Delphi Digital 2025 Outlook: Bitcoin still has huge potential, and stablecoins will continue to grow

Orijinal makalenin yazarı: Stacy Duvar

Orijinal çeviri: TechFlow

giriiş

As the year draws to a close, various studies and forecasts are pouring in. @Delphi_Digital recently released the 2025 Pazar Outlook, which provides an in-depth analysis of the current market situation and the outlook for future trends, covering a range of content such as Bitcoin price trends, major trends, and risk factors.

Since the full text is too long and it takes a lot of time to read it in full, TechFlow has specially compiled Stacy Muurs article on the core views of Market Outlook 2025.

This article divides the Delphi Digital report into three parts: the rise of Bitcoin, the bubble of the altcoin season, and future development trends. Bitcoins market value has reached about $2 trillion, but the performance of altcoins is lackluster. Looking ahead, the growth of stablecoins may bring hope for market recovery. At the end of the article, Stacy Muur also expressed her unique views on the kripto market in 2025, believing that the crypto market is evolving from the Wild West to a more regulated alternative stock market. Web3 native users will be willing to take high risks and participate in speculative transactions. New entrants will adopt robust risk management and focus on long-term value, and some narratives may be marginalized.

The rise of Bitcoin

There was a time when a Bitcoin price of $100,000 was considered a pipe dream.

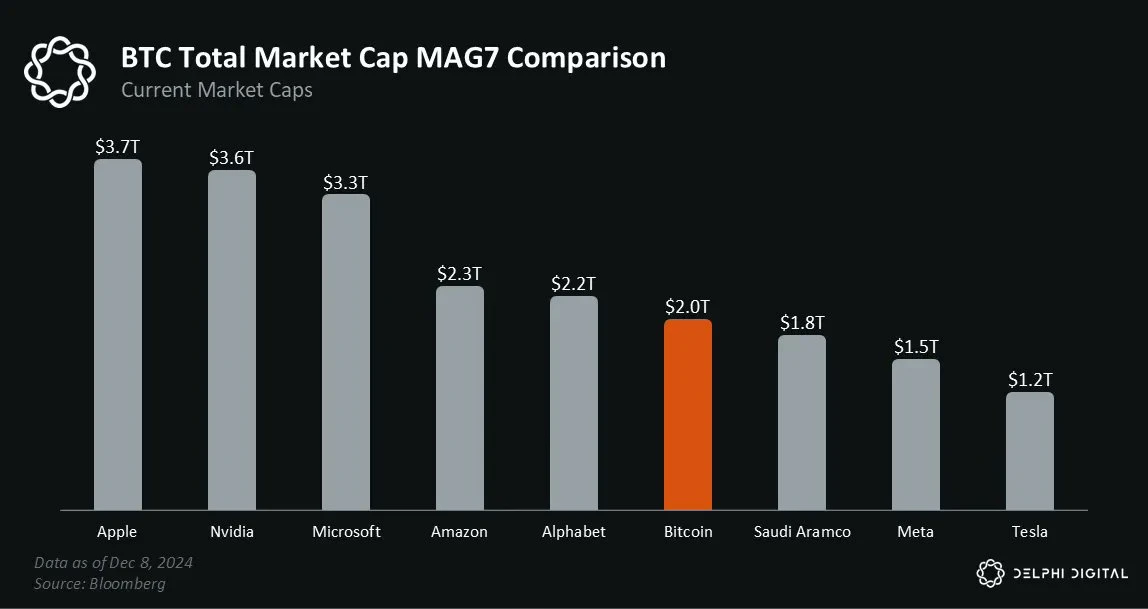

Now, that view has changed dramatically. Bitcoin’s current market capitalization is around $2 trillion — a staggering amount. If Bitcoin were a public company, it would be the sixth most valuable company in the world.

Although Bitcoin has already attracted widespread attention, its potential for growth remains enormous:

-

BTCs market capitalization accounts for only 11% of the total market capitalization of MAG 7 (Apple, Nvidia, Microsoft, Amazon, Googles parent company Alphabet, Meta and Tesla).

