ہفتہ وار ایڈیٹرز پک اوڈیلی پلانیٹ ڈیلی کا ایک فعال کالم ہے۔ ہر ہفتے ریئل ٹائم معلومات کی ایک بڑی مقدار کا احاطہ کرنے کے علاوہ، Planet Daily بہت زیادہ اعلیٰ معیار کے گہرائی سے تجزیہ کرنے والا مواد بھی شائع کرتا ہے، لیکن ہو سکتا ہے کہ وہ معلومات کے بہاؤ اور گرم خبروں میں چھپے ہوں، اور آپ کے پاس پہنچ جائیں۔

لہذا، ہر ہفتہ، ہمارا ادارتی شعبہ کچھ اعلیٰ معیار کے مضامین کا انتخاب کرے گا جو پچھلے 7 دنوں میں شائع ہونے والے مواد کو پڑھنے اور جمع کرنے میں وقت گزارنے کے لائق ہوں گے، اور ڈیٹا کے تجزیہ کے تناظر میں کرپٹو دنیا میں آپ کے لیے نئی ترغیب لائیں گے، صنعت کا فیصلہ، اور رائے کی پیداوار.

اب آئیں اور ہمارے ساتھ پڑھیں:

سرمایہ کاری اور انٹرپرینیورشپ

جی ایس آر: کیا سولانا ای ٹی ایف گزرے گا؟ قیمت پر ممکنہ اثر کیا ہے؟

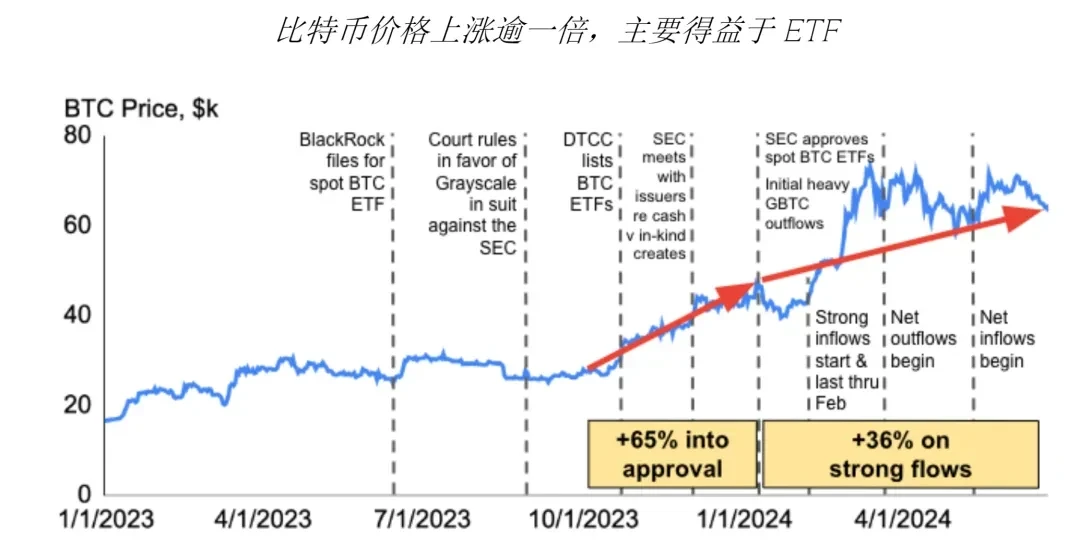

The two key factors that determine the next spot ETF are the degree of decentralization and potential demand. After analysis, if the United States allows additional spot digital asset ETFs, Solana will be the next one.

