کرپٹو کرنسی مارکیٹ کو سمجھنے کے لیے تین اہم الفاظ: جذبات، سیاست اور توقعات

1. Introduction: Characteristics of the current cryptocurrency market

The cryptocurrency market is well known in the financial world for its high volatility, high return potential, and high risk characteristics. As a relatively young and rapidly developing financial field, it exhibits dynamics that are very different from traditional markets. Every ups and downs of this market affect the nerves of investors around the world, and the driving factors behind it are often complex and diverse. This article will focus on understanding and analyzing the three key factors that affect the cryptocurrency market: market sentiment, political environment, and future expectations. These three factors are not only interrelated, but also largely dominate the short-term volatility of the market.

2. Keyword 1: Emotion

A sharp shift in market sentiment

The cryptocurrency markets sentiment tends to fluctuate more dramatically than traditional financial markets, and the first half of 2024 has been full of twists and turns. Looking back at the market trends so far this year, we can clearly see the ups and downs of investor sentiment.

Since April 13, the market has undergone a series of significant changes. In the early days, although the prices of most altcoins began to halve, investors remained optimistic and believed that this was just a necessary stage, similar to the process of two bull markets. However, on June 18, the market bottomed out again. This decline was related to higher-than-expected US inflation data, which further hit investor confidence.

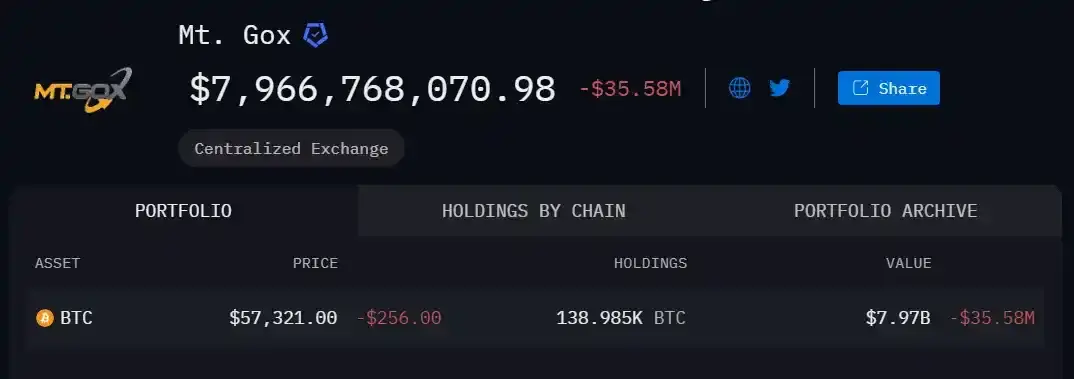

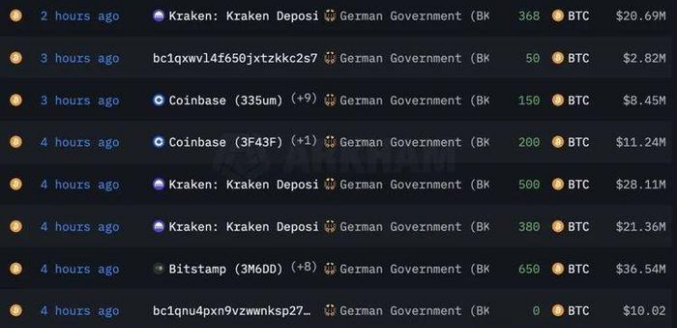

The third bottom on July 5 was caused by multiple factors, among which the most eye-catching was the Mentougou compensation incident.

As a former large exchange, Mt. Gox announced that it would pay about 142,000 BTC, 143,000 BCH and 69 billion yen to investors. At the same time, the German government announced plans to sell about 44,000 seized bitcoins, with a total value of more than 2.8 billion euros. These two pieces of news brought huge selling pressure expectations to the market in the short term.

The cumulative effect of this series of negative events far exceeds the impact of a single event. They not only directly affect the market supply and demand, but more importantly, shake investors confidence. The market began to question the long-term value proposition of cryptocurrencies, including its effectiveness as an inflation hedging tool, regulatory risks, and the possibility of large-scale adoption.

Interestingly, turning points in market sentiment often come from the unexpected. The news that Trump was sniped but not shot was like a shot in the arm, which quickly reversed the market atmosphere. Subsequently, the market began to gradually regain confidence and prices fluctuated upward. This rapid sentiment recovery highlights the resilience of the cryptocurrency market and investors confidence in the long-term prospects. In just 12 days (July 5-17), the market turned from general pessimism to cautious optimism, and the sentiment index quickly recovered from extreme panic to greed levels.

