Gate Ventures Araştırma Görüşleri: Telegram ve Ton, Trafik Kraldır

Telegram’s huge traffic

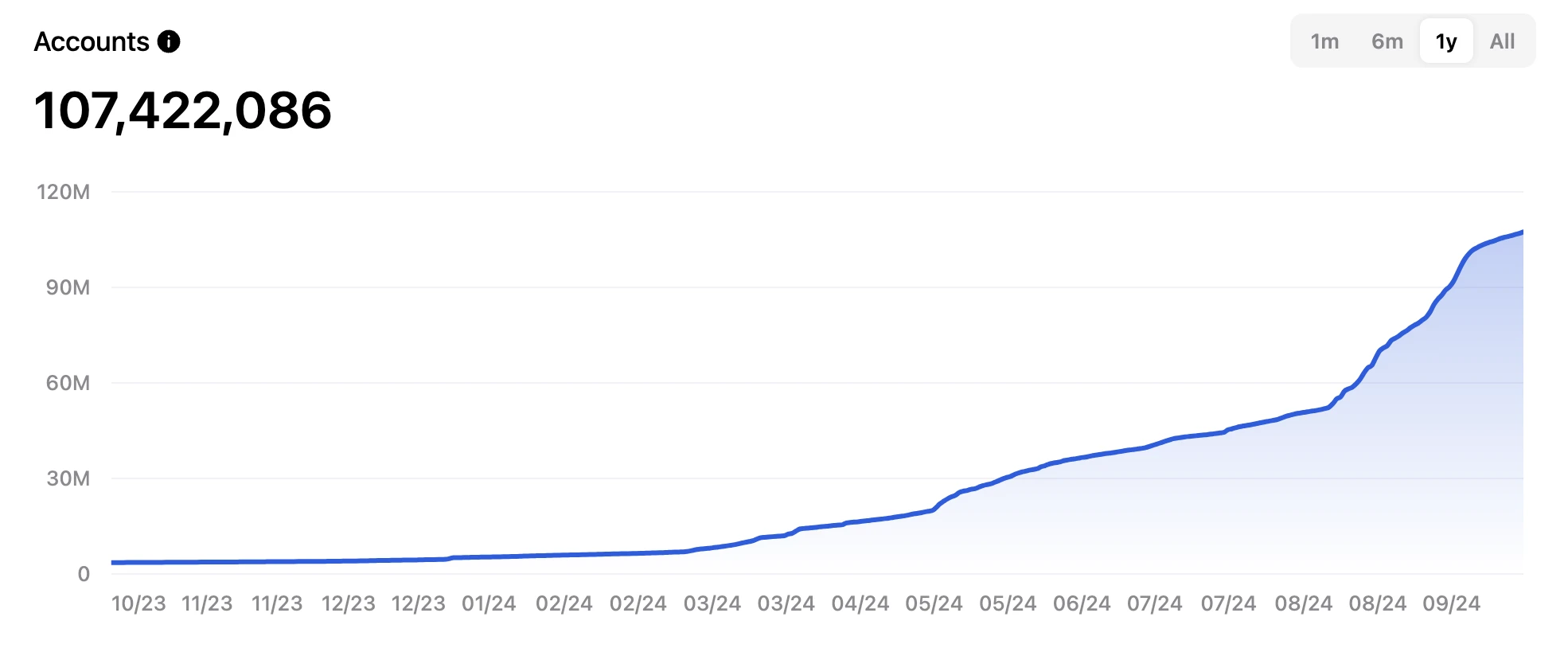

On September 13, 2023, Telegram officially launched the native embedded TON Space and announced the integration of the TON blockchain ecosystem. The newly launched self-hosted wallet function is directly integrated into the Telegram application, enabling 800 million active users to easily manage their digital assets on the platform. With this, the number of on-chain wallets of the TON blockchain has exceeded 100 million in one fell swoop. From the beginning of the year to October, it has become the fastest public chain in the history of blockchain to have more than 100 million wallets.

Telegrams integration strategy aims to convert its huge user traffic base into a user base for the TON ecosystem. Through innovative forms such as gas-free transactions, social finance, NFTs and Mini Apps, Telegram is building a richer, decentralized social platform. In this way, Telegram integrates blockchain technology into its core business, providing users with new social and financial services, thereby increasing user stickiness and ecological value.

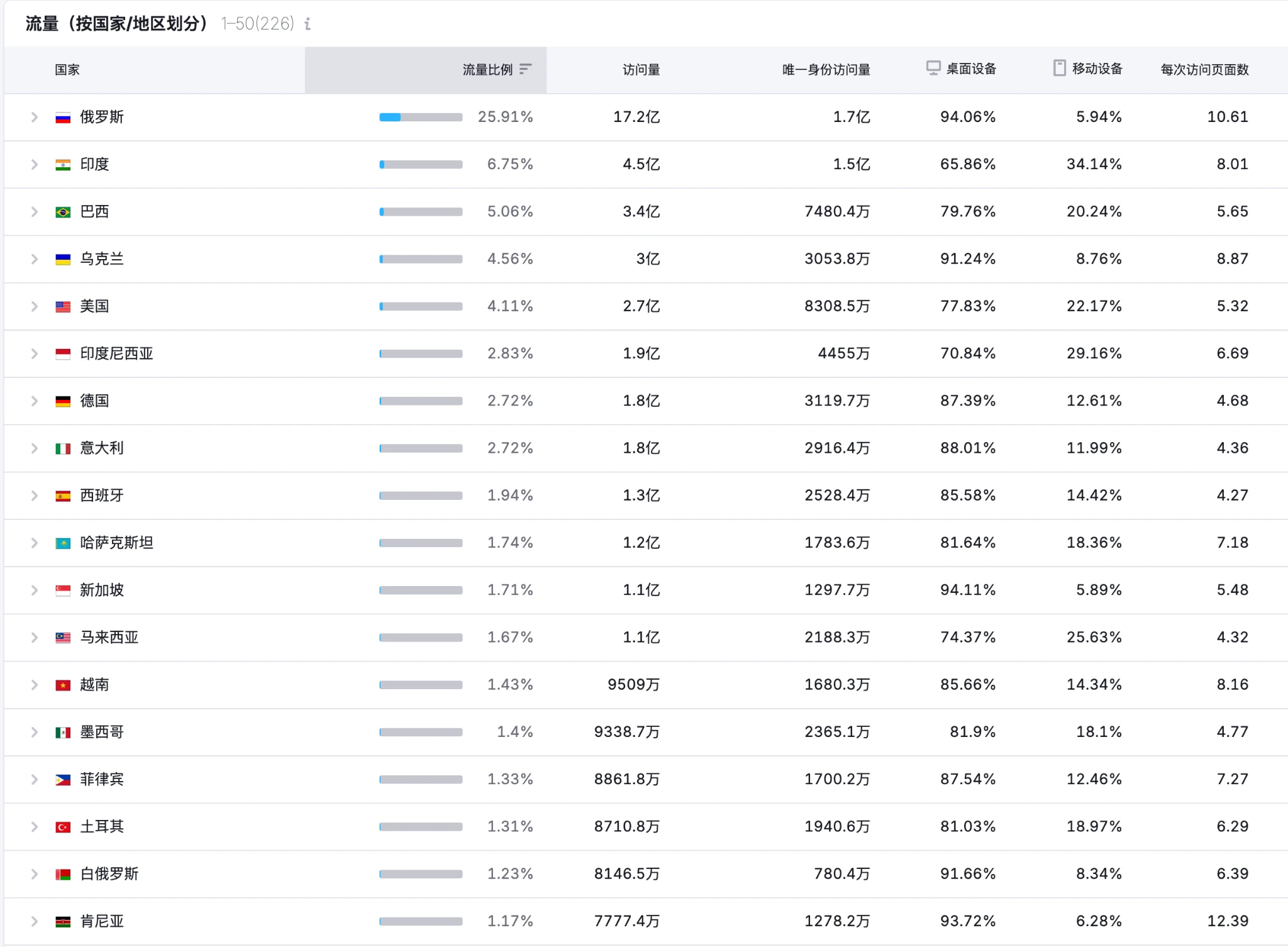

TG traffic source, source: Semrush

We analyzed the sources of traffic from October 2023 to October 2024 and found that about 25.9% of Telegram traffic came mainly from Russia, which is highly correlated with the fact that Russian project parties occupy an important niche in the TON ecosystem. We do observe that Russian market makers such as Gotbit have a strong influence in the TON ecosystem. However, this also means that the TON ecosystem may face stricter judicial review from Europe and the United States. Secondly, countries with higher traffic include India and Brazil, reaching 450 million and 340 million people, respectively. After deduplication, the number of single visitors from the United States ranks third, and the traffic is also very considerable.

With the support of Telegrams huge traffic base, TON has achieved explosive growth in monthly active users (MAU) since the TON Foundation took over the development. According to Hamster Kombat data, TON currently has about 240 million users (accounting for 25% of Telegrams MAU). A large number of lightweight applications (TAM) have attracted a considerable number of users, bringing a significant wealth-making effect, including DOGS, NOT, Catizen, Rocky Rabbit and Blum, which have more than 20 million users, and there are also many projects with more than one million users. This huge traffic pool has brought a turnaround to the current lack of users in Web3.

Project Details

product

-

Architecture Overview

Telegram Mini Apps (TMA) is a product similar to WeChat mini-programs, and is developed based on the Telegram ecosystem. Many developers have tried to combine it with the TON blockchain to build a Web2.5 Internet product. TMA is developed based on Web technology, so users can access TMA through all devices, but interaction with the TON chain requires the use of FunC, a special language for the TON chain, and the generation of Fift assembly code through the TON virtual machine (TVM) to run. TVM itself is implemented in C++.

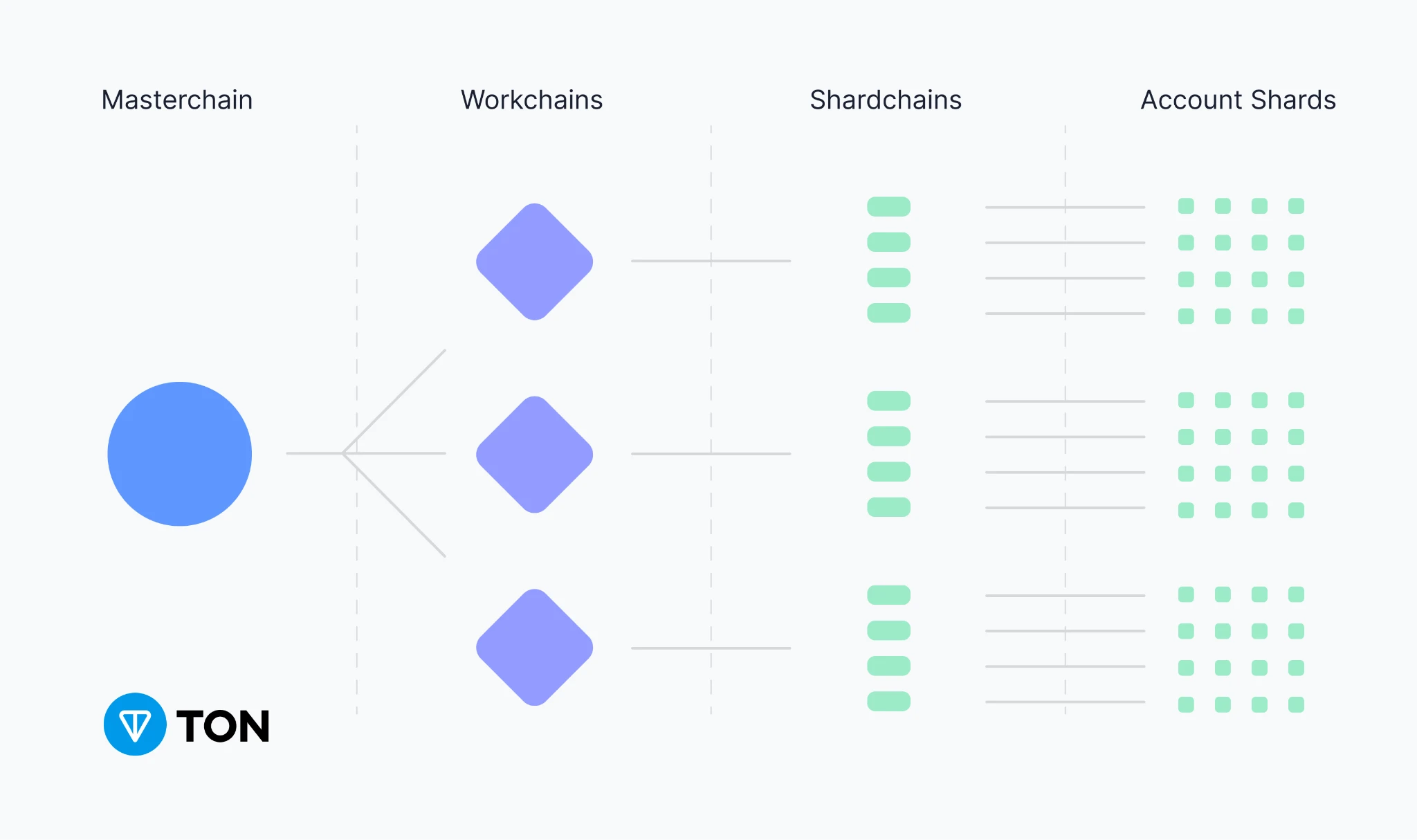

Technical architecture of TON blockchain

The TON chain adopts a sharded blockchain architecture, which is divided into four layers. In theory, TON can support up to 2³² workchains to execute in parallel, each of which can set independent operating rules according to its specific application or transaction requirements, and is further divided into 2⁶⁰ subchains (or shardchains). However, there is currently only one shard chain running on TON, called Basechain. In this architecture, Masterchain serves as the final state storage chain for all workchains, storing the core information of the protocol, including validator information, and maintaining the latest block hash records of all workchains and shardchains to achieve consensus across the entire network. Sharding chains are similar to sharded databases, so they support load balancing, which means that a database or workchain can be automatically split into multiple workchains to achieve higher concurrent processing capabilities.

