جاپان کی کرپٹو مارکیٹ کی موجودہ صورتحال: ضابطے میں بہت جلد مداخلت کی گئی، اور مسابقت اتنی اچھی نہیں ہے جتنی ہانگ

Original author: Rick Maeda

اصل ترجمہ: TechFlow

خلاصہ

-

Despite Japan’s early adoption of cryptocurrency, its journey has been rocky due to two of the largest crypto exchange hacks in history.

-

These events forced Japan’s regulators to step in earlier than in other countries and provide a clear regulatory framework for the industry.

-

However, strict regulations and high taxes make Japan less competitive than its neighbors such as Singapore and Hong Kong.

-

With low transaction volumes and a lackluster domestic startup environment, Japan faces numerous challenges in developing its Web3 industry, and a revival will require major policy changes.

تعارف

Due to a lack of high-yield opportunities and an unattractive domestic stock market, ordinary investors in Japan have long been known for their enthusiasm for leveraged trading. Japanese individual currency traders have been so influential in the TRY/JPY (Turkish Lira/Japanese Yen) foreign exchange trading pair that the international financial community has even coined the term Mrs. Watanabe to represent them. When Bitcoin and other cryptocurrencies entered the market for ordinary users in the early 2010s, Japanese day traders enthusiastically embraced this emerging asset class. However, investors soon faced domestic challenges, including two high-profile exchange hacks, which combined with Japans lack of attractiveness in entrepreneurship and investment, caused the country to decline in the Web3 field.

In this research article, we will:

-

A look back at the history of cryptocurrency in Japan, especially the various regulatory developments

-

Analysis of Japans current situation

-

Explore some of the key players in the domestic industry

The History of Cryptocurrency in Japan

Japan’s cryptocurrency history has seen many major events, such as the Mt. Gox and Coincheck hacks, which prompted the government to implement strict regulatory measures to protect investors and maintain the stability of the financial system. Japan continues to evolve its regulatory framework to address new challenges and opportunities in the cryptocurrency space.

The Early Days and the Rise of Mt. Gox

Year 2009:

-

Bitcoin, the first cryptocurrency, was introduced by an unknown person or group using the name Satoshi Nakamoto. In these early stages, awareness and adoption of cryptocurrencies were low everywhere, including in Japan, despite the creator’s use of a Japaneseized pseudonym.

2011 ~ 2013:

-

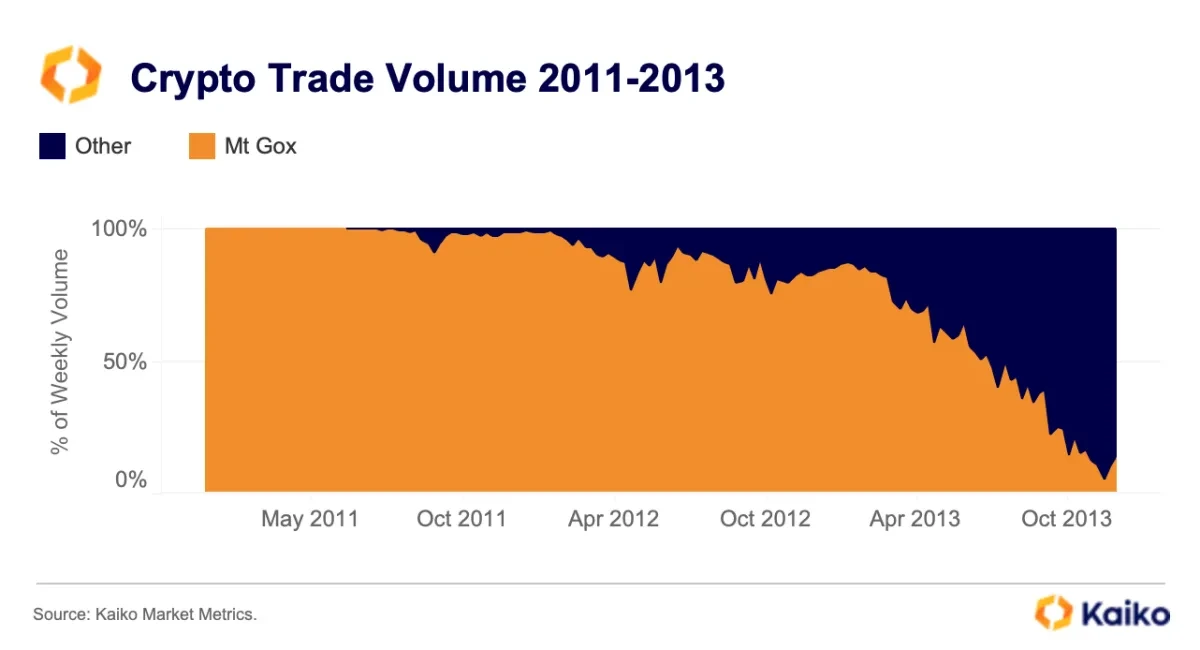

Mt. Gox, a Tokyo-based bitcoin exchange, became the largest bitcoin exchange in the world, processing the vast majority of bitcoin transactions at its peak (Figure 1).