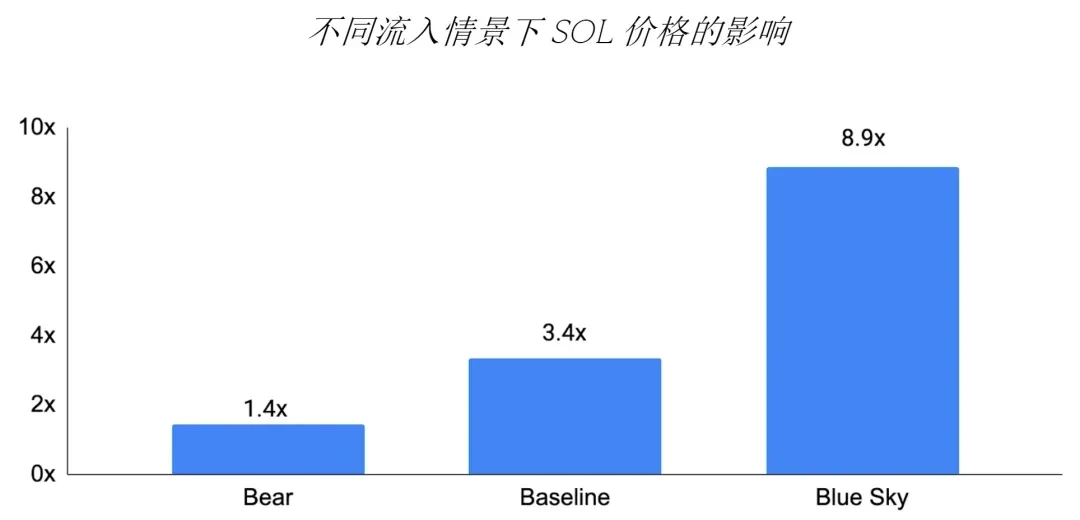

The spot Solana ETF could see inflows of 2%, 5%, or 14% of Bitcoin respectively (pessimistic, neutral, optimistic).  Referring to the impact of spot Bitcoin ETF on Bitcoin (increased 2.3 times), the conclusion is as follows:

Referring to the impact of spot Bitcoin ETF on Bitcoin (increased 2.3 times), the conclusion is as follows:

اس کے علاوہ تجویز کردہ: LUCIDA: Revealing the Crypto Macro Analysis Methodology of Top Researchers , The Final Chapter of Smart Money Tracking on the Chain: A List of the Addresses of the Top 10 Eco-Coin Ambush Masters , Will it rise or fall in the next three months? Bankless predicts the trends of 16 tokens .

گہرائی سے بحث: کیا اب بھی گورننس ٹوکن کی ضرورت ہے؟

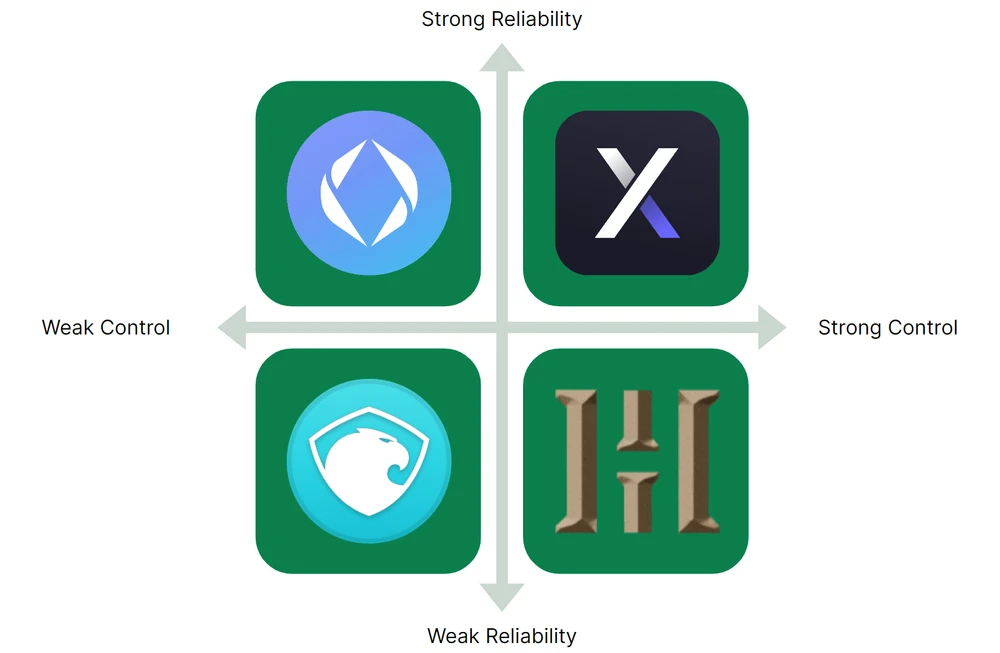

The article proposes a four-quadrant framework for evaluating governance tokens based on the reliability of token holders’ rights and control over economic value. It studies the tokens in each quadrant through sample cases, and finally provides builders and investors with advice on how to build and evaluate governance tokens.

