Gate Ventures Araştırma Görüşleri: Ana Akım Kamu Zincirlerinde MEV'in Mevcut Durumu

First, we analyzed the current DeFi ecosystem status of mainstream public chains from the essence of MEV attacks, because this directly affects the activity of MEV on the chain. Then we used Ethereum, Solana, Aptos, and Sui, four mainstream and relatively active public chains, as the main analysis targets to analyze the relationship between the MEV public chain architecture and MEV development. We found that the MEV system is actually closely related to the order of architecture and transactions, which also directly affects the user experience.

In models such as Sui and Ethereum that use Gas Fees to sort transactions, when on-chain transactions are active (such as active Meme transactions, large price changes, NFT Mints, etc.), it will encourage a vicious cycle of higher Gas Fees, which will in turn prevent some users from participating in the market at this time. Sui does not have the smoothing mechanism of EIP-1559, so Suis Gas Fees fluctuate more dramatically, and Ethereums growth under this protocol is relatively smooth.

In a sorting model based on a deterministic function such as Aptos, MEV will be concentrated at the tail, because the Leader node will have a complete view of the block only after the sorting is completed. This also makes the MEV on Aptos more complicated, with fewer preemptive attacks and more moderate Gas Fees.

In Solana, which is similar to Aptos, the sorting is based on the FCFS deterministic model, so Searchers prioritize speed, which will make Searchers with better hardware earn more profits. At the same time, relying on speed will flood the entire network with a large number of robots sending the same transaction to maximize the inclusion of their own transactions in the block, which will cause the network to crash. Jito Labs introduced a pseudo-Mempool similar to Ethereum, which supports proority fees to preempt transactions, which also brings high volatility of Gas fees and a large number of junk transactions.

We can see that different architectures and transaction sorting models will naturally lead to the corresponding MEV market status. These can be predicted based on transactions and architectures. Therefore, for Ethereum itself, EIP-1559 is a patch to deal with the Gas Fees sorting priority mechanism (involving value redistribution and smoothing the Gas growth curve), but this still cannot solve the Sandwitch attack and the extremely poor user experience of high Gas. Therefore, the current solution for MEV is mainly to build a transparent and open market, but the extremely poor user experience caused by the actual sandwich attack still needs to be solved in a targeted manner. At the same time, the problems caused by the architecture and derived protocols also need to be carefully discussed. Ethereum and Solana represent two architectures, and the problems they face are also different, so they need to be viewed case by case.

At the same time, we also realized that, except for Ethereum, most public chains have relatively shallow research on MEV, mainly due to the lack of corresponding communities to conduct extensive research and on-chain data support. There is still a relatively broad research space here, especially for emerging public chains such as DAG and new sorting models and other architectural level issues.

