$40 milyonu aşan geliriyle OP Stack, Unichain'in arkasındaki büyük kazanan oldu

Orijinal yazar: Grapefruit, ChainCatcher

Orijinal editör: Nian Qing, ChainCatcher

While the kripto community is celebrating the launch of the new Layer 2 network Unichain by DeFi leader Uniswap, Optimism, as the supporter behind the key underlying technology, is the silent winner behind the scenes.

In the Unichain developer funding event officially released by Uniswap on October 15, it was stated that Unichain is a new Layer 2 network built on OP Stack technology. As a member of Superchain, Unichain developers can also receive additional Optimism Collective Grants. This statement is undoubtedly a public endorsement of OP Stack technology, and also allows Uniswap to clearly express its favor for OP Stack among many L2 Stacks development solutions (such as Arbitrum, zkSync, etc.).

The cooperation between the two not only shows Uniswaps deep recognition of OP Stacks technical strength, but also introduces a strong ally to Optimisms Superchain ecosystem. As of October 17, the number of L2 or L3 chains built on OP Stack has climbed to 39, bringing Optimism more than $40 million in revenue.

The addition of Uniswap is undoubtedly the icing on the cake for Optimism. As a long-time backbone in the DEX market, Uniswaps huge user base and trading volume are likely to inject new vitality into Optimisms SuperChain ecosystem and open up new revenue growth space.

OP Stack鈥檚 revenue has exceeded 40 million US dollars, and its transaction share in the Layer 2 market accounts for about 60%

OP Stack is an open source modular toolkit launched by Layer 2 network Optimism. It supports developers to use the OP Stack toolkit to assemble or customize any Layer 2 network according to their own needs, thereby sharing the security and resources of the Ethereum network.

Since the Bedrock upgrade in June last year, Optimism has introduced the Superchain concept for the L2 network built on OP Stack, and renamed its previous Layer 2 mainnet Optimism to OP Mainnet, merging it with multiple other Layer 2 networks built on OP Stack into a unified OP chain network, namely Superchain.

In the SuperChain ecosystem, the underlying architecture of all chains is unified and standardized. Resources and information can be shared through the Optimism Bridge. Users and developers can regard all chains in the ecosystem as a single chain, namely Superchain. Developers only need to focus on creating applications that target the Superchain as a whole, and users do not need to consider cross-chain behaviors.

