Bitget ریسرچ انسٹی ٹیوٹ: SEC نے ETH 2.0 کی تحقیقات ختم کر دیں، ETH ایکو سسٹم کرنسیوں کو پورے بورڈ میں ریباؤنڈ کر دیا گیا

گزشتہ 24 گھنٹوں میں مارکیٹ میں بہت سی نئی مقبول کرنسیاں اور عنوانات سامنے آئے ہیں جو کہ پیسہ کمانے کا اگلا موقع ہو سکتا ہے بشمول:

-

The sectors with relatively strong wealth-creating effects are: ETH ecological blue-chip projects, Curve-related tokens;

-

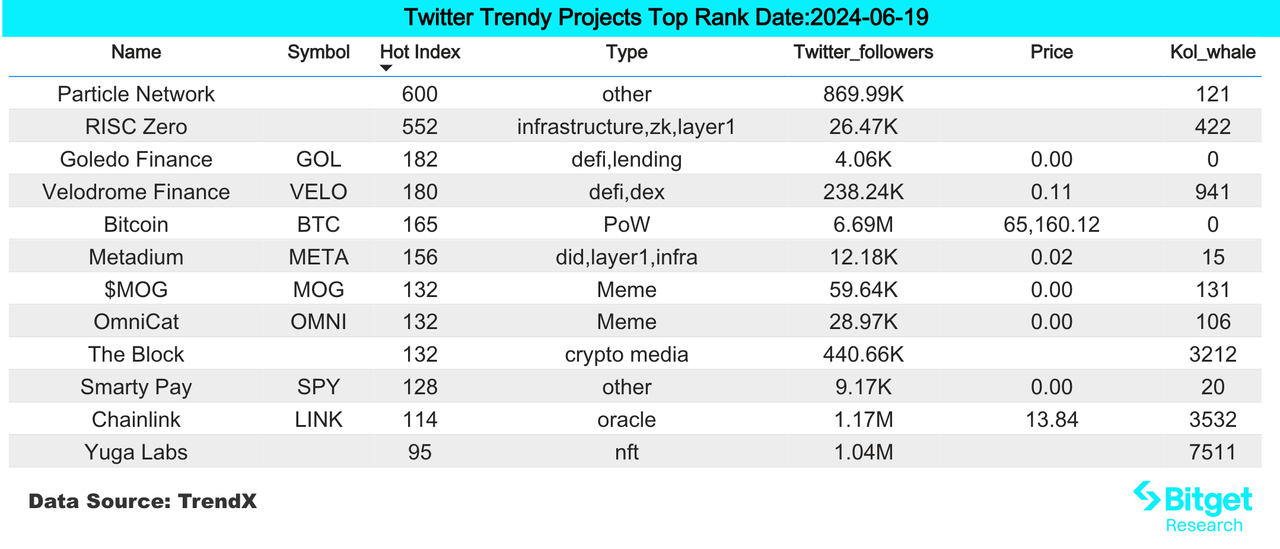

Hot searched tokens and topics: Renzo, Particle Network, DJT

-

Potential airdrop opportunities include: Skate, Sanctum

Data statistics time: June 19, 2024 4: 00 (UTC + 0)

1. بازار کا ماحول

On Tuesday, the crypto market fell across the board. Bitcoin fell below the $65,000 support level in the short term. Several mainstream altcoins fell by double-digit percentages. As of now, the trading price of Bitcoin has rebounded to $65,056, a 24-hour drop of 2.36%. According to Coinglass data, about $372 million of crypto leveraged long positions were liquidated in the past 24 hours, and the short positions were liquidated at $61.8 million. The market showed a clear spot premium, indicating that market participants speculative activities have decreased. Earlier, the BTC order book showed that the buying volume was concentrated around $65,000. It has now fallen to around $64,000. Bitcoin is still below the 50-day moving average, which puts pressure on the medium-term trend. Investors still need to remain patient.

In the U.S. stock market, Nvidia surpassed Microsoft to become the worlds most valuable listed company. At the close, the SP and Dow Jones indexes rose by 0.25% and 0.15% respectively, and the Nasdaq index was basically flat. We need to continue to pay attention to the correlation between Nasdaq and BTC. If the correlation begins to turn positive, but Nasdaq begins to fall, it will have a greater impact on the crypto market.

2. دولت سازی کا شعبہ

1) Sector changes: ETH ecosystem blue chip projects

بنیادی وجہ:

Bitwise has submitted an S-1 revision to the U.S. Securities and Exchange Commission (SEC) for an Ethereum spot ETF, which will include changes after the SECs first round of consultation. It is unclear whether more rounds of consultation are needed, and product fees have not yet been disclosed. According to this document, overall, the SECs end of its investigation into ETH 2.0 has led to a substantial rebound in the blue-chip tokens in the ETH ecosystem that had an eye-catching performance in the last bull market cycle. In the future, this sector will be stronger than other sectors, but it also depends on the overall market situation. The market is relatively weak now, and trading still needs to be cautious.

