Bitget Research Institute: مارکیٹ اتار چڑھاو کی ایک تنگ رینج میں رہتی ہے، اور BWB رجحان کے خلاف بڑھتا ہے

گزشتہ 24 گھنٹوں میں، مارکیٹ میں بہت سی نئی مقبول کرنسیاں اور عنوانات سامنے آئے ہیں، جو پیسہ کمانے کا اگلا موقع ہو سکتا ہے، بشمول:

-

The sectors with strong wealth creation effects are: blue chip public chain sector, RWA sector, Bitget platform currency

-

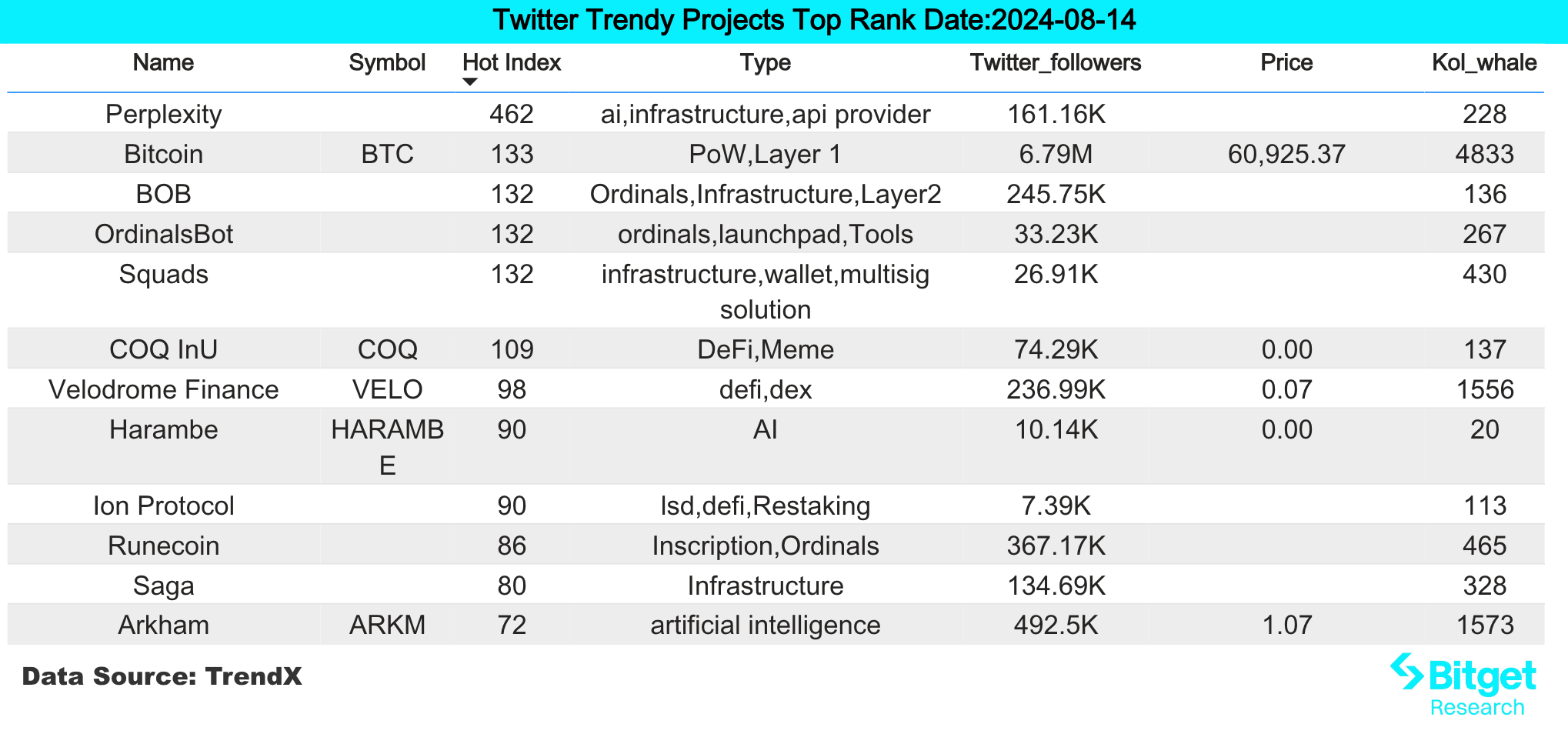

Hot search tokens and topics by users: Pump.fun, Perplexity

-

Potential airdrop opportunities include: Tonstakers, Kelp DAO

Data statistics time: August 14, 2024 4: 00 (UTC + 0)

1. بازار کا ماحول

In the past 24 hours, BTC briefly broke through $61,000, and the current box fluctuates between $59,000 and $61,000. The intraday amplitude has narrowed significantly, indicating that the staged rebound may encounter pressure. ETH briefly broke through $2,700, and the weekly capital flow of Ethereum spot ETF achieved positive growth for the first time, with a net inflow of 31,500 ETH last week, equivalent to $75.07 million. This round of capital inflow was mainly driven by Blackrock, which has purchased a total of $168.55 million worth of ETH. In terms of the market, the top blue-chip public chain sector has risen steadily in the past 7 days. At the same time, the number of Bitget Wallet users has exceeded 30 million, and the number of downloads in July has exceeded Metamask. Investors can continue to pay attention to BWBs performance in the future.