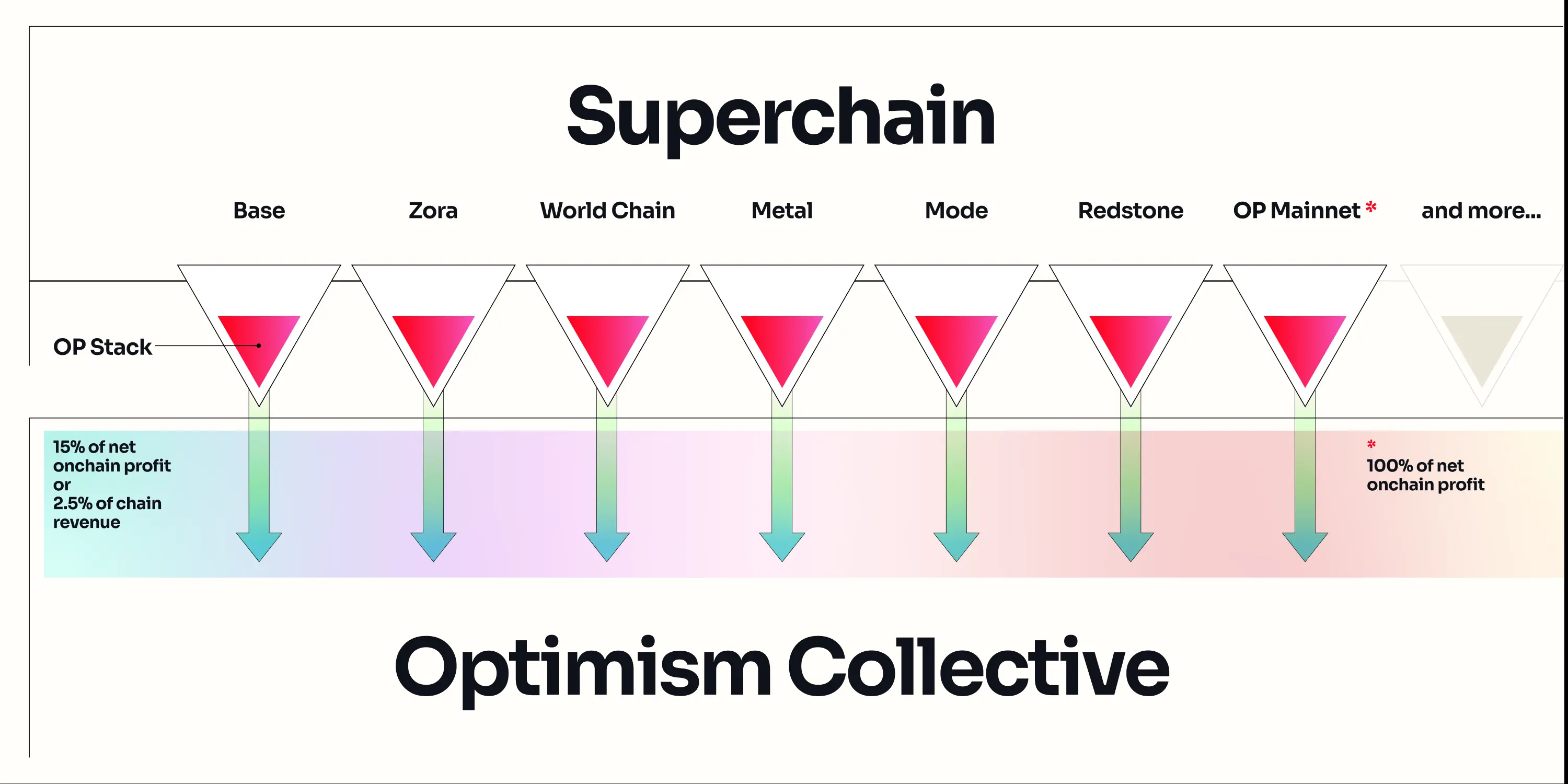

After Optimism and Base reached a revenue sharing model in August last year, Base will pay 2.5% of the total revenue of the network sorter or 15% of the profit, whichever is higher, to the Optimism Collective; the Optimism Foundation will provide 118 million OP tokens to Base in the next 6 years. This model not only promotes a win-win situation for Optimism and Base, but also sets an example for other Layer 2 networks built on the OP Stack.

Since then, each OP chain in the Optimism Superchain has adopted a standardized revenue sharing model. Each chain is required to pay 15% of the total revenue or net profit of the on-chain sorter (specifically the total revenue of the sorter minus the fees submitted to L1), whichever is greater, to the Optimism Collective.

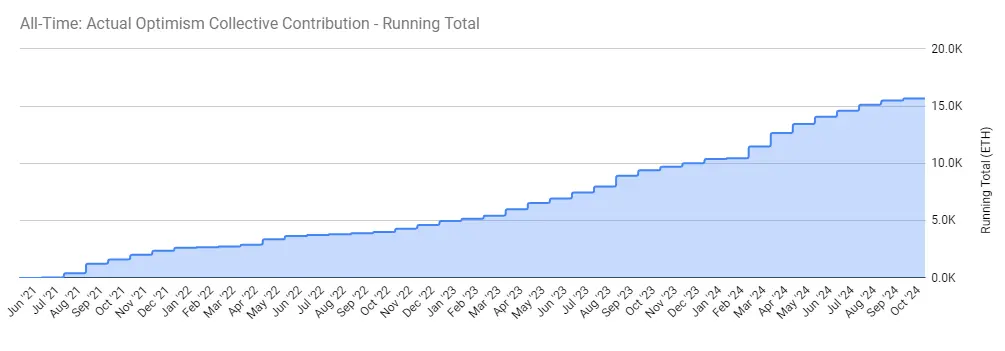

As of October 16, the governance organization Optimism Collective has received 15,673 ETH through Superchain, with a value exceeding US$40 million.

At present, 39 block networks based on OP Stack have joined the Superchain ecosystem, including Coinbases Layer 2 network Base, Uniswaps new Layer 2 Unichain, Soneium developed by Sony, SNAXchain, the application chain launched by Synthetix, Mode, L2 Cyber developed by social application CyberConnect, Worldcoin chain, etc.

The latest data from Superchain Eco on October 13 showed that all transactions on the OP Stack chain accounted for about 59.5% of the entire Layer 2 market. Last week, Superchain averaged 6.1 million transactions per day, accounting for 37% of all Layer 2 markets, and there are more than 5,300 developers deploying applications in the ecosystem.

Among these 39 OP Stack chains, the income of the OP Mainnet will all belong to the Optimism Collective, and the remaining 38 networks need to hand over 15% of the total income or net profit of the on-chain sorter according to the highest standard. Every month, the Optimism Collective will count the income of each OP chain.

In terms of revenue, according to Superchain statistics, as of October 17, Optimism Collective has earned 15,700 ETH (worth about 40.82 million US dollars), of which OP Mainnet has brought in the most revenue, contributing 12,775.25 ETH (about 33.21 million US dollars), accounting for 81.5% of the total revenue; followed by the Base network, which contributed 2,759.27 ETH (about 7.17 million US dollars), accounting for 17.6%, followed by Zora, Mode, RaaS platform Conduit and other networks.

With the rise of Base and the growth of transaction volume of OP chains such as Mint and Orderly, the revenue share contributed by Optimism Collective is also increasing. In the latest October, Optimism Collective received 244.9 ETH of revenue, of which Base chain contributed 44.8% of the revenue, and other chains contributed 13.8% of the revenue.

