گولڈمین سیکس کے سابق شریک سربراہ: فیڈ کی شرح میں بہت دیر سے کمی کرنا غلطی ہو سکتی ہے۔

Original author: Blockworks

Original translation: Peyton

Blockworks is a financial media brand that provides millions of investors with the latest news and insights on digital assets. Founded in 2018, Blockworks mission is to attract the next wave of investors and advance the digital asset space by providing world-class information and insights.

On July 2, 2024, Raoul Pal joins the show to discuss his theory of the Age of Exponentials. We dive into why liquidity will surge again in the second half of 2024, why diversification is a thing of the past, financial repression, the Fourth Turning, and how these factors affect the market.

Raoul Pal started his career at Goldman Sachs before co-founding Global Macro Investor, which focuses on providing comprehensive research on global economic trends to institutional investors. Pals expertise covers macroeconomic analysis, including emerging trends such as currencies, commodities, and digital assets such as Bitcoin. He is also the co-founder of Real Vision Group, a well-known financial media company that provides in-depth financial and economic interviews and analysis. He was one of the few investors who predicted the 2008-2009 subprime mortgage crisis.

کرنٹ liquidity cycle

Felix: Lets dig a little deeper. Id love to understand where you see us in the liquidity cycle from a global macro perspective?

Raoul: Absolutely. As I have been discussing for a long time, I think we are transitioning from macro crypto spring to macro crypto summer. Typically, this transition occurs when deflationary forces are still in place and economic growth begins to pick up.

Why is this important? Because it often prompts central banks and governments to increase liquidity.

1. The Fed focuses on two factors: unemployment and inflation. Both factors lag behind the business cycle. For example, Owner Equivalent Rent (OER), an important component of CPI, lags by about 15 to 18 months. Because the two unemployment and inflation indicators that the Fed focuses on have a lag, considering that some deflationary signs have already appeared, the Fed should cut interest rates.

Right now, the ISM survey is still below 50, indicating a weak economy, but even if the ISM hits bottom now, the Fed’s indicators won’t reflect that until next year. And when unemployment rises slightly, say to 4.5% to 5%, even if the ISM is above 50 and the business cycle is strengthening, this lagging indicator will keep the Fed cutting rates. This happens in every cycle because the Fed relies on lagging indicators.

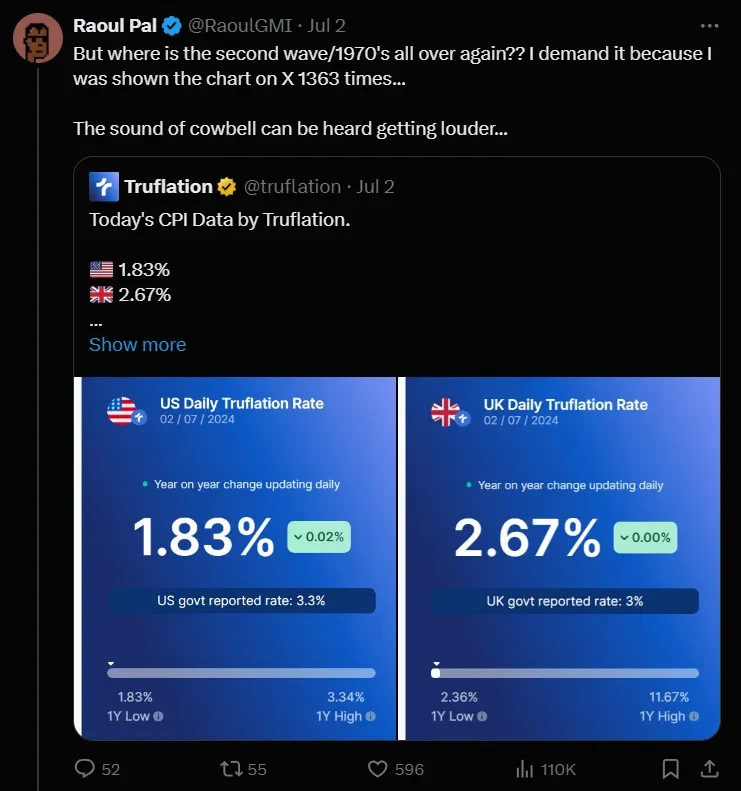

The factors that drive CPI down also lag behind the actual cycle. Currently, Truflation (a decentralized platform that provides RWA index) estimates that the actual inflation rate is about 1.83%, and the core CPI has also fallen sharply, but the Fed rate remains at 5.5%. If the Fed does not take action, it is possible that they will not be able to achieve their 2% inflation target.

https://x.com/RaoulGMI/status/1808126410566873358

2. This phase coincides with the election cycle , during which politicians often stimulate the economy to win support and extend this stimulus into the next year. Since 2008, the presidential election cycle has shown a pattern: the market tends to fall in the summer, then accelerate sideways during the election, and finally rebound regardless of the election results. This cycle is evident in both the stock and cryptocurrency markets.