Regarding the account model, although it is called an account chain, it actually only describes that transactions are executed sequentially (Tx 1 -> Tx 2 -> Tx 3 -> …). Accounts do not exist in the form of chains. They are essentially based on the Actor model, which has been widely used in multiple blockchains, including the derived Sui Objective model, Polygon Miden, Arweave AO, etc. However, it is worth noting that at present, its architecture is still quite simple. Although there is a design and conception of sharding chains, it still runs on a single chain.

-

Technical features

Actor Model

In TON, the basic unit is the Actor, which can be understood as similar to the smart contract in Ethereum. Accounts and smart contracts are both considered Actors. The Actor model was proposed by Carl Hewitt in 1973, aiming to solve the complexity problem caused by shared state in traditional concurrent programs through message passing. Each Actor has independent state and behavior, and does not share any state information with other Actors. Actors have logical execution capabilities and data storage capabilities, and perform the following steps in each transaction:

1. Something happens (most commonly an Actor receives a message)

2. The Actor handles the event by executing its code in the TON virtual machine according to its own properties.

3. Actor modifies its own properties (code, data, etc.)

4. Actors optionally generate outgoing messages

5. The Actor enters standby mode until the next event occurs

The combination of these steps is called a transaction. Each transaction is processed independently in parallel, and each transaction can send messages asynchronously to interact with other actors after processing. In this way, concurrency between actors is achieved.

Jetton

In TON, the token is called Jetton, and Jetton is also an Actor. The user wallet Actor does not directly store the Jetton balance. For example, for a Meme token called Gate Jeton, Gate Token is generated by deploying the Mint contract (Jetton). If a user wants to hold Gate Token, a new Actor will be generated, containing the minting contract address, balance information, and holder address of Gate Token. If 100,000 users want to hold Gate Token, 100,000 Actors will be generated. These Actors are theoretically located on a shardchain, but if a large number of holders send asset operation messages to the Gate Token Actor, sharding can be performed. The Actor model based on independent states makes parallel execution possible and makes it more scalable.

Message passing between Actors, source: TON

In general, we registered an Actor wallet with the TON account balance on the chain, but did not store the balance of other tokens Jetton. Other tokens also exist in the form of Actors, but have Holder Addresses. Actors interoperate through messaging.

Development Language

On TON, there are three programming languages available: Fift, FunC, and Tact.

● FunC is a low-level language similar to Lisp. As the main programming language for TON smart contracts, FunC emphasizes efficiency and flexibility. The language allows developers to directly manipulate memory and perform sophisticated resource management. However, due to its low-level characteristics, developers need to manually manage memory and handle underlying operations, which places high demands on programming skills and security awareness. If the operation is not careful, it may cause problems such as memory leaks and buffer overflows, bringing potential security risks to smart contracts.

● Tact is a higher-level language, but it is more complex and more difficult to program in.

● Fift is a low-level assembly and debugging language that can interact directly with the TON virtual machine and is suitable for low-level debugging and testing of smart contracts. However, Fift is still in its early stages, and the tools and documentation are not perfect. Similar to the evolution of traditional development, most engineers have experienced a transition from early low-level languages (such as C language similar to FunC) to higher-level languages (such as C++, JavaScript, Java, and Rust).

takım

Developers Anatoliy Makosov and EmelyanenkoK launched the Newton open source community to further promote the open source development of TON. The Newton team was later renamed the TON Foundation. Currently, the TON Foundation operates as a non-profit community, attracting more than 40 independent non-registered developers from different regions to participate, and relies on donations for support.

Pavel Durov is the founder and CEO of Telegram. Telegram is a messaging app launched in 2013 that attracted more than 60 million active users in less than two years. Prior to Telegram, Pavel founded VK, a popular social network in Russia and many other countries with more than 100 million active users. In early 2014, Pavel left Russia and VK to focus on Telegram.

Steve Yun is the current Chairman of the TON Foundation. He received his BA in International Studies from Simon Fraser University and completed his BA in Business Administration at Douglas College. Steve has held key positions in several organizations and has played a key role in the TON Foundation since 2018, from strategic contributor to founding member, and finally becoming Chairman in 2023. Prior to this, he served as COO at Koinvestor, where he was responsible for the financing of nine kripto projects, raising a total of $50 million, and leading strategic partnerships.

Dima D is the technical director of the TON Foundation. He holds an associate degree from the Moscow Aviation Institute and Moscow State Technical University, and a bachelors degree in computer science from the University of London. He has worked as an engineer at Stealth, ivi.ru, and The Open Platform, and joined the TON Foundation as product director in September 2022, and was promoted to technical director in August 2023.

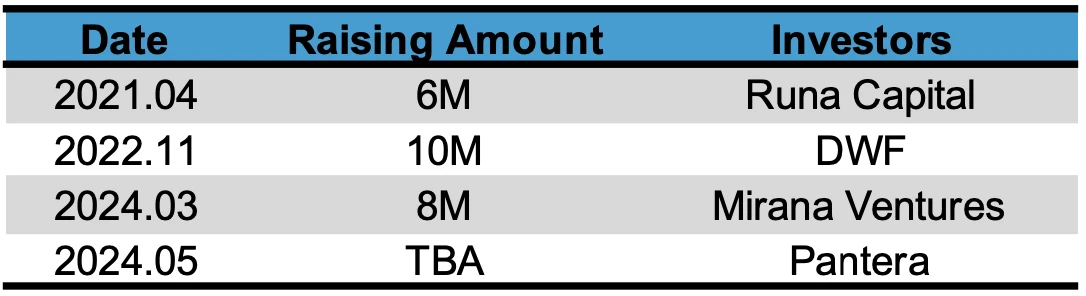

Finansman

The earliest TON token was called GRAM, and was issued in the form of an ICO. From January to March 2018, it was divided into several closed ICO rounds. The first stage was for trustworthy people and people within the company. The second stage was a public fundraising (minimum subscription amount of $1 million), with a target of $850 million and a final fundraising of $1.7 billion. The third round was cancelled due to over-subscription. However, in June 2020, under pressure from the US court, it announced the return of ICO funds, but only 72% (about $1.22 billion) could be returned immediately, and 110% could be returned one year later.

