Author: hyphin Source: onchaintimes Translation: Shan Ouba, Golden Finance

“This has never been a fad, the meme supercycle has arrived. We are being led to the promised land. In the new paradigm, there is no retracement.” – Everyone who posts a memecoin price prediction on Twitter.

giriiş

Since we last explored memecoin in March of this year, the total market value and market attention in this field have continued to grow steadily, with no obvious signs of stagnation. This undoubtedly makes memecoin the fastest “horse” in the field.

This phenomenon is mainly attributed to the natural viral nature of memecoin (through social media), the extremely low entry barrier, and the continuous emergence of new narratives to maintain the enthusiasm of speculators. While many projects fail to attract attention for long periods of time, market participants have become accustomed to frequently switching short-term trends to profit from them, while maintaining greater loyalty to investment targets with higher conviction value. Even if some people are reluctant to admit the fact, in the current market, the possibility of a proven meme token going to zero is much lower than people expect for an asset that relies entirely on impressions and has no real utility.

Although Solana is not the only driver of the growth of the total market value of these tokens, the main activities of memecoin do occur in the “trenches” of its on-chain ecology. Therefore, this article will focus on the Solana chain and try to observe the overall picture of its memecoin ecology from a more macro perspective.

Respect the Rise

With the birth of pompa.eğlence, a memecoin incubation platform native to Solana, the dynamics of the local market have changed significantly. It has become easier, cheaper, and safer (from a security perspective) to participate in speculative tokens than ever before. Standardized token deployment simplifies the process through a user-friendly interface, providing anyone with the opportunity to create new tokens without technical expertise, while eliminating potential vulnerabilities in malicious smart contracts.

Once a memecoin is generated in the platform, it can be traded directly on the platform’s internal market and automatically deployed to Raydium after reaching a market cap of approximately $69,000. However, most tokens fail to reach this threshold and ultimately never see the light of day.

Out of approximately 100 tokens, only one is able to “graduate” from pump.fun’s “university”. Saturated markets and limited liquidity are reasons for some of these failures (specific reasons are beyond the scope of this article).

Faced with such challenges, successful projects must have eye-catching ideas or uniqueness to attract speculators in the trenches. Despite this, the protocol has quickly established itself as the preferred platform for trading micro-cap tokens and launching new projects, far surpassing other similar platforms.

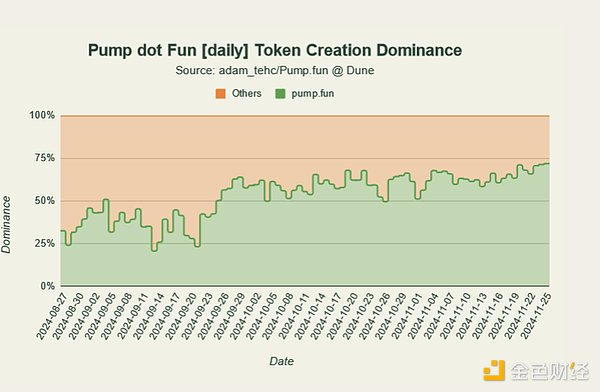

To date, it accounts for 71.9% of the deployed market, demonstrating the widespread popularity and far-reaching impact of this application. Recent developments have further fueled its mainstream adoption, attracting a large number of new users from TikTok who are fueling the fire with dreams of getting rich overnight.

To date, it accounts for 71.9% of the deployed market, demonstrating the widespread popularity and far-reaching impact of this application. Recent developments have further fueled its mainstream adoption, attracting a large number of new users from TikTok who are fueling the fire with dreams of getting rich overnight.

