Her iki kripto para biriminde de başarının sırrını arayan, halka açık şirketlerin en iyi 25 BTC varlığına hızlı bir bakış

Orijinal | Odaily Planet Daily ( @OdailyChina )

Yazar: Wenser ( @wenser 2010 )

Bitcoin has become a new driving force for the growth of listed companies stock prices. Microstrategys stock price has been rising , and its annual investment performance is even better than BTC; Metaplanet followed closely behind, and its copying homework operation helped boost its stock price by as much as 480%.

On October 15, according to medya raporları , Metaplanet, a Japanese listed company, doubled its BTC holdings this month, buying more than 450 Bitcoins in four operations, and the daily stock price rose by as much as 15.7%. As of now, its total BTC holdings have reached 855.5. More and more listed companies choose to regard BTC as an anti-inflation asset to diversify the risk of currency value fluctuations.

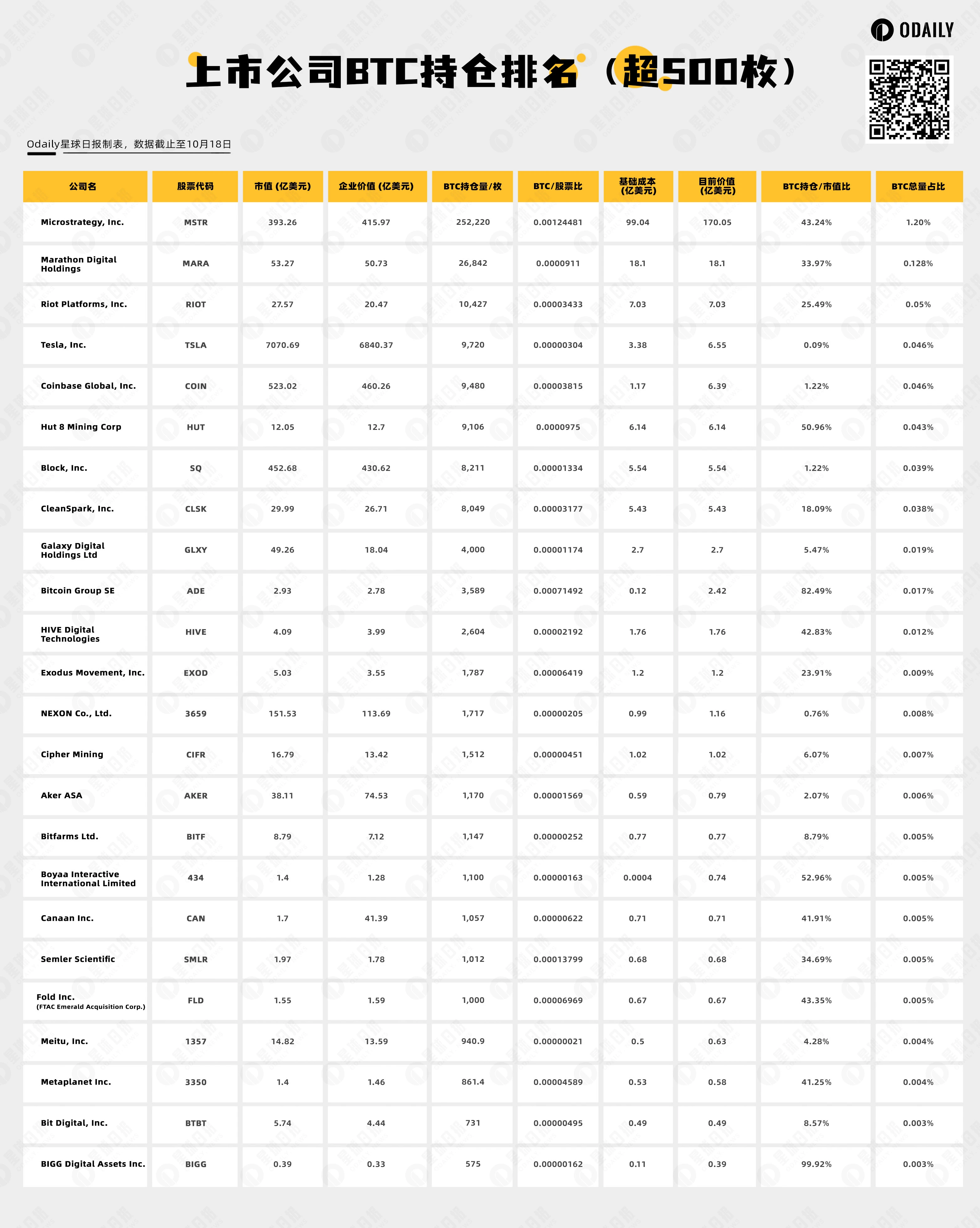

Odaily Planet Daily will briefly review and analyze the listed companies holding more than 500 BTC in the market for readers reference.

List of listed companies holding more than 500 BTC

Listed companies in various countries holding more than 500 BTC

The specific information is as follows:

MicroStrategy: 252, 220 BTC

As Metaplanet CEO Simon Gerovich previously said, “The company’s Bitcoin investment strategy was inspired by MicroStrategy and its Executive Chairman Michael Saylor.”

As the first stock in the strategic holding of Bitcoin, Microstrategy O started buying BTC in August 2020 and currently holds more than 252,000 bitcoins worth $16.933 billion, ranking first in BTC holdings among listed companies; his most recent purchase of BTC was on September 20 this year, when he purchased 7,420 BTC at an average price of $63,232, with a total expenditure of $9.903 billion.

Official account: @MicroStrategy

Stock Code: MSTR

Current share price: $194.09

Marathon: 26,842 BTC

As an old mining company, Marathon is also a member of the Bitcoin strategic reserve plan. It began to build BTC positions as early as the end of December 2020, when the BTC price was only US$29,359.6. Subsequently, its BTC holdings soared; its most recent BTC mining income report was announced on October 2 this year, when the BTC price was US$61,286, with a total increase of 642 BTC.

