بی ٹی سی ایل ایس ڈی، بی ٹی سی اسٹیکنگ فوائد کا اشتراک کرنے میں مزید صارفین کی مدد کیسے کی جائے؟

Babylon is a non-custodial Bitcoin staking solution that implements native asset staking on the BTC layer in a cryptographic trustless manner, and generates income by providing POS security guarantees for other blockchains through re-staking.

Bitcoins pledged in Babylon will not leave the main network, and security is guaranteed by the PoW mechanism. The pledge process is completely run in the cryptographic way of extractable one-time signature EOTS, without relying on any third-party bridge or custodian. Therefore, it has also been sought after and welcomed in the BTC community, which has extremely high security requirements.

Babylon allows Bitcoin holders to earn interest on staking while ensuring security, opens up the BTC staking track, and will completely change the way the BTC ecosystem is played. At the same time, the introduction of staking BTC can also solve the problems of inflation in small and medium-sized POS chains (if you want to convince everyone to Stake, you must provide relatively high inflation returns, such as staking for a year to get 10~15% or even 20% of the token) and difficult start-up (building a verification node requires a lot of money).

BTC Liquidity Staking

Similar to ETHs traditional liquidity token solution, the BTC liquidity pledge solution aims to provide BTC demand deposits, which can be deposited and withdrawn at any time and paid interest. In addition, the liquidity pledge tokens can also be used to obtain income from other DeFi projects (such as providing liquidity, lending, etc.). Users pledge on Babylon can be regarded as a time deposit, which has high returns but cannot be withdrawn in time.

At the same time, more non-mainnet BTC users can be introduced. For example, users holding wBTC on Ethereum can also participate in Babylon staking.

In essence, liquidity staking can be seen as the project party borrowing the users BTC to stake on Babylon, using the staking income to pay the users interest, and the bonds (liquidity staking tokens) given to the user can also be traded.

Currently, most of Babylons liquidity pledge tokens are built on Ethereum, and plans to support multiple chains in the future. Except for Lombard, where users directly pledge to Babylon, other projects adopt a custodial model, where the project party pledges to Babylon on behalf of the user, and a third-party institution provides liquidity.

pSTAKE

pSTAKE uses institutional custodial liquidity. Users funds are pledged to the Pstake storage address. Liquidity is supported by institutional custodial providers such as Cobo. The project party then pledges BTC to Babylon.

yBTC is the official liquidity pledge token, which has not yet been issued. It is expected that users can use yBTC to earn income on other DeFi projects, such as providing liquidity, lending, etc. yBTC will be issued on Ethereum at first, and then on other L2.

پروجیکٹ کی پیشرفت میں شرکت کے مواقع

The content of the v1 testnet is to use sBTC (BTC on the testnet) to deposit and withdraw on pSTAKE on the BTC testnet. v2 provides users with the function of obtaining staking income from Babylon on the mainnet. v3 will mint a liquid staking token called yBTC, so that users can use yBTC to participate in other DeFi projects while obtaining staking income. v4 makes the income more diversified.

The product is currently in the v1 stage, and the points plan has not yet been launched. It is expected to be launched together with the main network. Participating in the test network staking will bring additional points. Currently, 44,813 users have participated in v1 and pledged 40.65 sBTC.

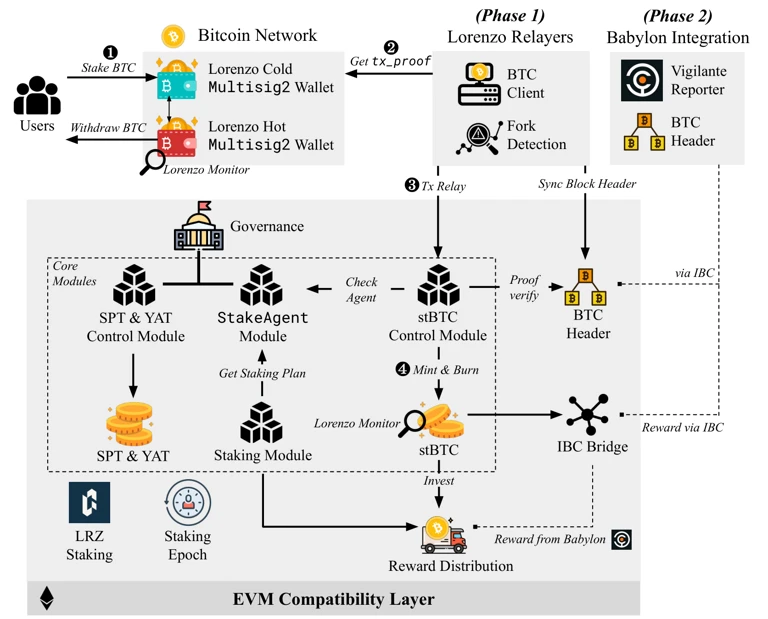

لورینزو

Lorenzo implemented a principal and interest separation business similar to Pendle based on BTC’s liquidity solution.