On-chain DEFI development

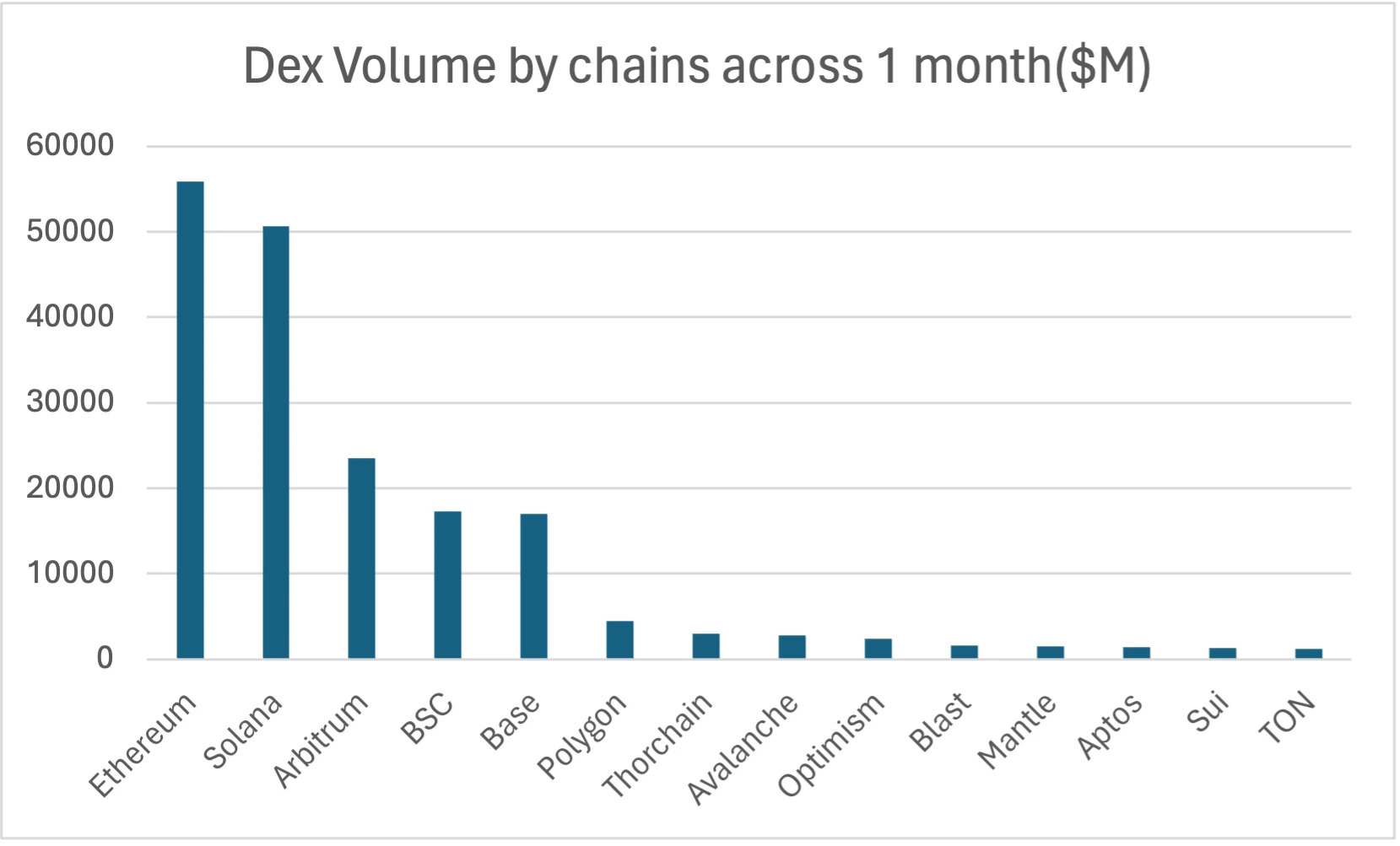

DEX Volume by chains

There are three main MEV methods: Sandwich, Arbitrage, and Liquidation. These three methods are essentially related to DeFi, especially the first two with the largest transaction volume, which are related to DEX. Therefore, the larger the DEX transaction volume on the chain, the more profits and opportunities can be earned, and the more intense the corresponding competition. In the DEX Volume in the past month, Ethereum and Solana far exceeded other public chains, which also means that the MEV of these two public chains is the most active.

At the same time, as Ethereum takes L2 as its main expansion goal, emerging Layer 2s such as Arbitrum and Base also have high transaction volumes, but this part of MEV is often earned by Sequencer. With the gradual decentralization of Sequencer, Layer 2s MEV problems and potential opportunities will gradually emerge.

In addition to Ethereum and Solana, excluding Layer 2, the Layer 1 with the largest transaction volume is BSC, with a DEX transaction volume of approximately $17.3 billion in the past month. BSC is a fork of Ethereum, so its architecture is similar and we will not go into details. Next, we will introduce the architecture of Ethereum, Solana, and emerging DAG public chains such as Sui and Aptos, as well as the development of MEV.

Ethereum

Ethereum MEV Architecture

In Ethereum, Flashbots introduced MEV-boost to make the entire MEV process transparent. This architecture is called PBS. Lets briefly introduce the entire PBS (Proposer Builder Seperate) sealed first auction model. When a user submits a transaction through an RPC agent, RPC is equivalent to running a node, submitting the transaction to the public Mempool, and multiple builders find the most suitable transactions to sort them to generate a profit-maximizing block (profit maximization refers to the transaction procedure Base+Priority+MEV). Then multiple builders interact with the Proposer through the Relayer. The Relayer is a bridge for multiple builders to interact with the Proposer. The Builder submits a quote to the Relayer, and the Relayer submits multiple block headers and corresponding quotes to the Proposer. The Proposer generally adopts the block with the highest quote. Among them, the Relayer will implement the MEVBboost specification, which is a technical specification proposed by Flashbot on how to standardize the interactive bidding between the Builder and the Proposer. In this process, all information is sealed, and Relayer only submits the block header to Proposer, so Proposer is resistant to censorship.

However, under the current PBS architecture, we have seen that since the introduction of the MEV-BOOST specification, this profit-maximizing sealed-bid auction mechanism has led to the gradual guidance of the Builder and Searcher towards cooperation and trust. After the interests of both the Searcher and the Builder are tied together, this trend of centralization is also very obvious. Under POS, it will lead to the centralization of the Validator. The entire MEV industry chain has become very centralized in all links, and it has also introduced the problem of multi-party trust. The Searcher trusts the Builder, and the Builder and Proposer trust the Relayer. The development of MEV centralization and trust is in clear violation of Ethereums ultimate vision of decentralization and trustlessness.

MEV statistics after ETH Merge, source: libMEV

In Ethereum, a total of $570 million in value has been extracted from the chain since the Merge, of which Searchers received a total of 15.2% of the value, and the remaining 84.8% returned to the ecosystem, most of which was obtained by Validators, or POS stakers, and the rest was obtained by all token holders.

By category, source: libMEV

As can be seen from the above figure, Sandwich as a negative effect of MEV accounts for about 66% of the total transaction volume, which is also the main on-chain activity with the greatest impact on user UX. Searchers tend to have a higher profit margin on Arbitrage, about 18.4%, and this is a more beneficial MEV. We think that this phenomenon of profit margin is caused by the high volatility of cryptocurrencies.