-

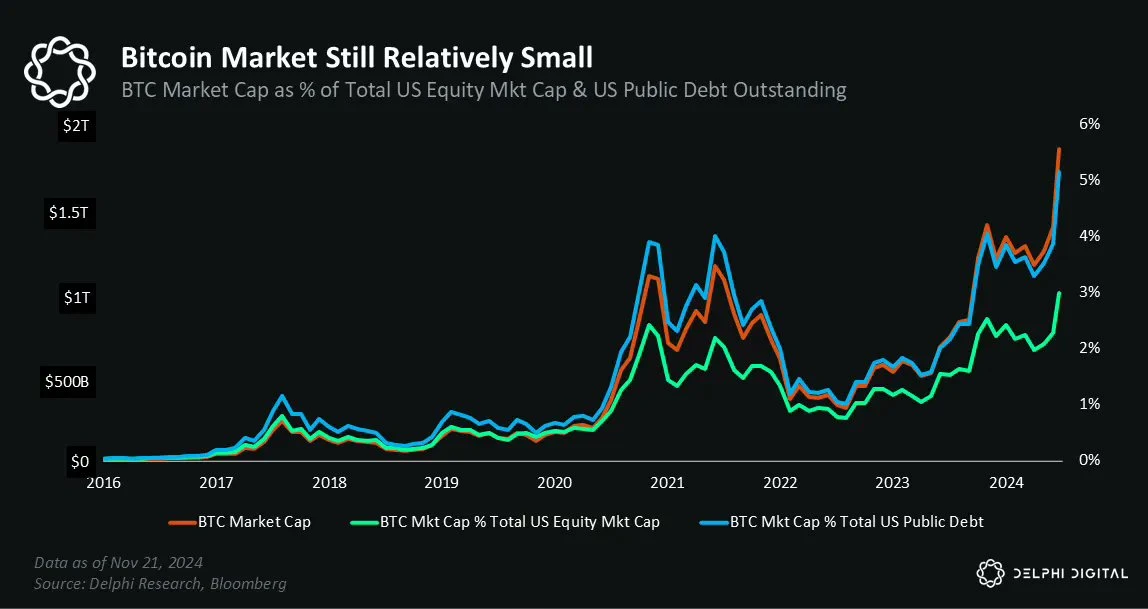

It accounts for less than 3% of the total market capitalization of the U.S. stock market and about 1.5% of the total market capitalization of the global stock market.

-

Its market capitalization is just 5% of total U.S. public debt, and less than 0.7% of total global (public + private) debt.

-

The total amount of money in U.S. money market funds is three times the market value of Bitcoin.

-

Bitcoin’s market value is only about 15% of the total global foreign exchange reserve assets. Assuming that global central banks shift 5% of their gold reserves to Bitcoin, this would bring more than $150 billion in purchasing power to Bitcoin – equivalent to three times the net inflow of IBIT this year.

-

Global household net worth has reached an all-time high of more than $160 trillion, $40 trillion higher than the pre-pandemic peak. This growth was mainly driven by rising house prices and a booming stock market. For comparison, this figure is 80 times the current market value of Bitcoin.

In a world where the Federal Reserve and other central banks are pushing currencies to depreciate by 5-7% per year, investors need to pursue annual returns of 10-15% to offset future losses in purchasing power.

What you need to know:

-

If the currency depreciates by 5% per year, its real value will be halved in 14 years.

-

If the depreciation rate is 7%, this process will be shortened to 10 years.

This is exactly why Bitcoin and other high-growth industries are attracting so much attention.