Governance tokens can add value in two main ways: by helping applications manage the risks inherent in their business models and by providing utility to their holders in the form of tangible economic value (like GMX).

Whether a cryptocurrency project is brand new or mature, it’s not too late to identify shortcomings and make changes.

بلاکچین اسپیس کمرشلائزیشن کے دور میں، کیا آخرکار "فیٹ ایپلی کیشنز" بڑھیں گی؟

Valuable order flow is more important than the quantity of order flow. Applications will account for the largest proportion of total value.

Looking ahead, applications should look to create new types of order flows, including: creating new assets (e.g. Pump and memecoins), building applications for new use cases (e.g. Worldcoin, ENS), creating vertically integrated better consumer experiences and supporting valuable transactions, such as Farcaster and Frames, Solana Blinks, Telegram and TG applications, or on-chain games.

ایئر ڈراپ

Odaily interviews LuMao Studio: Uncovering the secrets of Web3’s “brush traffic” world

A story-based article, including the unique structure of LuMao Studio, and the competitive and cooperative relationship between LuMao Studio and the project owner

میم

How to choose potential Meme coins based on TVL changes?

The Memecoin TVL pull-up theory holds that a major memecoin or a basket of major memecoins will serve as a leveraged bet for on-chain TVL.

Taking Base and TON as examples, TVL inflow = major memecoin performance. If you can predict that TVL will increase, you can hold a position in the major memecoin on that chain as a leveraged bet on the TVL prediction.

Predicting TVL growth can be divided into two categories: long-term and short-term. Long-term forecasts are essentially predicting where TVL will go over multiple months. Short-term approaches look at short-term catalysts like points programs or airdrops as the reason for TVL growth.

ایتھریم اور اسکیلنگ

L1 اور L2 ایک ساتھ ہجوم کے ساتھ، L3 کے دوسرے کون سے پروجیکٹس پر توجہ دینے کے قابل ہیں؟

The general idea of Layer 3 is to further scale Ethereum by creating highly customizable, cheap, fast, and interoperable chains with varying degrees of security and decentralization. Examples of Layer 3 frameworks include Arbitrum Orbit and zkSync Hyperchains. This article briefly introduces Degen Chain (DEGEN) and Sanko (DMT).

اس کے علاوہ تجویز کردہ: 2024 Ethereum Stakeholder Report: What issues do independent stakers care about?

کثیر ماحولیات

“Immediacy” and “promoting the purchase of valuable information” are the real battlefields for Blinks.

Blinks is effective in reaching new users, converting new users, and awakening old users.

Potential use cases include investment, consumption, community governance, decentralized social networking, blockchain games, etc.

اس کے علاوہ تجویز کردہ: ایک مضمون میں سولانا بلینکس کے 50+ جدید استعمال کے کیسز کو دریافت کریں۔ .

Beginners Guide: How to Play TON Ecosystem

The article introduces wallets, cross-chain bridges, CEX, and some on-chain applications, and believes that the gameplay of the TG APP, transfers, transactions, games, etc. can all be completed in TG, which is a more mobile user-friendly environment compared to other public chains.

TON ایکو سسٹم گیم الفا میں مہارت حاصل کرنے کے لیے، آپ کو ان ٹولز کی ضرورت ہے۔

This article includes how to configure the wallet, find popular TON ecosystem games, and how to open multiple game simulators.

ڈی فائی

Altcoins keep falling, it’s time to refocus on DeFi

There are three reasons for the sharp drop in the price of altcoins: insufficient growth on the demand side, excessive growth on the supply side, and a continuous wave of lifting of restrictions.