OTC financing situation

Ton Chain Ecological Development

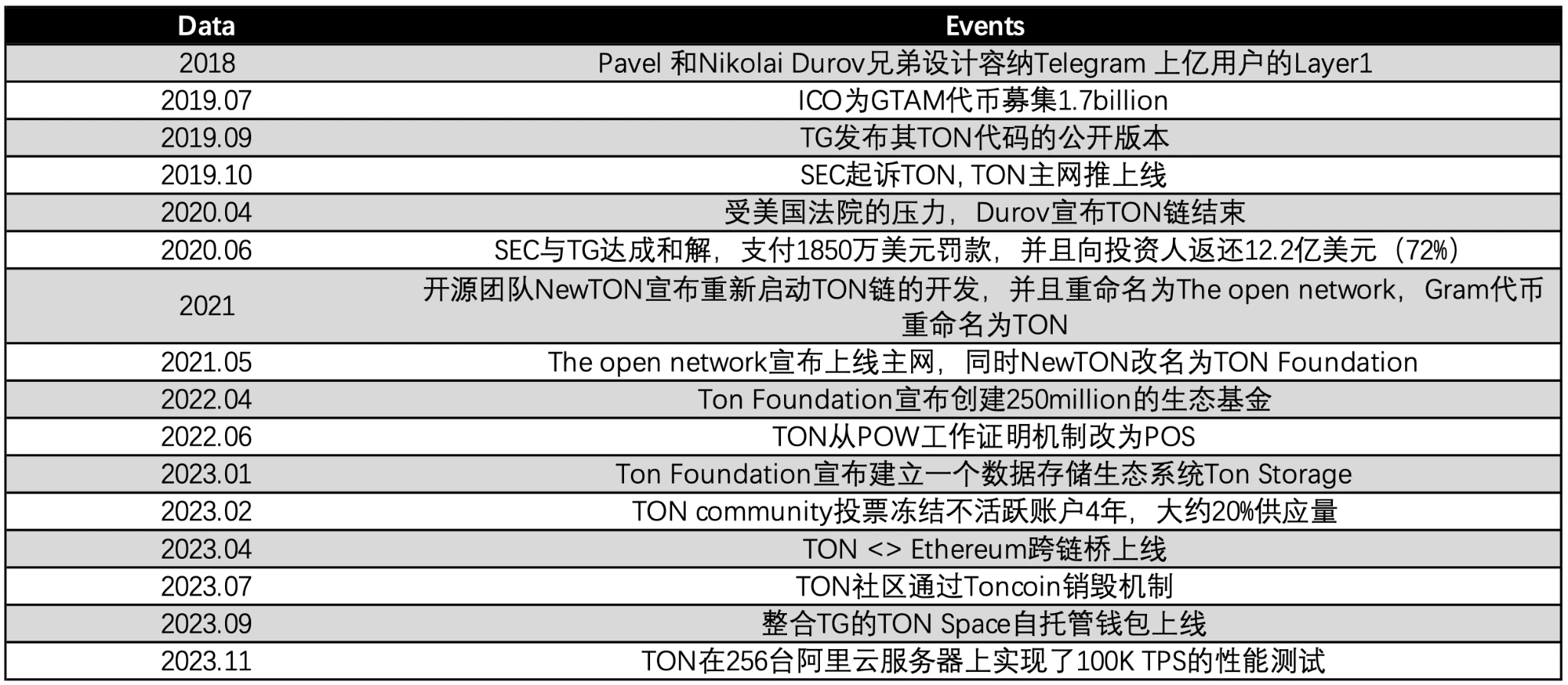

past

TON History

Now

Community

User Community

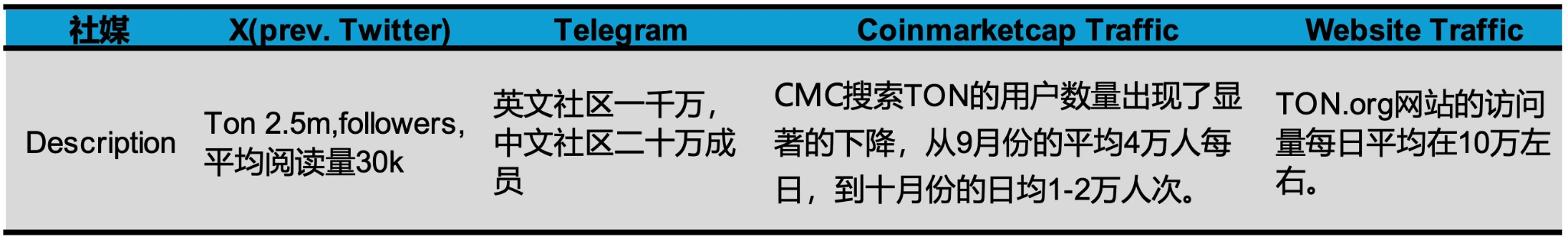

Social Media Statistics

Developer Community

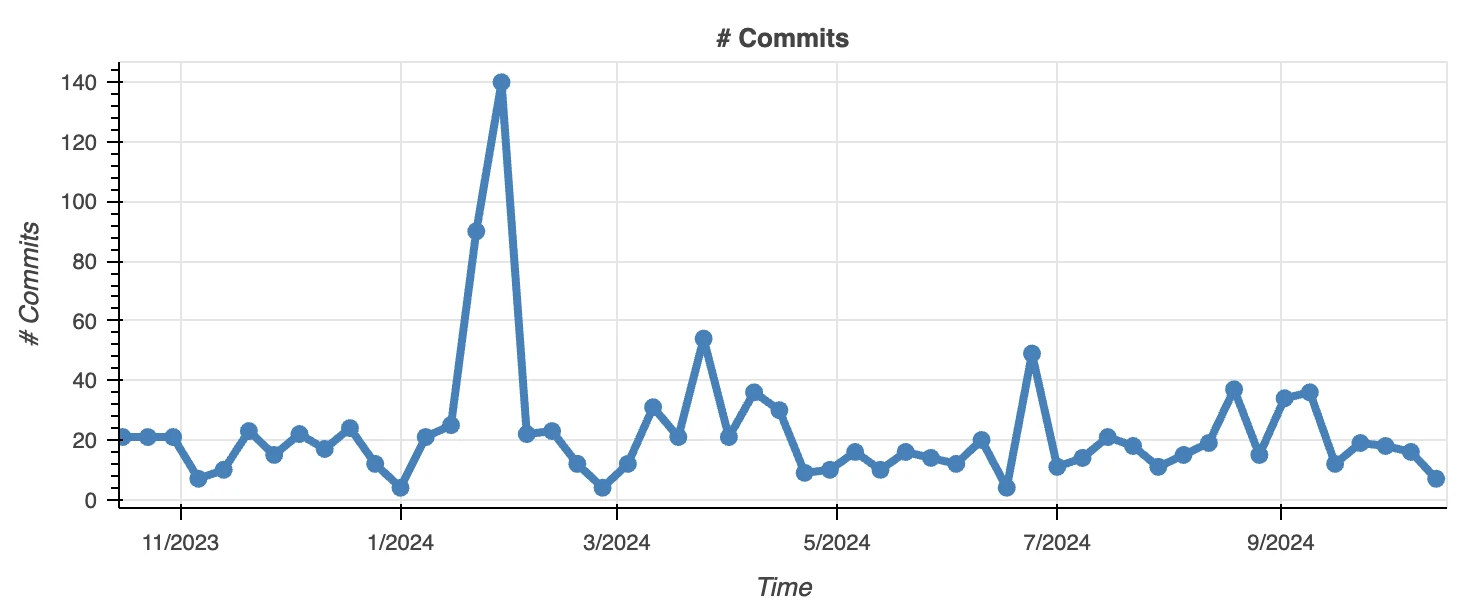

Commits, Image source: Cauldron

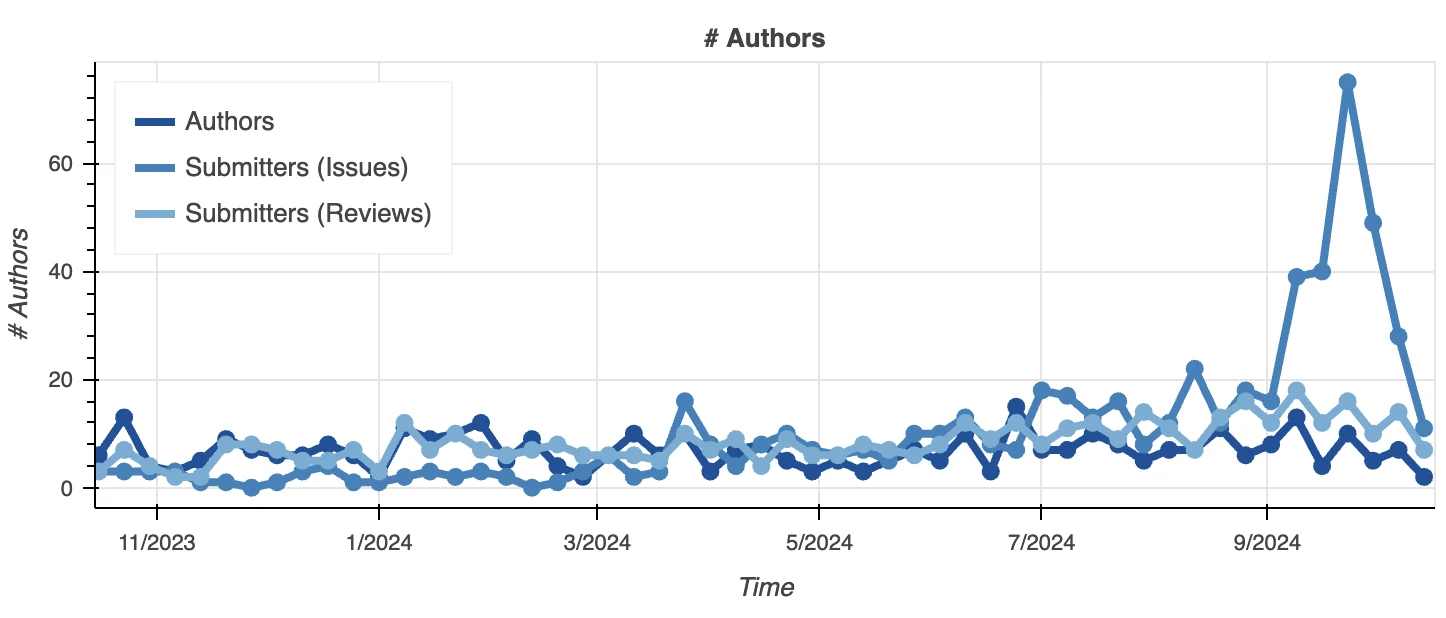

Authors, Image source: Cauldron

The development progress of the TON development library remains active and stable, with an average of about 10 commits per day. The number of core developers also maintains a stable number of issues and reviews for code submissions.

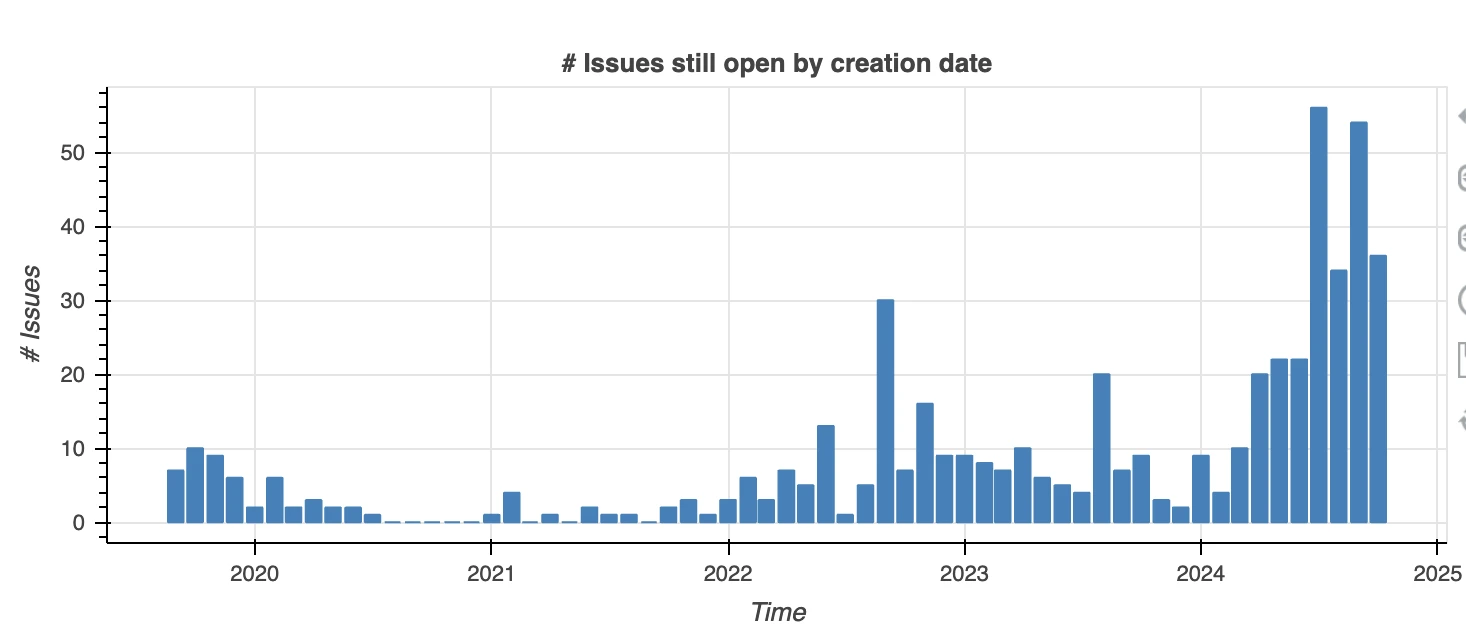

Issues, Image source: Cauldron

The increased attention to the TON ecosystem and the participation of developers have caused the number of issues in the code base to rise sharply, and the number of developers may still face a shortage.

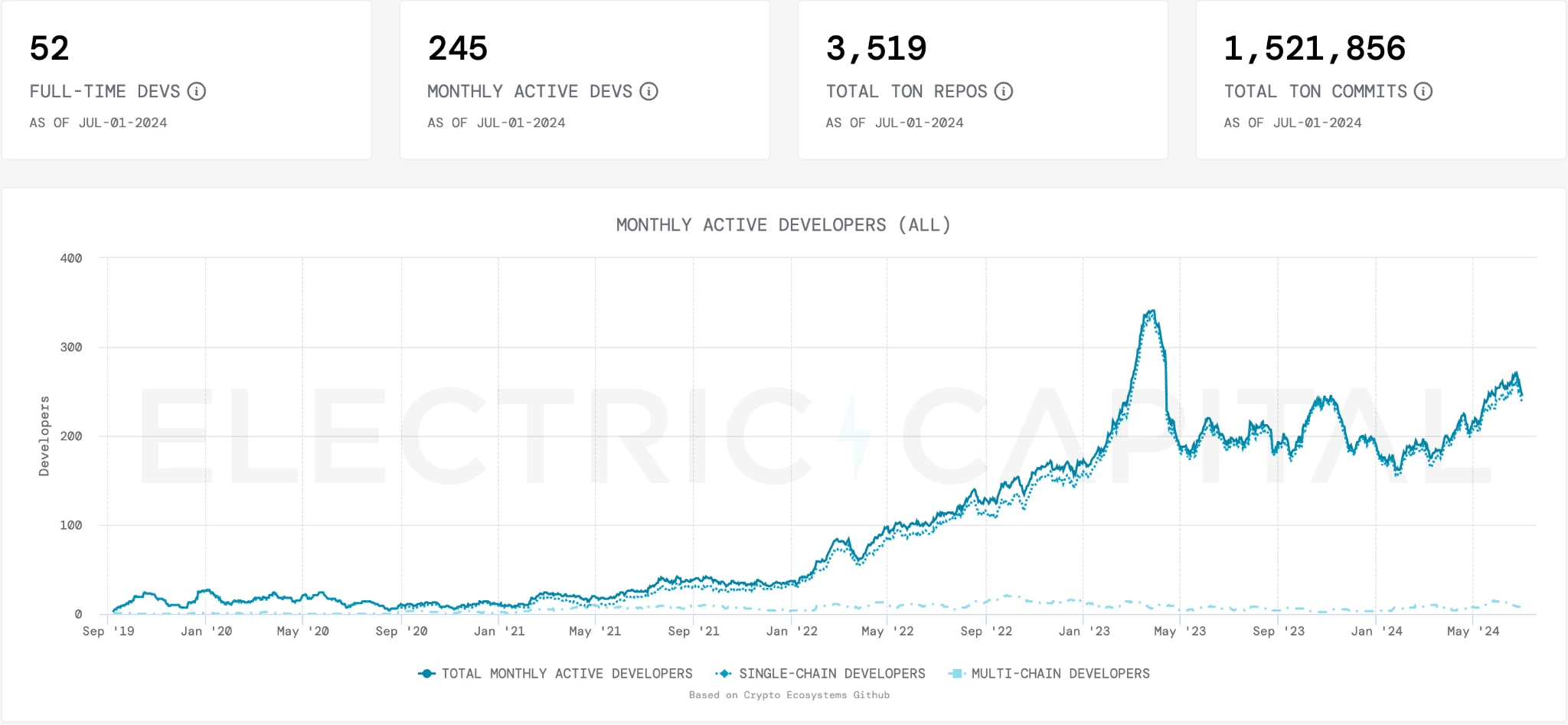

Developer growth, source: Elektrik Sermayesi

Since TON uses a unique development language and virtual machine, the number of professional developers is still relatively small. Many on-chain projects choose to outsource development, but overall, TONs developer ecosystem is still in its infancy and there is still a lot of room for growth in the future.

Ecology Landscape

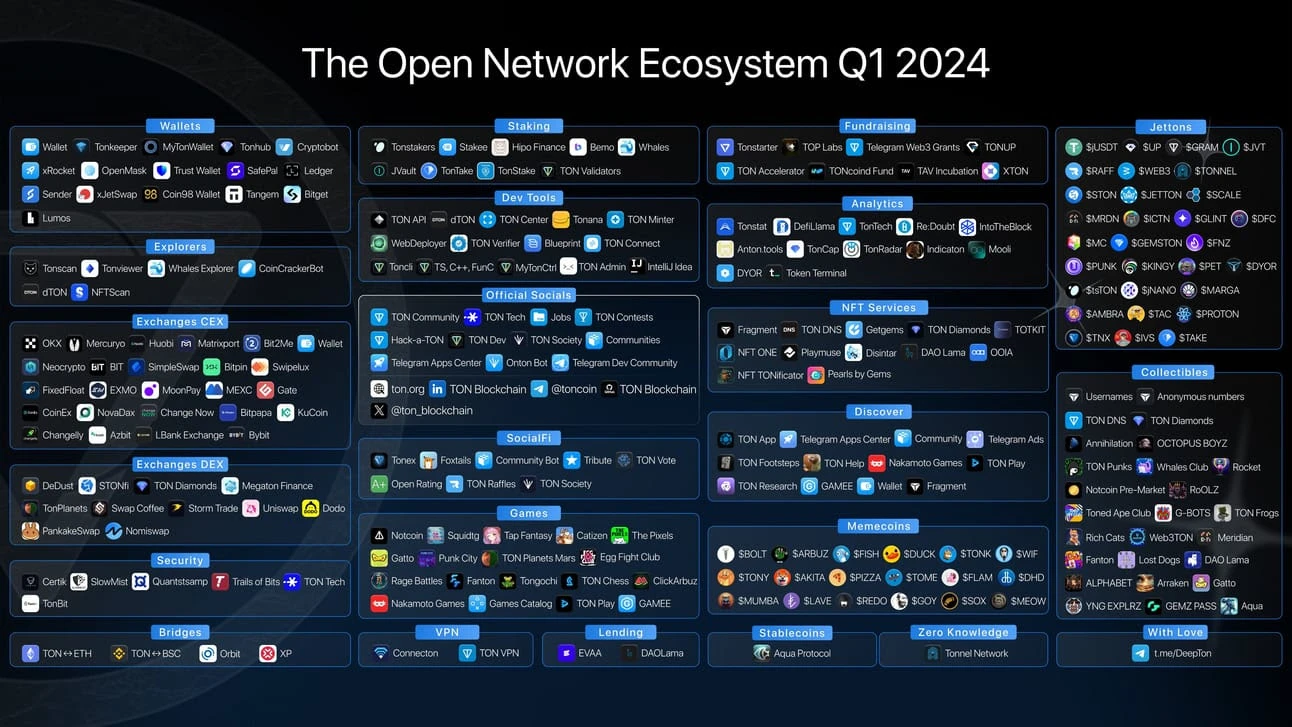

Ton ecosystem, source: Crypto Rand

In the development of the TON ecosystem, the first is the explosion of applications, which show a trend of diversification and consumer level, which is the direction currently lacking in the industry. At present, the main Tap to earn type of barrier-free small games that have accumulated a large number of users on TON, and the huge traffic has made the industry see its potential. Taking WeChat as an example, the top ten applications in WeChat applets with monthly active users (MAU) are all consumer applications, proving that consumer-level applications are the real rigid demand and have long-term growth potential. It is recommended to start with consumer applications of productivity tools to test the waters.

Next, we will introduce the development status and potential opportunities of TON ecological applications by category.