Users send BTC to Lorenzos multi-signature wallet, which is then held by a staking agent (a group of trusted Bitcoin institutions and TradFi giants) and receives stBTC as a staking certificate. Lorenzo then pledges BTC to Babylon.

After pledging Bitcoin liquidity, Lorenzo issues three types of tokens:

-

Liquid Principal Token (LPT): represents the tokenization of redeemable BTC principal, where stBTC is Lorenzo’s official LPT

-

Yield Accumulation Token (YAT): represents the right to claim the yield from the staked project at the end of the re-staking period. YAT is tradable and transferable, and is not transferable after expiration. Users can claim project rewards based on the YAT they hold. YAT is an ERC-20 token issued by re-staking to a staking agent.

-

Staking Proof of Stake Token (SPT): After users use YAT to claim project rewards, YAT will automatically be converted into SPT of equal value, enter a unified queue, and cannot be traded. The only purpose of SPT is to be destroyed in order when users destroy stBTC to withdraw BTC. The agentID associated with the destroyed SPT determines which staking agent will redeem BTC. If there are insufficient SPTs in the queue, users must wait for new SPTs to enter the queue. Users who generate SPTs by claiming YAT can use their own generated SPTs to redeem BTC first.

Since both LPT and YAT are tradable, anyone who owns YAT and LPT can use them to claim yield and withdraw re-staked BTC, respectively.

LPT like stBTC can be seen as another form of wrapped Bitcoin, and Lorenzos goal is to eventually replace wBTC. YATs value comes from accrued yields and speculation on future yields, and YAT has high volatility. The trading pair between stBTC and all YAT will be the base trading pair. There may also be trading pairs between LPT, YAT, and assets such as ETH, BNB, and USD stablecoins, creating huge arbitrage and investment opportunities for investors.

In the lending protocol, borrowers can use LPT and YAT as collateral to borrow any assets they want; in return, stakeholders have greater control over their investments and liquidity.

پروجیکٹ کی پیشرفت میں شرکت کے مواقع

Lorenzo’s mainnet will be launched in two phases (Lorenzo Phase One and Lorenzo Phase Two).

Lorenzo Phase One mainly tests the minting of stBTC from BTC and the exchange of stBTC to BTC.

Lorenzo Phase Two introduced a staking agent to decentralize the management of user-staked BTC and issue BTC-backed liquidity re-staking tokens. The staking agent can issue YAT to represent the users staking income. When users use YAT to claim project rewards, YAT will automatically be converted into an equivalent amount of SPT, which determines which staking agent will redeem BTC.

Pre-launch staking can earn rewards and points: https://app.lorenzo-protocol.xyz/staking

