2024 Memecoin Annual Consumption Report: The largest paying player spent $130 million in fees, Raydium and Bot were the

Original author: ChainCatcher, Tesa

Memecoin has become the biggest hot spot in the Crypto world in 2024. Rapidly soaring from a market value of $20 billion in 2023 to over $100 billion in 2024, Memecoin has not only consolidated its position in the kripto market, but its performance has far exceeded the Benchmark index of mainstream cryptocurrencies such as Bitcoin and Ethereum, becoming the most dazzling asset class of the year.

In this trading boom, a large number of pay-to-win players emerged. They paid huge fees in Memecoin transactions, which directly promoted the prosperity of public chains such as Solana, and also made Memecoin infrastructure platforms such as Raydium, Jito, and Pump.fun earn a lot of money.

Recently, ChainCatcher, Memecoin smart trading platform Tesa and Memecoin project Evan the Hobo jointly released the 2024 Memecoin Annual Consumption Report. The report deeply analyzes the consumption data of Memecoin players with transaction amounts exceeding US$1,000 among approximately 4 million user addresses on the Solana chain in 2024. Starting from the distribution of handling fees, it comprehensively presents the consumption behavior of Memecoin users in this year and the benefits of various platforms.

If you need a personal report on Solana consumption in 2024, please check this link: https://report.tesa.top/

Core data at a glance

-

Total Solana chain Memecoin transaction fees: over US$3.093 billion.

-

Revenue of major core platforms:

-

DEXs such as Raydium: earned $1.7 billion in fees, accounting for 56%.

-

Trading BOT: Cumulative fees amounted to US$750 million, accounting for 24%, of which Photon led with a 33% share.

-

MEV Infrastructure Jito: Earned $340 million, accounting for 11%.

-

Pump.fun: Earned $240 million, 8%.

-

User concentration: The top 10% of users contribute 90% of transaction fees, with whale users spending an average of $13,000.

-

Top users: Raydium’s biggest spenders spend nearly $130 million a year.

Memecoin total fee size and consumption distribution

1. Total fees exceeded US$3 billion

As the most popular Memecoin public chain in 2024, Solanas on-chain transaction fee data has almost become a microcosm of the entire Memecoin market consumption. By counting the approximately 4 million Solana user addresses with transaction amounts exceeding US$1,000 in 2024, it was found that the total transaction fees generated by Memecoin transactions on the Solana chain alone reached US$3.093 billion, demonstrating Solanas dominant position in Memecoin transactions.

2. DEX Raydium and other DEXs are the biggest beneficiaries, earning more than $1.7 billion in fees

The more than $3 billion in transaction fees contributed by Memecoin users mainly flow to four major platforms: decentralized exchanges (DEX) such as Raydium, trading BOTs (such as Photon), MEV infrastructure Jito, and one-click coin issuance platform Pump.fun.

Among them, DEXs such as Raydium ranked first with over $1.7 billion in fee income, accounting for 56% of the total, of which Raydiums fee income accounted for 80% of all Dex. Trading BOT ranked second with $750 million, accounting for 24%.

Jito, which provides priority trading (anti-squeeze) services, earned $340 million, or 11%, with its exclusive capabilities, while Pump.fun earned $240 million, or 8%, by simplifying the coin issuance process.

