Crypto Market Sentiment Research Report (2024.08.09-08.16): Mild Inflation Data Price Range Fluctuation

Mild inflation data, price range fluctuations

تصویری ماخذ: https://hk.investing.com/

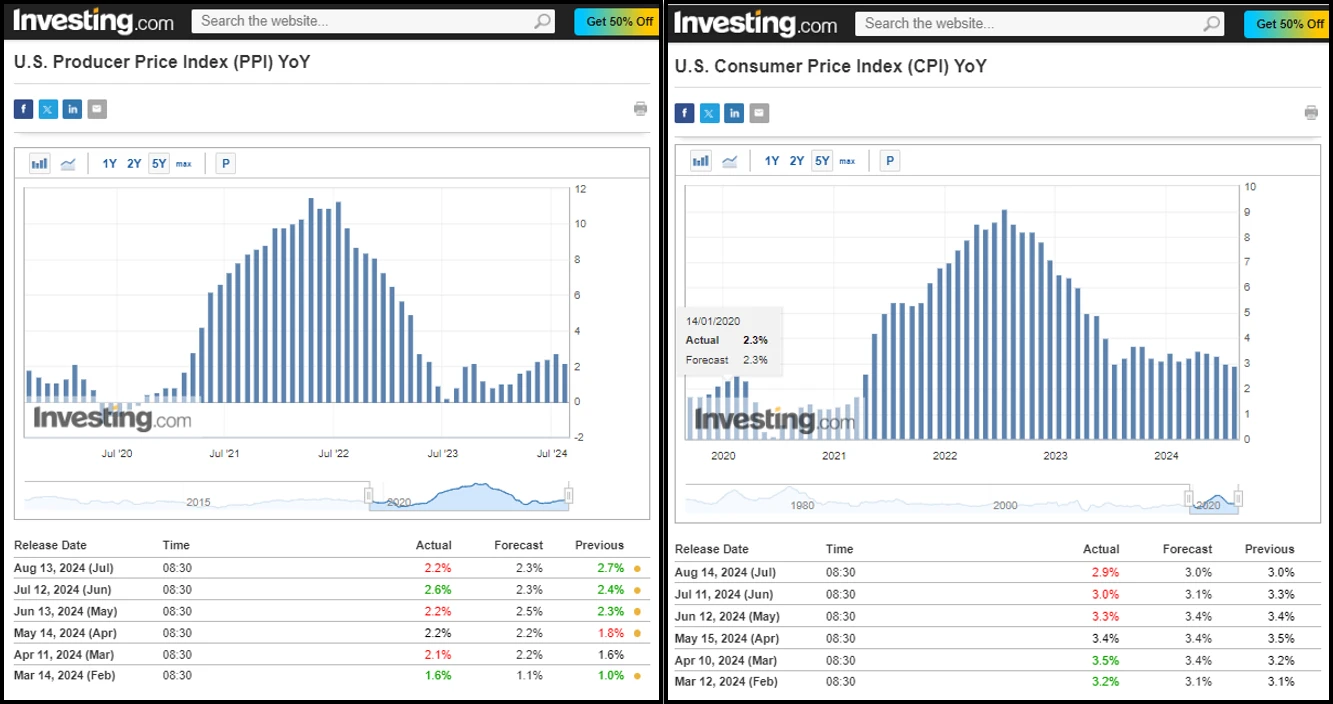

This week, two important inflation data, PPI and CPI, were released. CNBC said the data showed that the United States has passed the environment of ultra-high inflation. Moderate inflation data may mean that the Federal Reserve can turn its attention to other economic challenges, such as employment rate.

ڈیٹا: PPI data, an indicator of producer inflation, showed that prices rose by only 0.2% in July and were up about 2.2% year-on-year. This figure is now very close to the Feds 2% target, indicating that market expectations for the central bank to start cutting interest rates are basically on target.

CPI data, an indicator of consumer inflation, showed a year-on-year growth rate of 2.9% over the past 12 months, a figure that, while much lower than the high point in mid-2022, is still far from the Feds 2% target.