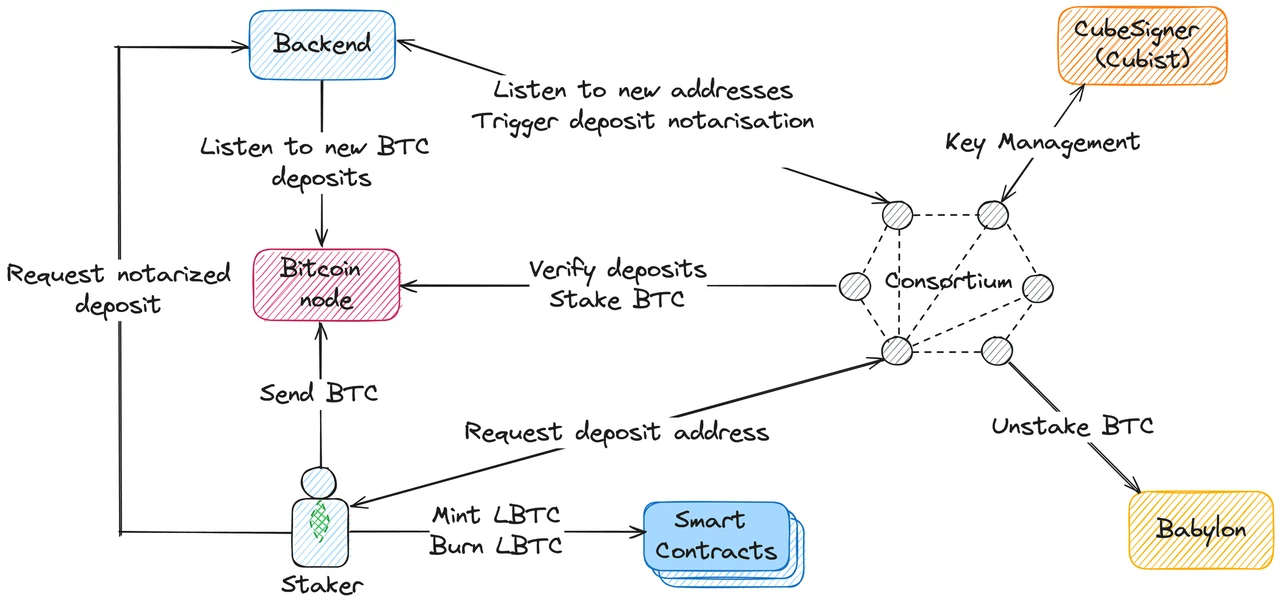

لومبارڈ

Lombard is more decentralized. User funds are directly pledged to Babylon instead of having liquidity provided by a trusted third party. The overall architecture consists of users, Bitcoin nodes, the backend, and Consortium (which is used to manage the pledge process and is a decentralized state machine that uses the Raft algorithm to reach consensus).

Lombards pledge process is managed by the decentralized Consortium. Users will send native BTC to the Consortiums address. Once the backend detects that there is a deposit at this address of the Bitcoin node, it will trigger the deposit notarization process to the Consortium. The Consortium will check the transaction to verify the deposit, then pledge BTC to Babylon and mint LBTC equal to the number of LBTC pledged by the user.

The role of LBTC

LBTC is Lombards liquidity staking token, and holders can obtain native returns through Babylon staking. LBTC is exchanged with BTC 1: 1. LBTC can cross chains and is compatible with DeFi and can be used as collateral for lending agreements, perp DEX, etc. In the future, the first phase of LBTC will be issued on Ethereum, and then expanded to multiple chains.

پروجیکٹ کی پیشرفت میں شرکت کے مواقع

Lombard is currently in the first phase and is running on the Ethereum mainnet in Private Beta mode. Eligible participants can stake native BTC and mint LBTC. It is worth noting that Lombard can only be staked but not withdrawn. You can continue to pay attention to Xs dynamics.

Phase 2 will begin in a few weeks and will open LBTC to the public while maintaining the deposit cap. The LBTC waitlist manages LBTC demand and provides us with a mechanism to reward early adopters with exclusive access and benefits over time.