The bubble of the cottage season

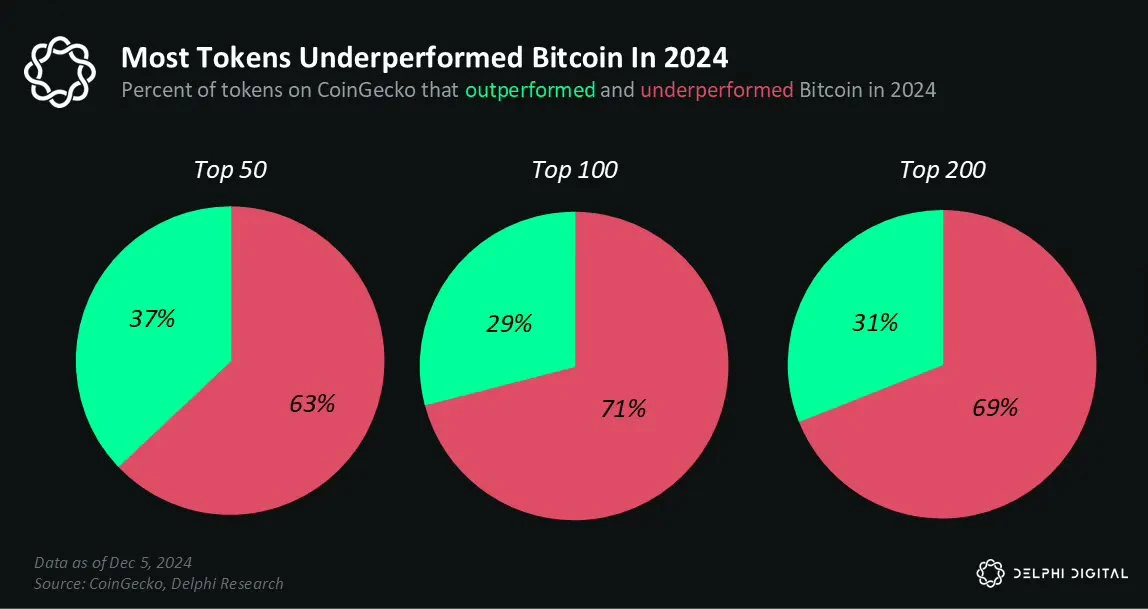

While Bitcoin has hit record highs one after another this year, 2024 has not been kind to most altcoins.

-

$ETH failed to break out above its all-time high.

-

$SOL hit a new high, but the gain was only a few dollars above its previous high, which pales in comparison to the growth in its market cap and network activity.

-

$ARB started the year strong but has seen its performance decline as the year draws to a close.

There are many similar examples. Just look at the performance data of 90% of the altcoins in your portfolio.

Why is this happening?

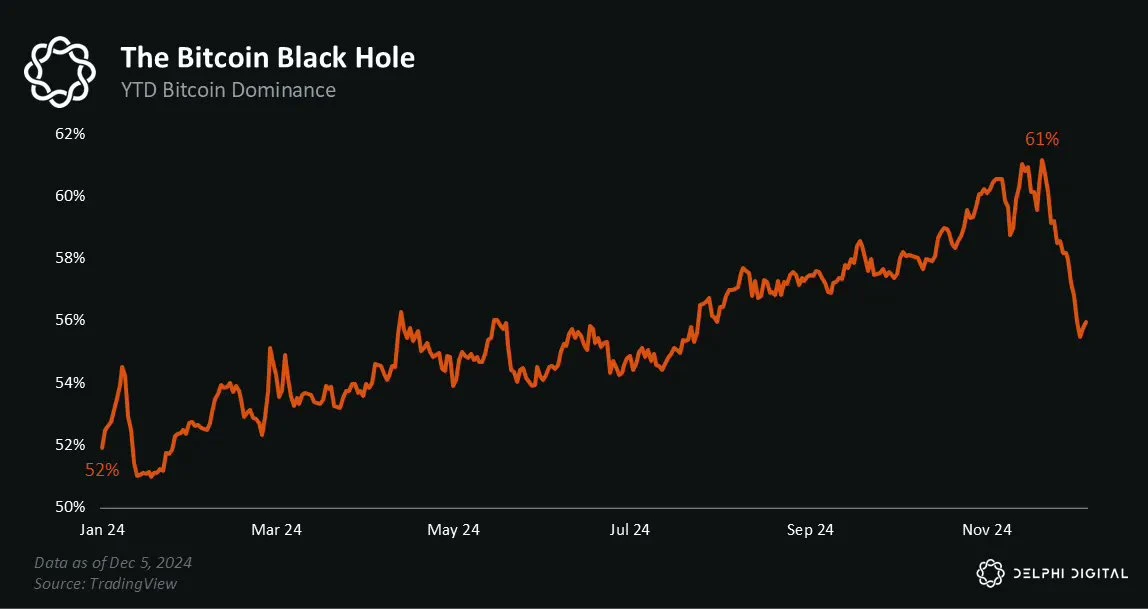

First, Bitcoin’s dominance is a key factor. BTC has performed exceptionally well this year, driven by ETF inflows and Trump-related factors. Its price has risen by more than 130% year-to-date, and its dominance has reached a three-year high.