Although the average MEV leakage is 15.2%, which is not unacceptable, the main impact of MEV is the user experience, especially under the EIP-1559 mechanism. In a highly volatile market, on-chain robots will be more active in looking for arbitrage opportunities. Ethereum is sorted by Gas Fees, so everyone is competing for handling fees, which will increase the users Gas cost. The EIP-1559 mechanism has not been particularly successful in suppressing the growth rate of this Gas, resulting in a sharp surge in Gas fees in a short period of time.

MEV trading profit distribution, source: Eigenphi

On Ethereum, the vast majority of profits from each MEV transaction are concentrated around 0.9 u.

Solana

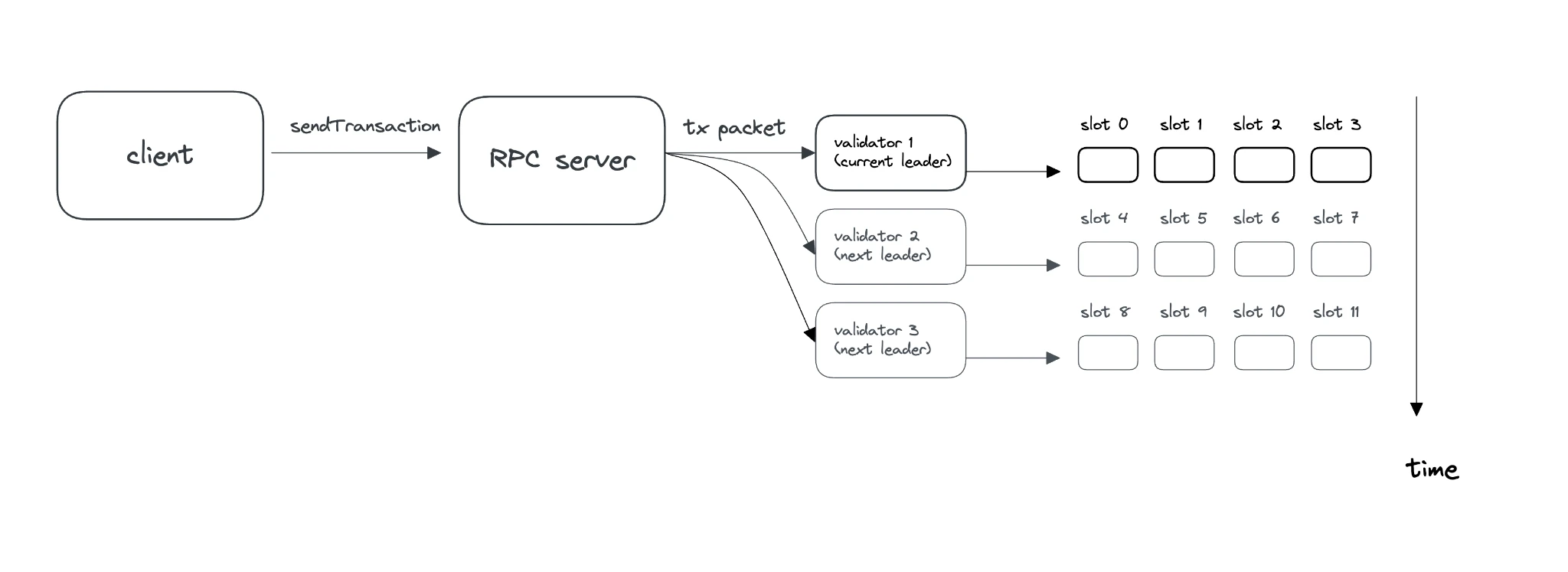

Solana鈥檚 architecture. Image source: Umbra Research

In Solanas block generation mechanism, since RPC interacts directly with the Leader and adopts the FCFS principle, it does not have an Mmepool like Ethereum.

