These signals suggest that ETH may be about to counterattack and break through $4,000

Kaynak: WE Messamore

In this bull market, Bitcoins growth far exceeds that of Ethereum. So far, BTC has increased by 133% this year, while ETH has only increased by 50%. Someone in the community joked: When BTC was priced at $52,000, ETH was breaking through $3,300; when BTC was priced at $72,000, ETH was still breaking through $3,300; BTC has now broken through $10,000, and ETH has finally broken through $3,300.

In addition to BTC, the price increases of public chain tokens known as Ethereum killers have also exceeded ETH. According to OKX data, SUI has risen by 74%, SOL has risen by 50%, and DOT has risen by 131% in the past month. Although the price of ETH reached $3,500 last Saturday, some investors still feel that its prospects of reaching $4,000 in this bull market are slim.

Greg Magadini, director of derivatives trading at Amberdata, said in a note to clients, “ETH is facing severe upward resistance due to its value proposition as ‘sound money’, Ethereum is turning to inflation, and almost all DeFi transactions are executed on L2, which I think is a significant drag on ETH prices.”

So, will Ethereum, the second largest blockchain in the kripto industry, really lag behind BTC and other Ethereum killers in this cycle as many people say? It may be too early to draw a conclusion now. The evolution of mainstream blockchains is an extremely long game – anyone who thinks they have won the war too early will fall into complacency and eventually lose everything.

The following clues indicate that Ethereum may be accumulating momentum for a counterattack, and a breakthrough of $4,000 is just around the corner.

ETH/BTC exchange rate shifts again

From a technical analysis, the price exchange rate between ETH and BTC is at a cyclical turning point and has formed a bottom. Based on past experience, this means that the price of Ethereum may rise soon, and even exceed the increase of Bitcoin.

Legendary commodity and foreign exchange trader Peter Brandt posted a post on the X platform on November 21 titled A letter from the grave? and attached a chart of Ethereum price and Bitcoin exchange rate. As shown below, the chart shows the rise of ETH when the ETH/BTC exchange rate was at a low level four years ago.

ETH Vs SOL

Over a longer period of time, while Ethereum was dormant, Solana has experienced a strong bull market. From the perspective of sector rotation, this may also mean that Ethereums market still has more room for upside.

Comparing the relative performance of ETH and the three most popular meme coins on the Ethereum chain with SOL and the three most popular meme coins on the Solana chain during the US election is another important signal for assessing these competing altcoin markets.

In the 30 days ending November 25, SOL outperformed ETH with a 50% increase compared to ETHs 34%. Despite this, Ethereums top three meme coins (SHIB, PEPE, FLOKI) still outperformed Solana meme coins (Bonk, WIF, POPCAT) overall during the same period.

The cumulative 30-day ROI of Ethereum plus its top three meme coins is 220%, while the ROI of Solana plus its top three meme coins is 200%.

Institutional support for Ethereum

In addition to the monthly Ethereum ETF net inflows and the rise in Ethereum futures trading volume in November, institutional investors have shown high confidence in ETH. Institutional investors do not hold ETH in the short term, they also lock it in staking contracts. This not only protects the network and is a means of earning additional income, but also shows that institutional investors have confidence in Ethereum and its long-term growth prospects.

İçinde early October, Carlos Mercado, a data scientist at blockchain strategy firm Flipside Crypto, noted that the number of Ethereum stakers has grown by more than 30% in the past 12 months. Blockworks Research, a New York City-based blockchain intelligence firm, released a anket of Ethereum users in mid-October, which showed that 69.2% of respondents staked Ethereum, and 78.8% of them were investment firms or asset management companies.

In addition, institutional investors are taking other measures to maintain their liquidity when staking ETH, with the report showing that more than 52% of respondents are involved in liquidity staking. This shows that these traditional financial participants are becoming more and more mature in the Ethereum DeFi ecosystem.