Official account: @MARAHoldings

Stock Code: MARA

Current share price: $18.08

Riot Platforms: 10,427 BTC

A North American Bitcoin mining company, Riot began producing BTC in December 2019, when the price of BTC was US$7,240; in January 2020, its BTC holdings were 514, worth US$3,752,200; its most recent BTC mining income report was published on October 3 this year, when the price of BTC was US$60,808, with a total increase of 408 BTC.

Official account: @RiotPlatforms

Stock Code: RIOT

Current share price: $9.08

Tesla: 9,720 BTC

As the global leader in new energy vehicles, Tesla also holds a large amount of BTC. After transferring a total of 11,500 BTC to multiple addresses on October 16, it currently still holds 9,720 BTC, worth US$654 million.

Official account: @Tesla

Stock Code: TSLA

Current share price: $221.33

Coinbase: 9,480 BTC

As the first listed kriptocurrency exchange in the United States, Coinbase also holds a large number of BTC. It is worth noting that the total cost of its holdings is only $117 million, and it is currently worth $636 million. In addition, it is worth mentioning that Coinbases packaged custody cbBTC has also developed rapidly since its launch. According to Kumul verileri , its current circulating supply has reached 6,515 pieces, worth $438 million.

Official account: @coinbase

Stock Code: COIN

Current share price: $210.48

Hut 8: 9,106 BTC

Bitcoin mining company Hut 8 was founded in 2011 and is headquartered in Toronto, Canada. Its BTC holdings can be traced back to December 2017, when the BTC price was US$14,229.5. Its most recent holdings change occurred on September 30.

Official account: @Hut 8 Corp

Stock Code: HUT

Current share price: $12.90

Block: 8,211 BTC

Its predecessor was Square, Inc., and it was officially renamed Block, Inc. in December 2021. It was originally founded in 2009 and is headquartered in San Francisco, California, USA; as one of the worlds leading payment groups, Block has attracted much attention due to its founder Jack Dorsey. In this years second quarter shareholder letter, the official claimed that BTC-related revenue exceeded US$2.61 billion, and total quarterly revenue reached US$6.16 billion, which can be called a money-making machine.

