Orjinal kaynak: @thedefiedge

Derleyen: Odaily Planet Daily Wenser ( @wenser 2010 )

Editör notu: bitcoin has risen to its highest point since the end of July, and top venture capital firms have once again made a profit on paper. Crypto KOL DeFi Edgy recently conducted a tracking survey on the on-chain assets of the eight major crypto venture capital firms, through which we can get a glimpse of the current asset allocation and investment preferences of these industry players at the top of the food chain. The following is the full text for readers reference. Odaily Planet Daily reminds: The following is only a perspective sharing and does not constitute investment advice.

The truth behind the wallets of the top 8 venture capital firms: Is it just about “casting a wide net and making profits early”?

This is the strangest cycle yet – no one knows what’s going to happen next.

At times like these, it helps to know what everyone else is doing. So, I spent the weekend digging into what the big VCs are doing these days. Now, I know some of you are thinking, “They’re just casting a wide net and profiting from getting in early.”

Look, I don’t think they are the smartest people in the cryptocurrency industry, especially after the last cycle. But we should still pay attention to them: they do have information advantages, sufficient funds, and are closer to the project than we are .

Im thinking:

• Are they doing something interesting?

• Are they also playing altcoins like us?

• Or do they still hold on to some of the old value coins from the past?

Bu yüzden, lets see what these opportunists in suits are up to.

Notice:

-

Don’t copy VC deals. They have access to better deals than us and they play a different game, this is just to make us more aware of other players in the space.

-

We don’t have all of their wallet information. We do our best using crowdsourced tags and our own on-chain analysis, but you can’t grab all of the addresses to do analysis.

-

We have selected several of the top funds and sorted them by size. We will describe each funds total assets, major holdings, minor holdings, and any interesting recent operations.

8 Top Crypto VCs and Their Major Holdings

1. a16z ($482.3 million)

Main assets:

– UNI: $436 million

– OP: $31 million

– COMP: $14 million

Small assets: ETH ($14,000), COLLE ($6,000)

A16z is one of the largest UNI token holders on the market, which means they have enough power to influence the communitys proposals, as 4% of the UNI supply is enough to reach the quorum, and they have been holding UNI tokens for many years. The recent changes to a16zs wallet are the initial unlocking of the OP tokens they are still holding.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/a16z

Odaily Planet Daily Note: With the continuous rise of BTC in recent days, the total assets of a16z have risen to about US$534 million.

a16z Asset Balance Panel

2. Galaxy Digital ($364.5 million)

Main assets:

– BTC: $194 million

– ETH: $115 million

– USDC: $40 million

– USDT: 5 million USD

– AVAX: $4 million

– USDC: $1.3 million

– AAVE: $1.14 million

Small assets worth mentioning ($100,000-500,000): MKR, OXT, UNI, TOKE;

The tokens they hold have all been washed by huge trading volumes, mainly stablecoins and BTC, and it is speculated that they may be distributing tokens and conducting some arbitrage strategies.

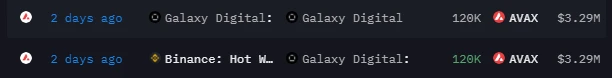

Recently, they withdrew $3.3 million worth of AVAX from Binance.

Search link: https://platform.arkhamintelligence.com/explorer/entity/galaxy-digital

Recently, perhaps affected by the market recovery, Galaxy Digital has transferred out various tokens such as BTC, ETH, USDT, USDC, etc. many times, and its current balance has been reduced to US$354 million.

Galaxy Digital Extract AVAX Records

3. Jump Trading ($286.4 million)

Main assets:

– USDC: $78 million

– USDT: $70.38 million

– stETH: $70.38 million

– ETH: $54.9 million

– T: $2.15 million

– WETH: $1.24 million

– SHIB: US$1.2 million

– SNX: $1.16 million

Small holdings include ($200,000-700,000 USD): MKR, LDO, GRT, DAI, UNI, KNC, HMT, BNB, CVX, COMP, INJ, and MNT.

Jumps portfolio is pretty typical, mostly ETH and stablecoins. Interestingly, they also hold non-mainstream tokens like Threshold Network, SHIB, and SNX. Despite previous claims that Jump has left the crypto space, they are still doing a lot of operations now.

Additionally, Jump recently started depositing ETH into LMAX, an institutional crypto exchange.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/jump-trading

Recently, perhaps due to the recovery of market conditions, Jump Tradings total assets have increased to US$350 million.