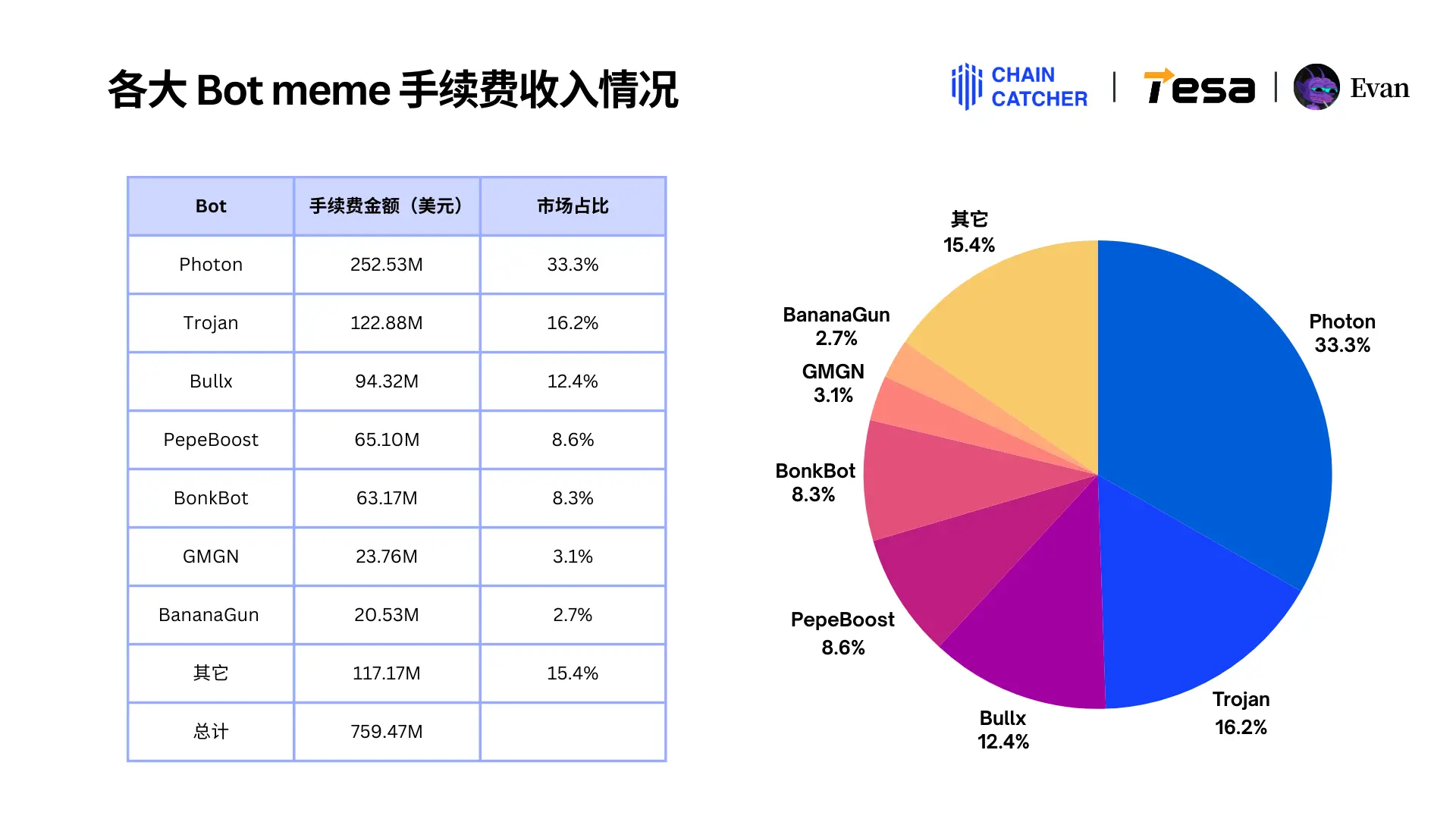

3. Photon is the most popular trading BOT, with transaction fees accounting for more than 33%

Among all types of trading BOTs, Photon performed the best, earning a total of $250 million in fees in 2024, accounting for 33.3% of the total fees of all trading BOTs. Trojan and Bullx followed closely behind, earning $123 million and over $9,400 in fees, respectively, accounting for 16.2% and 12.4%.

In addition, the revenues of other BOTs were also considerable: PepeBoost earned $65.1 million, accounting for 8.6%; BonkBot earned $63.17 million, accounting for 8.3%; GMGM and BananaGun earned $23.76 million and $20.53 million, respectively, accounting for 3.1% and 2.70%.

At the same time, the data provider of this report, Tesa meme trading platform, provides users with a completely different choice. Compared with the traditional BOT that charges 1% of the transaction amount, Tesa adopts a subscription model to reduce user transaction costs. In addition, Tesa has launched the CEX coin sniping function .

4. Whale users spent an average of $13,000 in Memecoin fees in 2024

In 2024, the average transaction fee expenditure of Memecoin players on various platforms showed significant differences:

-

Raydium: $445.45/user

-

Trading BOT: 193.89 USD/user

-

Jito: $87.07/user

-

Pump.fun: $63.13/user

Based on the amount of handling fees, users are divided into three categories:

-

Whale users (the top 5% with the highest transaction fees): The average annual expenditure per person is as high as $13,000.

-

Ordinary users (with transaction fees in the 20%-30% range): average spending per user is $171.28.

-

Novice users (the 25% with the lowest transaction fees): the average expenditure per person is only US$17.67.

In terms of platform preference, Raydium and Trading BOT have become the main places for whale users and ordinary users to spend transaction fees, while novice users are more inclined to choose Trading BOT and Pump.fun.

5. The largest “paying gold player” on a single platform spent $129 million in fees

In 2024, the Memecoin market gave birth to real pay-to-win players. Among them, the user address MfDuWeq on platforms such as Raydium paid up to $129 million in fees in one year, far ahead of other platforms.

In comparison, the maximum transaction fees of other platforms are relatively “moderate”:

-

Trading BOT: $1.43 million

-

Jito: $6,139,900

-

Pump.fun: $2,399,200

This significant difference further highlights Raydium’s dominance in the Memecoin trading market.

2. Memecoin user consumption concentration and cross-platform characteristics

1. The top 10% of users contribute more than 90% of the transaction fees

The consumption behavior of Memecoin users shows an obvious 80/20 rule: a small number of top users contribute most of the transaction fees. The specific data is as follows:

-

The top 1% of users contributed 67.46% of the transaction fees, with an average transaction fee of $53,000 per person.

-

The top 10% of users contributed 90.97%, with an average transaction fee of approximately $7,182 per person.

-

The top 20% of users contributed 95.24%. The average transaction fee per person was about $3,760.

This highly concentrated consumption pattern shows that the transaction fee income of the Memecoin market mainly depends on a small number of high-spending users, while the transaction fee expenditure of most ordinary users accounts for a relatively low proportion.