Figure 1: Global CEX trading volume by the end of 2013

The Mt. Gox hack and its aftermath

Year 2014:

-

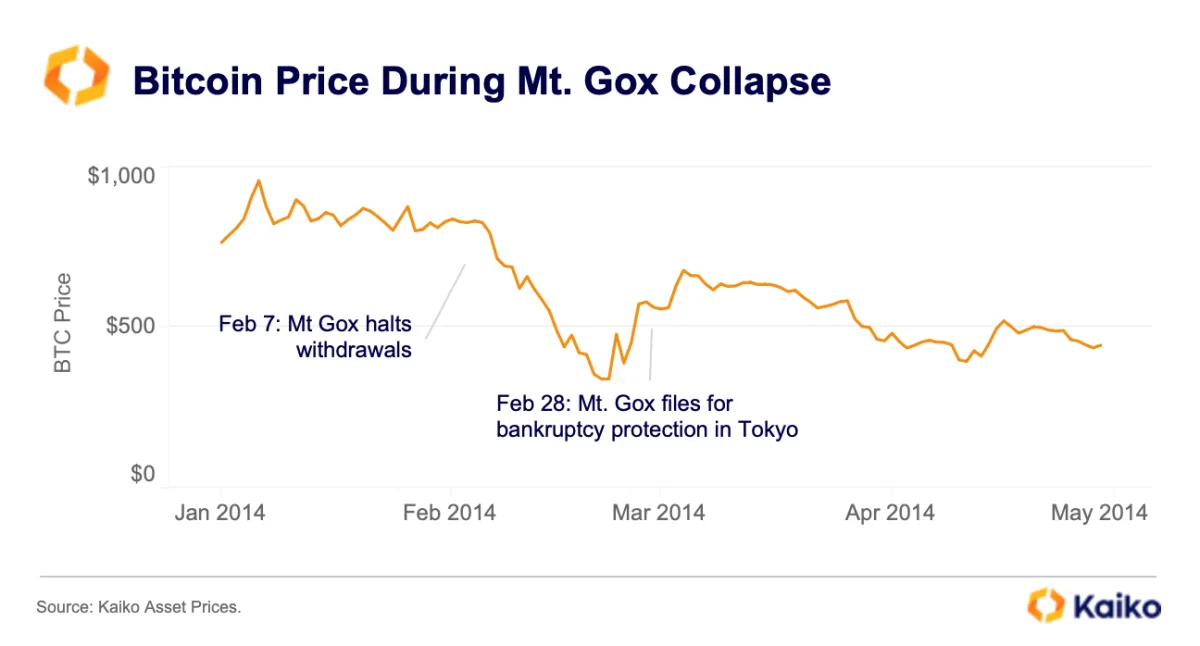

Mt. Gox halted trading, shut down its website, and filed for bankruptcy, announcing that approximately 850,000 bitcoins (nearly 7% of all bitcoins at the time, worth about $450 million) had been stolen. An investigation revealed that poor management and inadequate security measures were to blame for the loss.

Figure 2: Within 3 days after Mt. Gox stopped withdrawals, the price of Bitcoin fell by more than 40%

Regulatory developments and early regulations

2015:

-

The Financial Action Task Force (FATF), the intergovernmental policymaking body of the Group of Seven (G7), has issued guidance recommending that countries regulate virtual currency exchanges to combat money laundering and terrorist financing.

-

The Japanese government has begun drafting legislation aimed at regulating exchanges to protect consumers and ensure financial stability.

2016:

-

The Japanese Cabinet and Diet passed bills to amend the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA). These amendments recognize virtual currencies (such as Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash) as a means of payment and impose regulatory requirements on cryptocurrency exchanges, laying the foundation for the full implementation of cryptocurrency regulations.

-

The Financial Services Authority (FSA) is responsible for the implementation of these regulations, focusing on exchange registration requirements, cybersecurity measures, and anti-money laundering (AML) protocols.

Coincheck hack and increased regulation

2017:

-

The revised Payment Services Act came into effect in April, requiring cryptocurrency exchanges to register with the FSA and comply with AML and know-your-customer (KYC) regulations, which also classify Bitcoin as a prepaid payment instrument.

-

Bitcoin and cryptocurrencies have gained significant popularity in Japan, with many merchants such as Bic Camera, Japans largest electronics retail company, starting to accept Bitcoin as a payment method.

