Buy the rumor series: Expectations for improved regulatory environment rise, which cryptocurrency will benefit most dire

Yazar: @Web3 Mario

Abstract: We know there is a proverb, Buy the rumor, sell the news. Before the October election, the article DOGEs New Value Cycle: Political Traffic Potential and Musks Department of Government Efficiency (DOGE) Political Career published by the author has received good responses and expected results, and the author has also reaped a relatively rich return on investment. I would like to thank everyone for their encouragement and support. I personally think that there will be a lot of similar trading opportunities in this window period before Trump officially takes over, so the author decided to start a series of articles, Buy the rumor series, to explore and analyze the hot spots that are currently being hyped in the market and refine some trading opportunities.

Last week, there was a phenomenon that deserves great attention. With the strong return of Trump, the market has begun to hype the potential resignation of Gary Gensler, the chairman of the US SEC. You can see analysis articles about the successor in most mainstream media. In this article, we will analyze which kriptocurrency will benefit most directly as the expectation of improved regulatory environment rises. First of all, I think the ETH Staking sector will be the sector with the largest direct benefits, and Lido, as a leading project, may also get rid of the current price dilemma.

Let鈥檚 review the regulatory dilemma Lido encountered: Samuels v. Lido DAO lawsuit

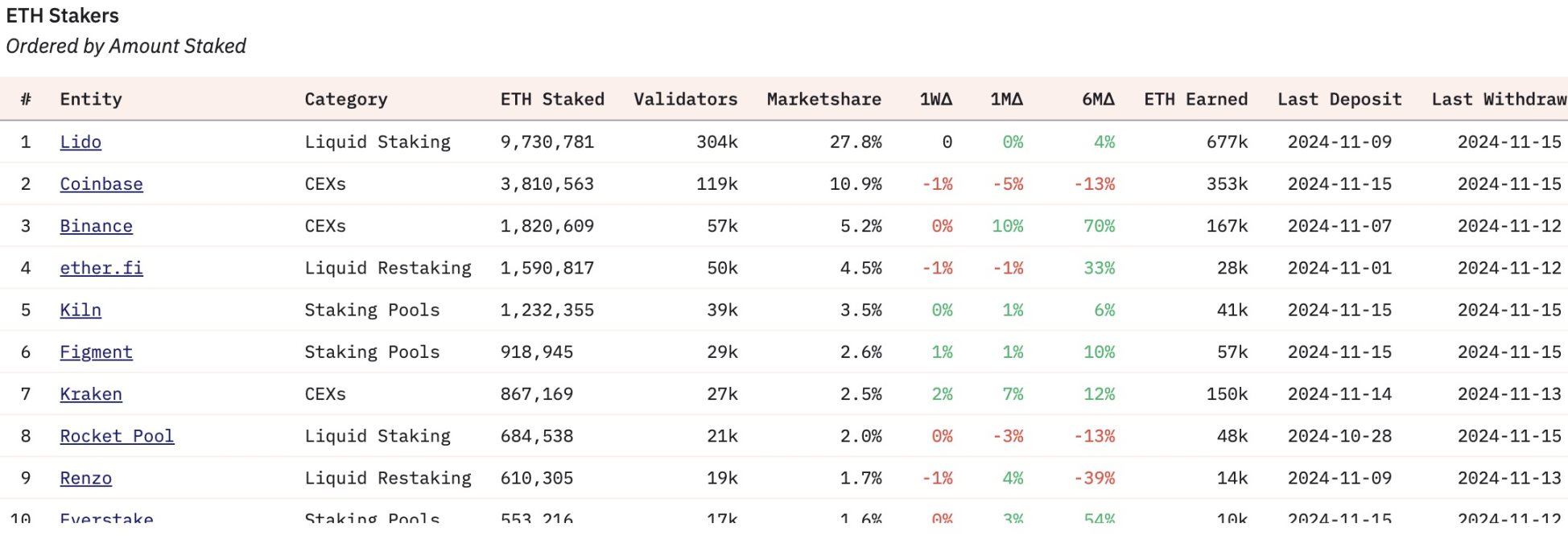

First of all, lets add some basic information. We know that Lido is the leading project in the ETH Staking track. By providing non-custodial technical services, it helps users participate in Ethereum PoS and earn income, and lowers the technical threshold of the entire process and the 32 ETH capital threshold of Ethereum Native Staking. After three rounds of fundraising, the project raised a total of 170 million US dollars. After launching in 2022, with its first-mover advantage, Lidos market share has remained at around 30% all year round. So far, according to Dunes data, Lido has also maintained a 27% market share and has not shown a significant decline, which shows that Lido is still relatively strong in terms of business demand.