LBTC Waitlist: https://lombard.finance/#LBTC_waitlist

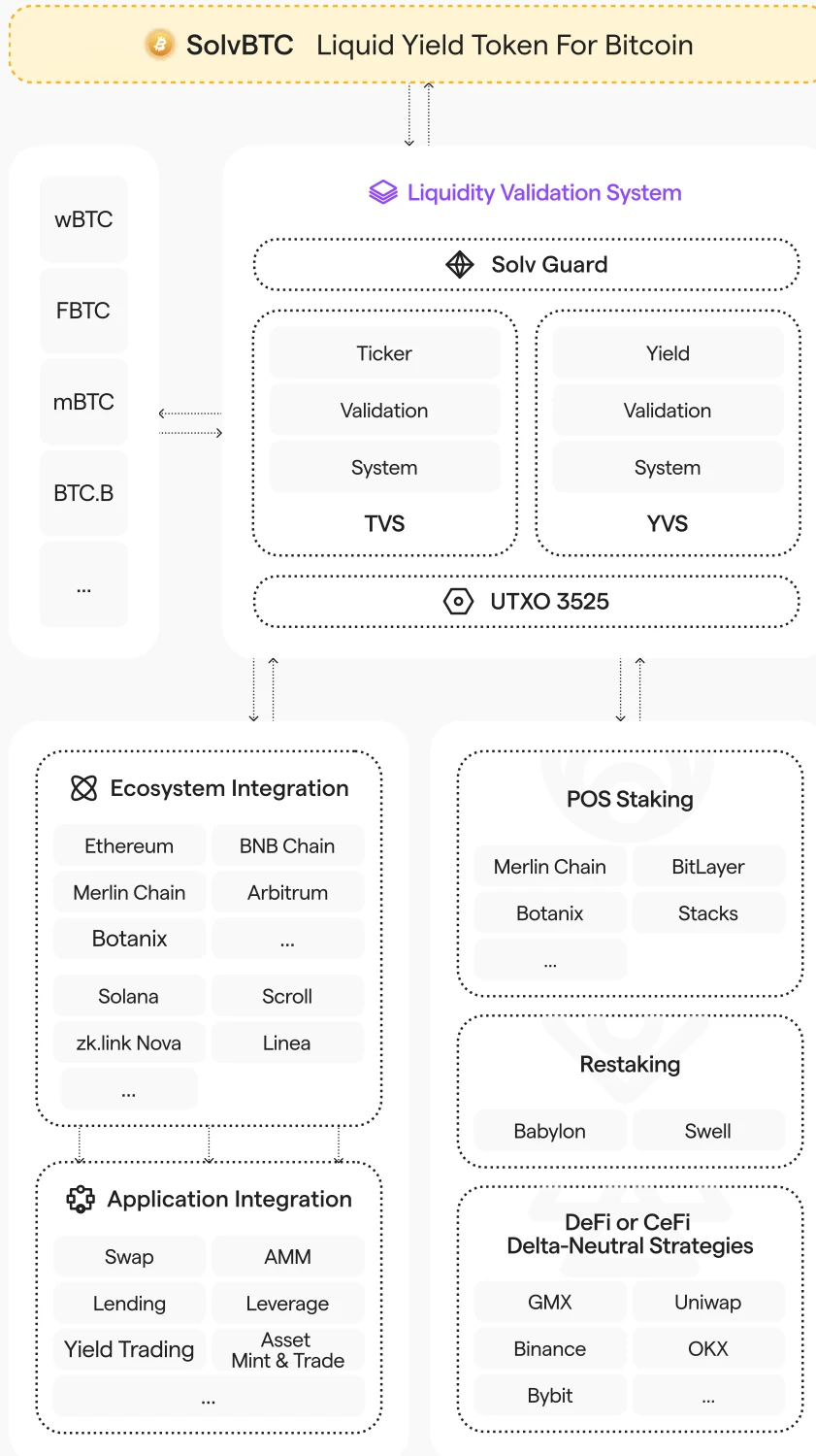

حل

Solv tokenizes the Staking and Restaking income from BTC Layer 2 (integrated with Babylon) and the DeFi income from ETH Layer 2 into SolvBTC. SolvBTC is seamlessly integrated with other protocols to deliver Bitcoin liquidity to various application protocols. Solv now supports Ethereum, BNB, ARB and Merlin.

Solv adopts a decentralized asset management architecture, including modules such as built-in security guards, price oracles, and tokens based on liquidity strategies, and establishes trustless process standards through smart contracts.

Solv also adopts a custodial model, where off-chain funds are held by reputable custodians.

What solvBTC.BBN does

solvBTC.BBN is Solv’s official liquidity staking token and will be integrated with various DeFi protocols.

Functions include:

-

DEX: Provide instant liquidity and high-yield opportunities to solvBTC.BBN holders without KYC.

-

Lending protocol: allows solvBTC.BBN holders to stake tokens to earn additional income, while allowing borrowers to obtain leveraged income positions.

-

Yield Trading Protocol: Enables users to trade BBNs future earnings, manage earnings volatility and optimize returns.

پروجیکٹ کی پیشرفت میں شرکت کے مواقع

Since its launch in April, SolVBTC has attracted more than 12,000 bitcoins staked on Merlin Chain, Arbitrum, and BNB Chain, with 20,000 users participating.