3. I think Japan will need to intervene with the support of the US Federal Reserve System , which will be beneficial to the business cycle of the worlds economies. This is necessary because the US dollar is too strong at this stage. Moreover, the Feds interest rate cut will help it refinance its debt at a low interest rate level. Because most of the debt is short-term at present. Lower interest rates will help this refinancing.

Felix: It seems like we all agree that the Fed should cut rates now. Do you think there is a chance they could make the mistake of cutting rates too late, or are they still on the right track?

Raoul: They could have acted earlier, as many forward-looking indicators have been pointing to deflation for some time. However, we should not think that central banks are stupid. If the goal this year is to refinance $10 trillion of debt – plus similar actions in Europe, China and Japan – then it makes sense to do it at the lowest possible interest rate. It looks as if they have a deliberate strategy of being below their inflation target. Looking at the coordination between central banks and governments, it is clear that they are not independent, just as the actions of the US Treasury and the Fed show that they are working together, and this coordination is also evident in Japan, China and Europe. So if they appear to be slow to act, it may be a deliberate move on their part to achieve the best possible refinancing outcome.

Dilemma in Japans foreign exchange market

Felix: You mentioned the yen jumping above 161 and suggested that the Fed easing policy is the best way to address this. However, they seem to be slow to act on this front. I am curious to know which side the central bank will prioritize when faced with this situation, domestic interests or international interests?

Raoul: I think they see it as equally important. Note Janet Yellens two recent visits to China. This is related to their debt refinancing cycle, because they need dollars; their real estate sector borrows in dollars. A global dollar shortage has begun, spreading from Silicon Valley Bank to Credit Suisse, a major player in the Eurodollar market. The Bank of Japan, which is at the center of the Eurodollar market, is also in desperate need of dollars, causing the yen to depreciate. Yellens visit to China is part of orchestrating this situation.

The strategy would appear to involve using Japan to pressure China. China does not want to devalue its currency, and Janet does not want to lend to them directly through swap agreements. Instead, she may use the Bank of Japan to intervene indirectly. At the same time, China may have agreed to buy US bonds, which Janet, as the worlds largest junk bond salesman, needs. This arrangement provides liquidity to the eurodollar market and encourages China to increase its Treasury holdings.

There is also a broad effort to recalibrate global trade. The US cannot afford to run such a large deficit, and all countries need economic growth. A weaker dollar is essential for global growth, it benefits emerging markets and boosts US exports. At the bottom of the economic cycle, it looks like this dance will end with the Fed cutting rates to reduce spreads and shock the market, possibly in July.

Felix: I share the same view, and it seems reasonable, but Powells speech today did not show any signs of immediate action.

Raoul: Indeed. However, giving Japan unlimited intervention capacity is a recurring theme. In every cycle, Japan intervenes in currency markets, causing a sharp depreciation of the dollar and stimulating global growth. While the United States benefits from a strong dollar, through lower inflation, it also hurts exports and increases the deficit. Everyone understands what the necessary steps are, which is why Yellens visit to China is so significant.

Diversification is a thing of the past

Felix: How do you manage asset allocation in these dynamic environments? A few years ago, you were actively doing macro-specific trades, but now you have moved to index-era style investing. How has this process evolved for you? Do you still engage in traditional macro trading?

Raoul: I dont trade macro anymore. My personal portfolio is entirely in crypto. At Global Macro Investor we have some technology bets and other investments, but its all part of the same trade. Over time I realized that everyone in macro was struggling because we werent focusing on the right thing: the liquidity cycle. Once you realize that everything is tied to this cycle, the question becomes which asset performs best.

Central banks have effectively eliminated the left tail risk, which is debt deflation – when the value of collateral falls too much, it leads to a vicious cycle of selling. They did this in 2008 by devaluing their currencies, which led to rising asset prices. They repeated it in 2012 and during the pandemic. Essentially, they will not allow debt deflation and will devalue their currencies by 8% per year to prevent it. Think of it as a put option that costs 8% per year to ensure that the system does not collapse.

