سائیکل کیپٹل میکرو ویکلی رپورٹ (5.20): سونے اور امریکی اسٹاک کے ریکارڈ بلندی پر پہنچنے کے بعد، کیا کریپٹو کرنسی بہت پیچھے رہ گئی ہے؟

Market Overview

-

As not so hard economic data are released one after another, the market continues to digest the dovish Powell (there are many hawkish other members), and expectations for rate cuts have rebounded. The Dow Jones Industrial Average has risen for five consecutive weeks, and the SP and Nasdaq have risen for four consecutive weeks. In particular, the Nasdaq Technology Index rose by more than 3% this week. After the CPI data this week, U.S. stocks have recovered all of Aprils losses and hit a record high.

-

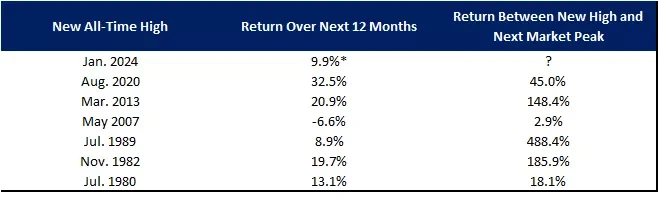

The bull run that began in October 2022 has not been without its setbacks, with the main setback coming from concerns that the Federal Reserve will keep interest rates high for a long time. Still, the SP 500 has returned nearly 52% since then, including a gain of more than 10% so far in 2024.

-

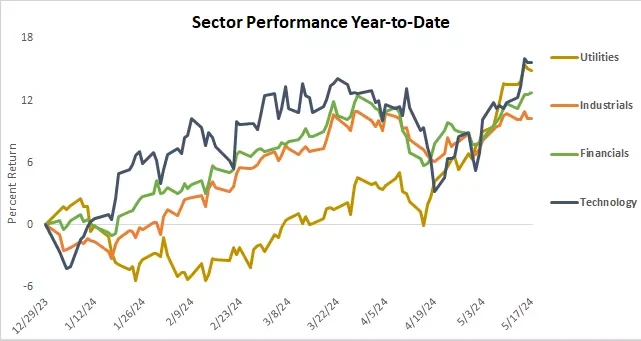

While a large part of the markets ascent since 2022 has been driven by the remarkable growth in the tech sector (along with the so-called Big Seven and particular enthusiasm for AI), what we need to see is that the breadth of the market has begun to expand recently, which is a positive sign for the durability of the bull market. It can be noticed that in recent weeks, cyclical sectors such as industrials and financials, as well as more defensive and interest rate sensitive sectors such as utilities, have gained ground.

-

Europes latest inflation data and speeches by central bank officials both support a June rate cut, which seems to be a foregone conclusion. However, European stock investors have begun to focus on the prospect of a rate cut after June. This prospect has been hit by the cautious speeches of officials, and European stocks closed slightly lower last week (but still near historical highs).

-

Chinese stocks continued to strengthen, supported by unprecedented real estate market stimulus policies. The CSI 300 rose to a 7-month high, the China Concept (HXC Index) rose to an 8-month high, and the Hong Kong stock markets strongest HSI rose 4.74% to a 9-month high, with the domestic real estate index rising 9.9% and 40% in the past four weeks. Analysts generally believe that the government wants to support this industry, but does not want to over-stimulate it, so it is still looking forward to more policy support.

-

Gold (historical high), silver (+11%), cryptocurrencies, copper, and crude oil all rose. The main background for the rise in copper prices is the expectation that the wave of electrification will drive the growth of copper demand, including electric vehicles, artificial intelligence data centers, or the expansion of power grid facilities to meet the surge in electricity demand. At the same time, as the production capacity of new copper mines decreases, the West sanctions Russias supply.