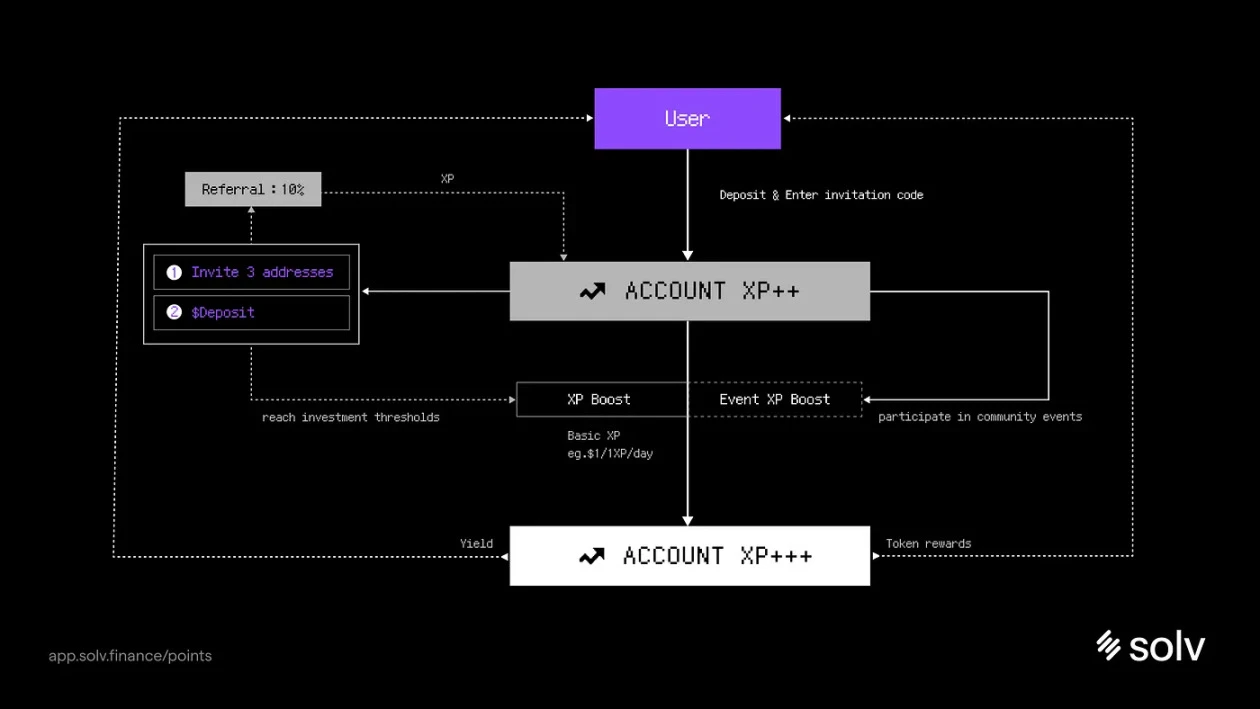

Total points (XP) are composed of three parts: basic points, acceleration points, and recommended points. Total points are the accumulation of three points.

Basic points

Basic Points Basic points are earned by depositing funds into Solv Vaults. The more a user deposits, the more basic points they get. And the longer the deposit is held, the more basic points they get. Basic points = (points per dollar deposited) × (holding time) Points are updated daily. A snapshot is taken every day to record the value of the mortgaged funds in the Vaults. Note: SolvBTC purchased from the secondary market will not generate any points.

Accelerated Points

The unlocking condition of the acceleration card is to invite three real investment users, with no limit on the amount. Your final points = (basic points) x (acceleration card coefficient). There are two types of acceleration cards:

-

XP Boost: You can get it after reaching a certain investment threshold. The larger the amount, the greater the multiplier. Everyone can see their own acceleration and the amount line to reach the next stage and the corresponding acceleration coefficient, and explore it on their own, which has a large marginal benefit.

-

Event XP Boost: Obtained by participating in events, valid for 7 days, multiple cards can be stacked. In mid-April, the system will display the Boost Card and the Boost Factor in your card pack. There will be a new round of Boost Card airdrops in the future.

Recommended Points

After attracting new users, users can obtain 10% of the basic points (Basic XP) of the downline, which will not affect the total score of the downline; there is no limit, the more real users you attract, the more you can earn.

بیڈرک

Bedrock, as a liquid staking mechanism, was originally developed for the Eigenlayer ecosystem, and then gradually developed into the largest staking entry on IOTX, gaining a total of nearly 200 million TVL in the ETH and IOTX ecosystems.

Recently, they were commissioned by Babylon and provided technical support to develop the BTC liquidity pledge protocol UniBTC, which allows Ethereum users to pledge their wBTC to Babylon. UniBTC is currently found on Ethereum.