Secondly, there is the phenomenon of market differentiation.

This year’s market divergence is a new feature of the crypto market. In previous cycles, asset prices usually moved in sync. When BTC rose 1%, ETH usually rose 2% and altcoins rose 3%, forming a predictable pattern. However, this cycle is very different.

Although a few assets performed extremely well, more assets were in a loss. The rise of Bitcoin did not drive the overall rise of other asset prices, and the altcoin season that many people expected did not arrive as expected.

Finally, Meme coins and AI Agents also play an important role.

The crypto market has always swung back and forth between “this is a Ponzi scheme” and “this technology will change the world.” In 2024, the “scam” narrative has become dominant.

In the public’s collective imagination, the crypto market always swings between “a future technologically unified global financial system” and “the biggest scam in human history” every two years.

Why does this narrative seem to cycle between these two extremes, and do so every two years?

Meme coin supercycle and market sentiment

The meme coin supercycle further reinforced the impression that the crypto market is a Ponzi scheme. Many people began to question whether the fundamentals of the crypto market really mattered, and even regarded it as a casino on Mars. These concerns are not without reason.

In this context, I would like to add a remark.

When memes are called the best performing assets of the year, people usually only focus on those mainstream memes (such as DOGE, SHIB) that already have significant market capitalization and successfully built communities. However, 95% of memes quickly lose value after launch, which is often overlooked. But even so, people are still willing to believe.

This belief caused a lot of money that had previously been invested in altcoins to move to Memecoin – a few people made a profit, but most failed. As a result, capital inflows were mainly concentrated between Bitcoin (institutional money) and Memecoin (high-risk investment), while most altcoins were ignored.

Delphi believes that 2025 will be the year of technology-driven market transformation, and these technologies will change the world.

But I’m not so optimistic about this. In 2024, a large number of KOLs (key opinion leaders) focused on Memecoin emerged. When I tried to create a folder containing real valuable channels on Telegram (you can find it here), I found that almost all channels were discussing ape calls (i.e. high-risk short-term investment advice). This is the nature of the attention economy, and these narratives have a profound impact on market trends.

What is the next trend?

The growth of stablecoins and credit expansion

A major challenge facing the current market is the oversupply of tokens. Driven by private investments and public token issuance, a large number of new assets have been influxed. For example, in 2024 alone, more than 4 million tokens were launched on Solanas pump.fun platform. However, in contrast, the total crypto market capitalization has only increased by 3 times over the previous cycle, compared with 18 times and 10 times in 2017 and 2020, respectively.