Importance and limitations of sentiment indicators

Here are a few commonly used sentiment indicators:

1) Fear and Greed Index: This is one of the most well-known sentiment indicators. It combines multiple factors such as market volatility, trading volume, social media trends, etc., and uses a value of 0-100 to represent the market sentiment state. The closer it is to 100, the higher the greed index.

2) Social media sentiment analysis: By analyzing the discussion heat and emotional tendencies on platforms such as Twitter and Youtube, especially the direction of KOLs, changes in market atmosphere can be quickly captured.

3) Bitcoin Rainbow Chart: This is a long-term trend indicator that divides Bitcoin prices into different color areas to reflect the overall sentiment of the market.

4) Network activity indicators: such as the number of active Bitcoin addresses and transaction volume, which can reflect user participation and market activity.

The importance of these sentiment indicators lies in that they provide a quantitative measure of market sentiment, which helps to identify possible market turning points and provides an additional reference dimension for investment decisions. However, these indicators also have limitations and may lag behind actual market changes. There may be contradictions between different indicators. The fact that a unilateral market may last for a long time does not necessarily mean an immediate reversal. Therefore, sentiment indicators can only be used as a reference, and only in combination with other market signals and fundamental factors can a comprehensive analysis and decision be made.

3. Keyword 2: Politics

3.1 Potential impact of the US election on the cryptocurrency market

As the worlds largest economy, the political changes in the United States have a profound impact on the cryptocurrency market. The 2024 US presidential election is undoubtedly the focus of global financial markets, especially the cryptocurrency market.

The Biden administration has been cautious about cryptocurrencies over the past four years, but there have been subtle changes in its policies recently. The SECs accelerated approval of Bitcoin ETFs is widely interpreted as a strategy to win support from crypto voters. This shift has indeed brought positive effects to the market, but we must also recognize that policy impacts are often short-term, and their long-term effects remain to be seen.

On the other hand, people may overestimate the influence of the Democratic Party on the crypto market. As the most popular Republican presidential candidate, Trump will have to wait until he enters the White House to truly implement his policy agenda. It still takes a certain transition time from the introduction of policies to their implementation. Under the current political landscape, it is difficult for any party to dominate the formulation of cryptocurrency policies alone.

3.2 Why the market may overestimate the impact of Trump’s election

Trump enjoys a high reputation in the cryptocurrency community, partly due to the contrast with the current President Biden. Bidens advanced age and some controversial policies have caused public dissatisfaction, while Trumps no war term and the image of fighting for America after the recent shooting have made many people regard him as the chosen one. However, this view may oversimplify the political reality in the United States.

