Rün çılgınlığı geri döndü, Bitcoin ekosistemi tam ölçekli bir patlamanın arifesinde mi?

The market is eagerly waiting for Bitcoin to break through the $70,000 mark. In the eyes of many players, if Bitcoin can break through $70,000 and stabilize near this price mark this time, the long-awaited bull market will officially begin.

Amid such optimism, important assets in the Bitcoin ecosystem have all seen increases. BRC-20’s $ORDI has risen by as much as 25% in the past week, and $SATS has risen by as much as 15%.

Even more lively is the rune market. The rune GIZMO•IMAGINARY•KITTEN, led by the new cat Gizmo released by Bitcoin Puppets artist @lepuppeteerfou on Twitter, has risen all the way to a peak market value of nearly 20 million US dollars since all of them were minted. Although @lepuppeteerfou himself denied that the runes were related to him, the market enthusiasm remains unabated.

The popularity of GIZMO•IMAGINARY•KITTEN has led to the emergence of two other “golden dogs”, namely KODA•FLUFFINGTON, which is based on the dog “Koda” of the founder of NodeMonkes, and POOKA•CANNOT•BE•STOPPED, which is based on the dog “POOKA” of zkshark, the founder of OMB. Both quickly broke through the $1 million market value, which is not easy to break through in the rune market. KODA•FLUFFINGTON’s market value peaked at nearly $4 million, and POOKA•CANNOT•BE•STOPPED’s market value peaked at nearly $3 million.

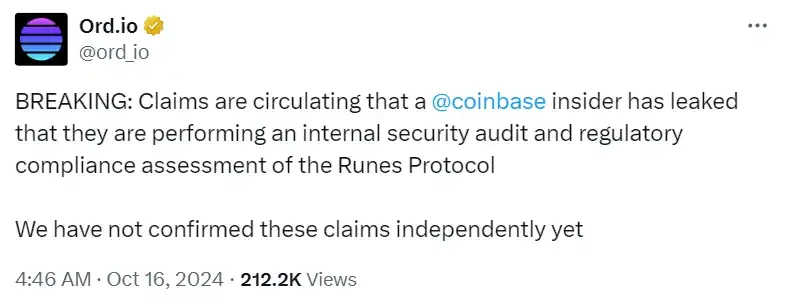

Several leading assets in the Rune market have also seen a sharp rise. PUPS•WORLD•PEACE and BILLION•DOLLAR•CAT have risen by up to nearly 9 times since the end of September, and DOG•GO•TO•THE•MOON has risen by up to 1 time. Just yesterday, @ord_io tweeted that an insider at Coinbase revealed that Coinbase is conducting an internal security audit and regulatory compliance assessment on Rune, but they have not independently confirmed these rumors. This cant help but make everyone imagine the recent rise of Rune.

If the bull market is about to start, based on the current situation, what prospects can we see for the Bitcoin ecosystem?

On the eve of great changes, should we continue to be conservative or move towards openness?

Whether OP_CAT on the Bitcoin mainnet can be revived is of great significance, because for the vision of implementing smart contracts on the Bitcoin mainnet, the question now is not can it be done, but whether it should be done.

The popularity of the Ordinals protocol last year undoubtedly contributed greatly to the openness of the Bitcoin ecosystem, but it only opened a crack in the door. The consensus of the Ordinals protocol is only a small subset of the Bitcoin consensus. Because of this, the FT protocols on Bitcoin such as BRC-20 and Runes are just like NFTs that can be infinitely fragmented in terms of user experience. Compared with the FT protocols of other chains, they can only be regarded as defective products.

The purchase interface of runes on Magic Eden looks like an NFT without the image.

Why is the lack of functionality or user experience in the protocol a problem of Bitcoin consensus? Because Bitcoin consensus has not been further opened up, resulting in so many restrictions on the Bitcoin mainnet. Protocols such as Ordianls, BRC-20, and Runes can only find ways to achieve the goal of issuing coins/images on the Bitcoin mainnet under these restrictions. Even so, there are still opposition forces such as Bitcoin Core developer Luke Dashjr who believe that the above protocols are a destruction of the Bitcoin mainnet and have been resisting these innovations.

If the BIP-347 proposal OP_CAT in Tapscript is passed and the Bitcoin mainnet finally completes the soft fork, it means that the consensus of Bitcoin will change dramatically, from conservative to open, and the narrative ceiling of Bitcoin will be opened again. I say opened again because I think Rune has taken the narrative of issuing coins on the Bitcoin mainnet to the extreme, and it is difficult for latecomers to shake its position, unless it is a dimensionality reduction attack like smart contracts.

However, whether OP_CAT can be revived in this round of bull market is a matter of great uncertainty. Being assigned a BIP proposal does not mean that the community has reached a consensus on a certain issue, but it means that the community can start a debate on this issue. We may not even have reached the stage of considering whether there is enough support, and we are still at the stage of this issue needs more discussion. Quantum Cats, one of Bitcoins blue-chip NFT projects, is essentially a campaign for the OP_CAT issue. Udi Wertheimer, like a politician active in Bitcoin, leads a blue-chip NFT community to cheer for the resurrection of OP_CAT. Udi has tried to debate head-on with Luke Dashjr on Twitter Space many times, but Luke often has an attitude of I dont care, and the cold treatment suppresses the supporters.

If OP_CAT can be successfully revived in this bull market, then the technical narrative of the Bitcoin ecosystem will be almost 100% rehberd by OP_CAT. Currently, the targets trying to do more on the revival of OP_CAT are Quantum Cats and the CAT 20 protocol on Fractal.

If not, Rune should continue to maintain its position as the most influential FT protocol in the Bitcoin ecosystem.