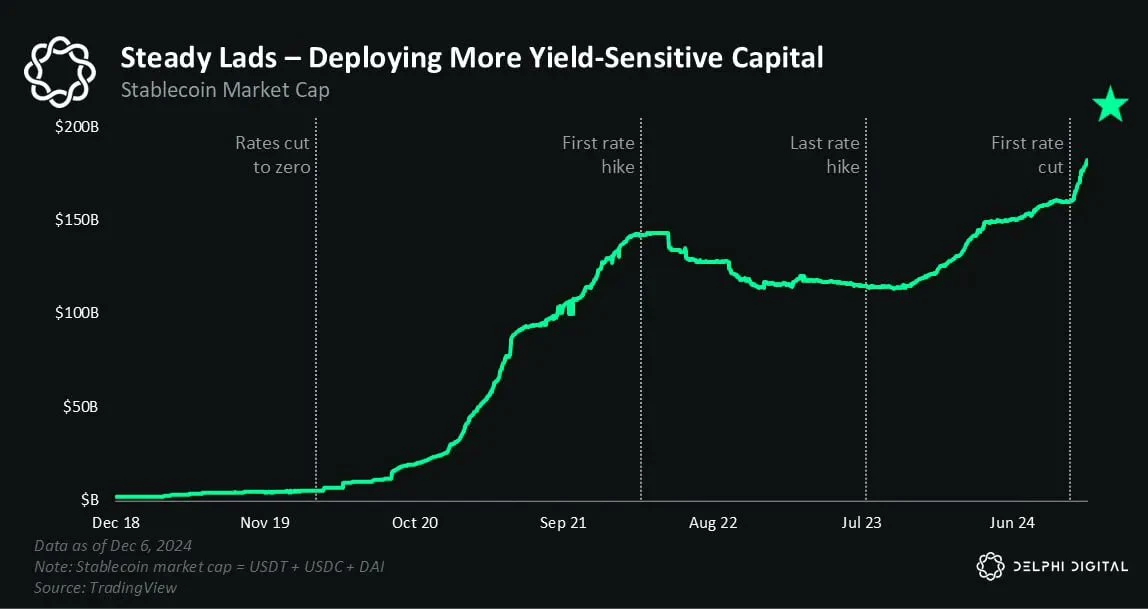

Two key missing factors in the market – stablecoin growth and credit expansion – are reappearing. With falling interest rates and an improved regulatory environment, speculative activity is expected to become active again, alleviating the current market imbalance. The core role of stablecoins in transactions and collateralization will play a vital role in market recovery.

Institutional capital inflows

Until last year, institutional investors remained cautious about crypto assets due to regulatory uncertainty. However, this began to change with the SEC’s reluctant approval of a spot Bitcoin ETF, paving the way for future institutional capital inflows.

Institutional investors usually tend to choose familiar investment areas. Although a few institutions may dabble in Memecoins, they are more likely to focus on assets with more fundamental support such as ETH/SOL, DeFi or infrastructure.

Delphi predicts that the market may see a full rebound similar to previous cycles in the coming year. Unlike in the past, this time the market will pay more attention to fundamentals-driven projects. For example, OG DeFi projects (original decentralized financial projects) may become the focus of attention due to their market-tested records; infrastructure assets (such as L1 protocols) may also regain their glory. In addition, RWA (real world assets) or emerging fields (such as artificial intelligence and DePIN) may also become hot spots.

Of course, not all tokens will achieve triple-digit gains like they have in the past, but the meme’s presence will be part of the market. This could mark a new starting point for a broad crypto rally driven by the overall market gains.

Note: Most institutional traders typically rely on options hedging strategies. Therefore, if a “broad rally” were to occur, the assets most likely to attract institutional interest would be those with options trading — currently primarily on Deribit and possibly Aevo.