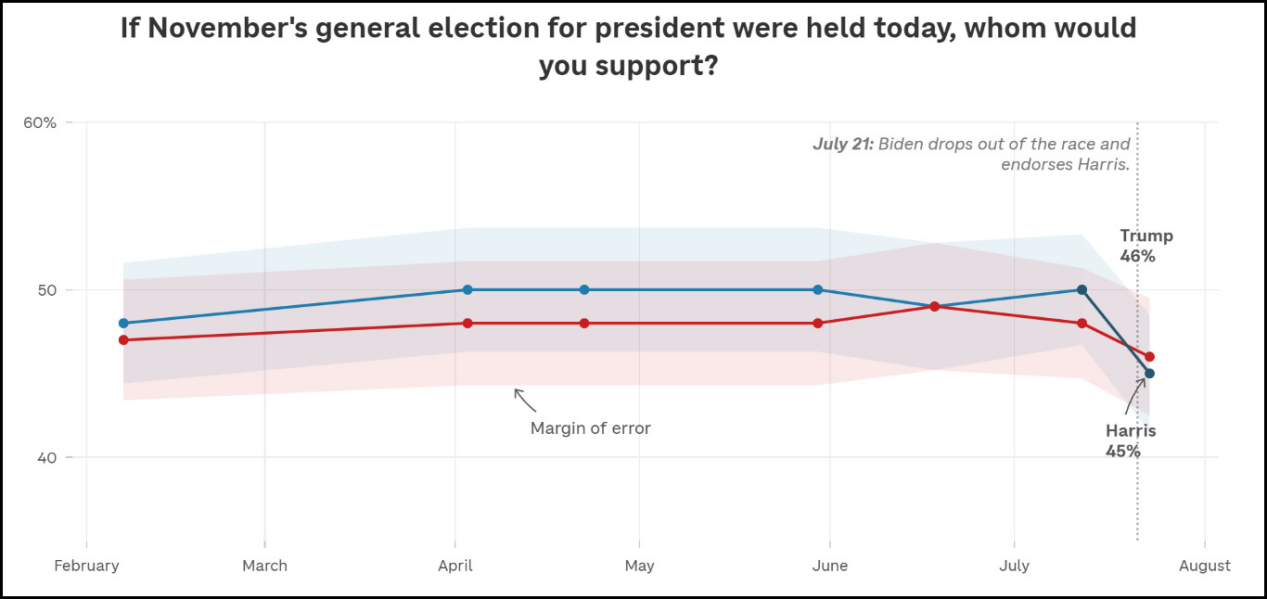

With Biden announcing his withdrawal from the race and Kamala Harris becoming a possible candidate for the Democratic Party, the election situation has become more complicated. In the past one or two years, racial conflicts in the United States have surged. As a mixed-race woman of African and Indian descent, Harris represents diversity and inclusiveness, and may attract a large number of minority and female voters. The latest polls show that Harriss approval rating is slightly higher than Trumps, which means the election result is far from known.

3.3 The Deeper Impact of the American Political Party Dispute

The US presidential election is not only a personal contest, but also a contest between the two different political philosophies of the Democratic Party and the Republican Party:

The Democratic Party: pursues liberalism and favors state intervention in the economy. Its main supporters include trade unions, intellectuals, urban elites, immigrants, feminists, ethnic minorities, and the LGBTQ+ community.

Republican Party: Adheres to conservatism and advocates economic laissez-faire. Its main supporters include religious organizations, big businesses, veterans, and white people (especially white men).

This deep ideological battle will determine the future policy direction of the United States, including its attitude towards cryptocurrencies. At present, Harris has not yet made clear her position on cryptocurrencies, which has brought new uncertainties to the market.

4. Keyword 3: Expectation

Bitcoin Conference

In the cryptocurrency market, expectations often influence price movements more than reality. Investors and market participants’ expectations are mainly based on major events and economic policies. In 2024, two key factors are shaping market expectations: the Bitcoin Conference and the Federal Reserve’s possible interest rate cut decision.

From July 25 to 27, 2024, the highly anticipated Bitcoin Conference will be held at the Music City Center in Nashville, Tennessee, USA. This conference is not only an annual event in the cryptocurrency community, but also a concentrated display of political influence. Republican presidential candidate Trump has confirmed his participation, and the market expects him to reveal more detailed cryptocurrency policy guidelines in his speech. At the same time, according to FOX Business, U.S. Senator Cynthia Lummis of Wyoming plans to announce a legislation at the conference requiring the Federal Reserve to hold Bitcoin as a strategic reserve asset. Although this plan is still undecided, its potential impact cannot be ignored. However, U.S. Vice President Harris has confirmed that he will not attend the conference, which may suggest that the Democratic Party is cautious about cryptocurrencies.

Therefore, the market is paying closer attention to whether Tesla CEO Elon Musk will attend the conference. It is reported that Musks private plane has arrived in Tennessee. As the worlds richest man and a well-known supporter of cryptocurrency, Musks attendance will greatly enhance the influence of the conference. If heavyweights such as Trump and Musk express support for digital currency at the conference, it may trigger a significant boost in market sentiment.

