Last Friday, the US macro data performed poorly. The one-year inflation rate expectation in May rose from 3.2% to 3.5%. The University of Michigan Consumer Confidence Index showed weakness, falling to 67.4, offsetting the positive impact of the recent weak employment data on market risk sentiment. The US 10-year Treasury yield once returned to above the 4.5% mark, and the two-year yield, which is more sensitive to interest rate policy, rose to 4.853%. Risk assets performed relatively steadily, and the three major US stock indexes rose and fell. Among them, the Dow and SP closed slightly up 0.32%/0.16% respectively, and the Nasdaq fell 0.03%. This week, the markets focus will be on the CPI data released on Wednesday, which may become a key driver of medium-term price trends.

ماخذ: سرمایہ کاری

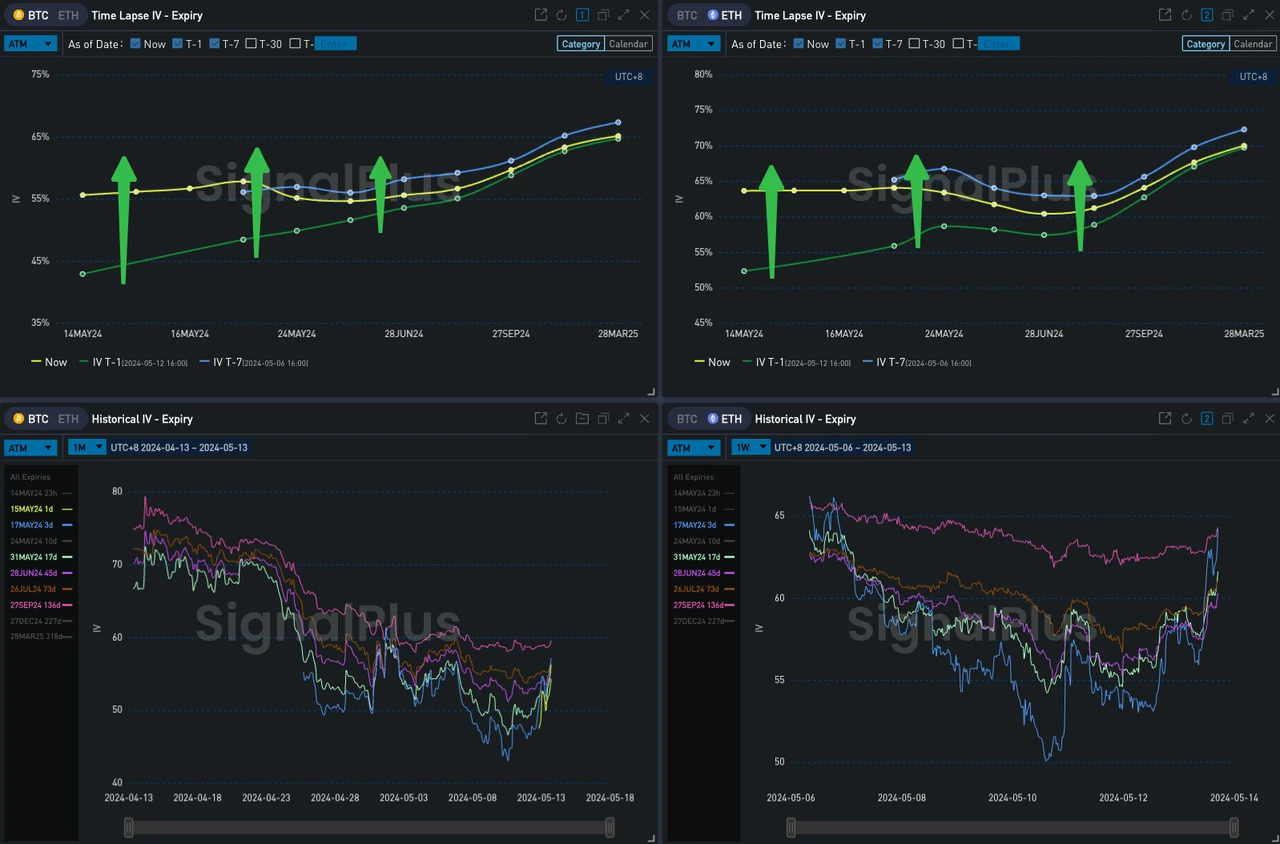

In terms of digital currency, as the beginning of the week, BTC started strongly, breaking through the 63,000 mark in the short term. The front-end implied volatility flattened and rose sharply. Among them, 17 MAY formed a local IV high under the influence of CPI uncertainty. Investors are closely watching whether consumer prices will show signs of cooling down, which will be a major boost to the market betting on digital currencies and other risky assets. On the other hand, a bad inflation report will also trigger traders concerns about economic overload and may lead to a decline in digital currency prices.