The reason for Lidos current low price can be traced back to the end of 2023, when the price of its governance token LDO also reached its historical high, with a market value of 4 billion US dollars. At this time, a lawsuit changed the entire price trend. This is the Samuels v. Lido DAO case, case number 3: 23-cv-06492. On December 17, 2023, an individual named Andrew Samuels filed a lawsuit against Lido DAO in the United States District Court for the Northern District of California. The core content of the lawsuit is to accuse the defendant Lido DAO and its partner venture capital company of selling LDO tokens to the public in an unregistered manner, in violation of the Securities Act of 1933. In addition, Lido DAO created a highly profitable business model by pooling users Ethereum assets for staking, but did not register its LDO tokens with the U.S. Securities and Değişme Commission (SEC) as required. Plaintiff Andrew Samuels and other investors purchased LDO tokens because they believed in the potential of the business model and eventually suffered economic losses, so they sought legal compensation.

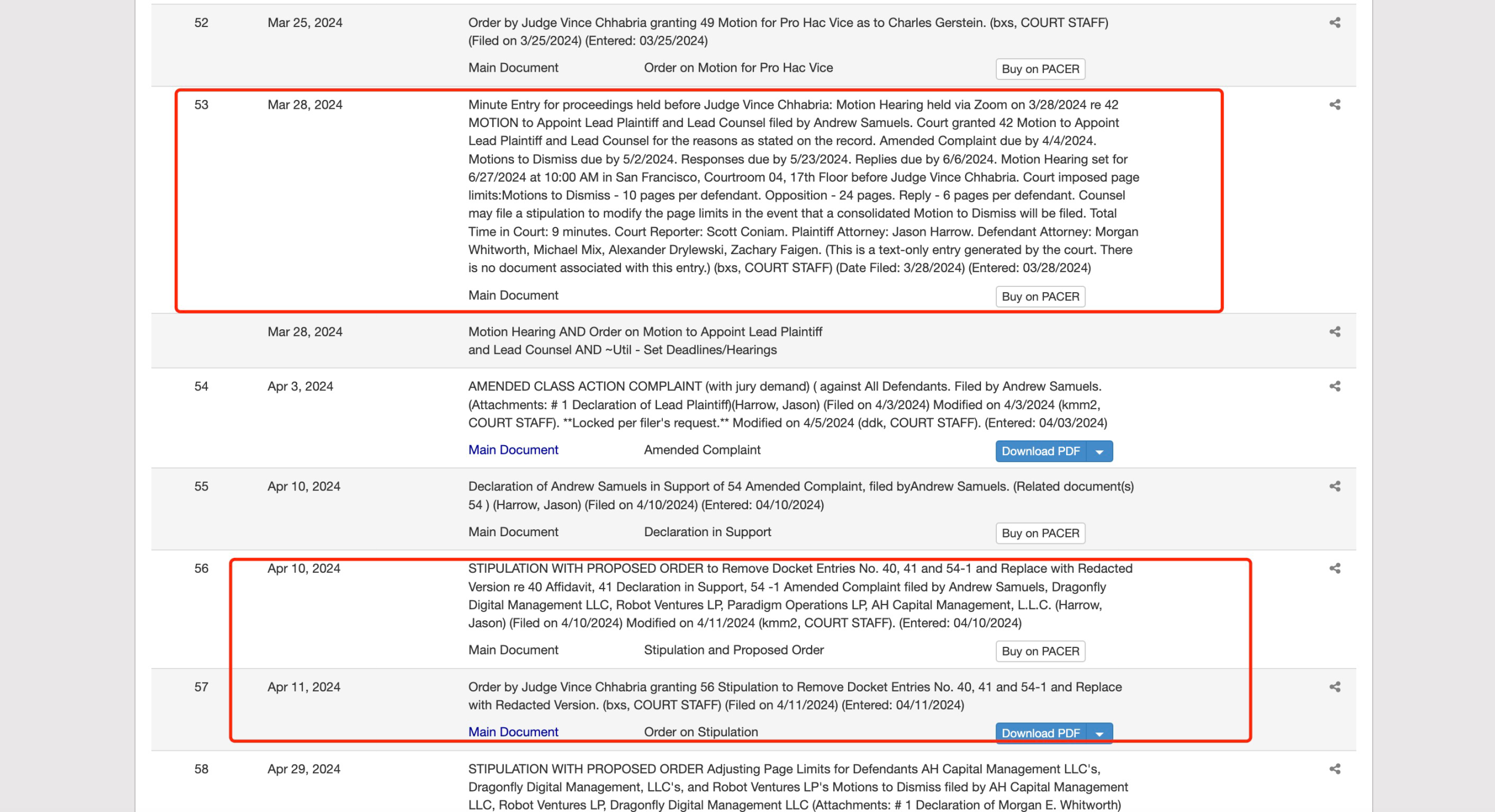

The case not only involves Lido DAO, but also includes charges against its major investors, including AH Capital Management LLC, Dragonfly Digital Management LLC, Lido DAO, Paradigm Operations LP, Robot Ventures LP, etc. According to the information displayed on the progress of the entire case, these institutions received subpoenas from the court in January 2024, when the price of LDO was at its highest point. After that, the legal process between the two parties has been limited to the lawyers of the investment institutions and lawyer Andrew Samuels, so the relevant influence has not spread.

It was not until the first motion hearing on March 28, 2024, the decision of which was entered on April 10, 2024, that the case was admitted on fact after some relevant provisions were amended.

