Mt.Gox نے 95,457 بٹ کوائنز کی ادائیگی کی ہے، اور چاروں ادائیگیوں کی وجہ سے مارکیٹ میں کمی آئی

On July 31, 2024, the Mt. Gox exchange issued an announcement stating that the trustee repaid some creditors in the form of Bitcoin and Bitcoin Cash through some designated cryptocurrency exchanges on July 5, 16, 24 and 31 in accordance with the compensation plan. To date, more than 17,000 creditors have been repaid.

Image: Announcement released by Mt.Gox Exchange

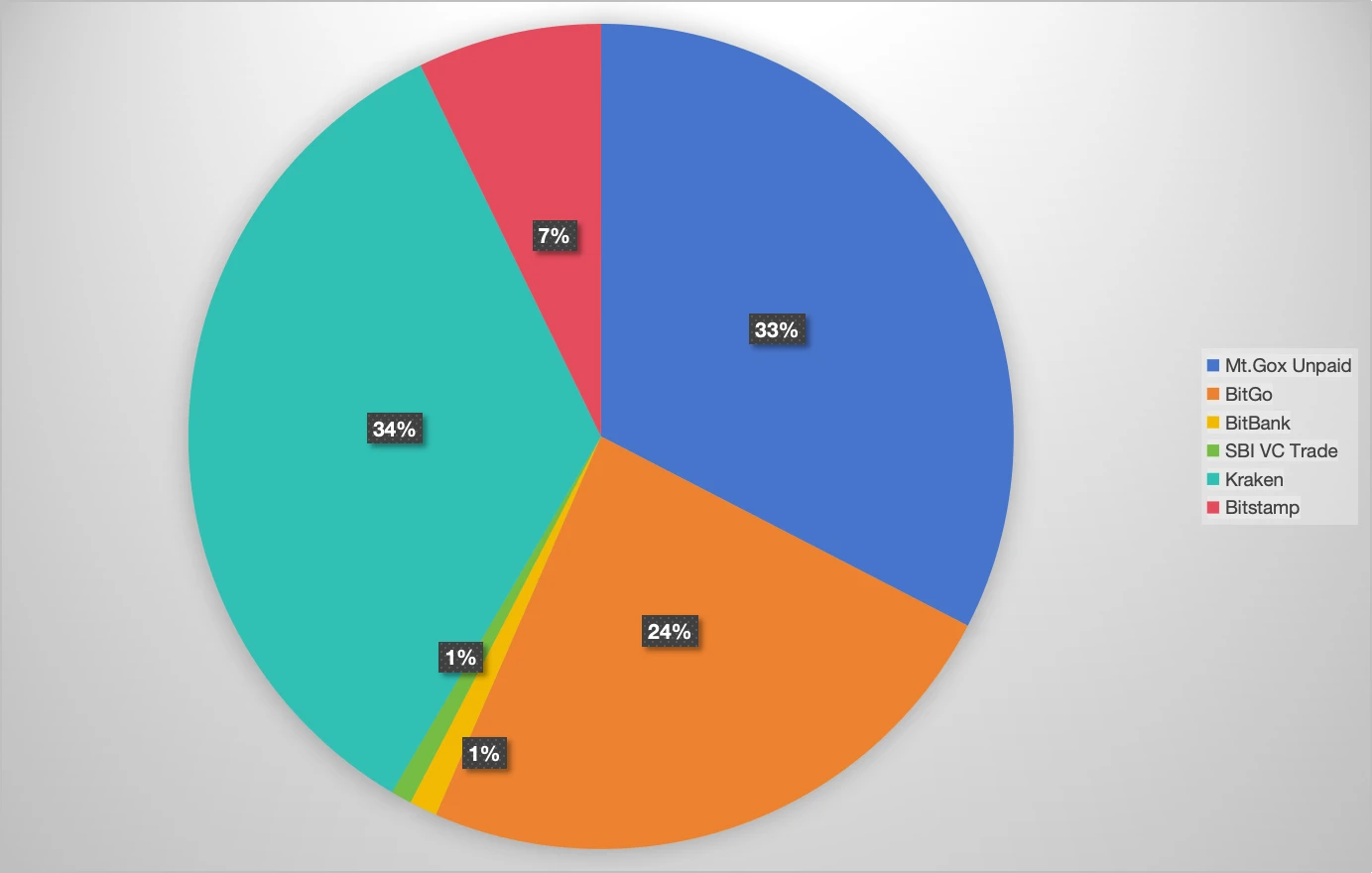

According to data from search.ichainfo.com, Mt.Gox has repaid 95,457 of the total 141,619 bitcoins, with a total value of up to US$6.16 billion, accounting for 67% of the total.

Mt.Gox executed compensation through a total of five exchanges, namely Bitbank, SBI VC Trade, Kraken, Bitstamp, and BitGo. Since the first four exchanges had already received bitcoins from Mt.Gox before July 31, the address that received 33,963 bitcoins on that day was most likely BitGo.

Image: Distribution of Mt.Gox repayment funds

1HRAprcXCzx1YqYv7dcCcDzf3vYVGPv3b2

12Gws9EsEiDZLinu2SWkHdk7TcobjTau9u

1MUQEiiQEckiBkrQswqq225nQTRWJ5SXZZ

In the compensation carried out by Mt.Gox Exchange in July, the virtual currency market was greatly affected. According to search.ichainfo.com, on the day of compensation and the next day, the price of Bitcoin fell to varying degrees, with a drop of between 4% and 8%.

In order to monitor the changes in funds in the remaining addresses of the Mt.Gox exchange, iChainfo Search launched the Mt.Gox special page (https://search.ichainfo.com/entity/mtgox), which displays the fund balances and latest transactions of Mt.Gox related addresses.

This article is sourced from the internet: Mt.Gox has repaid 95,457 bitcoins, and all four repayments caused market declines

Related: The decentralization dilemma of prediction markets from the perspective of Polymarket

Original author: dt Original translation: Lisa Recently, as the expectations of the $ETH ETF passing have been raised, the market has gradually returned to the EVM ecosystem. As the largest prediction market on the chain, Polymarket has attracted much attention for whether the $ETH ETF can pass smoothly. As the saying goes, a tall tree attracts the wind. Although Polymarket has gained huge liquidity, its settlement method has been questioned by participants. Let us follow Dr.DODO to explore the whole story of this controversial incident. Polymarket First, let me introduce the Polymarket protocol. Polymarket is a prediction market based on the Polygon public chain. Due to its early launch and long operation time, it is currently the largest prediction market on the chain. The platform allows traders to bet with…