1kx: پیشن گوئی مارکیٹ میں نئے کھلاڑیوں اور ترقی کے رجحانات پر ایک مختصر گفتگو

Original author: mikey, 1kx analyst

اصل ترجمہ: Luffy، Foresight News

There are many new builders in the prediction market, so it is necessary to have a comprehensive overview of this vertical. This article will briefly summarize the prediction market categories, GTM (go-to-market) strategies, product updates, mechanisms, and current development directions.

GTM

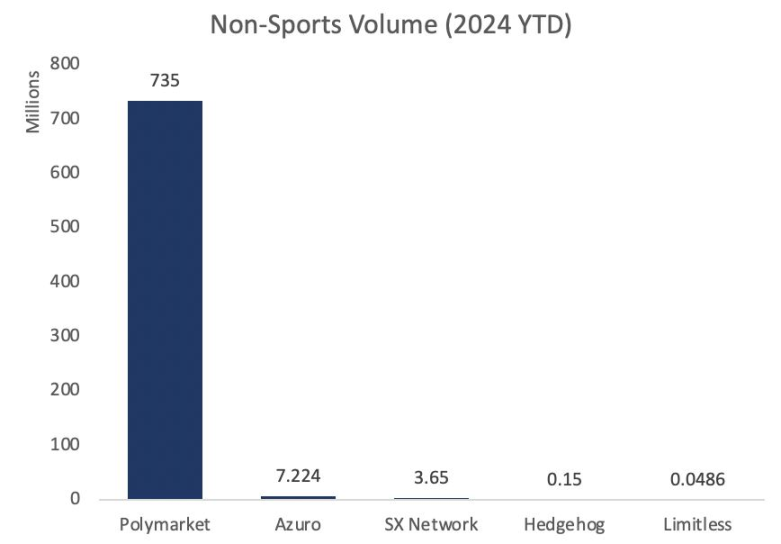

There are roughly two approaches to prediction market GTMs: non-sports and sports. The former is a relatively unexplored field that includes several target areas: cryptocurrency, politics, cultural events. Polymarket is clearly the leader in the non-sports field, with its GTM focusing mainly on political events.

If you compare the trading volume of prediction markets focused on sports events so far this year, you will find that the gap between Azuro and SX Network and Polymarket is even greater.

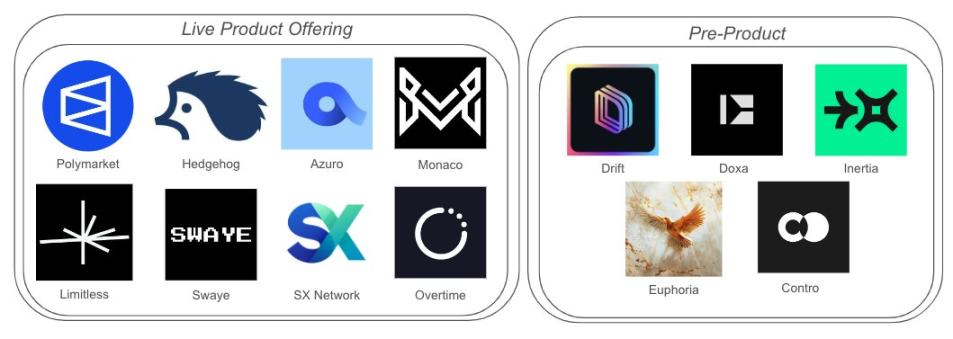

New competitors include Limitless on EVM (some of which support ETH trading) and Hedgehog on Solana. There are also competitors that have not yet launched, including: Drift Exchange, xMarkets, Inertia Social, Doxa and Contro.

New players generally focus on two common themes:

-

Permissionless Markets: Open Market Creation and Incentive Layers

-

Solution: Rely on artificial intelligence for market settlement, or create a more efficient system

This is exactly what Polymarket users have been waiting for.