-

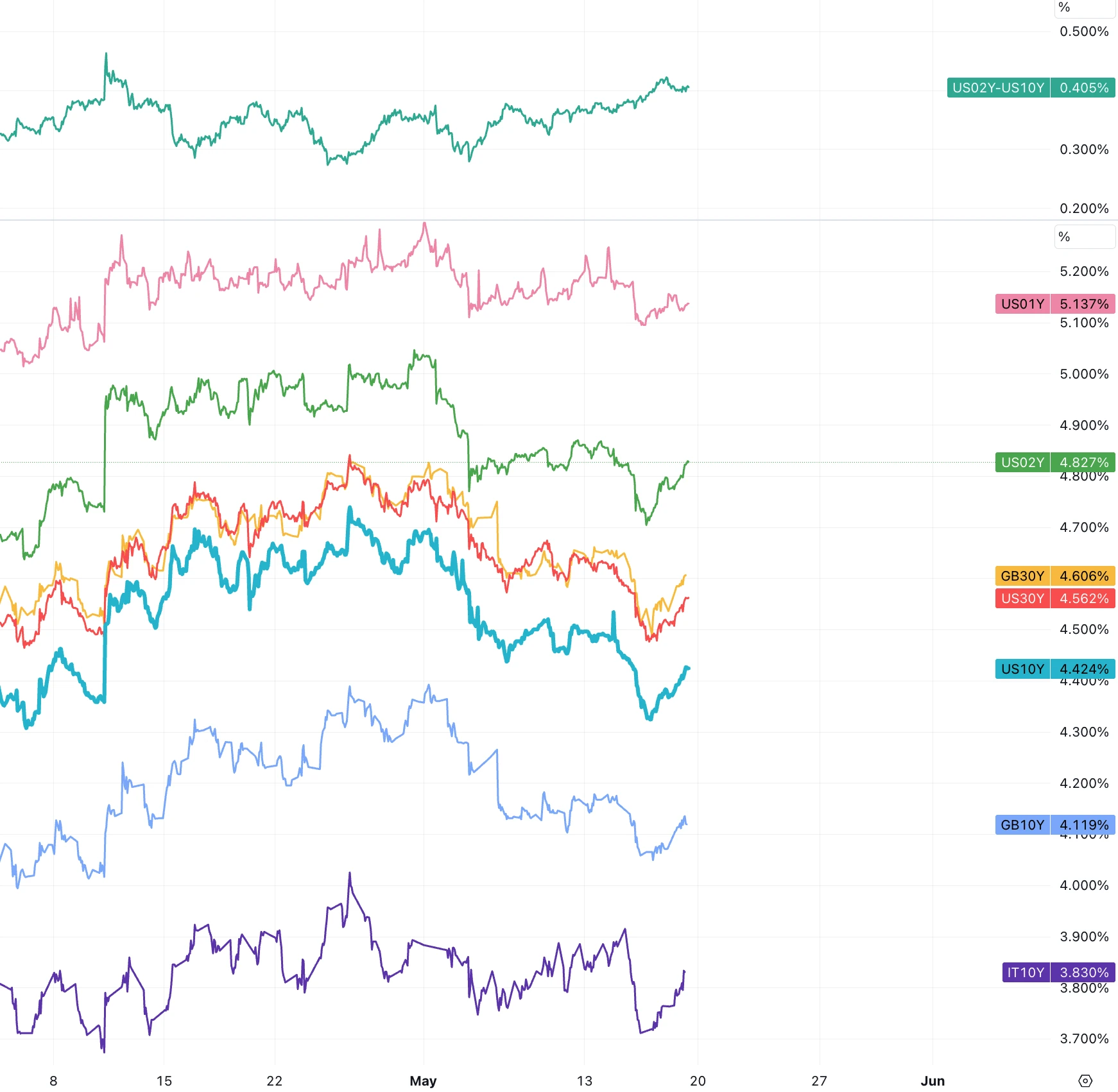

The V-shaped trend of U.S. Treasury yields fell only slightly throughout the week. Judging from the timing of the abnormal trend, this is related to the release of several leading indicators of the U.S. economy, which hinted that growth was facing serious resistance, although it was considered to be good for the stock market:

-

While it seems like goldiloc is back in the stock and commodity markets (the economy is doing well and the fed can keep inflation under control, though not necessarily back to 2%), there is some concern in the bond market.

Q1 results

Sofar 93% of SP 500 companies have reported earnings, and 78% have exceeded EPS expectations. The earnings growth rate of 5.7% is the highest year-on-year earnings growth rate since the second quarter of 2022 (5.8%). For the second quarter of 2024, 54 SP 500 companies issued negative EPS guidance and 37 SP 500 companies issued positive EPS guidance. Analysts expect EPS growth to reach 9.2% in the second quarter. In addition, analysts also expect earnings growth rates of 8.2% and 17.4% in the third and fourth quarters of 2024, respectively.

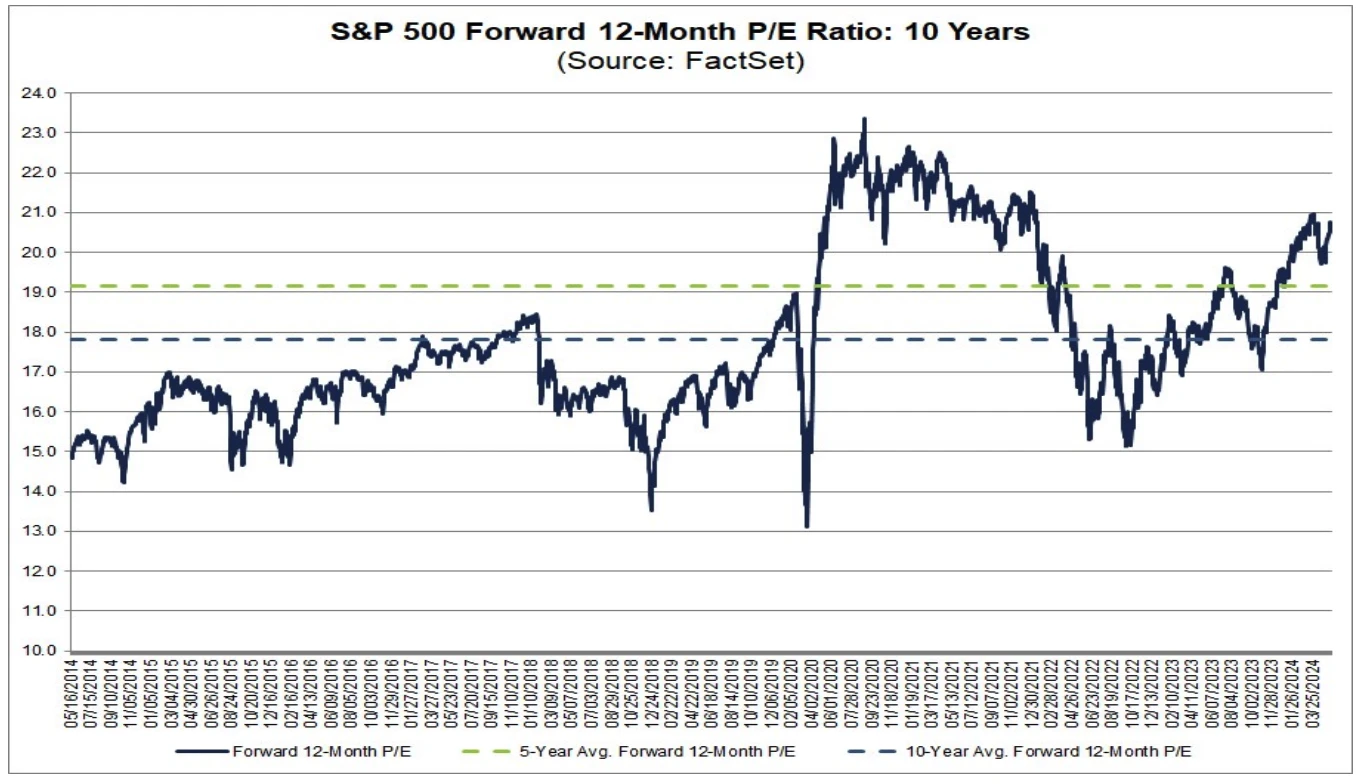

Optimistic expectations support high valuations: the SP 500s forward 12-month P/E ratio is 20.7. This P/E ratio is higher than the 5-year average of 19.2 and the 10-year average of 17.8:

