HBAR 6-Week Long Downtrend Strengthens, Price Recovery Uncertain

HBAR has been facing a persistent downtrend since mid-January, with the altcoin failing to recover from the market’s negative pressures.

Despite finding support at $0.20, broader market conditions and technical indicators suggest that a substantial rebound for HBAR is unlikely in the near future.

HBAR Bulls Nightmare Continues

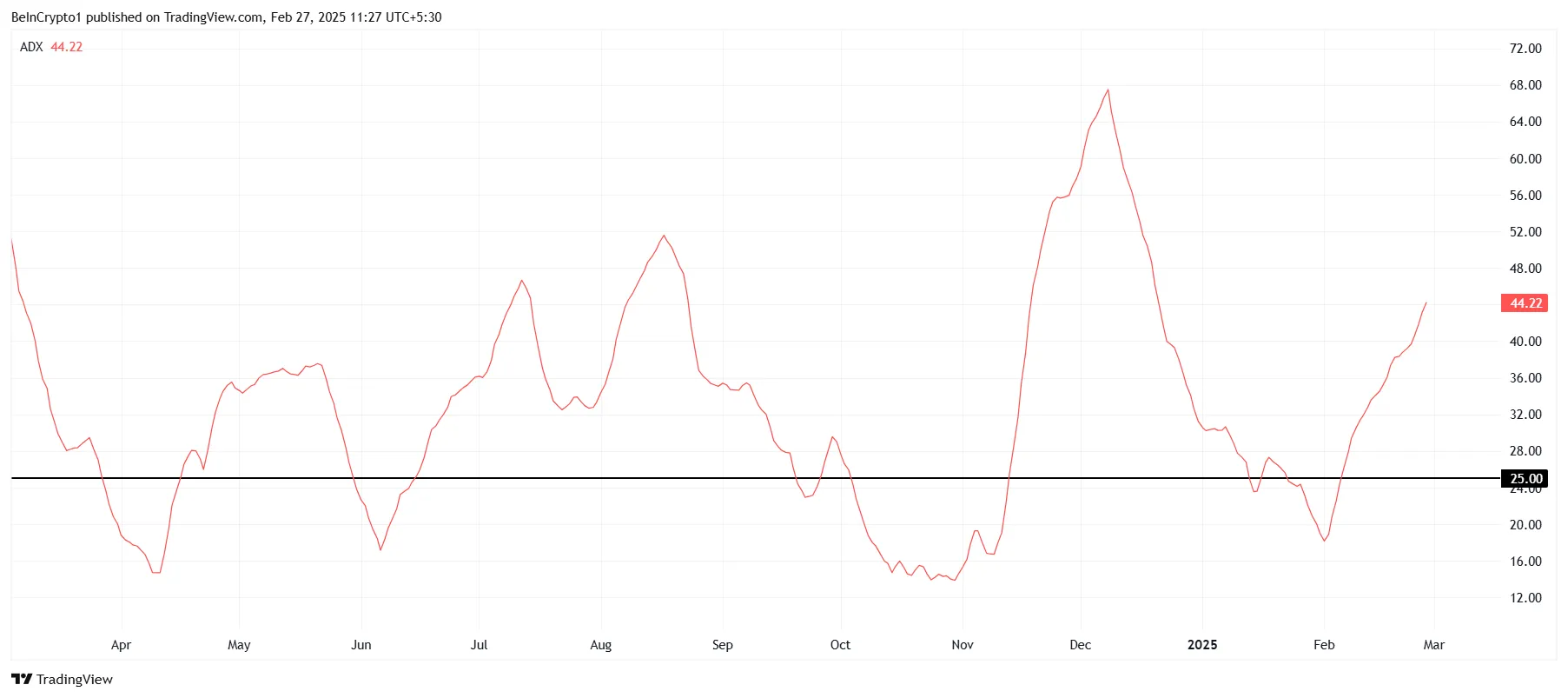

The ADX (Average Directional Index) has been rising steadily and currently stands at 44, significantly higher than the 25.0 threshold. This uptick indicates that the downtrend is gaining strength, suggesting that HBAR is more likely to experience further declines. As the selling momentum intensifies, investors could see prolonged losses if the trend continues.

In addition to this, market sentiment remains weak for HBAR. The ongoing downtrend reflects investors’ lack of confidence in a strong recovery as the price struggles to hold above critical support levels. The ADX indicator’s rise is a worrying signal that the downtrend may persist, limiting any potential recovery for the altcoin.

HBAR’s broader market momentum also reflects a bearish outlook, especially when considering the technical indicator RSI (Relative Strength Index). The RSI is hovering close to entering the oversold zone, indicating that the market sentiment is overwhelmingly negative. Historically, when RSI falls below 30.0, a reversal might be expected; however, past data suggests that this does not always guarantee a bounce-back.

HBAR’s position near the oversold zone does not necessarily signal an impending recovery. While an RSI below 30.0 typically indicates that the asset is oversold, historical trends suggest that such conditions have not always led to quick recoveries. This raises doubts about whether HBAR can bounce back in the short term or whether further declines are in store.

HBAR Price Needs A Strong Push

Currently, HBAR is trading at $0.20, holding above the support level of $0.19. Over the past six weeks, the altcoin has dropped significantly from $0.37 to its current price. If the downtrend persists, the altcoin could test lower levels, with the next key support at $0.17. A failure to maintain the $0.19 level would likely push HBAR further down.

The combination of technical indicators and the continued negative sentiment suggests that HBAR is at risk of further decline. Should the altcoin lose the $0.19 support, the next significant level of support at $0.17 could be tested, extending the losses for investors. A drop in these levels would deepen the negative outlook.

However, a break above the current downtrend and a successful breach of $0.22 could signal a shift in momentum for HBAR. Securing $0.22 as support could indicate that the altcoin is starting to recover, potentially invalidating the bearish thesis.

Bu makale internetten alınmıştır: HBAR 6-Week Long Downtrend Strengthens, Price Recovery Uncertain

Related: OSL Group Announces Expectations of Record Revenue and Positive Earnings in 2024

OSL Group (863.HK), the only listed company in Hong Kong that focuses on digital assets (together with its subsidiaries, the Group), today announced a profit forecast for the year ending December 31, 2024 (the Year). The Group expects to achieve record revenue in 2024 and to record profit for the first time since entering the digital asset market in 2018, marking a historic milestone. The Groups financial performance has improved significantly this year, demonstrating the effective leadership of the management team and the successful execution of the development strategy. 2024 Financial Performance Highlights Based on the preliminary review of the unaudited consolidated management accounts for the year and the information currently available to the Board, the Group expects that: – It will record revenue between approximately HK$337 million and HK$375…