-

The National Tax Agency (NTA) classifies cryptocurrency gains as “miscellaneous income,” making it taxable income.

2018:

-

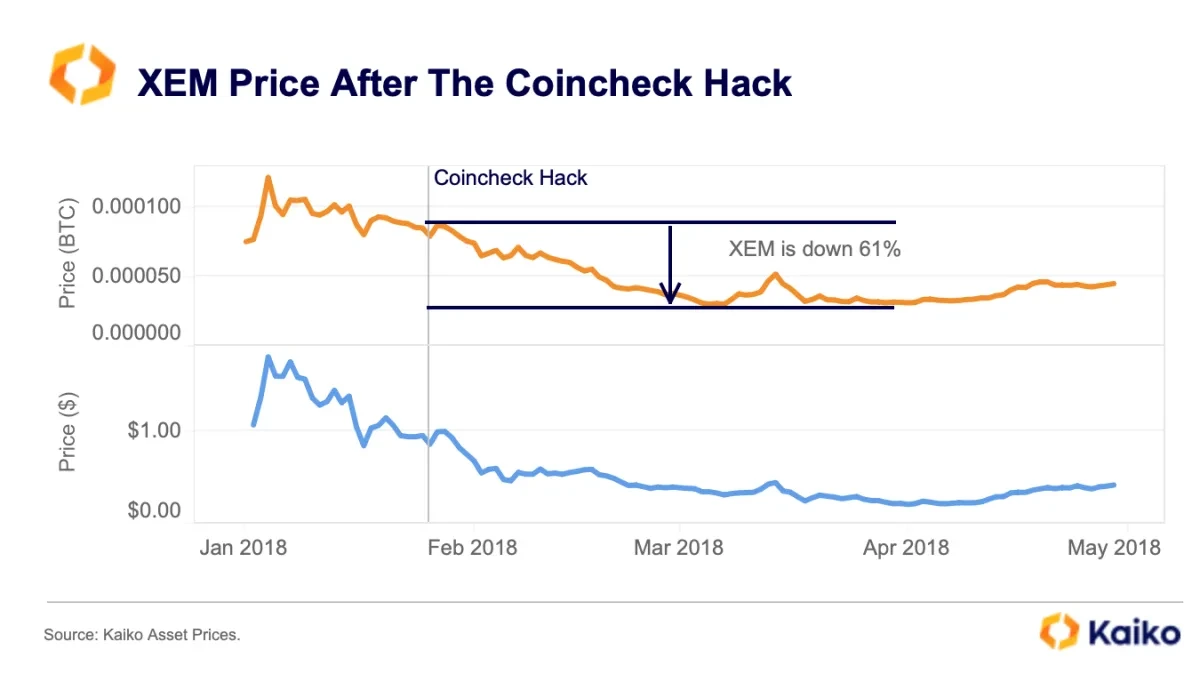

Coincheck, one of the largest cryptocurrency exchanges in Japan, was hacked, resulting in the theft of approximately 523 million NEM (worth approximately $530 million). Customers were eventually reimbursed in full by Coincheck. The hack remains one of the largest cryptocurrency heists in history and prompted the FSA to take stricter regulatory measures. As Cointelegraph reported, the exchange stored NEM in hot wallets rather than multi-signature wallets. Figure 3 shows that the price of NEM fell by more than 76% in the first two months after the hack. The first quarter of 2018 was the beginning of the bear market, but even without the bear market effect, the $XEM/$BTC trading pair fell by more than 61%.

Figure 3: XEM price trend during the Coincheck hack

-

Zaif, a smaller exchange, was hacked, losing around $60 million.

-

The Japan Virtual Currency Exchange Association (JVCEA) was established as a government-approved self-regulatory body to improve industry standards and is responsible for approving tokens for exchange listings.

-

The FSA issued business improvement orders to several cryptocurrency exchanges and conducted on-site inspections to ensure compliance with the new regulations.

-

The FSA has limited leverage on cryptocurrency margin trading to four times the deposit amount, in an effort to curb speculative trading and protect investors.

Leveraged Trading Regulations and Continuing Developments

2019:

-

Coincheck has now complied with the new regulations and resumed operations.

-

Japan’s Cabinet has approved new regulations that will limit leverage on cryptocurrency margin trading to 2-4 times the initial deposit.

-

The revised Financial Instruments and Exchange Act (FIEA) and Payment Services Act (PSA) came into effect, further tightening regulation on cryptocurrency exchanges and security token issuance (STO).

2020:

-

The FSA has reduced the maximum leverage for margin trading to 2x.

-

Further revised PSA and FIEA were implemented, focusing on strengthening user protection and market integrity.

2021:

-

Japan continues to develop its regulatory framework with a focus on enhancing investor protection, cybersecurity and preventing money laundering.