Macroeconomically, the increase in U.S. producer prices in July was lower than expected, with the PPI in July unchanged from the previous month. The more closely watched CPI data will be released on Wednesday, and the index is expected to show a slight increase. Against the backdrop of fading inflationary pressures, weak employment data in July prompted economists to expect the Federal Reserve to make a series of interest rate cuts starting next month. According to CMEs Fed Watch data, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 50.5%, and the probability of cutting interest rates by 50 basis points is 49.5%.

2. دولت پیدا کرنے والا شعبہ

1) Sector changes: blue chip public chain sector (FTM, APT, TON)

بنیادی وجہ:

-

The new public chain sector has been falling and consolidating for a long time. In the environment of oversold market rebound, it has been the first to attract the attention of funds; ETH has been too weak recently, and institutions have frequently sold ETH in the secondary market. Funds have a consensus on the layout of new public chains; at the same time, Aptos has launched the second Tapos game, which can be used on browsers and TG, and has received a lot of attention recently;

Rising situation: FTM, APT, and TON rose by 5%, 9%, and 6% respectively in the past 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

-

TVL continues to rise: According to DefiLlama data, Aptos TVL exceeded $400 million, a record high. At the same time, the total locked-in amount of TON ecosystem exceeded $80 million, also a record high, which is 4 times the TVL value in early March. In the future, we can continue to pay attention to the changes in TVL of each ecosystem, and maintain capital inflow to continue investing in the top public chains.

-

Ecosystem construction continues to gain momentum: Recently, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new fund of US$10 million to support the growth of the Aptos ecosystem and the widespread adoption of Web3.

2) Sector changes: RWA sector (ONDO, Pendle)

بنیادی وجہ:

-

The RWA sector is still the most popular sector in the current cryptocurrency industry, and is considered to have a large market size. ONDO and Pendle occupy the RWA treasury tokenization track and the crypto asset interest rate swap market track respectively. The asset volume ceiling of these two tracks is extremely high, and the protocol income that the protocol can generate increases with the growth of asset volume. Investors should pay special attention to each round of market rebound.

Rising situation: ONDO and Pendle rose by 3.4% and 6% respectively in the past 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

-

Total asset size of the protocol: The cash flow output of this type of protocol mainly depends on the asset size of the protocol. As the asset size accommodated by the protocol gradually increases, the income that the protocol can generate will also gradually increase, and the corresponding currency price will also have a strong performance.

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3) The sectors that need to be focused on in the future: Bitget platform coins (BGB, BWB)

بنیادی وجہ:

-

Bitget recently announced that in order to help the long-term development of Bitget Token (BGB) and enhance the rights and interests of BGB holders, Bitget will upgrade the token smart contract and expand the use of BGB in decentralized applications such as DeFi, DEX, and GameFi. The number of Bitget Wallet users exceeded 30 million, and the number of downloads in July exceeded Metamask, making the market optimistic about the rise in the price of the currency.

مخصوص کرنسی کی فہرست:

-

BGB: Bitget platform currency, the smart contract of the token will be upgraded recently. In the future, BGB will be deeply integrated into the development of DeFi, DEX, Gamefi and other applications. The potential demand for BGB may surge in the future, so it is recommended to pay close attention.

-

BWB: Bitget Wallet token, with a total market value of only US$500 million. The wallet track has good growth potential in the future and is suitable for long-term holders.

3. صارف کی گرم تلاشیں۔

1) مشہور ڈیپس

Pump.fun:

According to DefiLlama data, Solana meme coin platform Pump.funs protocol revenue in July reached 28.73 million US dollars, a record high. The platforms cumulative protocol revenue has reached 89.03 million US dollars. In the past three months, the Solana meme coin platform pump.funs fee account has converted a total of 222,073 SOLs into 35.54 million USDCs, with an average price of 160 US dollars. As pump.funs popularity also means that the meme token transactions on the Solana chain have entered a white-hot state, the marginal income and wealth effect of the god disk are decreasing.