It is the right time to pay attention to DeFi because PMF products have emerged from the bubble period – from the business perspective: it has a mature business model and profit model, and the leading projects have a moat; from the supply side: low emissions, high circulation ratio, and a small scale of tokens to be released; from the valuation side: market attention and business data diverge, and the valuation level falls into the historical low range; from the policy side: the FIT 21 Act is conducive to the compliance of the Defi industry and may trigger potential mergers and acquisitions.

The article further analyzes Aave, Uniswap, Raydium, Lido, and GMX as examples.

Ethereum ETF کے آغاز کے بعد، کیا RWA ٹریک ایک دھماکے کا آغاز کرے گا؟

Key sectors: Treasury, credit, real estate. Private RWAs remain largely untapped. Regulation and poor value accumulation are big risks.

اس کے علاوہ تجویز کردہ: RWA Narrative Renaissance: Who is on the cusp of the huge To B business?

گیم فائی، سوشل فائی۔

VC اور بلڈر کے نقطہ نظر سے بلاکچین گیمز کی مستقبل کی ترقی پر تبادلہ خیال کرنا

If you have strong technical skills, first consider a decentralized full-chain casual game based on a social platform.

If you have strong operational capabilities, first consider centralized GameFi mini-games based on a social platform, with TON being the first choice.

It is not recommended to invest in/produce large-scale 3A blockchain games targeting Web3 users. This is a pitfall.

Farcasters total number of users has reached 540,000, and the number of daily active users has surged from 2k at the beginning of the year to 56k at present, an increase of more than 28 times.

Farcaster protocol data is stored in the hub on and off the chain. Developers can choose to run the hub node themselves or use third-party service providers like Neynar to obtain data. All of this data is permissionless. Based on this available data, developers can build various clients and applications, which greatly increases the richness and innovation space of the Farcaster ecosystem.

Users can track the progress of the ecosystem through the decaster website . The article also introduces some highlight projects: WrapCast, Jam, Clubcast, BountyCaster, AlfaFrens.

توجہ دینے والے تاجروں کی نئی نسل کے لیے بنایا گیا، کرپٹو پروڈکٹس سوشل فائی کے قریب تر ہو رہے ہیں۔

ویب 3

نقطہ نظر: Web3 کو بڑے پیمانے پر داخلہ کی ضرورت ہے، بڑے پیمانے پر اپنانے کی نہیں۔

Crypto has boundaries. All its features (privacy, decentralization) come from its core value – permissionlessness, which is not available to most people on the planet. We think there are no new users now because the market is about to reach its actual TAM extreme.

The existing market has never been a problem, but high-frequency users are. The essence of Crypto growth is the process of cultivating high-frequency and large users. What Crypto/Web3 needs to make clear is let them make money and admit merchants from all over the world to come here and try to make money, provided that they learn the rules of Crypto. The way they make money is to play games involving money flows (trading, staking, lending, etc.), and everything revolves around this logic.

Web3 منی پروگرامز؟ MetaMask Snaps کی وضاحت کی گئی۔

The number of available Snaps listed on the official website is actually not very large. As of June 2024, there are only 68 at most. Due to understandable security considerations, a basic Snaps cant do much. Most of its functions require corresponding permissions first, so Snaps need to apply for relevant permissions from users when installing. Available permissions include lifecycle, transaction, signature, CRON, etc. Compared with the prosperous Web3 ecosystem, the number of available Snaps is pitifully small.

According to the classification on the MetaMask official website, it can be roughly divided into 4 types: account management, interoperability, notifications and chat, and security.

For most of MetaMasks current users, Snaps is not really a necessary feature, and MetaMask may need to do more work on how to promote it more effectively. But no matter what, it is at least a product built by a group of passionate developers who want to solve real problems, rather than a scam launched by a group of financial experts.