-

The FSA has established a new regulator to oversee cryptocurrency exchange operators and ensure they comply with changing regulations.

-

The FSA asked the JVCEA to implement a self-regulatory rule, the “crypto travel rule,” regarding information sharing during transactions.

Latest Developments

2022:

-

The FSA has introduced additional guidance for digital asset custody by exchanges, highlighting the need for strong internal controls and risk management practices.

-

The JVCEA introduced the travel rule in its self-regulatory rules, while the Cabinet Secretariat amended the Act on Prevention of Transfer of Proceeds of Crime (APTCP) to implement the rule.

-

Japan’s Tax Commission has amended its tax code to exempt token issuers from paying corporate taxes on unrealized cryptocurrency gains.

-

Japan is exploring the potential of issuing a central bank digital currency (CBDC), with the Bank of Japan conducting experiments and research.

-

The House of Lords passed a bill to regulate stablecoins, monitor money laundering and combat money laundering.

-

The Digital Society Promotion Headquarters of the Liberal Democratic Party (LDP) released the NFT White Paper: Japans NFT Strategy in the Web 3.0 Era, which put forward policy recommendations for the development and protection of NFTs.

-

Japan’s Ministry of Economy, Trade and Industry (METI) has established a Web3 Policy Office to create a supportive business environment for Web3-related industries.

-

The FSA is moving forward with lifting the ban on foreign-issued stablecoins.

2023:

-

The FSA continues to refine its regulatory approach, focusing on emerging trends such as DeFi and NFTs.

-

The FSA is conducting a public consultation on a draft order to amend the APTCP enforcement order to clarify the application of the travel rule to Japanese virtual asset service providers (VASPs).

-

Japanese Prime Minister Fumio Kishida has highlighted Web3 as a pillar of economic reform, calling it a new form of capitalism and emphasizing its potential to drive growth by solving social problems.

2024:

-

The JVCEA plans to simplify the listing process for digital currencies, aiming to streamline the approval process for tokens already on the market.

-

It is expected to eliminate the lengthy pre-vetting process for certain digital assets on authorized exchanges.

-

The cabinet approved a bill that would allow venture capital firms’ investment vehicles to directly hold digital assets.

