Ethereum ETF آ رہا ہے، کون سے ماحولیاتی ٹوکن پر توجہ دینے کے قابل ہیں؟

Original author: James, BlockTempo

After the U.S. Securities and Exchange Commission (SEC) approved the 19 b-4 exchange rule change documents for eight Ethereum spot ETFs in May, major issuers have also successively submitted updated versions of the S-1 registration application documents. Once approved by the SEC, the Ethereum spot ETF will be open for listing and trading.

Regarding the latest progress, Nate Geraci, president of The ETF Store, said today (8) that the submission of the revised S-1 application was due on the 8th. It is not clear how quickly the SEC will process it, but he is optimistic that the Ethereum spot ETF will be launched next week or within two weeks.

Bloomberg analyst James Seyffart also previously predicted that the Ethereum spot ETF could be listed later this week or during the week of July 15.

In its latest research report, Gemini estimates that once the United States approves the Ethereum spot ETF, net inflows in the first six months may be as high as US$5 billion. The current ETH/BTC ratio is close to a multi-year low. Strong capital inflows may trigger a compensatory rally. If the ETH/BTC ratio returns to the median of the past three years, ETH may rise by nearly 20%. If it reaches the maximum value of 0.087, it is expected to rise by 55%.

Which Ethereum ecosystems are worth paying attention to?

After the Ethereum spot ETF is successfully passed, if funds continue to flow in, Ethereum ecosystem projects will be expected to benefit. Therefore, we can focus on the largest areas and projects in the Ethereum ecosystem. The following will be an inventory for readers.

