اگست کے آغاز میں مارکیٹ گر گئی۔ کیا ین ثالثی عالمی اثاثوں کے خاتمے کا سبب بنی؟ ہا کیا ہو گا

The crypto markets 85% plunge on Monday caught most people off guard. Compared with the Mentougou incident and the US and German governments selling of coins some time ago, this plunge was more sudden. There was no obvious warning signal from the news, and the market sentiment became extremely panic. The panic greed index once fell to the freezing point of 17. Fortunately, the US stock market opened on Monday night and the trend was still stable. The expected decline did not occur. The BTC daily line closed steadily above 54,000 and slowly recovered throughout Tuesday, stabilizing at 56,000. Another day has passed. As various events and clues surface more clearly, we can better review the entire decline event. This article will also sort out and interpret this market crash.

تعارف

Before this incident, the market had already fallen into a special state. Since the US interest rate cut in September is 100% certain, the expectation of interest rate cut is no longer the main influencing factor for the market. The crypto industry has also fallen but not risen relative to the US stock market since March this year.

In the short term, US stocks are trading on earnings expectations. Recently, crypto-related MicroStrategy released its latest earnings report, with earnings lower than market expectations; Coinbases net profit in the second quarter fell by 97% and its revenue fell by 11% month-on-month. In addition, the delay in the release of Nvidias new chip and Buffetts reduction of Apple holdings also affected Meta, Google, Microsoft and other companies, causing a sharp correction in technology stocks… The return rate of US stocks has reached 9 times since 2016, and many investors have chosen to take profits. At the same time, the risk market is still being affected by many factors: global economic recession, geopolitical wars, interest rate hikes by the Bank of Japan, and the US election.

1. Risk assets and crypto markets are being bloodbathed

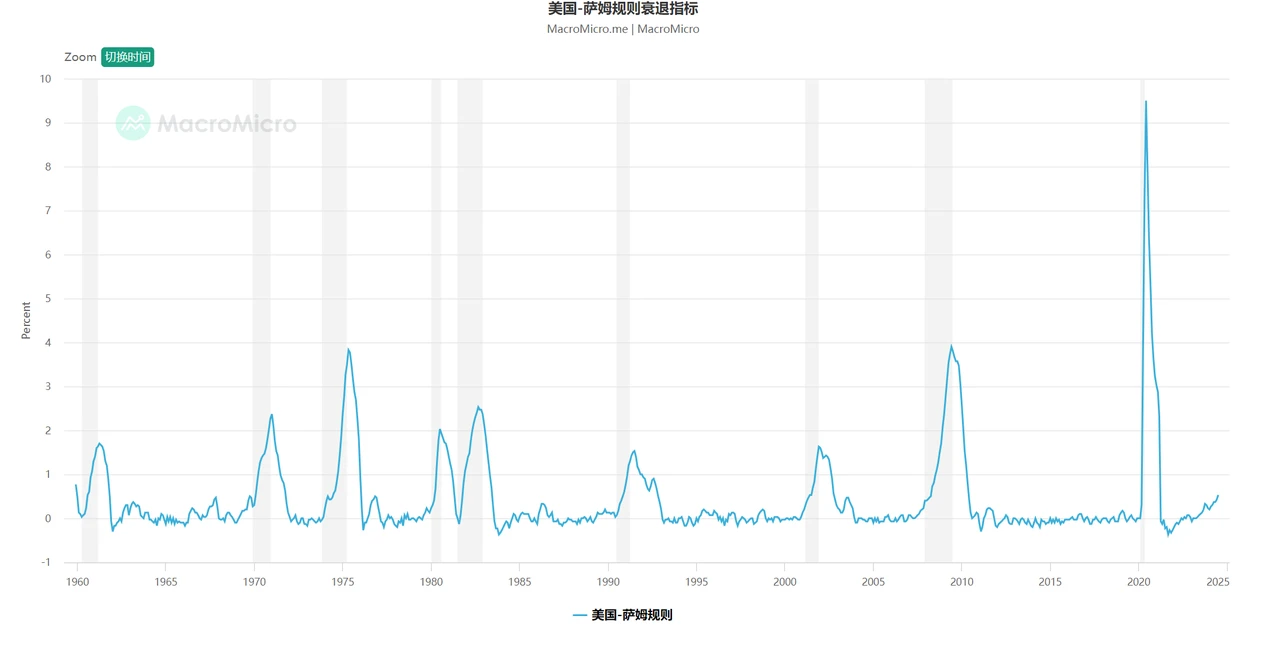

The U.S. stock market received a huge impact last Friday because the non-farm payrolls released in the United States were lower than expected, which triggered the Sahm Rule (proposed by Federal Reserve economist Claudia Sahm: if the unemployment rate based on the three-month moving average rises by 0.5 percentage points from last years low, the economy may be in recession. The indicator has been 100% accurate since 1970), which triggered concerns about an economic recession. The U.S. stock market received a huge impact and its market value evaporated by 2.9 trillion U.S. dollars at one point.

SAM indicator data source: MacroMicro

Before the opening of Monday, the U.S. stock market triggered a circuit breaker, but due to the time difference, some global stock markets had not yet opened, so the plunge was delayed to Monday.

