With a single-day increase of nearly 400%, CZs order project Travala actually has an annual revenue of 100 million US do

Orijinal | Odaily Planet Daily ( @OdailyChina )

Yazar: Wenser ( @wenser 2010 )

After the last time he released an image with the word ALT which was interpreted by the market as the alt season has come, Binance founder CZ directly supported the Travala project last night. I invested before the COVID-19 pandemic and the kripto winter, and I have continued to invest until now, BUILD.

Previously, the price of Travalas AVA token was only $0.74, with a market value of about $40 million. Affected by CZs open call, market funds moved quickly, and a large number of buy orders poured in. The price of AVA once exceeded $3.5, with the highest increase of nearly 400%. As of writing, the price of AVA remains around $3.1, with a 24-hour increase of up to 306%.

Travala claims to be a crypto-friendly travel platform that supports more than 100 cryptocurrencies for hotel and flight bookings. Odaily Planet Daily will analyze the project in this article.

Travala: $100 million in annual revenue, the “dark horse of the travel industry”

Founded in 2017, Travala is a global travel booking platform built on blockchain technology that supports cryptocurrency payments as well as traditional payment methods. Through the platform, users can book more than 2.2 million hotels in more than 230 countries and regions around the world, flights from more than 600 airlines, and more than 410,000 diversified travel activities. The platform also has varying degrees of cooperation with well-known travel platforms such as Booking.com, Priceline, Kayak, Skyscanner, and Google Hotels .

Juan Otero, co-founder and CEO of Travala, revealed in an interview that in the first quarter of 2020, the platforms total revenue was less than $1 million, and the annual revenue for that year was about $4.4 million. In the past few years, Travalas business has grown rapidly. In the first quarter of this year, the platforms revenue for the quarter exceeded $22 million.

On December 11, Travala officials cited media reports that Travala is about to launch a Bitcoin reserve plan and gönderildi : Travala has reached a milestone of $100 million in annual revenue. The platform will continue to promote the adoption of cryptocurrencies in the tourism industry and announce the AVA token and Bitcoin treasury reserve strategy.

At 11:49 pm on December 12, CZ retweeted Travala’s official tweet and directly revealed his identity as an “early investor in the project.”

CZ is a clear “caller”

After CZ’s open support: AVA’s “market value fluctuation magic”

While many people were still wondering What exactly is Travala?, a group of traders with a keen sense of the market had already found Travalas project token AVA from Binance, and were pleasantly surprised to find that such a RWA project that was established 7 years ago and has real business income has a token circulation market value of only 40 million US dollars.

After CZ’s call, the price of AVA quickly rose from $0.74 to around $1.5, but its market capitalization remained at $42 million, unchanged. More importantly, this token is only listed on Binance spot, and futures shorting is not possible, and other exchanges have not listed the project.

AVA token information at around 12:00 pm on the 12th

As the market continued to buy, the price of AVA rose rapidly in just a few hours, and rose above $3.5 at 5 am today. Basın saatine göre, the price of AVA tokens has stabilized at around $3.2, the market value has increased to $307 million, the market value ranking has risen to 363rd, and the 24-hour trading volume has exceeded $560 million.