Official account: @blocks

Stock Code: SQ

Current share price: $73.53

CleanSpark: 8,049 BTC

As one of the listed Bitcoin mining companies in the United States, the stock price rose 12.72% to $10.81 at the close of the stock market on October 14 ; it continued to climb 1.72% after the market to $11, and the current share price has risen to $11.84. Its predecessor was Stratea Inc., which was renamed CleanSpark, Inc. in November 2016. It was originally founded in 1987 and provides Bitcoin mining and energy technology solutions worldwide. It is worth mentioning that the companys energy department provides engineering, design and software, customized hardware, open automatic demand response, solar energy and energy storage solutions for military, commercial and residential customers for microgrids and distributed energy systems; and develops platforms for designing, building, operating and managing energy assets.

Official account: @CleanSpark_Inc

Stock Code: CLSK

Current share price: $11.84

Galaxy Digital: 4,000 BTC

The asset management companys BTC holdings can be traced back to September 2022, when its stock price was only around 5.7 Canadian dollars and the BTC price was only around 20,007 US dollars; after purchasing 4,000 BTC at one time, its holdings have remained unchanged. As of now, its stock price has risen by 147%; the BTC price has risen by 233%.

Official account: @galaxyhq

Stock Code: GLXY

Current share price: $ 14.46

Bitcoin Group SE: 3,589 BTC

A German private equity and consulting company, the company is engaged in cryptocurrency and blockchain business worldwide. It is a subsidiary of Bitcoin.de, which operates a digital currency Bitcoin trading platform. It was founded in 2008 and is headquartered in Herford, Germany. It is a subsidiary of Priority AG. It first purchased 3,768 BTC at an average price of $47,192 in December 2021, and sold 178 BTC at an average price of $20,109 in June 2022. The remaining 3,589 BTC have been held to date.

Resmi internet sitesi: https://bitcoingroup.com/de/

Stock Code: ADE

Current share price: $58.43

HIVE Digital Technologies: 2,604 BTC

HIVE Blockchain Technologies Ltd. is a cryptocurrency mining company operating in Canada, Sweden and Iceland, with tokens including ETH, ETHC and BTC. The company was formerly known as Leeta Gold Corp. and changed its name to HIVE Blockchain Technologies Ltd. in September 2017. It was first established in 1987 and is headquartered in Vancouver, Canada. Its most recent external output report was in September, when the number of BTC holdings increased by 37, and the market price at that time was US$64,041.

Official account: @HIVEDigitalTech

Stock Code: HIVE

Current share price: $3.45

Exodus Movement: 1,787 BTC

Founded in 2015, the company is the parent company behind the popular crypto wallet provider Exodus. According to SEC filings , it purchased 1,787 BTC at an average price of $42,509 in December 2023 and has held them ever since. So far, its stock price has risen by 687% and the value of its BTC holdings has risen by 59%.

Official account: @exodus_io

Stock Code: EXOD

Current share price: $18.10

NEXON: 1,717 BTC

NEXON Co., Ltd. mainly produces, develops and provides PC online and mobile game services. The company mainly covers regions including Japan, South Korea, China, North America, etc. Its classic PC games include MapleStory, Dungeon Fighter and EA SPORTS FIFA ONLINE 4, and provide about 60 online games in 190 countries and regions. Its predecessor was NEXON Japan Co., Ltd., which was renamed NEXON Co., Ltd. in April 2009. It was first established in 1994 and is headquartered in Tokyo, Japan. In April 2021 , it bought 1717 BTC worth $100 million at the average market price of $58,226 (including handling fees, the BTC price at that time was $54,992).

Stock Code: 3659.T

Current share price: $17.80

Cipher Mining: 1,512 BTC

The latest development of the US Bitcoin mining company is that it sold 772 BTC at an average price of US$64,041 at the end of September this year.

Official account: @CipherInc

Stock Code: CIFR

Current share price: $5.01

Aker ASA: 1,170 BTC

The company is a subsidiary of Norways TRG Holding AS. It is mainly engaged in industrial holding and financial investment related businesses. It was first established in 1841 and is headquartered in Lesak, Norway. In March 2021, it purchased 1,170 BTC at an average price of US$51,313, spending a total of US$58.754 million.