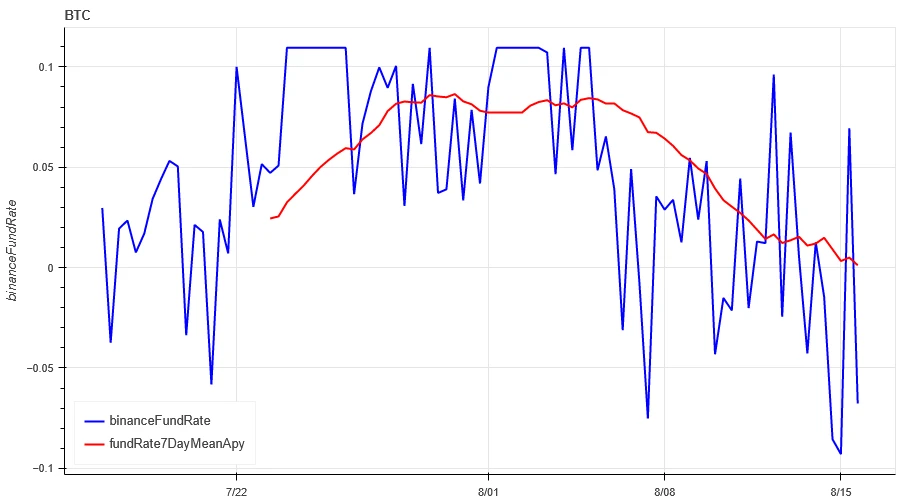

In terms of market conditions: After the release of the PPI data at 20:30 on the evening of the 13th, Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until the release of the CPI data at 20:30 on the 14th that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

Future events: The latest employment rate data will be released on September 6, the latest CPI and PPI data will be released on September 11 and 12, and the Federal Reserve will hold its interest rate decision at 02:00 Hong Kong time on September 19. September will be a critical node. If the Federal Reserve decides to cut interest rates, the market may bring a new round of surprises.

There are about 33 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

مارکیٹ تکنیکی اور جذباتی ماحول کا تجزیہ

جذباتی تجزیہ کے اجزاء

تکنیکی اشارے

قیمت کے رجحانات

BTC price fell -6.72% and ETH price fell -4.2% in the past week.

مندرجہ بالا تصویر گزشتہ ہفتے میں بی ٹی سی کی قیمت چارٹ ہے.

اوپر کی تصویر گزشتہ ہفتے میں ETH کی قیمت کا چارٹ ہے۔

جدول گزشتہ ہفتے کے دوران قیمت کی تبدیلی کی شرح کو ظاہر کرتا ہے۔

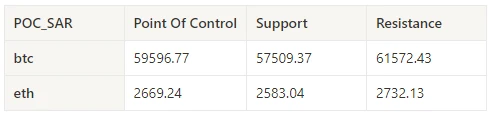

قیمت کے حجم کی تقسیم کا چارٹ (سپورٹ اور مزاحمت)

In the past week, both BTC and ETH have been fluctuating downward in a range of dense trading areas.

مندرجہ بالا تصویر گزشتہ ہفتے میں BTCs کے گھنے تجارتی علاقوں کی تقسیم کو ظاہر کرتی ہے۔

مندرجہ بالا تصویر گزشتہ ہفتے میں ETHs کے گھنے تجارتی علاقوں کی تقسیم کو ظاہر کرتی ہے۔