All roads lead to Raydium

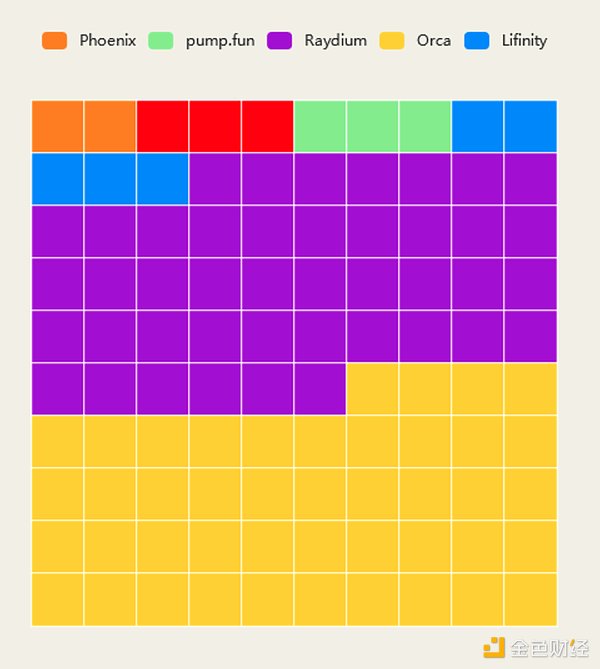

Whether it is a stealth offering, pump.fun tokens, or pre-sale tokens, the vast majority of memecoin liquidity pools are concentrated in Raydium. The influx of memecoins has not only expanded the market size, but also made this decentralized exchange one of the main drivers of Solana’s current on-chain transaction volume.

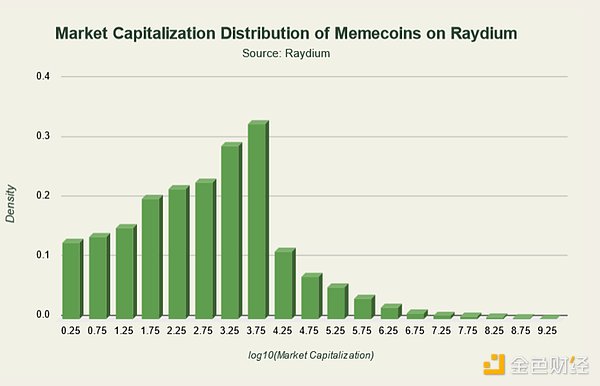

In the gold rush, the people who sell shovels are often the biggest winners. The same applies to the memecoin ecosystem. Regardless of the performance of memecoin, the platforms that support trading activities benefit from the surge in trading volume. According to common sense and market observation, only a few memecoins can truly stand out, and most are destined to be lost in the market. This view can be verified by observing the market value distribution of all existing trading pairs.

Given the lack of efficient annotation tools for data providers, in the analysis, we screened tokens with non-zero liquidity in all Raydium liquidity pools as of November 25, 2024, excluding legitimate projects in the official token list and CoinGecko. In the end, 493,203 liquidity pools and 474,161 unique tokens were obtained, which will serve as the basis for subsequent analysis.

Most active tokens have a market value concentrated in the range of US$100 to US$10,000, showing a more obvious peak distribution. The chart shows a right-skewed distribution curve with a declining tail – there are fewer tokens with higher market caps, which shows that maintaining a moderate market cap is a challenge in an attention-driven environment.

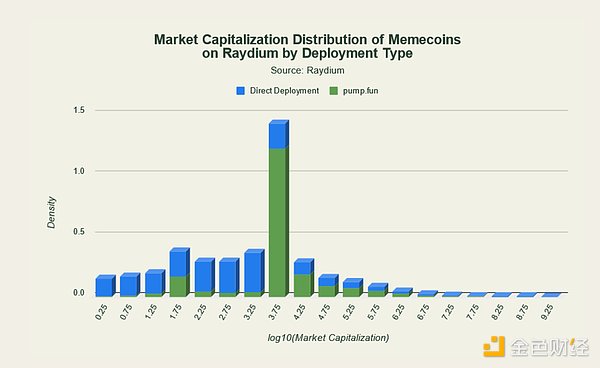

Separating the tokens from pump.fun from those deployed directly to Raydium helps reveal patterns in the overall distribution, as well as the unique performance of each.

Pump dot Fun

It is important to note that tokens on the Pump dot Fun platform must pass a certain market cap threshold to be supported by the liquidity pool. This means that they are usually given higher valuations in the initial stage due to higher liquidity supply, and the market capitalization is usually concentrated in the range of 5,000 to 15,000 US dollars. However, most of the tokens that successfully “graduated” have difficulty maintaining or exceeding their previous valuations after migrating to Raydium. These tokens have a higher proportion in the medium-market value range (hundreds of thousands of dollars to early millions of dollars). This reflects that the platform’s deployment process has filtered out unattractive memes to a certain extent, and the community can also use the popularity or momentum accumulated by the token on the platform as a booster for further development.