Stock Code: AKER

Current share price: $18.08

Bitfarms: 1,147 BTC

A Canadian Bitcoin mining company, founded in 2017. In December 2021, its BTC holdings once reached 3,301, but it subsequently reduced its holdings by 2,896 BTC in December 2022 and 20 BTC in March 2023; in September this year, its BTC holdings increased by 44, and the final number of holdings was temporarily fixed at 1,147.

Official Account: @Bitfarms_io

Stock Code: BITF

Current share price: $1.93

Boyaa Interactive International Limited: 1,100 BTC

Boyaa Interactive is a global online game operator based in Hong Kong, China, focusing on the development and operation of online chess and card games. Its BTC holdings were announced in January this year, but no specific source or corresponding proof was provided. (Odaily Planet Daily reminds: This is only for information sharing, and does not endorse any company or organization. Please choose investment targets carefully and pay attention to asset security.)

Resmi internet sitesi: https://www.boyaa.com.hk/

Stock Code: 0434.HK

Current share price: $0.20

Canaan: 1,057 BTC

Canaan Technology is the worlds first ASIC Bitcoin mining machine manufacturer and the first mining machine manufacturer listed on Nasdaq. It is also a well-known mining company. The current BTC holdings information is the investor news statement released in March this year.

Official account: @canaanio

Stock Code: CAN

Current share price: $1.00

Semler Scientific: 1,012 BTC

The company is a well-known listed pharmaceutical company in the United States, mainly engaged in the development, manufacturing and sales of innovative products and services that support the early detection and treatment of chronic diseases; its latest record of increasing holdings occurred in August this year , when it increased its holdings by 83 BTC, which was worth approximately US$5 million at the time.

Resmi internet sitesi: https://www.semlerscientific.com/

Stock Code: SMLR

Current share price: $26.82

Fold Inc. (FTAC Emerald Acquisition Corp.): 1,000 BTC

The company was formed in July this year by the merger of Bitcoin financial services pioneer Fold, Inc. (Fold) and listed special purpose acquisition company FTAC Emerald Acquisition Corp. (NASDAQ: EMLD) (FTAC Emerald), which was originally established in 2019. It has previously processed more than $2 billion in trading volume and issued more than $45 million in lifetime Bitcoin rewards to its customers. According to relevant media reports , its current position is 1,000 BTC purchased at a market price of $66,102.

Official account: @fold_app

Stock Code: FLD

Current share price: $10.84

Meitu: 940.9 BTC

Speaking of Meitu, perhaps many people in the crypto industry are a little unfamiliar with it, but when it comes to Meitu Xiuxiu APP, perhaps many people are familiar with it. As a Hong Kong-listed company, Meitu is influenced by its founder Cai Wensheng and is also one of the BTC holding companies, with nearly 1,000 holdings, ranking 22nd among listed companies. It was first established in 2008 and is headquartered in Xiamen, China; in September 2022, it purchased 940.9 BTC at an average price of US$20,185, spending a total of US$49.5 million, and then kept its position unchanged.

Stock Code: 1357.HK

Current share price: $0.33

Metaplanet: 861.4 BTC

A Japanese listed company, its main business is Japanese finance, trade and real estate, with more than ten years of diversified business experience. With the official approval of the Bitcoin spot ETF in the United States, it started its own BTC strategic holding plan in April this year. Its latest increase was on October 16, when it purchased another 5.909 BTC at an average price of US$67,474, bringing its latest BTC holdings to 861.4. It is worth mentioning that, as of now, its stock price has risen by as much as 468%, while BTC has only risen by 1% during the same period.

In addition, if Metaplanet was inspired by MicroStrategy to start the BTC reserve plan, then its move also opened up new growth ideas for some Japanese listed companies. At the end of September this year, Remixpoint, a Japanese listed company, announced in a statement the number of crypto assets (virtual currencies) it purchased and their amounts: a total of 750 million yen (about 5.27 million US dollars) was spent to purchase 64.4 BTC (600 million yen), 130.1 ETH (50 million yen); 2,260.5 SOL (50 million yen) and 12,269.9 AVAX (50 million yen). The purchase is part of the companys announcement on the 26th that it would purchase a total of 1.5 billion yen in virtual currencies. At the board meeting on the same day, Remixpoint decided to purchase virtual currencies as part of its cash management strategy. On the other hand, considering the possibility of further depreciation of the yen, the company invested and held part of its surplus funds in virtual currencies, thereby diversifying the risk of fluctuations in the value of the currencies held and controlling its exposure to the yen.