ٹیبل گزشتہ ہفتے میں BTC اور ETH کی ہفتہ وار گہری تجارتی حد کو ظاہر کرتا ہے۔

حجم اور کھلی دلچسپی

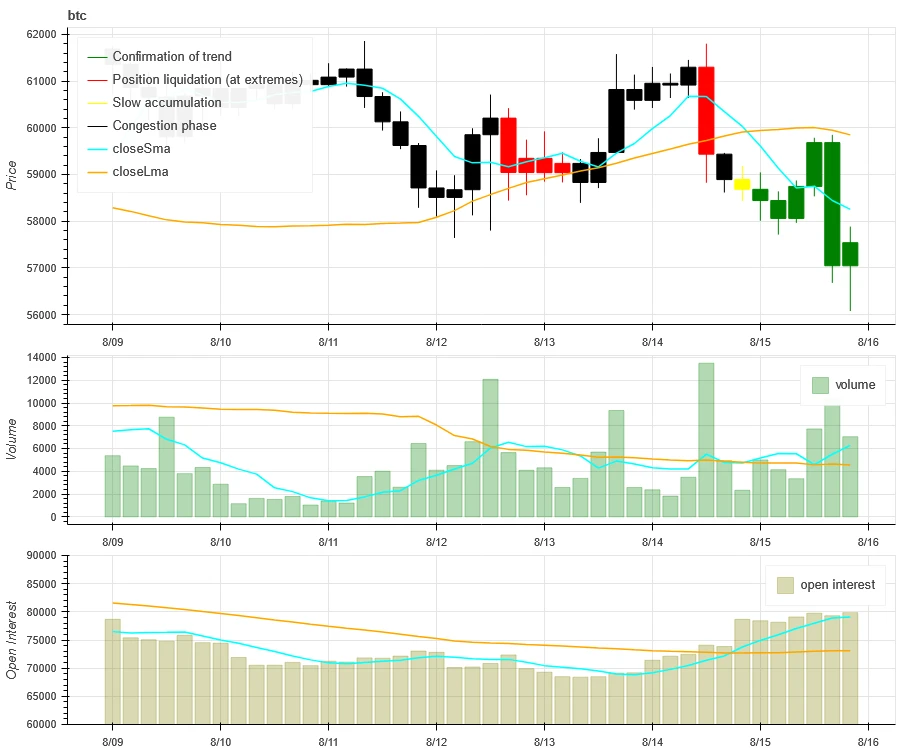

In the past week, both BTC and ETH had the largest trading volume when they rebounded sharply on August 12; the open interest of BTC increased while that of ETH decreased.

اوپر دی گئی تصویر کا اوپری حصہ BTC کی قیمت کا رجحان دکھاتا ہے، درمیانی حصہ تجارتی حجم دکھاتا ہے، نیچے کھلی دلچسپی ظاہر کرتا ہے، ہلکا نیلا 1 دن کی اوسط، اور نارنجی 7 دن کی اوسط ہے۔ K-لائن کا رنگ موجودہ حالت کی نمائندگی کرتا ہے، سبز کا مطلب ہے قیمت میں اضافے کو تجارتی حجم، سرخ کا مطلب ہے بند ہونے والی پوزیشنز، پیلے کا مطلب ہے آہستہ آہستہ جمع ہونا، اور سیاہ کا مطلب ہے پرہجوم حالت۔

اوپر کی تصویر کا اوپری حصہ ETH کی قیمت کا رجحان دکھاتا ہے، درمیانی حصہ تجارتی حجم، نیچے کھلی دلچسپی، ہلکا نیلا 1 دن کی اوسط، اور نارنجی 7 دن کی اوسط ہے۔ K-لائن کا رنگ موجودہ حالت کی نمائندگی کرتا ہے، سبز کا مطلب ہے کہ قیمتوں میں اضافے کو تجارتی حجم کی حمایت حاصل ہے، سرخ رنگ کی پوزیشنیں بند ہو رہی ہیں، پیلا آہستہ آہستہ پوزیشنیں جمع کر رہا ہے، اور سیاہ ہجوم ہے۔

