IOSG وینچرز: Cryoto گیم مارکیٹ کو گہرائی سے تلاش کرنا اور Ronin کے پیچھے مسابقت کو تلاش کرنا

As a product directly facing retail, games have always been expected to have a high level of mass adoption in this cycle. However, since 24 years ago, the performance of the entire secondary game sector has been lackluster. In addition to the overall downturn in the market, it is also because we are still in the early to middle stages of the bull market cycle, and retail will come later in the cycle. Historically, the leading order of indicators is BTC price > Crypto interest > blockchain game interest.

And when they finally arrive, it will be clear who really has PMF (Product Maket Fit), both in terms of game content and Infra.

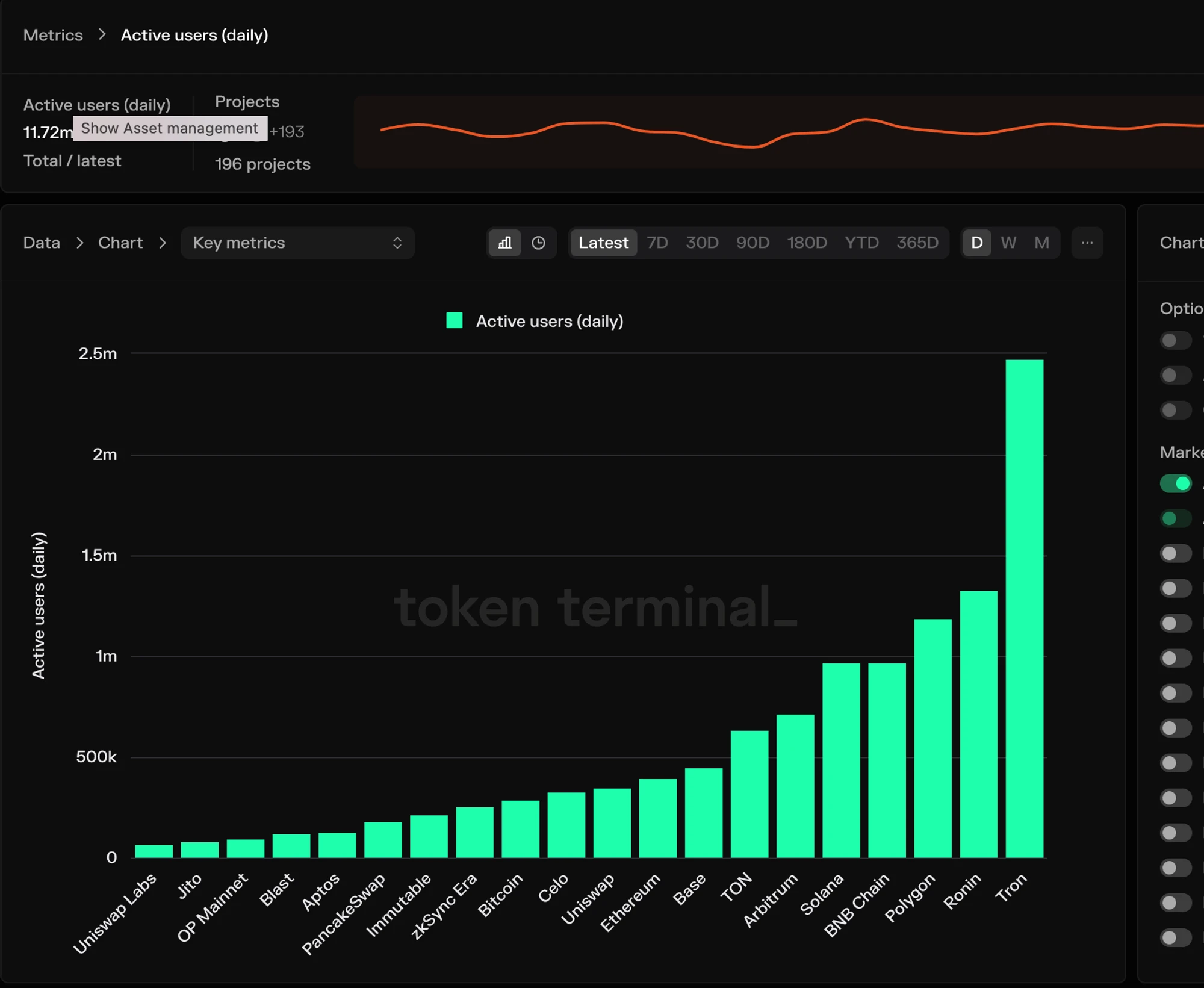

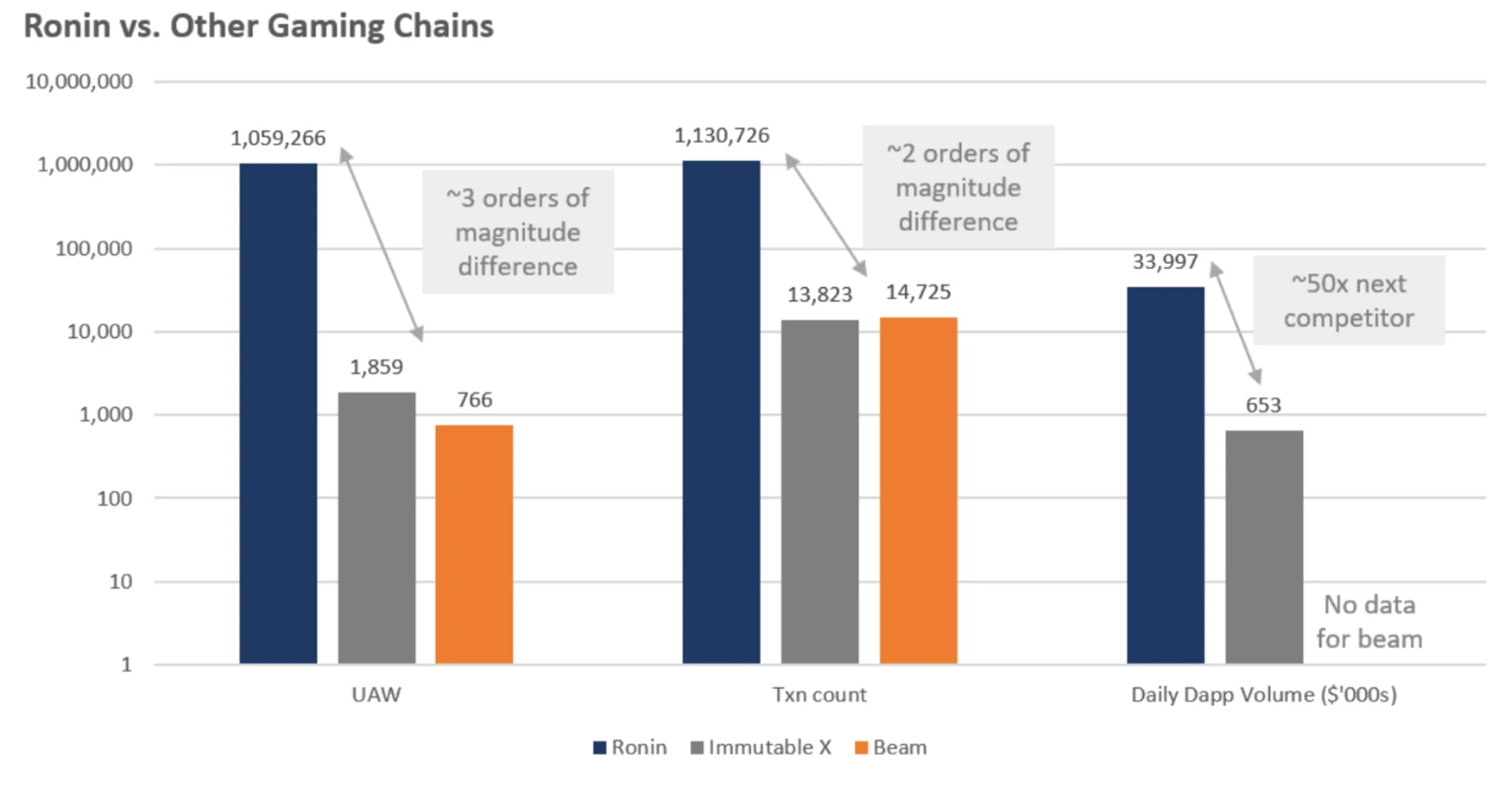

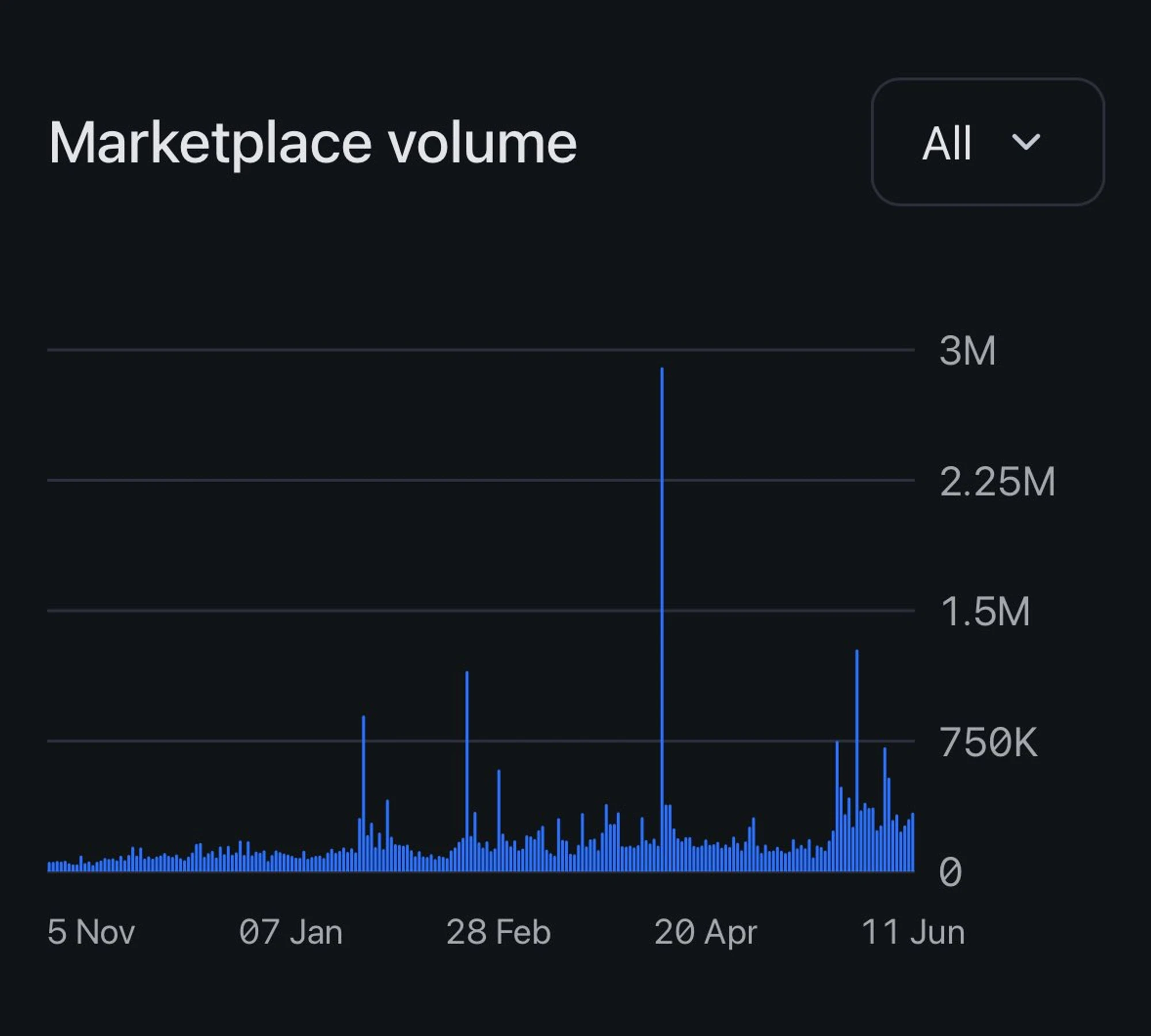

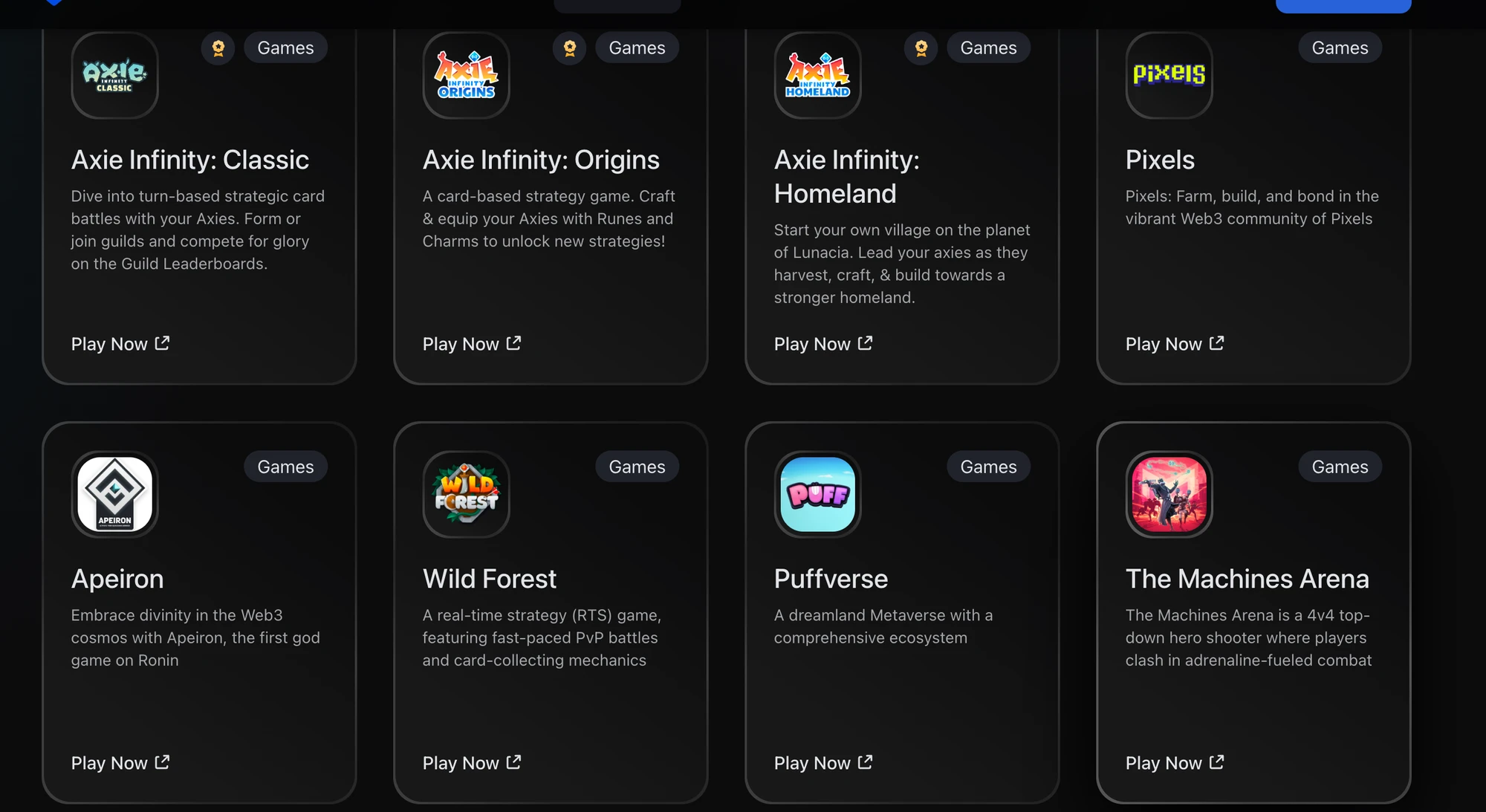

In this period of time when there are not many incremental users, there is an ecosystem that has maintained a very high user base and growth, thats Ronin (Sky Mavis behind it is also the developer of the hit GameFi Axie in the last cycle. Currently, the most popular game on Ronin is Pixel)

Ronin is essentially a side-chain of the previous generation, and its technology is not very good. The market may have only given these two a spotlight when $RON and $PIXEL were listed on Binance.

This article will explore the real competitiveness behind Ronin – Sky Mavis localized distribution and operation capabilities. In the vast ghost chain, if everyone suddenly finds out that your property, although not heavily advertised as being close to the mountains and the sea, or having school district facilities, actually has quite a few residents, how do you think the market will re-price it?