Price data

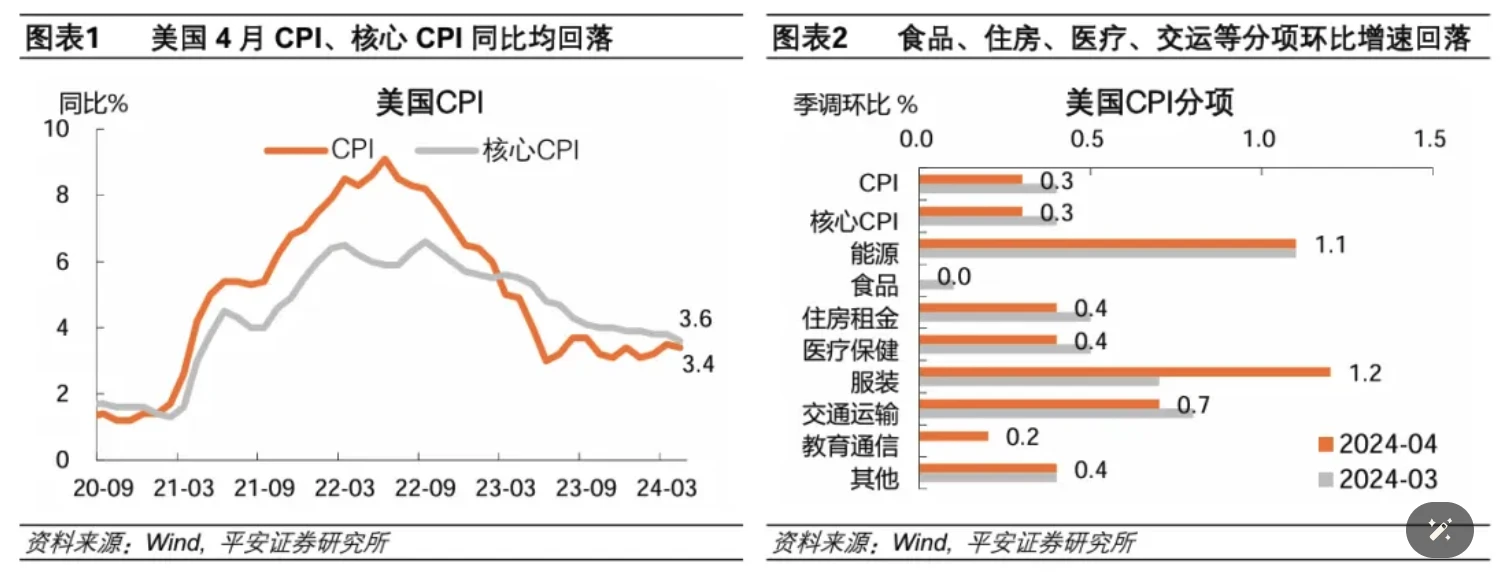

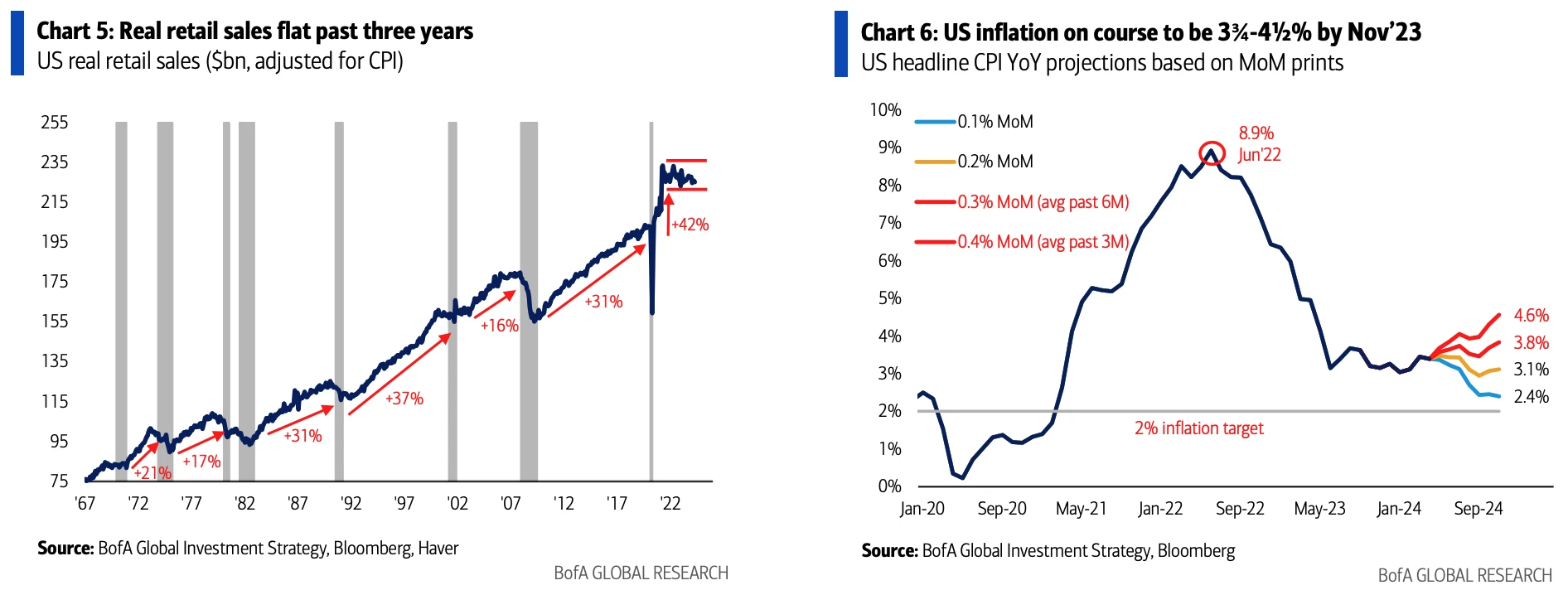

Last week, the much-anticipated April CPI (Consumer Price Index) report was released. The results were in line with market expectations, with inflation seemingly returning to a milder trend after months of reports exceeding expectations that caused market anxiety.