ماخذ: TradingView

There are two other things worth noting. According to Cryptonews, Japanese investment consulting service company Metaplanet has clearly stated in its statement that the companys Bitcoin-first, Bitcoin-only strategy, and provides financial solutions such as long-term yen lending and regular stock issuance, adding that this is to continuously accumulate more Bitcoin rather than retain the increasingly weak yen.

Another thing is about the US election. Recently, the Biden administrations series of measures to strengthen digital currency regulation have caused dissatisfaction among investors. As a supporter of the current US President Biden, billionaire Mark Cuban suddenly turned recently. He believes that under Bidens leadership, Gary Gensler, chairman of the US Securities and Exchange Commission, has failed to protect investors and made it almost impossible for legal cryptocurrency companies to operate. He warned that if he continued to oppose Bitcoin and cryptocurrency, Republican presidential candidate Donald Trump would likely win the 2024 presidential election. In fact, Trumps attitude towards Bitcoin has also changed 180 degrees recently. In 2019, he publicly stated that he did not like Bitcoin, but recently at the Mar-a-Lago event, he generously told the participants that if you support cryptocurrency, youd better vote for Trump, which caused a sensation in the community. The remarks were described by the US media Politico as a new weapon against Biden, and the development of digital currency policies will also play an increasingly important role in the next election.

Source: Deribit (as of 13 MAY 16: 00 UTC+ 8)