ہفتہ کے گرم عنوانات

گزشتہ ہفتے میں، the US and German governments transferred Bitcoin ; Mt.Gox has officially started to compensate some creditors in the form of BTC and BCH ; Japanese creditors: have received compensation from Mt.Gox , and the number of tokens paid is 13% of the positions held that year; the market plummeted ; Bloomberg: Mt.Gox, the government, and miners’ selling pressure caused Bitcoin to fall , and the Fed’s potential policy shift will reverse market sentiment;

In addition, in terms of policy and macro markets, the SEC sued Consensys, accusing MetaMask of engaging in securities offerings and sales and acting as an unregistered broker; a U.S. judge dismissed the SECs allegations against Binance BNB secondary sales and Simple Earn, and approved other charges to proceed; the SEC has returned the S-1 form to the ETH spot ETF issuer and required it to be revised and resubmitted before July 8;

In terms of opinions and voices, Glassnode: Volatility continues to be compressed historically, and there may be greater fluctuations in the future ; Matrixport Investment Research: Summer consolidation plus market shipment, it is recommended to hold BTC options and wait for the US election to be realized ; Arthur Hayes: Looking back at the laws of the century-old economic cycle, Bitcoin is about to enter a macro turning point ; Galaxy Research Director: Mt. Goxs repayment will not have much impact on Bitcoin prices; Andrew Kang: We may see Bitcoins extreme correction to the $40,000 range; German lawmakers called on the government to stop selling Bitcoin , saying that this move may affect the stability of the crypto market; Casey: Runes and inscriptions will be programmable like Bitcoin; Vitalik Buterin: Crypto regulation has caused anarchy and tyranny, and honest crypto developers have been forced into a desperate situation; Vitalik published an article to explore ways to provide Ethereum users with faster transaction confirmation times ، اور hand-picked the route Epoch and slot ; Vitalik: Prediction markets and Community Notes are becoming the two flagship social cognitive technologies today; Justin Sun: This years goal is to achieve $1 billion in protocol revenue for TRON ; Starknet Founder: About 400 million STRKs are reserved for future airdrop rounds ; friend.tech: We have heard community feedback and FRIEND will not move out of Base; STIX founder: The reasonable off-market valuation of ENA in the locked state is 70% off;

In terms of institutions, large companies and leading projects, the high expenditure in the Polkadot Treasury operation report for the first half of 2024 has caused controversy (Polkado official response ); Telegram introduced the function of channel owners to publish paid photos and videos , which users can purchase with Stars; Blast launched a governance system and initiated the first proposal to enable points for BLAST holders; Blast announced the points distribution details for the second phase of the airdrop , and will distribute 10 billion BLAST; Lido launched the community staking module test network ; Notcoin plans to launch a trading robot function to support the buying and selling of tokens on Telegram; Ava Labs launched the Avalanche inter-chain token transfer ICTT solution ; ZKsync launched Elastic Chain ; marginfi will launch mrgnswap, allowing users to leverage long/short any Meme token ; Aevo announced the launch of the automatic trading Vault Aevo Strategies; WEL L3s unsmooth opening caused controversy;

From a data perspective, Vitalik Buterin’s net worth is estimated to be at least $830 million … Well, it’s been another week of ups and downs.

منسلک کے لیے ایک پورٹل ہے۔ "ہفتہ وار ایڈیٹر کے انتخاب" سیریز۔

اگلی بار ملتے ہیں ~

This article is sourced from the internet: Weekly Editors Picks (0629-0705)

Original title: Zedd: Unpacking the long march of Magic Eden towards the market winner Original source: Mabel Jiang, HODLong Original translation: Ladyfinger, Lucy, BlockBeats This article is compiled from the podcast HODLong, which aims to explore the development of the Web3 community with listeners. The dialogue guests include project operators, investors, other ecosystem participants, etc., with a special focus on the Web3 community in Asia. This episode interviewed Zedd, co-founder of Magic Eden, hosted by Mabel Jiang, the host of HODLong. Mabel Jiang was a partner of Multicoin Capital and is currently the growth officer of STEPN, Gas Hero, FSL Ecosystem and MOOAR. Before entering the cryptocurrency field, Zedds early career was consulting for corporate clients at Bain Company. Then in 2017, Zedd joined dYdX, which became his starting point…