The Solana Argument

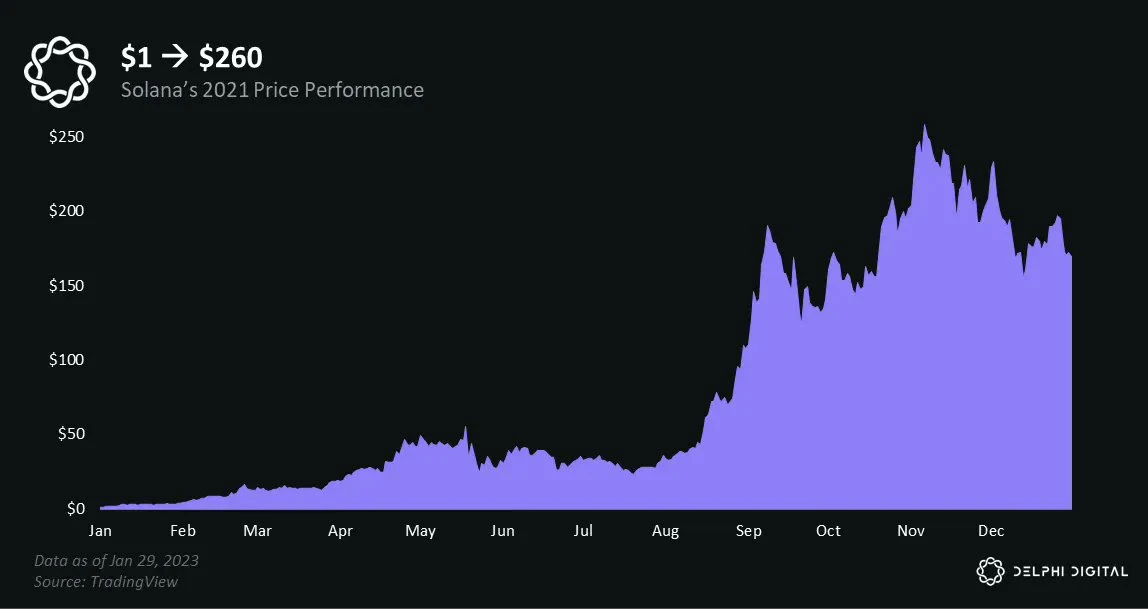

@Solana shows the resilience of the blockchain ecosystem. After a 96% market cap loss due to the FTX crash, Solana has staged a remarkable recovery in 2024.

The following are its key performance highlights:

-

Developer momentum: Solana has successfully reignited developer and user interest by hosting hackathons and airdrops such as the Jito airdrop. This increased engagement not only drives innovation, but also forms a virtuous cycle of technology development and user adoption.

-

Market leadership: Solana is in a leading position in the crypto market trends from Meme to AI applications in 2024. It is particularly noteworthy that its Real Economic Value (REV, a comprehensive measure of transaction fees and MEV) exceeds Ethereum by more than 200%, showing strong market vitality.

-

Future Outlook: Solana is considered to be expected to challenge Ethereums dominance in terms of scalability and user experience. Compared with decentralized Layer-2 solutions, Solana provides a seamless user experience and a highly centralized ecosystem, which gives it a significant advantage over the competition.

Stacys Final Thoughts

Current market conditions may be reminiscent of 2017-2018, when Bitcoin reached an all-time high of $20,000 on New Year’s Eve before falling back in early 2018. However, I don’t think it’s appropriate to compare the crypto market in 2018 to 2025. The two are in completely different market environments — the once chaotic and disorderly “Wild West” is rapidly evolving into a more regulated alternative to the stock market.

We need to realize that the scope of the crypto market goes far beyond the discussion circles of Crypto Twitter (CT) and Platform X. For those who are not active on these platforms, their understanding and perception of the market may be completely different.

Looking ahead to 2025, I believe the crypto market will diverge into two main directions:

-

Web3 native users: This group is deeply involved in the crypto market, familiar with its unique way of operation, and willing to take high risks to participate in speculative transactions such as Meme, AI agents, and pre-sale projects. These behaviors are reminiscent of the Wild West era in the early days of the crypto market.

-

Ordinary investors: including institutional investors and retail investors, who generally take a more robust risk management approach and prefer fundamentals-based investment strategies. They view the crypto market as an alternative to the traditional stock market, focusing on long-term value rather than short-term speculation.

So, which areas are likely to be marginalized? Early DeFi projects, RWA (real world assets) and DePIN (decentralized Internet of Things) protocols that fail to take the lead in their fields or in the blockchain ecosystem may gradually lose market attention. This is just my opinion.

PS: This article summarizes the core ideas in @Delphi_Digitals 2025 market outlook. If you want to fully understand Delphis detailed forecasts for 2025 and beyond, I strongly recommend reading its original research report.

This article is sourced from the internet: Delphi Digital 2025 Outlook: Bitcoin still has huge potential, and stablecoins will continue to grow

As the chapter of the rebirth of the man of destiny in Black Myth: Wukong comes to an end, another journey of learning from the past has quietly entered the middle of the journey – this is the journey of the new generation of Web3 games (Web3 Game). As one of the most classic narratives of Web3, GameFi is gradually shifting from play to earn to play to play, focusing more on gameplay rather than emphasizing financial attributes. Just as Wukong grew up in the wind and rain and faced challenges, these Web3 games are also exploring their own true scriptures. As the first research report in the PKUBA路SectorScan series this semester, this report will focus on sorting out the Web3 game projects in each segment track that have the…

MERHABA