs can fly, but when it is in free fall, it is like hell on earth. In the monkey market stage when there are not so many new narratives in the market, it is very likely that more mistakes will be made. At this time, it may be a good thing to be familiar with some crypto-native financial management methods and means to form a more reasonable allocation of funds.

Previously, Binance co-founder He Yi also said that financial management is a low-risk option.

In fact, not many people in the industry are talking about the financial management market. In addition to the funding issue, the main reason may be that this type of financial management is a one-time deal, and you only need to deposit funds to realize after-sleep income. There are not many angles to discuss, so more often sharing is only between some specific communities and acquaintances, just like the Benmo community in the Chinese-speaking area. Moreover, this kind of real income often has a limited ceiling, so in order to avoid dilution of income, it is less spread. But the benefits of this field are obvious. In addition to the non-existence of the take-over-losing money feature of the secondary market, it can also let you sleep like a baby.

Rhythm sorted out some APY projects that have been discussed in the community recently, mainly stablecoins and derivative tokens. Among them, the TVL of DeFi projects is more than 50 million, and explained the corresponding sources of income. The main source of DeFi is the subsidy of the protocols own tokens. CEXs financial management projects come from the cooperation between CEX and projects. Among them, the highest-yielding activity APY is as high as 200%. Although it has ended temporarily, the ideas can still be used as a reference. The following projects do not constitute investment advice and are sorted according to community popularity.

PayPal USD

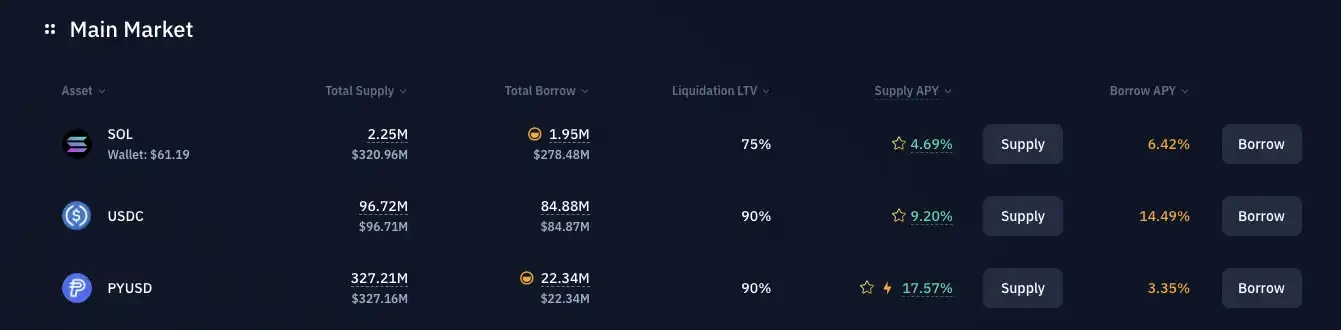

The most discussed stablecoin investment project in the community is PayPal USD (PYUSD), a stablecoin launched by payment giant Paypal and issued by Paxos. Currently, the APY yield of PYUSD on the Solana chain is generally higher than 15%. Taking Kamino, the largest lending platform on Solana, as an example, 320 million PYUSD enjoys an APY of 17.57% borrowing income, and another lending platform Marginfi has an APY of over 18%.