Everyone also focused on the yen arbitrage. Since last Wednesday, the small non-farm payrolls, unemployment claims and non-farm payrolls released by the United States have all reflected the poor macroeconomic situation. Coupled with the sudden interest rate hike by the Bank of Japan, the expectation of dollar depreciation and yen appreciation has been further deepened. Traders hurriedly lifted their previous arbitrage behavior of using low-cost yen to buy foreign currencies for high-yield investments on Monday. In other words, they sold US stocks or other high-yield assets to cover their positions in yen, which led to the tragic phenomenon of global risk assets being sold off.

Risk asset performance

On August 5, global stock markets fell across the board. Asian markets opened first, and Japanese and Korean stocks were hit hard. The decline of the Japanese Topix Index triggered the circuit breaker mechanism several times, falling 20% from the July high, falling into a technical bear market, and the treasury bond futures triggered the circuit breaker mechanism. The Nikkei Index fell by more than 4,000 points, with a single-day drop of more than 12%; the Korean Stock Exchange Index (KOSDAQ) also triggered the circuit breaker mechanism after a sharp drop of 8%. The European Stoxx 600 Index fell by 3%; the Italian FTSE MIB Index fell by more than 4%; the German DAX Index fell by 3%; the Portuguese stock index PSI fell by 2.43%; the Israeli benchmark stock index fell by #%; the Indonesian main stock index fell by 4%; the Indian stock market NSE 50 Index fell by more than 3%; the Taiwan stock market plummeted by 8%, the largest drop since 1967. Global stock markets collapsed like dominoes, causing stampedes.

Performance of mainstream crypto assets

The crypto market was also hit hard in Mondays plunge. BTC prices fell below $50,000 twice during the day, hitting $48,900, with the largest drop of more than 15%. BTCs weekly Bollinger Bands fell below the lower track. ETH was even worse. Affected by the suspected liquidation news of Jump Trading, it once fell to $2,100, a drop of more than 22%, erasing all gains in 2024. SOL was relatively resistant to the drop. It quickly rebounded after hitting $110 during the day, and finally closed down 6%. It is hard to imagine that SOL fell from a high of $193 to this point in just one week. Other cryptocurrencies also collapsed, and the market was wailing. The plunge triggered market panic, and the Fear and Greed Index fell to 26 on the same day, indicating that the market was in a state of fear.