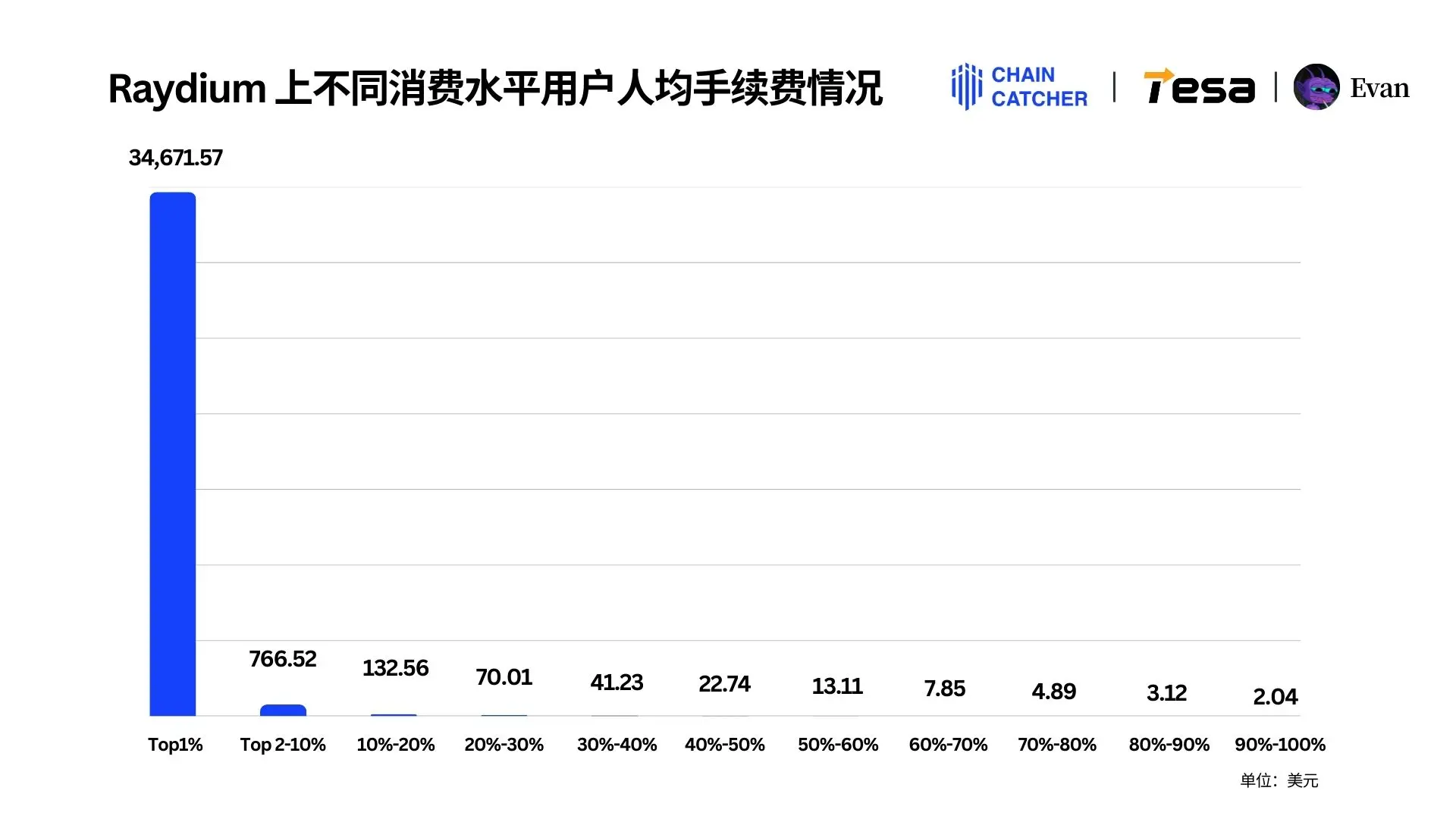

2. Raydium has the highest consumption concentration, while Pump.fun has the lowest

Among the four Memecoin platforms, Raydium, Trading BOT, Jito and Pump.fun, Raydium has the highest consumer concentration. Data shows that the top 1% of users contributed $1.358 billion in fees, accounting for 79.88% of the total fees of $1.7 billion, and the average fee per person reached $34,700; while the average fee per user ranked 2-20% was less than $800, and the average fee per long-tail user ranked after 20% was less than $100. This also reflects the characteristics of Raydiums high reliance on top users.