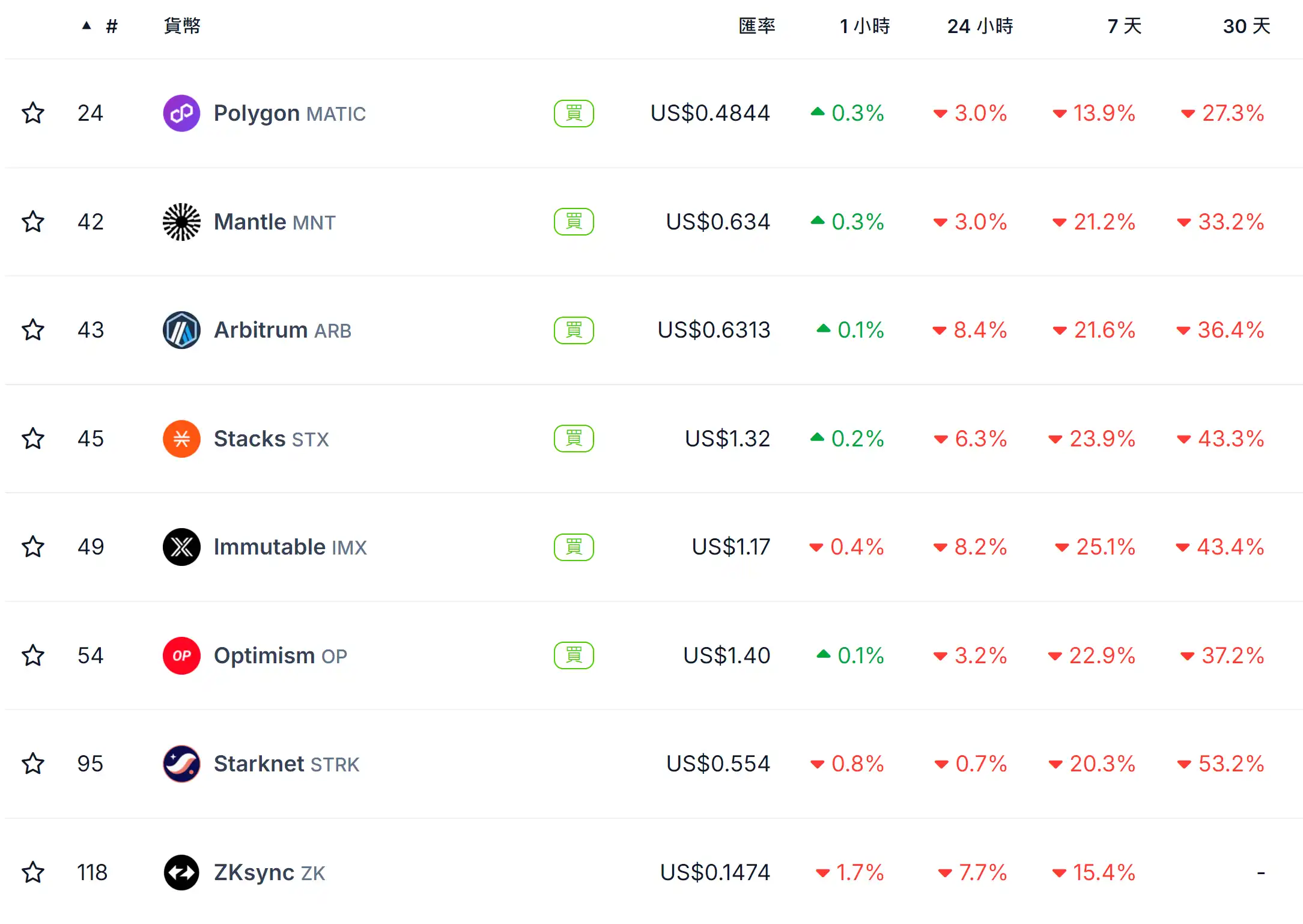

Layer 2

Layer 2 aims to support the prosperity of the ETH ecosystem with high TPS and low GAS. Its importance is self-evident. Major projects include MATIC, MNT, ARB, STX, IMX, OP, STRK, ZK, AEVO, MANTA, BLAST, etc. Coingecko data shows that the Layer 2 ecosystem tokens have fallen by 25% to 50% in the past 30 days.

Layer 2 token performance. Source: Coingecko

ایل ایس ڈی

The LSD protocol is a node-related staking service that emerged after ETH switched from POW to POS. Major projects include LDO, SSV, RPL, FXS, etc. Coingecko data shows that the LSD ecosystem token has fallen by 25% to 50% in the past 30 days.