Jump transfer operation record

4. Wintermute ($159.8 million)

Main assets:

– USDC: $16.6 million

– WBTC: $11.15 million

– PEPECOIN: $10.52 million

– ETH: $10.39 million

– USDT: $9.11 million

– TKO: $4.67 million

– CBBTC: $4.63 million

– MATIC: $4.41 million

– BMC: $4.36 million

– NEIRO: $3.48 million

Small assets (US$200,000-3 million) include BASEDAI, TON, ZK, MOG, stETH, ARB, ENA, ARKM, APE, LDO, ONDO, etc.

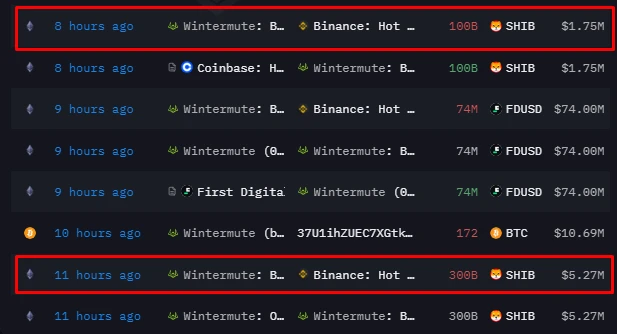

Wintermute is betting big on meme tokens. Besides their largest holding (PEPECOIN – thats not PEPE, thats another meme coin), they also have sizable holdings in MOG, NEIRO, COQ, APU, SHIB, BENJI, etc.

They are best known for being the market maker for the Meme Madeni Para project.

Wintermute has recently accumulated a certain amount of cbBTC (Coinbase BTC) and BTC in their wallets; in addition, they have sent more than $6 million in SHIB to Binance.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/wintermute

Recently, perhaps due to the recovery in market conditions, Wintermutes total assets have risen to US$229 million.

Wintermute Operation Log

5. Pantera Capital ($161.15 million)

Main assets:

– ONDO: $152 million

– ETHX: $4.4 million

– SD: $1.11 million

– ECOX: $9.416 million

– LDO: $388,000

– PERC: $375,000

– NOTE: $274,000

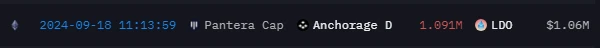

Recently, Pantera moved nearly $3 million of MATIC to Coinbase, and recently moved $1 million of LDO to Anchorage, an institutional-oriented crypto staking platform. Interestingly, most of their ETH has been moved to centralized exchanges.

In addition, we can also see that the value of their investment funds in ONDO has shrunk by 56%. It is worth noting that Pantera is one of the early private investors in ONDO.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/pantera-capital

Recently, perhaps due to the recovery in market conditions, Panteras total assets have increased to US$178.9 million.

Pantera sells LDO operation record

6. Blockchain Capital ($67.1 million)

Main assets:

– AAVE: $32.8 million

– UNI: $18.35 million

– ETH: $4.16 million

– UMA: $2.12 million

– SAFE: $1.89 million

– 1INCH: $1.88 million

– COW: $1.62 million

– FORT: $1.31 million

– USDC: $1 million

Small assets ($100,000-600,000): SUSHI, BAL, PSP, USDC, PERP

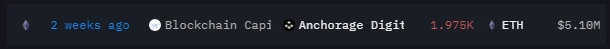

The AAVE token that makes up its largest holding is interesting, Blockchain has held AAVE for many years and may be worth watching carefully due to its recent continued price increase. In addition, like Pantera, Blockchain previously moved over $5 million worth of ETH to the Anchorage exchange.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/blockchain-capital

Recently, perhaps affected by the market recovery, Blockchains total assets have risen to US$75.73 million.

Blockchain transfer ETH operation record

7. Spartan Group ($35.38 million)

Main assets:

– PENDLE: $16.93 million

– GAL: $2.65 million

– MNT: $2.49 million

– OP: $1.4 million

– IMX: $1.18 million

– WILD: $1.09 million

– GRT: $1.04 million

– AEVO: $982,000

– USDC: $841,000

– PTU: US$800,000

– RBN: $778,000

– 1INCH: $700,000

Small assets (US$100,000-500,000) include: MAV, CHESS, MPL, G, DYDX, ALI, BETA, PSTAKE, ETH.

We can see that Spartan Group has a heavy position in Pendle. Other than that, we don’t see many major transactions. They are mainly trading USDC arbitrage strategies.

Interestingly, they have moved all BEAM assets to Sophon, an upcoming chain, and you can start depositing assets now to participate in the airdrop interaction.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/spartan-group

Recently, perhaps due to the rebound in market conditions, Spartan Groups total assets have risen to US$38.03 million.