پروجیکٹ کی پیشرفت میں شرکت کے مواقع

Users can earn Bedrock rewards and Babylon points by holding uniBTC. It should be noted that uniBTC cannot be unpledged yet, but uniBTC can be sold directly because it can be exchanged with WBTC at a 1:1 ratio.

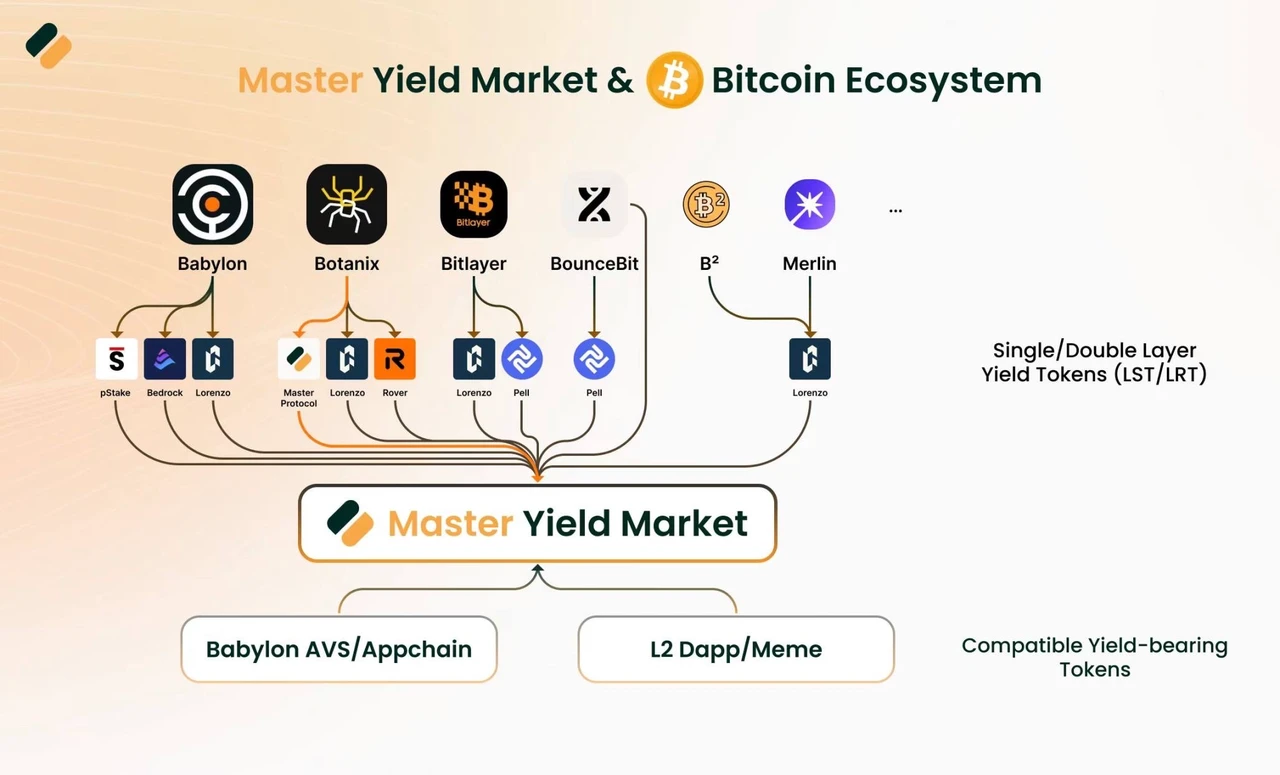

Master Protocol

Master Protocol is a revenue aggregation platform that aggregates BTC ecological projects such as Bouncebit (stBBTC), Babylon, and BitLayer, allowing users to pledge or trade through the platform.

Master Protocol has two main products:

-

Master Yield Market: Provides profit-making trading opportunities, aggregates Bitcoin ecosystem assets, packages them into MSY, and then splits them into MPT (principal) and MYT (interest) for users to trade.

-

LST Protocol on Botanix Spiderchain: Liquidity staking protocol to improve Bitcoin liquidity and yield. Not yet launched, will cooperate with Botanix in the future

Master Yield Market

The basic function of Master Yield Market is to aggregate Bitcoin ecosystem assets, package them into MSY, and then split them into MPT and MYT for users to trade. Its principle is similar to the Pendle protocol:

• MPT (Master Principal Token): represents the principal. Purchasing MPT can lock in the profits of the underlying assets in advance, which is equivalent to a fixed-income product. Whales or institutions will like this low-risk product. The purchased funds will be moved to the LST protocol and BTC L2.