With left tail risk removed and everything tied to the debt refinancing cycle, currencies depreciating over time, this could be the best macro risk investment opportunity ever. When I analyzed, only the Nasdaq and cryptocurrencies have been rising, with an average annual return of 177% for the Nasdaq and 150% for Bitcoin since 2011. Despite its volatility, Bitcoin has outperformed all other assets.

Felix: The Sharpe Ratio of Bitcoin is incredible.

Raoul: It is. In the long term, it is unmatched. Bitcoin is a unique asset class. I realized too late that this is the only trade. People hate it because they want to go back to traditional trades like oil or USD/JPY. But if our goal as investors is to maximize profits, we have to focus on the best trades, which means diversification in cryptocurrencies is no longer any good.

The Debt Era

Translators note: Debt monetization, also known as fiscal deficit monetization, or commonly known as helicopter money, simply means that the central bank finances government debt by printing (issuing) currency.

Felix: I want to dive a little deeper into your specific theory on index assets and cryptocurrencies, but first, where does this refinancing cycle ultimately lead to? Is it never-ending, or does it end when the debt-to-GDP ratio falls? Where is the turning point?

Raoul: Right now, we use all of our available GDP to service private sector debt, which is about 100% of GDP. The average interest rate is about 2%, and GDP growth in the U.S. is about 1.75%. Basically, all economic growth is now used to service debt. Meanwhile, government debt is also 100% of GDP. Where is this trajectory leading? The answer is toward monetization.

As populations age, continued growth relies on population expansion, increased productivity, and continued debt accumulation. However, since the 2008 financial crisis, debt growth has only served to service existing liabilities. Population growth in the Western world is stagnant or even declining—demographic challenges loom. Productivity growth has been lackluster due to an aging workforce, forcing us to turn to technologies such as artificial intelligence and robotics.

Amazon, for example, has rapidly increased its robotic workforce from 250,000 to over 1 million in three years, outnumbering human employees. These technologies are expected to increase productivity three to tenfold, shaping a future of virtually unlimited productivity potential through automation. This evolution changes economic calculus toward a scenario of productivity expansion driven by AI and robotics. This shift relies on the expansion of electricity consumption and improvements in the efficiency of computing power, and significant progress is expected – investments in green energy in Europe and China foreshadow a 75% reduction in electricity costs over the next decade.

A similar dynamic played out after World War II, when yield curve control and productivity gains drove the baby boom recovery. Now, we are following a similar playbook as AI and robotics promise to replicate a 30% increase in global population from a productivity perspective.

Felix: So, debt monetization seems to be a transitional strategy that maintains social stability while promoting necessary capital investment.

Raoul: Exactly. Moreover, it is not realistic to allow a systemic collapse, as some in financial circles suggest. With debts reaching 350% of global GDP, the consequences are dire – a possible return to pre-modern economic conditions or a jeopardy of global trade. It seems preferable to mitigate these risks even at a cost of 8%. Strategic investments can effectively offset these costs.

Felix: I get it. As a 30-year-old, my generation is struggling with home buying challenges. In Canada in particular, housing affordability is a growing problem that resembles a Ponzi scheme. The high leverage that is common in home buying remains during this period.

Raoul: In a devaluation cycle, assets with limited supply appreciate due to currency devaluation, while variable incomes tied to GDP growth stagnate, leading to wider poverty. Countries like Australia and Canada have seen rising property values due to capital-rich immigration and strong pension systems. However, widespread homeownership remains elusive. P/E ratios continue to climb amid currency devaluation – a clear trend.

Felix: Does this context support your thesis on cryptocurrencies and index assets?

Raoul: Exactly. In this environment, traditional assets lose their appeal. Cryptocurrencies and index assets gain significant upside potential due to their scarcity and technical support, making them an essential part of modern investment strategies.

Banana Zone and Bubbles

Felix: We mentioned the “Banana Zone” a few times. For those who may not be familiar, can you explain what it is and how it relates to the current price cycle?

Raoul: We use the term banana zone to describe periods of increased liquidity and unusually high market volatility, especially right before an election or major event. We originally mentioned this concept in the last quarter of last year, noting that liquidity tends to drive markets into a banana zone where market prices rise vertically. This area is symbolized on the price chart by a large yellow candlestick that resembles a banana. Its a funny term, but it indicates that during these times, everything seems to go crazy because of liquidity and market cycles.

