Bitget ریسرچ انسٹی ٹیوٹ: BTC معاہدے کی شرح مثبت ہو جاتی ہے، اس بات کا اشارہ ہے کہ فنڈز مختصر مدت میں خرید رہے ہیں، اور آدمی

گزشتہ 24 گھنٹوں میں، مارکیٹ میں بہت سی نئی مقبول کرنسیاں اور عنوانات سامنے آئے ہیں، جو پیسہ کمانے کا اگلا موقع ہو سکتا ہے، بشمول:

-

The sectors with relatively strong wealth creation effects are: well-known Meme and ETH ecological projects

-

Hottest tokens and topics searched by users: Raydium, BGB, ETH Spot ETF

-

Potential airdrop opportunities include: Fuel, DeBank

Data statistics time: July 9, 2024 4: 00 (UTC + 0)

1. بازار کا ماحول

The market continued to fluctuate yesterday, with BTC fluctuating in a narrow range of $55,000 to $57,500, with a certain amount of intraday trading space. The German government continued to transfer BTC to centralized exchanges, which was interpreted by the market as continued selling pressure. However, the US BTC spot ETF showed a net inflow for two consecutive trading days, with a single-day net inflow of up to $296 million yesterday, the third highest single-day net inflow since June. The BTC contract rate turned positive, indicating that funds were buying BTC spot and contracts, and funds were flowing back to the crypto market in the short term.

On the macro level, the market is paying attention to the US CPI data to be released on Thursday, which is expected to grow by 3.1% month-on-month. If it is lower than 3.1%, the probability of the Fed cutting interest rates in September may increase significantly, which is good for the crypto market. In addition, several institutions have submitted revised ETH spot ETF S-1 forms. The ETH ETF may be approved in July, so you can pay attention to the performance of ETH.

2. دولت سازی کا شعبہ

1) Sector changes: Well-known memes (BONK, PEPE, BOME)

بنیادی وجہ:

-

Blue-chip tokens such as ETH and SOL began to rebound;

-

The markets attention to the Meme coin sector has increased, Bithumb has launched BRETT, and Justin Sun and the founder of IOSG have expressed their attitudes towards Meme coins.

Rising situation: BONK, PEPE, and BOME rose by 21.4%, 12%, and 9.8% respectively within 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

-

Price token trend: For BONK, the trend of SOL token will affect the price of BONK, because BONK on DEX is denominated in SOL. Keep an eye on the price trend of ETH and SOL. If ETH and SOL maintain an upward trend, you can continue to hold Meme assets in the relevant ecosystem.

-

Increase or decrease in open interest: Check the contract data on the tv.coinglass website to understand the movement of major funds. In the past 24 hours, the open interest of BONK has surged by 70%, mainly due to the increase in net long positions. The account long-short ratio has fallen below 1, indicating that major funds have opened long positions in BONK through contracts. In the future, you can continue to pay attention to changes in contract data.

2) Sectors that need to be focused on in the future: ETH ecosystem projects (UNI, LDO, PEPE)

بنیادی وجہ:

Many institutions have submitted S-1 forms for ETH spot ETFs. The S-1 documents for ETH spot ETFs may be approved by the SEC in July. ETH ecological assets may have room for speculation. Recently, the track has experienced a large correction and has fallen out of layout space;

مخصوص کرنسی کی فہرست:

-

UNI: The first DeFi Swap project on blockchain applications. Uniswap鈥檚 average daily revenue in the past was around $1 million, which is a considerable income.

-

LDO: The leading LSD project in the ETH ecosystem, with a TVL of 29.6 billion US dollars and a valuation of less than 1.6 billion US dollars, is relatively undervalued;

-

PEPE: Currently, it is the most hyped meme coin in the ETH ecosystem. It has a very strong community foundation and is likely to continue to rise along with the ETH price.

3. صارف کی گرم تلاشیں۔

1) مشہور ڈیپس

Raydium:

Yesterday, the Solana ecosystem DEX Raydium protocol fees reached 2.5 million US dollars, surpassing the Ethereum network protocol fees (1.36 million US dollars) and the Solana network protocol fees (1.15 million US dollars) to rank second.