1. The ups and downs of crypto games

Whether in crypto or the real world, the evolution of bubbles generally follows a very typical cycle. The same is true for blockchain games.

1. The first cycle 20-21: When a new thing appears, Narratives > Fundamentals. A sexy narrative with a high enough ceiling will attract countless hype funds and attention. We are already transforming traditional finance, why not transform traditional Internet? Why not make Web3 games? Simple and easy-to-understand narrative + the entire track is in the ascendant, there are not many hype targets to choose from, and the market value of GameFis leading project is blown up by attention.

2. The second cycle 21-22: The success of new things attracts countless people to join. The enthusiastic funds and entrepreneurs will not explore the deep reasons for the success of new things, but only blow bubbles around the narrative. Among many entrepreneurial projects, some people have discovered the deep reasons for the success of new things and intend to add various levers to overplay this opportunity. Due to various reasons, the bubble bursts.

People are disenchanted with narrative, and the market’s perception has slipped to another extreme. Play to earn is so dead.

3. The third cycle 23-24: Because there are still large amounts of financing and projects under development in the previous bubble, and the entire track has not been completely falsified, people always have fantasies about reviving a bubble. So they continue to produce products and bring them to the market, but find that the market no longer buys the narratives of the old era.

So the projects tried to align with other new narratives… Countless gaming layer 2, countless 3A games, countless AI games.

However, when a track is no longer new and there are a wide variety of target options, the question is often, ok, good points, but whats so special about it?

Currently, it is the third cycle of crypto games. The market is more rational, and attention and funds will be focused on projects with real moats. For game projects, if they cannot find their own Unique PMF and just rely on narrative to follow the crowd, the probability of failure is high.

2. What is Value Pro of Crypto Games? Who are the real game users?

There is a big misalignment among the project owners, VCs, players, and retail investors. VCs think it is FOCG (Fully On-Chain Gaming), and think it is ground-breaking gameplay innovation. Project owners think it is AAA. Exchanges think it is the increase in web2 users. Players think it is making a lot of money. Retail investors think it is a super high multiple. We are in it for very different things, which has also led to the lack of synergy in the performance of the game in the first and second levels since 23 years. All hype does not last long.

So looking back at the P2E craze in 2021, what is Axies real PMF and what is Sky Mavis/YGGs moat?

In fact, the answer is not complicated, but it is covered by a more fancy and sexy narrative. Crypto natives turn a blind eye to this very Web2 logic.

The real core competitiveness lies in the local marketing channels/localized operation capabilities in Southeast Asia.

Without a steady stream of low ARPU (Average Revenue Per User) new users, there will be no asset accumulation, and without asset accumulation, any positive flywheel will be difficult to operate continuously. —- Whale Big R Studios are all smart money, and they have calculated the rate of return clearly for you, and they all plan to withdraw before you.

Under the prisoners dilemma, the game economy does not even have the opportunity to grow into a big r treasure pavilion and is already on the decline.

The fact is: a small incentive + simple and easy to get started with no threshold + a large number of users who are keen on gambling and pursuing small profits are the secret formula for all successful Crypto games we have seen. It just doesnt sound very impressive, so all parties pretend to be confused.

To put it more abstractly, this is a game of speculation. Secondary investors speculate on the price of coins (speculate on the progress of this Ponzi scheme), project owners invest part of their equity, and use the strong dollar to acquire customers in low- and middle-income countries for retention. Players can make a fortune by simply operating and relaxing + getting paid + having a certain chance to get company options.

The classic template of airdrop, if we add a game shell and omit various on-chain operations, can there be more Normie e-begger, and everything will be more cyberpunk and more interesting.

Of course, if your game is fun and interesting enough, it is always feasible to make a Meme coin and play with the attention economy.

3. The market has been overlooked

After we have identified the player group with the highest PMF, the question is where to find them? Southeast Asia is a market that cannot be ignored. In this market, the culture, language, and economic development level are very different from those in Europe, America, and China. Many of Tencents self-developed games were only able to solve the problem of not adapting to the local environment in Southeast Asia by relying on Garena for distribution. Garenas experience in localization is that you have to make something that users like and that they can afford, and you have to come from them and go to them.