Spartan also takes advantage of airdrops?

8. DeFiance Capital ($33.6 million)

Main assets:

– PYUSD: 20 million USD

– LDO: $6.08 million

– BEAM: $3.94 million

– USDC: $1.1 million

– TBILL: $1.04 million

Small assets ($50,000-300,000 USD) include VIRTUAL, AVAX, BAL, MCB, USDT, and INSUR.

DeFiance has been betting heavily on gaming tokens, with their most recent transaction involving several transfers from Shrapnel, a Web3 shooter game.

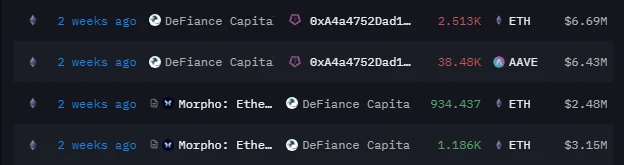

Additionally, they recently received a large amount of ETH from Morpho.

Sorgu bağlantısı: https://platform.arkhamintelligence.com/explorer/entity/defiance-capital

Recently, perhaps affected by the market recovery, the total assets of DeFiance have risen to US$34.8 million.

Is there “insider trading” between Morpho and DeFiance?

Looking at the overall trend of venture capital holdings:

Based on the above information, we can see that –

-

Common holdings: a16z, Jump, Wintermute and Blockchain Capital prefer top DeFi tokens (UNI, AAVE), ETH and stablecoins . This may be because in a bear market, the above institutions pay more attention to liquidity and DeFi protocols.

-

Long-term holding: a16z and Blockchain Capital are among the “diamond hands” of the industry – they have held assets such as UNI and AAVE for many years respectively.

-

Stablecoin arbitrage: Many institutions are doing this, as evidenced by their high stablecoin trading volumes.

-

Bitcoin Layer 2 Network: This track continues to receive a lot of investment. BTC L2 companies and projects have previously raised a total of $94.6 million, a month-on-month increase of 174%.

-

Early-stage investing still dominates: nearly 80% of invested capital and pre-seed deals account for 13% of all investment activity.

-

Shift in popular investment areas: Although the NFT and GameFi tracks were very popular in 2021, these two areas have cooled down rapidly in 2024; venture capital now prefers hot trend tracks such as AI, infrastructure and even Meme coins .

We recently reviewed a Galaxy report on “VC Trends to 2024” and here are some highlights worth sharing:

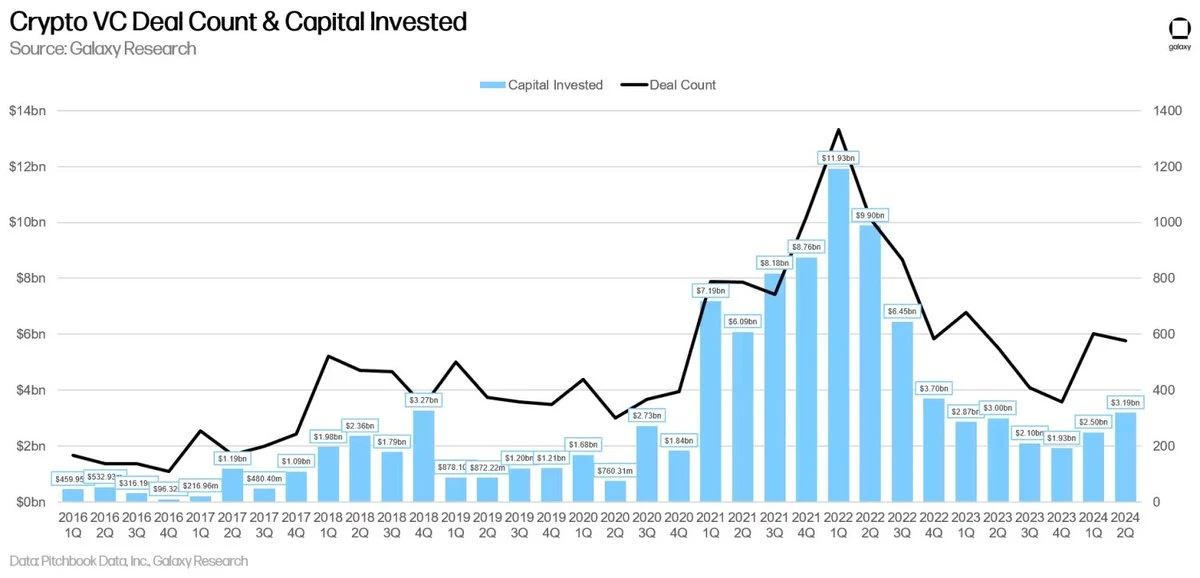

VC investment has dropped significantly compared to the same period in 2021-2022. Despite this, VCs still invested $3.19 billion in the second quarter of 2024 (up 28% from the previous quarter).