Where are we now? Japan struggles with Web3 adoption

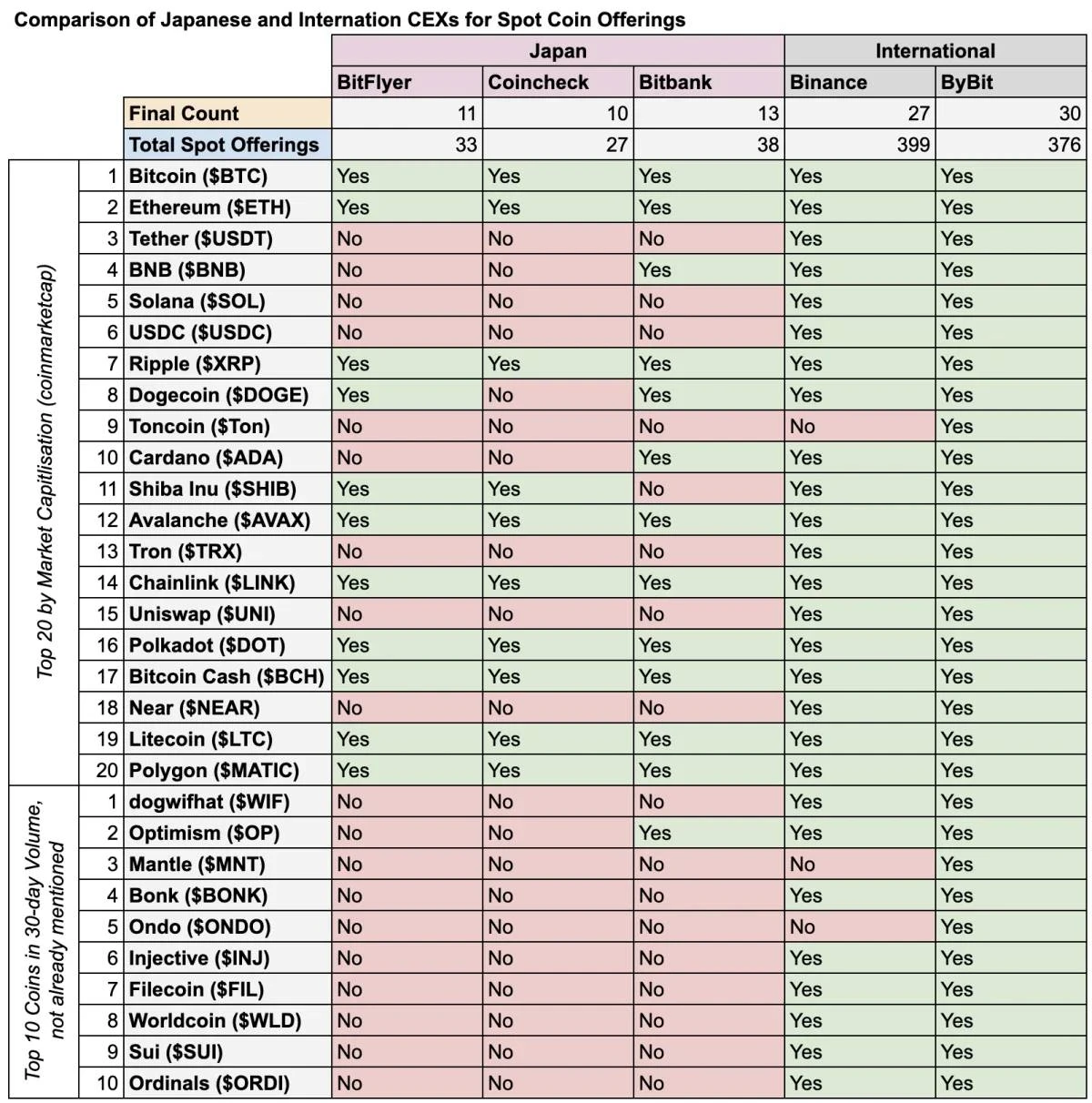

Japan’s weakness in Web3 adoption stems mainly from regulatory restrictions , especially in terms of exchange listings and taxation. Exchange listings are strictly regulated by the FSA, and local CEXs lack major cryptocurrencies and are unable to provide liquidity for stablecoins (Figure 4).

Figure 4: Local CEXs have limited products.

Note: We looked at USDT pairings on Binance and ByBit as neither of them offer USD fiat.

For ByBit, $SHIB and $BONK are offered in blocks of 1000 units ($1000 BONK and $SHIB 1000)

In addition to Bitbank offering the most coins among Japanese exchanges, this reinforces the dominance of major coins on Japanese exchanges (Figure 5):

Figure 5: Market share of the top two assets on Japanese and international CEXs.

Duration: 2024 to date

Meanwhile, cryptocurrency gains are considered miscellaneous income and are taxed at the same personal income tax bracket plus local taxes, up to 55% (Figure 6).

Figure 6: Japan’s capital gains tax on cryptocurrencies is prohibitively high

There was a time when yen trading volumes exceeded dollar trading volumes before institutional investors stepped in, but the challenges mentioned above make things difficult.

Figure 7: Japanese Yen’s بازار Share in Global Fiat Currency Trading Volume

The absolute dominance of the Japanese yen, which once accounted for more than 60% of all fiat currency trading volume, quickly disappeared during the pandemic. However, the total share of Asian fiat currency trading volume has remained relatively stable as trading volume shifted from the Japanese yen to the Korean won (Figure 8).

Figure 8: Market share of Japanese Yen trading volume relative to other currencies

Interestingly, when we rebase JPY and USD volumes to their all-time highs in November 2021, JPY volumes show a stronger recovery in this cycle (Figure 9).

Figure 9: JPY and USD trading volumes based on all-time highs in November 2021 = 100

On the institutional side, Japan is a content IP-rich country with companies like SEGA and Kodansha, making it an ideal place for NFT and game-driven projects. In theory, these companies can bring attention, users, research capabilities, and capital. The problem is that this strategy has shown minimal results in any country, and this has been touted as a bull case for Japan for many years.

Politically, the recent defeat of the deregulatory ruling party in the April 2024 House of Representatives election has raised concerns, giving momentum to the opposition Constitutional Democratic Party. However, given the LDPs continued majority in both houses of the Diet, and the growing international and domestic competition for Web3 adoption, we do not see these developments as a cause for concern at this time.

Cryptocurrency faces many headwinds, but simply put, many of the issues are cultural and therefore unquantifiable and without easy solutions. Being a cosmopolitan city, English proficiency is extremely low, there is a lack of inherent entrepreneurial spirit, a stable job at a well-known local company is still seen as the pinnacle of post-graduation employment, corporate caution contrasts with the fast-moving nature of cryptocurrencies, and so on. All of these factors are relative, especially compared to Asian competitors such as Singapore and Hong Kong, but many of them are also absolute, making the challenge even more difficult. Add to that challenges with taxation and CEX product offerings, and its hard to imagine Japans adoption rate catching up to its Asian neighbors any time soon.

Major players in the Japanese crypto market

i) Centralized Exchanges (CEXs)

As mentioned earlier, Japan’s centralized exchanges are not competitive in terms of product offerings compared to their international counterparts, while high capital gains taxes make cryptocurrency trading unattractive. These challenges are reflected in the trading volumes of domestic exchanges, and the user interface and user experience (UI/UX) of these exchanges also lag behind foreign competitors.