بڑھتی ہوئی صورتحال:

ENS, LDO, and RPL have risen by 16%, 20%, and 17% respectively in the past 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

At present, the ETH spot ETF is likely to be approved and start trading in a few weeks to months. Before and after the ETH spot ETF is approved, the ETH/BTC exchange rate may continue to rise, and ETH is expected to break new highs in the next few months. The breakthrough of ETH will drive the market value of the entire altcoin to rise sharply. Traders on ETH will begin to have greater demand for leverage and trading. Blue chip projects, especially blue chip DeFi projects with actual returns, will continue to rise, ushering in the altcoin season.

2) Sector changes: Curve-related tokens (CRV, CVX)

بنیادی وجہ:

Influenced by yesterdays news, Bitwise submitted an S-1 revision for Ethereum spot ETF, and the SEC will end its investigation into Ethereum 2.0, which means that ETH is not a security. ETH ecosystem assets CRV and CVX also rose sharply.

بڑھتی ہوئی صورتحال:

CRV and CVX have risen 17% and 36% respectively in the past 24 hours;

مارکیٹ کے نقطہ نظر کو متاثر کرنے والے عوامل:

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

3) Sectors that need to be focused on in the future: AI sector

بنیادی وجہ:

-

Binance نے حال ہی میں FET، AGIX، اور OCEAN کے ASI میں انضمام کے لیے حمایت کا اعلان کیا، جس کی وجہ سے یورپ اور ریاستہائے متحدہ میں گرما گرم بحث ہوئی ہے اور اس نے اعلیٰ کمیونٹی کی توجہ مبذول کرائی ہے۔

-

Arweave AO announced that it has launched AO token minting. Users holding AR can obtain AO. AO issuance is relatively fair and is used for data layer business.

مخصوص کرنسی کی فہرست:

-

TAO: Bittensor ایک اوپن سورس پروٹوکول ہے جو بلاکچین پر مبنی مشین لرننگ نیٹ ورکس کو طاقت دیتا ہے۔ مشین لرننگ ماڈلز کو باہمی تعاون کے ساتھ تربیت دی جاتی ہے اور انہیں TAO میں ان معلومات کی قدر کی بنیاد پر انعام دیا جاتا ہے جو وہ اجتماعی کو فراہم کرتے ہیں۔

-

قریب: حال ہی میں، NEAR ایکو سسٹم میں بہت سے AI پروجیکٹس بلڈنگ/فنڈنگ کے مرحلے میں ہیں۔ NEAR کے مستقبل کا AI مرکز بننے کی امید ہے۔

-

ASI: انضمام کے بعد FET، AGIX، اور OCEAN کے ٹوکن میں زیادہ اتار چڑھاؤ ہو سکتا ہے اور قیاس آرائیوں کے مواقع ہو سکتے ہیں۔

-

AR: Arweave’s new token AO is about to be issued, backed by technical fundamentals and has a good track record.

3. صارف کی گرم تلاشیں۔

1) مشہور ڈیپس

Renzo: Liquidity re-pledge protocol Renzo announced the completion of $17 million in financing, which was divided into two rounds, the first round was led by Galaxy Ventures, and the second round was led by Abu Dhabi-based Nova Fund – BH Digital. Due to the good news, the REZ token rose by 3.74% in a short period of time. Although the token price fell sharply, Renzo still has $3.8 billion in TVL, and user loss is not serious.

2) ٹویٹر

Particle Network: Positioned as a modular L1 that empowers chain abstraction. In the test network Phase 1, Particle Networks Universal Account is based on Particle L1s unique high-performance EVM execution environment, linking various mainstream L1/L2s such as Ethereum, BNB Chain, Polygon, and BTC L2s. Currently, the number of accounts on its chain has exceeded 1 million, and there may be airdrops in the future. It is popular and users are recommended to participate.

3) گوگل سرچ ریجن

عالمی نقطہ نظر سے:

DJT: Pirate Wires, an American media outlet, published a tweet on the X platform, saying, Rumor has it that Trump is launching an official token on Solana — $DJT. This move has led to a surge in attention to the DJT token, and the on-chain data analysis platform Arkham officially stated that Arkham Intelligence will offer a $150,000 bounty to any user who can clearly prove the identity of the issuer of the Trump-themed Solana on-chain token DJT. But then the price began to fall back, and has fallen by more than 57% in the past 24 hours. The token price fluctuates greatly and is highly uncertain, so users are not recommended to continue paying attention.

ہر علاقے میں گرم تلاشوں سے:

(1) There is a lack of attention on a unified theme in Asia. Each country has its own focus, and there is little attention paid to projects and hot issues.

(2) There is a significant difference between the hot searches in Europe and the United States and those in Asia: English-speaking countries have shown a concentrated focus on meme tokens. For example, meme tokens such as boden, pepe, trump, and floki have a high level of attention in the United States. The United Kingdom pays more attention to public chain projects, and monad, icp, and hedra have always remained on the hot search list.