The rune market needs to undergo more tests

A rune becomes a FT in the true sense only after it is listed on CEX. Before listing, the nature of the rune is not much different from that of NFT, which is reflected in the market value, that is, it has a great recoil – when liquidity is good, the market value will soar rapidly, otherwise, it will roll wildly to the floor, a bunch of small orders will be stuck near the floor price, and then a lower price sell order will appear, resulting in a dead cycle where no one cares.

The true market value of Rune needs to be tested by the liquidity of CEX, which may be one of the reasons why CEX is very slow in listing Rune coins.

In addition to CEX, there are also rune swap products like Dotswap on the Bitcoin mainnet, and Magic Eden will soon launch the rune swap function. An interesting phenomenon is that Dotswaps rune swap product is very good, but it has not won enough traffic. Instead, CAT 20 on Fractal has brought good attention to Dotswap. I wonder if Magic Eden can improve the on-chain liquidity of runes with its own traffic and excellent user experience.

In terms of the richness of currencies, Rune has already had Cult coins such as PUPS•WORLD•PEACE, but the hot topics are still relatively thin. At present, they are still centered around a few large NFT projects in the circle or are simply generated based on the size of the holder group. More players are needed to enter to create a better environment for the formation of content and even Cult coins. This can also be reflected in the fact that PUPS•WORLD•PEACE and BILLION•DOLLAR•CAT have both bridged to Solana to achieve greater breakthroughs.

As for the prospects of BRC-20, it is a bit bleak at present. The three coins $ORDI, $SATS and $PIZZA are almost all the BRC-20 currently.

The NFT blue chip echelon has been relatively stable, and there is still room for exploration of the uniqueness of narrative

NodeMonkes, Bitcoin Puppets, OMB (Ordinal Maxi Biz), Quantum Cats, Pizza Ninjas, these five projects have already secured their blue chip status. In addition, Bitcoin Shrooms is a special project, with a very high inscription number, a very low total volume, but a stable floor price above 1 BTC.

In terms of pure art NFTs, since generative art has become a thing of the past on Ethereum, art on Bitcoin needs to seek breakthroughs in subject matter, such as conceptual art that combines Bitcoin’s own cultural attributes, or AI art, etc. From this perspective, CENTS may be the most unique art series on Bitcoin at present, and its uniqueness lies in the fact that “it is really impossible to achieve the flavor of Bitcoin on other chains.”

The artist behind CENTS is Rutherford Chang. The series selected copper penny coins minted in 1982 and earlier from hundreds of thousands of penny coins (in 1982, the material of penny coins was changed from copper to zinc due to cost reasons). In addition to burning them on Bitcoin, the physical penny coins were melted into a complete copper block.

Bitcoin has created a kind of value entanglement for CENTS:

– You cant tell if its 1 cent engraved on a Bitcoin or 1 satoshi engraved on a penny.

– Artificially created deflation of pennies and Bitcoin. All 1-cent coins in the CENTS series are old pennies made of 95% copper + 5% zinc from 1982 and before, which are actually deflationary and no longer issued. At the same time, the number of Bitcoins available for burning has also decreased by 1 satoshi.

– The legal value of a 1 cent coin is 1 cent. The production cost of a 1 cent coin is higher than 1 cent, and the value of 1 satoshi is less than 1 cent. These 10,000 1 cent coins have been transferred to a lower-priced value medium, but they have a higher value. Now, the price of 1 CENTS is about $330, and the auction price of a physical copper bar in June was $50,400. The legal value of 10,000 1 cent coins is $100.

– Over time, the legal value of the 1 cent coin may no longer exist, the production cost of minting 1 cent coins may continue to change, and the value of 1 satoshi may be much higher than 1 cent.

This narrative cannot be replicated on other chains because no currency on other chains can make people feel like a real coin or a currency like Bitcoin.

The DMT concept is also a unique artistic narrative of Bitcoin that deserves attention. In short, there are many types of data in the Bitcoin blockchain, such as block hash value, block size, block height, block target difficulty, etc. Creating specific digital assets based on these data is what DMT hopes to achieve. At present, except for the leading Natcats, no other DMT concept projects have attracted enough market attention.

Çözüm

Whether OP_CAT can be revived in this bull market will determine the direction of the Bitcoin ecosystem. Some directions that have not yet become market hotspots, such as Lightning Network (Taro, RGB, CKB), BitVM, etc., which are not mentioned in this article, may receive more attention if OP_CAT fails to be revived.

The Bitcoin ecosystem is the only place in the current Crypto market where the technical narrative can still run smoothly. The reason is simple – Bitcoin is like an old computer that is still equipped with a Pentium 4 processor. It already has enough hardware to update it. It just depends on whether the computer room administrators can reach a consensus. But it is so difficult to reach a consensus. In addition to the collision of concepts, there must be real conflicts of interest.

But no matter what, the Bitcoin ecosystem will kesinliklenitely be one of the important narratives of this bull market, and it will be a very special existence compared to other ecosystems.

This article is sourced from the internet: The rune craze is back, is the Bitcoin ecosystem on the eve of a full-scale explosion?

In the past half month, OP_NET and Arch, two smart contract implementations on the Bitcoin mainnet, have sparked a lot of discussion. The interesting thing is that the name OP_NET is very similar to the familiar OP_CAT, both starting with OP_, which is very confusing and makes people think that the two are similar. Therefore, I would like to mention OP_CAT at the beginning. First of all, OP_CAT is a Bitcoin opcode. Since last year, the community led by Udi Wertheimer, the founder of Quantum Cats or Great Wizard Taproot Wizards, has been calling for the revival of OP_CAT. It is called resurrection because OP_CAT is an existing Bitcoin opcode, but Satoshi Nakamoto removed it in 2010 because it could cause potential DoS attacks. CAT is the abbreviation of the…