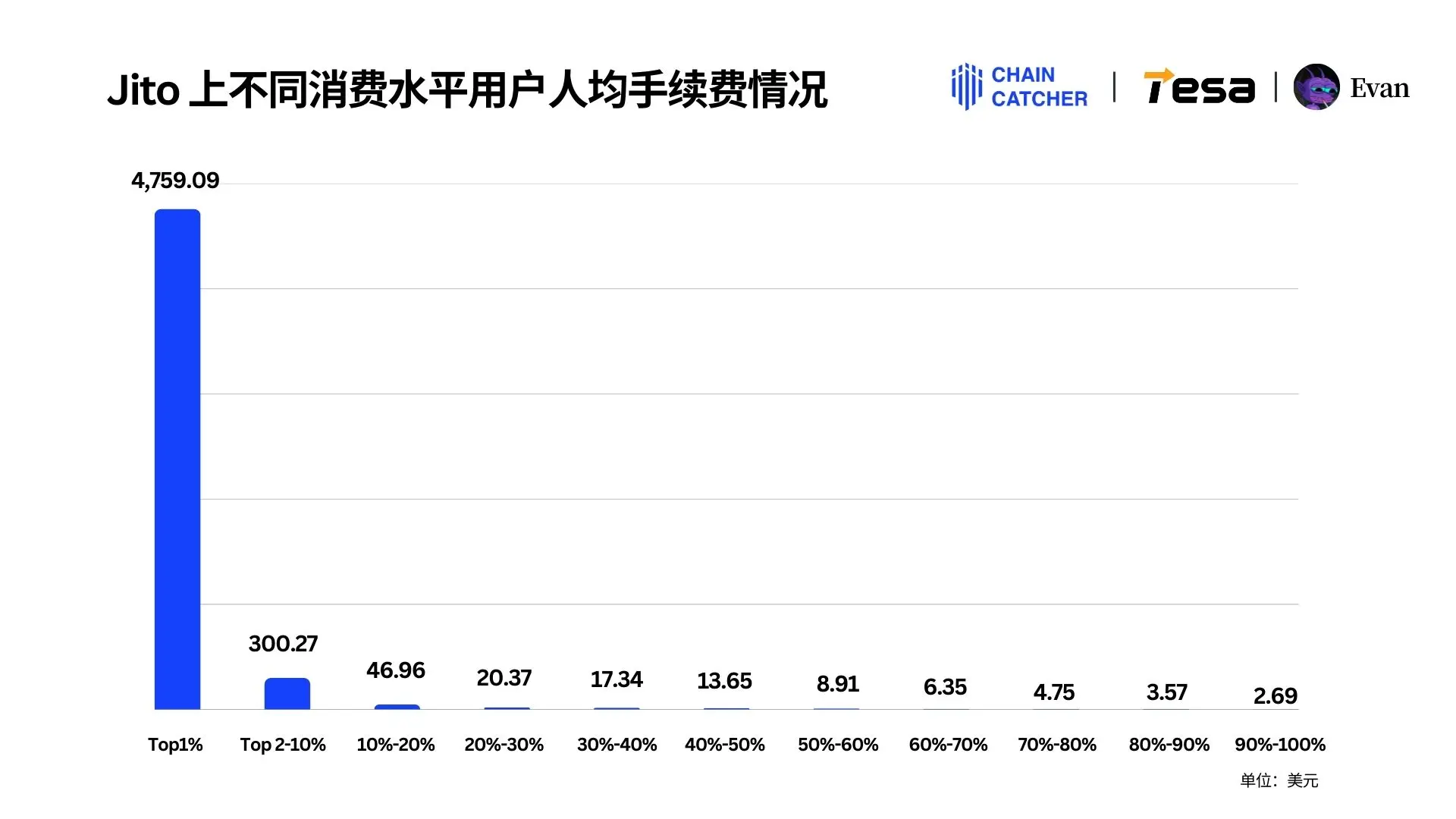

In contrast, the top 1% of Jito users contributed $186 million in fees, accounting for 54.55%. Although the concentration is lower than Raydium, it is still more than half. The average fee per Jito user and long-tail user is also quite different. The top 1% of users is about $4,759, while the users ranked between 2% and 10% drop to $300, and the long-tail users ranked after 10% have an average fee of less than $50.

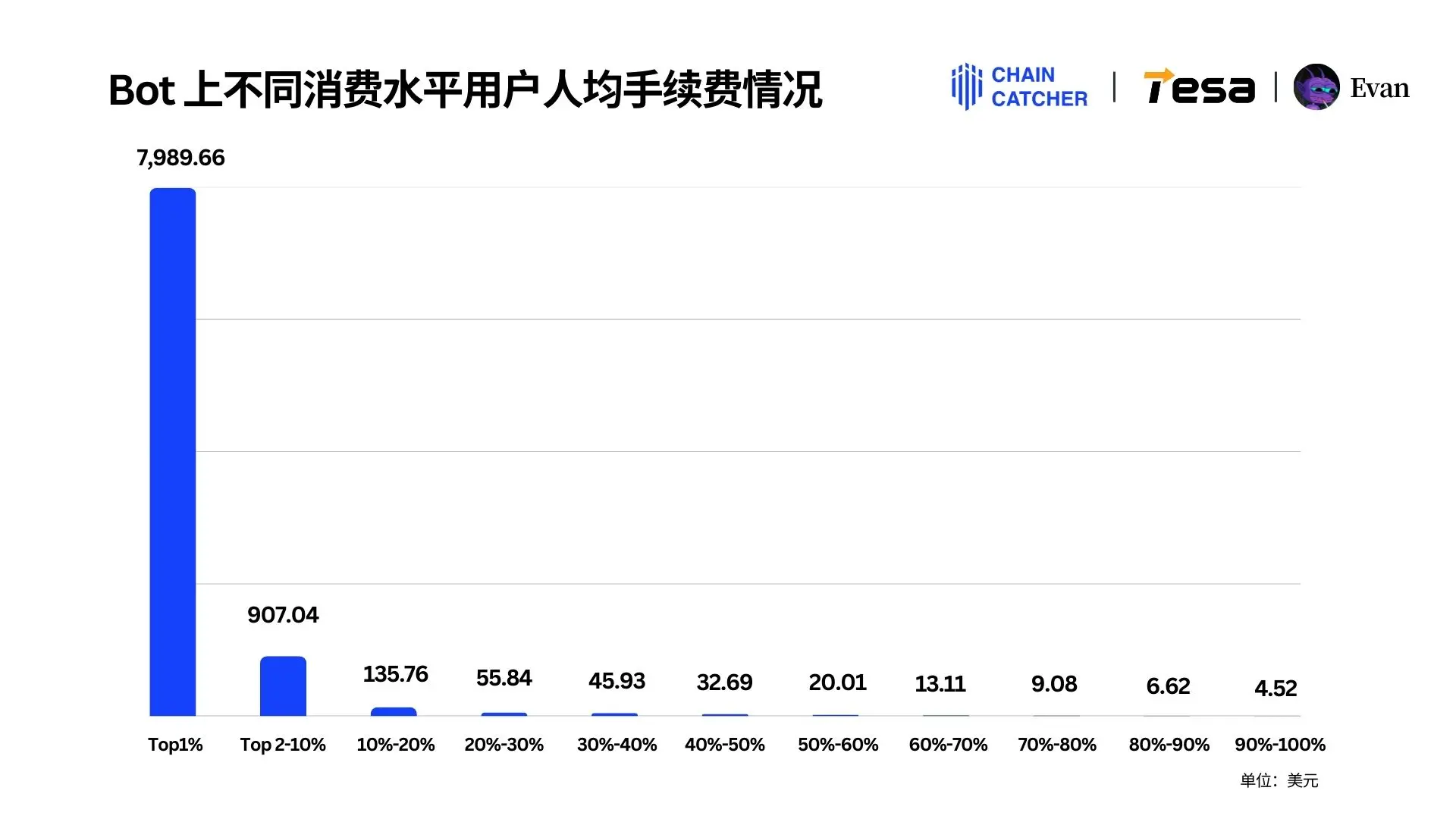

The top consumption concentration of trading BOT and Pump.fun is relatively low:

-

Trading BOT: The top 1% of users contributed $313 million, accounting for 41.24%.