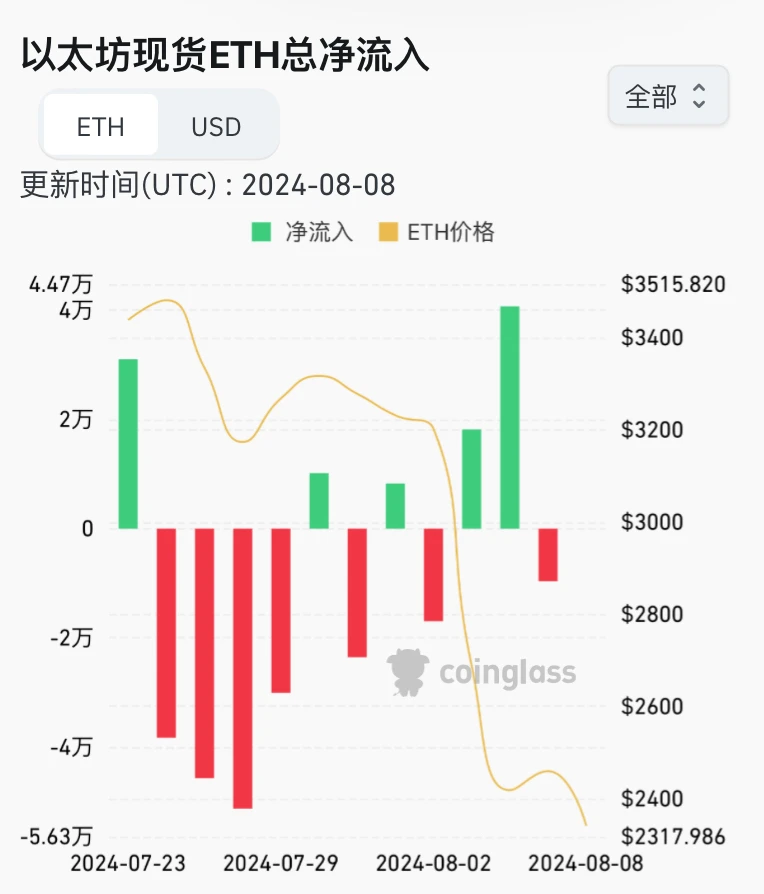

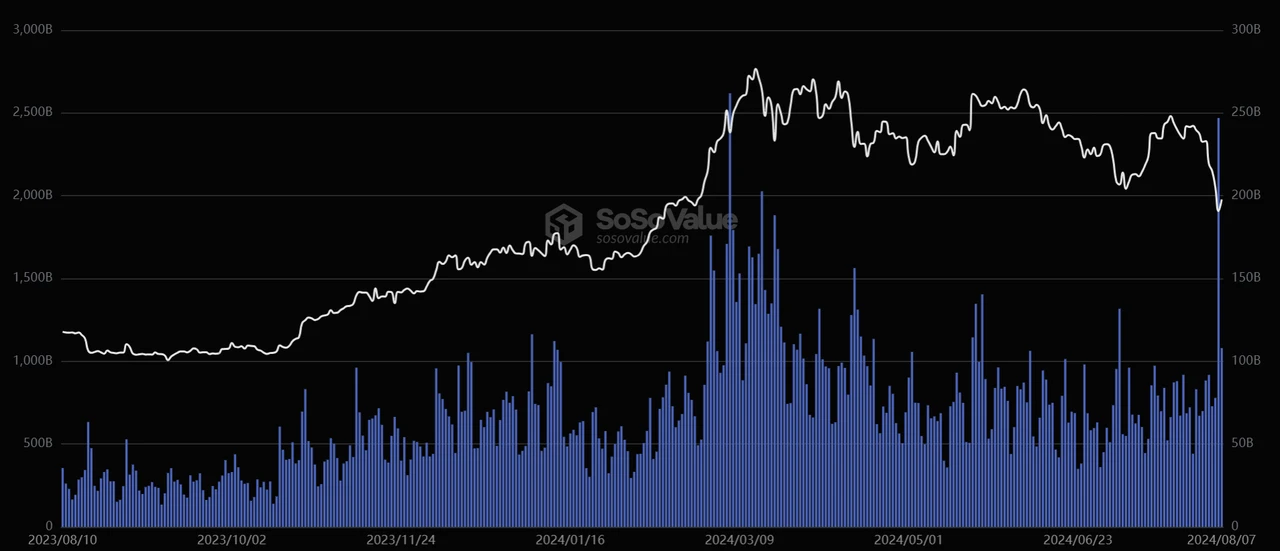

ETF inflow and outflow:

BTC spot ETF has continued to experience large net outflows for several consecutive days, and the market still needs more time to repair.

Last Friday, August 2, Bitcoin spot ETFs had an overall net outflow of $237 million, mainly from $104 million from Fidelity FBTC and $87 million from Ark Fund ARKB. Ethereum ETFs had a net outflow of $54 million, mainly from Grayscale ETHE, and other ETFs had only some small transactions.

On Monday, August 5, the ten US Bitcoin ETFs had a total net outflow of $168 million, of which FBTC had an outflow of $58.04 million, ARKB had an outflow of $69 million, and GBTC had an outflow of $69.12 million. The nine US Ethereum ETFs had a total net inflow of $48.8 million, of which Grayscale had an outflow of $46.8 million, and the other ETFs had net inflows, with Blackrocks ETHA inflow reaching $47.1 million.

On Tuesday, August 6, US Bitcoin ETF inflows were still negative, with a total net outflow of $148 million. Nine US Ethereum ETFs had a total net inflow of $98.4 million, of which Grayscales ETHE had an outflow of $39.7 million, while Blackrocks inflow reached a staggering $110 million. ETF inflows were positive for two consecutive days, indicating that institutions are more interested in Ethereum.

What caused the crash?