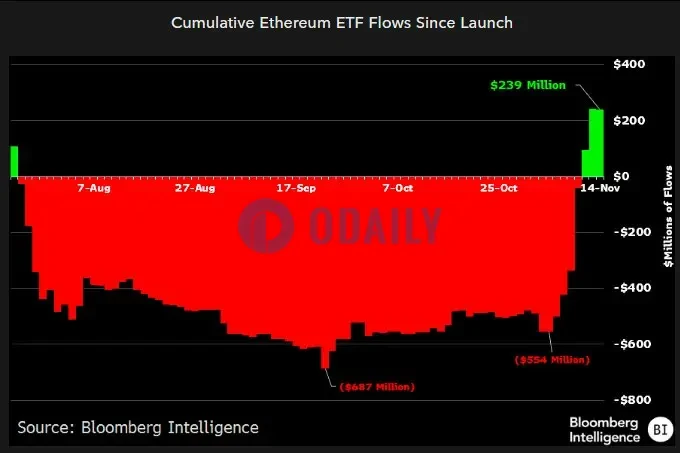

Eric Balchunas, senior ETF analyst at Bloomberg, also bunu yazdı since Trumps victory, Ethereum ETF has emerged from the abyss of capital outflows and finally ushered in fresh air and net inflows. According to the Bloomberg Intelligence data he showed, the cumulative capital flow of Ethereum ETF has turned positive, indicating that institutional investors confidence in Ethereum continues to grow.

DAPP transaction volume increased during the month

Another fundamental analysis of Ethereum’s price is the monthly activity of Web3 or DApps secured by its blockchain network. According to DApp Radar, Ethereum’s Dapp volume is rising as the ETH/BTC exchange rate reaches a historical inflection point and ETF investor sentiment turns bullish, and the calendar span is almost the same as the increase in ETH futures volume and ETF inflows.

In the past 30 days, Ethereums DApp transaction volume has been far ahead of DeFi tokens. Ethereums decentralized application layer transaction volume is $150 billion, far exceeding the second-ranked Arbitrum (ARB) at $32 billion and the third-ranked BSC (BNB) at $26 billion.

At the same time, The Block Pro analysis on November 21 also pointed out that driven by ETF fund inflows, Bitcoin gains and post-election bullish sentiment, Ethereums daily on-chain transaction volume surged to US$7.13 billion, the highest level of the year, an increase of 85% in just two weeks.

Ethereum Price Prediction: $6,000 by 2025?

Cryptocurrency analyst Ali Martinez tahmin edilen on November 20 that ETH will outperform Bitcoin by the end of this macro market cycle. In his optimistic forecast for the coming months, he believes that Ethereum will rise to $6,000, while predicting that Ethereum will reach at least $4,000 in this cycle.

And it said: Every market cycle goes through a stage where Ethereum outperforms Bitcoin, which has not happened in the current cycle, but is kesinliklenitely about to happen. Since ETH is still lagging behind, there is an opportunity to buy before it outperforms the market.

Christian 2022.eth, co-founder of NDV, also yazdı : Since October, I have gradually built up a position of more than $8 million in BNB. I believe that BNB and ETH will catch up and lead in the second half of the bull market.

This article is sourced from the internet: These signals suggest that ETH may be about to counterattack and break through $4,000

Orijinal|Odaily Planet Daily (@OdailyChina) Yazar: Wenser (@wenser 2010) SocialFi yolunun büyüme ikileminden kurtulup kurtulamayacağı, Fi bağlantılarının hematopoetik yeteneğinin yeterince doğrulanması için güvenilmesi gerekebilir. Önceki makalede SocialFi'nin anlatı başarısızlığı, şifreli sosyal ağların hala bir geleceği var mı? , mevcut SocialFi yolu projelerinin temel sorunlarını kısaca analiz ettik. Bu sorunları çözmek için, şifreli projelerin temel özellikleri ve avantajlarıyla birlikte, SocialFi projesinin geleneksel mobil İnternet gişe rekorları kıran uygulamalarının geliştirme fikirlerinden kısmen ders çıkarması da gerekebilir. Bu makalede, Odaily Planet Daily geleneksel sosyal ürünlerin ve SocialFi projesinin Fi yönlerini parçalara ayırıp açıklayacak ve ByteDance'in popüler…