So they put on the shelves many skins and props that dont fit the game world view, made the game extremely lightweight, sacrificed the graphics performance, and maximized the adaptability of low-end devices/poor networks. Products that are too far away from users will eventually be punished by the market.

In reality, many crypto games are facing GTM difficulties because they do not understand the market. They don’t know who their users are, where their users are, how to use UA and how to retain their users. They ignore the low ARPU (Average Revenue Per User) market, and thus Degen retail repeatedly launches Layer 2 and 3A products for a small market.

But when you come to the Philippines in Southeast Asia, these are not problems. Here you will find the most realistic p2e game scene/educated users and infrastructure. The per capita income here is less than $11, and 40% of the people do not have bank accounts. During the Axie boom in 2021, people could even use SLP to buy snacks at gas stations/restaurants. PESO has depreciated severely, and people are strong in gambling.

Although the collapse of the Axie bubble caused heavy losses to countless local players, as the market recovered, a new batch of P2E games have emerged in this market again. This rebirth after the bubble actually shows that there is real user demand behind it.

Pixel, the top-ranked game on Ronin, has seen its number of users in the Philippines increase from 80,000 to 830,000 between November 2014 and March this year, accounting for 30% of the world’s P2E gamers based in the Philippines. Interestingly, many Pixel players are actually real farmers in the suburbs of Manila. They work in the fields during the busy farming season, and earn extra income by harvesting vegetables in the crypto world during the slack season. Luke, the founder of Pixel, said that Filipino farmer players even gave him various suggestions in the community to make the game more realistic, such as fertilizers for crops, sowing and harvesting cycles, etc. . .

People don’t understand why a pixel-style Ranch Story web game without a particularly large wealth effect can continue to attract users, and why FDV on Binance has reached 1 billion?

Actually, I dont understand

1) Most players don’t actually expect to make a lot of money. They just collect as many pumpkins as they can and sell them for as much as they can. They are content with a small fortune and feel a sense of ownership when they see a full warehouse.

2) These are the few options that they can access, play with, and trust, and behind each of these subdivisions is the moat that Sky Mavis has accumulated over 3-4 years of hard work.

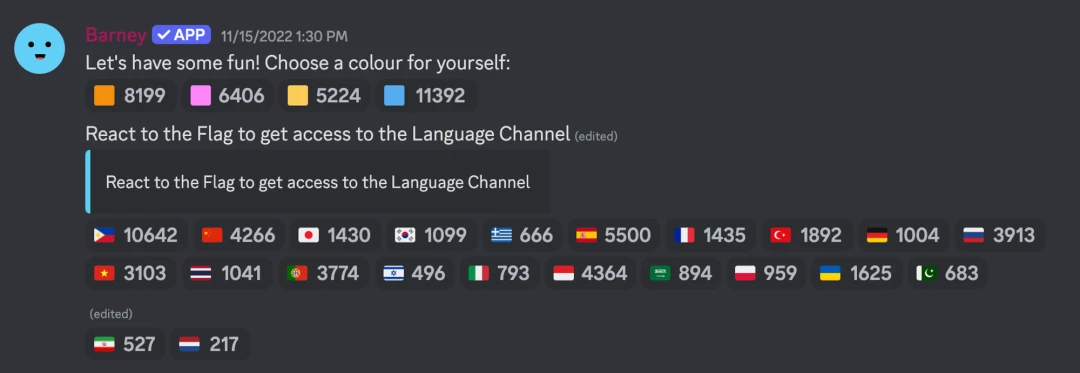

On the nationality verification interface of the Pixel discord:

In the Philippines, people gather in Internet cafes to play Heroes of Mavia and Nifty Island. Many players are full-time.

The Internet cafe/Mobile cafe in Vietnam is a completely unfamiliar gaming scene to many Western development teams.

Many people have never tried to stay in an Internet cafe with a temperature of 30 degrees, with the heat and noise of the host computer in their ears, and earn money by playing games for others under the sweat and cigarette smell of netizens. How can you ask them to make a blockchain game with real PMF?

In addition to game players, there is also a very complex business ecosystem around p2e games, such as Internet cafes, gold-making guilds, blockchain game education media, software and hardware developers, etc. Players are exposed to new game information through these very local channels and have very local/offline organizational connections with mature player communities, because they may be exposed to a certain game because their friends/neighbors/teachers/colleagues are playing it.