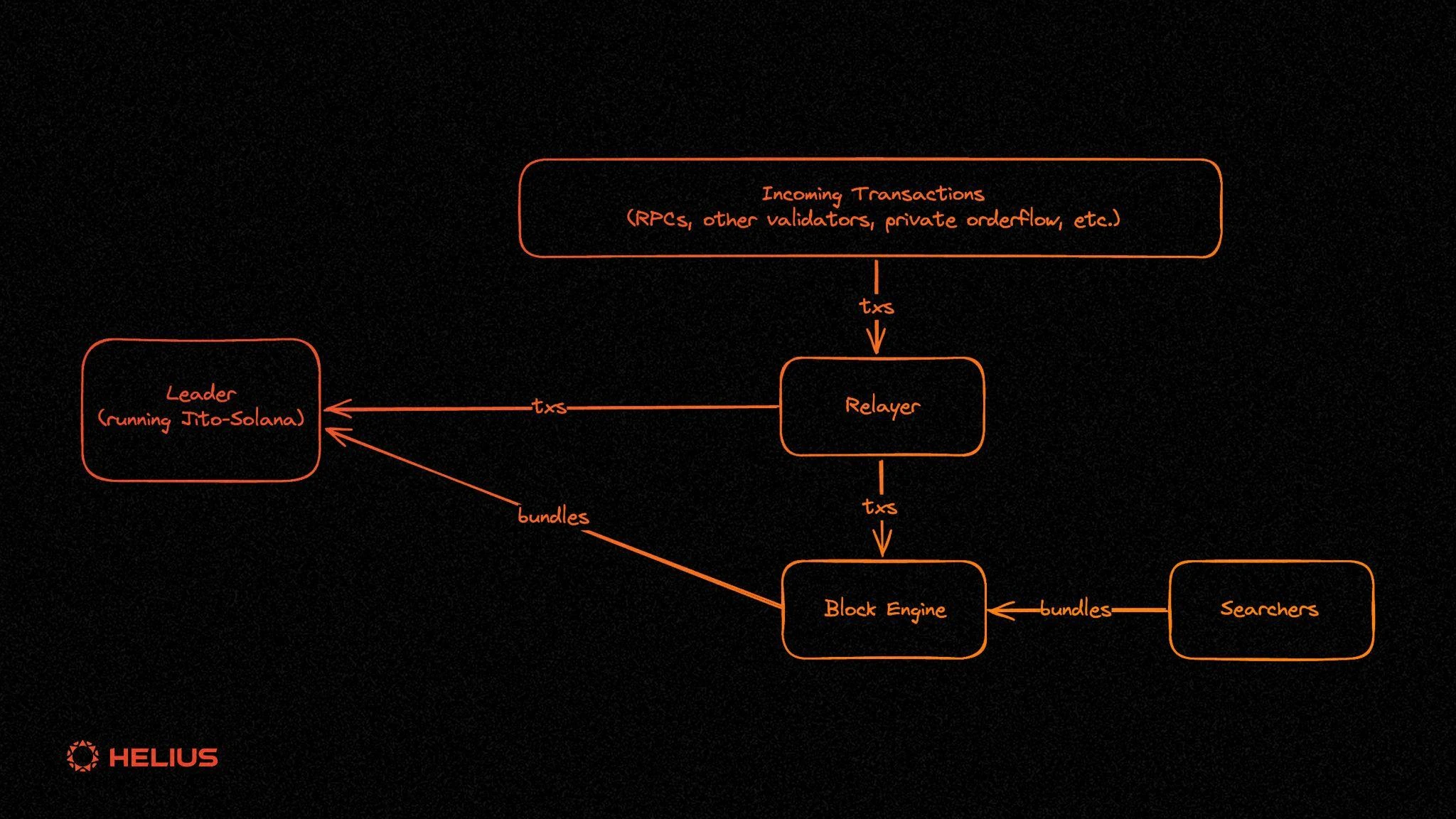

MEV-compatible architecture under Jito client, source: Helius

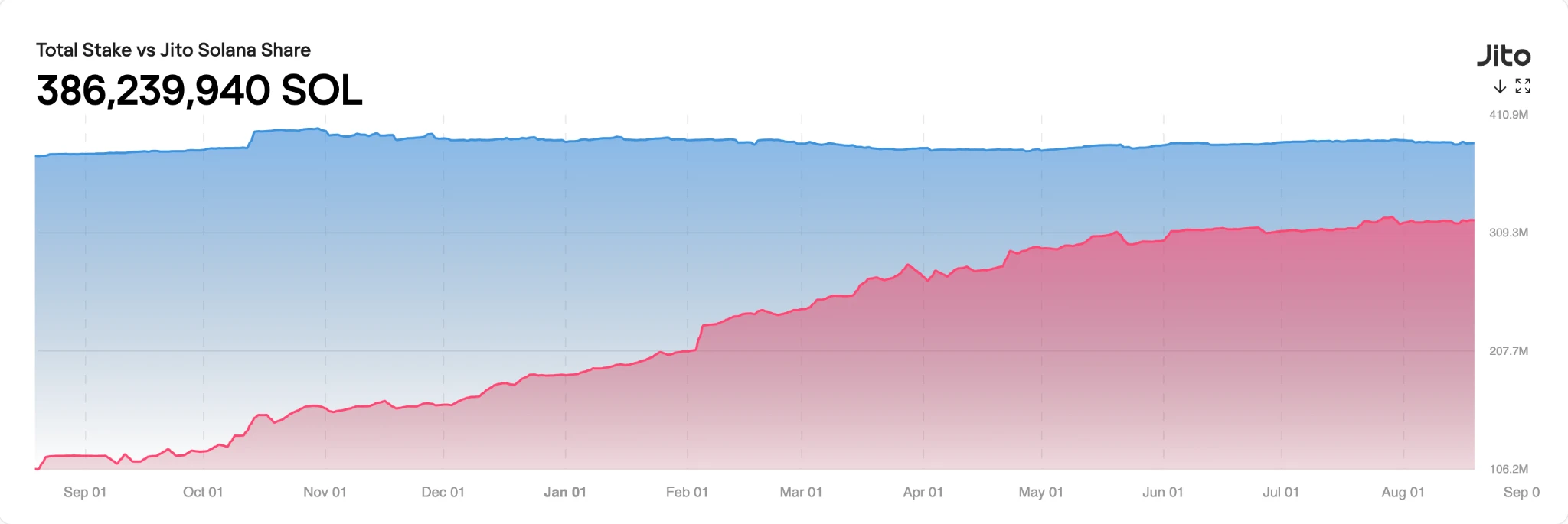

Jito Labs client currently occupies 50% of the client market share, so Jito Labs built a pseudo mempool by itself. Users enter a pseudo mempool through RPC and stay for about 200 ms. Jito Labs provides an off-chain inclusion guarantee to ensure that all transactions in the bundle are included in the block. Searchers can bid for the opportunity to attack pending transactions. Searchers bid for the Bundle that maximizes profits, and then the Block Engine is responsible for finding the Bundle with the highest bid and submitting it to the Leader running the Jito Labs client.

This is the root cause of MEV, but MEV has its positive externalities and demand. If Jito Labs does not do pseudo mempool, other projects will do it, so Jito Labs chooses to take over this market to make the entire MEV process more transparent and fair, and reduce negative externalities. Of course, this demand for MEV bots puts users in the most vulnerable position, because validators will charge fees, mev bots will get arbitrage benefits, but users will suffer higher slippage and possible failed transactions.

Solanas fundamental design is FCFS, so there will not be a dramatic increase in Gas Fees during peak network activity. After the Jito Labs client introduced the pseudo memory pool, MEV bots often used speed to preempt transactions, and because the handling fees were relatively fixed and low, MEV bots often sent a large number of identical transactions unscrupulously, which indirectly led to DDOS attacks. Since the client chose the QUIC protocol to send transactions for speed, the client often maintained transaction channels between multiple users. When the client cannot carry a large number of transactions, the client will disconnect certain connections on its own, and users often lack economic benefits. The client will collude with MEV to disconnect users, which also leads to users being unable to send transactions during peak hours. This is actually a potential censorship attack.