-

Pump.fun: The top 1% of users contributed $96.62 million, accounting for 39.07%.

This difference shows that there are significant differences in user structure and profit model among different platforms.

In terms of per capita transaction fees, there is also a big difference between the top users and long-tail users on Trading BOT and Pump.fun. The per capita transaction fee of the top 1% of users on Trading BOT reached US$7,990, while the per capita transaction fee of users ranked between 2% and 10% was less than US$1,000, and the per capita transaction fee of users ranked at 20% was less than US$60.

The average transaction fee for the top 1% of users on Pump.fun reached $2,467, while the average transaction fee for users ranked between 2% and 10% was less than $300, and the average transaction fee for users ranked after 20% was less than $50.

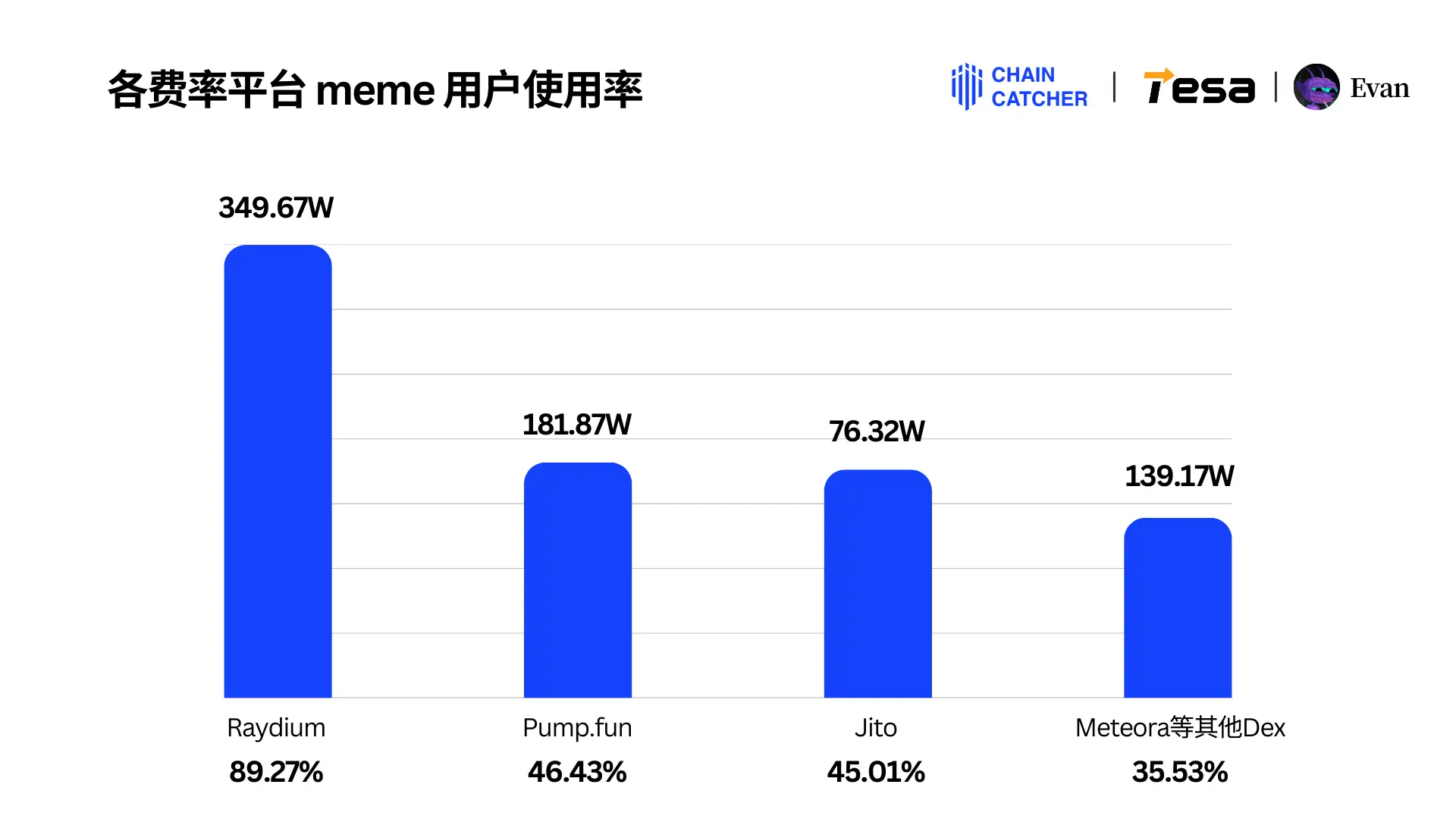

3. Raydium has the highest usage rate, with more than half of users relying on trading BOT

In the Solana DEX ecosystem, although Raydium’s transaction fee is higher (0.25%) and Meteora’s is lower (0.16%), Raydium still attracts the vast majority of users with its strong market advantages. Statistics show:

-

Of the approximately 4 million Solana addresses, approximately 89.27% (3,496,800 addresses) have used Raydium.

-

In comparison, the combined usage of Meteora and other DEXs is only 35.53% (1.3917 million addresses).