The fundamental trends in the CPI report are encouraging. The overall core CPI fell to 3.6% year-on-year, the lowest level in three years. It rose 0.3% month-on-month, lower than the expected 0.4% and 0.4% last month. Although these numbers alone are not particularly optimistic, this is the first CPI report this year that is not higher than expected, so it is enough to make the long-term sentiment of the bulls burst out completely after the FOMC.

Among them, commodity prices continued to fall, and the decline in the cost of automobiles and household goods played a boosting role. In the past 6 months, the core commodity side has been falling except for February, echoing Powell’s recent statement that commodity inflation has basically returned to the pre-epidemic level, and continued deflation is suppressing inflation. Core services rose by 0.4% month-on-month and 5.3% year-on-year, and it is still the most problematic part of the CPI. The biggest of them is housing, which rose by 0.4% month-on-month and 5.5% year-on-year. Rent inflation and owner’s equivalent rent (OER) both rose by 0.4%. Housing and gasoline contributed more than 70% of the increase in nominal CPI this time. Other services including transportation, auto insurance, and medical care fell slightly, and education unexpectedly rose by 0.2% (additional disturbance caused by the student movement?)

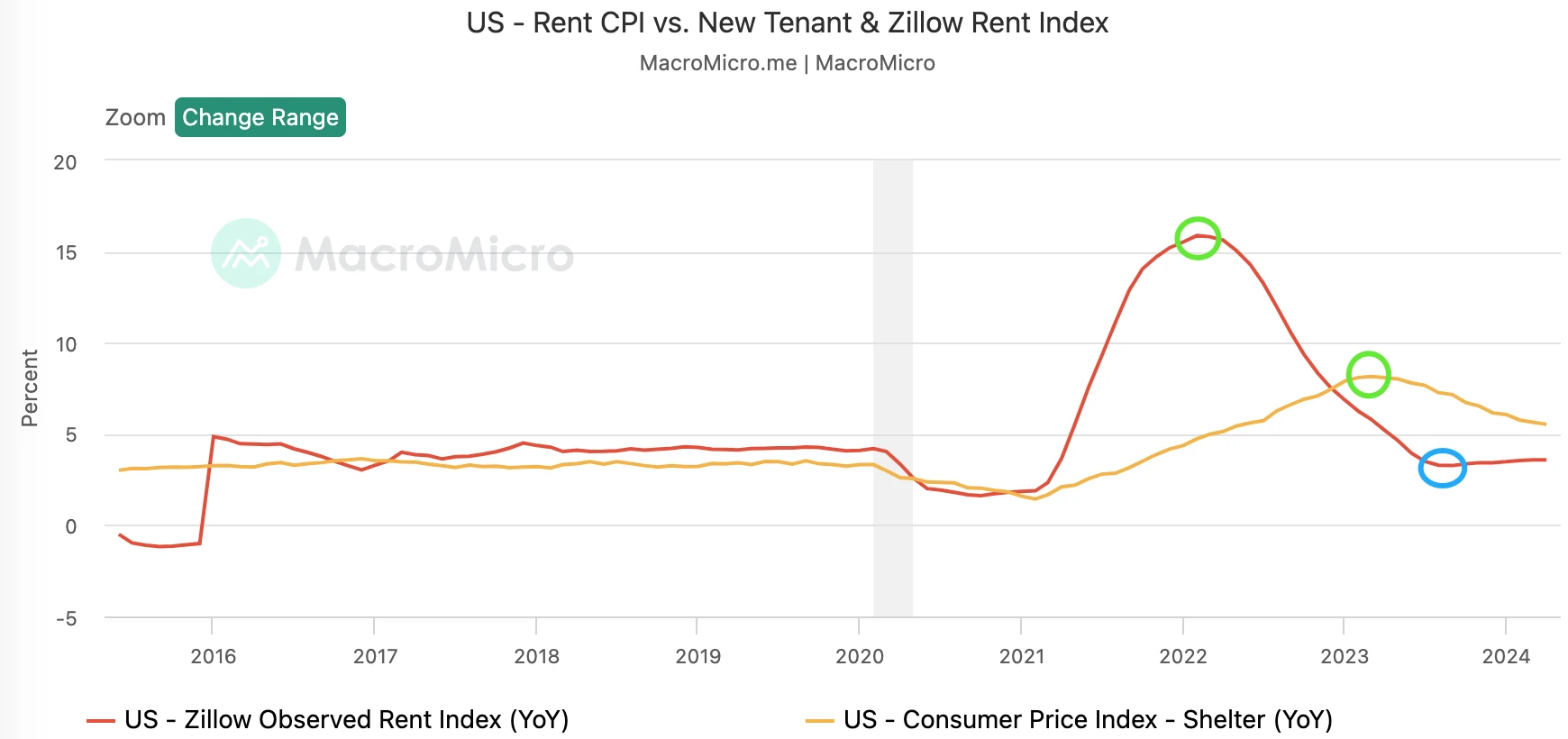

Rents lag for about a year, and house price increases are also expected to slow, so why do officials believe that inflation will continue to decline? Zillows new rental price year-on-year growth rate bottomed out in September at +3.27%, but then stagnated. Coupled with rising commodity prices, this makes people wonder whether future inflation data will continue to be better than expected:

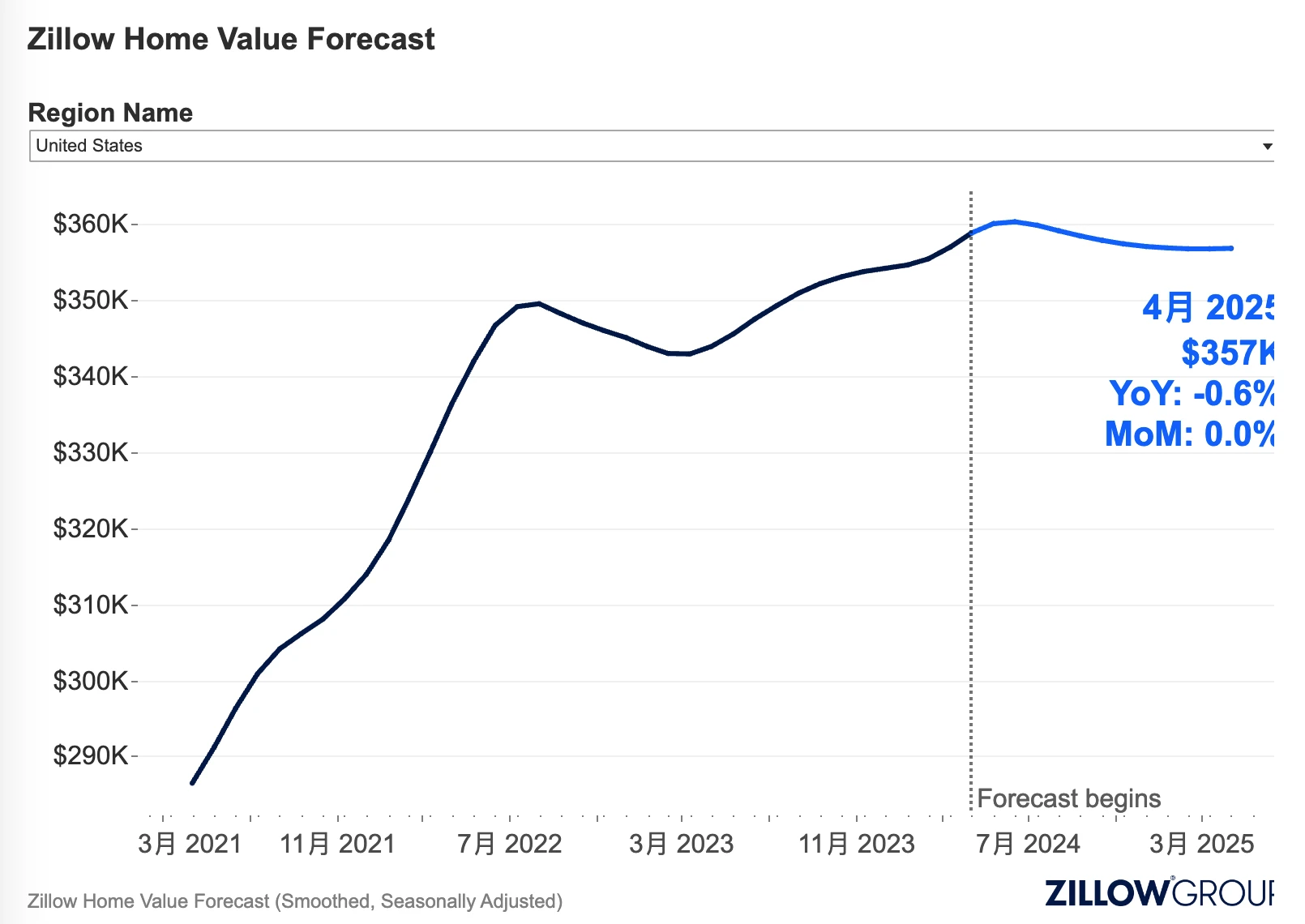

Zillow expects home prices to peak this summer and turn downward. It now expects a 0.6% increase in 2024, down from the 1.9% increase in 2024 forecast last month and well below the average annual appreciation rate of around 5% before the pandemic. Zillow predicts home prices will fall 0.9% over the next 12 months. The main reason is a surge in listings and a shift in the market in favor of buyers:

Nick, the new Fed mouthpiece, noted that after the April report, two more CPI reports are needed to boost the Feds confidence. The Fed may still not cut interest rates before September. The significance of the April CPI data is that it retains the possibility of a rate cut later this year and calms some concerns that the Fed may need to open the door to further rate hikes.

The PPI data released on Tuesday is quite interesting. Driven by energy prices and service costs, the nominal PPI rose by 0.5% month-on-month in April, significantly higher than the expected 0.3% and 0.2% last month. The annual increase was 2.2%, in line with expectations, but a new high this year. The core PPI excluding food and energy also rose by 0.5%, significantly higher than the expected 0.2%, and the annual increase was 2.4%, also in line with expectations.

These inflation figures are obviously not good news, but the market did not fall much before the opening. The reason is that the government revised the previous month. The nominal and core month-on-month growth in March changed from the original increase of 0.2% to a decrease of 0.1%. This completely changed the interpretation, from inflation to deflation. The market was confused all of a sudden. Should it be nervous about the significantly higher than expected PPI, or happy about the timely deflation last month? From the final trend, the market chose the latter, and the three major stock indexes all rose at the opening.