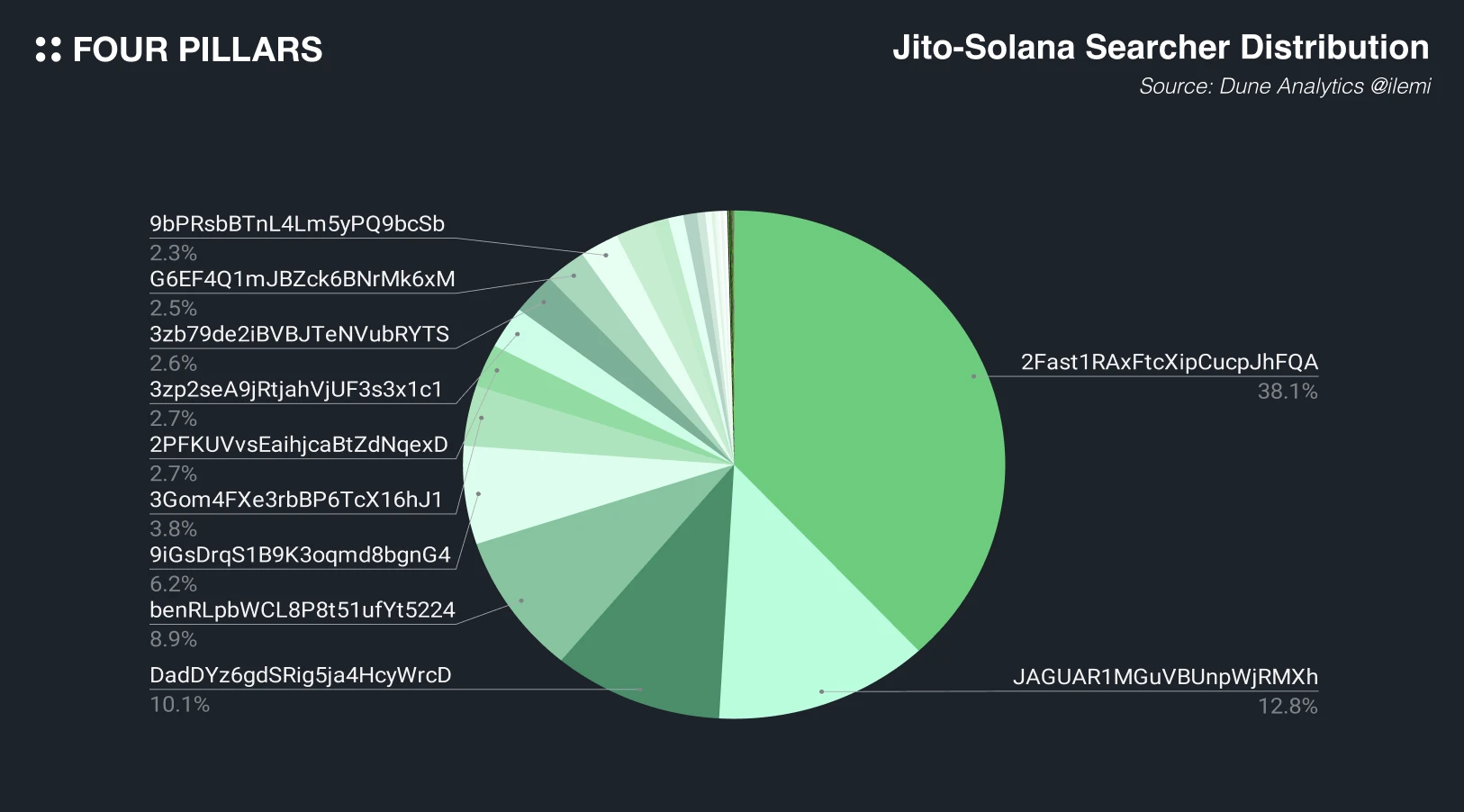

Searchers profit distribution, source: Four Pillars

In this architecture, speed is the first priority. This also leads to the concentration of profits among Searchers, as Searchers with better hardware can earn more profits.

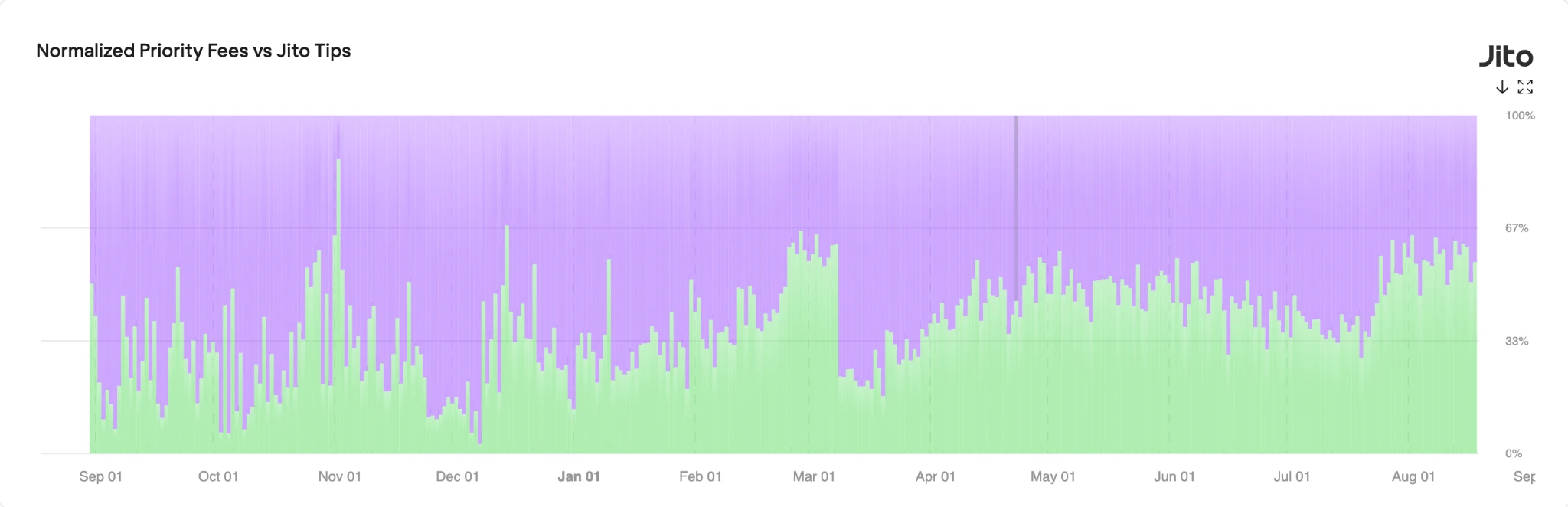

The ratio of priority fees to Jito tips. Source: Jito

After Jito Labs introduced the pseudo mempool, it also supported Priority Fees, which allowed block builders to bid for Bundles. In the pseudo mempool client built by Jito Labs, Priority Fees will be burned, which is about half of Gas Fees.

Jito client staked Sol percentage: Source: Jito

Currently, MEV on Solana is still relatively simple. Compared with Ethereum, Ethereum uses Gas Price as the main sorting method, while Solana uses the FCFS algorithm. Due to the low cost, Searchers naturally tend to send a large number of identical transactions to the network to ensure that they are successfully included. Speed is not the first priority on Ethereum, which will also cause large fluctuations in Gas Fees. Both solutions will lead to poor user experience during peak hours, one is that transactions cannot be sent and the other is that transactions bear high handling fees.

It is worth noting that due to the existence of the pseudo mempool, the sandwich attack brought by MEV caused users to suffer a very poor user experience. Therefore, the foundation and jito cooperated to shut down the mempool, and also reviewed these validators, forcibly removing the validators involved in the sandwich attack from the validator network.

DAG

Aptos is similar to Sui in that both are based on DAG. In this article, we aim to provide readers with a basic introduction to Narwhal Mempool and analyze how the ordering of transactions within DAG affects MEV.