تاریخی اتار چڑھاؤ بمقابلہ مضمر اتار چڑھاؤ

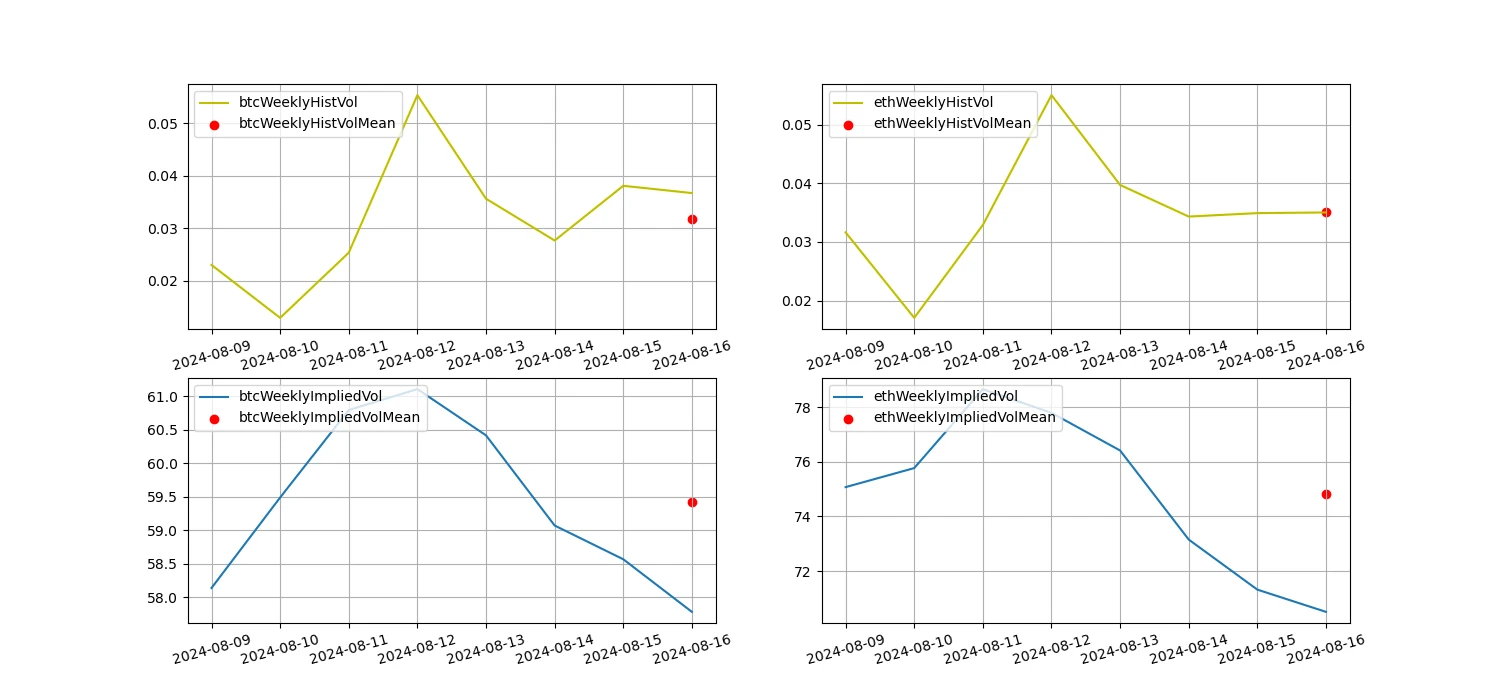

In the past week, the historical volatility of BTC and ETH was the highest when they rebounded sharply on August 12; the implied volatility of BTC and ETH both decreased.

پیلی لکیر تاریخی اتار چڑھاؤ ہے، نیلی لائن مضمر اتار چڑھاؤ ہے، اور سرخ نقطہ اس کی 7 دن کی اوسط ہے۔

واقعہ پر مبنی

The PPI and CPI inflation data were released this past week. After the PPI data was released at 20:30 on the evening of the 13th Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until 20:30 on the 14th when the CPI data was released that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