ماخذ: سگنل پلس

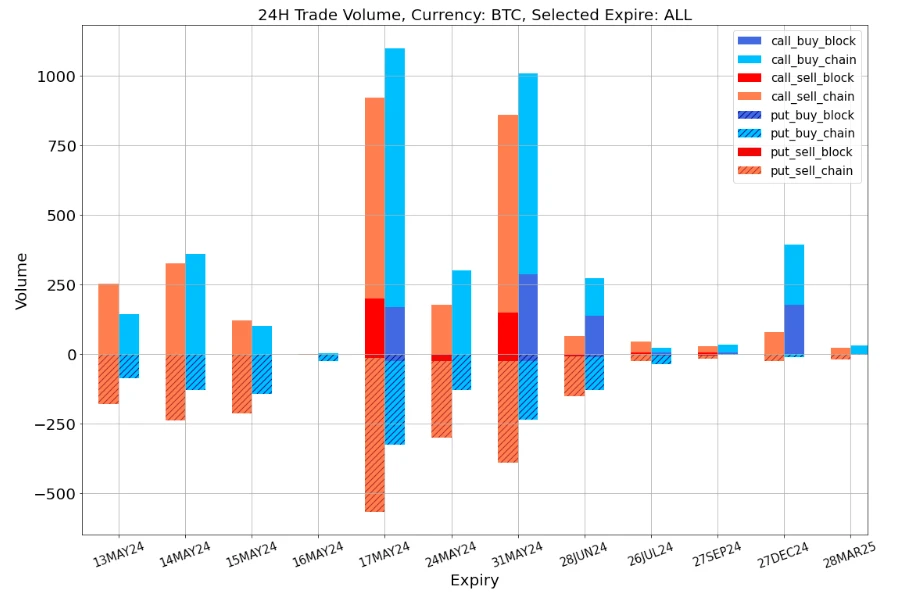

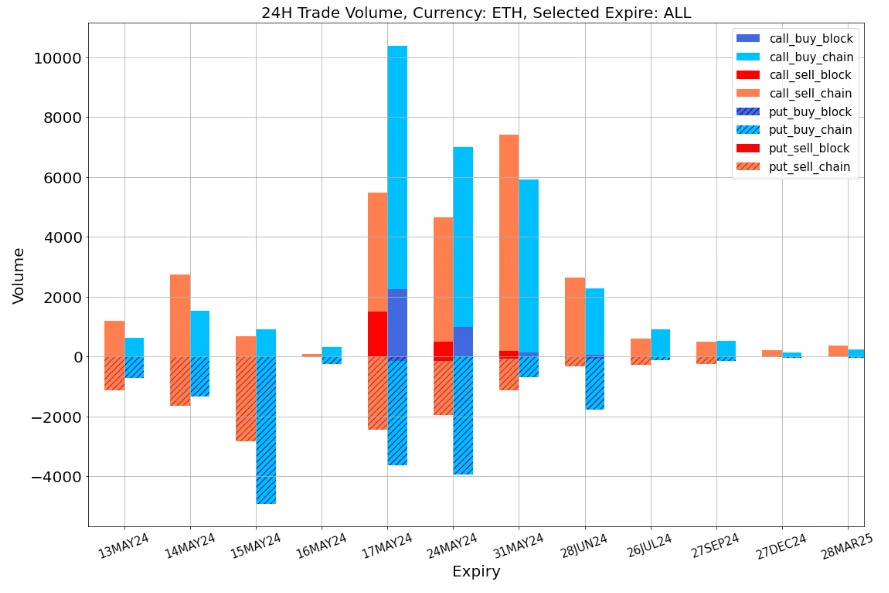

Data Source: Deribit, BTC ETH overall transaction distribution

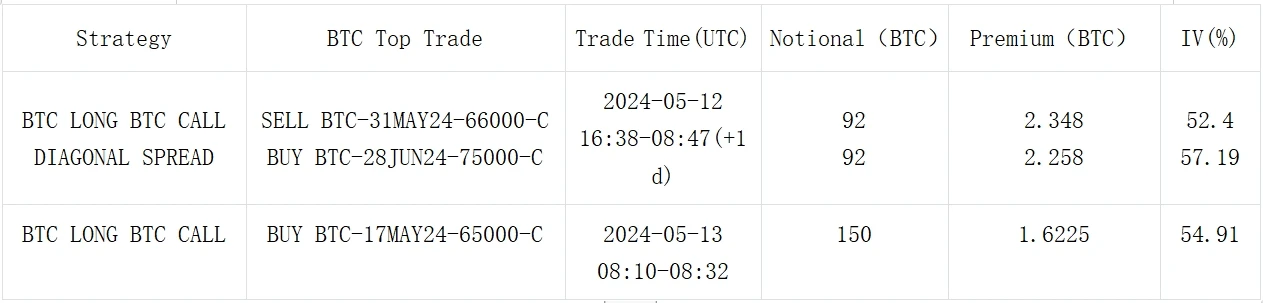

ماخذ: ڈیریبٹ بلاک ٹریڈ

ماخذ: ڈیریبٹ بلاک ٹریڈ

آپ ریئل ٹائم انکرپشن کی معلومات حاصل کرنے کے لیے ChatGPT 4.0 کے پلگ ان اسٹور میں SignalPlus تلاش کر سکتے ہیں۔ اگر آپ ہماری اپ ڈیٹس فوری طور پر حاصل کرنا چاہتے ہیں، تو براہ کرم ہمارے ٹویٹر اکاؤنٹ @SignalPlus_Web3 کو فالو کریں، یا ہمارے WeChat گروپ میں شامل ہوں (اسسٹنٹ WeChat: SignalPlus 123)، ٹیلی گرام گروپ اور Discord کمیونٹی میں مزید دوستوں سے بات چیت اور بات چیت کرنے کے لیے۔ سگنل پلس کی سرکاری ویب سائٹ: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240513): Strong Start

متعلقہ: Crypto Whale Meme Coin PEPE میں $10.4 ملین خریدتی ہے

مختصراً کرپٹو وہیل PEPE میں $10.4 ملین کی سرمایہ کاری کرتی ہے۔ لین دین میں 1.238 ٹریلین PEPE شامل ہیں۔ PEPE کی قدر میں پچھلے مہینے 29.70% اضافہ ہوا ہے۔ ایک قابل ذکر لین دین نے کرپٹو کرنسی مارکیٹ کو ہلا کر رکھ دیا ہے کیونکہ ایک کرپٹو وہیل نے مبینہ طور پر $10.4 ملین کی سرمایہ کاری meme coin PEPE میں کی۔ مارکیٹ کی سرگرمیوں میں اضافے کے درمیان سامنے آنے والی اس خاطر خواہ سرمایہ کاری نے اس میم سے متاثر ڈیجیٹل اثاثے کے مستقبل کے بارے میں شدید بحث کو جنم دیا ہے۔ کرپٹو وہیل نے 1.24 ٹریلین PEPE ٹوکنز اسپاٹ آن چین خریدے، جو کہ ایک معروف کرپٹو اینالیٹکس پلیٹ فارم ہے، نے اس لین دین کو نمایاں کیا۔ 0x1a2e64b8a1977bf018850b377020bc33eaaaac3c9 کے نام سے ایک کثیر دستخط والے والیٹ کے بارے میں تفصیلات سامنے آئیں، جس نے Binance سے حیران کن 915.85 بلین PEPE ٹوکنز کی نقل و حرکت میں سہولت فراہم کی۔ اس ابتدائی لین دین کی قیمت تقریباً $7.75 ملین تھی، جس کا حساب $0.000008466 فی ٹوکن کی شرح سے کیا گیا تھا۔ اگلے 28 گھنٹوں کے دوران تیزی سے…