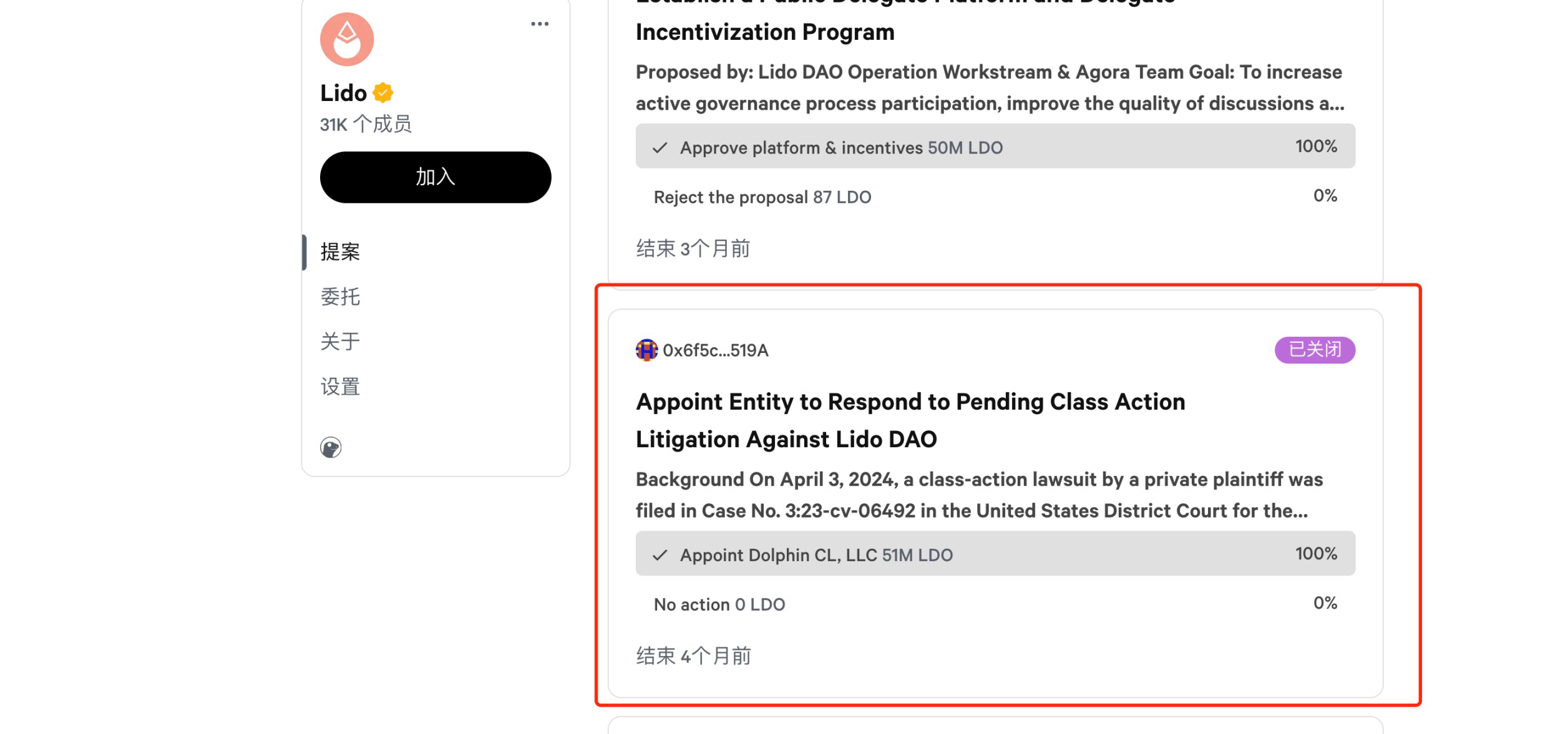

Thereafter, on May 28, 2024, Andrew Samuelss legal team unilaterally announced a motion to declare Lido Dao in default. The reason for this operation is that Lido DAO believes that it does not operate as a company, so it has ignored the lawsuit. If it is finally declared in default, Lido will face some unfavorable judgments, such as failure to defend itself, and based on the previous similar Ooki DAO case, the result is unfavorable to the absent party. The motion was passed by the court on June 27 and required Lido DAO to respond within 14 days. After that, Lido DAO had to initiate a community proposal on July 2, 2024 to hire Dolphin CL, LLC in Nevada as a defense lawyer and apply for 200,000 DAI related funds. So far, the case has been widely known to the community. After several arguments between the two sides, the case seemed to enter a cooling-off period after September.

At the same time, another case also had a substantial impact on Lido, that is, the SEC in Consensys Software Inc. on June 28, 2024, case number 24-civ-04578, note that this date actually occurred the day after the judgment of the Lido case was issued that Lido DAO as an operating organization had been fully informed of the lawsuit. In this lawsuit, the SEC believes that Consensys Software Inc. engaged in unregistered securities offerings and sales through its service called MetaMask Staking, and operated as an unregistered broker through MetaMask Staking and another service called MetaMask Swaps.

According to the SEC鈥檚 complaint, since January 2023, Consensys has offered and sold tens of thousands of unregistered securities on behalf of liquidity staking program providers Lido and Rocket Pool, which created and issued liquidity staking tokens (called stETH and rETH) in exchange for staked assets. While staking tokens are typically locked and cannot be traded or used during the staking period, liquidity staking tokens, as the name implies, can be freely bought and sold. Investors in these staking programs provided funds to Lido and Rocket Pool in exchange for liquidity tokens. The SEC鈥檚 complaint alleges that Consensys engaged in unregistered securities offerings and sales by participating in the distribution of staking programs and acting as an unregistered broker in these transactions.

In this lawsuit, the stETH certificate issued by Lido to participating users was clearly described by the SEC as a security. So far, Lido has officially ushered in a low period under strong regulatory pressure. In the previous description, the time rhythm of the case progress was sorted out in the hope of echoing its price trend. In other words, in fact, the core factor that suppresses the price of LDO is the impact of the lawsuit brought about by the increased regulatory pressure, which triggers the risk aversion of institutional investors or retail investors, because if the judgment is unfavorable, it means that Lido DAO will face a considerable fine, which is bound to have a great impact on the price of LDO.