Given the popularity and regularity of sports prediction markets, they have obvious appeal in Web2. It is difficult to get users to move to Web3 because most users value brand and user experience. In addition, Web2 sports betting has an advantage in marketing funds, with at least 5 sports betting companies spending more than $100 million per year.

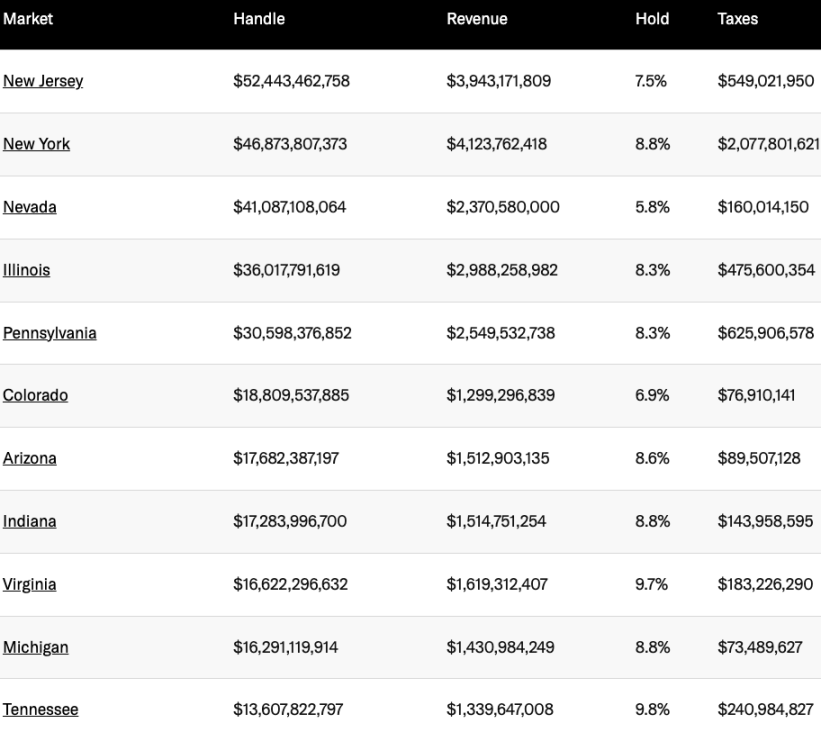

The amount of money Americans bet on a single Super Bowl (about $23 billion) is 10 times the total amount bet on the cryptocurrency prediction market (about $2 billion). Even the amount bet on a single state is far more than $2 billion.

More on-chain money = more on-chain sports betting, just like internet bookmakers are dominated by mobile devices. One of the limiting factors in prediction markets is lack of money. On the non-sports side, LogX will support the TRUMP perpetual product, similar to FTX in 2020. Doxa is also working on lev. The counterparties for both projects are liquidity pools. Liquidations and bad debts are potential issues.

I hope Polymarket explores multiple betting models more. Technically, the Trump and Biden win the nomination market is a leveraged bet because it requires guessing on two different events.

I would love to see a market like “will a, b, c, and d happen?” I don’t think initial liquidity will be a problem and LPs won’t miss such an opportunity.

In the sports prediction market, several protocols already allow leverage through so-called parlays, where users win prizes only when they correctly guess multiple unrelated events. SX Bet, Azuro and Overtime already support this functionality.

میکانزم

There are roughly two types of working mechanisms for prediction markets: Web2.5 and Web3. The Web2.5 model usually uses cryptocurrency as a payment channel, such as Stake/Rollbit. Users can bet with cryptocurrency, but the counterparty is the team behind the application, and the products interact on the chain.