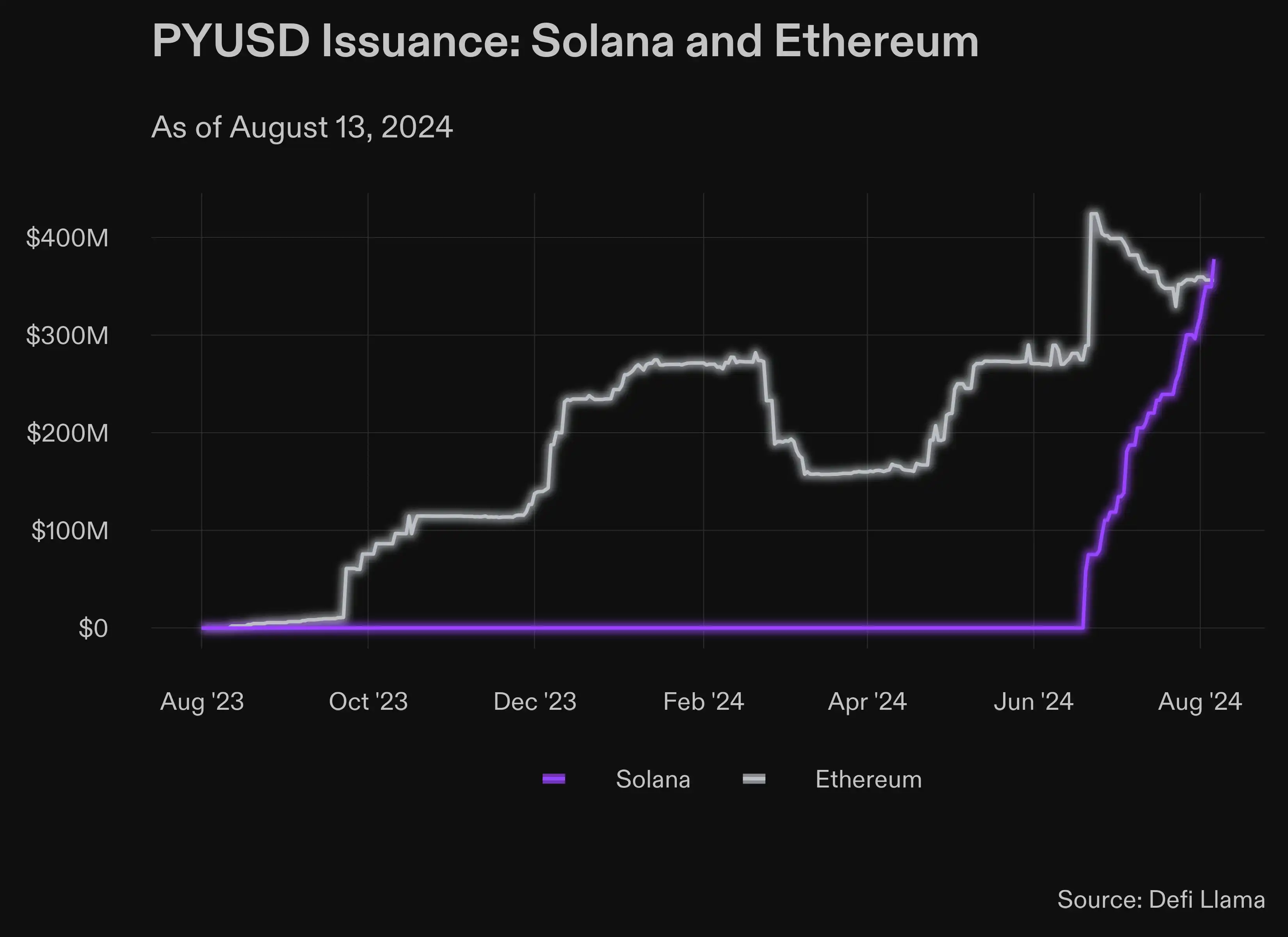

Perhaps it is related to the recent efforts of the Solana Foundation to vigorously promote payment and PayFi. According to the community, the high incentives for PYUSD on the Solana chain are provided by Solana and Paypal, but there is no clear statement about the source of the subsidy. With the endorsement of Paypal and the high interest, the issuance of PYUSD on the Solana chain surpassed Ethereum in mid-August, becoming the largest issuance platform for PYUSD.

