ویلتھ بی میکرو ماہانہ رپورٹ: امریکی سود کی شرح میں کمی کی الٹی گنتی شروع ہوسکتی ہے، ایتھریمس کی 10 ویں سالگرہ کا خیرمقدم

The newly released economic data from the United States in July dispelled market concerns, and the market is currently betting on an astonishing 100% probability of a rate cut in September; U.S. stocks are switching styles as expected, with large-cap technology stocks breaking up and small-cap stocks and non-tech sectors ushering in spring; the crypto market was swept by emotions in July, but has now stabilized; Ethereum spot ETF was listed for trading, and Grayscales selling pressure temporarily put pressure on prices, but the selling speed was fast and the pressure may not last too long.

On July 25, the United States announced that its GDP in the second quarter of 2024 grew by 2.8% year-on-year, higher than the expected 2.0% (1.4% in the first quarter). The PCE price index grew by 2.6% in the second quarter, lower than 3.4% in the first quarter. The core PCE price index, which excludes food and energy prices and is the most important inflation indicator of the Federal Reserve, grew by 2.9%, also lower than the previous value of 3.7%. However, the market does not seem to buy this data. On the day the data was released, the U.S. stock market was shaken, from opening high to plummeting, and then pulled up and fell again. The long and short sides fought fiercely throughout the day, and the market could not reach a consensus.

In fact, quite a few investors believe that the economic data given by relevant US institutions are not true, which can be seen from the revision of non-farm data. At the beginning of the month, the US Department of Labor announced that the non-farm data for this month was 206,000 (expected to be 190,000), but at the same time, the number of new non-farm jobs in April was significantly revised down from 165,000 to 108,000, and the number of new non-farm jobs in May was significantly revised down from 272,000 to 218,000. After the revision, the total number of new jobs in April and May decreased by 111,000 compared with before the revision. According to statistics, the number of jobs was revised down in 4 of the past 5 months. This practice has obviously caused various speculations and even suspicions in the market, believing that economic data is just a tool for the US government to manipulate policies.

The long-term interest rate hike has already had a significant impact on the US economy. Currently, the market is speculating that many economic data are creating momentum by the Federal Reserve and relevant departments of the US government to create the rationality of interest rate cuts. Of course, the effect is also very good: the current FedWatch Tool shows that the probability of maintaining the current interest rate level in September is 0, in other words, the probability of interest rate cuts starting in September is 100%!

This extreme situation can only mean that the market has begun to adjust the pricing of all assets in line with expectations. The overall US 10-year Treasury bond interest rate has entered a downward channel, and funds have begun to shift from the risk aversion of the interest rate hike cycle to the appropriate pricing of various assets in the interest rate cut cycle.