• MYT (Master Yield Token): represents interest. The unit price of MYT is low, but it can improve the utilization rate of funds, which is equivalent to leveraging and speculating on expected returns. This part of retail investors will prefer it and the price will fluctuate.

Points Program

Master Yield Pass is an incentive measure launched by Master Protocol. A total of 10,000 of them were minted for free on Base on June 24. Currently, all the NFTs have been minted for free. The benefits of staking Master Yield Pass include:

-

Earn points from the Trading Pool and Referral Pool in exchange for future token airdrops.

-

Platform fee dividends: Assuming the total transaction volume reaches $200 million and the platform fee reaches the million-dollar level, each NFT can receive more than $100 in dividends. (In comparison, the cumulative transaction volume of Pendle, a yield trading platform on Ethereum, has reached billions of dollars.)

-

Future rights: such as whitelist qualifications for NFT/events/IDO, etc.

چکرا۔

Chakra is a ZK-driven shared modular Bitcoin settlement layer that provides unified settlement services for all second-layer networks, builds an aggregated liquidity and interoperability network, and releases Bitcoin liquidity to the entire chain ecosystem.

Chakras funds on the Bitcoin network will be managed by the MPC solution service provided by Cobo, and then pledged to Babylon to obtain pledge income. After the transaction is retrieved and verified, tlBTC will be used as a pledge certificate to allow pledge users to mint.

What tlBTC does

tlBTC corresponds 1:1 to the amount of BTC pledged on the Bitcoin network. tlBTC has three uses:

-

As a pledge certificate, users can enjoy the pledge income of the underlying Babylon while holding it

-

As a liquid asset, users can invest it in the DeFi ecosystem (Dex, Lending, Stablecoin) to obtain additional income

-

As the native asset for full-chain settlement, Bitcoin’s good liquidity and stability are utilized to achieve high-efficiency, low-latency, and low-slippage settlement.