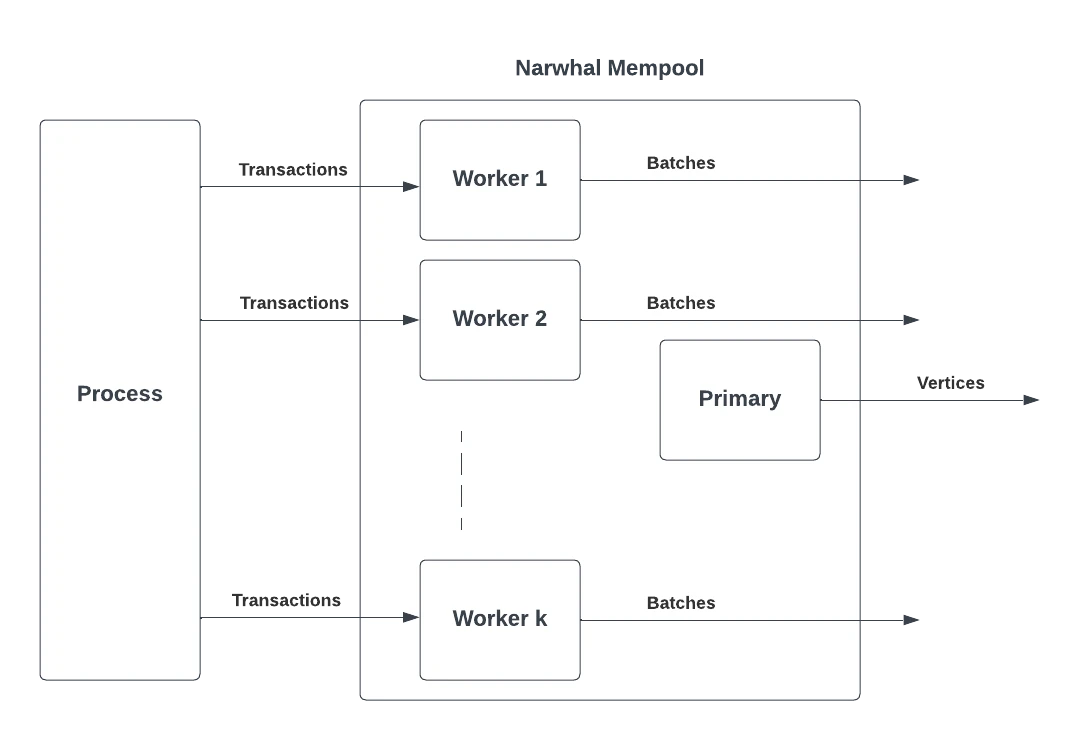

Narwhal Mempool, Image source: Rohan Shrothrium

Under the DAG algorithm, users submit transactions to Workers, and then these Workers can process unrelated transactions in parallel. Workers package transactions into batches and broadcast them to other nodes. A primary node manages multiple Worker nodes. The primary node is responsible for collecting the summaries of these batches and the certificates of proof to form blocks and broadcast them. Eventually, these blocks will form a vertex of the DAG. As shown in the steps above, the transactions in these blocks have not yet been sorted and executed.

Then, a sorting algorithm such as Suis Bullshark will be used. This algorithm will select a leader and verify whether the leader has received enough votes. The leader will then use deterministic functions to sort global transactions, such as gas fees, randomness, and other factors. After sorting, the block will be broadcast to all validators, who will verify the content and sorting of the block, and then all validators will need to execute the transactions in the block.

Under the algorithm combination of DAG + Bullshark, a Leader is selected in each round for global sorting. The leakage of MEV is often related to the transaction sorting. Once it sees the order of transactions, it can insert transactions to extract MEV. In a block, if the Leader nodes transaction is placed in the first half, which we call the top of the block, it can be given priority to process the transaction; if the transaction is placed in the second half, which we call the bottom of the block, a complete view of the block can be obtained to build a more complex MEV.

Sui

In Sui, the transaction sorting rules are based on the most common Gas Fees. Therefore, in this environment, some arbitrage operations are generally carried out, such as CEX-DEX arbitrage. When it finds an arbitrage opportunity in a transaction, it only needs to initiate a copy transaction with a higher Gas Fee, so this is deterministic in the sorting.

Aptos

Aptos adopts other sorting strategies, so the Leader also needs to re-sort all transactions according to the strategy before it can determine all transactions and have a complete view of the block. At this time, its transactions can only be placed at the end of the block. This also makes the MEV on Aptos more complicated, because these MEVs are often not preemptive transactions, but complex MEVs under a complete view.

From the user experience point of view, users often face higher Gas Fees on Sui Chain, because MEV strategies are all carried out with high Gas, which will lead to Gas competition. Aptos is praised for having a good user experience because it is not sorted by Gas Fees, so the complexity of Leader node MEV attacks is often higher, which means higher costs. But the user experience is better.

In models such as Sui and Ethereum that use Gas Fees to sort transactions, when on-chain transactions are active (such as active Meme transactions, large price changes, NFT Mints, etc.), they will promote a vicious cycle of higher Gas Fees, which will prevent some users from participating in the market at this time. However, Aptos strategy of sorting first and then displaying minimizes the MEV of users during the transaction process and increases the cost and complexity of the MEV strategy.