جذبات کے اشارے

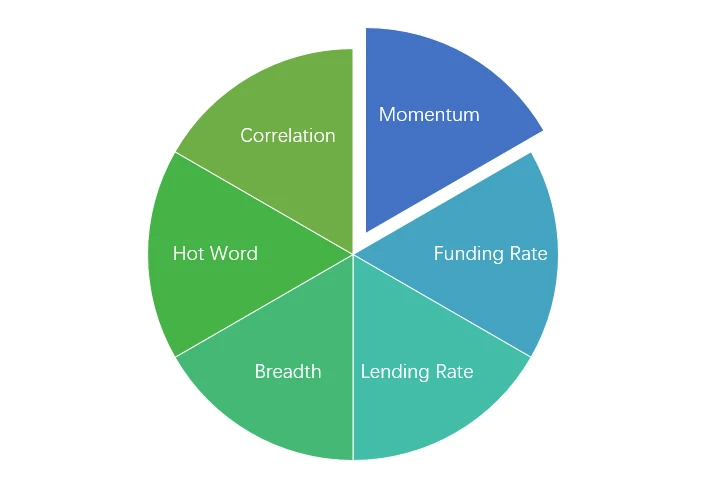

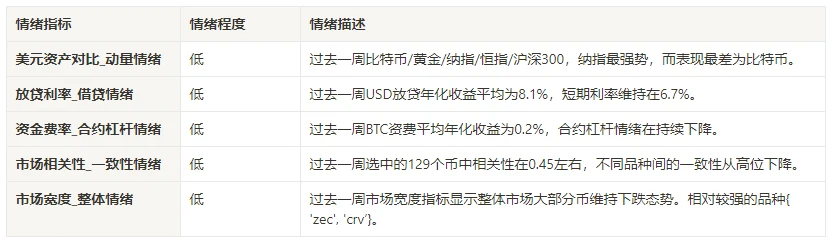

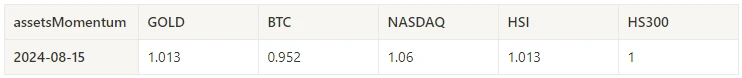

Momentum Sentiment

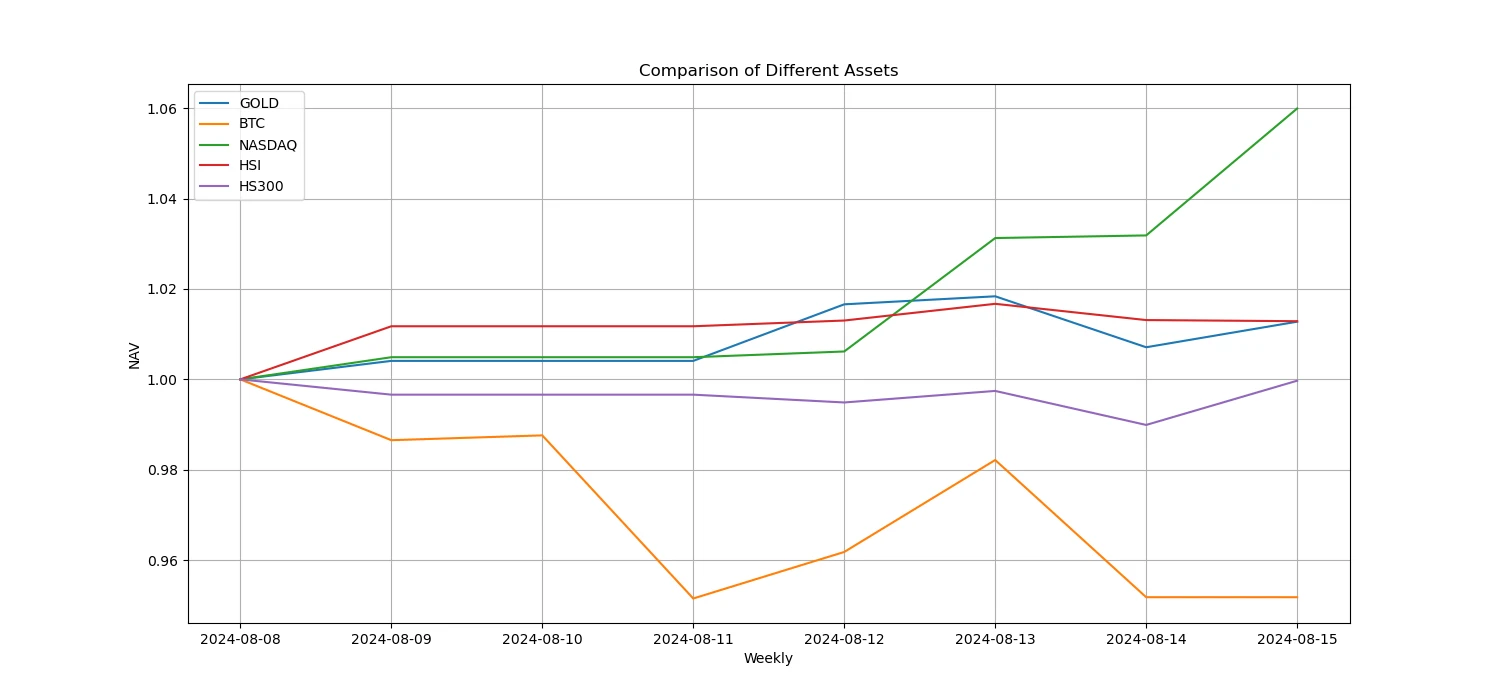

پچھلے ہفتے، Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300 میں، Nasdaq سب سے مضبوط تھا، جبکہ Bitcoin نے بدترین کارکردگی کا مظاہرہ کیا۔