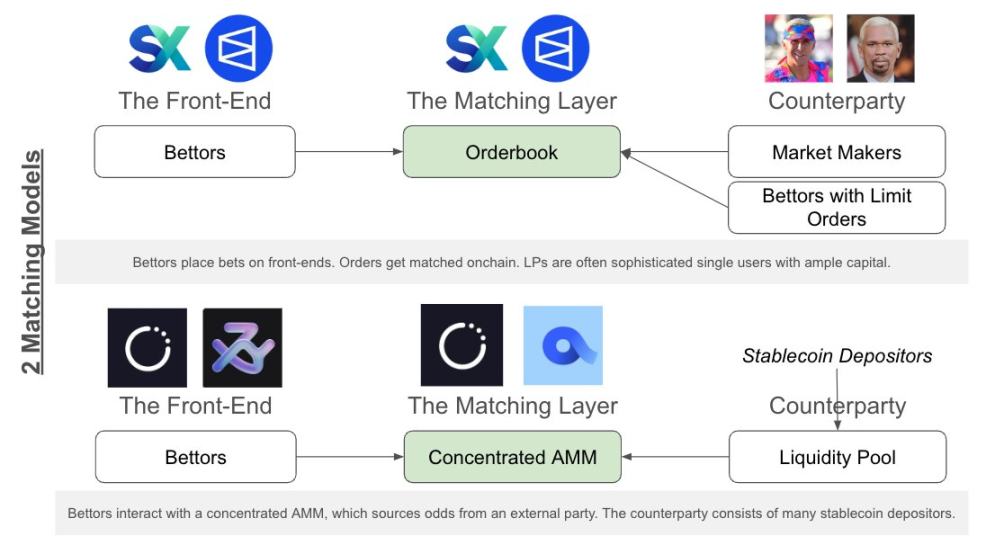

Part of the product logic of the Web3 model will be placed on the chain, whether it is an NFT position or a bet executed through a smart contract. There are usually two ways to match on-chain bets, either an AMM that relies on passive LPs, or the platform acts as an order book for the exchange.

In Web3, Memecoins have become a prediction market in themselves, with $TRUMP and $BODEN being typical examples. Holders can profit from two aspects: 1) being in the right direction; 2) attracting attention. Memecoins allow you to speculate on other people’s speculative behavior, whether you are right or wrong.

A new protocol called Swaye attempts to combine the advantages of prediction markets and Memecoins, where early entrants not only bet on specific outcomes, but also have an incentive to attract attention, as betting activity on either side helps increase PL.

Profit Model

How do prediction market protocols make money? There are several ways:

-

Transaction Fees

-

A portion of trader profits (Web2 model follows this path)

-

Counterparty Profit and Loss (Web2 prefers to serve clients who lose money)

Most protocols use either method 1 or method 3. Polymarket currently does not charge any fees.

Next step

What’s next? AI agents are the next big opportunity in prediction markets because they can react quickly to news. They are able to manage orders and place bets, they can also calculate the expected value of an outcome and take calculated risks. Several teams are working in this area.

In the next few years, at least 1 protocol will compete head-on with Polymarket’s trading volume. Given how much Polymarket currently incentivizes its market, competitors will likely need to use incentives such as points, tokens, or USDC heavily.

Everyone is asking if trading volumes can be sustained after the US election, and so far, non-election volumes on Polymarket have remained stable since the beginning of the year.

This article is sourced from the internet: 1kx: A brief discussion on new players and development trends in the prediction market

Related: SignalPlus Volatility Column (20240619): SEC ends investigation into Ethereum

Yesterday (JUN 18), the monthly rate of US retail sales in May, which was called horrible data by the market, was lower than expected by 0.1%, and the previous value was revised down from 0% to -0.2%. After the data was released, the yield of US bonds fell slightly, giving up yesterdays gains, and the three major stock indexes closed slightly higher. On the other hand, many Fed officials gave speeches, expressing the conservative view that it would take a few more months or a few quarters to see data supporting interest rate cuts. Source: SignalPlus, Economic Calendar In terms of digital currencies, the markets focus over the past day has been on Ethereum. The first thing to mention is that the SEC has ended its investigation into the Ethereum…