Is Optimism the Layer 2 winner?

Through a set of standardized and open source OP Stack toolkits, Optimism has successfully created the Superchain ecosystem, which not only provides developers with the underlying tools and technical support for efficient access to Ethereum, but also unlocks a variety of complex application scenarios including games and social networking. This open and vibrant ecosystem has attracted a large number of developers and projects to join, forming a strong network effect. With the increasing number of projects built on OP Stack, the ecosystem has entered a virtuous cycle, and the revenue brought by the Superchain ecosystem has also risen, with significant economies of scale.

Through Superchain, Optimism has created its own unique business model and currently has two clear revenue paths: one is the direct on-chain revenue brought by its Layer 2 mainnet OP Mainnet; the other is the on-chain revenue sharing of the Superchain ecosystem composed of OP chains.

These two paths together constitute Optimisms unique competitiveness in the L2 market. Compared with competitors such as Arbitrum, StarkNet, and zkSync, it has formed its own unique business model and its revenue performance is also more unique.

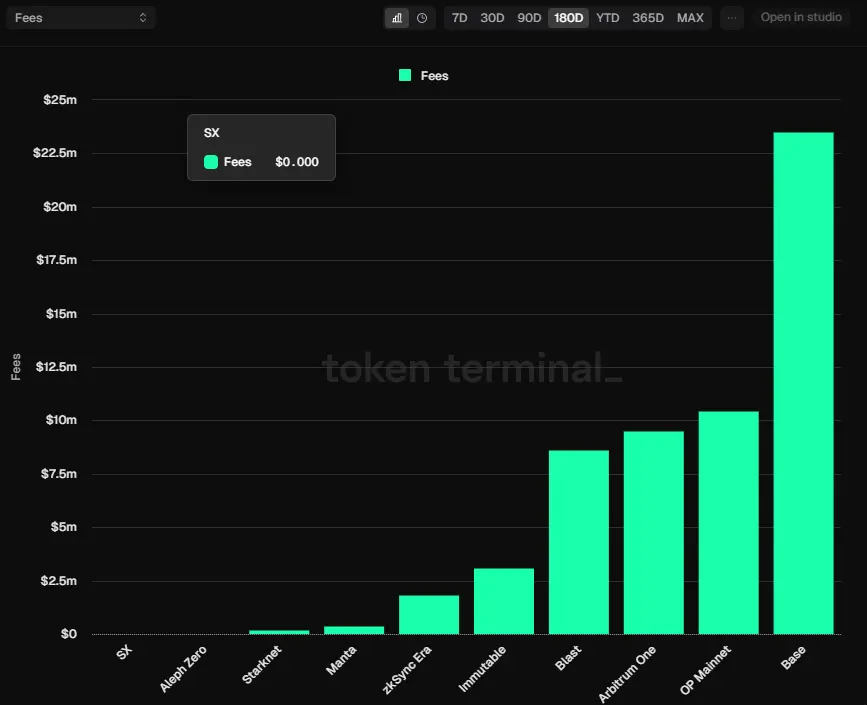

Buna göre Jeton termianl data platform, in the Layer 2 market in the past six months, Base has topped the list with $23.51 million in revenue, followed by Optimisms OP Mainnet with $10.24 million in revenue, ranking second. Although Arbitrums TVL has long been ranked first in the Layer 2 market, its revenue is only $9.49 million, less than OP Mainnet. zkSync and StarkNets revenues are even more limited, at $1.84 million and $170,000, respectively.

In addition, in addition to the OP Mainnet revenue, 2.5% of Bases revenue or 15% of its profits will belong to Optimism. If calculated based on 2.5% of the revenue, that is, Optimisms revenue: OP Mainnet + 2.5% Base chain revenue, a total of US$587,000 will need to be paid to Optimism within the next six months.

In the future, a portion of every transaction that occurs on the OP Stack chain will eventually flow into Optimisms pocket, continuously generating revenue for it. With the continuous addition of heavyweight projects such as Uniswap, it is foreseeable that the revenue brought by OP Stack is expected to continue to grow.

This article is sourced from the internet: With revenue exceeding $40 million, OP Stack is the big winner behind Unichain

Related: deBridges governance token DBR is now live and airdropped to 491,000 wallets

deBridge鈥檚 governance token DBR has entered circulation and has been airdropped to 491,286 early users and loyal community members in the DeFi space. DBR is the SPL token on Solana, with an initial circulation of 1.8 billion and a total supply of 10 billion. All airdrop recipients can choose to receive 50% at the Token Generation Event (TGE) and the remaining 50% after 6 months, or choose to receive 80% at the TGE, but a 20% penalty will be deducted. The tokens of all strategic partners and core contributors will be locked until they are unlocked 6 months after TGE (20% will be unlocked, and the rest will be unlocked gradually on a quarterly basis over 3 years). Trading has started at $0.03/DBR ($300M fully diluted valuation), trading on-chain via…