The banana zone also applies to the technology and artificial intelligence sectors. We are in a period of unprecedented technological change. We are integrating advanced robotics, self-driving vehicles, gene editing, and other cutting-edge innovations into our daily lives. Despite this, some investors still prefer traditional assets because they appear relatively cheap. However, technology and cryptocurrencies are where exponential growth is happening.

Even as these assets go through bubble cycles and corrections, the long-term trend is still upward as technology becomes more integrated into every aspect of our lives. If you choose to invest, it is critical to focus on the best performing assets, such as technology. Viewing these assets as bubbles ignores the fact that “tomorrow will be more digital than today.”

Felix: People are often haunted by past bubble cycles, like those in 2000, and are cautious because of past failures like Cisco. But I think that despite the caution, there is a general belief in its potential.

Raoul: Caution is understandable, especially after past bubbles. But look at companies like Amazon, Google and Facebook. Despite short-term volatility, they have proven long-term resilience and growth. My point is simple: if the world is becoming increasingly digital, then tech stocks are likely to be good investments. Even with bubble cycles, the overall trend will still favor tech.

Change your investment framework

Felix: How do you get yourself comfortable with the process of investing? I had the same experience of always worrying about a recession, but I ended up taking a more nuanced and optimistic approach. Do you have any advice on how to make that transition?

Raoul: Change your mindset – you should expect a market sell-off. See it as an opportunity to invest again. For example, if the price of Bitcoin goes up to $200,000 and then drops to $70,000, thats an opportunity to invest again. This cyclicality can be seen as a gift. Someone on Twitter pointed out that every four years, Bitcoin becomes the worst performing asset, but this provides another opportunity to earn good returns. Embrace the long-term perspective, just like you would manage your 401k. Get excited about market downturns and be ready to invest when prices are low.

Some may recommend selling at market highs, but instead, you should focus on buying when prices are discounted. This way, you avoid the pressure of timing the market perfectly. By facing and embracing your fears, they lose their power. This psychological approach is widely applicable in life as well. Many people worry about their financial future, but long-term thinking and reducing investment risk can ease these concerns. Changing your mindset from fear to opportunity will completely change your entire approach to investing.

The Fourth Turning

Translators note: The Fourth Turning is a book by William Strauss and Neil Howe that explores a recurring cyclical pattern in American history. In this theory, events unfold in a cyclical fashion called a saecula that lasts approximately 80 to 100 years. These saecula are divided into four turning points, each of which affects the attitudes and behaviors of a generation, influencing how society responds to challenges and shapes the future. This theory has been influential in understanding long-term social patterns and predicting future trends.

Felix: We also want to discuss how this framework is affected by political uncertainty and the Fourth Turning. As observers outside the United States, we note that significant political stakes are likely to impact policy, including as it relates to cryptocurrency. How do you manage these uncertainties, especially given the accelerating pace of political change?

Raoul: This is very interesting. I see the battle over cryptocurrency regulation as part of the generational conflict inherent in the Fourth Turning. Institutions are having trouble keeping up with technological advances like AI, and regulating these distributed systems is nearly impossible. Neil Howe has spoken about the need for new institutions and infrastructure, and this is now evident. The rise of populism stems from the conflict between different generations over debt and economic opportunity. Older generations are blamed for the current problems, but the real problem is systemic.

This conflict will not be resolved until technology completely takes over. The fear of technology is huge, especially innovations like blockchain and artificial intelligence. Society is likely to split into two groups: those who accept technology and those who resist it. This split may lead to major social changes, similar to the split between Neanderthals and Homo sapiens. Felix: And biohackers and so on.

Raoul: Yes, we are increasingly merging with technology, enhancing our cognitive, physical and genetic abilities. There will be people who resist this change. This dichotomy could lead to a scenario where technologically advanced people coexist with those who reject these advances. The pace of change is too fast to achieve harmony for some time. It is difficult for humans to cope with rapid change, leading to social tensions.

I choose to invest in these technological changes rather than worry about them. I can retreat to my house in Little Cayman where the impact of these changes may be less. This dual existence allows me to enjoy the benefits of technology and the tranquility of nature.

Crypto Investment Philosophy

Felix: This leads into your crypto investment thesis pretty well. What do you think about the current state of crypto investing? Can you explain more about your thoughts on the risk-reward trade and your philosophical stance across various assets? I know you’ve gone through a journey from Bitcoin to Ethereum and now being deeply involved in the Solana ecosystem.