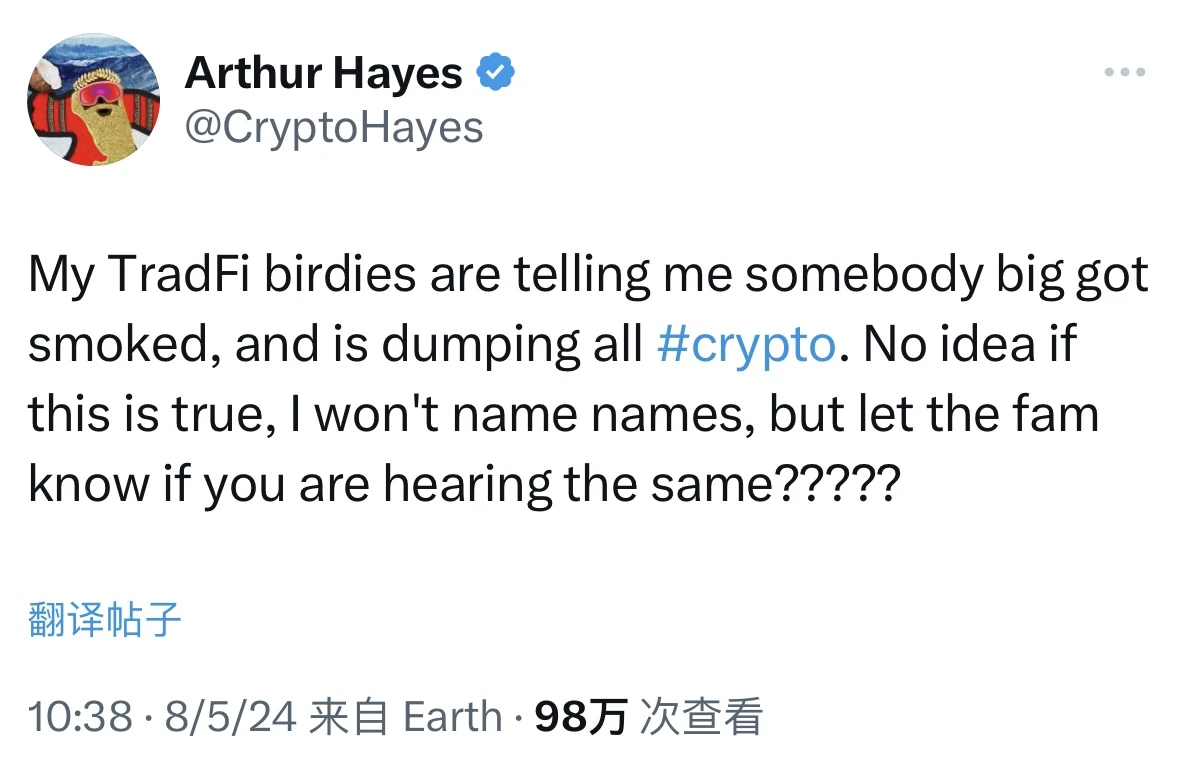

Lets turn back to the crypto market. In addition to the factors of the yen interest rate hike and the selling of U.S. stocks and crypto assets with better liquidity to close yen arbitrage positions, there is another trigger for the decline of crypto assets, that is, the market maker giant Jump is suspected of selling all cryptocurrencies.

On August 5, Arthur Hayes, the founder of BitMEX and a well-known KOL, tweeted that he had learned from a source that a certain whale had been hit hard and was selling all cryptocurrencies. I dont know if this is true, I wont name it. Currently, most community users speculate that the whale is Jump Trading.