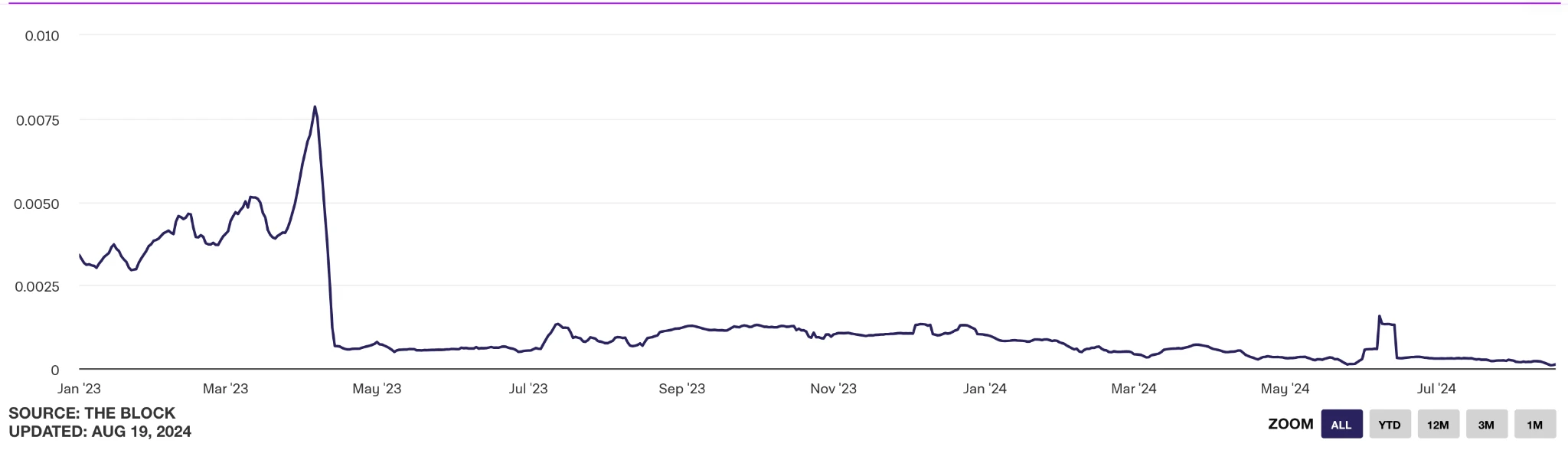

Aptos transaction fee, source: The block

SUI GAS FEES, Image source: Sui Explorer

According to historical data, the average Gas Fees on the chain of Aptos and Sui are at the same order of magnitude, 0.0 0x. However, it can be seen from the chart that Suis Gas Fee is prone to large fluctuations, while Aptos is relatively smoother. The reason for this user experience is also inseparable from the MEV brought by its sorting algorithm.

Referanslar

https://www.umbraresearch.xyz/writings/mev-on-solana

Uyarı:

Yukarıdaki içerik yalnızca referans amaçlıdır ve herhangi bir tavsiye olarak değerlendirilmemelidir. Lütfen herhangi bir yatırım yapmadan önce her zaman profesyonel tavsiye alın.

Gate Ventures Hakkında

Kapı Girişimleri Gate.io'nun girişim sermayesi kolu olup, Web 3.0 çağında dünyayı yeniden şekillendirecek merkezi olmayan altyapı, ekosistemler ve uygulamalara yatırım yapmaya odaklanmaktadır. Kapı Girişimleri Ekipleri ve yeni kurulan şirketleri, sosyal ve finansal etkileşim modellerini yeniden tanımlamaları için yenilikçi düşünce ve yeteneklerle güçlendirmek amacıyla küresel endüstri liderleriyle birlikte çalışır.

Resmi internet sitesi: https://ventures.gate.io/ Twitter'da: https://x.com/gate_ventures Orta: https://medium.com/gate_ventures

This article is sourced from the internet: Gate Ventures Research Insights: Current Status of MEV on Mainstream Public Chains

Next week, 15 projects will have token unlocking events. ZETA and MAV will have huge amounts unlocked, while the remaining tokens will have small amounts unlocked. ZetaChain Project Twitter: https://twitter.com/zetablockchain Project official website: https://www.zetachain.com/ Number of unlocked tokens this time: 54.74 million Amount unlocked this time: Approximately 40.67 million US dollars ZetaChain is a foundational public blockchain that enables full-chain, universal smart contracts and messaging between any blockchain. ZetaChain aims to build a fluid multi-chain crypto ecosystem. These “full-chain” smart contracts can send data and value between connected blockchains, including Bitcoin, Ethereum, Polygon, and more. ZETA is in a period of rapid release, mainly unlocking 26.26 million (US$18.49 million) and 18.67 million (US$13.15 million) ZETA consultants. Other amounts include US$3.7 million for ecosystem growth, US$1.85 million for user growth, and…