Utilities

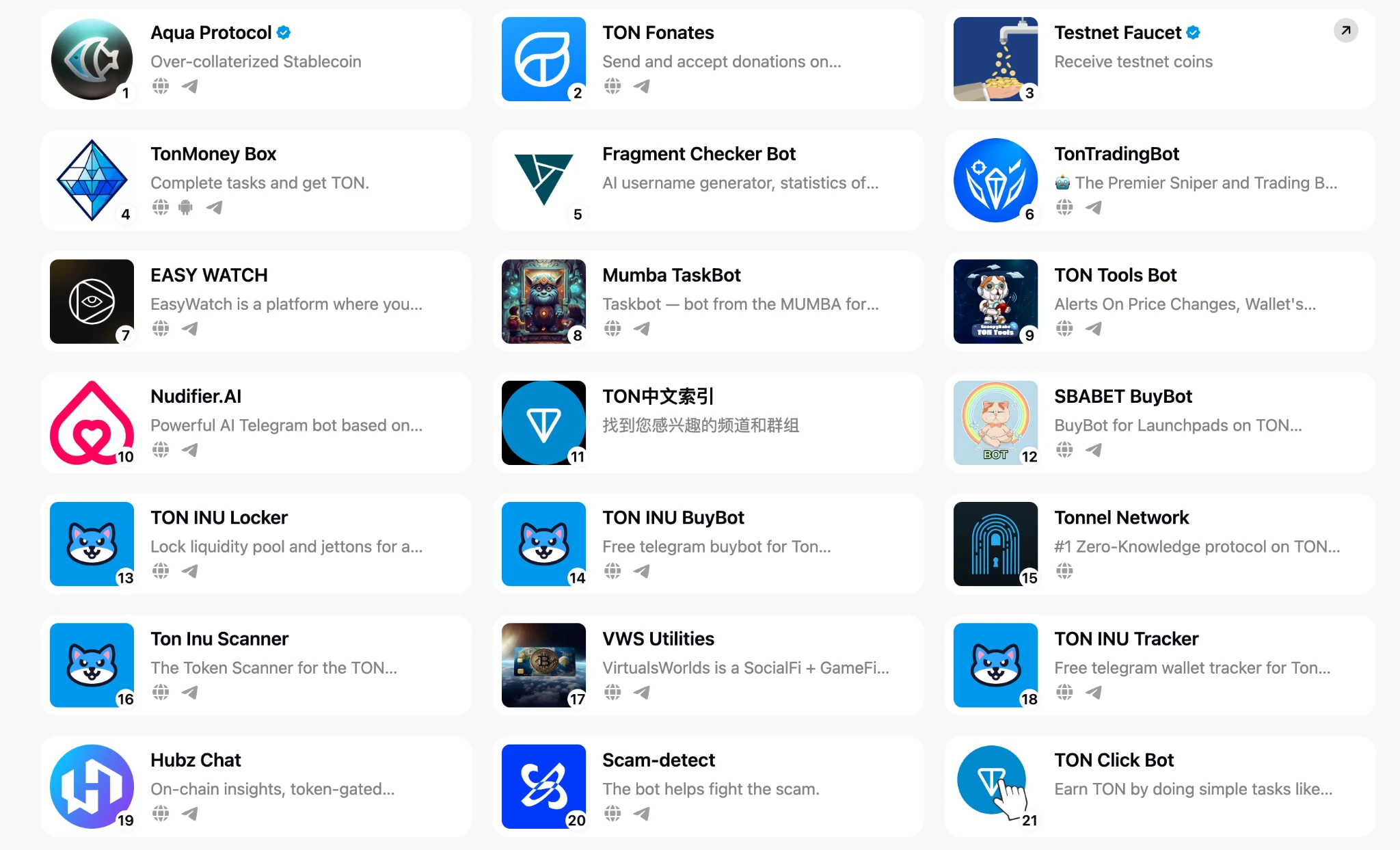

Utilities, Image source: ton app

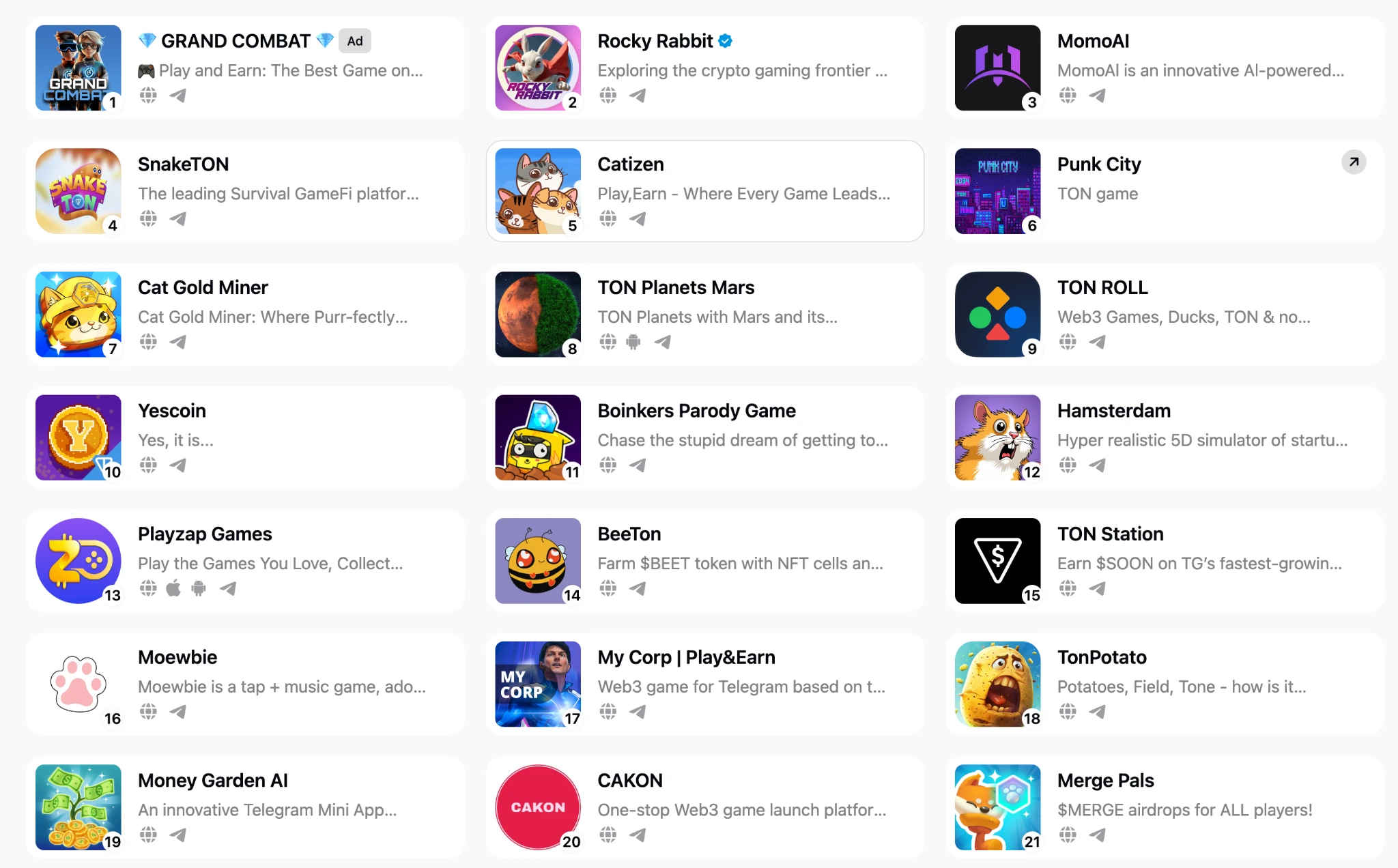

GameFi

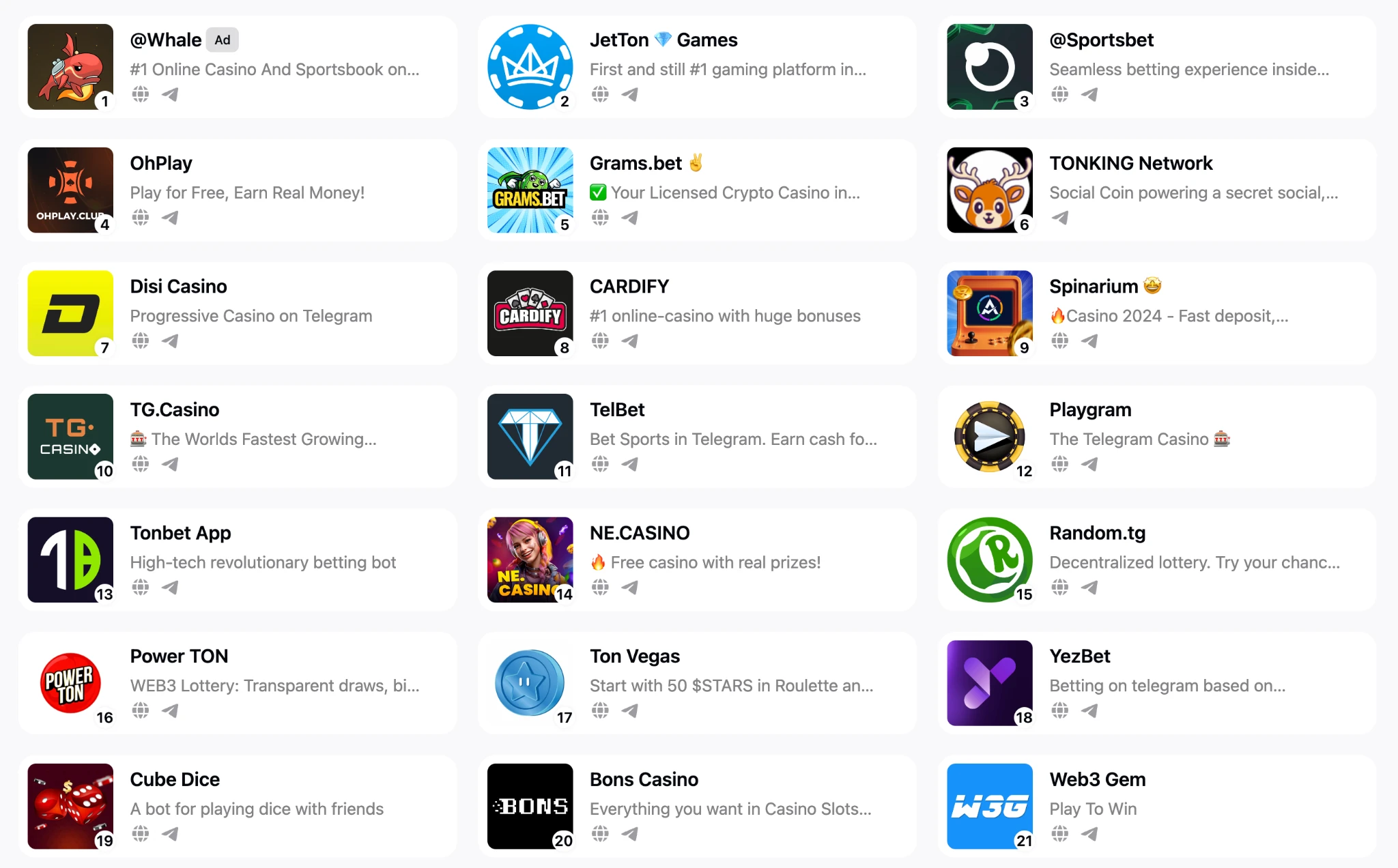

Gambling, Image source: ton app

Currently, JetTON Games, a gaming game of the gaming type, has the highest monthly active users (MAU), reaching 4.3 million. Its main mode is to collect tickets through the cut watermelon mini-game, task platform and in-app purchase, so that users can share the prize pool.

Gaming, Image source: ton app

Among non-gambling games, Rocky Rabbit is currently the most popular game, with 8.7 million subscribers. However, we found that its gameplay is still relatively simple, usually a combination of light games, task platforms and in-app purchases.

GameFis iconic ecosystem TGE time

We also noticed that the popularity of most projects is just due to the airdrop expectations. Once the airdrop ends, their data will drop sharply.

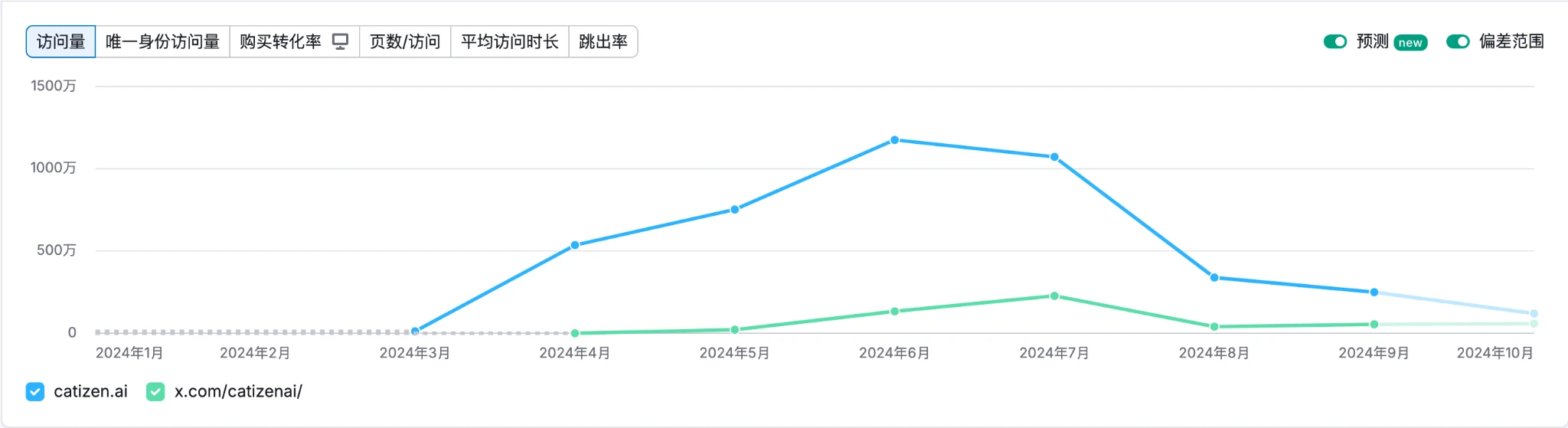

Catizen data analysis, source: Semrush

Catizens data for the past month, source: Semrush

Taking Catizen as an example, we analyzed the data of its official website Catizen.ai and page X. The traffic peaked in June and July because the team announced two rounds of financing in June and July, respectively, with Binance leading the strategic round in July. Since then, Catizens data has hit new highs many times, reaching 585,218 daily active users (DAU) and 8,914,877 channel subscribers.