Without localized touchpoints and distribution and operation strategies, game projects in these markets are like sailing in the dark. This gap cannot be bridged by inviting a few local KOLs to post soft articles. Guess what? Most Filipino gamers don’t even use Twitter….

Distribution channels are one aspect, but for p2e games that require real money investment, the publisher’s brand/security endorsement is even more important.

Contrary to what many outsiders imagine, the collapse of Axie, including the collapse of the entire crypto world in 2022, actually had a very limited impact on public opinion. The reason behind this is not only that the market is inherently very degenerate, but also because players such as YGG/Sky Mavis have been investing in PR for many years (such as making documentaries about improving the livelihood of local low-income people, and stories of people from the bottom of society all-in on Axie turning over and becoming rich), which has given local people a relatively positive perception of crypto.

Therefore, in the eyes of players, P2E game = the game I see on the Ronin platform. Think about it from another perspective. If Chinese players spend a lot of money, do they feel more secure in Tencent games? If you have already put all your assets in the Ronin wallet, how easy is it for you to migrate to other games? Or, do you know of other games/wallets?

In fact, the entire Ronin ecosystem is like an isolated island compared to other chains that focus on interoperability and are eager to open up liquidity, firmly concentrating users attention and money within the ecosystem.

So for those who want to enter the Philippines, Ronin is the one only go-to.

4. P2E never dies, it only grows on suitable soil

Whether it is the Philippines, Eastern Europe, or Africa, the markets where these recently emerging free-to-play games are popular have the following similarities:

-

1) Fiat currency faces certain crises

-

2) The population structure is getting younger, with a large number of young people with free time

-

3) Underdeveloped economy, per capita income ~ US$10

Although these markets have good Crypto adaptability, their ARPU (Average Revenue Per User) is low, and they are not traditional Degen retail sources (North America, China, and South Korea). Funding is often involved in gray industries, so they are often ignored by project parties.

The cake of the sinking market is the elephant in the room.

There are many ways to make things work in the crypto world. You can tell the sexiest narratives or make the most down-to-earth products. If you choose the latter, please carefully cultivate your sinking market and face your Normie users directly.

Many crypto-native projects are very lacking in localization and normie gtm in the sinking market. After all, many projects have long regarded only two types of users as coin speculators and coin sellers, and their operations are completely free-range in some minority language regions.

Eat up the piece of cake in your hand that others look down upon, and then you will find that perhaps other people are hungry.

This article is sourced from the internet: IOSG Ventures: Deeply exploring the Cryoto Game market and exploring the competitiveness behind Ronin

ظاہر ہے کہ اس ہفتے کچھ بڑا نہیں ہوا، صرف توقع سے زیادہ ہفتہ وار بے روزگاری کے چھوٹے دعوے (231k بمقابلہ 212k) تمام بڑے اثاثہ جات کو یکجا کرنے کے لیے کافی تھے، اور Fed鈥檚 کی کمزوری پر توجہ مرکوز کرنے کے لیے حالیہ تبدیلی کو دیکھتے ہوئے جاب مارکیٹ، مارکیٹ نے بلاشبہ اس معلومات کو بہت سنجیدگی سے لیا اور شرح میں کمی کی امیدوں کو دوبارہ زندہ کرنے کے لیے جاب مارکیٹ میں سست روی کے تمام آثار تلاش کرنے کی کوشش کی۔ جیسا کہ پہلے ذکر کیا گیا ہے، موجودہ غیر متناسب رسک ریوارڈ سیٹ اپ (فیڈ اعلی افراط زر کو نظر انداز کرتا ہے اور روزگار میں سست روی کے آثار تلاش کرتا ہے) کو عام طور پر خطرناک اثاثوں کی حمایت کرنی چاہیے، اس لیے اسٹاک، بانڈ کی قیمتیں اور یہاں تک کہ بی ٹی سی سب کے ساتھ مل کر بڑھے بے روزگاری فائدہ کے اعداد و شمار. روزگار کے حالیہ اعداد و شمار کو زیادہ قریب سے دیکھنا، جبکہ نان فارم پے رولز اب بھی نسبتاً صحت مند ہیں…