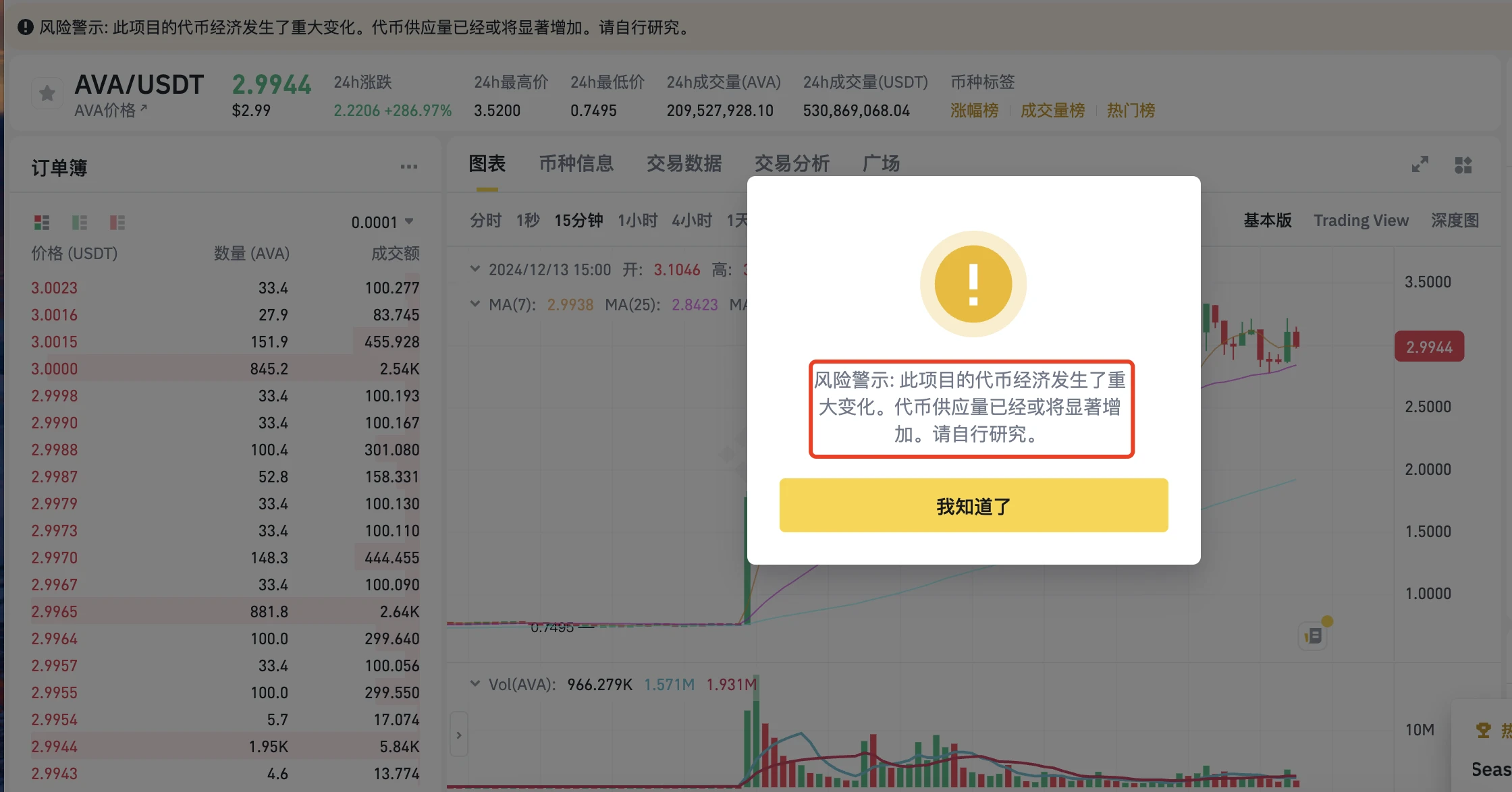

It is worth mentioning that the circulation and market value of AVA are similar to the ACX token previously listed on Binance. The market value data also experienced short-term and drastic fluctuations, which is suspected to be a problem with Coinmarketcaps related statistical data. Users will also see relevant risk warnings after entering the AVA token interface for the first time.

In October this year, Binance explicitly introduced risk warning banners and pop-up notifications for projects on the platform, including AVA, CHZ, ENJ and other tokens. Risk warning banners and pop-up notifications will also be introduced for the following tokens whose token economic models have undergone significant changes in the past 18 months.

AVA Jeton Binance Interface

The former negative example has now transformed into the hottest star on the platform.

The bumpy road that took 7 years to support 100+ cryptocurrency payments

According to Odaily Planet Daily Express, as early as December 2018, Travala resmen açıklandı that it would add XRP as a payment method on its platform. Subsequently, Travala began its seven-year journey of building a crypto-friendly platform that supports cryptocurrency payments.

-

In December 2018, Travala announced that it would support DASH and EOS for hotel reservations.

-

In February 2019 , Travala announced that it would accept BTC for bookings at 550,000 hotels, allowing users to travel to 82,300 destinations;

-

In March 2019, Travala announced that it would accept TRX Ve LTC related reservation payments.

-

Daha sonra, BCH , BNB , XLM , Ve ADA also became payment options. In September of the same year, the platform resmen açıklandı that it would move from the NEO blockchain to the Binance Chain and begin to repurchase and destroy its native token AVA.