مندرجہ بالا تصویر پچھلے ہفتے میں مختلف اثاثوں کے رجحان کو ظاہر کرتی ہے۔

قرضے کی شرح_قرضے کا جذبہ

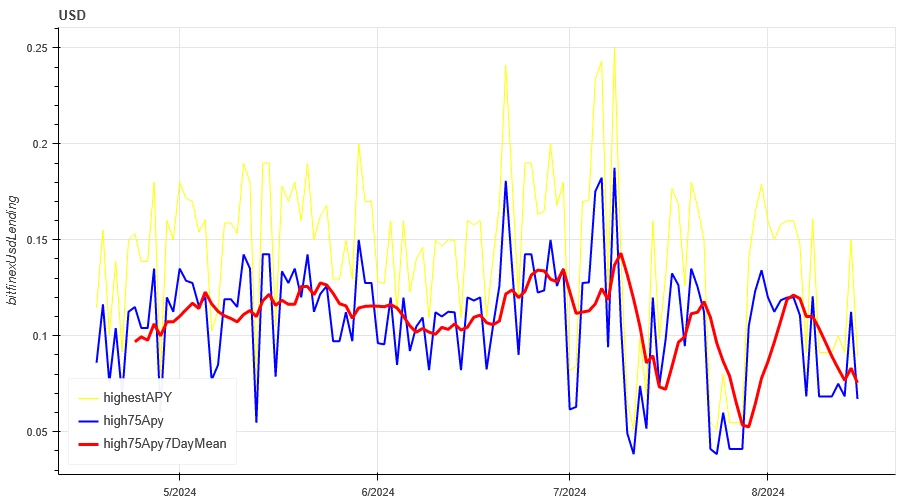

The average annualized return on USD lending over the past week was 8.1%, and short-term interest rates remained at 6.7%.

پیلی لکیر USD شرح سود کی سب سے زیادہ قیمت ہے، نیلی لائن سب سے زیادہ قیمت کی 75% ہے، اور سرخ لکیر سب سے زیادہ قیمت کی 75% کی 7 دن کی اوسط ہے۔

جدول ماضی میں مختلف ہولڈنگ دنوں میں USD کی شرح سود کے اوسط منافع کو ظاہر کرتا ہے۔

فنڈنگ ریٹ_کنٹریکٹ لیوریج کا جذبہ

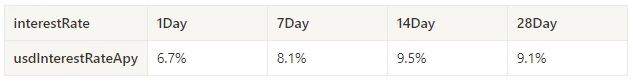

The average annualized return on BTC fees in the past week was 0.2%, and contract leverage sentiment continued to decline.