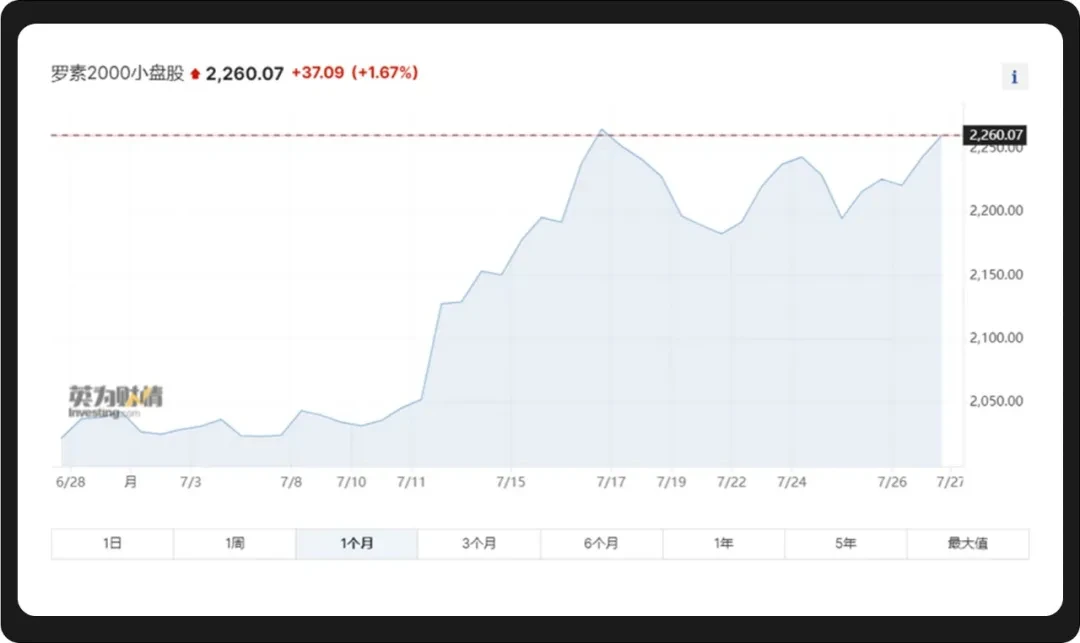

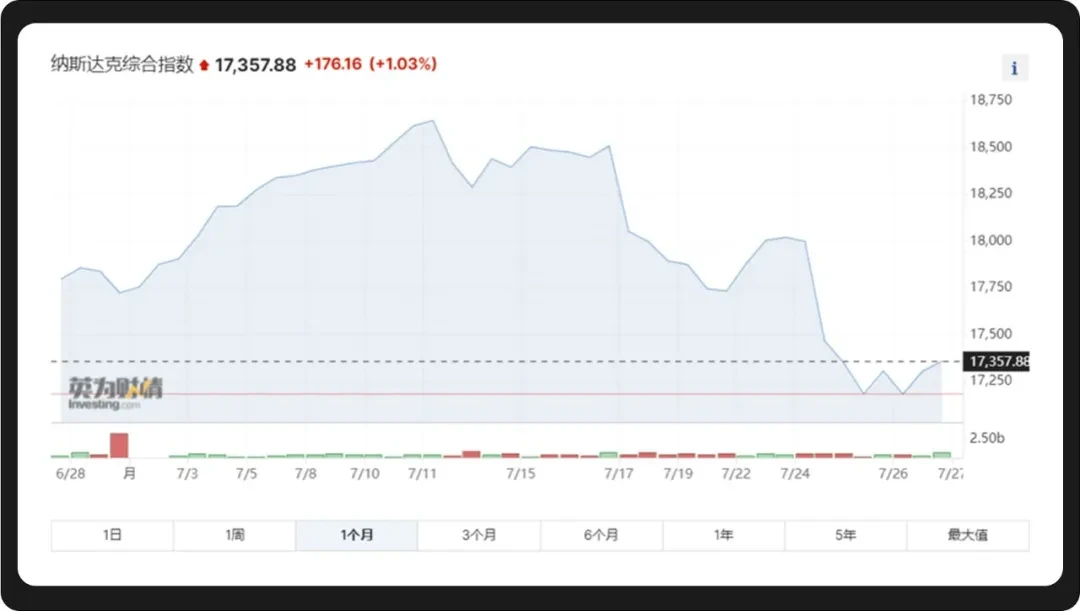

Lets first look at the trend chart of the Russell 2000 Small Cap (RUT) and the Nasdaq Composite (IXIC) over the past month. These two indexes are very interesting: On July 11, when IXIC peaked, RUT took off.

July 11 was the day when the United States released the latest CPI data. The market keenly captured the signal of easing inflation. Everyone agreed that interest rates could be cut in September, so funds quickly withdrew from large-cap stocks, the group collapsed, and began to pour into small-cap stocks. WealthBee pointed out in its May monthly report that during the interest rate hike cycle, funds poured into leading companies in the AI industry, and with the arrival of the interest rate cut cycle, the markets risk preference will change first, and then the US stock market may usher in a style change. During the interest rate cut cycle, the abundance of liquidity will increase the speculativeness of the market. Compared with large-cap stocks, small-cap stocks have higher volatility and are more suitable for speculation. Therefore, this big cut small style change is also reasonable.

In addition, among the current Magnificent 7 of US stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Tesla (TSL), Nvidia (NVDA), Amazon (AMZN), Meta Platforms (META), Tesla and Alphabet have announced their second-quarter financial reports. Teslas second-quarter operating profit was $1.605 billion, down 33% year-on-year, and the market expected $1.81 billion; adjusted earnings per share were $0.52, lower than the market expectation of $0.6. Googles parent company Alphabets financial report is relatively good. The total revenue in the second fiscal quarter was US$84.742 billion, an increase of 14% compared with US$74.604 billion in the same period last year; net profit was US$23.619 billion, an increase of 29% compared with US$18.368 billion in the same period last year; diluted earnings per share were US$1.89, an increase compared with US$1.44 in the same period last year. These data exceeded market expectations, but YouTube advertising and revenue did not meet expectations. The overall situation of these two companies is not very ideal, which has also intensified the markets suspicion of Magnificent 7s overall profitability. The market is also waiting for Apples second fiscal quarter report on August 1.

In the AI narrative, if only Nvidia benefits, and the other six in the Magnificent 7 fail to maintain sustained performance, it may be difficult for them to support themselves. Combined with the style switch, the US stock market may usher in more corrections. Observing the subsequent performance of Apple, Microsoft and Nvidia, if they can exceed expectations, combined with the overall liquidity brought to the market by the interest rate cut, the beta returns of the US stock market may continue.