USDC-Sui

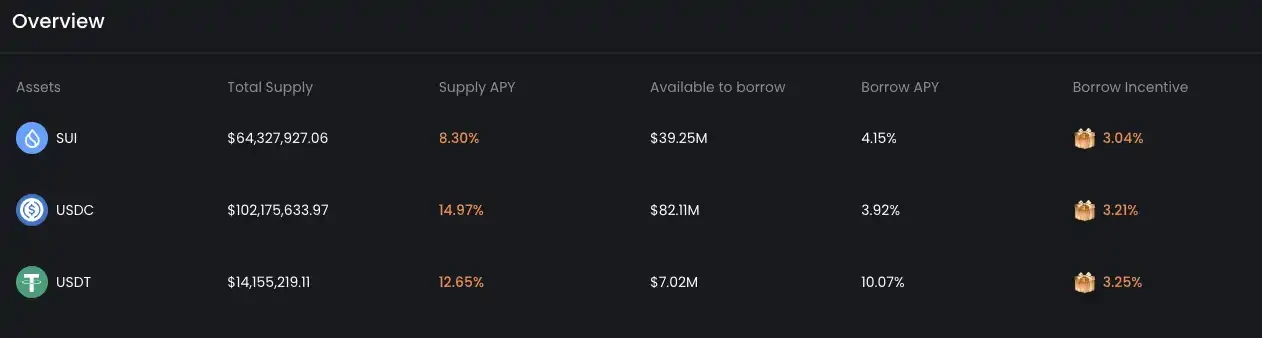

As a popular Sol Killer recently, in addition to technological development, Sui has never stopped promoting the development of DeFi on its own network. As the largest lending platform on the Sui network, USDC on NAVI currently has a TVL of over 100 million US dollars and provides an APY return of 14.9%. Similarly, most of the income comes from Suis incentives to users.

Since the current entry and exit of the USDC network requires cross-chain methods such as Wormhole, and Wormhole has performance restrictions on cross-chain, users who want to participate in the Sui network need to plan their time reasonably and have a time margin.

Bybit-USDE

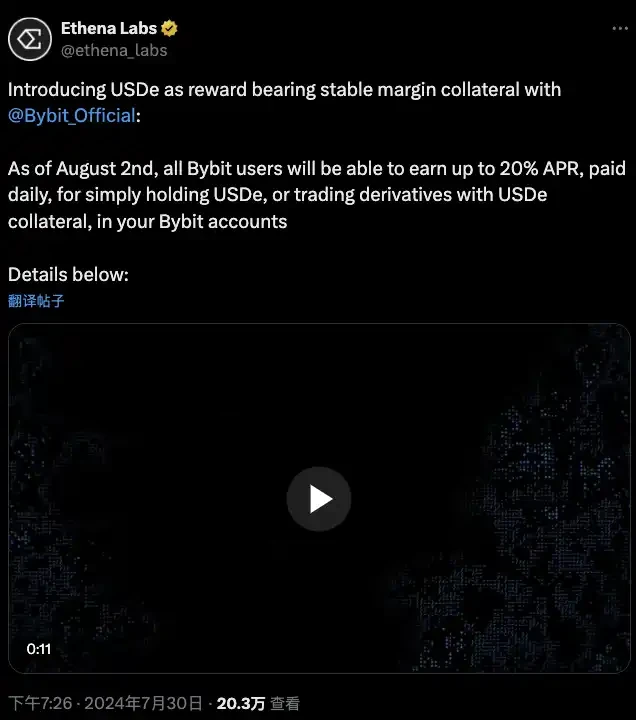

جیسا کہ پہلے Rhythm کے ذریعہ رپورٹ کیا گیا تھا، 30 جولائی کو، Ethena Labs نے اعلان کیا کہ 2 اگست سے، تمام Bybit صارفین 20% APY آمدنی حاصل کر سکتے ہیں، جو روزانہ ادا کی جاتی ہے، صرف USDe کو اپنے Bybit اکاؤنٹس میں رکھ کر یا USDe کو مشتقات میں حصہ لینے کے لیے بطور کولیٹرل استعمال کر کے۔ لین دین…

As of todays posting, Bybits USDe APY is 12.47%, which is still competitive. However, according to the event announcement, the total prize pool for this event is 3.3 million USDe. If users still want to participate in the USDe event, they should reasonably estimate the event stop time to avoid concentrated sales after the event stops, which may cause potential slippage of USDe. It is worth noting that due to the recent perpetual contract funding rate being lower than 0, the overall income of the Ethena protocol has also been greatly affected. Its official website shows that the APY of sUSDe is 4%.