Currently, there are 29 crypto asset trading service providers registered with the Financial Services Agency (FSA) in Japan. We present the current market landscape in a chart.

-

BitFlyer is the largest exchange by trading volume and has maintained its dominance in recent years.

Figure 10: Share of trading volume of centralized exchanges in Japan

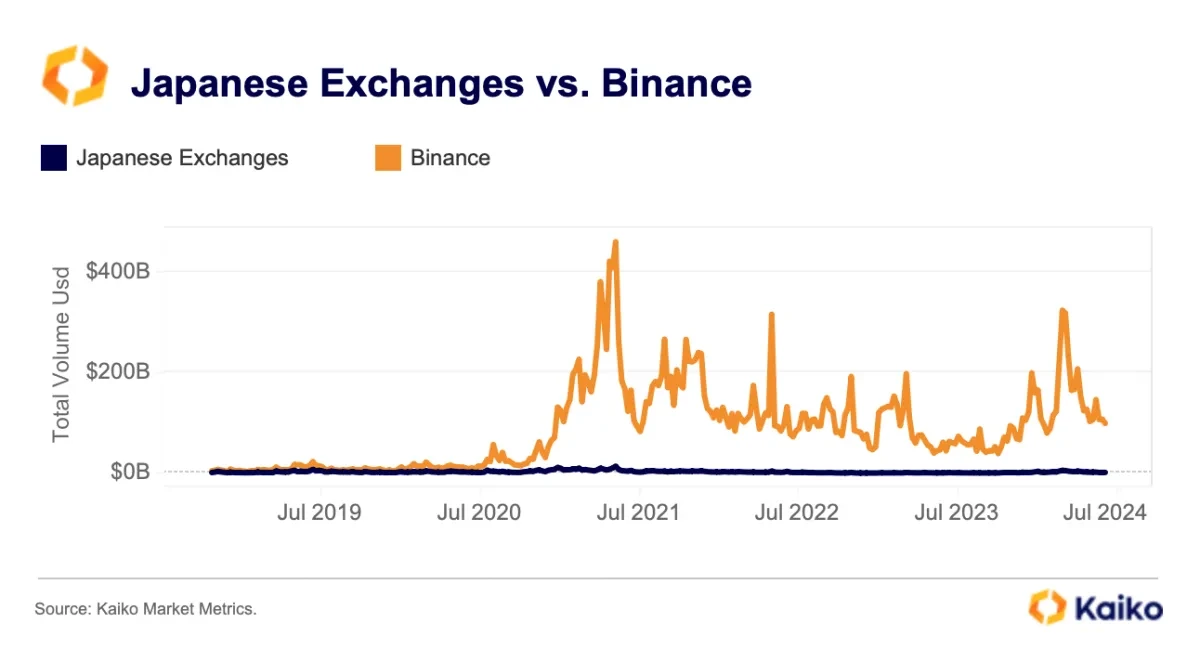

However, Japan’s domestic exchanges are barely competitive in terms of trading volume compared to top international exchanges, and since the pandemic, Binance has left Japanese exchanges far behind.

Figure 11: Comparison of total spot trading volume of Japanese exchanges and Binance

This difference can also be observed when comparing the depth of exchanges’ spot BTC order books.

Figure 12: 1% deep spot BTC order book, comparison of Japanese exchanges and Binance

ii) Investor Group:

SBI Digital

SBI Holdings (TYO: 8473) is a Tokyo-based financial services group founded in 1999. Initially part of SoftBank Group, it became independent in 2000. SBI Holdings operates in multiple fields, including financial services, asset management, and biotechnology. It is known for combining technology with traditional financial services to drive innovation and growth.

SBI Digital Asset Holdings is a subsidiary of SBI Holdings that focuses on digital assets and blockchain technology and is the largest cryptocurrency investment group in Japan. Launched in 2020, SBI Digital aims to revolutionize the traditional financial industry by providing comprehensive solutions such as digital asset trading, token issuance, and custody services. They provide a secure platform for various digital asset transactions and facilitate token issuance, enabling companies to raise funds through innovative methods such as security token offerings (STOs). Their custody services ensure the safe storage and management of digital assets, using advanced security measures to protect investments. SBI Digital also collaborates with global financial institutions, such as a joint venture with SIX Digital Exchange to set up a crypto venture fund in Singapore, aiming to increase the liquidity and infrastructure of digital assets throughout Asia and Europe. Another important initiative is the Digital Space Fund launched in 2023, with a fund size of up to US$660 million, focusing on Web3, Metaverse, AI, Fintech and other emerging technologies.