This phenomenon shows that when Memecoin users choose a trading platform, they do not simply consider the fee as the deciding factor, but pay more attention to comprehensive factors such as liquidity, user experience and platform stability.

In addition, the use of trading BOT is also very common:

-

More than 2.11 million addresses use the transaction BOT, with a utilization rate of 53.83%.

-

In comparison, the usage rates of Pump.fun and Jito are 46.43% and 45.01% respectively, which have not yet exceeded half.

These data reflect users high dependence on efficient and convenient trading tools, and also demonstrate Raydiums absolute dominance in the market.

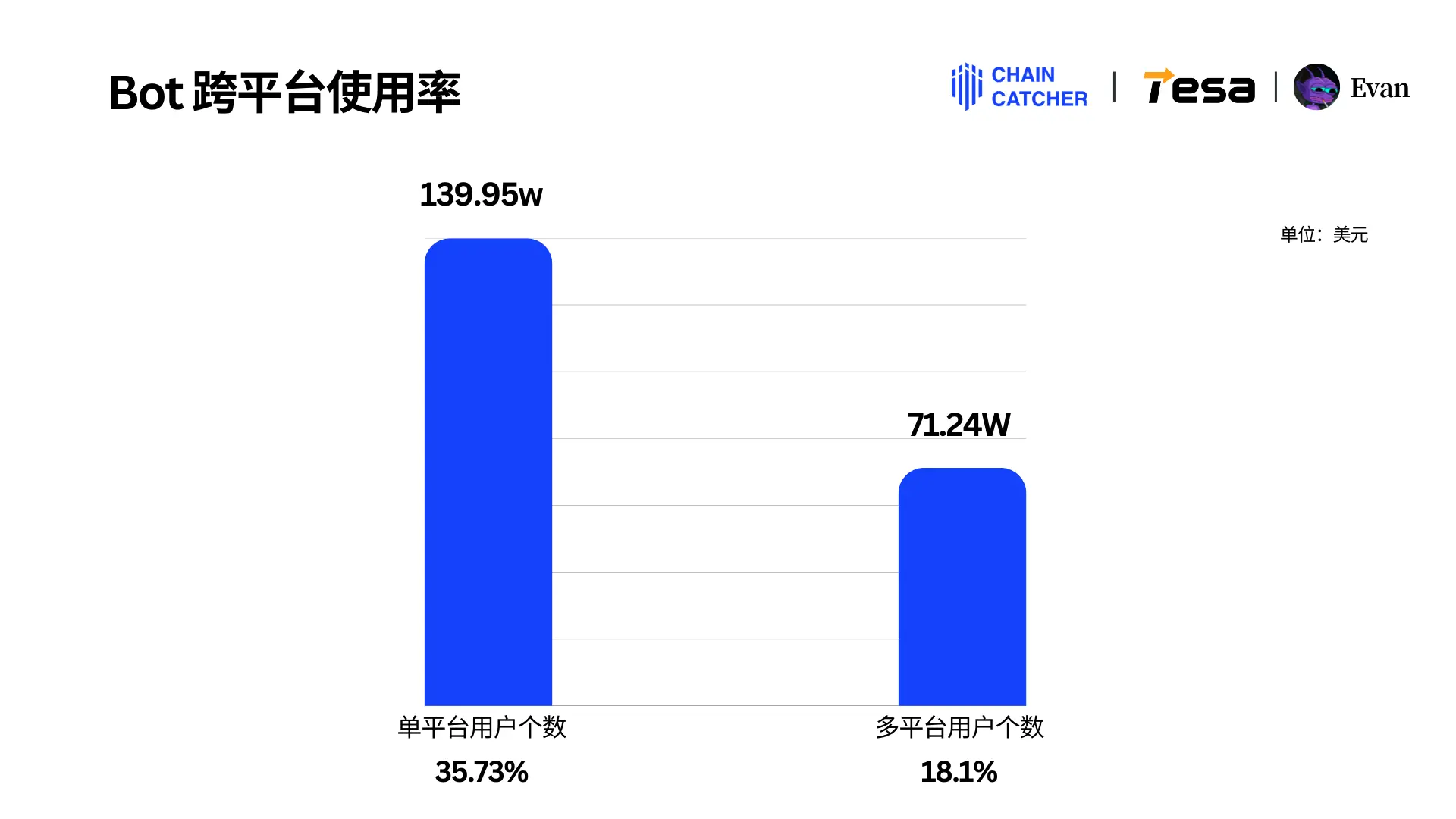

4. More than half of bot users only use a single bot platform

In the BOT trading market, users’ choices show obvious concentration. Data shows:

-

66% (1,399,500) of BOT user addresses use only a single transaction BOT.

-

34% (712,400) of users choose to use multiple BOT transactions.

This ratio indicates that users have a high degree of loyalty to the BOT platform they choose, or that because there is no obvious differentiation between platforms, users lack the motivation to switch or trade on multiple platforms after selecting a BOT.