However, after the team announced the start of the airdrop on September 14, the number of visits dropped sharply, from 260,000 daily visits to 36,000, a drop of 86%, and the retention rate was only 14%. A similar situation also occurred in Hamster Kombats token generation event (TGE) on September 26, with a retention rate of only 7% of its official website visits. The retention rate data shows that TMAs quality improvements can indeed significantly improve user retention. Although the data has declined significantly, due to the large base, a considerable user base has been retained.

Consumer Dapps

Shopping, Image source: ton app

Such products (such as Play Wallet and Solo) even have Russian as their default language. Play Wallet provides on-off ramp services for third-party fiat currency deposits and withdrawals, while Solo supports cryptocurrency recharges for global mobile phone cards. As it is an H 5 Web application (WebAPP), its user experience (UX) is still not smooth enough. At the same time, the monthly active users (MAU) of such applications are also low, and the product market fit (PMF) still needs to be further explored.

NFT Service, Image source: ton app

Ton Diamond Volume, Image source: Ton Diamond

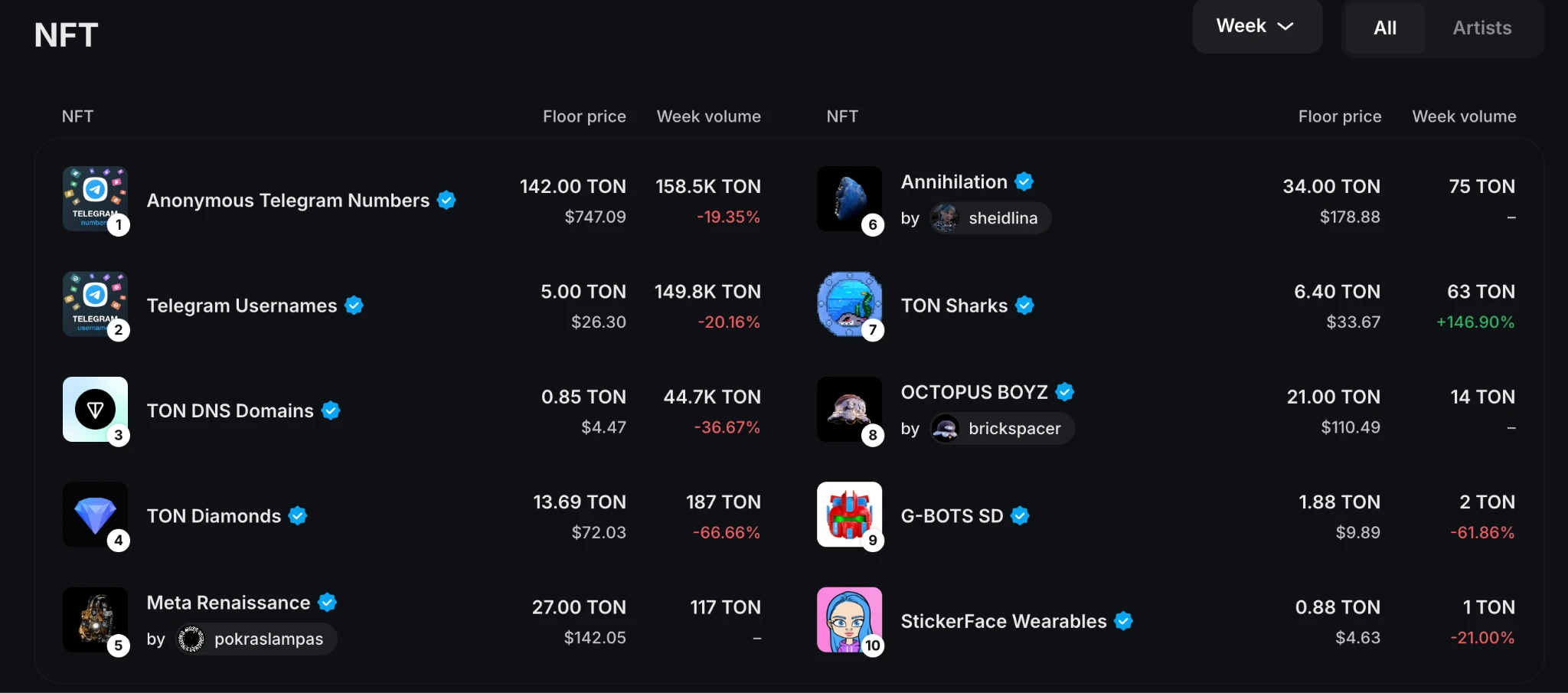

Among the NFT trading platforms built on TON, the largest trading platform, Ton Diamond, has a weekly trading volume of only about 1.8 million US dollars, and its liquidity is still relatively weak. However, as an ecosystem centered on the social platform Telegram, there are many contents with NFT potential and naturally adapted to the identity attributes of NFT. Therefore, we are still optimistic about the NFT ecosystem on TON.

Socials, Image source: ton app

TON Dating is currently one of the most popular social products. We found that most of these products are Web2.5 products that meet user needs and are actually implemented. TON Datings monthly active users (MAU) in the past month reached 361,826. Another social application WhoWhere also shows the characteristics of early Web2 products, but its interactive experience is still insufficient, and the number of users has not reached scale, making it difficult to form effective social stickiness.

DeFi

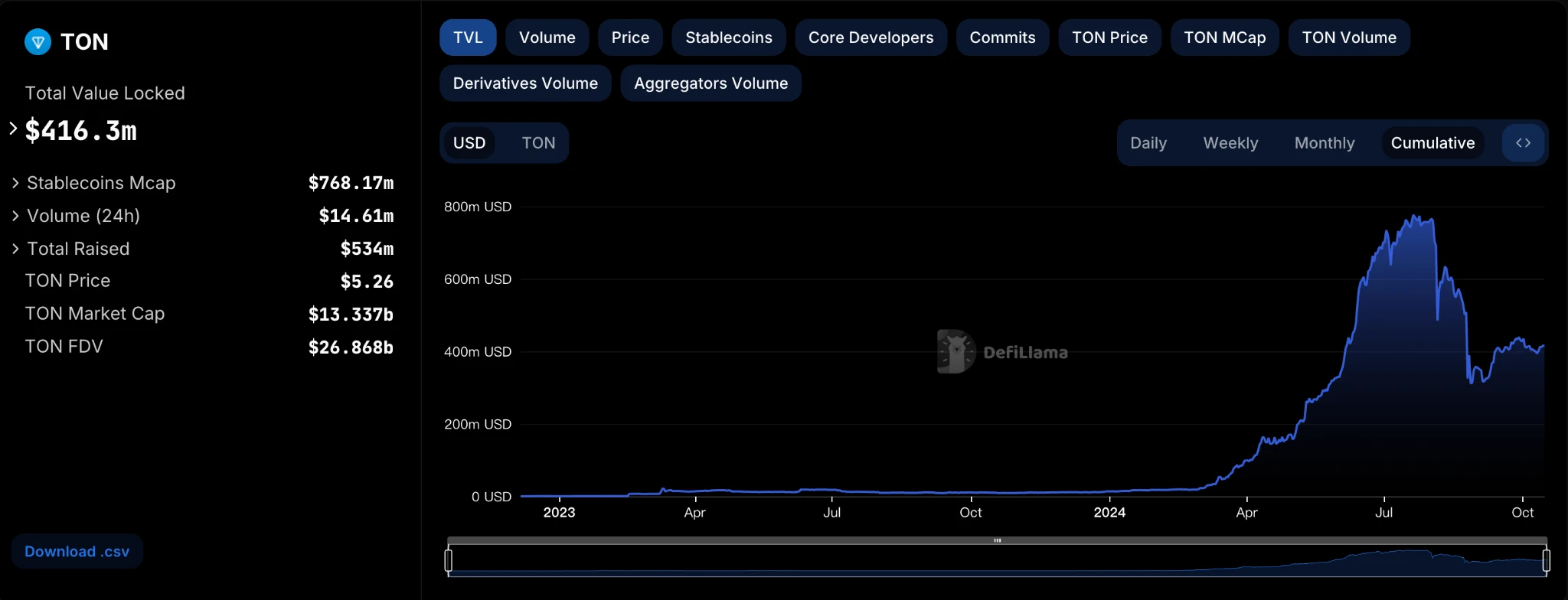

DeFi, Image source: Defillama

TONs DeFi ecosystem is still a very weak point, in large part because its FunC language is not widely used, and its completely native TonVM requires developers to be familiar with it.

DeFi Rankings, source: Defillama

There are only 8 ecosystem projects on TON with more than 10 million TVL.

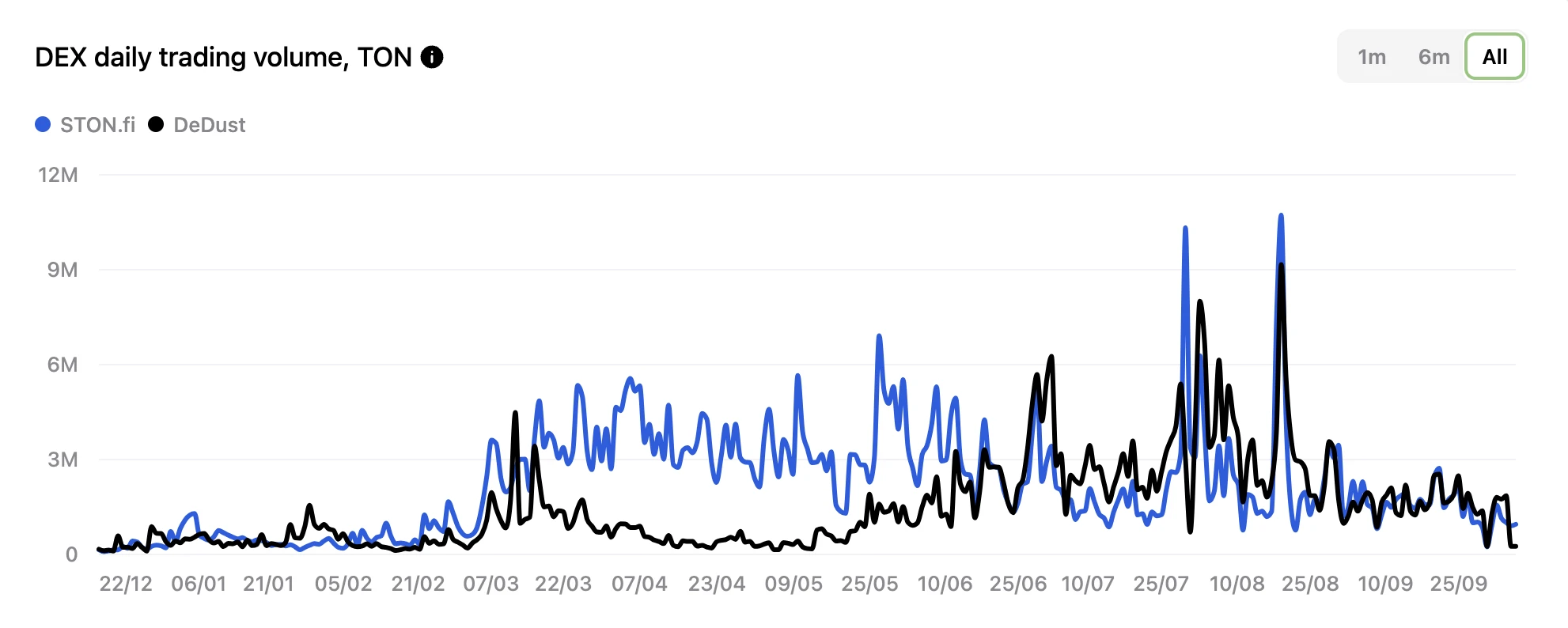

TON chain transaction volume, source: TON Stat

TON Stat counts the daily trading volume of two major DEXs. After a wave of TON chain coin issuance and wealth effect, its DEX trading volume has declined.

Stablecoin'ler

TON stablecoins, source: Artemis

The transfer fee on TON is about $0.1-0.2, and based on a social platform with 900 million monthly active users, it naturally fits with consumer demand. Therefore, consumer financial scenarios such as stablecoin transfers are crucial to its application expansion. In traditional social software, financial lending is a key way to convert traffic, and low-interest DeFi and stablecoins (such as Stablecoins) on the chain make this business more attractive.

Currently, the TON ecosystem mainly uses USDT, and it is growing rapidly, from 9.4 billion in May to 7.68 billion in October, with a monthly compound growth rate of 62.23%. If blockchain technology has product-market fit (PMF) in consumer scenarios, it can be foreseen that the DeFi system on TON has great growth and development potential.