SBI provides a variety of services in both traditional finance and crypto, including custody solutions and market making services through its subsidiary B2C2.

iii) Agreement/Project:

Astar Network

Astar Network is a decentralized application (dApp) platform built on the Polkadot ecosystem and one of the most important crypto projects in Japan (though famously, its headquarters is not in Japan, but in Singapore). It was founded by Sota Watanabe, a well-known figure in the Japanese blockchain field. Astar aims to provide developers with a scalable, interoperable and decentralized network to deploy their applications. The network supports multiple virtual machines, including the Ethereum Virtual Machine (EVM) and WebAssembly (WASM), allowing developers to write smart contracts in a variety of programming languages.

Astar Network is a decentralized application (dApp) platform built on the Polkadot ecosystem. Although Astar is one of the leading crypto projects in Japan, it is headquartered in Singapore. The platform was founded by Sota Watanabe, a well-known figure in the Japanese blockchain field, and aims to provide developers with a scalable, interoperable and decentralized application deployment platform. Astar supports multiple virtual machines, including Ethereum Virtual Machine (EVM) and WebAssembly (WASM), allowing developers to write smart contracts in multiple programming languages.

Astar facilitates the development of dApps by providing the necessary tools and infrastructure, driving innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications. Astars integration with Polkadot enhances its interoperability with other blockchains, making it an important part of the blockchain ecosystem.

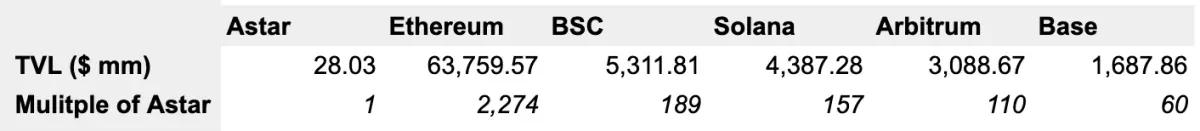

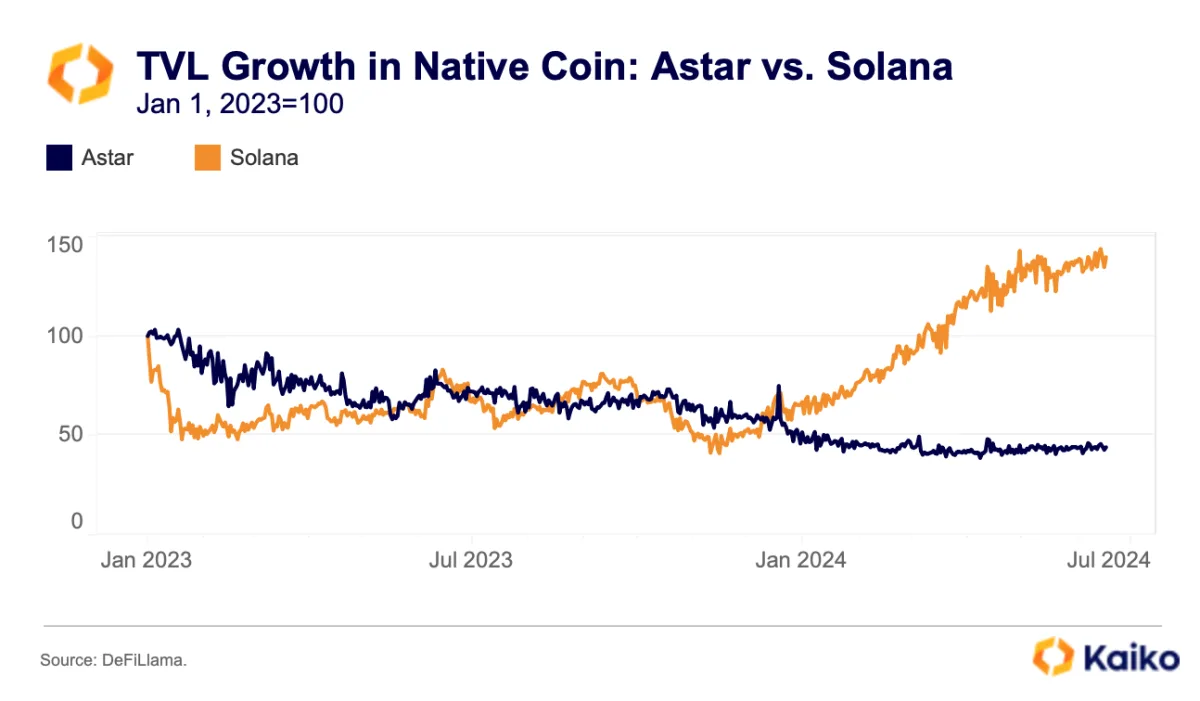

Astar is significant in Japan as it is one of the country’s leading blockchain projects, demonstrating the interest and investment in blockchain technology by the Japanese tech community. However, activity on Astar is still in its infancy: Figure 13 shows the chain’s TVL in USD, and Figure 14 shows the growth of its native token’s TVL.