ممکنہ، استعداد ایئر ڈراپ مواقع

Skate

Skate aims to break the siloing of DApp applications with the full-chain application layer Skate. That is, Dapps can run on multiple chains with a single state, and new blockchains can also be connected to Skate. Users and developers only need to interact with Skate alone to access various networks instantly and have unified liquidity. The project party will airdrop 8% of the tokens.

Skates predecessor was the on-chain asset management protocol Range Protocol, which completed a $3.75 million seed round of financing in September last year, led by HashKey Capital and Nomad Capital.

Specific operation method: Currently, you can get 600 Ollies points and early bird NFT by completing simple tasks. Link your wallet and complete simple social media tasks such as forwarding tweets. You can mint an early bird NFT without gas fee. You can get more points by inviting.

مقدس مقام

سولانا ایکو سسٹم LST پروٹوکول سینکٹم نے باضابطہ طور پر لائلٹی پروگرام سنکٹم ونڈر لینڈ کے آغاز کا اعلان کیا۔ رپورٹس کے مطابق، Sanctum Wonderland کا مقصد SOL کا مکمل استعمال کرنا ہے تاکہ گیمفائیڈ تجربے کے ذریعے فوائد حاصل کیے جا سکیں۔ صارفین پالتو جانور جمع کر سکتے ہیں اور SOL کو اسٹیک کر کے اپ گریڈ کرنے کے لیے تجربہ پوائنٹس حاصل کر سکتے ہیں، اور پالتو جانوروں کے ذریعے EXP کما سکتے ہیں۔

اس سے قبل، سولانا ایکو سسٹم لیکویڈیٹی اسٹیکنگ سروس پروٹوکول سینکٹم نے اپنا بیج راؤنڈ توسیعی راؤنڈ فنانسنگ مکمل کیا، جس کی قیادت ڈریگن فلائی نے کی، جس میں سولانا وینچرز، سی ایم ایس ہولڈنگز، ڈی فائینس کیپٹل، جین بلاک کیپٹل، جمپ کیپٹل، مارین ڈیجیٹل وینچرز اور دیگر شامل تھے۔ کل فنانسنگ اب US$6.1 ملین تک پہنچ گئی ہے۔

شرکت کا مخصوص طریقہ: لنک کھولیں، بٹوے کو جوڑیں، دعوتی کوڈ کو پُر کریں، ② انفینٹی کے لیے سول کا تبادلہ کریں، کم از کم 0.122 SOL + 0.05 جمع کریں۔ ڈپازٹ والیٹ کو کم از کم 0.172 SOL تیار کرنے اور کم از کم 0.11 SOL جمع کرنے کی ضرورت ہے۔ پالتو جانور خود بخود بڑھے گا اور EXP کمائے گا۔ LST بیلنس 0.1 SOL سے کم ہونے کے بعد، پالتو جانور ہائبرنیشن میں داخل ہو جائے گا اور EXP کمانا بند کر دے گا۔ جو لوگ قابل ہیں ان کو 1 SOL سے زیادہ جمع کرنے کی سفارش کی جاتی ہے۔ 1 SOL 10 EXP فی منٹ کمائے گا، جسے کسی بھی وقت نکالا جا سکتا ہے، اور GAS فیس انتہائی کم ہے۔

اصل لنک: https://www.bitget.com/zh-CN/research/articles/12560603811433

【اعلانیہ】مارکیٹ خطرناک ہے، لہذا سرمایہ کاری کرتے وقت محتاط رہیں۔ یہ مضمون سرمایہ کاری کے مشورے پر مشتمل نہیں ہے، اور صارفین کو اس بات پر غور کرنا چاہیے کہ آیا اس مضمون میں دی گئی کوئی رائے، آراء یا نتیجہ ان کے مخصوص حالات کے لیے موزوں ہے۔ اس معلومات پر مبنی سرمایہ کاری آپ کے اپنے خطرے پر ہے۔

This article is sourced from the internet: Bitget Research Institute: SEC ends investigation into ETH 2.0, ETH ecosystem currencies rebound across the board

Original author: Nina Bambysheva, Forbes reporter Original translation: Luffy, Foresight News When FTX filed for bankruptcy, savvy crypto traders smelled a lucrative opportunity. Sam Bankman-Fried’s (SBF) crypto empire was wiped out of billions of dollars in customer funds, but still held $3.4 billion worth of various cryptocurrencies, an estate that had to be sold to satisfy creditors, likely at well below market prices. Most of the companies responsible for managing bankrupt assets had little experience with cryptocurrencies, and early attempts to integrate funds sometimes resulted in embarrassing losses of tens of thousands of dollars. In September 2023, bankrupt FTX tapped the asset management arm of billionaire Michael Novogratzs Galaxy Digital Holdings to help manage its massive cryptocurrency reserves, including selling, hedging, and staking cryptocurrencies. This process allows token holders to…