Official account: @Metaplanet_JP

Stock code: 3350.T

Current share price: $7.50

Bit Digital: 731 BTC

Bit Digital Inc. , one of the oldest Bitcoin mining companies in the United States, was founded in 2017 and is headquartered in New York. It was formerly known as Golden Bull Limited and changed its name to its current company name in September 2020. According to resmi haberler , it reduced its holdings of 307.4 BTC at a market price of US$64,041 at the end of September this year. It is also one of the few listed companies that have recently reduced its holdings of BTC. Its BTC holdings have thus fallen below the 1,000 mark, from 1,038 BTC previously to 731 today.

Official account: @BitDigital_BTBT

Stock Code: BTBT

Current share price: $3.89

BIGG Digital Assets Inc: 575 BTC

BIGG Digital Assets Inc. is a Canadian digital currency operation and investment company. It has developed a digital currency tracking search and analysis engine QLUE, which serves law enforcement, regulatory technology, regulators and government agencies; its product BitRank Verified mainly provides risk scores for digital currencies, enabling regulatory technology, banks, ATMs, exchanges and retailers to meet traditional regulatory and compliance requirements. The company also develops brokerage and trading software to facilitate mass consumers and investors to buy and sell digital currencies while taking into account compliance and security. After purchasing 575 BTC at an average price of US$20,185 in September 2022, it has kept its position unchanged. Its holding cost is only US$10.94 million, and it has currently achieved a profit increase of up to 353%.

Stock Code: BIGG

Current share price: $0.11

Summary: BTC will become a strategic reserve resource for more listed companies to maintain the value of shareholders assets

Buna göre İstatistik on September 30, MicroStrategy, Block, Metaplanet, Semler Scientific, OneMedNet and British football club Real Bedford FC purchased a total of about 48,836 bitcoins, with an estimated investment of about $3.09 billion, currently worth about $3.1 billion. After the price of bitcoin hit a record high in March this year, the frequency of corporate purchases of bitcoin has increased significantly, reaching 32 times, far exceeding the 9 times in the whole of last year.

In addition, among the top 25 listed companies in terms of BTC holdings, only MicroStrategys BTC holdings exceed 1% of the total BTC of 21 million, accounting for 1.2%; Marathon, which ranks second, holds only 0.128%.

Nine mining companies, including Marathon and Riot, account for 36% of the top 25 listed companies holding more than 500 BTC; other listed companies cover multiple industries such as technology, consulting, payment, exchanges, medicine, games, finance, and the Internet.

At a time when the anti-inflation properties of physical gold are further weakened, more listed companies may choose to join the BTC strategic reserve army in the future for various reasons, including maintaining the value of shareholders assets, and embark on a path of dual cultivation of currency and stocks, using cryptocurrencies including BTC to enhance their own anti-fragility and reflexivity, so as to maintain the value of their own assets in one currency wave after another.

This article is sourced from the internet: A quick look at the top 25 BTC holdings of listed companies, looking for the secret to success in both cryptocurrencies and stocks

Manşetler Fed'in Eylül ayında faiz oranlarını 25 baz puan düşürme olasılığı 67%. CME'nin Fed Watch verileri, Federal Rezerv'in Eylül ayında faiz oranlarını 25 baz puan düşürme olasılığının 67%, faiz oranlarını 50 baz puan düşürme olasılığının ise 33% olduğunu gösteriyor. Federal Rezerv'in Kasım ayına kadar faiz oranlarını 50 baz puan düşürme olasılığı 45.2%, kümülatif 75 baz puanlık bir kesinti olasılığı 44.1% ve kümülatif 100 baz puanlık bir kesinti olasılığı 10.8%. Scroll Foundation'ın şüpheli resmi hesabı başlatıldı ve TGE ve airdrop bilgileri yayınlayabilir Birçok topluluk üyesinin geri bildirimlerine göre, Ethereum L2 ağı Scroll Foundation'ın resmi hesabı…