Raoul: My view on cryptocurrency has evolved significantly. When I talk about cryptocurrency, especially to young people, I describe it as a global utility similar to the internet. The key difference here is that blockchain technology is tokenized, providing a behavioral incentive system for network growth. Essentially, the more people join and use the network, the more valuable it becomes. This creates a unique opportunity for investment because its not just about the technology – its about the growth of the network and its applications.

We now have a cryptocurrency market cap of $2.5 trillion, and if current growth trends continue, it could reach $100 trillion by 2032. This represents an unparalleled wealth generation opportunity. The challenge is to navigate this space effectively and avoid being distracted by the various distractions. While Bitcoin remains a key player, the broader space, including Ethereum and Solana, also offers various opportunities.

Felix: That’s an interesting perspective. It seems like the main focus should be on capturing overall growth rather than getting stuck in a specific asset. Can you talk about how you manage your time horizon and position size in this context?

Raoul: Managing your investment horizon and position size is critical. I am not emphasizing on maximizing your position or taking extreme risk. The idea is to capture most of the growth while managing risk. If cryptocurrencies grow from $2.5 trillion to $100 trillion, you don’t need to take the most risk to reap the gains. Instead, you can take a more cautious approach and capture the main upside while managing risk.

Felix: It seems like there is often a lot of skepticism about cryptocurrencies, especially when prices fluctuate wildly. How do you view this skepticism and how does it affect your investment strategy?

Raoul: I understand the skepticism because the crypto space is very easily driven by emotions and narratives. People want to see immediate results and often have difficulty thinking long-term. I have made it clear that while I have allocated a large portion of my liquid net worth to Solana, I am also diversified. I do not currently hold much Bitcoin because I believe other assets offer better potential returns. I do not currently hold much Bitcoin because I believe other assets offer better potential returns. This does not mean that I have given up on Bitcoin; just that my focus has changed based on current opportunities.

The challenge is to avoid being swayed by hype and fear. For example, during a market downturn, people panic and miss out on buying opportunities. Rather than trying to time the market perfectly, it is better to buy during a sell-off and hold through the correction. The key is to stick to a long-term investing philosophy and not let short-term volatility affect your strategy.

Felix: The concepts of investment horizon and volatility management are critical. Do you think exchange-traded funds (ETFs) and other investment vehicles are impacting market volatility and providing stability?

Raoul: Yes, ETFs and other investment vehicles have played a role in reducing volatility. Especially in the United States, the use of vehicles like 401(k) accounts to make regular investments has helped stabilize the market. In addition, the introduction of options and other financial instruments can also reduce volatility. As the crypto market matures, with increased institutional participation and a deeper understanding of the network, the market may experience less extreme volatility.

Felix: It’s interesting to see how sentiment and market cycles can influence views on technology. Given the skepticism that exists about some technology narratives, do you think time is a major factor in changing market sentiment?

Raoul: Time is a big factor in changing market sentiment. Skepticism of technology, especially after a cycle of hype and disappointment, is natural. People expect to see immediate results and often overlook the incremental development of technology. For example, blockchain adoption has been gradual, often experimenting in fringe areas before reaching an exponential growth phase. The key is to understand that technological advances take time to fully materialize.

Felix: Regarding Bitcoin, do you still think it is an important asset? Even though it may not have the explosive growth potential like other assets, does it still have value in your opinion?

Raoul: Yes, Bitcoin remains an important asset. It acts as a primitive collateral and as a tool to protect against currency debasement. Although it may not be the best performing asset in terms of growth, it still has important value, especially as a hedge against currency debasement. Its use as a store of value and widespread adoption ensures that it maintains its relevance, even if its dominance in the cryptocurrency space may weaken over time.

This article is sourced from the internet: Former Goldman Sachs co-head: Fed cutting rates too late could be a mistake

Original article: How do layer 2s really differ from execution sharding? Compiled by: Odaily Planet Daily Asher One of the points I made two and a half years ago in my “ Endgame ” article was that , at least technically, different paths forward for blockchain looked strikingly similar. In both cases, there are a large number of transactions on the chain, and processing these transactions requires: (i) a lot of computation; (ii) a lot of data bandwidth. Ordinary Ethereum nodes, such as the 2 TB reth archive node running on the laptop used to write this article, are not powerful enough to directly verify such a huge amount of data and computation, even with excellent software engineering work and Verkle trees . Instead, in the L1 sharding and rollup-centric…