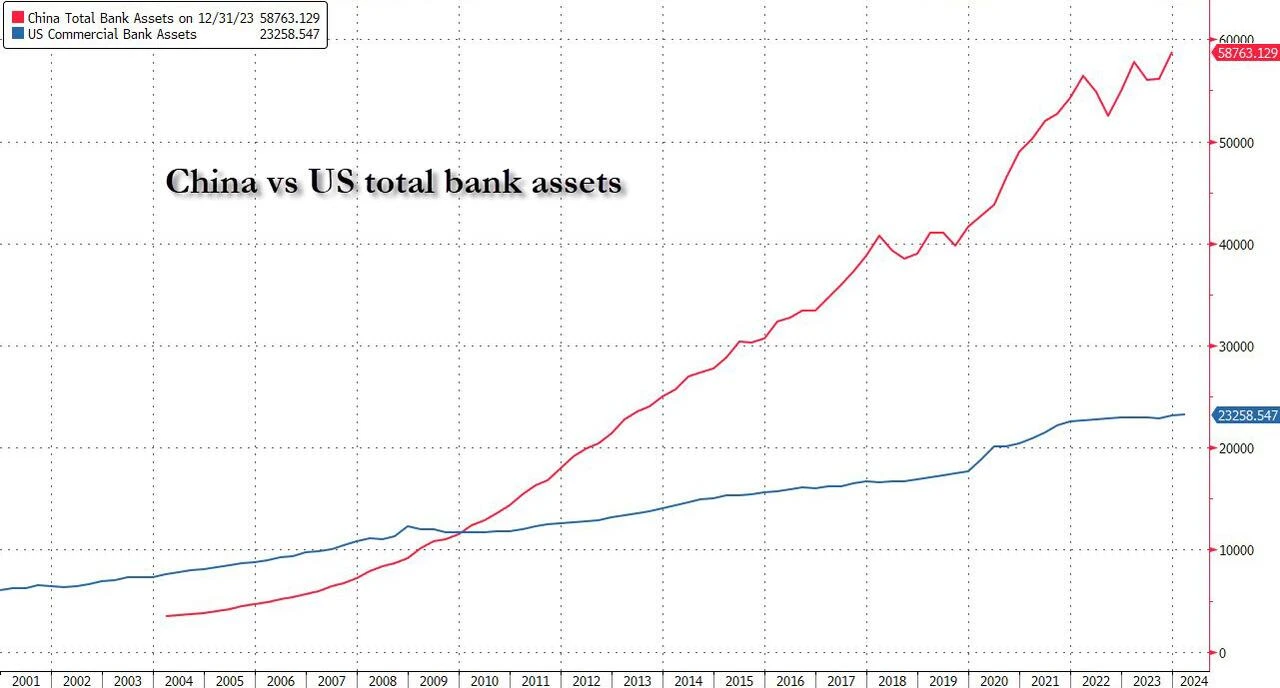

CN sells off record amount of US debt

As of March, China sold U.S. Treasuries for the fifth consecutive month, with a total of $53.3 billion sold in the first quarter, setting a record. Even during the 2008 financial crisis, such a sustained reduction in holdings of government and agency bonds was not observed.

Bloomberg analysis points out that despite being close to the Feds rate cut cycle, China is still selling dollars and the US dollar, so there should be a clear intention… As the Sino-US trade war restarts, Chinas selling of US securities may accelerate, especially if Trump is re-elected as president.

While selling off dollar assets, official gold holdings are rising again. According to PBOC data, the share of gold in reserves climbed to 4.9% in April. This is the highest level since 2015. The IMF mentioned that since 2015, China and countries with close relations have increased their gold holdings in foreign exchange reserves, while countries in the US camp have remained basically stable, which seems to mean that their central banks may buy gold out of concerns about the risk of sanctions.

On the other hand, Japan is buying. According to the Ministry of Finance, overseas holdings of U.S. Treasuries reached $8.09 trillion in March, up from $7.97 trillion the previous month, setting a new record high. U.S. Treasuries have performed strongly this month, with the most foreign buying in three months. The volume of U.S. Treasuries held by Japan has also risen sharply, now at a record high of $1.19 trillion.

MEME is booming, companies immediately cash out and suppress stock prices

From Monday to Wednesday, Roaring Kittys return to X after three years triggered a massive short squeeze on heavily shorted GameStop and AMC Entertainment Holdings, and the companys market value rose to $19.8 billion. The rally lasted only two days before entering a correction. Then on Friday, GME announced that it would use this MEME hype to issue 45 million additional shares, which severely suppressed the hype enthusiasm (retail is fuel, not people), but the stock has still nearly doubled so far in May (AMC also announced an additional $250 million in shares this week). In addition, GameStop also predicted that net sales in the first quarter would drop from $1.24 billion in the same period last year to between $872 million and $892 million.

It seems that the tokens of the MEME concept in cryptocurrencies have not been affected by the negative impact of the stock market. They have strengthened significantly in the past 7 days. Among them, PEPEs 10% increase has brought its market value to 4 billion US dollars, setting a new historical high. Its market value has entered the top 30 cryptocurrencies (including stablecoins). It is the only token in the top 100 that has rebounded to a new high.

The GME meme coin on Solana rose 40 times last week, in line with the GME stock trend:

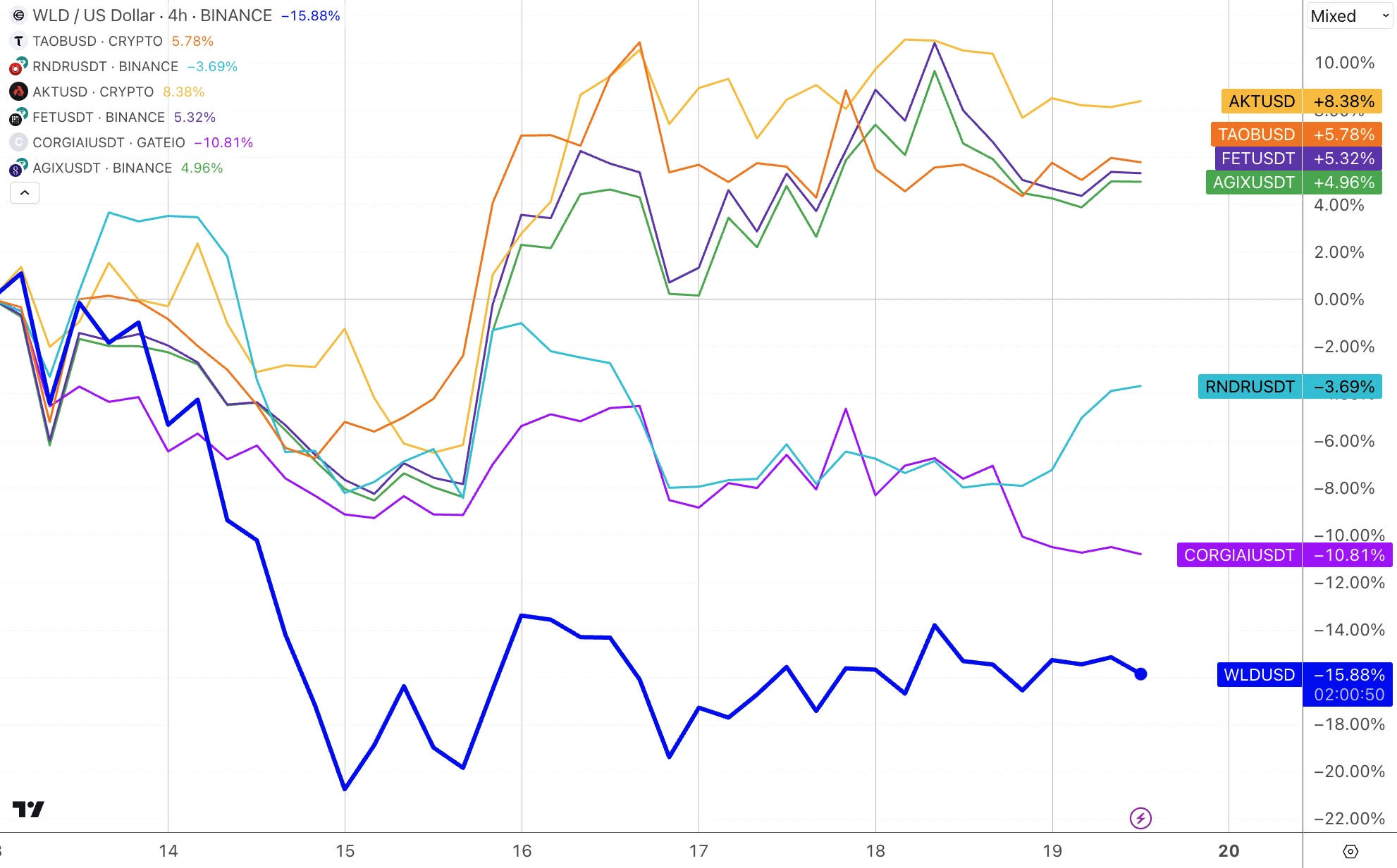

GPT 4 o One step closer to AGI

OpenAI launched a new AI model last week, called GPT 4o, which will be open to all users. It can perform reasoning across text, audio, and vision (images and videos) in real time, twice as fast as GPT 4 Turbo, and at half the cost. The new model can observe your emotions and can handle situations where you interrupt it. The new audio model can respond in an average of 320 milliseconds, which is almost the same as the response time of human communication. In the food video, 4o can have a video conversation with the user to help the user analyze the surrounding environment. OpenAI also demonstrated that 4o can help guide children to learn mathematics in real time on an iPad.

Microsofts stock price and AI-related cryptocurrencies did not react much to this. Apple, on the other hand, is said to have finalized the details of integrating some GPT technologies into the iPhone. If Siri can use these technologies, its interaction quality and user experience will achieve a huge leap, so it was Apple that reacted the most last week.

Tesla has rehired the laid-off supercharger team

According to Bloomberg, one of the returnees is Max De Zegher, the former director of North American charging business, second only to Rebecca Tinuity, the companys previous general manager of charging business. It is not clear how many people have been called back. Last Friday, Musk wrote on x that Tesla would spend more than $500 million to expand its supercharging network, and emphasized that these were just new sites and did not include the original operating expenses, trying to dispel market doubts. As for Musks erratic behavior, some supporters quoted what he said before, saying that if you want to simplify the steps, the easiest way is to delete it. If you dont add back at least 10% in the end, it means that you havent deleted it thoroughly enough. But others said that the best talents must have been snatched away immediately, and even if Tesla recruited them back, it would be a little worse, which is not a good thing.

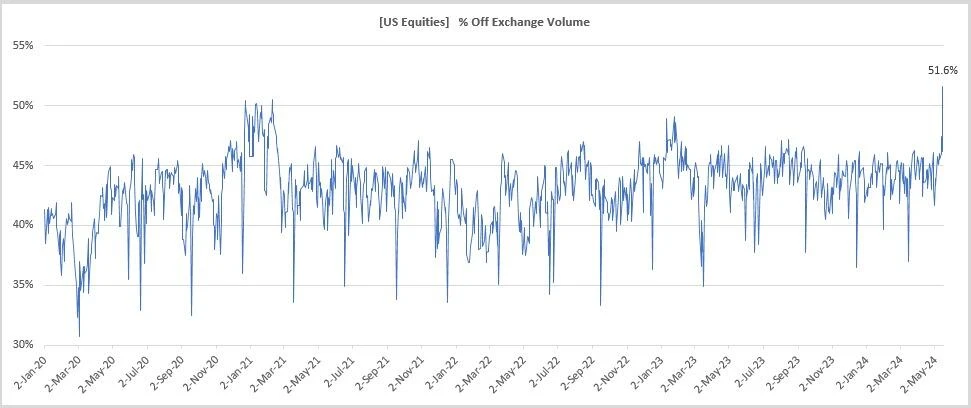

Retail investor sentiment is high

Rising OTC volumes are often seen as an indicator of rising retail trading activity, and Fridays OTC volume accounted for 51.6% of all U.S. stock trading yesterday, the highest level on record. Goldman Sachs analyst Scott Rubner said he heard more talk about FOMU (fear of missing out on a big performance) this week. In addition, the hashtag #DOW 40 K is trending on social media, indicating that retail traders are excited about the recent performance of the Dow Jones Index.

لیکویڈیٹی

Money market funds saw inflows for the fourth week in a row (+$16.4 billion), returning to all-time highs above $6 trillion after a seasonal tax-related decline, to their highest level in a month:

The abundance of cash is also reflected globally, with foreign central banks use of the Feds reverse repurchase agreements (earning interest on deposited cash) rising to the highest level in a year:

Inflows into Ut and Infra sectors were the largest in more than a year:

13 F shows Bitcoin ETFs are extremely popular in the first quarter

Nearly 1,500 holding records worth $10.7 billion, accounting for 20% of the total value of ETFs, were reported, of which 929 institutions own at least 1 Bitcoin ETF. Among them, 44% of companies hold IBIT, 65% of companies own Grayscale GBTC (which should be the shares converted after the listing, not the increase in holdings), 99% of which are located in the United States, and Hong Kong companies rank second.

The largest owner, MILLENNIUM, is worth $1.9 billion. Bracebridge Capital, a hedge fund that manages the endowments of Yale and Princeton universities, holds more than $400 million. The Wisconsin Investment Board (dominated by public pensions) reports that it has more than $160 million in Bitcoin funds. JPMorgan Chase, which has been critical of Bitcoin, also reports owning a small amount of spot Bitcoin ETF shares.