Direct Deployment

Among the tokens in the low market value range (hundreds to thousands of dollars), a clear dense distribution can still be observed, indicating that many small-scale, less popular tokens have difficulty gaining significant attention. This may be related to the saturation of the market, the timing of the introduction of these tokens to the market, or the lack of a clear narrative, creativity, and promotion on Twitter. Although barely perceptible in the data, there are also some memes with ultra-high market caps that are listed on multiple centralized exchanges and predate the creation of the Pump dot Fun platform.

The continued low concentration of token market caps in the dataset supports the aforementioned point. While trend weakness and the bursting of speculative bubbles are huge challenges for every token, misaligned incentives have greatly accelerated the rapid collapse and death of many memecoins. In this space, pseudo-anonymous scammers and “developers” with malicious intent face almost no consequences, which effectively makes public fraud the norm, causing many seemingly promising projects to die in the cradle.

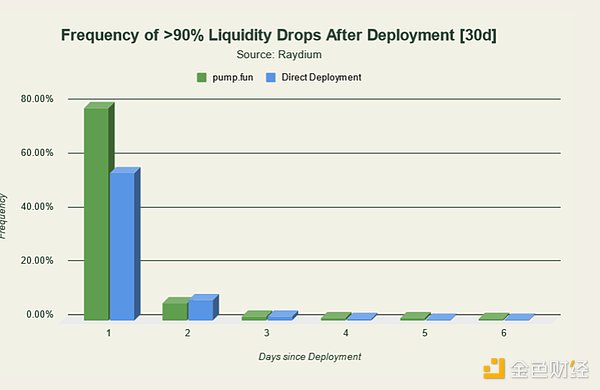

Diving deeper, it turns out that a significant portion of tokens are intentionally designed to fail in order to extract maximum value from unsuspecting speculators. This threat is ever-present, presenting a potential risk to those investors brave enough to participate in the market. In the past 30 days alone, almost two-thirds of tokens sold off in large quantities within 24 hours of issuance, with more than 90% of liquidity evaporated. For most tokens, recovery is nearly impossible after such a catastrophic event during their formative years. However, occasionally, some angry holders try to regain lost momentum through community takeovers, creating new social media accounts and starting over, motivated by stubbornness or even revenge. While the results of such attempts are often disappointing, if done right, they could provide a nice exit opportunity for backers.

Çözüm

Solana’s memecoin ecosystem is both dynamic and unpredictable, characterized by endless creativity, rampant speculation, and the ever-present risk of exploitation. Platforms such as Pump dot Fun and Raydium have become the epicenter of this thriving ecosystem, providing opportunities as well as challenges for participants. While the rapid rise of a few standout tokens has fueled dreams of “getting rich quick,” the sobering reality is that most memecoins struggle to sustain early momentum, ultimately leaving behind a trail of shattered hopes.

Amid this evolving speculative frenzy, one thing is clear: careful due diligence is essential. In a world where virality often trumps intrinsic value, surviving in this niche requires a keen eye for trends and a firm skepticism of promises of “easy riches,” whether as a curious observer or an active participant.

An estimated 617 million people are currently using kriptocurrencies worldwide (about 7.51% of the total population). If this number reaches 8%, it could mark a turning point for BTC towards mainstream adoption – whether through stablecoins, decentralized finance, new financial services, or even simple speculation. With only 8% penetration in a few key regions, the awareness and usage base reflected in this number will form a network effect, stimulating more institutional and public interest. Historically, the 8% adoption threshold marks the transition from early adopters to early majority — a critical stage that will see cryptocurrency gain widespread acceptance by 2025. Review of Trump’s BTC Conference Speech Trump delivered a keynote speech at the 2024 BTC Conference in Nashville, advocating that the U.S. government include BTC as a strategic asset…

İyi

İyi