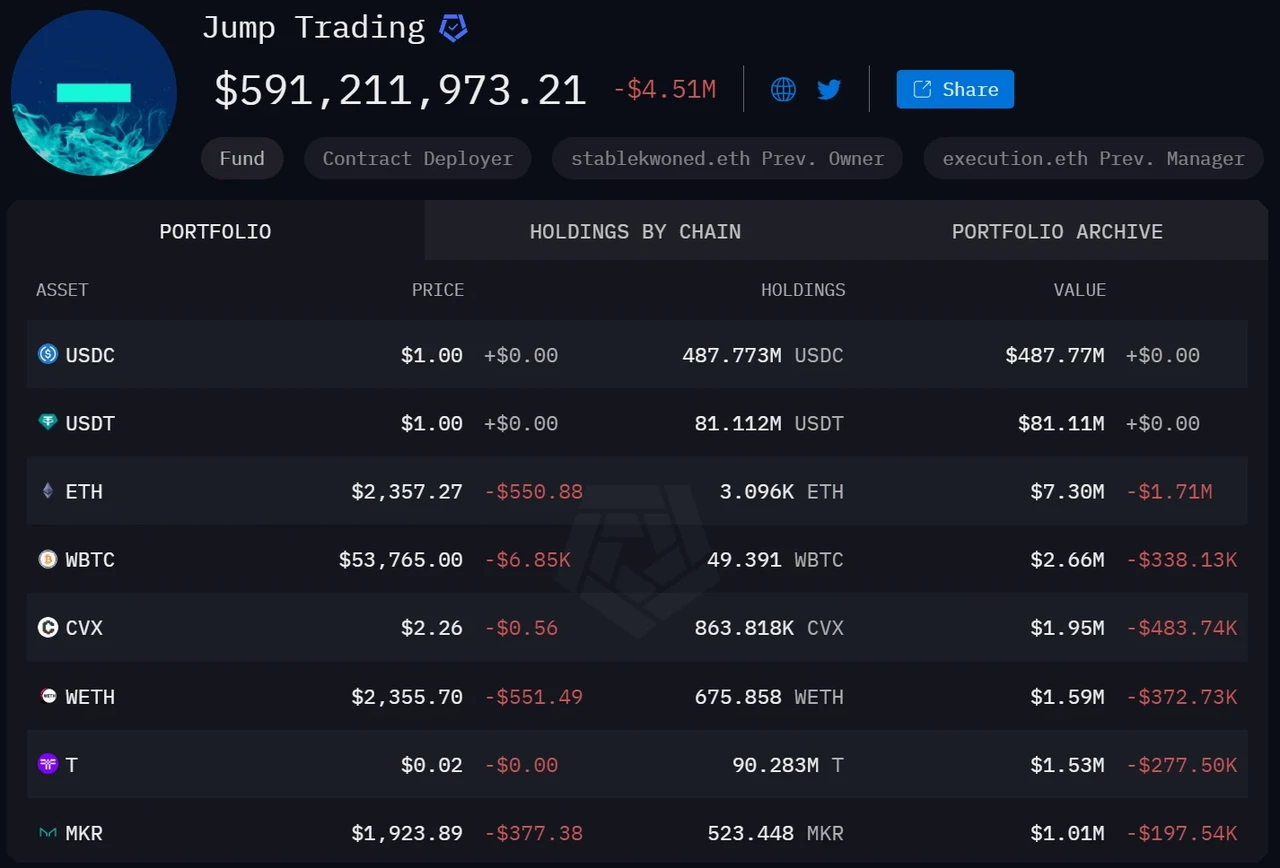

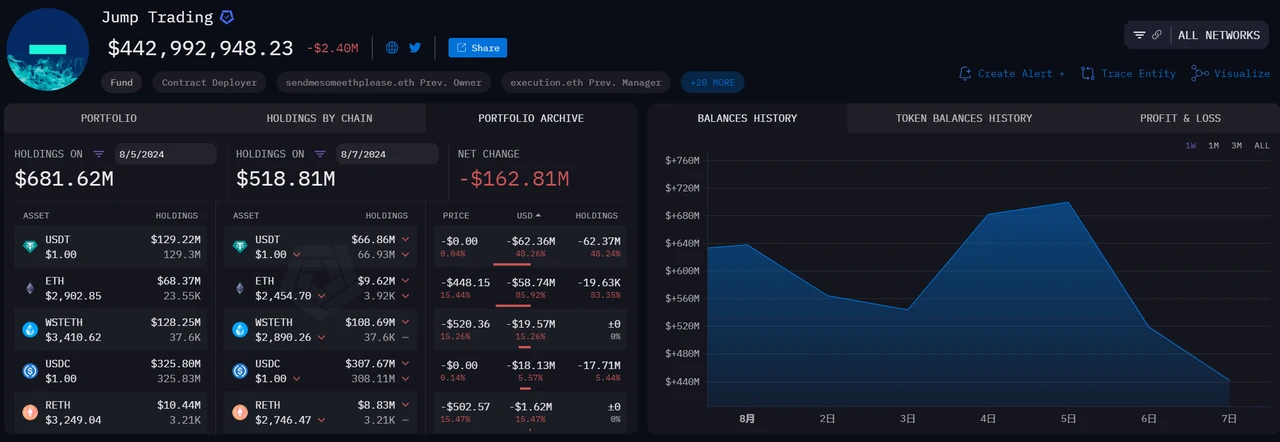

According to Arkham data, Jump Trading鈥檚 stablecoin positions accounted for 96% of its total positions on August 5, with a total value of $590 million, of which $569 million were stablecoins. It is suspected that most of its digital assets have been sold in exchange for stablecoins.

You can take a closer look at Jump鈥檚 holdings at the end of August 5:

-

USDC holdings valued at $325 million

-

USDT holdings valued at $129 million

-

WSTETH holdings worth $128 million

-

ETH holdings worth $68 million

-

RETH holdings valued at $10.44 million

-

WETH holdings valued at $3.05 million

As of August 7, Jump is still releasing the ETH staked on the chain and continues to sell it off, and its asset holdings are still declining:

-

USDC holdings valued at $307 million

-

USDT holdings valued at $66.86 million

-

WSTETH holdings worth $108 million

-

ETH holdings worth $9.62 million

-

RETH holdings valued at $8.83 million

-

WETH holdings worth $2.58 million

Jump holdings changes, source: Arkham

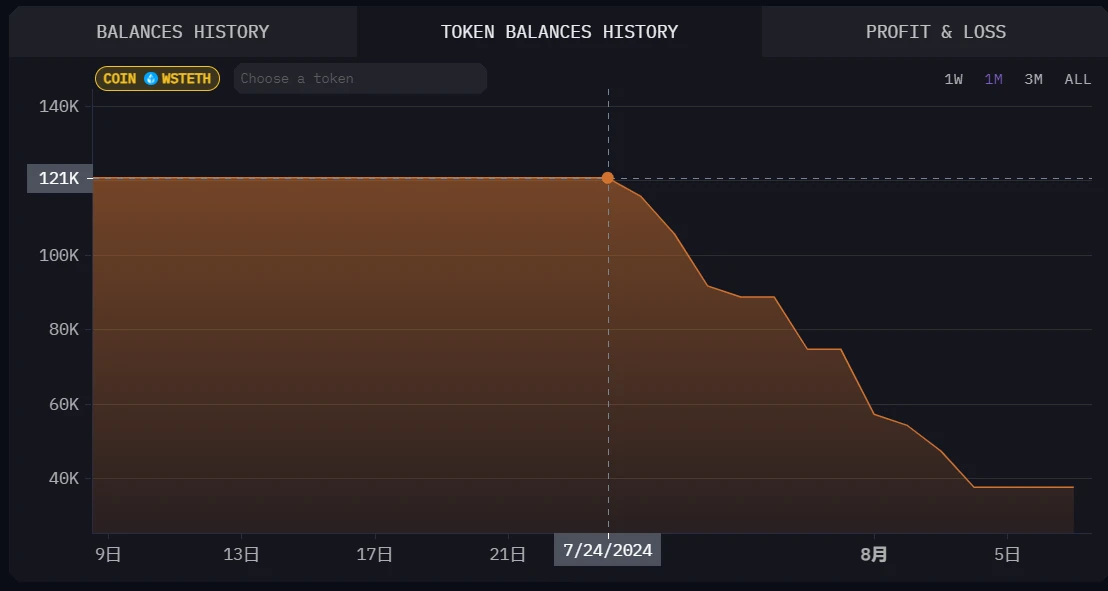

So was the ETH crash really caused by Jump selling?

According to Arkham data monitoring, Jump Trading has actually started selling since July 24. As of August 7, 83,000 wstETH (US$377 million) have been sold. The selling did not start after the big drop. If you look closely at Jumps transfer data, you can find that during the big drop, they took another 200 million US dollars to the exchange to buy the bottom. Conspiracy theorists say that Jump is likely to take advantage of the panic selling of retail investors, and in the case of poor liquidity on weekends, they smashed the market with one hand and opened short orders with the other, and then bought the bottom when the price fell to the right level.

Jump wstETH holdings change, source: Arkham

Jump on-chain wallet transaction record, source: Arkham

In summary, this sharp drop is more like a leverage cleanup caused by the short-term emotional panic caused by Japans interest rate hike, not a real black swan event. The fact is that the market has ushered in a recovery trend since the oversold on August 5, and both the US stock market and the crypto market have begun to recover. In a bull market, a 20% price correction is also very normal.