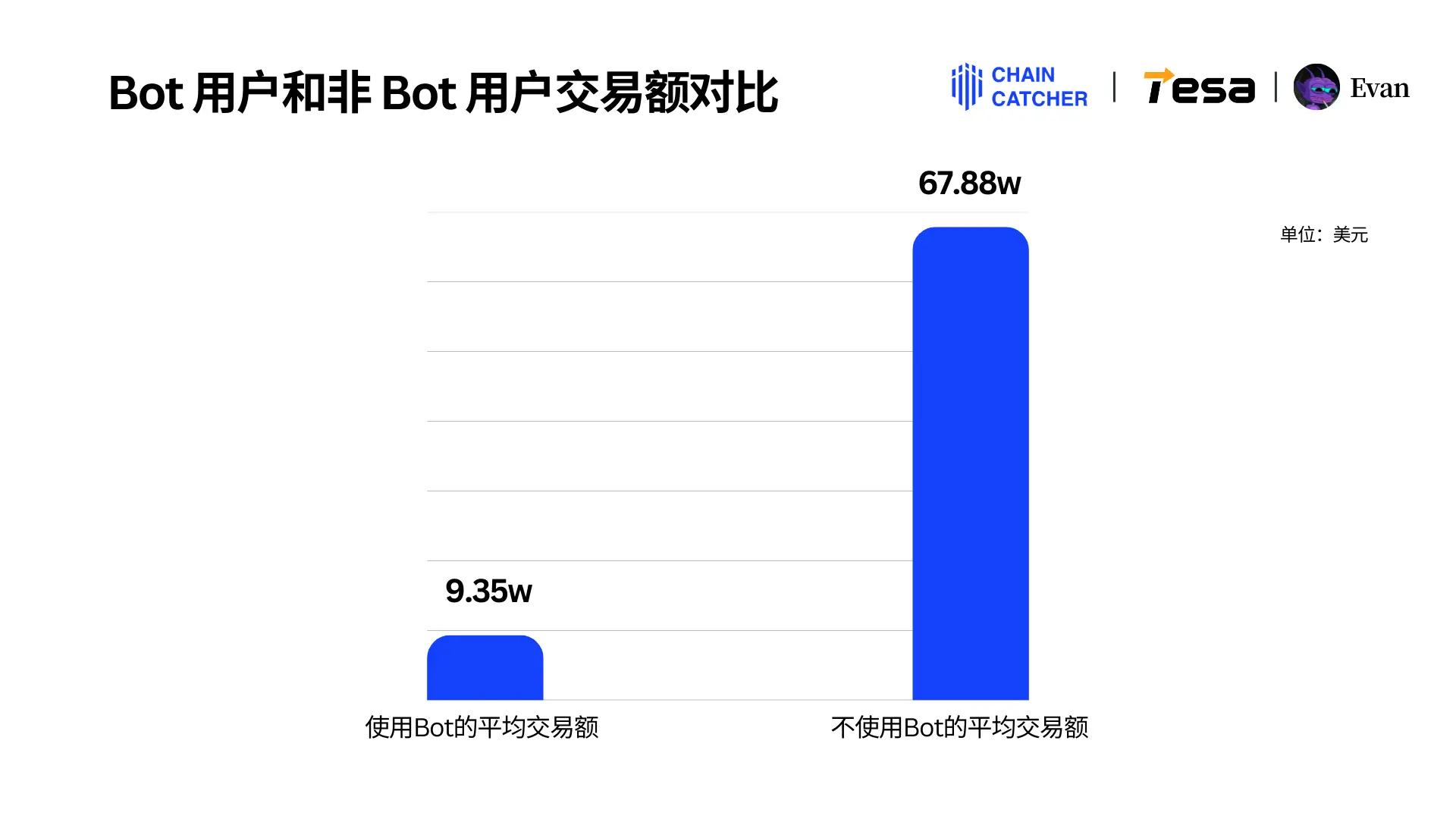

5. The transaction volume of users who do not use BOT is significantly higher

Compared with users who use trading BOT, the average transaction amount of users who do not use BOT is several times higher:

-

Users of BOT: Average transaction amount is $93,500.

-

Users who do not use BOT: The average transaction amount is as high as US$678,800.

This data may reflect that ordinary users and novice users account for a large proportion of the BOT user group, while whale users with high transaction volumes prefer manual operations or use efficient tools to pursue more precise control.