Bloomberg analysts commented, “Typically, these big fish institutions don’t show up in the 13 F for a year or so (when the ETFs get more liquidity) but as we’ve seen, these are not ordinary good signs because institutions tend to act en masse.”

IBIT also stands out for breaking the previous record of $10 billion set by a traditional ETF, crossing the threshold in 49 days. The JPMorgan Nasdaq Equity Premium Yield ETF (JEPQ) previously held the record, which took about three years.

Highlights of Big Fish’s actions in the first quarter

Shift in AI investment: Although Nvidia has been dominant in the field of artificial intelligence, many investors have turned their attention to other companies in the first quarter. For example, Druckenmiller cut his holdings in Nvidia, believing that it is overvalued in the short term. At the same time, some investors have begun to pay attention to other stocks that are expected to benefit from the AI revolution, such as Apple, Meta Platforms, and Microsoft.

Focus on Chinese companies: The Chinese stock market has been going through a rough patch due to concerns about a slowing Chinese economy. However, some prominent investors have seen investment opportunities and have increased their holdings of Chinese retail and technology companies. For example, David Tepper has significantly increased his holdings in companies such as Alibaba, Baidu, and Pinduoduo. Big short Michael Burry has significantly increased his holdings in JD.com and Alibaba.

Buffetts Secret Stock Revealed: Berkshire Hathaway has been keeping one of its portfolio stocks a secret. In its latest 13-F filing, the mystery is finally revealed: the stock is Swiss-domiciled insurance company Chubb.

CME intends to trade Bitcoin, Coinbase plummets upon hearing the news

On Thursday local time, according to media reports, the Chicago Mercantile Exchange plans to launch spot Bitcoin trading to meet the needs of Wall Street. CME declined to comment. After the news came out, the US crypto asset trading platform Coinbase fell 9.4% in the overnight market. However, CME mainly provides services for institutions, while Coinbase mainly serves retail investors – Coinbases retail trading revenue in Q1 was US$935 million, far higher than the institutional revenue of US$85 million.

This week’s focus

If there were disagreements about inflation signals last week, the next major catalyst is Nvidias report this week. Consensus estimates that Nvidias revenue for the first quarter of fiscal 2025 is expected to reach $24.65 billion, more than double the year-on-year growth. The company previously provided revenue guidance of $24 billion, plus or minus 2%. Net profit for the same period is expected to be $12.87 billion, a year-on-year increase of more than 530%.

Since the third quarter of 2022, NVIDIA has exceeded expectations for five consecutive quarters. You know, ChatGPT had not yet appeared at that time. The real explosion was in the spring of 2023, and then NVs profits began to soar due to the hot sales of artificial intelligence GPU chips. One problem is that the percentage of exceeding expectations in the last three quarters has gradually narrowed, from 2 x% to single digits, but there is no need to worry too much. After all, this is much stronger than before. Many institutions have raised NVIDIAs new target price range, ranging from US$1,100 to US$1,350.

There are several factors driving NVs upward performance guidance. First, the announcements of four technology companies, Microsoft, Google, Amazons AWS, and Meta, show that capital investment in cloud computing this year is as high as $177 billion, far higher than last years $119 billion, and will continue to increase to $195 billion in 2025. These investments will provide impetus for Nvidias continued growth in data center revenue and profits, especially in the next generation.

Blackwell AI chip will be released later this year. NV data center revenue has soared from 50% to 80%, and AI remains Nvidias main growth driver.

Analysts high confidence in Nvidias future performance growth potential is mainly based on: First, product supply and market demand. Better supply of H100 GPUs (shortened delivery time) and strong demand for H200 GPUs in China provide strong support for Nvidias current quarterly performance. The upcoming Blackwell series of GPUs (B100 and B200) are expected to be sold from the third quarter and occupy most of the market share in the fourth quarter. The average selling price of these two GPUs is about 40% higher than existing products, indicating higher revenue potential.

AMD and Intel are catching up with Nvidia. However, in the GPU market, NV firmly controls about 92% of the market share. As we have analyzed before, NVs barriers are not only the chip itself, but also the software and community ecology, which comprehensively reduce the cost of customers and make it impossible for competitors to surpass it in the short term.

In terms of valuation, NV has entered the 2 trillion club. Apples revenue is more than 7 times that of NV, so NV needs to maintain high growth to maintain its stock price. However, in order to invalidate the growth story, it will take several consecutive quarters of poor financial performance to change the markets view and cause the stock price to fall sharply. Therefore, even if this financial report disappoints everyone, the market position will not be shaken by an unsatisfactory financial report, and a rebound is expected in the short term when there are no alternatives.

In recent weeks, we have seen technology companies that have exploded, including ASML, Inter, AMD, SMCI and ARM. After the earnings reports that were lower than expected, the stock prices of all of them fell by 10 to 30%, but as of now, they have basically recovered more than half of the losses.

In addition, several senior Fed officials will make speeches this week, including Board members Barr and Waller, as well as regional Fed presidents Williams and Bostic. The focus will be on the statement of Waller, the next Fed successor, who did not make any comments on the economic and monetary policy outlook in his speech last week. The minutes of the last FOMC meeting will also be released on Thursday.

This article is sourced from the internet: Cycle Capital Macro Weekly Report (5.20): After gold and US stocks hit record highs, is the cryptocurrency far behind?

Related: Whale-Backed PEPE Coin’s Price Jumps 50%: What’s Next?

In Brief PEPE price has escaped the descending wedge it was stuck in for the past month, looking at a potential 60% rally. Whale accumulation seems to be driving the rally, with more than 3.3 trillion PEPE added in the last two weeks. Over $600 million worth of PEPE is at the cusp of turning profitable, which would boost the rally. PEPE price has seen a more than 50% rise in the span of a week and is seemingly going to continue this rally. The meme coin has also received support from its whales, and this chunk of PEPE supply could be just the boost it needs. PEPE Investors See Potential PEPE price, trading at $0.00000738 at the time of writing, has witnessed massive support from its investors. These meme coin enthusiasts have added PEPE to their wallets,…