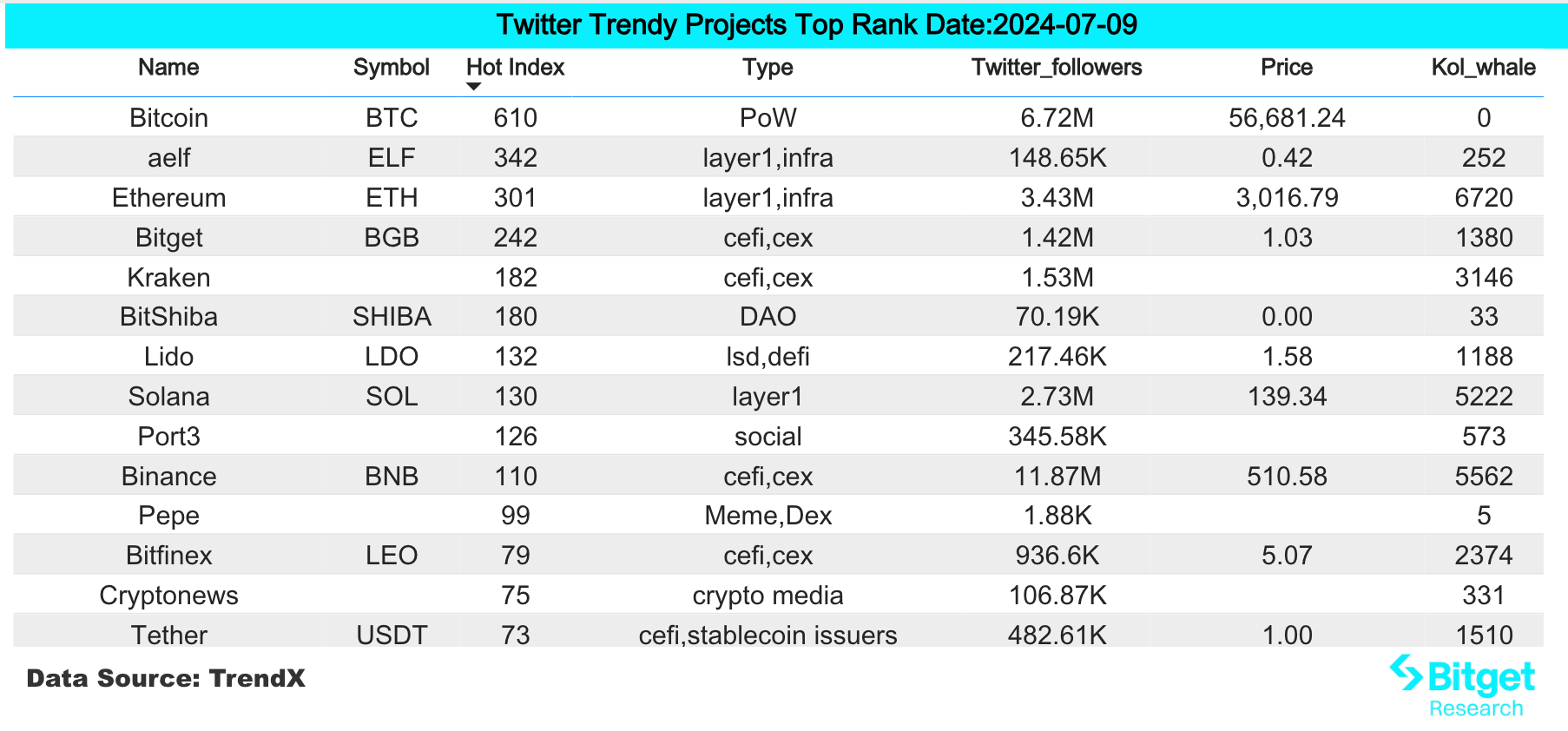

2) ٹویٹر

BGB:

Yesterday, Bitget launched the BGB/USDT contract trading pair with a maximum leverage of 50 times. A week ago, on July 1, Bitget announced the upgrade of the BGB smart contract address to further enrich the rights and interests of BGB holders, expand its use scenarios in decentralized applications such as DeFi, DEX, and GameFi, and provide more value and opportunities for BGB holders.

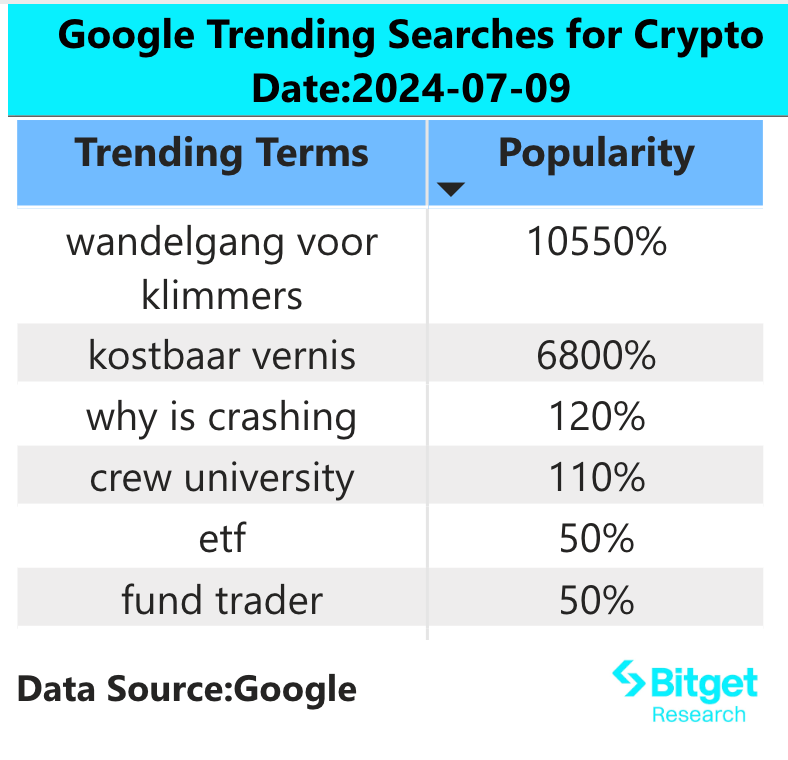

3) گوگل سرچ ریجن

عالمی نقطہ نظر سے:

ETH Spot ETF:

On July 8, according to the filing documents of the U.S. Securities and Exchange Commission (SEC), VanEck has submitted its Ethereum spot ETF S-1 revised registration statement, intending to rename VanEck Ethereum Trust to VanEck Ethereum ETF. On July 9, according to The Block, after VanEck submitted the revised S-1 registration statement, 21 Shares, BlackRock, Fidelity, Franklin Templeton and Grayscale also submitted revised S-1 registration statements before the deadline.

ہر علاقے میں گرم تلاشوں سے:

(1) There are no obvious characteristics in the Google Trends hot searches of Asian countries, but it is worth noting that SLP appeared in the hot searches in the Philippines. At the same time, the Philippine stablecoin PHPC was launched on Ronin yesterday. This shows that the game public chain and the entire GameFi sector have very high traffic and recognition in the Philippines.

(2) There are no obvious characteristics in the hot searches of European and American countries. For example, the hot searches of China should be BLAST, VET, and JUP, while those of the United States are MAGA, XAI, etc. Each country is different, which shows that there is a lack of hot spots in the current market.

ممکنہ، استعداد ایئر ڈراپ مواقع

ایندھن

ایندھن ایک UTXO پر مبنی ماڈیولر ایگزیکیوشن لیئر ہے جو ایتھریم تک عالمی سطح پر قابل رسائی پیمانہ لاتا ہے۔ ایک ماڈیولر ایگزیکیوشن لیئر کے طور پر، ایندھن عالمی تھرو پٹ کو اس طرح حاصل کر سکتا ہے جس طرح یک سنگی زنجیریں نہیں کر سکتیں، جبکہ ایتھریم کی حفاظت کو وراثت میں ملتی ہے۔

ستمبر 2022 میں، Fuel Labs نے Blockchain Capital اور Stratos Technologies کی قیادت میں فنانسنگ کے ایک دور میں کامیابی کے ساتھ $80 ملین اکٹھا کیا۔ متعدد سرکردہ سرمایہ کاری کے اداروں نے سرمایہ کاری کی، جیسے CoinFund، Bain Capital Crypto اور TRGC۔

شرکت کا طریقہ: آپ ایندھن کے ذریعہ قبول کردہ ٹوکن براہ راست اپنے حاصل کردہ پوائنٹس میں جمع کروا سکتے ہیں۔ شرکاء ہر $1 کے لیے 1.5 پوائنٹس فی دن کما سکتے ہیں جو وہ درج ذیل اثاثوں میں جمع کرتے ہیں:

پوائنٹس: ETH، WET، eETH، rsETH، RETH، wbETH، USDT، USDC، USDe، sUSDe اور stETH؛ 8 سے 22 جولائی تک، ezETH جمع کرنے سے آپ کو روزانہ 3 پوائنٹس حاصل ہوں گے۔

ڈی بینک

DeBank is a multi-chain DeFi portfolio tracker that supports DeFi protocols across multiple chains. DeBank also announced last year that it would launch the DeBank Chain based on OP Stack, and the mainnet will be launched in 2024.

Yesterday, DeBank announced that DeBank XP had been snapshotted at 8:00 am Beijing time on July 4. All active addresses have the opportunity to claim the initial XP airdrop. The initial XP of each address will be confirmed by its on-chain assets, credit, and Web3 social ranking on DeBank. The XP claim page is already available on DeBank, and the claim will last for one month.

اصل لنک: https://www.bitget.com/zh-CN/research/articles/12560603812485

銆怐اعلانیہ銆慣یہ مارکیٹ خطرناک ہے، لہذا سرمایہ کاری کرتے وقت محتاط رہیں۔ یہ مضمون سرمایہ کاری کے مشورے پر مشتمل نہیں ہے، اور صارفین کو اس بات پر غور کرنا چاہیے کہ آیا اس مضمون میں کوئی بھی آراء، خیالات یا نتائج ان کے مخصوص حالات کے لیے موزوں ہیں۔ اس معلومات پر مبنی سرمایہ کاری آپ کے اپنے خطرے پر ہے۔

This article is sourced from the internet: Bitget Research Institute: BTC contract rate turns positive, indicating that funds are buying in the short term, and many institutions submit ETH spot ETF S-1 forms

Original | Odaily Planet Daily Author | Asher In the past week, the overall crypto market was sluggish, and the GameFi sector experienced a certain degree of correction, but many popular projects continued to update their project dynamics this week. Perhaps now is a good time to lay out the GameFi sector. Therefore, Odaily Planet Daily summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector fell 10.0% in the past week; the current total market value is $18,665,081,150, ranking 27th in the sector ranking, down two places from the total market value sector ranking last week. In the past week, the number of tokens in the GameFi…