project progress

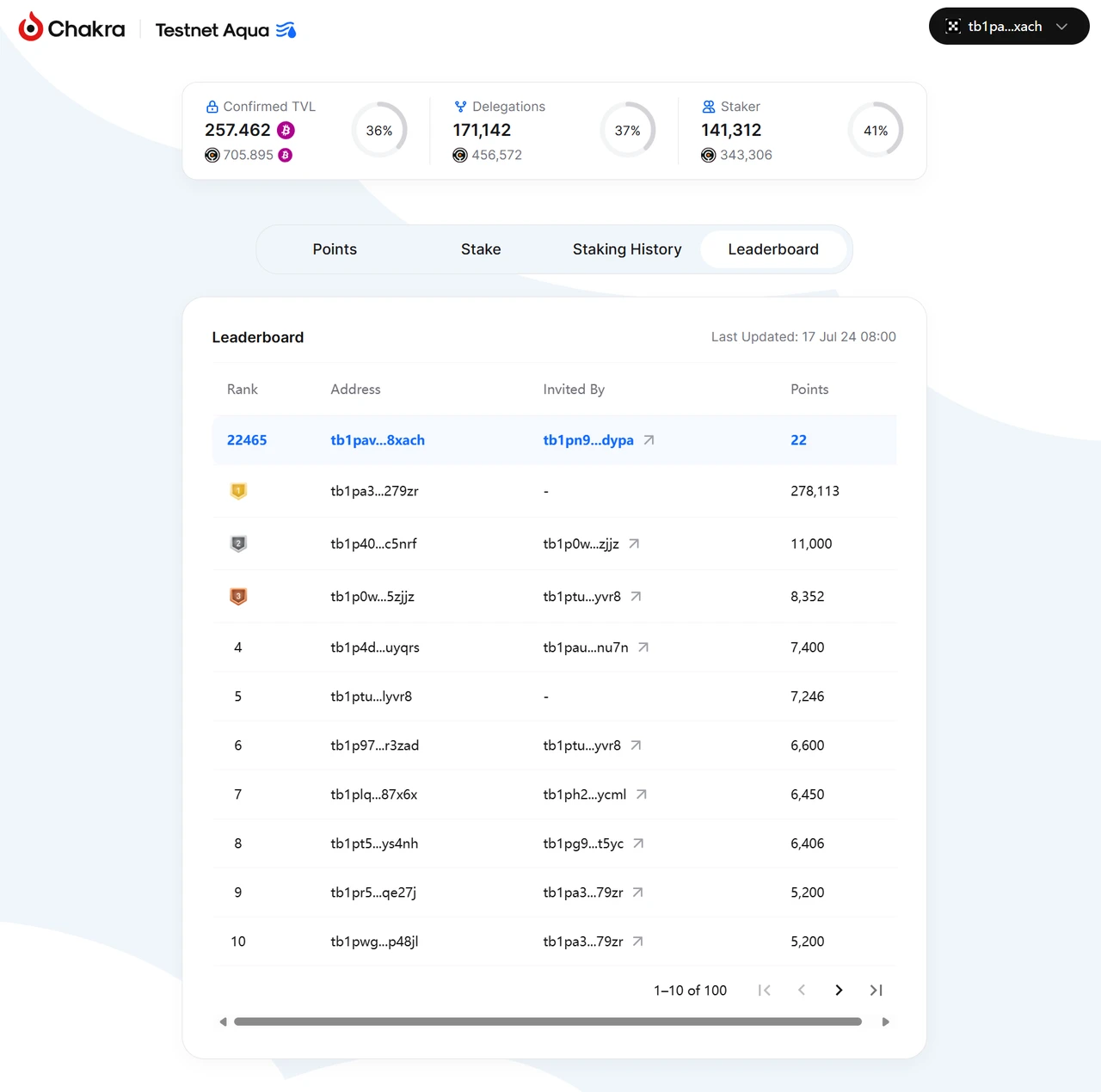

Recently, Chakra has launched joint testnets with Babylon several times, and has always maintained the first place in the three Cap stages. In the latest Testnet-4 Cap 3, Chakra, as the top-ranked Finality Provider of Babylon, has a total confirmed TVL of 258.401 sBTC (36% of Babylons total TVL) and has received 171,142 pledge delegations (37% of Babylons total pledge delegations).

Chakra has launched a points system on the testnet. For every 0.0005 sBTC staked per day, 1 point can be obtained. Through invitations, 10% of the invitees points can be obtained. The testnet supports both self-custody staking and MPC staking, and points can be obtained in both staking methods.

at last

Babylons BTC staking will also be launched soon. The changes in the BTC ecological landscape brought about by BTC staking are enormous.

BTC staking is first and foremost about increasing the yield of the overall assets, just like ETHs DeFi. Currently, the market size of BTC interest-bearing exceeds $10 billion, with a yield between 0.01% and 1.25%. The staking rewards of PoS blockchains often range from 5% to 20%. The income from staking BTC to provide staking for other PoS chains can be dozens of times higher than traditional BTC interest. Even though some BTC communities prefer the culture of hoarding coins, the increase in income is real. Users can gain income from using BTC, which can overflow to BTC L2 and other ecosystems, and the positive flywheel can be started.

Of course, BTC staking led by Babylon cannot be compared with ETH staking, because the BTC chain itself has no native income, but is more similar to eigenlayers restaking business. The related ecology will also be similar to the LRT protocol under eigenlayer.

Therefore, the monopoly of giants in ETH staking is unlikely to occur in BTC staking, and exchanges are less motivated to exit the market because the scale effect will not lead to more stable profits. Early projects in the BTC staking field have the opportunity to stake their own stakes, and investors can easily gain high returns from rapid growth.

This article is sourced from the internet: BTC LSD, how to help more users share BTC staking benefits?

Related: The Nature of ایئر ڈراپs: A Scam, a Gift, or a Giveaway?

Original|Odaily Planet Daily Author: Wenser The ZK (ZKsync) and ZRO (LayerZero) token airdrops have come to an end amid criticism and dissatisfaction. The Blast airdrop, which is the highest interest rate deposit in the L2 network, is also on its way. The soul-searching question of what is an airdrop has once again aroused widespread market discussion. Odaily Planet Daily will combine past industry views and recent key figures remarks in this article for readers reference. Jupiter Lianchuang: Airdrops are gifts, not rewards, loyalty programs, and growth tools As the discussion about whether ZK and ZRO are the Endgame of airdrops is raging, Jupiter co-founder Meow posted on the social media platform today: Airdrops are gifts. Its not a reward, its not a loyalty program, its not a means of growth.…