آوے جی ایچ او

Aave, one of the benchmarks of DeFi protocols, is also providing incentive subsidies for its stablecoin GHO. The incentive plan has increased GHOs APY to more than 20%. Currently, about 75 million GHO is staked in it.

جی ایچ او کو اسٹیک کرنے کے بعد، صارفین کو کمیونٹی کی طرف سے بنائے گئے میرٹ انٹرفیس پر ترغیبی انعام کے اس حصے کا دعوی کرنے کی ضرورت ہے۔

لیکن یہ بات قابل غور ہے کہ پروٹوکول کے ساتھ وعدہ کیا گیا GHO کی ان لاکنگ کی مدت 20 دن ہے، جو GHO کی لیکویڈیٹی لچک کو دوسرے پروٹوکول کے مقابلے کم بناتی ہے۔

بائننس-ٹن

Binance Launchpool not only launched Toncoin, but also launched a series of financial activities related to TON. The most notable one is the Super Earn activity that has ended. The activity provides TON holders with a high annualized APY of 300%, even if each user only deposits a maximum of 1,350 TONs and the activity market is 20 days. But the expected income is more than 200 TONs. As expected, Super Earn reached the subscription limit within a few minutes after it was opened.

Since this activity requires the deposit of non-stable coins, as an optimization method, users can pledge stable coins on CEX to borrow Ton, and get this APY without considering the rise and fall of Ton. If you are a DeFi Degen, you can pledge USDT on the Ton network to borrow Ton. In this case, you don鈥檛 even need to pay the borrowing APY, because USDT鈥檚 APY is higher. This method can be widely used in scenarios that require non-stable coins.

مندرجہ بالا مضمون میں مستحکم مالیاتی انتظام کے کچھ طریقوں کا خلاصہ کیا گیا ہے جن پر کمیونٹی میں بہت زیادہ بحث کی جاتی ہے۔ جہاں تک زیادہ APY ریٹرن حاصل کرنے کے طریقوں کا تعلق ہے، جیسا کہ DeFi鈥檚 سیکنڈ پول اور LuMao اسٹوڈیو کا ایئر ڈراپ گیم پلے، ریٹرن کا استحکام، واپسی کا ذریعہ، اور چھٹکارے کا وقت غیر یقینی ہے، اس لیے وہ ابھی اس میں شامل نہیں ہیں۔

By continuously looking for risk-free returns like this, any user familiar with cryptocurrencies will have the opportunity to participate and enter a Fire-like state where income covers daily expenses. I hope that this basic stablecoin APY income strategy will allow everyone to have the last piece of land for themselves while facing the anxiety of the myth of getting rich quickly.

یہ مضمون سرمایہ کاری کے مشورے پر مشتمل نہیں ہے۔ صارفین کو غور کرنا چاہیے کہ آیا اس مضمون میں کوئی بھی آراء، خیالات یا نتیجہ ان کے مخصوص حالات کے لیے موزوں ہے۔ اس معلومات پر مبنی سرمایہ کاری آپ کے اپنے خطرے پر ہے۔

This article is sourced from the internet: Stablecoin APY Earnings Guide: Let Your Crypto Assets Pay Your Rent

Related: In-depth analysis: How big is the scale of MEV at L2?

Original author: sui 14 Original translation: Ladyfinger, BlockBeats Editors Note: This article deeply analyzes the impact of the Dencun upgrade on the Ethereum L2 network, reveals the positive results of the upgraded L2 network in reducing transaction costs, increasing user activity and asset inflows, and points out the negative effects such as network congestion and high rollback rate caused by MEV activities. The article calls on the community to pay attention and jointly develop MEV solutions that adapt to L2 characteristics to promote the healthy development of the Ethereum ecosystem. Introduction In this post, we aim to provide a data-driven overview of the current state of L2. We monitor the importance of the Dencun upgrade’s gas fee reduction for L2 in March, examine how activity on these networks has evolved,…