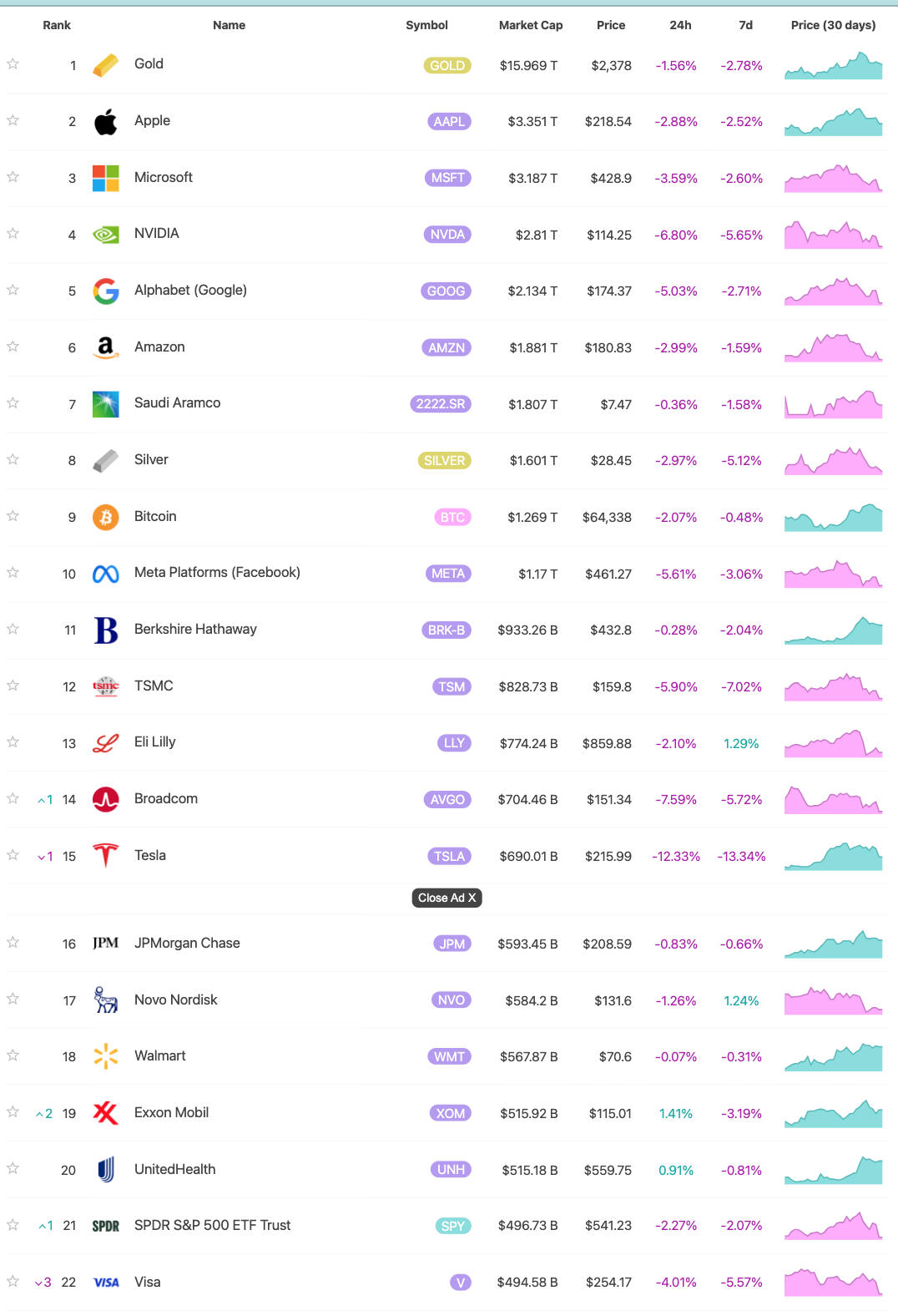

شرح میں کمی

Another important factor affecting market expectations is the Feds possible interest rate cut decision. The recent sharp drop in U.S. stocks, and Teslas stock price plummeted by more than 12%, has also affected the crude oil, gold and cryptocurrency markets. Some people speculate that in order to save the economy and stabilize the approval rating, the Democratic Party may be forced to cut interest rates before the election to boost the economy. For the incumbent Democratic Party, stabilizing the economy is crucial to maintaining approval ratings. If the Fed cuts interest rates before the election, it may stimulate short-term economic growth and benefit the Democratic Partys election. This may have a positive impact on the cryptocurrency market, as a low interest rate environment usually drives investors to seek high-yield assets.

5. Conclusion: Look at the market rationally and do a good job of risk management

Sentiment reflects the collective psychological state of market participants. Sentiment changes are often rapid and difficult to predict. Investors need to remain rational and avoid being swayed by short-term emotions.

Political factors reflect the complex interaction between cryptocurrencies and the traditional financial system and regulatory environment. Investors need to pay close attention to policy changes and understand their potential impact on the market.

Expectations, as a bridge connecting the present and the future, often have a greater impact on market trends than current reality. Investors need to consider long-term development trends while paying attention to short-term expectations.

Successful investors need to consider these factors comprehensively, seize long-term opportunities in short-term fluctuations, and find certainty in uncertainty.

This article is sourced from the internet: Three key words to understand the cryptocurrency market: sentiment, politics and expectations

Original author: Nancy, PANews Ethereum’s 10th anniversary has ushered in a milestone, with 9 spot ETFs finally “passing customs” and being approved, and 8 issuers have won the victory of mainstreaming Ethereum after years of regulatory resistance. On the first day of listing on July 23, the trading volume of Ethereum spot ETF exceeded $1 billion, which is 23% of the $4.6 billion trading volume of Bitcoin spot ETF on the first day in January this year. Although the rise in market demand will drive up the price of crypto ETFs, the competition between homogeneous products is bound to be fierce, which has been reflected in the market structure of Bitcoin spot ETFs. Among these issuers, the crypto-native institution Bitwise does not have the appeal of traditional giants such as…