3. Risk assets rebound violently, and the crypto market may reverse

US stock market

Following the general plunge in risk asset markets on Monday, U.S. stock index futures rose on Tuesday, with Nasdaq futures up 2%, SP 500 futures up 1.5%, and Dow futures up 1%. After the spot opened, the three major indexes rose collectively. As of the close, the Dow rose 0.76%, the Nasdaq rose 1.03%, and the SP 500 rose 1.04%. After the Japanese stock market plummeted on August 5 and triggered the circuit breaker mechanism, the Nikkei 225 index rose by more than 3,200 points after opening on August 6, an increase of more than 10%, and the Topix index futures triggered the upward circuit breaker mechanism and automatically suspended trading. As of the close of August 6, the Nikkei 225 index rose 10.23%. South Koreas KOSPI index soared, and the increase expanded to 5%, triggering a suspension again.

At the same time, institutions also took over the buying. When the market crashed on Monday, hedge funds aggressively bought US stocks at the bottom, purchasing $14 billion in stocks. Cathie Woods Ark Invest bought Tesla, Meta, Amazon, Coinbase, Robinhood and other stocks totaling more than $60 million.

Strong institutional buying behavior also further strengthens the bullish theory, and multiple indicators also suggest that US stocks may be close to a short-term bottom: the 14-day RSI of the SP 500 and Nasdaq 100 are both close to 30, which means oversold and there may be a short-term rebound.

کرپٹو مارکیٹ

After the plunge on Monday, the crypto market started a wave of oversold rebound on August 6. Bitcoin rose 3.7%, reaching a high of $57,000, and the overall trend was wide fluctuations. Ethereum rose 5.8%, and SOL rebounded more than 15%. Is the worst of the sell-off over? Lets take a look at the data:

-

The total cryptocurrency market capitalization plunged on Monday and has now recovered from 1.94 trillion to 2.1 trillion.

-

BTC and ETH hit record highs in trading volume on August 5, and based on historical statistics in the chart below, prices will reverse due to such volume. Although an immediate reversal is not guaranteed, the rate of decline will be slowed down as a result.

-

After the sharp drop on August 5, the open interest of Bitcoin contracts dropped by more than 30% to US$25.8 billion, and the funding rate turned sharply negative. A large number of leveraged long positions were closed, and the long leverage may have been cleared. The fastest phase of the market decline may have ended.

-

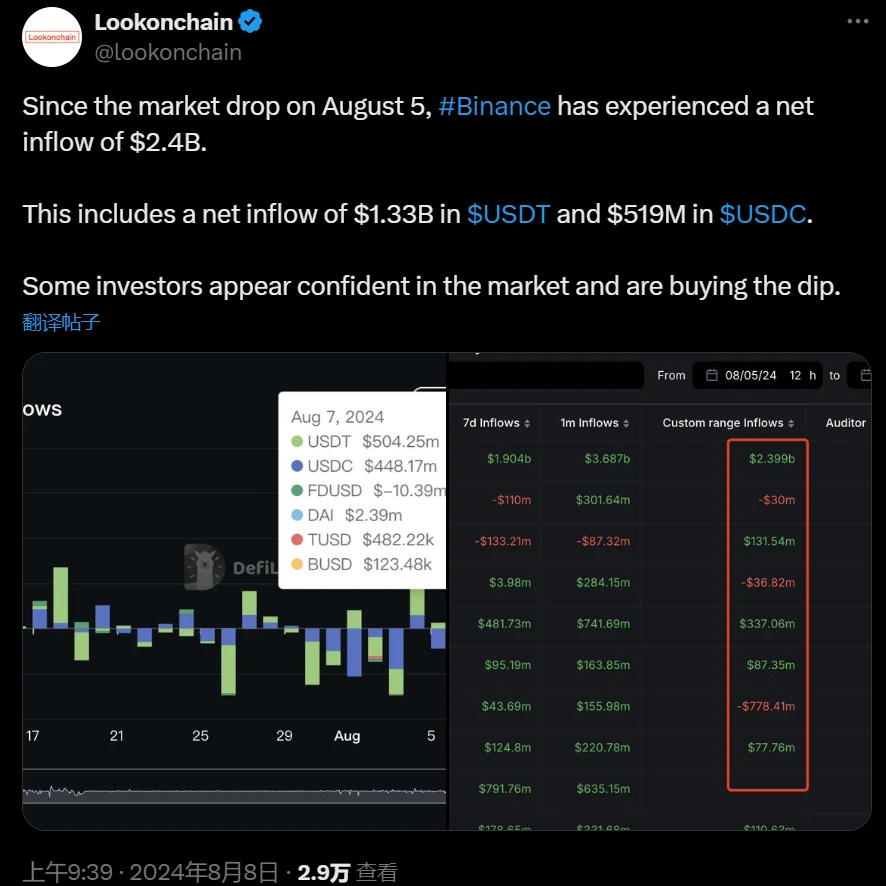

According to Lookonchain data monitoring, CEX stablecoin funds continue to flow in, and Binance has experienced a net inflow of $2.4 billion since the crash on August 5. This means that investors seem to be confident in the market and are buying on dips.