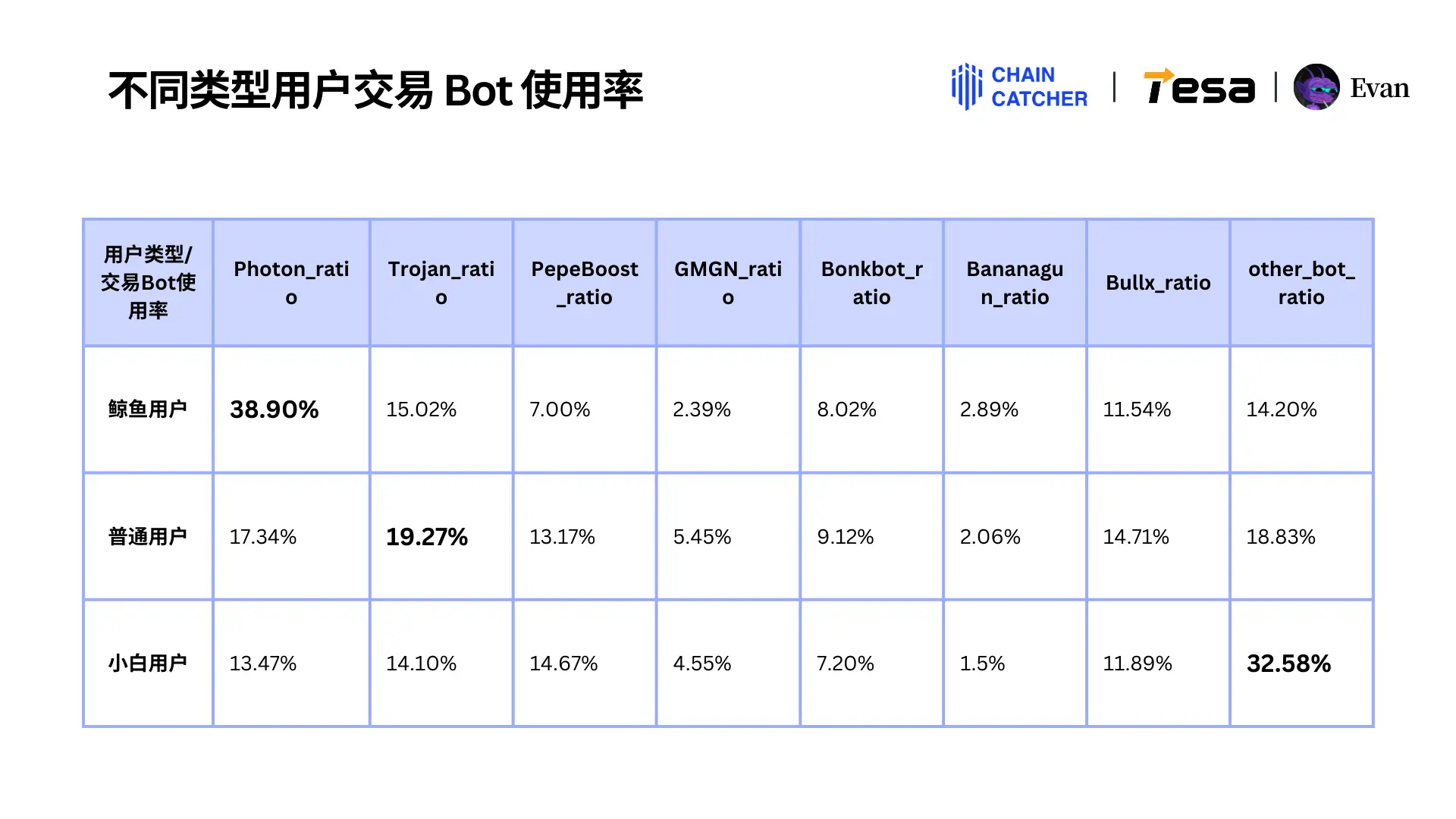

6. Whale users prefer Photon, while ordinary users prefer Trojan

Users with different consumption levels show significant differences in their choice of trading BOTs:

Whale users (top 5%)

-

Photon is the most popular trading bot, contributing 38.9% of the transaction fees.

-

Trojan followed closely behind, accounting for 15.02%.

This choice shows that whale users prefer to use Photon BOT, which has powerful functions and stable performance.

Ordinary users (20%-30%)

-

Trojan became the first choice for ordinary users, accounting for 19.27% of the total fees.

-

Photon and Bullx ranked second and third with 17.34% and 14.71% respectively.

The choices of ordinary users are more diverse, showing a wide acceptance of different BOT features.

Novice users (minimum 25%)

-

The choices of novice users are relatively scattered. Trojan, Photon, PepeBoost, and Bullx are the main trading bots, all contributing more than 10% of the transaction fees.

This distribution reflects that novice users tend to try multiple tools when using BOT rather than focusing on a single platform.

3. Analysis of the TOP 10 Memecoin addresses with the highest annual consumption in 2024

1. The transaction fees of 5 addresses exceeded 10 million US dollars, with the highest cost reaching 133 million US dollars

In Memecoin transactions in 2024, the top 10 user addresses with the highest total transaction fees showed a very high consumption concentration, with 5 addresses having a total transaction fee exceeding 10 million US dollars:

-

MfDuWe: USD 133 million (commission rate 0.3%, total transaction amount USD 44.855 billion).

-

kpqUj 8: 19.86 million US dollars.

-

YubQzu: $18.2 million

-

HBGdum: $11.9 million.

-

7 vi 5 dy: 11.89 million US dollars.

2. Comparison of users with the highest and lowest transaction fees

-

The address with the highest transaction fee, MfDuWe, exhibits a huge transaction size and expenditure, with its fees accounting for 0.3% of the total transaction amount.

-

In contrast, the fee rates for addresses 13 g 21 m and 89 VB 5 U are only 0.005%, the lowest level.

This data fully reflects the consumption differences between different users in the Memecoin market, as well as the significant contribution of top users to the overall fee income.

3. Details of the top 10 addresses with the highest total transaction fees on platforms such as Raydium, Jito, and Pump.fun

The top 10 user addresses on the Raydium platform have shown extremely high contribution to transaction fees, with each address spending more than $10 million per year. These users spend almost all of their transaction fees on the Raydium platform. Details of the top 10 addresses:

The transaction fees of the top 10 addresses in Jito’s total transaction fees range from 1.2 million to 6.2 million US dollars. Details of the top 10 addresses:

The top 10 addresses with the highest total transaction fees on Pump.fun have a transaction fee range of $500,000 to $2.4 million. Details of the top 10 addresses:

4. Details of the top 10 bot fees

4. To check your personal Memecoin consumption bill for 2024, please refer to:

This article is sourced from the internet: 2024 Memecoin Annual Consumption Report: The largest paying player spent $130 million in fees, Raydium and Bot were the biggest beneficiaries

Related: What changes will the Prague upgrade bring to Ethereum?

In the first quarter of 2025, Ethereum will usher in the Prague/Electra upgrade, referred to as the Prague upgrade or Pectra upgrade, which is the next milestone of Ethereum. Unlike previous major upgrades, the Pectra upgrade does not have a prominent main goal, but focuses on multiple technical improvements and optimizations. This article will introduce the important content that this upgrade will involve. Ethereum’s important upgrade after The Merge Here are the key points of the upgrade: (1) Bring significant improvements to Ethereum’s scalability, including L2 solutions such as sharding technology and rollup. (2) The security and stability of Ethereum will be enhanced through advanced encryption technology and improvements to the PoS protocol. (3) Developers will benefit from new programming languages, improved tools, and simplified smart contract deployment. (4) Users…