Figure 13: Astar’s TVL in USD compared to larger chains

Figure 14: Astar TVL vs. Solana TVL, calculated in their native currencies ($ASTR and $SOL), with January 23rd = 100

بیگ

Backpack is one of the most exciting wallet providers in recent years. Their non-custodial wallet currently supports Solana, Ethereum, and Arbitrum, offering browser extensions as well as iOS and Android apps. Interestingly, the company was founded by two non-Japanese founders who chose Tokyo as their headquarters. We spoke to Tristan Yver, co-founder of Backpack, about why they chose to set up the company in Japan:

-

Who are you and what is Backpack?

I’m Tristan Yver, co-founder of Backpack. Backpack is a cryptocurrency wallet that aims to manage all crypto assets by providing a secure, user-friendly platform. I’m also one of the founders of the Mad Lads NFT collection, the leading NFT collection on Solana and one of the strongest communities in crypto.

-

Why did you choose Japan as your headquarters location?

We chose to set up our headquarters in Japan because the regulatory environment is improving and we have a local team based here. Of all the countries in Asia, Japan is the most desirable place for our team to set up headquarters because of the high security and quality of life here. We are also committed to promoting Japan as a thriving Web3 country and inviting other founders and teams to visit us.

-

What do you think needs to change in the country to increase cryptocurrency adoption?

In order to promote the popularity of cryptocurrency in Japan, more resources need to be provided for engineers to learn blockchain programming, and the startup sector needs to realize the huge opportunities in the Web3 space. I also think that friendlier tax policies will attract more individual investors to participate in the crypto market.

-

Can you tell us about the upcoming updates for Backpack?

We are excited to add more blockchain support to Backpack Wallet. We started with Solana and Ethereum, now support Arbitrum, and will soon support Base, Optimism, and Polygon. These innovations are designed to provide users with the best non-custodial crypto management experience.

نتیجہ

While Japan got an early start in general user adoption, regulatory scrutiny following exchange hacks, high taxes, limited currencies offered by exchanges, and cultural barriers have left the country far behind its Asian peers in the Web3 space. The current LDP government, led by Kishida, has its sights set in the right direction, but progress has been slow. Activity on local exchanges reflects this struggle, and it’s hard to see any catalyst that could change Japan’s fortunes at this point. However, the comprehensive regulatory environment, as well as the lifestyle factors Tristan mentioned such as safety and quality of life, continue to make Japan an attractive place to live, and as we’ve seen at Backpack, talented individuals may choose Japan as their base of operations.

This article is sourced from the internet: Current situation of Japan’s crypto market: regulation intervened too early, and competitiveness is not as good as Hong Kong and Singapore?

متعلقہ: مارکیٹ بنانے والوں کو سمجھنا: گرے ایریا پریڈیٹر، وہ کرپٹو دنیا کے لیے اتنے اہم کیوں ہیں؟

اصل مصنف: من جنگ اصل ترجمہ: ٹیک فلو سمری مارکیٹ بنانے والے اہم لیکویڈیٹی فراہم کر کے، موثر تجارتی عمل کو یقینی بنا کر، سرمایہ کاروں کے اعتماد کو بڑھا کر، اور مارکیٹوں کو مزید آسانی سے کام کر کے اتار چڑھاؤ اور لین دین کے اخراجات کو کم کرنے میں اہم کردار ادا کرتے ہیں۔ مارکیٹ بنانے والے لیکویڈیٹی فراہم کرنے کے لیے مختلف ڈھانچے کا استعمال کرتے ہیں، جن میں سب سے عام ٹوکن قرض دینے والے پروٹوکول اور برقرار رکھنے کے ماڈل ہیں۔ ٹوکن قرض دینے کے پروٹوکول میں، مارکیٹ بنانے والے ایک مخصوص مدت (عام طور پر 1-2 سال) کے لیے مارکیٹ کی لیکویڈیٹی کو یقینی بنانے کے لیے پروجیکٹس سے ٹوکن ادھار لیتے ہیں اور معاوضے کے طور پر کال کے اختیارات وصول کرتے ہیں۔ دوسری طرف، برقرار رکھنے کے ماڈل میں مارکیٹ بنانے والوں کو طویل مدت تک لیکویڈیٹی برقرار رکھنے کے لیے معاوضہ دیا جاتا ہے، عام طور پر ماہانہ فیس کے ذریعے۔ جیسا کہ روایتی بازاروں میں ہوتا ہے، مارکیٹ بنانے والے کی سرگرمیوں کے لیے واضح اصول و ضوابط کرپٹو کرنسی مارکیٹ کے ہموار کام میں اہم کردار ادا کرتے ہیں۔ اس…