On-chain data

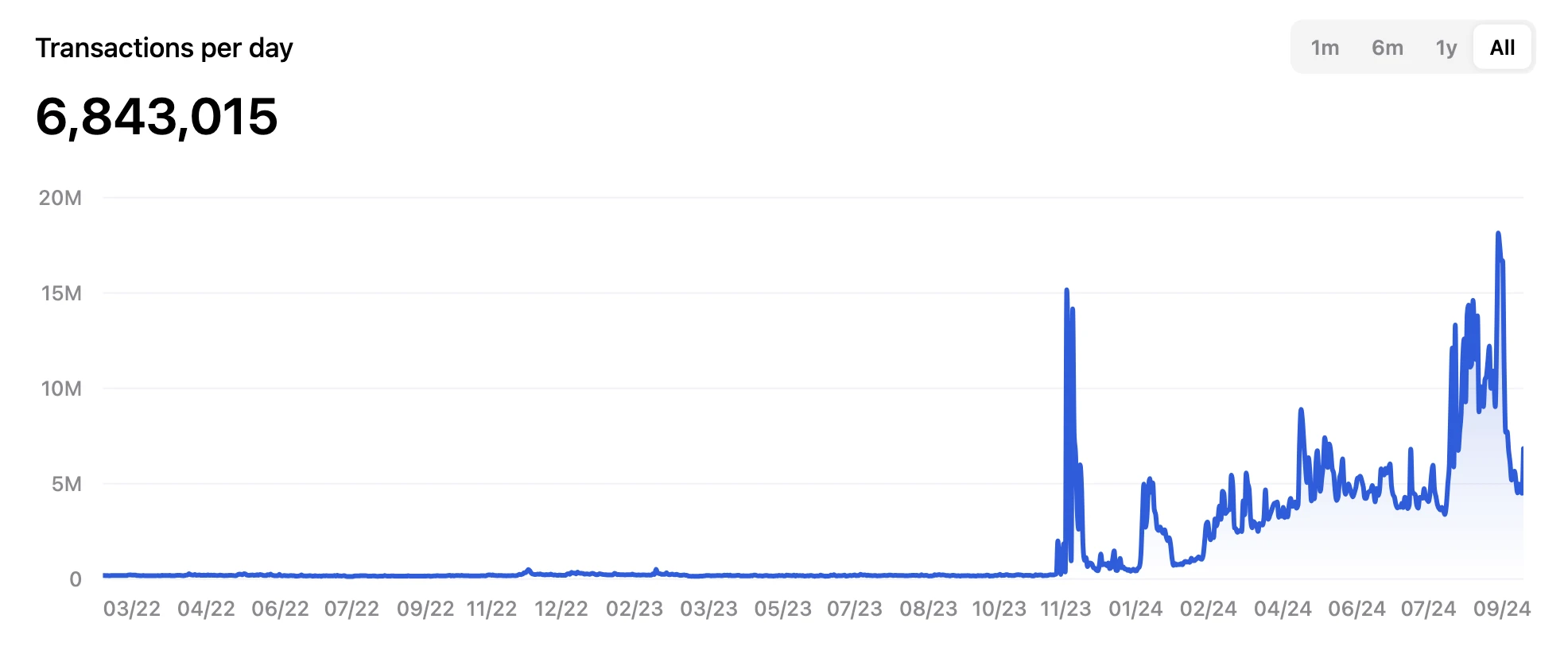

TON on-chain transactions, source: TON Stat

Number of accounts on the TON chain. Source: TON Stat

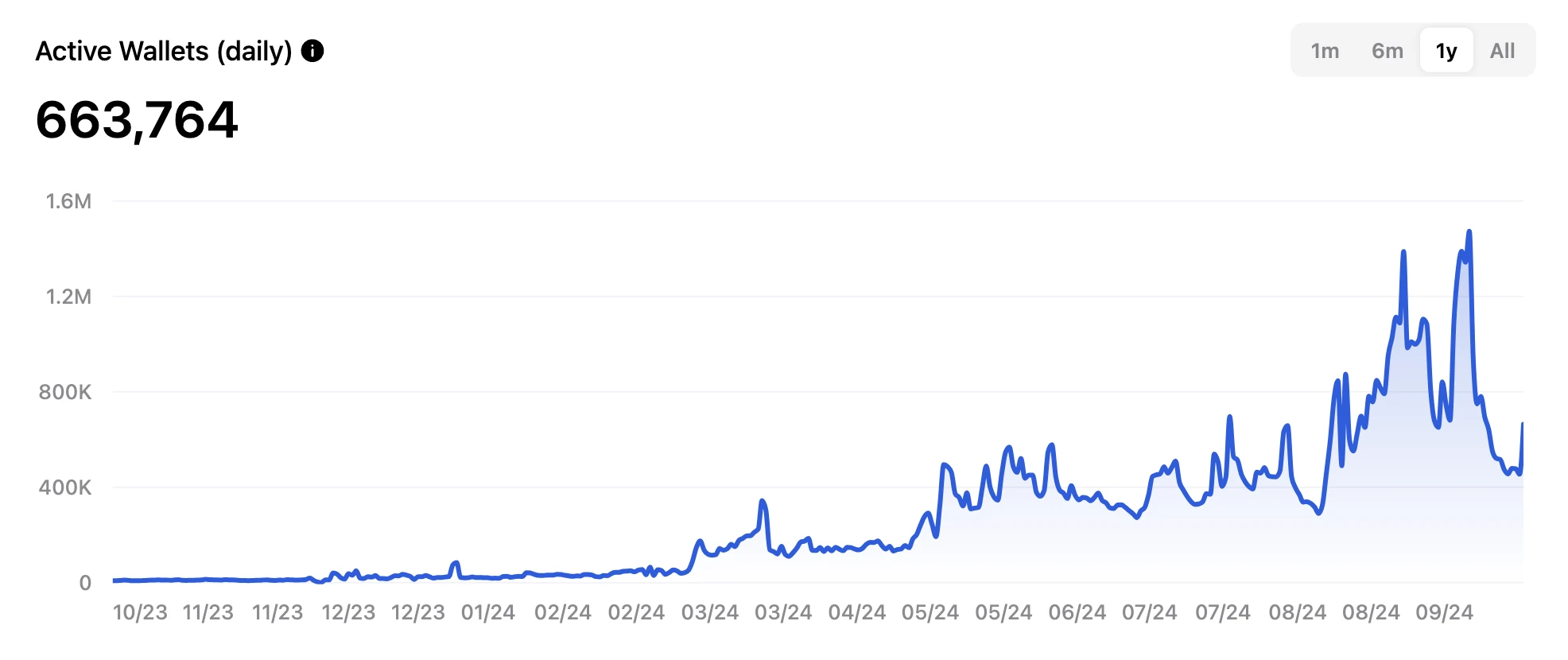

TON chain daily activity, source: TON Stat

TON chain monthly activity, source: TON Stat

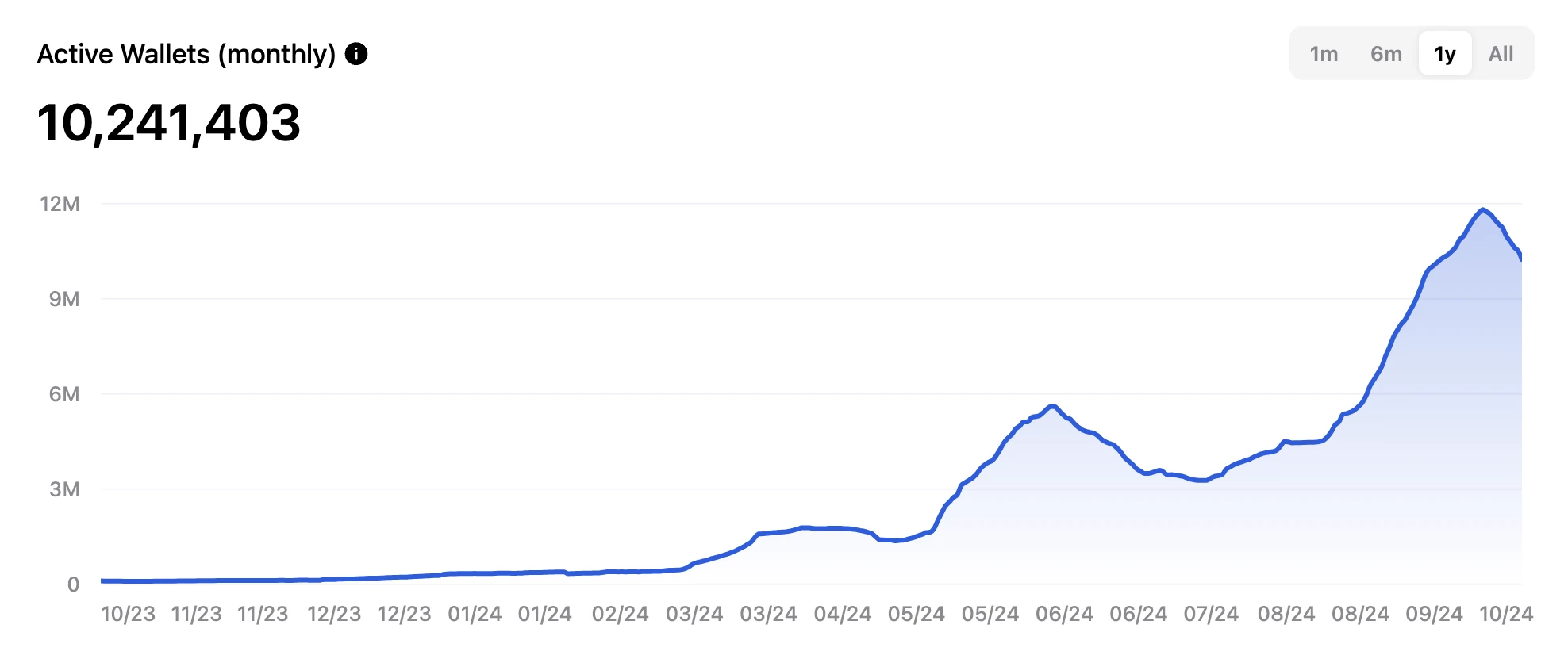

The number of wallets on TON has experienced explosive growth in the past six months, exceeding 100 million wallets. However, it can be seen from multiple data that the first wave of growth potential of its ecosystem has begun to slow down, including monthly active users and daily active users. The first wave of ecosystem growth was mainly based on simple games such as Tap to earn, but its retention rate and conversion rate show that this simple ecosystem-driven growth has already reached the vast majority of reachable users, and the remaining users need more sophisticated products to further tap into.

In general, the retention rate of the ecosystem on TON is still very low, Catizen is only 14%, and pure tap to earn like Hamster is only 7%, but the improvement of the application content of the project still has a significant improvement in the retention rate. The main business model of the ecosystem is to attract users through airdrops, with a game as the main feature, adding a task system to rehber other ecosystems, and in-app purchases. The UX is still poor, the coin price cannot be maintained after the coin is issued, the gameplay is still single, the revenue method is also very fixed, and the traffic explosion is accidental, so new products are not launched in time after the coin is issued to improve the retention rate and secondary conversion.

At present, in addition to the booming development of GameFi, the construction of other categories in the TON ecosystem is still in a very early stage, including DeFi applications, where only 8 projects have exceeded 10 million US dollars. Consumer applications are also in the initial development stage, with weak infrastructure, and most projects have not yet found product market fit (PMF). This reflects both the current limitations of the ecosystem and the potential opportunities in the future. As the initial growth model of making money on the chain gradually ends, how to convert the 75% of users who are not on the chain into on-chain users in the future and retain the existing 25% of users will depend on the refined operation of the ecosystem and the discovery of the true PMF of blockchain technology in the field of consumer applications.

gelecek

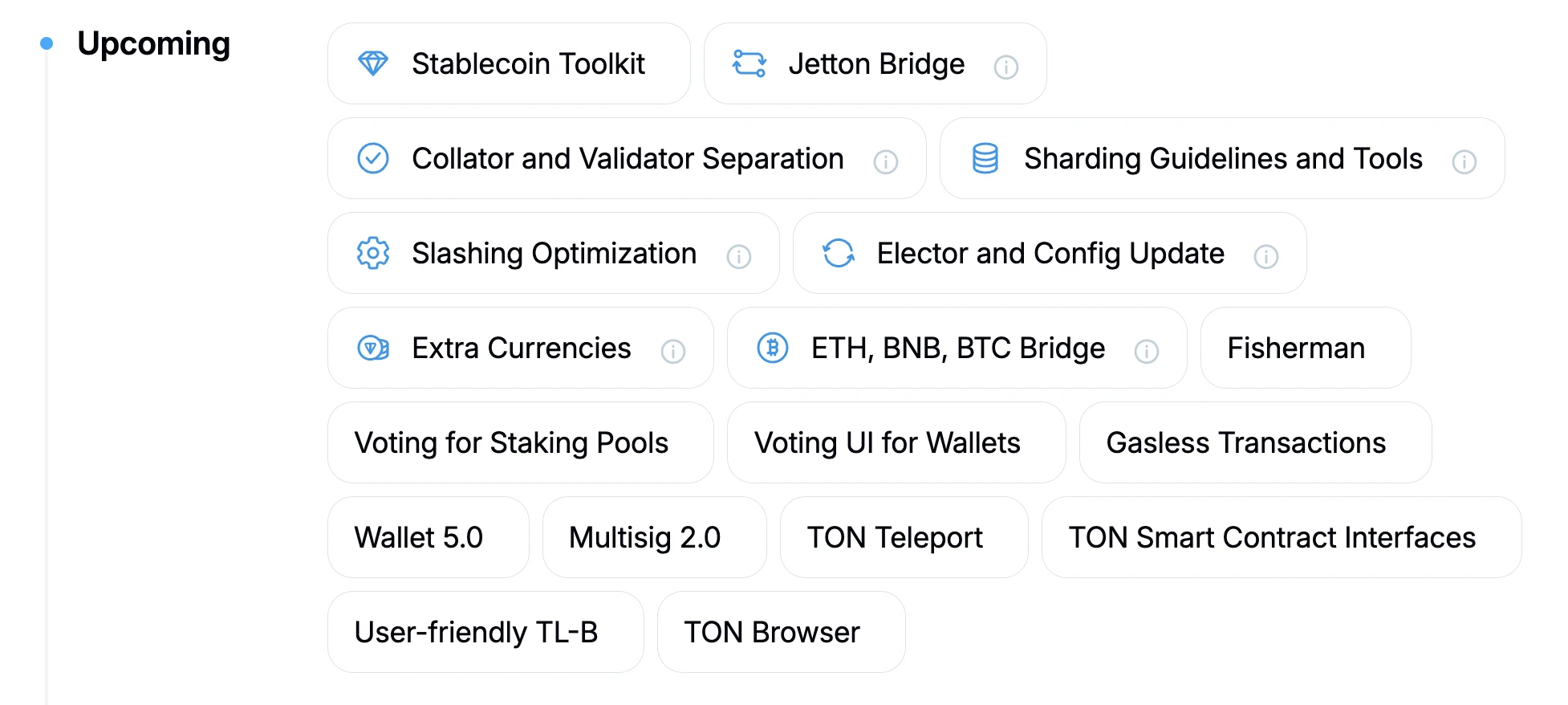

TON Roadmap, Source: TON Website

TON also announced its future work roadmap on its official website. All of these are carried out in parallel. Among them, we believe that the following three have more symbolic significance for the future strategic development of TON.