2) ٹویٹر

Perplexity:

Prediction market Polymarket is partnering with AI-driven search engine Perplexity to display news summaries of events. When users click on an event on Polymarket, they can now see relevant news summaries based on Perplexity search results, as well as a search box that users can use to ask more questions.

Perplexity completed a $73.6 million Series B financing in January this year at a valuation of $520 million, led by IVP. Perplexitys total financing has reached $100 million. With Perplexitys search tools, users can instantly get reliable answers to any question, with complete sources and citations. There is no need to click on different links, compare answers, or dig for information endlessly. Since the project adopts equity financing, it is unlikely to issue cryptocurrency.

3) گوگل سرچ ریجن

عالمی نقطہ نظر سے:

دھماکہ:

According to official news, Blast announced that the second round of distribution of the second phase of Gold (gold points) has been launched, with a total of 11 million Gold distributed to DApps. This distribution officially reserves 10 million Gold for existing DApps on the Blast mainnet and 1 million Gold for newly launched DApps. According to defillama data, the TVL of the Blast mainnet has fallen by more than 60% from its peak and is now reported at US$883 million. At the same time, the price of Blast tokens has fallen by more than 46%, which is a serious decline, and the current market situation is unclear. Users are advised to participate with caution.

ہر علاقے میں گرم تلاشوں سے:

(1) From the perspective of Asia: The projects and sectors that each region pays attention to are very scattered, without much in common, but there are some sporadic hot spots in a small range. For example, Vietnam, the Philippines and Singapore are more concerned about RWA-related projects, and Indonesian layer 1 projects frequently appear in hot searches. Malaysia is more concerned about mainstream currencies such as Bitcoin.

(2) In European and American countries, the hot search words are relatively scattered and have no universal characteristics. At the same time, the enthusiasm for memes in European and American countries has declined, and the hot searches are mainly concentrated on pepe and floki.

(3) In addition to the TON ecological hot words in the CIS region, hot words such as solana ecological lst project sanctum and ai type also appeared in the hot searches.

ممکنہ، استعداد ایئر ڈراپ مواقع

ٹون اسٹیکرز

Tonstakers is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.8%. The current project TVL is 256 million US dollars, and the potential valuation is relatively high.

The project has received attention from the Ton Foundation, and currently the protocol has 68,000 pledgers. The project is cooperating with Ton core developers, Tonkeeper, OKX and other institutions, and will be supported in the future coin issuance.

Specific participation methods: 1) Visit the project official website and click stake now; 2) Link the Ton wallet to stake.

کیلپ ڈی اے او

Kelp DAO is currently building an LRT solution on EigenLayer. Its re-staking token is rsETH. Currently supported LSTs include ETHx (Stader), sfrxETH (Frax) and stETH (Lido). According to DefiLlama data, Kelp DAO TVL is currently $617 million.

Kelp DAO has launched Kelp Miles incentives. Kelp Miles is used to track users contributions to Kelp and to determine future reward distribution ratios. Kelp Miles depends on the users LST re-staking amount and staking days. This project is also known as the top unsold project in Restaking, and it is estimated that the coin will be issued in Q2.

How to participate: (1) Link your wallet to Kelp DAO; (2) Prepare ETHx (Stader), sfrxETH (Frax) and stETH (Lido) or ETH for investment; (3) Hold the converted rsETH and accumulate points.

اصل لنک: https://www.bitget.fit/zh-CN/research/articles/12560603814350

銆怐اعلانیہ銆慣یہ مارکیٹ خطرناک ہے، لہذا سرمایہ کاری کرتے وقت محتاط رہیں۔ یہ مضمون سرمایہ کاری کے مشورے پر مشتمل نہیں ہے، اور صارفین کو اس بات پر غور کرنا چاہیے کہ آیا اس مضمون میں کوئی بھی آراء، خیالات یا نتائج ان کے مخصوص حالات کے لیے موزوں ہیں۔ اس معلومات پر مبنی سرمایہ کاری آپ کے اپنے خطرے پر ہے۔

This article is sourced from the internet: Bitget Research Institute: The market remains in a narrow range of fluctuations, and BWB rises against the trend

Original author: Richard Yuen Original translation: TechFlow The downstream front-end application layer will become one of the largest components of the on-chain economy Many are calling for more applications, but for the wrong reasons — this is not about VCs trying to drive up their infrastructure assets, or looking for the next 100x speculative story. Here are some ideas. 1. Value chain – upstream, midstream and downstream To understand how the crypto/blockchain space might evolve, we can draw on the evolution of mature industries such as the internet. In a mature Internet industry, its value chain can be divided into upstream, midstream and downstream. Upstream: The underlying technologies and infrastructure that make the Internet possible; including hardware, connectivity, networks, core software and protocols, etc. Midstream: Platforms built on underlying infrastructure;…