LSD token performance. Source: Coingecko

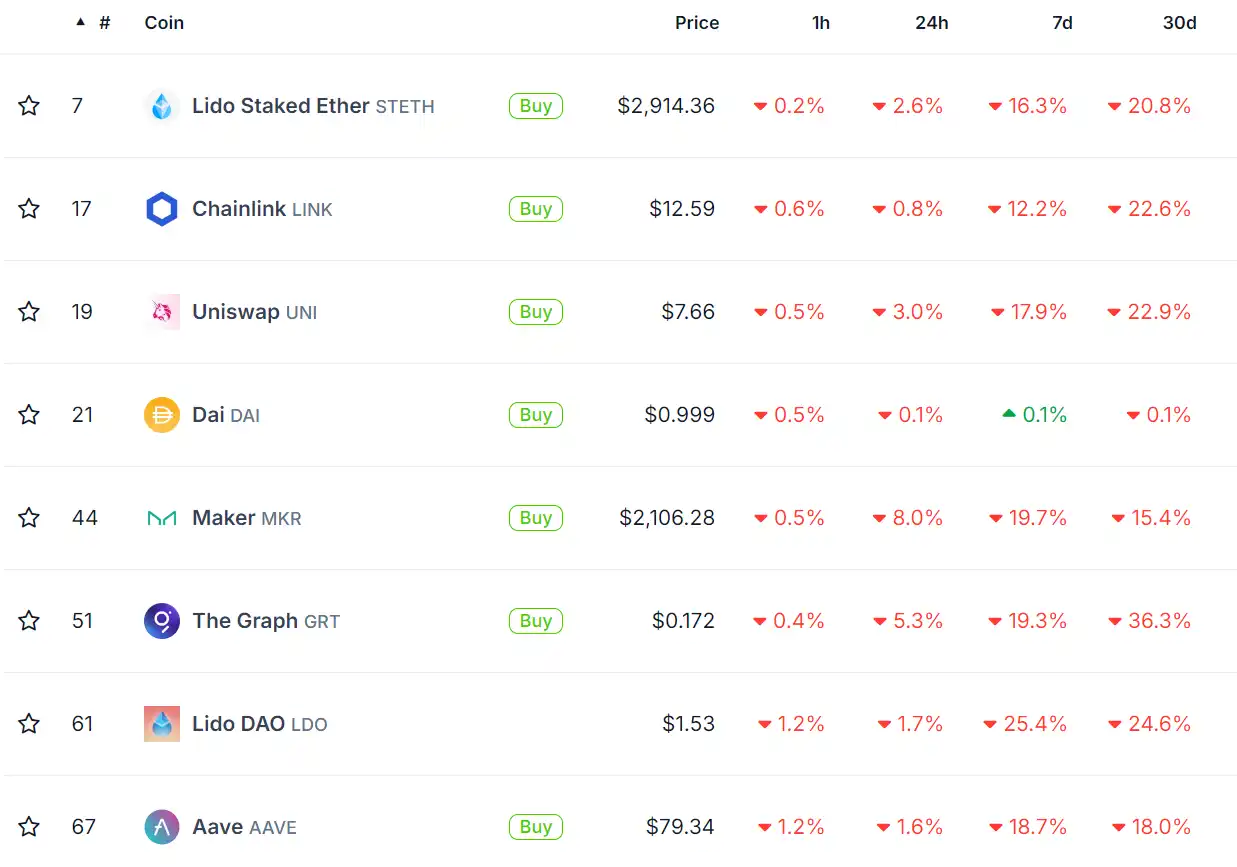

ڈی فائی

DeFi applications cover Dex, lending, stablecoin trading, stablecoin issuance, etc. Major projects include Pendle, UNI, AAVE, COMP, CRV, MKR, etc. Coingecko data shows that the DeFi ecosystem tokens have fallen by 15% to 40% in the past 30 days.

DeFi token performance. Source: CoinGecko

Stablecoin protocol based on ETH collateral

There are many ways to issue stablecoins, one of which is to issue them with collateral assets. The largest collateral asset includes ETH. After having LSD and re-staking, the project party will use the collateralized ETH to obtain liquidity income, and the stablecoin will have a natural yield. The main projects include ENA, LBR, etc., but ENA has fallen by as much as 60% in the past 30 days.

ENA token performance. Image source: Coingecko

Re-pledge

Re-staking refers to staking assets again after the initial staking. Re-staking has developed into one of the mainstream DeFi applications on Ethereum. Major projects include REZ, ETHFI, ALT, BB, etc. Coingecko data shows that DeFi ecosystem tokens have performed badly in the past 30 days, with a drop of 40% to 60%.

Re-staking token performance. Image source: Coingecko

The approval of the Ethereum ETF may bring huge development opportunities to the Ethereum ecosystem. The above projects are just part of them. There are many other potential projects worth paying attention to. Please keep an eye on market trends and make investment decisions based on your risk tolerance.

This article is sourced from the internet: Ethereum ETF is coming, which ecological tokens are worth paying attention to?

The game sector in the Telegram x TON ecosystem has attracted a lot of attention recently. Dont underestimate this combination. Although the TON ecosystem is currently in a relatively early stage, it has great development potential backed by Telegrams huge user base. In addition, the TON Foundation has announced a series of Grant project lists to support innovations in the fields of social Web3, games, DeFi, etc., and to support project development. With this strong funding and the support of Telegrams traffic, Telegram x TON ecosystem games have been very popular recently, with both user base and project popularity growing rapidly. In this issue, we will share with you two relaxing and interesting hot games. Click to mine coins game——NOTCOIN Listing on Binance, Attracting 30 million users, 5 million daily…