1. Gas-free transactions: This is the most interesting milestone in the TON roadmap for 2024. No other major chain offers gas-free transactions, so TON can revolutionize the blockchain space and attract more users from other ecosystems. In every blockchain, users have to pay gas fees for their transactions. Blockchain protocols cannot eliminate gas fees because they prevent spammers from clogging the network by sending thousands of transactions per second. TON may subsidize gas fees for certain cases (such as Telegram wallets or USDT transfers) to attract more users to use TON for their daily needs.

2. Technology and user expansion: TON plans to attract 500 million Telegram users by 2028 and use sharding technology to provide sufficient transaction execution time and lower transaction fees.

3. Stablecoin Aletkit: To support consumer finance, Stalecoin Toolkit can help developers build natively supported stablecoin transfer services and financial services built on stablecoins.

Ekonomik Model

Token Tahsisi

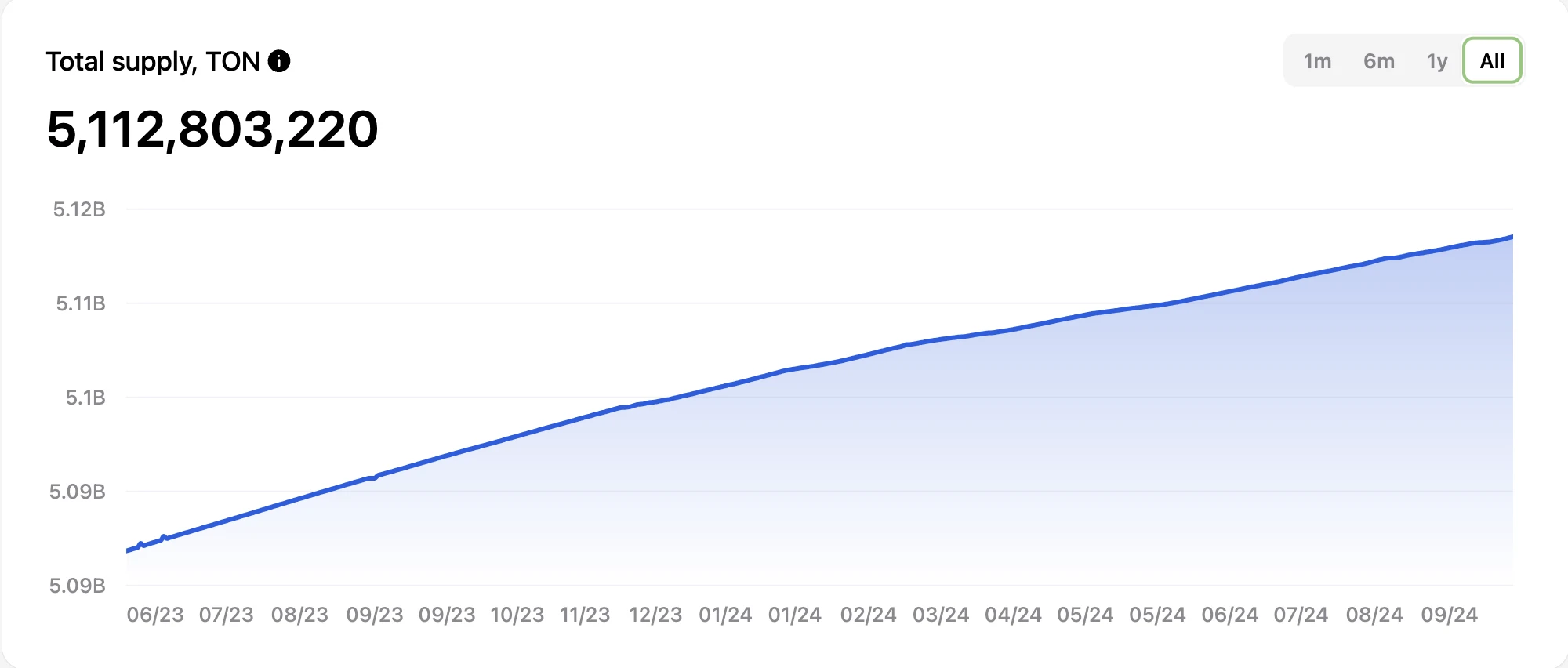

From July 2020 to June 2022, TON initially adopted the PoW proof-of-work mechanism, with an initial token supply set at 5 billion TON, of which the team allocated 72.5 million TON (1.45%) and the remaining 4.9275 billion TON (98.55%) were pre-mined. It is reported that addresses associated with the TON Foundation mined about 85% of the tokens. It is worth noting that in 2023, the community voted to freeze inactive accounts for 4 years, involving about 20% of the token supply.

The TON Believers Fund was launched through a lock-up smart contract, allowing TON holders to lock up tokens for five years – including a two-year cliff period, followed by a three-year linear release. The deposit period ends on October 23, 2023, with a total of approximately 1.033 billion TON locked up, plus approximately 284 million in rewards, for a total of approximately 1.317 billion TON that will be locked up for two years. Starting from October 12, 2025, approximately 37 million TON will be unlocked every 30 days in 36 installments to be added to the circulating supply. After these two lock-up events, the total circulation of TON has decreased by approximately 2.3 billion.

TON Total Supply, source: TON Stat

Currently, the issuance rate of TON is about 1% per year. As of September 9, 2024, the total supply is about 5,112,895,953 TON. According to CoinPazarCap data, the current number of TONs in circulation is 2,536,837,448, with a market value of US$12.8 billion and a fully diluted valuation (FDV) of US$25.7 billion.

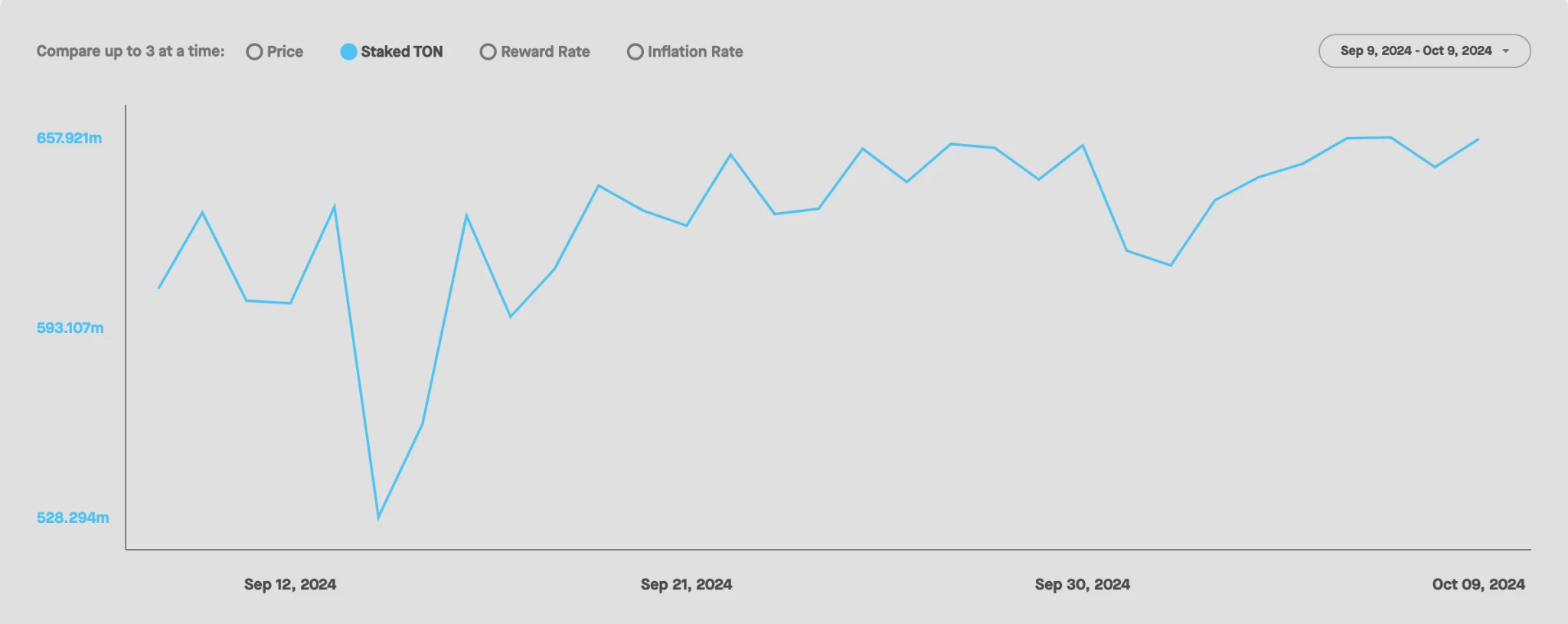

Staked TON, source: StakingRewards

As of October 9, 2024, according to the StakingRewards statistical caliber, the total TONcoin staked by TON is 657.4m.

TON LSD development status, source: TONstat

According to Tonstat, the traditional stake of TON is 616.6 million, and Liquid Staking is 62.3 million. Referring to the development of LST on other chains, TONs stake ratio still has a lot of room for improvement. Taking the lower Ethereum stake ratio (28%) as a reference, TONs stake ratio still has a 220% growth potential. If Liquid Staking accounts for 45% of the overall stake ratio, then LSD on TON still has about 445% growth space.

Handling Fees

Fees on TON are difficult to calculate in advance because their amount depends on transaction runtime, account status, message content and size, blockchain network settings, and many other variables that cannot be calculated before the transaction is sent.

Fee calculation formula, source: TON

Fee Details

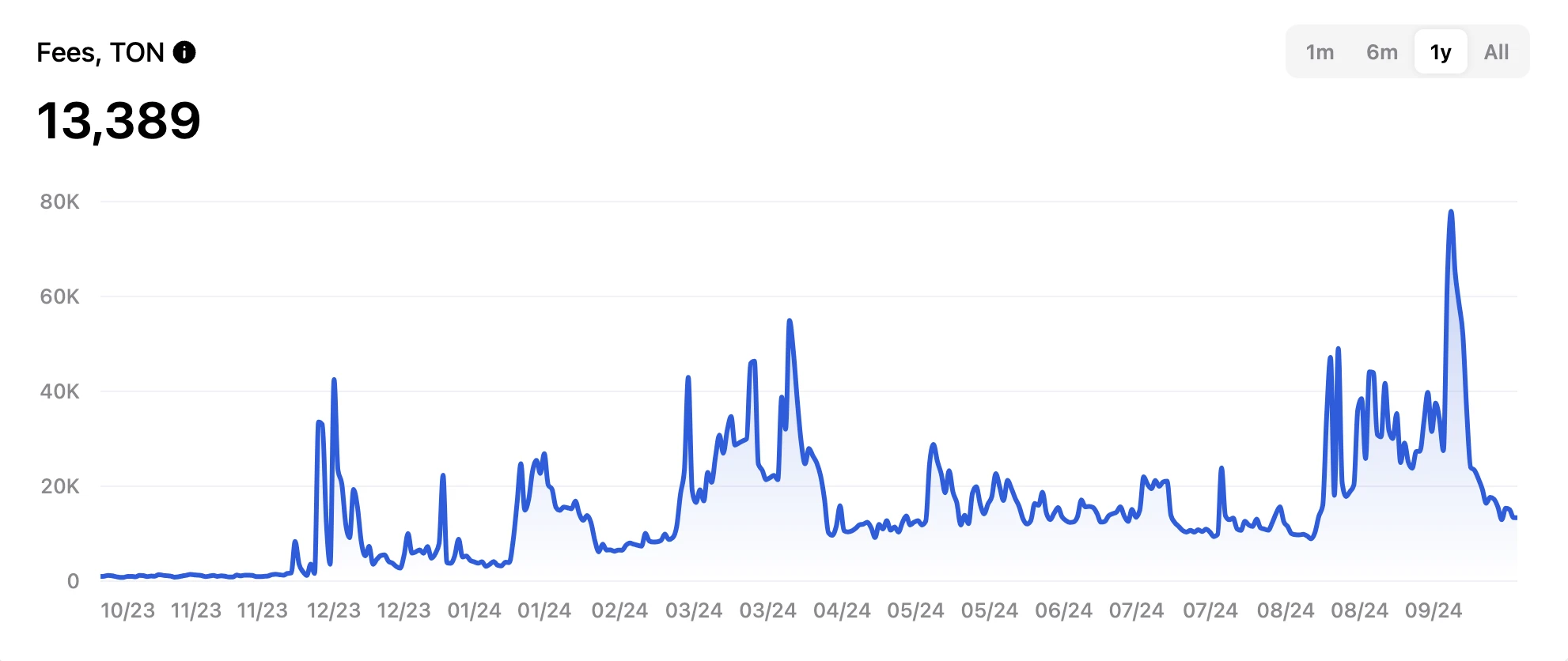

TON transaction fee revenue, source: TON

TON’s data has declined recently, but even so, based on a daily fee of 13,389 TON, the annual fee income is about 5 million TON, equivalent to about $25 million. In comparison, Jito’s fee income on Solana is $200 million, and Ethereum’s annual fee income is $660 million.