بلیو لائن بائننس پر BTC کی فنڈنگ کی شرح ہے، اور سرخ لکیر اس کی 7 دن کی اوسط ہے

جدول ماضی میں مختلف انعقاد کے دنوں کے لیے BTC فیس کی اوسط واپسی کو ظاہر کرتا ہے۔

مارکیٹ کا ارتباط_اتفاق رائے

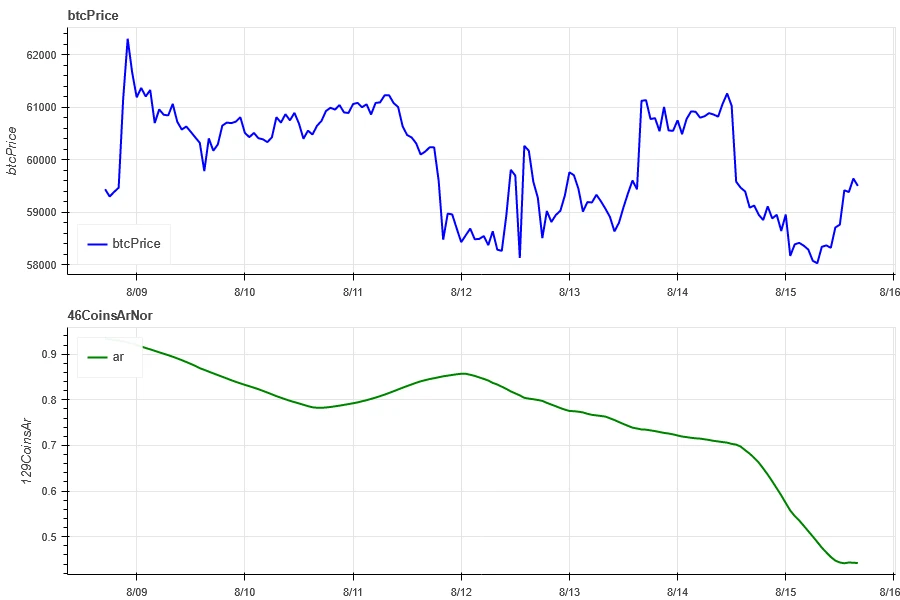

The correlation among the 129 coins selected in the past week was around 0.45, and the consistency between different varieties has dropped from a high level.

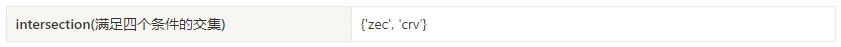

اوپر کی تصویر میں، نیلی لائن بٹ کوائن کی قیمت ہے، اور سبز لائن ہے [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, Ape، apt، arb، ar، astr، ایٹم، آڈیو، avax، axs bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, cv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos, etc ایتھ، فیٹ، فل، فلو، ایف ٹی ایم، ایف ایکس ایس، گالا، جی ایم ٹی، جی ایم ایکس، grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme , mina, mkr, near, neo, ocean, one, ont, op, pendle qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz، yfi، zec، zen، zil، zrx] مجموعی ارتباط

مارکیٹ کی وسعت_مجموعی جذبات

Among the 129 coins selected in the past week, 4% of them were priced above the 30-day moving average, 24% of them were priced above the 30-day moving average relative to BTC, 6% of them were more than 20% away from the lowest price in the past 30 days, and 7% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

اوپر کی تصویر یہ ہے [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, anpekr apt، arb، ar، astr، ایٹم، avax، axs، bal، band، bat، bch، bigtime، blur، cake، celo، cfx، chz، ckb، comp، cv، cvx، سائبر، ڈیش، ڈوج، ڈاٹ، dydx، egld، enj، ens، eos وغیرہ، فیٹ، فل، فلو، ایف ٹی ایم، ایف ایکس ایس، گالا، جی ایم ٹی، جی ایم ایکس، grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic ، من، مانتا، ماسک، میٹک، میمی، مینا، ایم کے آر، قریب، نو، nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, run, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, سشی، ایس ایکس پی، تھیٹا، ٹیا، ٹی آر ایکس، ٹی، اوما، یونی، vet, waves, wif, wld, woo, xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] ہر چوڑائی کے اشارے کا 30 دن کا تناسب

خلاصہ کریں۔

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) showed a volatile downward trend, especially when the historical volatility and trading volume reached a peak during the sharp drop and rebound on August 12. The open interest of BTC increased, while that of ETH decreased. The implied volatility decreased. Bitcoin performed the worst in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while Nasdaq performed the strongest. Bitcoins funding rate continued to decline, reflecting the continued decline in market participants interest in its leveraged trading. The correlation between the selected 129 currencies remained at around 0.45, showing that the consistency between different varieties has declined from a high level. The market breadth indicator shows that most cryptocurrencies in the overall market are still in a downward trend. The market began to rise after the PPI data was released on the 13th, and then the market began to fall after the CPI data was released on the 14th.

ٹویٹر: @ https://x.com/CTA_ChannelCmt

ویب سائٹ: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.09-08.16): Mild Inflation Data Price Range Fluctuation

Related: When live streaming happens in Web3: Will Pump.fun create a “live streaming magic”?

Pump.fun is the most special product in this cycle. Since its launch more than 4 months ago, more than 1.17 million tokens have been issued on Pump.fun, and the cumulative revenue has exceeded 50 million US dollars. How to understand this number? Compared with Uniswap, the top traffic product in the previous bull market, it is estimated that Uniswap Labs annual revenue is about 25 million to 30 million US dollars. It can be said that Pump.fun is not a typical Web3 project. It does not have a complex token economics model or a DAO governance mechanism. However, with its precise market positioning, Pump.fun has created a business market that is sure to make money. Under the dominance of the attention economy, many people will interpret the continued prosperity of…