Is stETH a security? And why Lido鈥檚 subsequent development is the most worthy of attention

After the above analysis, we can already identify that the current reason for the low price of LDO is not because the business is not as expected, but because of the uncertainty caused by regulatory pressure. We know that the core of the above two cases is to determine whether stETH is a security. Usually, whether an asset can be confirmed as a security needs to go through the so-called Howey test. To briefly introduce, the so-called Howey test is a standard used in US law to determine whether a transaction or instrument constitutes a security. It originated from the 1946 US Supreme Court ruling on the case of SEC v. WJ Howey Co. This test is crucial to the kesinliklenition of securities, especially in the field of cryptocurrency and blockchain, and is often used to assess whether tokens or other digital assets are regulated by US securities laws.

Howe testing is mainly based on the following four criteria:

-

Investment funds: whether it involves investment of money or other value.

-

Common Enterprise: Whether the investment is into a common enterprise or project.

-

Expected Profits: Whether the investor has a reasonable expectation of profiting from the efforts of others.

-

Efforts of others: Whether the source of profit mainly depends on the management and operation of the project developer or a third party.

If a transaction or tool meets all of the above conditions, it may be identified as a security and regulated by the U.S. Securities and Exchange Commission (SEC). In the current regulatory environment that is not favorable to cryptocurrencies, stETH is identified as a security. However, the cryptocurrency community holds the opposite view. For example, Coinbase believes that the ETH Staking business does not meet the four elements of the Howey test and should not be considered a securities transaction.

-

No money invested: During the staking process, users always retain full ownership of their assets rather than handing over funds to a third party for control, so there is no investment.

-

No joint enterprise: The staking process is completed through a decentralized network and smart contracts, and the service provider is not a joint enterprise with the user.

-

No reasonable profit expectation: Staking rewards are the labor income of blockchain validators, similar to salary compensation, rather than the profit return expected from investment.

-

Not dependent on the efforts of others: Institutions providing staking services only run public software and computing resources to perform verification, which is technical support rather than management behavior, and rewards are not based on their management efforts.

From this we can see that there is still room for discussion on whether the certificate assets related to ETH Staking will be identified as securities, which is greatly affected by the overall subjective judgment of the SEC. Finally, let me summarize why I say that the subsequent development of Lido is the most worthy of attention:

1. The core factor of price suppression is regulatory pressure, the subjective factors of regulatory pressure account for a high proportion, and the current price is at a low point from a technical perspective.

2. ETH has been defined as a commodity, so there is more room for discussion on related viewpoints compared to other fields, such as SOL.

3. ETH ETF has been approved, and the relevant top resources mobilized will certainly provide assistance to promote the sales of ETF. I will expand on this a little here, because there is already relevant information spreading. This part of the follow-up information generally believes that the current capital inflow of ETH ETF is always not as good as BTC ETH. The reason lies in differentiation. For most traditional funds, BTC, as the standard of the entire cryptocurrency track, is relatively easy to understand, while for ETH ETF, it is not that attractive. If ETH ETF can be allowed to provide buyers with indirect staking income, it will significantly increase its attractiveness.

4. The legal costs of resolving related lawsuits are relatively small. We know that in the Samuels v. Lido DAO case, the plaintiff was not the SEC, but an individual. Therefore, the legal costs of the dismissal judgment are small compared to cases directly sued by the SEC, and the impact is relatively small.

To sum up, I think during this window period, as the possibility of changes in the regulatory environment increases, Lidos subsequent development is worth paying attention to.

This article is sourced from the internet: Buy the rumor series: Expectations for improved regulatory environment rise, which cryptocurrency will benefit most directly

Original | Odaily Planet Daily ( @OdailyChina ) Author | Fu Howe ( @vincent 31515173 ) In the third quarter of 2024, primary market investment and financing showed a downward trend. At the macro level, the Federal Reserve started a new round of interest rate cuts after a lapse of four years, with the first cut of 50 basis points in September; with the US election approaching, the crypto market faces the last critical node of the year. From the perspective of the crypto market, meme coins have become a new growth point, but they still face problems such as weak radiation, short duration and unpredictability, making it difficult to become a new internal driving force. No new economic model has yet emerged. Due to a combination of factors, the…