-

In January 2020 , Travala announced support for stablecoin Tether (USDT) payments.

itibariyle July 2021 , Travala had revenue of $9.8 million in the second quarter of that year and accepts more than 40 cryptocurrencies, Binance Pay, and fiat payment methods; cryptocurrency purchases account for approximately 70% of the platforms business.

In June 2023, Travala officially announced that its total revenue in May of that year was nearly 5.5 million US dollars, including accommodation reservations, air ticket reservations, activity reservations and concierge service reservations; 78% of all reservations were paid with cryptocurrencies. Among them, the proportions of USDT, ETH, BTC, USDC and AVA (Travala.com platform token) were 24%, 8%, 7%, 5% and 5% respectively, the proportion of payment using Binance Pay was 13%, and the proportion of payment using other cryptocurrencies was 16%. In addition, reservations from Binance Pazarplace accounted for 3%.

In June this year, thanks to the rapid development of the TON ecosystem, Travala resmen açıklandı support for TON payments. In September, Travala officially announced that it had integrated with Solana, expanding to a third network in addition to Ethereum and BNB Chain.

Travala CEO Juan Otero said: This integration will allow users to book flights, hotels and accommodations using Solana-based assets, including SOL, USDT and USDC. Users can also receive SOL travel rewards of up to 10% of their booking value through its loyalty program, which previously supported BTC and Travalas native token AVA as payment rewards. This is also when Travala officially announced the US$100 million revenue milestone, the official Solana account in the comment section posted a message to congratulate reason.

Travala CEO

It can be seen that since its inception, Travala has been making steady progress in its crypto-friendly support: the increase in payment currencies, the increase in booking areas and hotels, and the increase in the number of travel activities are all examples.

Ek olarak, users can enjoy different levels of discounts when booking travel on Travala, such as:

-

Depending on membership level, users can enjoy direct discounts of up to 5%;

-

Crypto Rebates: After completing a trip, users can earn up to 5% cashback in AVA tokens, and Platinum and Diamond members can earn up to 10% back in Bitcoin on bookings made through Travala.com, which can be used for future bookings or transferred off the platform;

-

AVA Payment Discount: Pay your booking in full with AVA tokens and enjoy an additional discount of up to 3%;

-

AVA Smart Rewards: All members except Smart Basic can receive up to 6% annualized AVA token rewards for completing specific tasks or using AVA on the platform every quarter.

The latest news is that the platform has launched an invitation rebate program that helps others use cryptocurrencies to book, and users can get up to 5.5% commission on each booking order.

Şunu belirtmekte fayda var ki the AVA token hit an all-time high of $6.45 in April 2021, and then fell below $2 in December 2021. After that, it fluctuated up and down and gradually came to the recent price of around $0.7.

As for whether it can return to new highs in the future, in addition to the support of key figures such as CZ, it also depends on whether the continued repurchase of AVA tokens and the BTC reserve plan can effectively boost market confidence.

A quick look at Binance’s investment projects in the 2022 industry winter

According to the relevant information of Rootdata Ve Binance platform , the projects invested by Binance Labs before 2022 and whose tokens have been listed on Binance mainly include the following information. In addition to the conventional L1 public chain, DEX, and GameFi projects, the only tokens that can be involved in the CZ investment concept are currently SES , KAVA , CTK , ANKR , vesaire.

Considering the randomness of CZ’s orders and the high risk of ambushing these tokens, please choose carefully and pay attention to the risks.

AI sorts out relevant information for reference only

This article is sourced from the internet: With a single-day increase of nearly 400%, CZs order project Travala actually has an annual revenue of 100 million US dollars

Original author: Miles Deutscher , Crypto Analyst Original translation: Yuliya, PANews The market is experiencing a critical turning point. After Bitcoin broke through the $100,000 mark this week, investors attention has turned to the next price target. Based on comprehensive data analysis, multiple indicators are showing that Bitcoin is expected to reach a new high of $150,000 in 2025. This report will conduct in-depth analysis from the following four dimensions through 10 key indicators: Timing cycle analysis Macroeconomic factors Market demand dynamics On-chain data indicators Timing cycle analysis 1. The current Bitcoin price trend is highly similar to previous cycles. 2. The market has entered its most explosive phase, which is the period when prices accelerate fastest. 3. Throughout historical cycles, Bitcoin will enter the red zone (97%) of the…