-

Whales holding more than 1,000 bitcoins continue to increase their holdings during the decline.

Data source: IntotheBlock

-

AHR 999 Index: On August 7, the AHR 999 Index was 0.61, and the index has fallen sharply since August 5. The current 200-day fixed investment cost is $60,950, and the theoretical fixed investment range is 0.45-1.2. The current price of around 55,000 is a good buying opportunity for long-termists.

-

BTC鈥檚 relative strength index (RSI) fell to 26 at its low on Monday. The low RSI level indicates that Bitcoin is oversold and is a good place to buy at the bottom.

-

The SOL/ETH exchange rate broke through 0.06 on August 7, setting a new all-time high, and market sentiment is not completely depressed.

-

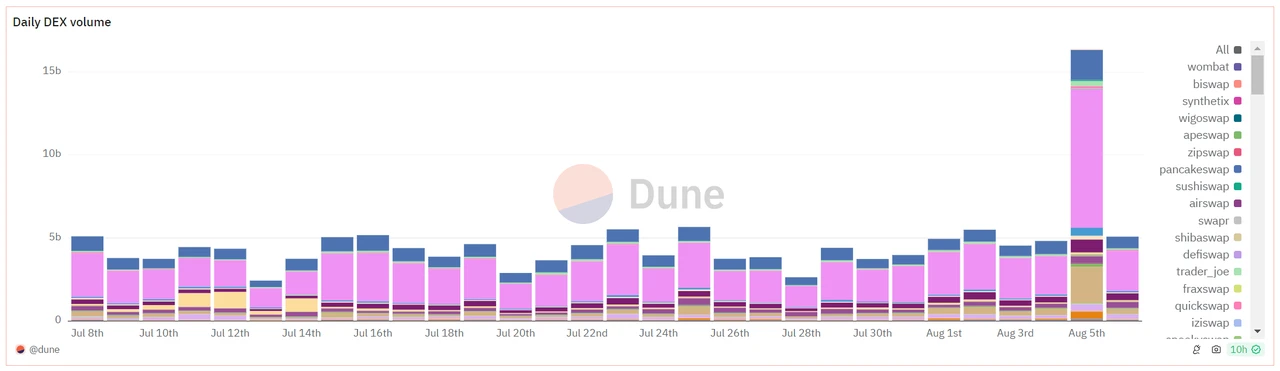

According to DUNE data monitoring, the total transaction volume of DEX on August 5 exceeded US$20.2 billion, setting the third highest record in history, and altcoin trading was active.

4. Subsequent influencing factors

As mentioned in the introduction, the risk market is also affected by many factors: global economic recession, geopolitical wars, interest rate hikes by the Bank of Japan, and the US election. People seem to be no longer sensitive to news about the war between Russia and Ukraine and the Middle East. The recent conflict between Iran and Israel, the conflict between Palestine and Israel, and the Hezbollah attack in Lebanon have had very limited impact on the market. The US election is also worth our attention in the future, and the US stock market does not seem to have fully priced in the expectation of a global economic recession.

Global recession concerns

The proponents of Sams Law mentioned above believe that the current rise in unemployment does not necessarily mean that the economy has already entered a recession. We are still in a strong position. Overall, it is difficult to confirm that we are already in a recession. Judging from the data on US economic activity, there is not much evidence to support the economic slowdown. US companies earnings in the second quarter are expected to increase by more than 10% year-on-year, with almost no signs of weakness.

Goldman Sachs CEO: US economy is not at risk of recession

Goldman Sachs CEO David Solomon said, The U.S. economy is not at risk of recession, and the Federal Reserve is not expected to cut interest rates urgently. He believes that the July employment report data is not bad, but weaker than people expected. Solomon believes that this shock will continue for a while, which may be healthy. Citigroup also said that the recession scenario is definitely not priced in. If the U.S. economy really declines, it will never be so easy, and the market may be much worse than it is now.

Fed officials: Inflation is falling, employment is good

Fed official Goolsbee said that inflation has fallen sharply and employment is relatively good. If the economy deteriorates, the Fed will balance the risks and take measures to repair it. Before the September meeting, we can be more patient and wait for more data.

The impact of the Bank of Japan rate hike and the yen carry trade

This weeks Black Monday hit the global risk market. As Japans interest rates have been at extremely low levels for many years, and even implemented a zero interest rate policy from 2001 to 2006, borrowing money at low interest rates in Japan and then converting the funds into high-interest currencies such as the US dollar and the euro to invest in assets in high-interest countries has become a common arbitrage behavior for market participants in the past 20 years.

The long-term downturn of the yen has always provided liquidity for capital arbitrage in the global market, and has also contributed to the asset bubble of relevant countries and markets. The interest rate hike and balance sheet reduction by the Bank of Japan on July 31 directly led to a sharp rise in the yen exchange rate. Global capital passively removed cheap leverage and sold various assets to repay yen debts.

Yen carry trade supports the bull market of global stock markets, and the long bull market of US stocks also benefits from the sufficient liquidity provided by yen carry trade. Massive amounts of yen funds are widely distributed in the worlds stock markets, foreign exchange markets, and commodity markets, influencing the worlds market conditions. Bitcoin is also a beneficiary of the long-term depreciation of the yen. The end of yen carry trade and the withdrawal of funds will trigger a global asset price crisis and decline. As financial institutions remove leverage, the credit tightening that we do not want to see will occur.