On-chain address

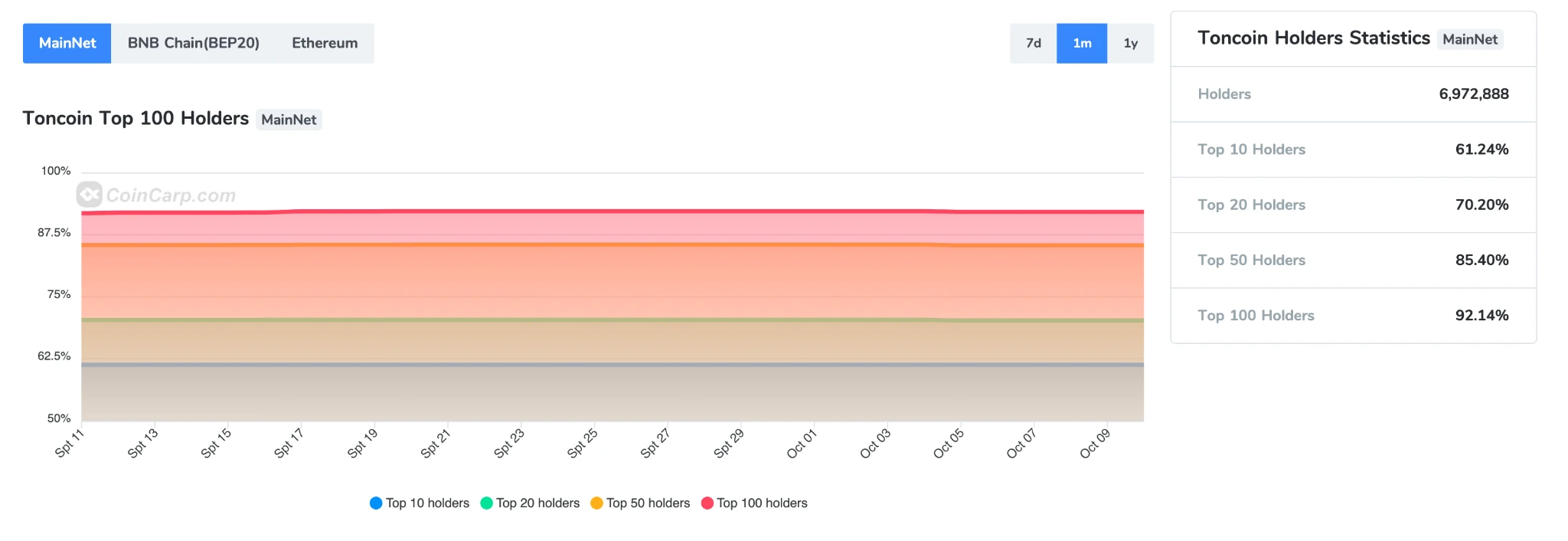

Ton top 100 coin holders, source: bozuk para balığı

TONs on-chain coin holdings are very concentrated. In the token distribution section, we also mentioned that about 85% of the early coin mining addresses are associated with the TON Foundation.

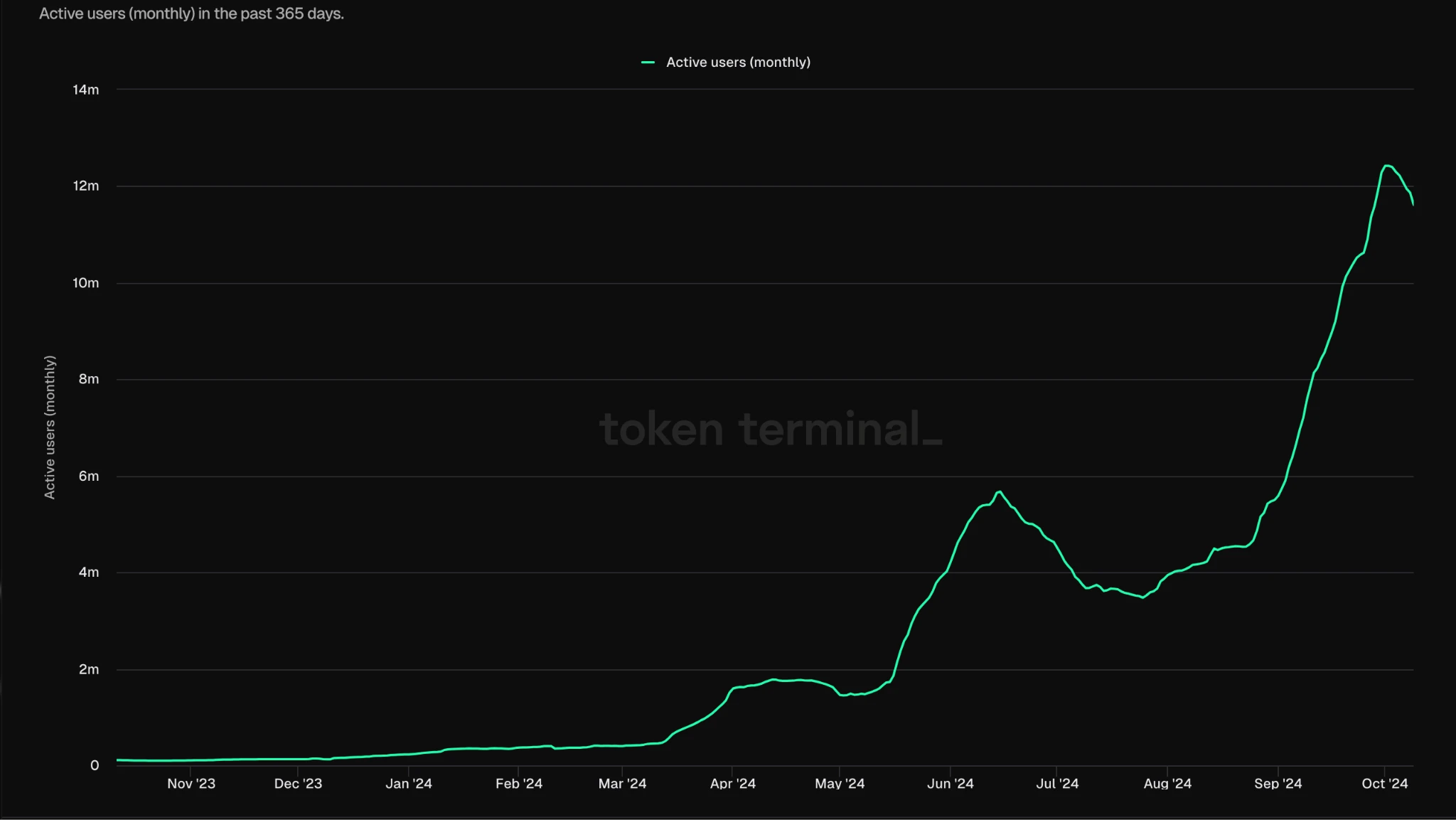

TON MAU, source: Token terminal

With the help of Telegrams huge traffic base, TON has achieved significant growth in monthly active users (MAU) since the TON Foundation took over the development. According to data from Hamster Kombat, TON currently has about 240 million users (about 25% of Telegrams MAU), but the peak of MAU on the chain is only about 12 million, and the conversion rate of Telegram users to the TON chain is still low, only about 5%. This low conversion rate also means huge potential opportunities. We believe that the barriers to the conversion of Telegram users (TMA) to on-chain users may lie in factors such as the unfriendly wallet user experience (UX) and the lack of users knowledge of blockchain.

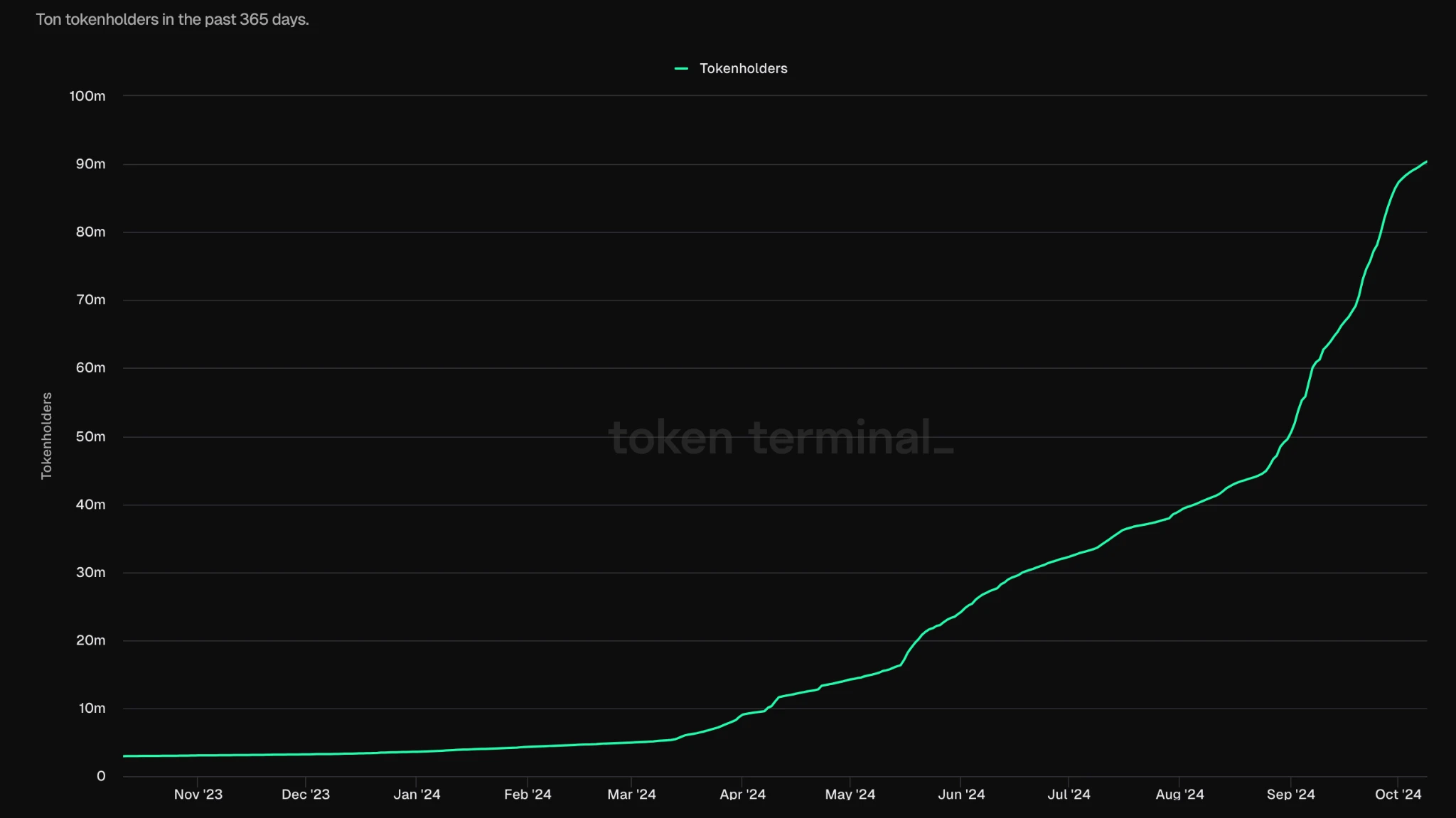

Token Holders, Source: Jeton Terminali

There are currently about 90.4 million token holders on the chain, but after a surge from May to October, the growth rate has slowed down significantly. Hamster has almost reached most potential conversion users. Next, how to tap the remaining 75% of users on Telegram and convert more active users on the chain among the existing 25% of users will require more real and life-like application scenarios.

Ton Chain Revelation

We can get many profound inspirations from the combination of Telegram and TON blockchain. This integration not only expands the functional boundaries of social platforms, but also provides new development ideas for other social applications such as WeChat and LINE. First, relying on a large user base, social platforms can quickly popularize blockchain technology, lower the threshold for users to enter the digital asset field, and further enhance user stickiness. Secondly, by building a rich decentralized application ecosystem, the platform can provide users with a diverse service experience, attract more developers to participate, and thus form a virtuous cycle ecosystem. Especially in the decentralized financial ecosystem, blockchain technology has significantly improved the transparency of finance, lowered the entry threshold for users and reduced intermediary costs.

For applications with large user groups such as WeChat, LINE, and Facebook, business model innovations such as decentralized digital asset trading, on-chain development of financial and social value, can open up new sources of income and growth space for the platform. In countries where token issuance is legal, these utility tokens, which are different from traditional equity, can enjoy global liquidity, thereby significantly improving the companys revenue and profitability.

However, the combination of TON and Telegram still faces some core issues in blockchain technology and industry development. Even with the incentive of on-chain subsidies, the on-chain adoption rate of Telegram users is only 25%, and 75% of users have not yet achieved on-chain. Among these 25% of users, we roughly estimate that the retention rate of simple Tap to Earn applications is only about 10%. The first wave of traffic growth and wealth creation effect of the TON ecosystem is coming to an end. The next focus is how to effectively conduct secondary conversions for these on-chain users and high-traffic application users, and attract the remaining 75% of Telegram users through products with real product-market fit (PMF).

In general, it can be seen from a number of data that the first wave of TONs outbreak is coming to an end, and a number of data show a downward trend. However, based on Telegrams huge traffic base and the goal of onboarding 800 million users in the future, there are still many opportunities worth exploring. For example, the lack of infrastructure within the TG ecosystem, the number of active users (DAU), total locked value (TVL), and trading volume (Trading Volume) of the non-GameFi ecosystem are all far lower than the game track. TONs potential is still promising, especially in the field of stablecoins and consumer finance. This track may be easier to succeed under official promotion, allowing 900 million monthly active users to enjoy low-cost, barrier-free inclusive financial services. But in this process, the deposit and withdrawal process of inclusive finance, the wallet user experience (UX) and the concurrent carrying capacity of infrastructure are all key points worthy of further construction.

Referanslar

TON blockchain: a group of related whales mined 85% of TON supply

TON Tokenomics: An Overview

How to shard your TON smart contract and why – studying the anatomy of TONs Jettons

Gate Ventures Hakkında

Kapı Girişimleri Gate.io'nun girişim sermayesi kolu olup, Web 3.0 çağında dünyayı yeniden şekillendirecek merkezi olmayan altyapı, ekosistemler ve uygulamalara yatırım yapmaya odaklanmaktadır. Kapı Girişimleri works with global industry leaders to empower teams and startups with innovative thinking and capabilities to rekesinliklene social and financial interaction models.

Resmi internet sitesi: https://ventures.gate.io/

Twitter'da: https://x.com/gate_ventures

Orta: https://medium.com/gate_ventures

This article is sourced from the internet: Gate Ventures Research Insights: Telegram and Ton, Traffic is King

In the past week, BTC finally broke through the previous pressure level and entered the range of $67,000-$69,000. On the 21st, it broke through $69,000 and reached a high of $69,519. Although it encountered resistance and fell to $66,571 on the same day, BTC returned to above $67,000 as the market opened positions on dips. As of the publication of this article, the price of BTC fluctuated around $67,185 (the above data is from Binance spot, October 22 at 15:00). Currently, BTC has a strong resistance level near $70,000, and the price is relatively mild in the short term. However, as the US election approaches, the Trump effect gradually emerges and the market arranges positions in advance, if BTC successfully breaks through the resistance level, it is expected to challenge…