In July, due to the compensation of the Mt.Gox case, the selling pressure of the German government and Trumps speech at Bitcoin 2024, the market brought huge fluctuations – the price of Bitcoin fell below $54,000 at its lowest, then broke through $70,000, and then fell back to around $66,000 at the end of the month. Recently, the Bitcoin Volatility Index has reached a higher peak level, which shows that the market is currently in a stage where both long and short sides are evenly matched.

The Mt.Gox incident had been anticipated by the market, and the German government鈥檚 selling pressure was not very large (about 1,000 coins per day on average). In theory, it would not have caused a major impact on the secondary market. Therefore, the sharp drop at the beginning of the month was more of an emotional sell-off.

As a well-known crypto-friendly president, Trump also emphasized in his speech at Bitcoin 2024 in late July that the United States will be made the worlds Bitcoin center, and even said that not a single Bitcoin will be sold and the United States will establish a national Bitcoin reserve, which seems to want to inject new boosters into the market. During his speech, the price of Bitcoin first fell sharply by $1,200, falling below $67,000, and then quickly rebounded, eventually soaring to a high of $69,000. But after Trumps speech, the price of Bitcoin fell again, reflecting the markets disagreement on the feasibility of Trumps remarks and their long-term market impact. Perhaps the market has also overestimated the probability of Trumps election as president. At present, Harris, the Republican rival, is not weak. She also has a high approval rating with multiple political correctness buffs, and Harriss current preference for cryptocurrencies is still vague.

While Bitcoin volatility has sparked heated discussions, the Ethereum market has also reached a milestone this month: On July 23, Eastern Time, the Ethereum spot ETF began trading on the 10th anniversary of the first public sale of Ethereum. However, the market performance was quite flat: Farside Investors data showed that the net inflow on the first day of trading exceeded US$100 million, but there was a continuous net outflow in the following days.

From the table, we can see that Grayscales products continue to have a large outflow, which is exactly the same as the scene when the Bitcoin spot ETF was launched before: Grayscale also sold a large amount of Bitcoin when the Bitcoin spot ETF was launched. Grayscale will convert the existing Grayscale Ethereum Trust ETHE into an ETF, and the previous fee rate is still 2.5%. The high fee rate is far higher than that of other competitors, which will inevitably lead to a large number of investors selling, either to lock in profits or to buy competitors products.

However, there is no need to worry too much about this situation. At present, the selling speed of Grayscale ETFE is very fast. When ETHE was listed, Grayscale held about 2.63 million Ethereum, equivalent to about 9 billion US dollars. As of the 26th, as much as 1.5 billion US dollars had flowed out. Such an outflow speed will quickly reduce the selling pressure. The pain is only temporary. The speed of launching Ethereum spot ETF has proved that crypto assets are being accepted by traditional markets at a faster rate than expected, and the future of crypto assets must be bright.

Overall, the market in July was almost dominated by emotions. Perhaps the crypto market currently lacks a new bull market narrative, coupled with the decoupling from the US stock market, and is in a relatively chaotic period as a whole, making it more susceptible to emotions.

However, at present, the market has fully digested the sentiment and is showing a spiral upward recovery trend. The price of Bitcoin is moving in the right direction. Bitcoin spot ETFs are also continuing to have net inflows, which reflects that the market panic has not continued, indicating the arrival of a larger market in the future.

Despite the uncertainty in the macro economy and traditional financial markets, the crypto asset market has shown its independence and resilience, and is expected to play an increasingly important role in diversified investment portfolios, providing investors with new growth opportunities. This month, the price of Bitcoin has gone through a roller coaster trend, which is more emotional, and the long-term trend represented by the Bitcoin spot ETF remains unchanged. The launch of the Ethereum spot ETF has also brought new vitality and stability to the market. The future of the crypto market is full of challenges, but also full of hope.

This article is sourced from the internet: WealthBee Macro Monthly Report: The countdown to the US interest rate cut may begin, Ethereums 10th anniversary welcomes the listing of spot ETFs, and market sentiment spirals back to normal

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money. The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. As a related risk asset, Bitcoin fell due to the negative impact of U.S. stocks. The sectors with relatively strong wealth-creating effects are: Solana Meme, ETH ecology; Hot searched tokens and topics by users are: Nillion Network, Bitcoin; Potential airdrop opportunities include: Espresso, Mezo; Data statistics time: July 12, 2024 4: 00 (UTC + 0) 1. Market environment The annual rate of the unadjusted core CPI in June was 3.3%, lower…