Statistics on venture capital investment amount and number of investment cases

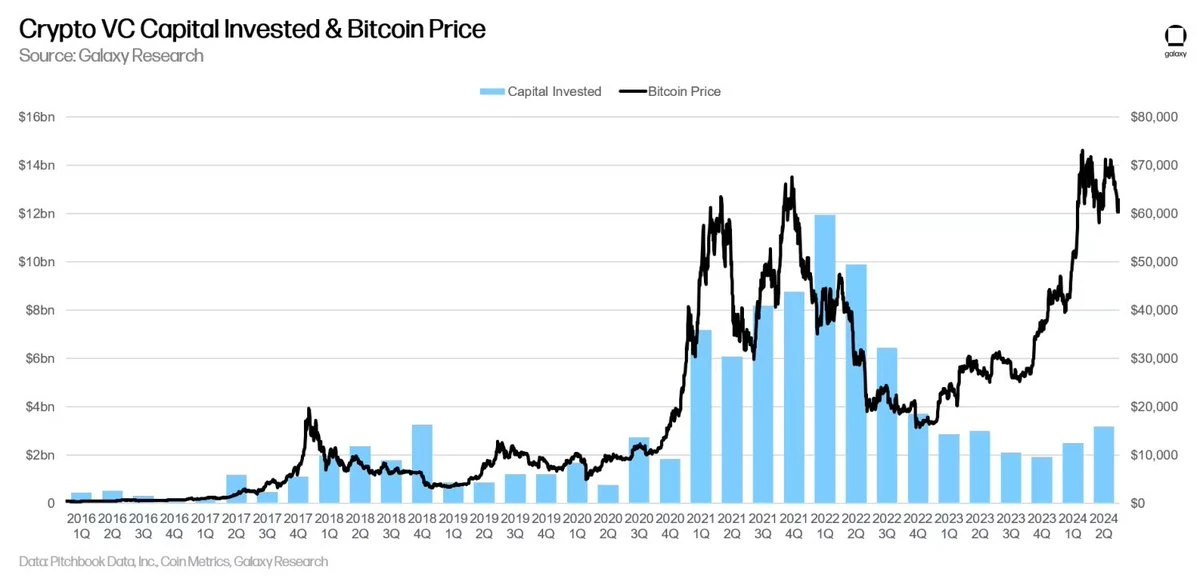

Interestingly, the scale of investment does not completely increase or decrease with the rise and fall of BTC prices. This correlation was more accurate in the past, but now it seems that venture capital funds are tighter and liquidity is more scarce.

Correlation chart between venture capital investment size and BTC price

Most investments are still concentrated in tracks such as NFT/Games/DAOs, followed by infrastructure. According to the report data, In the second quarter of 2024, companies and projects in the Web3/NFT/DAO/Metaverse/Games category raised the largest share of crypto venture capital (24%), totaling $758 million. The two largest deals in this category were Farcaster and Zentry, which raised $150 million and $140 million, respectively.

Pie chart of investment proportions in different tracks

Hopefully, this in-depth analysis will provide you with useful information about how venture capital firms are investing in the crypto space. The key to this analysis is to help you see through the surface of their investment behavior and trading operations, predict some potential trends, and understand how venture capital firms operate.

Always remember: don’t blindly follow venture capital deals, but use them as an information resource to enhance the depth and effectiveness of your research.

Related tool references:

This article is sourced from the internet: Revealed: 8 top VC holdings and recent operations

Related: AC New Article: Why DeFi is the key to the future?

Original author: Andre Cronje Original translation: TechFlow Before we dive in, why are we talking about finance in the first place? Barter existed before any currency existed. I raise chickens and you grow wheat. I give you chickens and you give me wheat. One year, my chickens dont do so well, but I still need wheat, so I promise to give you more chickens next year. I owe you an IOU. Maybe you dont need more chickens, but your neighbor wants them, so you can trade that favor for something else. In its most basic form, this is currency, a standardized favor that anyone willing to accept agrees is worth a given value. Eventually, we start measuring everything in terms of favors. So now I had a pile of favors…