There is no way to track the size of the yen carry trade. The Wall Street Journal can only estimate the foreign currency loans of Japanese banks based on data from the Bank for International Settlements: as of March this year, the amount of foreign currency loans reached 1 trillion US dollars. As of the first quarter of this year, Japans net international investment, that is, outbound investment, reached 487 trillion yen.

Institutions have different opinions. Citigroups currency analysts predict that the current adjustment is just the beginning. JPMorgan Chase and UBS believe that the yens carry trade has been lifted by 3/4 after the stock market crash on Monday and the rebound on Tuesday, while Goldman Sachs and Societe Generale believe that the yens carry traders selling has ended.

Bank of Japan Governor Uchida also sent a dovish signal after the stock market plummeted, promising not to raise interest rates when the market is unstable, to temporarily maintain the current loose monetary policy, and to carefully consider the situation of the financial market in future interest rate policy decisions.

امریکی انتخابات

The US election is still in full swing, and the Trump and Harris campaigns are preparing for the final showdown. The Harris campaign recently raised a record $200 million, surpassing the Trump campaigns July fundraising of $138.7 million.

According to the latest survey by Ipsos, Harris and Trump currently have basically the same voter support. According to last months data, both had support of 43%. Harris received 70% support from African-American voters interviewed, a huge increase from Bidens 59% support from African-American voters at the time. Trumps support among African-American voters also rose slightly, from 9% in May and June to 12% in July. At the same time, Trumps support among white voters also increased, from 46% in May and June to 50% in July. Harris support among white voters rose from 36% to 38% in July.

Looking at the crypto prediction market Polymarket, as of August 8 before this article was published, Harris鈥檚 probability of being elected was 50%, exceeding Trump鈥檚 49%.

The US election is expected to continue to affect the volatility of risk markets, regardless of the final result. As Arthur Hayes said, Whether Trump or Harris wins the next US presidential election is not important to the crypto industry. Both the Republicans and Democrats will loosen monetary policy, just in different ways, so cryptocurrencies will rise, but the road may be very bumpy.

V. نتیجہ

The Bank of Japan has recently adopted a mildly dovish attitude because they have seen the serious impact of monetary policy on risk markets and the economy, and this is why they have calmed the market. The sudden change of decades of loose monetary policy will definitely disrupt the global market. Since the beginning of this year, due to the increased correlation between the yen and the US market, the rise of the yen is often accompanied by the decline of US stocks. We need to pay close attention to the policies of the Bank of Japan. It is expected that the logic of the yen will also have an important impact on the recovery and recovery of global risk assets in the future.

BTC is still on an upward recovery trend and is in a consolidation phase after an oversold rebound. There should be no greater fluctuations before the US election is settled, and the market repair will also take time. Bitcoin below $60,000 is extremely attractive to institutions. If we are optimistic, the bull market may return in the first quarter of 2025 or the beginning of next year, accompanied by a series of interest rate cuts.

The recent panic selling in the market reflects that the current market is overly sensitive to the release of US economic data, and the market panic may be misplaced. Like most industry analysts, I am still optimistic about the prospects of the crypto market. I hope everyone can stabilize their mentality and not let panic affect investment decisions.

As the transaction volume of on-chain DEX breaks new records, Meme has also been gaining popularity in recent days. XT Exchange focuses on discovering high-quality assets, research-driven, screening out on-chain contract risks for users, and launching the latest hot Meme coins at the first-hand speed. Buy value coins – on XT.com .

New users can register via the following link: https://www.xt.com/zh-CN/accounts/register/start?channel=XTlabs

Friends who are interested in Memecoin are also welcome to join our Tugou community to find the golden dog on the chain as soon as possible: https://t.me/memetothemars

銆怐اعلانیہ銆慣اس کا مضمون صرف حوالہ کے لیے ہے اور اس میں کوئی سرمایہ کاری کا مشورہ نہیں ہے۔ سرمایہ کاری میں خطرات شامل ہیں، براہ کرم احتیاط سے کام کریں۔ قارئین کو اپنے حالات کی بنیاد پر اس مضمون کے مواد کا آزادانہ جائزہ لینا چاہیے اور سرمایہ کاری کے فیصلوں کے خطرات اور نتائج کو برداشت کرنا چاہیے۔

This article is sourced from the internet: The market plummeted at the beginning of August. Did the yen arbitrage cause the collapse of global assets? What will happen next?

Related: Ten questions and ten answers to dispel the rumors surrounding the Mt. Gox incident

Original | Odaily Planet Daily Author | Azuma On the afternoon of June 24th, Beijing time, a news about Mt.Gox will initiate BTC and BCH repayments quickly triggered the market. Due to concerns about potential selling pressure, the already weak cryptocurrency market was further frustrated. BTC once fell below the $60,000 mark, and ETH also once approached $3,200. However, there is still a lot of confusion and even rumors about the Mt. Gox repayment incident itself, so that most readers do not know the full picture of the incident, and thus cannot actively assess the potential impact of the incident on the market. In order to dispel these doubts, Odaily Planet Daily will combine market data and interviews with creditors (dForce founder Mindao) to clarify this information in the…